Harmonising computation for concentration limits across NBFCs

/1 Comment/in Financial Services, Housing finance, NBFCs /by Kaushal Shah– Kaushal Shah, finserv@vinodkothari.com

Reserve Bank of India (RBI) has recently announced amendments to the Credit and Investment concentration norms, specifically targeting Base and Middle Layer Non-Banking Financial Companies (NBFCs). The circular, dated January 15, 2024, brings about notable changes aimed at ensuring uniformity and consistency across NBFCs while computing the concentration norms.

What has RBI done?

For Middle Layer NBFCs (NBFC-MLs) :

- In addition to the use of Credit Default Swaps (‘CDS’), RBI has now allowed NBFC MLs to offset the aggregate exposure with the following additional Credit Risk Transfer (CRT) instruments:

- Cash margin/caution money/security deposit held as collateral on behalf of the borrower against the advances for which right to set off is available;

It is pertinent to note that, as per para 84 of the SBR Directions, already requires the NBFC for the purpose of assignment of risk weight to net off the amount of cash margin/ caution money/security deposits held as collateral against the advances out of the total outstanding exposure of the borrower.

- Central Government guaranteed claims which attract 0 per cent risk weight for capital computation;

- State Government guaranteed claims which attract 20 per cent risk weight for capital computation; and

- Guarantees issued under Credit guarantee Schemes of Credit Guarantee Fund Trust for Micro and Small Enterprises, Credit Risk Guarantee Fund Trust for Low Income Housing and individual schemes under National Credit Guarantee Trustee Company Ltd

Housing finance companies regulatory framework: RBI proposes sectoral harmonisation

/0 Comments/in Financial Services, Housing finance, RBI /by Team FinservChirag Agarwal, finserv@vinodkothari.com

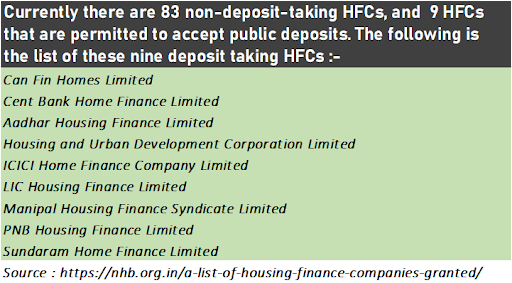

The RBI has proposed changes in the regulations applicable to housing finance companies (HFCs). While larger part of these proposed changes will impact deposit-taking HFCs, there are some provisions and privileges, currently applicable to NBFCs only, which are being extended to HFCs as well.

It may be recalled that the Finance Act, 2019 had moved the regulatory powers over HFCs to the RBI, whereas supervision remains with the NHB. Accordingly, RBI vide its Press release dated August 13,2019 issued direction that HFCs will henceforth be treated as Non-Banking Financial Companies (NBFCs) for regulatory purposes and RBI will carry out review of extant regulatory framework applicable to HFCs and come out with new revised regulations in due course. On October 22, 2020, the RBI issued a circular titled “Review of regulatory framework for Housing Finance Companies (HFCs)”, introducing a revised regulatory framework for HFCs. The circular emphasized the need for further harmonization between the regulations of HFCs and NBFCs over the next two years to ensure a smooth transition with minimal disruption. As part of this initiative, the RBI has released, on 15th January, 2024, a draft circular titled “Draft circular on Review of regulatory framework for HFCs and harmonisation of regulations applicable to HFCs and NBFCs” for public comments. The objective is to streamline the regulations governing HFCs, aligning them more closely with the regulatory framework applicable to NBFCs.

The proposed changes relate to both acceptance of deposits, and otherwise. Some of the proposed changes will be applicable to all HFCs. Below, we have provided a table comparing the guidelines applicable to NBFCs with the modifications proposed for HFCs to align them with the guidelines for NBFCs. Our point-wise analysis on the proposed changes is provided below:

Read more →Commercial Real Estate exposures: Lending risks and Regulatory focus

/1 Comment/in Banks, Financial Services, Housing finance, NBFCs /by Team Finserv– Team Finserv | finserv@vinodkothari.com

Background

Lending backed by value or liquidity of certain types of assets is regarded as sensitive sector exposure and calls for a special focus of the lending institution from a risk management perspective. Regulators view it with attention, for reasons of the vulnerability of these exposures to cyclical price changes, as also the contribution of such lending to asset bubbles and systemic instability. Capital market and commercial real estate lending are two instances. Lending to capital markets (equity shares) may cause an excess flow of liquidity into stocks, thereby creating an asset bubble. When the bubble bursts, lending goes bad, and of course with several other systemic implications. Same is the case with commercial real estate. Flow of easy or cheap money causes investor interest in CRE to build up, thereby causing prices to spiral up, resulting into asset bubble.

It is for this reason that CRE exposures have always been seen by regulators with concern.

Read more →Non-consideration of acquired or transferred home loans for HFC principality test

/0 Comments/in Financial Services, Housing finance /by Vinod Kothari Consultants-Financial Services Division (finserv@vinodkothari.com)

The RBI issued Master Directions for HFCs on August 13, 2019. The Master Directions define an HFC as one which is principally engaged in the business of providing housing finance. To prove the principality of business, an HFC must have at least 60% of its total assets deployed in the housing finance business, and 50% of its total assets must be deployed in individual housing finance.

Certain leading HFCs in the market have not included acquired housing finance assets in the computation of PBC. This practice is based on the RBI’s stance of not allowing HFCs to count housing loans acquired through direct assignment as a part of housing finance assets.

Interestingly, as informed by the HFCs, the RBI is also not allowing the originator to count the assets as a part of its housing finance assets once they are sold. Therefore, this leads to a conundrum, housing loans assigned are neither counted as housing finance assets in the books of the seller nor in the books of the buyer.

A representation was made by the Indian Securitisation Foundation requesting the RBI to provide a clarification regarding the inclusion of acquired housing finance assets in the computation of PBC, which has been turned down by the RBI.

This is likely to have an adverse impact on the secondary market for housing loan loans which is not in line with the admitted policy of encouraging the secondary market in home loans.

In the same line of argument, where home loans have been securitised, they will be removed from the home loan book for the purpose of principality test, both for the originator and for the investor.

The above stand taken by the RBI is ununderstandable, since a direct assignment is nothing but an inorganic way of creating a home loan book. Even for the purpose of priority sector lending requirements, loans acquired by way of direct assignment are taken as priority sector loans in the hands of the buyer, based on their original eligibility for the same.

See representation made to the RBI here- https://indiansecuritisation.com/product1/21642683272.pdf

NHB Master Circular on HFC Returns

/0 Comments/in Financial Services, Housing finance /by Staff– Team Finserv | finserv@vinodkothari.com

Relevant Links:

- NHB Master Circular dated December 31, 2021

- Formats of the returns and statements specified in the Master Circular

- ORMIS Portal

- HFC Manual for filing on ORMIS Portal

- Master Direction – Non-Banking Financial Company – Housing Finance Company (Reserve Bank) Directions, 2021

FAQs on Transfer of Loan Exposure

/0 Comments/in Banks, Financial Services, Housing finance, NBFCs, RBI, Securitisation /by StaffThe RBI has consolidated the guidelines with respect to transfer of standard assets as well as stressed assets by regulated financial entities under a common regulation named Reserve Bank of India (Transfer of Loan Exposures) Directions, 2021 (“Directions”).

The Directions divided into five operative chapters- the first one specifying the scope and definitions, the second one laying down general conditions applicable on all loan transfers, the third one specifying the requirements in case of transfer of loans which are not in default, that is standard assets, the fourth one provides the additional requirement for transfer of stressed assets and the fifth chapter is on disclosure and reporting requirements.

Under the said Directions, the following entities are permitted as transferor and transferee to transfer loans-

We bring you this frequently asked questions on Transfer of Loans to assist you better understand the guidelines.

The file can be downloaded at this link: https://mailchi.mp/887939b2f979/qa32ogwo2t

We have also published FAQs on Securitisation of Standard Asset, the contents of FAQs can be accessed here and the file can be downloaded at this link.

Summary of Scale Based Regulations

/0 Comments/in Financial Services, Housing finance, NBFCs, RBI, Uncategorized /by StaffA layered approach to NBFC Regulation:

/0 Comments/in Factoring, Financial Services, Housing finance, IPOs and listing, NBFCs, RBI /by StaffFAQs on Securitisation of Standard Assets

/0 Comments/in Accounting and Taxation, Accounting Standards, Financial Services, Housing finance, Indian Accounting Standards (Ind AS), NBFCs, RBI, Securitisation, Uncategorized /by StaffOn September 24, 2021, the RBI released Master Direction – Reserve Bank of India Securitisation of Standard Assets) Directions, 2021. The same has been released after almost 15 months of the comment period on the draft framework issued on June 08, 2020. This culminates the process that started with Dr. Harsh Vardhan committee report in 2019.

It is said that capital markets are fast changing, and regulations aim to capture a dynamic market which quite often leads the regulation than follow it. However, the just-repealed Guidelines continued to shape and support the securitisation market in the country for a good 15 years, with the 2012 supplements mainly incorporating the response to the Global Financial Crisis. Read more →