RBI streamlines floating rate reset for EMI-based personal loans

Major exercise for home lenders to reflect changes in existing home loans by year-end

– Team Finserv | finserv@vinodkothari.com

As indicated in the last Monetary Policy review, the RBI introduced new regulations for rate-based variations in floating rate loans, requiring lenders to mandatorily provide as many as 6 options to borrowers. The new regulations, vide the August 18, 2023[1] circular, will require all long-term consumer credit lenders, mainly home lenders, to incorporate changes in their policies and agreements by the end of the calendar year. We are of the view that this will also necessitate lenders to provide a meaningful fixed rate borrowing option, both at the start of the loan as also at the time of interest rate variations.

India is a floating rate lending market

In India, most lending for anything over 3 years typically reserves the lender’s option to transmit interest rate changes to the borrowers – hence, these rates are floating or adjustable-rate loans. Floating rates are tied to a benchmark, internal or external, reflecting changes in interest rates in the financial environment. Hence, most long-term loans, such as home loans, LAP loans, auto loans, etc. usually have floating rates. RBI data indicates that a staggering 94.8% of home loans provided by 14 scheduled commercial banks had floating rates by the end of March 2023 [See Table 2]. Further, 72% of all loans from these banks were on a floating rate basis, showcasing the preference for floating over fixed rates in India [See Table 1].

Table 1

| Share of Floating Rate Loans [Expressed in terms of percentage] | |||

| Public Sector Banks (PSB) (8) | Private Sector Banks (PVBs) (6) | All SCBs (14) | |

| Agriculture | 91.9 | 40.9 | 79.4 |

| Industry | 83.3 | 80.5 | 82.3 |

| Services | 77.3 | 75.3 | 76.3 |

| Personal (Retail Loans) | 70.5 | 51.7 | 60.2 |

| Others | 79.1 | 26.4 | 73.9 |

| Total Advances | 79.5 | 61.7 | 72.0 |

Table 2

| Housing Loans – Share of Floating Rate Loans [Expressed in terms of percentage] | |||

| Public Sector Banks (PSB) (8) | Private Sector Banks (PVBs) (6) | All SCBs (14) | |

| Housing Loans | 92.9 | 98.0 | 94.8 |

Note: As on March 31, 2023; Number in parenthesis indicates number of banks covered in the analysis

Source (Table 1 and Table 2]: Financial Stability Report, June 2023[2]

Is floating rate really the borrower’s choice? A priori, it may be argued that the hope for decreasing interest rates in the long run often encourages borrowers to consider floating rate loans. However, the reality is that most lenders force the floating rate option on the borrowers, by pricing the fixed rate alternative to a prohibitive level[3].

Floating rate loans hurt with hurt feeling:

How does the floating rate really work? If interest during the subsisting term of the loan have gone up, lenders have two options to reflect the revised interest rates on their existing loans – either revise the EMI, or elongate the term keeping the same EMI. Mostly, lenders choose the second option, as that does not require the post-dated cheques or NACH instructions to be changed.

However, elongation of the tenure is a silent killer. It is a pain which is pushed to the future. Since the present EMIs remain the same, the borrower doesn’t feel the pain at all. However, the least he realises is that he has an added burden to pay the same EMIs now over a longer period. Quite often the extension of maturity of the loan takes the EMI burden to the time when the borrower will be well past his working life, and exactly when he would have hoped to retire with peace, he would be carrying the burden of EMIs on his back with his earnings having stopped.

The illustration below shows the additional number of EMIs a borrower has to pay as a result of elongation of tenor.

Assumptions

| Loan amount | ₹ 100000 |

| Rate of interest | 6.50% |

| Tenure | 180 months |

| EMI | ₹ 871.11 |

| Rate increase after | 24 months |

| Increase in the rate of interest | 2.00% |

| Increase in the number of EMIs as a result of elongation of tenor due to interest rate reset | |||||||||||

| Increase in interest rate by | Reset happening number of months since inception | ||||||||||

| 6 | 12 | 18 | 24 | 30 | 36 | 42 | 48 | 54 | 60 | ||

| 0.50% | 9.6 | 8.8 | 8.0 | 7.3 | 6.7 | 6.1 | 5.5 | 4.9 | 4.4 | 4.0 | |

| 1.00% | 20.9 | 19.1 | 17.4 | 15.8 | 14.3 | 12.9 | 11.6 | 10.4 | 9.3 | 8.3 | |

| 1.50% | 34.6 | 31.4 | 28.4 | 25.6 | 23.1 | 20.8 | 18.6 | 16.6 | 14.8 | 13.1 | |

| 2.00% | 51.8 | 46.5 | 41.8 | 37.4 | 33.5 | 29.9 | 26.6 | 23.7 | 21.0 | 18.5 | |

| 2.50% | 74.4 | 66.0 | 58.5 | 51.9 | 46.0 | 40.8 | 36.1 | 31.8 | 28.0 | 24.6 | |

| 3.00% | 106.6 | 92.5 | 80.6 | 70.4 | 61.7 | 54.0 | 47.3 | 41.4 | 36.2 | 31.5 | |

| 3.50% | 160.0 | 132.9 | 112.2 | 95.6 | 82.1 | 70.8 | 61.1 | 52.9 | 45.7 | 39.5 | |

| 4.00% | 303.1 | 212.2 | 165.0 | 133.8 | 110.9 | 93.2 | 78.9 | 67.2 | 57.3 | 49.0 | |

Elongation of term is not the only cause for concern among borrowers. The RBI says that the regulator has observed several instances of opaque terms about variation of interest rates, mostly leaving the borrowers without choice.

The new framework

In response, the RBI has introduced a dedicated framework to standardize how regulated entities address interest rate resets for EMI-based personal loans. Initially mentioned in the RBI’s Statement on Developmental and Regulatory Policies on August 10, 2023[4], the final framework was officially announced on August 18, 2023[5] (“Framework”). This article aims to discuss the new guidelines and their potential impacts.

Applicability

The Framework is addressed to all the major categories of lenders namely,

- All Scheduled Commercial Banks

- Regional Rural Banks

- Primary (Urban) Co-operative Banks

- State Co-operative Banks and District Central Co-operative Banks

- Non-Banking Financial Companies

- Housing Finance Companies

Further, this Framework will apply only in case of Personal Loans, the meaning of which has to be derived from the RBI Circular – XBRL Returns – Harmonization of Banking Statistics dated January 4, 2018[6], which includes:

Personal loans refers to loans given to individuals and consist of (a) consumer credit, (b) education loan, (c) loans given for creation/ enhancement of immovable assets (e.g., housing, etc.), and (d) loans given for investment in financial assets (shares, debentures, etc.).

Further, the term consumer credit has been defined to meaning the following:

Consumer credit refers to the loans given to individuals, which consists of (a) loans for consumer durables, (b) credit card receivables, (c) auto loans (other than loans for commercial use), (d) personal loans secured by gold, gold jewellery, immovable property, fixed deposits (including FCNR(B)), shares and bonds, etc., (other than for business / commercial purposes), (e) personal loans to professionals (excluding loans for business purposes), and (f) loans given for other consumptions purposes (e.g., social ceremonies, etc.). However, it excludes (a) education loans, (b) loans given for creation/ enhancement of immovable assets (e.g., housing, etc.), (c) loans given for investment in financial assets (shares, debentures, etc.), and (d) consumption loans given to farmers under KCC. For risk weighting purposes under the Capital Adequacy Framework, the extant regulatory guidelines will be applicable.

While the together the two definitions cover a wide gamut of loans, interesting to note is that only loans to individuals will be covered under this Framework. Therefore, business loans or loans for commercial purposes shall not get covered under this. Even the loans given to SMEs for business purposes such as LAP or working capital loans would not be covered.

This Framework will be relevant to both existing and new loans. Implementation is required by December 31, 2023, providing lenders just over four months from the notification date to integrate these new requirements.

A table summarising the coverage of the Framework is provided below:

| Covered by the new framework | Not covered by the new framework | Rationale |

| Home loans at floating rate of interest | Home loan at fixed rate of interest | The definition of personal loan |

| LAP to individuals other than for business purposes | LAP given to an individual/sole proprietor | Mostly, LAP is for business purposes. If the LAP is for personal purposes or is not connected with a business end-use, it will be covered |

| Auto loans having rate variation clause | Auto loans not having rate variation clause | |

| Student loans having rate variation clause, whether with or without moratorium | Fixed rate student loans | |

| Loans against shares | Mostly provide for bullet repayment | |

| Financial leases | Strictly speaking, not loans |

Table 3: Coverage

Board approved policy

Lenders must establish a Board-approved policy outlining, at the very least, the following details:

- Options to extend to customers

- Maximum allowable frequency for borrowers to switch between floating and fixed rate loans

- Applicable charges related to the provided borrower options

Options to be provided to the borrowers

The Framework proposes that with every interest rate reset, borrowers should be presented with the following choices:

- Option to switch to a fixed rate – subject to the lender’s approved policy, which might limit the frequency of rate switches. The lender can also impose switching charges, but these must be transparently disclosed during loan sanctions and subsequent cost revisions.

The primary concern here is how a lender determines the fixed rate during a transfer. Will it be based on the prevailing fixed rate available for new loans, or will there be an added premium to account for the increased interest rate risk the lender must now assume? It’s probable that this risk will be reflected in the switching fees charged to borrowers. As a result, borrowers might be offered the prevailing fixed rate when they switch.

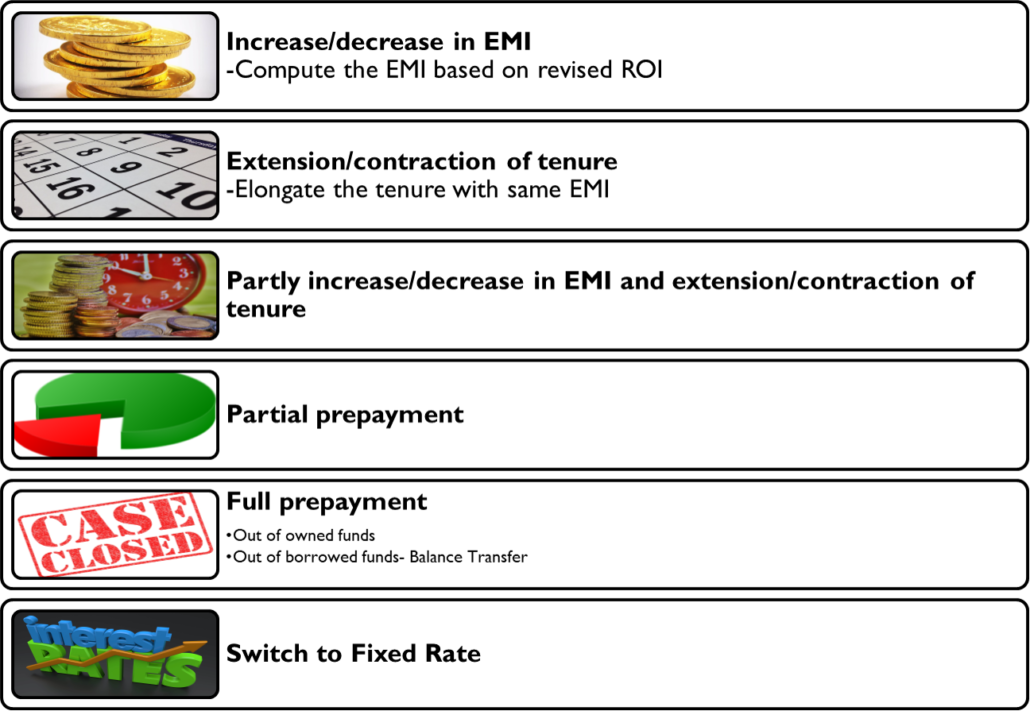

- Option to increase/decrease the EMI amount, extend/contract the loan tenure, or both – ensuring that elongating the tenure does not result in negative amortization[7]. Technically, the borrowers are given this option even now, however, going forward, the lenders will have to be more vocal about the options. Read Vinod Kothari’s article, Home Loans: India needs to promote fixed rate loans[8], to understand the impact of rate hike on EMIs and elongated tenures in case of home loans.

- Option to partially or fully prepay the loan during its tenure – however, the lenders can apply foreclosure charges for prepayment penalties as per RBI’s existing directives outlined in other circulars. It may be noted that the HFC and NBFC Directions restrict imposing of floating charges/ prepayment penalties on any floating rate term loans sanctioned to individuals for other than business purposes.

Furthermore, beyond the points mentioned earlier, borrowers also have an implied option at their disposal — the option of a balance transfer. This enables borrowers to choose to move to a different lender that provides a lower interest rate.

An illustration of the various options available with the borrowers have been provided below:

Figures 1: Options with the Borrower

While the borrowers will have the above options at their disposal, it is also important to note that the lender must decide on a default option which may be applied automatically, should the borrowers fail to express their wishes. Ideally this should also be communicated to the customers.

Communication and disclosures

The main objective of the Framework is to enhance transparency, and therefore, has prescribed quite a few additional disclosure requirements:

- Impact of the interest rate reset on the payment schedule – The lenders will have to, at the time of sanctioning the loan, demonstrate to the borrower the potential impact any interest rate reset might have on the EMI or the tenor or both. This could turn out to be a tricky job, especially while dealing with the unorganised sector. It will be interesting to see how regulated entities address this requirement.

- Communication about reset of interest – As and when there is an interest rate reset, the same shall have to be communicated to the customers. Along with this communication, the lenders must ideally also apprise the borrowers about the options they have, and their financial implications.

- Communication about change in the charges associated with the options available with the borrowers – If during the course of the tenor the lender changes any of the charges/ costs associated with exercise of any of the options, communicated to the customer at the time of the loan sanction, the same may be communicated to the customer.

- Quarterly statement regarding the loans – The lenders, shall have to, share / make accessible to the borrowers, through appropriate channels, a statement at the end of each quarter which shall at the minimum, enumerate the principal and interest recovered till date, EMI amount, number of EMIs left and annualized rate of interest / Annual Percentage Rate (APR) for the entire tenor of the loan. This statement shall be made simple and easily understood by the borrower.

- Communication to the existing customers – For the existing customers, by December 31, 2023, the lenders will have to communicate the various options they have at their disposal and ideally, also the costs associated with them.

The question arises whether agreements executed with borrowers in case of existing loans would have to be revised by way of an addendum/ supplementary deed, to accommodate the prescribed changes. Considering that the changes are owing to regulatory prescriptions, the same may be a one-way communication not requiring borrower consent.

Will lenders have to effectively give a reasonable fixed rate option at the time of lending

The Framework mandates lenders to provide an option to switch to a fixed rate during an interest rate reset. However, the question arises: should this option be available only at the time of the switch or right from the inception? In an ideal scenario, this option should be presented at the outset of lending. Yet, it must be a sensible choice. As highlighted previously, there’s a significant disparity between the interest rates of fixed and floating options. Unless this gap narrows, the provided option may not hold any practical significance.

Conclusion

The Framework aims to increase transparency in the manner in which interest rate resets are dealt with, however, at a policy level, is it not time to promote fixed rate loans in the country? As has been highlighted by Vinod Kothari in his article, Home Loans: India needs to promote fixed rate loans[9]:

Indian home lenders, over time, have been loathe to take interest rate risk on a long-term funding product. The question is: who is better positioned to take the risk of interest rate changes: a financial sector entity with loads of tools in its possession for managing interest rate risk, or a lay household who has no clue or access to such tools?

…….

From a financial policy viewpoint too, floating rate home loans have an issue, which is recognised by the RBI itself in its Financial Stability Report referred above. This is about transmission of impact of policy rates. If the RBI increases the policy rate (say, repo rate), its intent is to curtail liquidity. As interest rates increase, the mortgage lender passes the burden to its existing borrowers, which reduces the net disposable income of the borrower. Of course, the contract in income available for consumption is much more for borrowers with lower income, implying a socially unjust impact of a macro-economic measure, intended to curb inflation.

…….

Thus, considering the multifaceted concerns raised, the time might indeed be ripe for a re-evaluation of the prevalent preference for floating rate home loans in India.

[2]https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/0FSRJUNE20231159B36F45EA406E9D704BBC8F73D785.PDF (last accessed on 18th August 2023)

[3] As on the date of this article, a leading schedule commercial bank offers floating rate home loans at 9 – 9.4% whereas it offers fixed rate loans at 14%, therefore, indicating a gap of as high as 5%.

[4] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=56174 (last accessed on 18th August 2023)

[5] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12529&Mode=0 (last accessed on 18th August 2023)

[6] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=11199&Mode=0 (last accessed on 18th August 2023)

[7] Negative amortisation refers to a situation where the scheduled payments on a loan are insufficient to cover the interest costs. As a result, the unpaid interest gets added to the loan’s principal balance. This leads to the loan balance increasing over time, rather than decreasing as it would with regular amortization.

[8] Read Vinod Kothari’s article Home Loans: India needs to promote fixed rate loans here: https://www.linkedin.com/pulse/home-loans-india-needs-promote-fixed-rate-vinod-kothari%3FtrackingId=5bHlTSgmQEytPhAmNHjf%252FQ%253D%253D/?trackingId=FrZbgz8CQAWUSyBJcrOoWQ%3D%3D (last accessed on 18th August 2023)

[9] Read Vinod Kothari’s article Home Loans: India needs to promote fixed rate loans here: https://www.linkedin.com/pulse/home-loans-india-needs-promote-fixed-rate-vinod-kothari%3FtrackingId=5bHlTSgmQEytPhAmNHjf%252FQ%253D%253D/?trackingId=FrZbgz8CQAWUSyBJcrOoWQ%3D%3D (last accessed on 18th August 2023)

Leave a Reply

Want to join the discussion?Feel free to contribute!