Revised Regulatory Framework for IDs of listed entities in India

-Independence becomes stricter!

Payal Agarwal, Executive ( payal@vinodkothari.com )

Updated on 6th August, 2021

Introduction

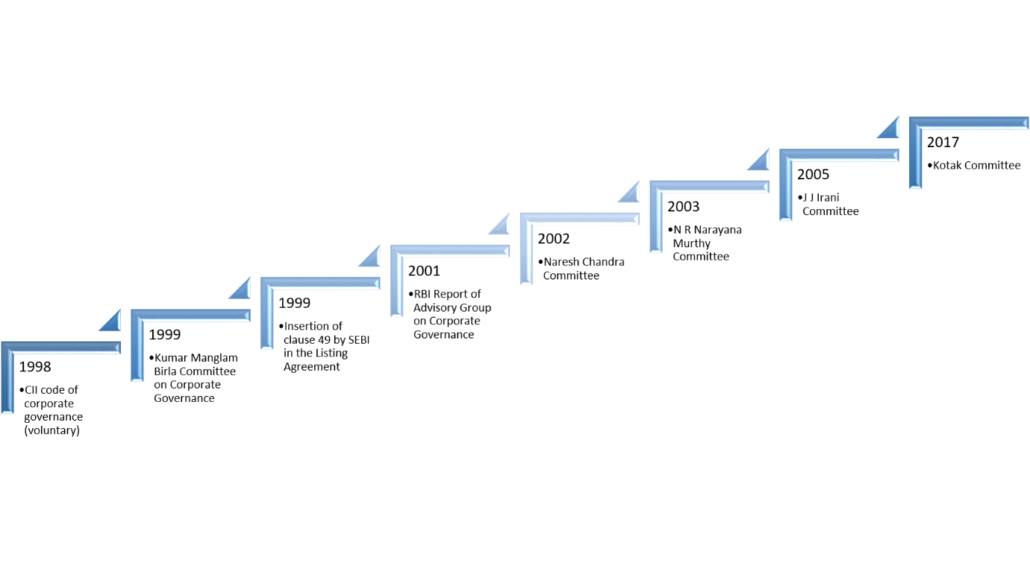

The concept of independent directors was first introduced in the Desirable Corporate Governance Code issued by the Confederation of Indian Industry[1] followed by the recommendation in the Corporate Governance Committee constituted by SEBI and headed by Mr. Kumar Mangalam Birla[2] (Kumar Mangalam Birla Committee). Later in the year 2000, SEBI incorporated the recommendations of the Kumar Mangalam Birla Committee under Clause 49 of the Listing Agreement[3]. Independent directors have always been regarded as the means to strengthen the corporate governance framework in a public or a listed company.

Keeping in mind the intent of the lawmakers to introduce the requirement for having Independent Directors (IDs) on the board of certain companies, it is understood that SEBI cannot accept a situation where the IDs themselves turnout to either be ineffective for strengthening the corporate governance or act against the interest of the public shareholders. Therefore, with the intent to further strengthen the role and responsibility of IDs, SEBI had introduced a Consultation Paper[4] (Paper) on review of regulatory provisions related to IDs on 2nd of March, 2021. Through this Paper, SEBI had proposed to make stringent regulatory changes in the provisions of the Listing Obligation and Disclosure Requirements Regulations (LODR/ Listing Regulations) relating to

- eligibility criteria of IDs,

- role of Nomination and Remuneration Committee (NRC),

- composition of Audit Committee (AC) and Nomination and Remuneration Committee (NRC)

- appointment and removal procedure of IDs

Further, SEBI, in its Board Meeting held in July, 2021 discussed to review the regulatory framework applicable on IDs and incorporate amendments in the Listing Regulations based on public comments and discussions w.e.f. 1st January, 2022. However, the changes in the regulatory framework as notified on 3rd August, 2021 vide SEBI (Listing Obligations and Disclosure Requirements) (Third Amendment) Regulations, 2021 [the Amendment Regulations],was initially notified to be applicable with immediate effect whose applicability has now been deferred to the date as originally decided in the Board Meeting of SEBI, i.e., 1st January, 2021 .

A brief snippet on the changes can be accessed here.

This write up critically covers the changes in the regulatory framework for IDs pursuant to the Amendment Regulations and discusses the potential impact of the same on the working of a company including the corporate governance aspects. The amendments are discussed below under the relevant heads.

1.Widening the criteria for independence

Regulation 16(1) of the Listing Regulations provides the definition of “independent director”. SEBI seeks to broaden the criteria of “independence” by expanding the outreach of the restrictions given under the said Regulation and at the same time standardising the cooling off period provided therein.

Amendments in line with the Paper

The Paper proposed two amendments in the independence criteria of IDs in addition to the extant definition which have been made applicable with the notification of the Amendment Regulations:

- KMPs and employees of companies falling under the promoter group of the listed entity & relatives of such KMPs should not be eligible to act as an ID until a cooling off period of 3 years has passed.

This is in addition to the existing fetter on the KMP and employee of the listed entity, its holding, subsidiary or associate company.

- Another amendment is with regard to increasing of the cooling-off period in Regulation 16(1)(iv) and Reg 16(1)(v) of the Listing Regulations.

Currently, the Regulations specify a cooling-off period of 2 years in case of material pecuniary transaction between a person or his relative and the listed entity or its holding, subsidiary or associate company. This has been increased to 3 years to make it similar to the other provisions of Regulation 16 where a cooling-off period of 3 years is required to be satisfied.

Amendments not proposed in the Paper

Certain amendments not proposed in the Paper but brought by means of the Amendment Regulations are given below:

- The criteria under Regulation 16(b)(v) earlier provided only for the pecuniary relationship of the relatives of proposed ID with the company. This has been amended in line with Section 149(6)(d) of the Companies Act, 2013.

- Further, a proviso has been inserted after Regulation 16(b)(vi)(A) providing a relief to the proposed ID appointment when the relative of such proposed appointee is a mere employee and not KMP.

Rationale behind the Amendment Regulations:

This amendment aims to make the independence criteria more broader and stricter so that there is no way by which the candidates influenced by promoter group entities can take undue benefit due to any loopholes in the language of law.

On the other hand, the amendment increasing the cooling off period is for making the same uniform all through the independence criteria.

Further, it has to be noted that the amendments are in harmonisation with the provisions of the Companies Act, 2013, as also contemplated in the Board meeting of SEBI and does not bring in any drastic changes in the existing requirements apart from looping in promoter related entities as well.

Actionable arising pursuant to the Amendments

- Revised declaration to be obtained so as to ensure compliance with meeting the revised independence criteria as soon as possible.

2.Process for appointment/ re-appointment and removal of independent directors

The Paper proposed to bring a major change in the procedure of appointment/ re-appointment as well as removal of IDs by means of “dual approval”. However, the said proposal has not been brought under the current Amendment Regulations. The changes have been brought to have the following impact:

| Matter | Requirements under extant provisions | Proposal under Paper | Provisions as per Amendment Regulations |

| Appointment/ Removal of IDs | Ordinary Resolution | § Dual approval (Special Resolution in case the proposal fails)

§ Prior approval of Shareholders |

§ Special Resolution

§ Shareholder’s approval required within earlier of – § Next general meeting § 3 months from appointment of a person on board |

| Re-appointment of IDs | Special Resolution | Dual approval (Special Resolution in case the proposal fails)

|

Special Resolution

(no change from the existing provisions) |

| Filling of vacancy of IDs | Later of the following –

§ Next board meeting § 3 months from vacancy |

Within 3 months from vacancy | Within 3 months from vacancy |

Further, in case of appointment of any other director in board, whether executive, non-executive, additional director, director appointed due to casual vacancy etc , every such appointment has to be regularised by the shareholders within a maximum period of 3 months from such an appointment.

Rationale for such Amendments

- Requirement of passing a special resolution

While SEBI had, in its Paper, proposed the “dual approval” model in line with the legislative requirements of Israel and UK, especially in interest of the minority shareholders, the Board disclosed that majority of comments were against such proposal due to practical difficulties in implementation of the same, citing causes such as delay in appointment due to an unintended deadlock, voting skews in case of minority public shareholders having significant shareholding etc. Due to such practical difficulties, a balanced approach has been chosen to require a special resolution for all cases related to appointment, re-appointment as well as removal.

- Time gap available to regularise the appointment by the shareholders

Similarly, as regards the proposed prior approval before appointment, the majority of comments dissented against the proposal citing reasons of additional compliance burden on companies, giving a midway suggesting that while the prior approval should not be mandated, a timeline should be provided within which the appointment should be approved by the shareholders.

Actionable pursuant to the Amendments

After the Amendment Regulations come into force, it would be necessary to regularise the appointment of all directors appointed in additional capacity within 3 months of the board meeting in which they were appointed by way of shareholders’ approval. Considering the fact that the amendments have been notified well in advance, the companies will not be able to excuse themselves for some further time after the amendments come into effect.

The amendments can be explained with the help of following examples –

1.A director has been appointed in additional capacity on 10th December, 2021. His appointment will have to be approved by shareholders within 3 months, i.e., 10th March, 2022.

2. A director has been appointed as additional director on 20th August, 2021 in the board of a company. The period of 3 months ends on 20th November, 2021. However, since the amendments are effective from 1st January, 2022, he may continue as an additional director in the board of the company till 31st December, 2021. However, if his appointment is not been approved by the shareholders within such period of time, he’ll have to resign from his position. The proposal of his appointment will have to be re-considered afresh by the NRC and board of the company, followed by a shareholders approval within 3 months.

3.Resignation of IDs

Through the Paper, it became clear that the intention of SEBI is to strictly monitor the resignation of the IDs where the real cause of resignation should be clearly known in place of the apparent cause the company and ID may try to show.

The Paper provided for a cooling off period of 1 year in two cases:

- Where the ID resigns on account of discretionary reasons of pre-occupation, other commitments or personal reasons – Mandatory cooling period of 1 year before joining another Board as an ID;

- Similar cooling period of 1 year in case of transition from ID to WTD in the same company.

Further, the Paper also proposed that the complete resignation letter of the outgoing ID needs to be disclosed to the stock exchange. The same has been made effective vide the Amendment Regulations.

While the proposal of cooling-off period in case of transition of an ID as a whole-time director in the same company has been implemented by means of insertion of sub-regulation (11) in existing Regulation 25, the requirement of such cooling-off period has been further extended to the joining of such person as a whole-time or executive director in the holding, subsidiary, associate or other group companies belonging to the same promoter(s) as well.

The first proposal with regard to the cooling-off period in case of resignation due to personal / discretionary reasons has not been brought into force on account of comments received from public raising concerns over showing ingenious reasons in resignation letter to avoid falling into the cooling-off requirements, or compelled to work in pressurizing circumstances.

Rationale for such Amendments

The cooling off period of 1 year before transition of an ID as a WTD in the same company has been proposed to ensure there is no compromise in the independence of the director during his term as an ID.

It is observed that IDs often resign for reasons such as pre-occupation, other commitments or personal reasons and then join the boards of other companies. There is, therefore, a need to further strengthen the disclosures around resignation of Independent Directors. However, considering the comments received from majority of public, such a proposal has not been implemented.

4. Role of NRC in selection of candidates for the role of ID

The NRC is required to recommend the persons to be appointed as IDs in the board of the company. Though the Listing Regulations already requires the NRC to formulate criteria regarding such appointment, the role of NRC, in practice, does not suffice the intent of law properly.

Therefore, vide the Amendment Regulations, SEBI has brought amendment to Para A of Part D of Schedule II of the Listing Regulations thereby specifying the following procedure for selection of candidates for the role of NRC. The procedure is in line with the proposal laid down in the Paper.

- Evaluate the balance of skills, knowledge and experience

- On the basis of above evaluation, prepare description of required roles and capabilities required for that particular appointment of ID

- Identify the suitable candidate fitting the said description

- For identifying persons, NRC may

- use services of external agencies

- May consider candidates from wide variety of backgrounds ( for diversity)

- And consider time commitment of appointees

- The person identified and recommend to the Board should possess capabilities as per description.

Rationale for such Amendment

While the law requires NRC to lay down detailed criteria of qualifications and attributes for directors, apparently there is a lack of transparency in the process followed by NRC. There is therefore, a need to prescribe disclosures regarding the process followed by NRC for selection of candidates for the post of ID.

Actionable pursuant to the Amendments

Any ID appointed on the board of a listed company after the Amendment Regulations come into effect, shall be appointed after following the due procedure as provided in the Amendment Regulations. This implies that even where the meeting of NRC for recommendation of appointment of a person as an ID is held before the Amendment Regulations coming into force, due process will be required to be followed. This is also required to ensure that the additional disclosures required to be made in the notice of general meeting for appointing IDs are available with the company (discussed in later parts of the article).

5.Modification in composition of NRC and AC

The Paper also sought to bring in some changes in the constitution of NRC and AC. The following changes were proposed –

- NRC to comprise of 2/3rds of ID (earlier atleast one-half IDs required)

- AC to comprise of 2/3rds of IDs and 1/3rds of Non-executive directors(NED) that are not related to promoter (presently, the AC requires atleast 3 members of which atleast 2/3rds shall be IDs)

The proposals have been implemented partially. While the changes in composition of NRC as proposed in the Paper has been made effective vide the Amendment Regulations, the changes in composition of AC has been rejected on account of decreasing flexibility of the companies.

Approval of Related Party Transaction by AC

Rather, an important amendment has been made to balance out between the flexibility of the companies on one end and the efficiency of the AC on another. Post amendment, all related party transactions of the companies are required to be approved by only the IDs of the Audit Committee. The executive directors, who are a part of the AC, are not allowed to approve such transactions, however, restriction is not with respect to voting and it is understood that they may accord their dissent to a proposed related party transaction. However, practically, there may be rarely any instance, where the related party transaction, otherwise approved by the independent directors of an AC, has been dissented to by other members of the AC. Further, it shall apply to all the prospective related party transactions, and shall not affect the related party transactions which have already been approved prior to the amendments including the ones under omnibus approval.

A new proviso under Regulation 23(2) has been inserted as follows –

“Provided that only those members of the audit committee, who are independent directors, shall approve related party transactions.”

Rationale for such Amendment

Considering the importance of the Audit Committee with regard to related party transactions and financial matters, it was proposed that AC shall comprise of 2/3rd IDs and 1/3rd Non-Executive Directors (NEDs) who are not related to the promoter, including nominee directors, if any. However, the comments received from the public stakeholders have highlighted the risk of losing flexibility by the companies in case of such rigid composition. Therefore, in view of the same, while the composition of the AC has been kept intact, the requirement of only IDs approving the related party transactions have been made effective. The same serves as a balanced approach ensuring both flexibility of companies and efficiency of Audit Committee.

6.Enhanced disclosure requirements

The Amendment Regulations provide for some additional disclosure requirements in line with the amendments as follows:

At the time of appointment –

- Details of companies from which the listed entities have resigned in the previous three years

- Skills and capabilities required for the role

- Manner in which the proposed appointee meets such requirements

At the time of resignation –

- Complete letter of resignation

- Names of listed entities in which the resigning director holds directorships, indicating the category of directorship and membership of board committees, if any

Actionable pursuant to the Amendments

In the light of the amendments, additional details shall be required to be made available to the shareholders for appointment of independent directors.

Similarly, in case of resignation, the letter of resignation and details of continuing directorship shall be made filed with the stock exchanges by the listed entity as received from the resigning ID.

7. Requirement of D&O Insurance

| Earlier requirement | Requirement post amendment | |

| Applicable to | Top 500 listed entities | Top 1000 listed entities |

| With effect from | 1st October, 2018 | 1st January, 2022 |

Conclusion

The changes brought vide the Amendment Regulations are extremely significant and will have a remarkable impact on the corporate governance of listed entities. More transparency may be achieved by means of these amendments like enhanced disclosure on resignation, appointment, selection of candidates as IDs, etc. of all, the amendments seek to check the interference of promoters at all levels of corporate governance and ensures much more independence to the IDs where the IDs will be independent in both letter and spirit. In areas where the proposals under the Paper seemed to be more rigid, the Amendment Regulations have allowed the companies to take breath in line with the comments received from the public shareholders. However, some amendments required immediate actionable, and especially, at this point of time, when most of the companies are having their AGMs, which was creating a hassle for the listed companies. However, SEBI has come up with a clarification deferring the applicability of the Amendment Regulations. Further, a proposal with respect to remuneration of IDs allowing stock-options to them has been dropped, atleast for the time being in the said Amendment Regulations.

[1] http://www.nfcg.in/UserFiles/ciicode.pdf

[2] http://www.nfcg.in/UserFiles/kumarmbirla1999.pdf

[3] https://www.sebi.gov.in/legal/circulars/feb-2000/corporate-governance_17930.html

[4] https://www.sebi.gov.in/reports-and-statistics/reports/mar-2021/consultation-paper-on-review-of-regulatory-provisions-related-to-independent-directors_49336.html

Our other articles on related topic can be accessed here –