– By Harsh Juneja | Executive (corplaw@vinodkothari.com)

(Updated as on February 03, 2023 by Lovish Jain | Executive)

Background

Section 135(5) of the Companies Act, 2013 (‘the Act’) requires every eligible company [as per section 135(1)] to spend at least 2% of the average of net profits of immediately preceding 3 financial years towards Corporate Social Responsibilities(‘CSR’) activities. The CSR spending may sometimes include contributions made to NGOs or other beneficiaries, or money paid to implementing agencies. However, quite often, the expense may relate to procurement of goods or services which are applied to one or more CSR activities. This procurement of goods or services comes with the tax cost, viz., GST. So the question is, does this GST paid, while acquiring goods or services, give rise to an input tax credit, such that the same may be claimed as a set off? A related, and more important question is, whether CSR expense for the purpose of sec. 135 (5) be the amount net of the ITC, if the ITC is claimable, or the gross amount paid?

Input Tax Credit

Eligibility

Section 16(1) of the Central Goods and Service Tax (‘CGST Act, 2017’) prescribes the eligibility criteria for taking Input Tax Credit. It states that “Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.”

Until the Budget 2023 announcement, there was no explicit provision clarifying the position whether input tax credit would be available for acquiring goods or services for carrying out CSR activities. In the Finance Bill, 2023, a proposal has been made for amendment in section 17 of the CGST Act, 2017 to disallow the availability of input tax credit for expenditure made towards CSR activities. Please refer to our article on the same

There have been rulings by Appellate Tribunal and Advance Rulings under GST w.r.t. the same.

Hon’ble CESTAT Mumbai, in the case of M/s Essel Propack Ltd. vs Commissioner of CGST, Bhiwandi, gave a view that the CSR gives a company an economically, socially and environment sustainability in the society in the long run, as a company can not operate without providing benefits to its stakeholders. Therefore, it held that if companies are unable to claim input services in respect of activities relating to business, production and sustainability of the companies themselves would be at stake.

Hon’ble High Court of Karnataka, in its judgement, in the case of M/s Commissioner of Central Excise, Bangalore vs. Millipore India (P) Ltd., also was of view that CSR Expenses are mandatorily incurred by employers towards benefit of the society and “to maintain their factory premises in an eco-friendly manner”. Therefore, the tax paid on such services shall form part of the costs of the final products and thus, the company can claim these taxes paid as input services.

Uttar Pradesh Authority for Advance Ruling (‘AAR’) in the matter of M/s Dwarikesh Sugar Industries Ltd held that a company is mandatorily required to undertake CSR activities and thus, forms a core part of its business process. Hence, the CSR activities are to be treated as incurred in “the course of business”.

Telangana State AAR in the matter of M/s. Bambino Pasta Food Industries Private Limited has clearly held that expenditure made towards CSR, is an expenditure made in the furtherance of the business. Hence the tax paid on purchases made to meet the obligations under CSR will be eligible for ITC.

Section 135(7) is a penal provision under the Act which deals with penalty on non-compliance of section 135(5) and (6). It was observed by the AAR that a Company fulfilling eligibility criteria under section 135(1) of the Act is required to mandatorily spend towards CSR and thus, must comply with these provisions to ensure smooth run of business.

Thus, Uttar Pradesh AAR held that the expenses incurred by the Company in order to comply with requirements of CSR under the Act qualify as being incurred in the course of business and are eligible for ITC in terms of the Section 16 of the CGST Act, 2017.

Contrary ruling: Free Supply of Goods

Section 17(5)(h) of the CGST Act excludes “goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples” for the purpose of availing ITC on payment of GST. The term ‘gift’ is not defined anywhere in the CGST Act. However, in layman’s language, gift means a thing given willingly to someone without payment.

In the matter of M/s. Polycab Wires Private Limited, Kerala AAR held that distribution of necessaries to calamity affected people under CSR expenses shall be treated as is if they are given on free basis and without collecting any money. Hence, for these transactions, it was held that ITC shall not be available as per section 17(5)(h).

However, a contrast has been drawn in the Uttar Pradesh AAR Ruling towards goods given as ‘gift’ and given as a part of CSR activities. Gifts are voluntary and occasional in nature whereas CSR expenses are obligatory and regular in nature. AAR held that since CSR expenses are not incurred voluntarily and have to be incurred regularly, they are not to be treated as ‘gift’ and thus, should not be restricted under section 17(5)(h) for claiming ITC.

One may also refer to explanation 2 to Section 37(1) of Income Tax Act, 1961, as also cited by Hon’ble High Court of Delhi in the matter of Pr. Commissioner of Income Tax vs. M/s Steel Authority of India Ltd which provides that, any expenditure incurred by an assessee on the activities relating to CSR referred to in section 135 of the Companies Act, 2013 shall not be deemed to be an expenditure incurred for the purposes of the business or profession.

Availing Benefit through Beneficiary

A company contributes a sum towards a beneficial organisation such as NGOs, Charitable Trusts and Section 8 Companies (‘implementing agencies’) towards fulfillment of CSR activities. However, these implementing agencies also need to hire services of vendors to complete these activities. These vendors charge GST on the services rendered by them. Since these implementing agencies often do not generate any output, the question raises can these organizations also claim ITC on the services rendered by them?

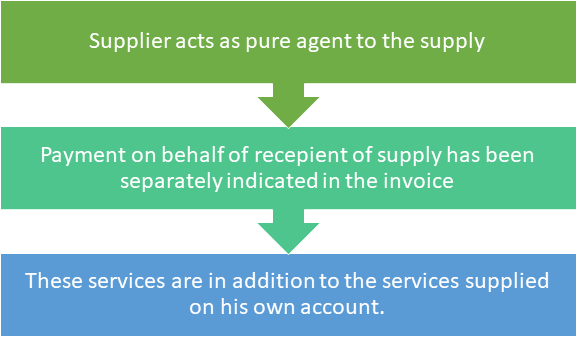

There is a concept of ‘pure agent’ in GST. Explanation to Rule 33 of CGST Rules, 2017 prescribes that a pure agent means a person who –

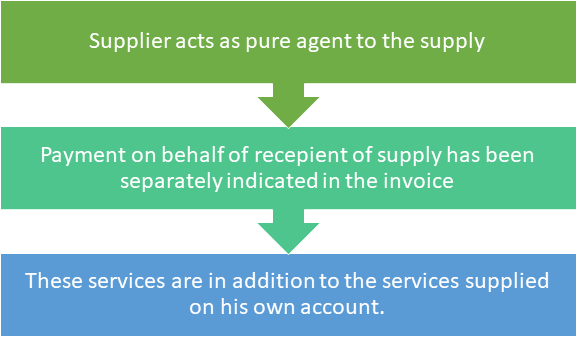

The implementing agencies fulfill this eligibility criteria of being a ‘pure agent’. Rule 33 also contains some conditions on the fulfilment of which, expenses incurred by the supplier as a pure agent of the recipient of the supplier of goods or services, are excluded from the value of supply-

In our case, if an implementing agency avails any goods or services from a vendor to fulfil the CSR activities for a company, then the payment of any such amount to the vendor shall be treated as a supply made as a pure agent by the implementing agency on behalf of recipient of supply, i.e., the company. Thus, these expenses incurred by the implementing agencies shall be excluded from the value of supply and therefore, are not liable for payment of GST.

CSR Contribution: Pre-GST or Post-GST?

The Act does not clarify that the amount to be contributed towards CSR activities should be inclusive or exclusive of taxes. However, it seems that since GST is charged on supply of goods and services, irrespective of the intention of social benefit, the amount contributed towards CSR can be both inclusive and exclusive of GST. Having said that, the question still pertains on the inclusivity of the amount of GST paid towards the amount of CSR expenditure for the purpose of section 135(5) of the Companies Act, 2013.

Conclusion

While the rational view would be, expenses incurred on GST for fulfilment of CSR activities should be eligible for claiming input tax credit, however, the Finance Bill, 2023 proposes otherwise. The effective date of the amendment will be 1st April 2023. Hence, once the Budget proposals are passed, any acquisition of goods or services for CSR purposes will be denied the benefit of GST set off. So the next question is whether the CSR expenditure would be inclusive of GST. We deal with the same citing illustrations in our article.