Webinar on KFS & APR – New Rules by RBI on Retail & MSME Lending

-Vinod Kothari and Anita Baid | finserv@vinodkothari.com

Loading…

Loading…

Our related resources on the topic:

-Vinod Kothari and Anita Baid | finserv@vinodkothari.com

Loading…

Loading…

Our related resources on the topic:

-Chirag Agarwal & Archisman Bhattacharjee I finserv@vinodkothari.com

In the realm of personal finance, the attraction of borrowing money without incurring interest charges is an enticing prospect. Zero percent interest rate loans, often advertised as promotional offers by retail financing companies, credit card companies, retailers, and financial institutions, have garnered significant attention in recent years. But what exactly are these loans? Are they really zero-interest loans? No one would believe that the lender is getting zero income on the loans. And if the lender is indeed getting some income, even if not from the borrower, that income is not completely disconnected with the loan. Therefore, are there fair disclosure requirements that may require the lender to disclose his yield on the so-called zero interest loans?

Zero percent financing refers to a loan where no interest is applied, either throughout its duration or for a set period.

One form of zero percent interest rate loans is known as merchant subvention. In this model, the seller or manufacturer of the product assumes responsibility for paying the interest to the lender. This arrangement allows the merchant to effectively market and sell the product, attracting more customers to the merchant’s business. Meanwhile, the customer gets the perceived “feel good” benefit of obtaining the product at a zero percent interest rate. If happiness is all about feeling good and not necessarily being good, it is a mutually beneficial situation for the buyer, seller and the lender.

Another form of zero percent loan may be where lenders load additional charges in some form other than interest, and pretend to provide an interest-free loan. These could comprise of of a one-time high processing fees, or similar other charges, which disguise the interest component . This practice, we understand, is deceptive and is against the concept of fair lending. Hence, if the lender is charging interest in form of the so-called “other charges”, and claims to be providing interest-free loan, that is a case of lie. However, in this article, we are not dealing with a lie – we are dealing with a half-truth. .

And what is that half truth? , If the lender is making his target yield by way of third party cashflows, such as merchant subvention, product discount, etc., is it fair for the lender to demonstrate that he is lending free of interest? .

It is a well-established practice among dealers or manufacturers to offer subventions or discounts on products to customers availing loans from financial institutions. In such instances, banks/NBFCs, leverage their volumes and vendor relationships to secure favourable terms. Here, it becomes imperative that these benefits are passed on to customers without altering the applicable rate of interest (RoI) of the product. Furthermore, the actual discount is not provided by the bank/NBFC, but by the merchant as a part of the merchant’s customer acquisition strategy. As a regulated entity, the lender is expected to ensure full and transparent disclosure of these benefits to customers

Hence, the lender showing the loan as 0% is essentially passing the discount or benefits provided by the merchant to the lender. It cannot be contended that the lender would have bought the product or service but for the purpose of the loan. In fact, the lender is not the actual purchaser; the lender is simply aiding or pushing the sales of the merchant by offering credit. It is the credit facility that triggers the purchase; it is the purchase that triggers the discount. Hence, there is a clear nexus between the grant of the merchant’s benefits to the lender.

Quite often, the issue is – will the customer be able to get the same discount, subvention or benefits if the customer was to make a direct purchase from the vendor? The answer will mostly be negative. The lender has a relationship with the vendor, whereby the lender gives volumes as well as regular business. But no lender will obviously do a loan without a threshold rate of return. There is absolutely nothing wrong in saying that the interest charged to the customer is zero, but at the same time, to not make basic disclosure about the extent of discount or benefits that the lender gets from the merchant will be a case of half truth.

The following is a diagrammatic illustration of how the concept of merchant subvention works

The concept of annualised percentage rate (APR) has also been introduced to enhance transparency and reduce information asymmetry on financial products being offered by different regulated entities, thereby empowering borrowers to make informed financial decisions. Accordingly, discussion on what is APR and how merchant subvention should be disclosed holds precedence.

In India, as per Key Facts Statement (KFS) for Loans & Advances the term APR ”is the annual cost of credit to the borrower which includes interest rate and all other charges associated with the credit facility”. The said circular covers retail loans, MSME term loans, digital loans, MFI loans, and all loans extended by banks to individuals. Our FAQs on the said circular can be read here.

Further, as per Para 2(a)(iii) of the Display of information by banks APR allows customers to compare the costs associated with borrowing across products and/ or lenders. Further, through the circular dated September 17, 2013 the RBI emphasised that it is important to ensure that the borrowers are fully aware of associated benefits, with emphasis on indiscriminately passing on such benefits without altering the Rate of Interest (RoI). To address this, the RBI directed that when discounts are provided on product prices, the loan amount sanctioned should reflect the discounted price, rather than adjusting the RoI to incorporate the benefit.

The Consumer Credit (Disclosure of Information) Regulations 2010, which is a UK regulation defines the term APR as “annual percentage rate of charge for credit xx…. and the total charge for credit rules”. Further, as per the regulation, APR helps the borrowers compare different offers.

The Truth in Lending (Regulation Z) defines APR in the case of closed-end credit as a “measure of the cost of credit, expressed as a yearly rate, that relates the amount and timing of value received by the consumer to the amount and timing of payments made”.

In accordance with the definition as provided under the Key Facts Statement (KFS) for Loans & Advances APR includes the following:

c. Third-party service provider fees/charges (if collected by lender on behalf of third-party)

However, excluding contingent charges like penal charges, foreclosure charges, etc.

The intent is to have simple transparent, and comparable (STC) terms of the loan communicated to the customer upfront and hence, an illustrative example for the computation is provided. The illustration includes all charges that the RE levies.

In accordance with the definition provided, APR refers to the annual percentage rate of charge for credit along with the total charge for credit as provided under credit rule As per FCA handbook, the total charge for credit, applicable to an existing or potential loan agreement, encompasses the “comprehensive cost” incurred by the borrower.

“Comprehensive cost” includes all pertinent expenses such as interest, commissions, taxes, and any other associated fees that are obligatory for the borrower to be paid in conjunction with the loan agreement.

The FCA handbook further specifies that the total cost of credit includes fees to credit brokers, account maintenance expenses, payment method costs, and ancillary service fees. However, the total cost of credit to the borrower must not take account of any discount, reward (including ‘cash back’) or other benefit to which the borrower might be entitled, whether such an entitlement is subject to conditions or otherwise.

To summarise, the components of APR as per UK regulations are:

Further, the following shall not be considered while computing the APR and hence, will be disclosed separately:

Section 107(a)(1)(A) of the Consumer Credit Protection Act outlines how to calculate the annual percentage rate (APR) for credit facilities other than open-ended ones. The APR is the rate that, when applied to the unpaid balance of the loan, equals the total finance charge spread out over the loan’s term. This means that the APR represents the finance charge stretched over the entire duration of the loan. Finance charges, as defined by the Act, include various fees like interest, service charges, origination fees, credit investigation fees, insurance premiums, and other related charges.

Hence, the components of APR as per USA include:

d. Third-party service provider charges (such as insurance charges)

Upon examining international practices, it becomes evident that the APR encompasses more than just the rate of return; it also incorporates additional charges, often in the form of finance charges, which are annualised over the tenure of the loan. To summarise and consolidate the various laws discussed above, the following factors are considered in determining the APR:

However, certain elements which are not included in the calculation of APR:

While US law suggests factoring in discounts when calculating the APR, the stance established by the RBI is clear that: discounts cannot be incorporated when declaring the APR- as the same would be deceptive and shall not disclose the actual bifurcation of cost. Similarly, the perspective under UK law aligns with this stance to separately disclose the merchant discount and deduct it from the APR.

The RBI addressed regulatory concerns pertaining to zero percent loans facilitated by merchant subvention through its circular dated September 17, 2013. A key focus was ensuring borrowers full awareness of associated benefits, with emphasis on indiscriminately passing on such benefits without altering the Rate of Interest (RoI). To address this, the RBI directed that when discounts are provided on product prices, the loan amount sanctioned should reflect the discounted price, rather than adjusting the RoI to incorporate the benefit.

As discussed, the rate of interest is a part of the Annual Percentage Rate (APR), which is a measure used by borrowers to compare similar products from different lenders. If the lender changes the rate of interest, it affects the entire APR, making it difficult for customers to compare different loan products. It is important to understand that whether or not there’s a merchant subvention, the rate of return for the lender remains unchanged, hence the APR irrespective of there being any merchant subvention should also remain unaltered.

The RBI through its circular dated September 17, 2013 notified certain “pernicious” practices being followed by banks regarding merchant subvention, whereunder it had provided a specific way of disclosing the discount, which directed that when discounts are provided on product prices, the loan amount sanctioned should reflect the discounted price, rather than adjusting the RoI to incorporate the benefit. We have aimed to understand the requirement of by RBI via an example below:

Assume a lender offers a loan of Rs. 100,000 for 6 months to someone without charging any interest. However, the lender only gives Rs. 95,000 to the merchant, and the remaining Rs. 5,000 is covered by the merchant i.e., the interest component of the loan is recovered from the merchant. The lender still expects the borrower to repay Rs. 100,000. So, to show the true cost in the APR, the lender should disclose the actual amount lent, which is Rs. 95,000, instead of the full Rs. 100,000. Additionally, the lender should include the interest rate the lender is effectively earning, on Rs 95000. This transparency helps customers understand exactly what they’re paying, making it easier to compare different loan options and lenders.

The circular as mentioned above was directed specifically for banks, however, NBFCs should also be guided by the same principles. There could be another method of disclosing the discount provided by the merchant. For instance, considering the above scenario, let say, the lender provides a loan of Rs. 1,00,000 and the merchant provides a subvention of Rs. 5,000. In this case, the APR is disclosed considering the subvention received from the merchant. Accordingly, the lender shows the loan to be Rs.1,00,000 and the interest of Rs.5000 is shown as a discount to the borrower, which has been recovered from the merchant. Even though the disclosure is being done for the subvention amount, this method does not depict the actual IRR of the lender. .

Note, however, that the APR computation in the two approaches will be different. The Table below shows the two APRs:

| Particulars | First option | Second option |

| Cost of the asset | 100000 | 100000 |

| Less: Discount | 5000 | |

| Net cashflow of the lender | 95000 | 100000 |

| Interest on the cashflow for 6 months(IRR computed on monthly intervals) | 10.30% | 10% |

| Amount of interest | 5000 | 5000 |

| Less: Discount | -5000 | |

| Amount paid by the borrower | 100000 | 100000 |

As may be noted from the above computation, the first option, computing the APR on a loan size of Rs 95000 shows the APR as 10.30%, while the second approach makes a simple interest computation for 6 months @ 10%. The second approach shows a lower APR than the actual yield.

As per IND AS 109 Effective Interest Rate (EIR) has been defined as “The rate that exactly discounts estimated future cash payments or receipts through the expected life of the financial asset or financial liability to the gross carrying amount of a financial asset or to the amortised cost of a financial liability. When calculating the effective interest rate, an entity shall estimate the expected cash flows by considering all the contractual terms of the financial instrument (for example, prepayment, extension, call and similar options) but shall not consider the expected credit losses. The calculation includes all fees and points paid or received between parties to the contract that are an integral part of the effective interest rate,transaction costs, and all other premiums or discounts”.

The definition states that the calculation of EIR will include fees and points paid or received between the parties to the contract that are an integral part of the effective interest. While in normal course, this should refer to the cashflows emanating from the contract between the lender and the borrower. But in the present case, if only the cash flows between the lender and borrower is considered, it will give an EIR of 0%, indicating that the lender is not earning from the transaction, which is not the true picture. The subvention from the third party is an essential element in the entire scheme of things, it is through this the lender is recovering its income. Therefore, in the present context, a wider meaning should be ascribed to expression parties to the contract that are an integral part of the effective interest; and subvention received from third parties should also be considered for the purpose of determining the effective interest rate and the gross carrying amount of the loan.

The essence of the accounting definition is that cashflows that are “integral part” of the credit facility are included in EIR computation. While the subvention is paid by a third party and not a party to the contract, but it cannot be contended that the subvention is not an integral part of the loan. Taking such a view would lead to an impracticality showing the loan as having zero EIR.

The lure of zero percent interest rate loans is increasingly being used by vendors and lenders, in the realm of personal finance. However, it is crucial to understand the nuances and implications associated with such loans, particularly those facilitated through merchant subvention arrangements. Regulatory concerns have arisen regarding the transparency and fair disclosure of these loans, particularly in ensuring that the actual cost of credit is accurately represented to consumers. Distorting the interest rate structure compromises transparency and hampers informed decision-making by borrowers.

The components of the APR vary across different jurisdictions but universally include factors such as the rate of interest, associated charges, fees, and expenses related to the loan. However, discounts and contingent charges are typically excluded from the APR calculation. To uphold fair lending practices and ensure transparency, lenders must disclose the true cost of credit, including any merchant subvention arrangements, without altering the APR. This transparency empowers consumers to make informed choices and fosters trust in the financial system. A half truth reminds one of the Mahabharat anecdote of “Ashwatthama is dead”, suppressing whether it was elephant or man.

Watch our Webinar here: https://youtu.be/DBCROyxRJEY

Loading…

Loading…

Archisman Bhattacharjee and Manisha Ghosh I finserv@vinodkothari.com

On April 16, 2024, the Reserve Bank of India (RBI) issued Draft Directions on the Regulation of Payment Aggregators (PAs) (‘Draft PA Directions’) serving two primary purposes:

All-inclusive APR disclosure; third-party payments also included; no lender-induced changes during the validity period of KFS

-Team Finserv | finserv@vinodkothari.com

(Updated as on April 25, 2024)

The RBI vide its Statement on Developmental and Regulatory Policies dated February 08, 2024 announced its decision to mandate Regulated Entities (REs) to provide Key Fact Statement (KFS) for retail and Micro, Small & Medium Enterprise (MSME) loans.

Following the aforesaid, RBI issued a notification dated April 15, 2024 (Circular) to “harmonise” the instructions in this regard for all REs.

Since the intent of the RBI is to harmonise similar requirements, the KFS Circular overrides similar extant requirements in case of lending by banks to individuals, and digital lending.

Contents

| Meaning and Intent |

| Scope and Applicability |

| Contents of KFS |

| Meaning of Retail Lending |

| Meaning of MSME Lending |

| Validity period and Cooling off period |

| Annualised Percentage Rate |

| Other Requirements |

1. What is KFS?

2. How will KFS help transparency?

The intent is to have simple transparent, and comparable (STC) terms of the loan communicated to the customer upfront. The standardised format provides is simple and concise and has all the necessary details of the loan – annual percentage rate, fees, recovery mechanism, and associated risks in a straightforward format.

3. Has the format of KFS and other disclosures been prescribed?

Yes, the format for KFS has been prescribed in Annex A of the Circular. Further, formats for computation of APR and amortization schedule to be given to the borrower has also been prescribed in Annex B and C of the Circular respectively.

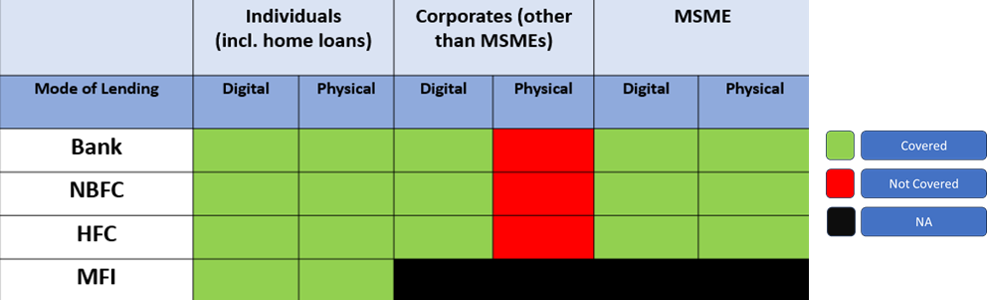

4. Which all entities are covered by the new requirement?

The following entities will be covered under the scope of the Circular –

5. In what kind of loans will KFS be mandatorily applicable?

Coverage of the Circular

6. Will the KFS norms be applicable on Housing Loans as well?

In case of housing loans extended by HFCs, sharing of most important terms and conditions (MITC) are applicable (Para 85.8 read with Annex XII of the HFC Master Directions). MITC is akin to KFS, however, the format of KFS is more focused on interest rate and other charges as well as a few qualitative terms of the loan, whereas MITC provides several other relevant details.

The Circular is addressed to HFCs as well. Further, meaning of “retail lending” (see below) includes home loans as well. In the absence of any other clarification, we would advise lenders to prepare MITC as well as KFS in case of home loans.

7. What happens to the existing circulars on Digital Lending and Microfinance Lending?

The existing provisions for KFS and APR in the Digital Lending Guidelines, MFI Directions and Display of Information by Banks circular shall stand repealed.

8. When does the new requirement become applicable?

The Circular is applicable with effect from October 1, 2024 to all new retail and MSME term loans sanctioned. Further, digital loans, MFI loans and bank finance extended to individuals post the said applicability date would also require to be aligned with the new requirement.

It would, therefore, appear that extant requirements continue to apply from now until 30th September.

It would actually be better for lenders to transition into the new requirement before 1st October, at least on a parallel basis – this will serve as a dry run upto the new requirement from 1st October.

9. In case of banks, what is the applicability of this Circular?

The KFS Circular applies to banks for (a) all loans to individuals, as covered by Display of information by banks; (b) any loans to MSMEs; (c) any microfinance loans; (d) any digital loans.

10. Whether loans under digital lending need to comply with the Circular or will they continue to follow extant guidelines?

The Circular applies to digital loans as well. In fact, it repeals Para 5.1 and 5.2 of the digital lending guidelines dealing with APR and KFS provisions. However, until October 1, 2024, the existing guidelines may continue to be followed.

11. In case of co-lending transactions, is the compliance on the originating co-lender or the funding co-lender?

While specific details of co-lending arrangements are required to be shared with the borrower; the borrower interface is typically done by the originating co-lender. Hence, the originating co-lender should be making the requisite disclosures. Funding co-lenders may ensure that the originating co-lender is making the requisite disclosures.

12. What are the contents/format of KFS?

13. KFS is intended to be a “standardised format”. What is the significance of the format being standardised? Does the lender have the discretion to add/delete fields?

The Circular prescribes for a “standardised format” for KFS. The intent behind this standardisation is to enhance transparency and to facilitate the comparability of the loan terms offered by different lenders. The RBI refers to the KFS as a “standardised format”. Therefore, in our view, the comparability of the KFS will be compromised if it was loaded with new details or subjectivities not envisaged in the standard format.

14.Can the lender, for instance, add clauses like “this is not a sanction letter; the grant of the loan is eventually subject to sanction by the lender’s internal credit committee”, or similar conditionalities?

It is important to note that the format of the KFS is standardised. Therefore, the KFS is expected to remain limited to the fields given in the standardised format. However, the KFS may be an annexure to a sanction letter – see below.

15. Is the present practice of issuing sanction letter redundant? Can a lender issue a sanction letter in addition to KFS?

The KFS is a summarised version of the terms of the loan. However, the grant of the loan itself may have several conditions, typically comprised in the sanction letter. The RBI’s Fair Practices Code refers to a sanction letter – NBFCs shall convey in writing to the borrower in the vernacular language as understood by the borrower by means of sanction letter or otherwise, the amount of loan sanctioned along with the terms and conditions including annualised rate of interest

Hence, first, the sanction letter does not become redundant. Secondly, if there are conditionalities or compliances relating to the loan, the same may be contained in the sanction letter. For example, the borrower may be required to complete some conditions precedent. There are normally several conditions subsequently, commonly called “post-disbursement conditions”. Each of these may be contained in the sanction letter.

15A. The charges mentioned in KFS are an amount X. The KFS also says this amount can be varied by the company. Can the variation of this amount in future be done without the borrower’s consent?

Charges mentioned in KFS may relate to charges payable at the time of the taking the loan, charges over the term of the loan, and may include contingent charges too. Para 8 of the Circular also says that whatever is not disclosed cannot be charged without the explicit of the borrower.

Therefore,

(a) there is no question of charging something that is not a part of the KFS, without the borrowers’ explicit consent.

(b) as for amounts already disclosed, while the company would have reserved the right to vary, however, in our view, these charges cannot be varied as this would disrupt the comparability and standardisation of the KFS.

15B. The KFS circular applies from 1st October 2024 – can the company impose charges not already a part of the loan agreement and make them applicable before 1st October?

Since the KFS circular is coming with the perspective of fairness in practices, and given the fact that the prospective applicability date is merely to allow companies time to adhere to and transition to the new paradigm, the move as proposed will be seen as a way to take undue advantage of the applicability date.

16. Does the issuance of a KFS amount to a binding commitment on the part of the lender to lend?

The language of Explanation below clause 5 of the KFS Circular may give such an impression. It says: “Validity period refers to the period available to the borrower, after being provided the KFS by the RE, to agree to the terms of the loan. The RE shall be bound by the terms of the loan indicated in the KFS, if agreed to by the borrower during the validity period.”

However, in our view, the KFS is only the terms of the loan. The binding force of the KFS during the “validity period” is only on the terms, and not on the grant of the loan itself. If the conditions precedent for availing the loan have been satisfied, the lender will be bound by the terms as contained in the KFS; however, the grant of the loan itself is based on conditions precedent may still form part of the sanction letter.

17. Is it permissible for REs to include additional terms in the KFS alongside those outlined in the standardized format?

The purpose of requiring a standardized KFS for borrowers is to guarantee consistency in loan terms across different lenders, enabling borrowers to make fair comparisons. Therefore, we believe that REs should avoid subjectivity and strictly follow the standardized format outlined in the notification.

18. Can REs charge fees/charges not mentioned in the KFS?

The answer to this is positive as REs can charge fees/charges not mentioned in the KFS with the explicit consent of the borrower.

19. What are Equated Periodic Installments and how are they computed?

Equated Periodic Installment (EPI) refers to a fixed amount comprising both principal and interest repayments that a borrower must pay at regular intervals over a predetermined number of periods to repay a loan fully. These payments ensure the gradual amortization of the loan. When these installments are made on a monthly basis, they are commonly known as Equated Monthly Instalments (EMIs).

20. What is the meaning of retail loans?

Further, it may be noted that credit card receivables, though extended to individuals, are excluded from the purview of the Circular.

21. Give some examples of loans which are not retail lending?

Some examples of loans not considered as retail lending are –

22. What is lending to MSMEs?

Loans to entities satisfying the following conditions and holding Udyam registration as MSMEs:

| Investment in Plant & Machinery | Investment in Equipment | |

| Micro Enterprise | Upto 25 lakh | Upto 10 lakhs |

| Small Enterprise | 25 lakh – 5 crore | 10 lakhs – 2 crore |

| Medium Enterprise | 5 crore – 10 crore | 2 crore – 5 crore |

23. Are all loans to MSMEs covered under the scope of the Circular?

The Circular explicitly states its applicability solely to “MSME Term Loans”. Therefore, we understand that working capital loans or lines of credit extended by REs to MSMEs fall outside the scope of the Circular.

24. What is a Validity Period?

The validity period refers to the timeframe within which the borrower, upon receiving the KFS from the RE, can agree to the loan terms. In case the borrower accepts the terms outlined in the KFS during this validity period, the RE is bound by these terms as indicated in the statement.

25. How long should the Validity Period be?

In terms of the notification, the KFS must possess a validity period of a minimum of three working days for loans with a tenor of seven days or more, and one working day for loans with a tenor of less than seven days.

26. What if the customer does not accept the terms during the validity period?

The RE is only bound by the terms mentioned in the KFS if the same is accepted by the borrower during the validity period. Accordingly, if the borrower fails to accept the KFS terms during the validity period, the RE reserves the right to change the terms after the end of such period.

27. Where will the validity period be disclosed?

Going by the standardised format for KFS provided by RBI, there is no requirement to mention the validity period in the KFS. However, to ensure that the borrower is aware of the same, the validity period can be mentioned in the covering note or sanction letter.

28. What will be considered a Working Day?

Working days would mean Monday to Friday of the week excluding public holidays.

29. What is the difference between the validity period and cooling off period in case of digital loans?

| Validity Period | Cooling off Period |

| Applicable for digital as well as physical loans. | Applicable only for digital loans. |

| Pre-disbursement phase | Post-disbursement phase |

| Provided to the borrower to accept the terms of the loan as indicated in the KFS | Provided to the borrower for exiting digital loans without any pre-payment penalty in case a borrower decides not to continue with the loan. |

| The RE is bound by the terms of the loan if accepted by the borrower during the validity period. | Grants the borrower the right to repay the principal and the proportionate APR during this period. |

30. Is it necessary to provide a validity period to borrowers before approving top-up loans, even if the terms of the top-up loan are identical to those of the existing loan?

Yes, the notification is applicable from October 01, 2024. Accordingly, after this date, KFS should be provided for all top-up loans. Subsequently, following this date, KFS should be furnished for all top-up loans. As a result, borrowers must also be provided with a validity period to accept the terms of the top-up loan.

31. What is APR?

Annual Percentage Rate (APR) is the annual cost of credit to the borrower that includes interest rate and all other charges associated with the loan.

32. What are the components of APR?

The following are the components of APR –

Excluding

33. Are charges recovered on behalf of third party also a part of the lender’s APR?

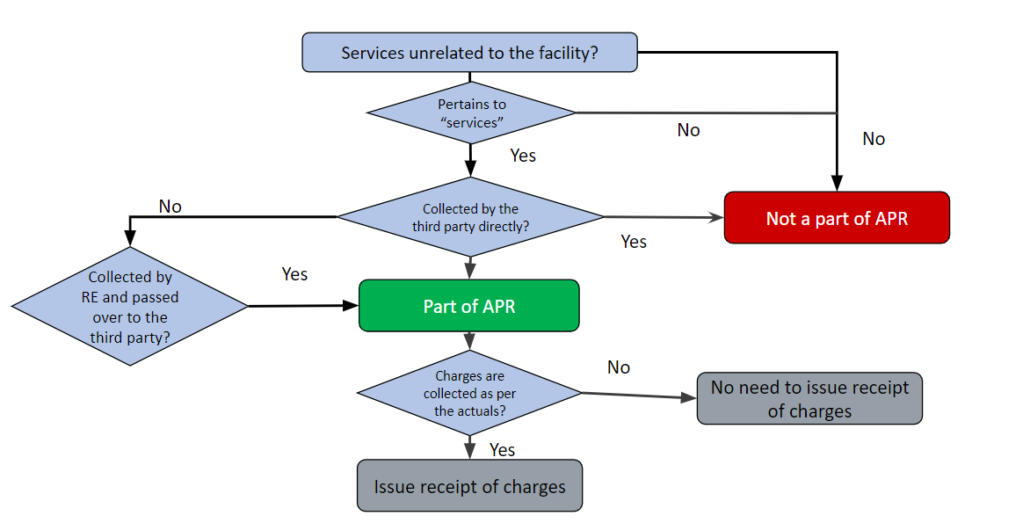

Yes, the charges that borrowers pay to the RE, which are passed on to third-party service providers based on actual expenses, like insurance or legal charges, will also be included in the calculation of APR. See the discussion below.

33A. What is the meaning of the expression “service providers”? Can statutory charges such as stamp duty etc also be a part of APR?

The Circular uses the following language: “Charges recovered from the borrowers by the REs on behalf of third-party service providers on actual basis, such as insurance charges, legal charges etc., shall also form part of the APR and shall be disclosed separately.” In our view, the expression “service providers” has been used consciously, to refer to some entities providing services either in relation to the loan, or the subject matter of the loan.

Stamp duty is a statutory charge and is in the nature of a tax/duty payable to the statutory authorities. It cannot be contended that the state is providing any specific service either in relation to the loan or the subject matter of the loan. Hence, in our view, it is only the charges payable in respect of services, recovered by the lender, which should be forming part of the APR.

34. Should charges not directly linked/integrated with the loan, also form part of the APR? Will the answer remain the same even if such charges are deducted from the disbursement amount ?

As regards the inclusion of charges within APR, the essential basis should be the definition of APR, defining it as “the annual cost of credit to the borrower which includes interest rate and all other charges associated with the credit facility”. Therefore, a lender providing a credit facility imposes charges, in addition to interest, by whatever name called, including for third party services which are related to the credit facility or the subject matter of the credit facility, should be forming part of the APR. This will, of course, not include contingent charges such as delinquency penalties, repossession charges, etc.

The charges imposed by lenders may, illustratively, be as follows:

The charges for third-party services, which are typically related to the loan or the subject matter of the loan may be as follows:

The mode of collection of these charges does not matter – that is, these may be charged separately, or may be deducted from the disbursement.

35 .Whether statutory dues would form part of APR?

See answer above.

36. If, for instance, the borrower is required to place a security deposit/cash collateral, which is free of interest, is the impact of the same also captured in the APR?

While the placing of the security deposit may impact the overall cost of the borrower, but in our view, it is inappropriate to incorporate this cashflow as a part of the loan cashflows.

37. In case of loans for vehicles, it is common practice to require the borrower to make a down payment to the supplier. Is the same also captured in the APR?

The APR is computed on the loan amount; down payment is not a part of the loan.

37A In which all cases insurance charges paid to the third party will form a part of the APR ?

We take some illustrative situations below:

37B If cash flows are not at uniform period of time, how will the APR be calculated?

If cash flows are not at uniform periods of time, lenders generally use the XIRR method to calculate interest. Note that IRR formula fails to capture non-equidistant cashflows. However, XIRR is annually compounded rate. It may be converted into a monthly rate by using “nominal” formula, or de-compounding from a year to a month, and then multiplying the result by 12. It should be noted that XIRR is generally greater than APR.

37C In case of a demand loan, will the APR be computed based on the sanctioned amount or on the disbursed amount?

For demand loans, the APR should be calculated based on the sanctioned amount. This reflects the potential maximum cost of credit to the borrower if the borrower chooses to utilize the entire sanctioned amount.

38. Lenders quite often get payouts or subvention from third parties, say vendor, OEM, insurance companies, etc., which supplement the returns of the lender. Are these also disclosed as a part of the APR?

In our view, there is no reason to include payouts by third parties, that is, other than the borrower, as a part of the borrower’s cost of credit.

Having said this, if there are discounts/subventions being given by a vendor, the lender should make a fair disclosure of the discount, showing the same as a deduction from his cost of interest.

Graphical illustration summarising APR

39. What are the disclosure requirements?

Following additional disclosures are to be made by the REs along with KFS –

40. What are the other requirements as per the Circular?

As per the Circular REs are obligated to do the following –

41. In case of digital loans how will RE be able to explain the contents of KFS to the borrower?

For digital loans, REs may have the option to exhibit a pre-recorded video within their application or present a document that elucidates the contents of the KFS.

42. What will be the impact of this circular in existing loans?

REs will not be required to issue KFS in existing loans. However, compliance with this circular will be required for any new loan or top-up loan provided to existing customers.

43. Para 7 of the Circular provides that charges recovered from the borrowers by the REs on behalf of third-party service providers on actual basis shall also form part of the APR and has to be disclosed separately. So does this imply that any amount over and above the actuals will not form a part of APR?

In case the RE is collecting charges that are over and above the actuals, the same is int he form of charges levied by the RE itself and by default should always be included in the APR computation. However, in case of collection of charges on actuals on behalf third-party service provider, the RE shall be required to provide receipt and related documents will have to be provided to the borrower, within a reasonable time.

44. The KFS also needs to disclose the phone number and email id of the grievance redressal officer. So, will it be sufficient compliance with the regulations if a generic email id of the grievance redressal cell is provided ?

As per the KFS format provided, a generic email id and phone number can be provided by the RE in the KFS subject to the customer complaints being redressed within one working day.

45. The KFS must reveal whether the loan is currently or potentially subject to transfer to another RE entity or securitization. Therefore, if an RE fails to disclose this information while providing the KFS to the borrower, does it mean the RE is barred from transferring or securitizing the loan?

In case, the RE has revealed its intention to not transfer/securitise the loan but subsequently after disbursal intends to transfer/securitise the loan, it has to obtain the borrowers approval.

46. The Circular has prescribed that if the charges/fee payable cannot be determined prior to sanction, an upper ceiling may be prescribed by the RE. How will this upper ceiling be determined by the RE ?

The upper ceiling should be mentioned by the REs considering the maximum amount of charges that can be levied.

47. The Circular also extends to all HFCs. Henceforth, do HFCs solely need to furnish the KFS, or is there still an obligation to supply the MITC to borrowers as per the HFC directions?

The HFC directions require MITC to be provided to all borrowers for home loans. Additionally, the relevant provision of the HFC directions that mandates MITC provision has not been repealed. Therefore, until further regulatory clarity is provided on the subject, HFCs are obligated to furnish both MITC and KFS to borrowers.

48. What are the actionables for REs?

The immediate actionables for an RE shall be as follows:

Our other resources on the topic are:-

Watch our Webinar on the topic here:

Team Finserv | finserv@vinodkothari.com

Three rating agencies reported different numbers, but barring the exception of one, the other two hold that the volumes in FY 24 have been lower than the last peak, FY 20. FY 20 was exceptional – it was the year post ILFS, where all balance sheet lenders and investors to NBFCs rushed to off balance sheet transactions, as bankruptcy remoteness became the key objective. The next year was an exception again – Covid wave. However, FY24 was a year of brisk economic lending, and retail credit expansion. There were, therefore, strong reasons that the watermark reached in FY 20 will be crossed. However, it just remained slightly off that, or, if the numbers given by Care Ratings are to be trusted, marginally crossed the mark.

One obvious reason is the merger of HDFC with HDFC Bank. The two contributed major chunks to Direct assignment volumes. Estimated volume lost due to the merger is around INR 40000 crores[1]. However, the other instrument that has dug a shovel in securitsation/ DA volumes is the rise in co-lending.

Read more →Vinod Kothari | finserv@vinodkothari.com

From lenders’ perspective, demand and call loans seem to be as liquid as money in a bank fixed deposit, and yet an option to earn substantially higher interest rates. The practice of demand loans exists in the financial marketplace; at the same time, it is often commonplace in the case of intra-group loans. However, there are various risks, considerations and regulatory implications in case of such lending.

This article goes beyond Reg. 28 of the Scale Based Regulations of the RBI and discusses economics, policy issues, liquidity and credit risk considerations, both for the lender and the borrower, as well as issues like NPA treatment, expected credit losses, etc.

The word “call money” is typically used in the banking sector for very short-term loans, which are callable at any time by the lender. Demand loan is a term usually associated with longer-term loans, though with no fixed repayment date, that is to say, the loan may be demanded back by the lender at any time. The following features of demand/call loans are discernible:

– Team Finserv | finserv@vinodkothari.com

The Reserve Bank of India on 19th December 2023 issued a notification[1] imposing a bar on all regulated entities[2] (REs) with respect to their investments in AIFs. We had covered the same in our earlier write-up. The Circular has already created some bloodshed as several banks took a hit in their Q3 results. Though late, yet welcome, the RBI has now come with some relief by a March 27 2023 circular. The following Highlights are based on the original circular, as amended by the March 27th circular :-

Direct or indirect investments:

Investments through mutual funds and FOFs exempt:

Priority distribution model or structured AIFs

In our view, there is a need to review the regulatory mechanism for AIFs, as currently, AIFs are being used as instruments of regulatory arbitrage.

[1] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12572&Mode=0

[2] Commercial Banks (including Small Finance Banks, Local Area Banks and Regional Rural Banks), Primary (Urban) Co-operative Banks/State Co-operative Banks/ Central Co-operative Banks, All-India Financial Institutions, Non-Banking Financial Companies (including Housing Finance Companies)

Other articles related to the topic:

-Archisman Bhattacharjee I finserv@vinodkothari.com

Loading…

Loading…

– Vinod Kothari | finserv@vinodkothari.com

One of the most important, and often the most complicated issues in applying IndAS 109 to financial assets, particularly loan portfolios, is to the computation of expected credit losses (ECL). The following points need to be noted about ECL computation: