SEBI revisits mode of bidding in public issue of debt securities

Permits submission through UPI mechanism and online interface

-CS Henil Shah & CS Burhanuddin Dohadwala

Introduction

In order to streamline the process in case of public issue of debt securities and to add an addition to the current Application Supported by Blocked Amount (‘ASBA’) facility. Securities and Exchange Board of India (‘SEBI’) vide its circular dated November 23, 2020[1] (‘November 23 Circular’) has introduction Unified Payments Interface (‘UPI’) mechanism for the process of public issues of securities under:

- SEBI (Issue and Listing of Debt Securities) Regulations, 2008 (‘ILDS Regulations’);

- SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013 (‘NCRPS Regulations’);

- SEBI (Issue and Listing of Securitised Debt Instruments and Security Receipts) Regulations, 2008 (‘SDI Regulations’) and

- SEBI (Issue and Listing of Municipal Debt Securities) Regulations, 2015 (‘ILDM Regulations’).

The said circular shall be effective to a public issue of securities for the aforesaid captioned regulations which opens on or after January 01, 2021 (‘effective date’). Earlier, SEBI Circular dated July 27, 2012[2] (‘Erstwhile Circular’) provided the system for making application to public issue of debt securities. The Erstwhile Circular will stand repealed from the effective date. However, SEBI Circular dated October 29, 2013[3] w.r.t allotment of debt securities shall continue to remain in force.

Earlier in November, 2018[4] SEBI had introduced use of UPI as a payment mechanism with ASBA, to streamline the process of public issue of equity shares and convertibles and implemented the same in 3 phases.

The article below covers the role required to be done by the issuer in case of public issue of debt securities.

Background

UPI[5] is an instant payment system developed by the National Payments Corporation of India (‘NPCI’), an RBI regulated entity. UPI is built over the IMPS (‘Immediate Payment Service’) infrastructure and allows you to instantly transfer money between any two parties’ bank accounts.

The facility to block funds through UPI mechanism whether applying through intermediaries (viz syndicate members, registered stock brokers, register and transfer agent and depository participants) or directly via Stock Exchange (‘SE’) app/ interface is set for upto and amount of Rs. 2 lakhs, which is the maximum limit approved by NPCI for capital markets vide its circular dated March 03, 2020[6].

Appointment of Sponsor Bank

Sponsor Bank as a term was introduced under the SEBI circular dated November 01, 2018 meaning a self-certified syndicate bank appointed by issuer to conduit/act as a channel with SE and NCPI to facilitate mandate collect requests and/or payment instructions of retail investors.

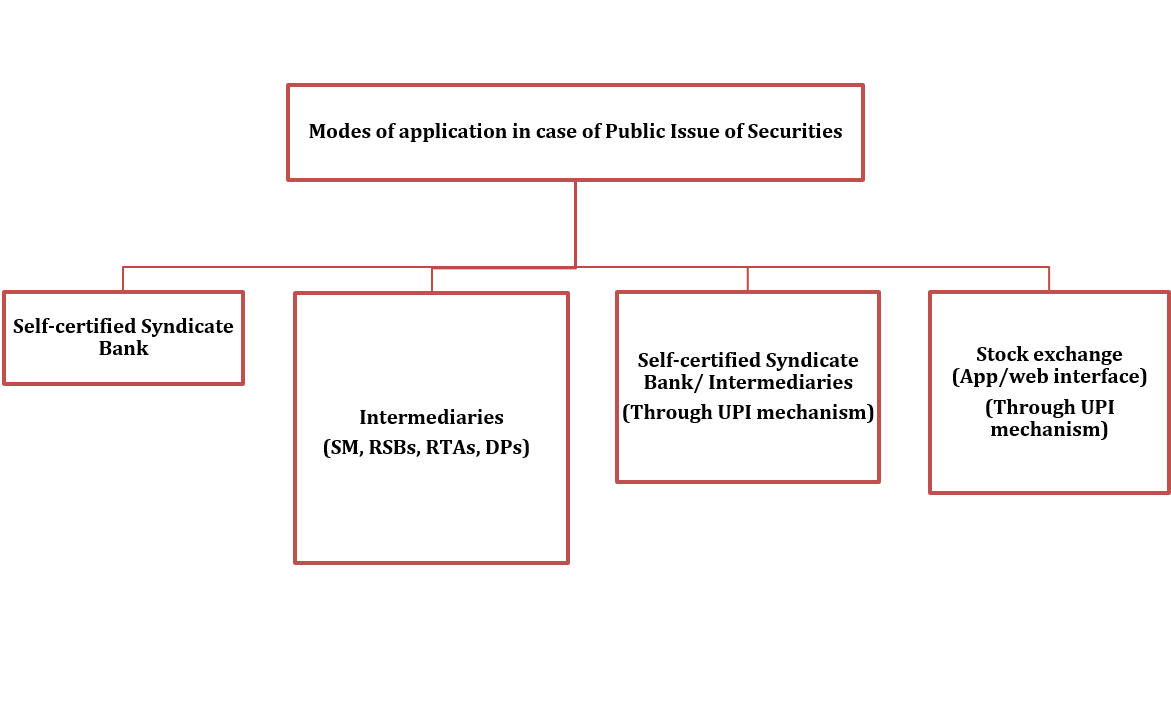

Comparison of mode of application under November 23 Circular and Erstwhile Circular

| November 23 Circular | Erstwhile Circular | Remarks |

| Direct application through SE app/web-interface along with amount blocked via UPI mechanism. | Direct application over the SE interface with online payment facility; | Online payment facility stands replaced with UPI mechanism. However, it is not clear as to how the application to be submitted where amount to be invested is above 2 lac rupees. |

| Application through intermediaries along with details of his/her bank accounts for blocking funds | Application through lead manager/syndicate member/sub-syndicate members/ trading members of SE using ASBA facility | No change |

| Application through SCSBs with ASBA. | Applications through banks using ASBA facility; | No change |

| Application through SCSBs/intermediaries along with his/her bank account linked UPI ID for the purpose of blocking of funds, if the application value is Rs.2 lac or less. |

– |

New insertion. |

|

– |

Application through lead manager/syndicate member/sub-syndicate members/ trading members of SE without use of ASBA facility | This was discontinued for all public issue of debt securities made on or after October 01, 2018 vide SEBI Circular dated August 16, 2018[7]. |

|

– |

Application through lead manager/syndicate member/sub-syndicate members/ trading members of SE for applicants who intended to hold debt securities in physical form. | No reference made in the present circular |

Modes of submitting application as per November 23 Circular

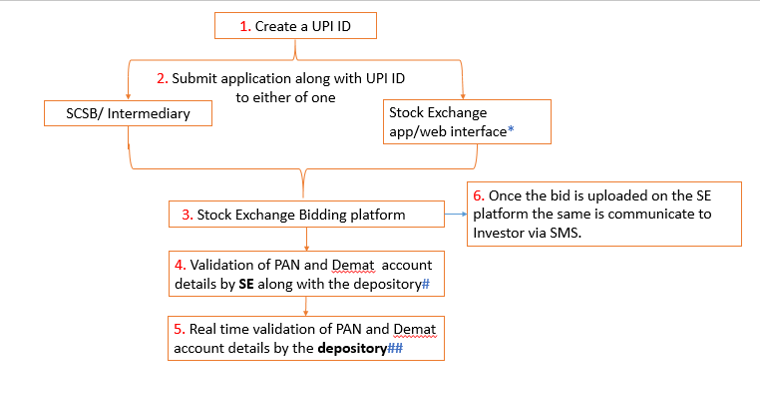

Process of the applying utilizing UPI mechanism is produced in a diagrammatic form as below:

Process of the applying utilizing UPI mechanism is produced in a diagrammatic form as below:

* Application made on SE App/web interface shall automatically get updated on SE biding platform

# Upon bid being entered under the bidding platform SE shall undertake validation process of PAN and Demat account along with Depository.

## In case of any discrepancies the same are reported by depositories to SE which in turn relays the same to intermediaries for corrections.

Roles of issuer in case of public issue of debt securities

Apart from appointing a sponsor bank by the issuer the roles of issuer remain same as those already required under the SEBI circular dated July 27, 2012 i.e.:

- Use of SE platform;

- Entering to agreement with SE with respect to use of same;

- Dispute resolution mechanism between the issuer and SE and maintenance of escrow account remain the same.

Only the aforesaid roles are aligned with newly introduced with UPI Mechanism.

Allotment of securities within 6 days

SEBI vide its circular dated November 10, 2015 had, in order to stream line the process of public issue of equity shares and convertibles issued a circular to reduce the timeline for issue from 12 working days to 6 working days and same was introduced for public issue of debt securities, NCRPS and SDI vide circular dated August 16, 2018[8]. The same has been re-iterated/repeated under the November 23 Circular. Indicative timelines for various activities are re-produced under Annexure-A.

Additional data details required to be mentioned under the Application and biding form relating to UPI

- Under Main Application form

- Payment details –UPI ID with maximum length of 45 characters

- Acknowledgement slip for SCSB/broker/RTA/DP

- Payment details to include UPI

- Acknowledgement slip for bidder

- Payment details to include UPI ID

- Overleaf of Main Application form

- UPI Mechanism for Blocking Fund would be available for Application value upto Rs. 2 Lakhs;

- Bidder’s Undertaking and confirmation to include blocking of funds through UPI mode;

- Instructions with respect to payment / payment instrument to include instructions for blocking of funds through UPI mode.

Conclusion

Public issue application using UPI is a step towards digitizing the offline processes involved in the application process by moving the same online. UPI mechanism in public issue process shall essentially bring in comfort, ease of use and reduce the listing time for public issues.

Annexure A:

Indicative timelines for various activities

| Sr. No. | Particulars | Due Date (working day) |

| 1. | Issue Closes | T (Issue closing date) |

| 2. |

|

T+1 |

| 3. |

|

T+2 |

| 4. |

|

T+3 |

| 5. |

|

T+4 |

| 6. |

|

T+5 |

| 7. | Trading commences; | T+6 |

Our other materials on the topic can be read here –

[1] https://www.sebi.gov.in/legal/circulars/aug-2018/streamlining-the-process-of-public-issue-under-the-sebi-issue-and-listing-of-debt-securities-regulations-2008-sebi-issue-and-listing-of-non-convertible-redeemable-preference-shares-regulations-_40004.html

[2]https://www.sebi.gov.in/legal/circulars/jul-2012/system-for-making-application-to-public-issue-of-debt-securities_23166.html

[3]https://www.sebi.gov.in/legal/circulars/oct-2013/issues-pertaining-to-primary-issuance-of-debt-securities-amendment-to-simplified-debt-listing-agreement_25622.html

[4] https://www.sebi.gov.in/sebi_data/attachdocs/nov-2018/1541067380564.pdf

[5] https://www.sebi.gov.in/sebi_data/commondocs/mar-2019/useofunifiedpaymentinterfacefaq_p.pdf

[6] https://www.npci.org.in/PDF/npci/upi/circular/2020/UPI%20OC%2082%20-%20Implementation%20of%20Rs%20%202%20Lakh%20limit%20per%20transaction%20for%20specific%20categories%20in%20UPI.pdf

[7] https://www.sebi.gov.in/legal/circulars/aug-2018/streamlining-the-process-of-public-issue-under-the-sebi-issue-and-listing-of-debt-securities-regulations-2008-sebi-issue-and-listing-of-non-convertible-redeemable-preference-shares-regulations-_40004.html

[8]https://www.sebi.gov.in/legal/circulars/nov-2020/introduction-of-unified-payments-interface-upi-mechanism-and-application-through-online-interface-and-streamlining-the-process-of-public-issues-of-securities-under-sebi-issue-and-listing-of-debt-_48235.html

Leave a Reply

Want to join the discussion?Feel free to contribute!