Transacting by exception: Listed cos in India give substantive carve outs for RPTs

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA, SEBI /by Vinod Kothari ConsultantsThe article has been published in ICSI – WIRC-E Newsletter (June-July 2020 edition):

Refer page 43 of ICSI – WIRC-E Newsletter

Easing of DRF requirement

/8 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Housing finance, MCA, NBFCs /by Vinod Kothari Consultants-by Smriti Wadehra

(smriti@vinodkothari.com)

-Updated as on 29th September, 2020

Pursuant the proposal of Union Budget of 2019-20, the MCA vide notification dated 16th August, 2019 amended the provisions of Companies (Share Capital and Debentures) Rules, 2014 [1].(You may also read our analysis on the notification at Link to the article) The said amended Rules faced a lot of apprehensions, especially, from the NBFCs as the notification which was initially expected to scrap off the requirement of creation of DRR for publicly issued debentures had on the contrary, rejuvenated a somewhat settled or exempted requirement of creation of debenture redemption fund as per Rule 18(7) for NBFCs as well.

As per the notification, the Ministry imposed the requirement for parking liquid funds, in form of a debenture redemption fund (DRF) to all bond issuers except unlisted NBFCs, irrespective of whether they are covered by the requirement of DRR or not. In this regard, considering the ongoing liquidity crisis in the entire financial system of the Country, parking of liquid funds by NBFCs was an additional hurdle for them.

Creation of DRR is somewhat a liberal requirement than creation of DRF, this is because, where the former is merely an accounting entry, the latter is investing of money out of the Company. Further, the fact the notification dated 16th August, 2019 casted exemption from the former and not from the latter, created confusion amidst companies. The whole intent of amending the Rule was to motivate NBFCs to explore bond markets, however, the requirement of parking liquid funds outside the Company as high as 15% of the amount of debentures of the Company was acting as a deterrent for raising funds by the NBFCs.

Considering the representations received from various NBFCs and the ongoing liquidity crunch in the economy of the Country along with added impact of COVID disruption, the Ministry of Corporate Affairs has amended the provisions of Rule 18 of Companies (Share Capital and Debenture) Rules, 2014 vide notification dated 5th June, 2020 [2]to exempt listed companies coming up with private placement of debt securities from the requirement of creation of DRF.

What is DRR and DRF?Section 71(4) read with Rule 18(1)(c) of the Companies (Share Capital and Debentures) Rules, 2014 requires every company issuing redeemable debentures to create a debenture redemption reserve (“referred to as DRR”) of at least 25%/10% (as the case maybe) of outstanding value of debentures for the purpose of redemption of such debentures. Some class of companies as prescribed, has to either deposit, before April 30th each year, in a scheduled bank account, a sum of at least 15% of the amount of its debentures maturing during the year ending on 31st March of next year or invest in one or more securities enlisted in Rule 18(1)(c) of Debenture Rules (‘referred to as DRF’). |

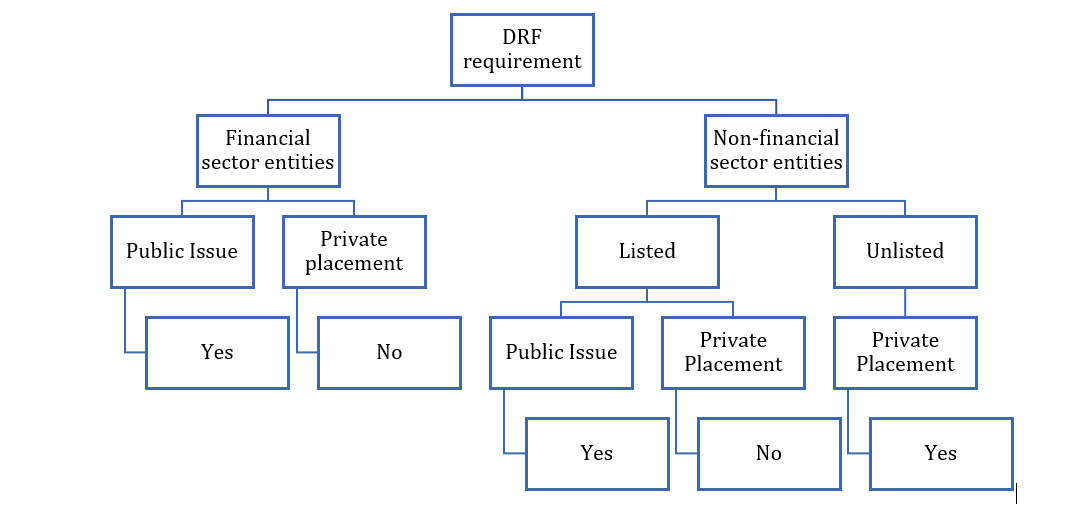

The notification has mainly exempted two class of companies from the requirement of creation of DRF:

- Listed NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 and for Housing Finance Companies registered with National Housing Bank and coming up with issuance of debt securities on private placement basis.

- Other listed companies coming up with issuance of debt securities on private placement basis.

However, the unlisted non-financial sector entities have been left out. In a private placement, the securities are issued to pre-selected investors. Raising debt through private placement is a midway between raising funds through loan and debt issuances to public. Like in case of bilateral loan arrangements, but unlike in case of public issue, the investors get sufficient time to assess the credibility of the issuer in private placements, since the investors are pre-identified.

The intent behind DRF is to protect the interests of the investors, usually when retail investors are involved, with respect to their claims on maturity falling due within a span of 1 year. This is not the case for investors who have invested in privately placed securities, where the investments are made mostly by institutional investors.

Further, companies chose issuance through private placement for allotment of securities privately to pre-identified bunch of persons with less hassle and compliances. Hence, the requirement of parking funds outside the Company frustrates the whole intent.

Further, it is a very common practice to roll-over the bond issuances, hence, it is not that commonly bonds are repaid out of profits; the funds are raised from issuance of another series of securities. This is a corporate treasury function, and it seems very unreasonable to convert this internal treasury function to a statutory requirement.

Though, in our view, the relaxation provided in case of private issuance of debt securities is definitely a relief, especially during this hour of crisis, but we are not clear about the logic behind excluding unlisted non-financial sector entities.

Even though, the financial sector (76%) entities dominate the issuance of corporate bonds, however, the share of the non-financial sector entities (24%) is not insignificant. Therefore, ideally, the exemption in case of private placements should be extended to unlisted non-financial sector entities as well.

A brief analysis of the amendments is presented below:

Practical implication

Pursuant to the MCA notification dated 16th August, 2019, the below mentioned class of companies were required to either deposit or invest atleast 15% of amount of debentures maturing during the year ending on 31st March, 2020 by 30th April, 2020. This has been extended till 31st December, 2020 for this FY 2019-20 by MCA due to the COVID-19 outbreak. However, pursuant to the amendment introduced by MCA notification dated 5th June, 2020 the status of DRF requirement stands as amended as follows:

| Particulars | DRF requirement as MCA circular dated 16th August, 2019 | DRF requirement as per MCA circular dated 5th June, 2020 |

| Listed NBFCs which have issued debt securities by way of public issue | Yes. | Yes. Deposit or invest before 31st December, 2020 |

| Listed NBFCs which have issued debt securities by way of private placement | Yes | Not required as exempted. |

| Listed entities other than NBFC which have issued debt securities by way of private placement | Yes | Not required as exempted |

| Listed entities other than NBFC which have issued debt securities by way of public issue | Yes | Yes. Deposit or invest before 31st December, 2020 |

| Unlisted companies other than NBFC | Yes. | Yes. Deposit or invest before 31st December, 2020 |

Please note that the aforesaid shall be applicable from 12th June, 2020 i.e. the date of publication of the notification in the official gazette. In this regard, if for instance companies which have been specifically exempted pursuant to the recent notification, have already invested or deposited their funds to fulfil the DRF requirement may liquidated the funds as they are no longer statutorily require to invest in such securities.

Synopsis of DRR and DRF provisions[2]

A brief analysis of the DRR and DRF provisions as amended by the MCA notification dated 16th August, 2019 and 5th June, 2020 has been presented below:

| Sl. No. | Particulars | Type of Issuance | DRR as per erstwhile provisions | DRR as per amended provisions | DRF as per erstwhile provisions | DRF as per amended provisions |

| 1. | All India Financial Institutions | Public issue/private placement | × | × | × | × |

| 2. | Banking Companies | Public issue/private placement | × | × | × | × |

| 3.

|

Listed NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 and HFC registered with National Housing Bank | Public issue | √

25% of value of outstanding debentures |

× | √ | √ |

| Private Placement | × | × | √ | × | ||

| 4. | Unlisted NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 and HFC registered with National Housing Bank | Private Placement |

× |

× |

× |

× |

| 5.

|

Other listed companies | Public Issue | √

25% of value of outstanding debentures |

× | √ | √ |

| Private Placement | √

25% of value of outstanding debentures |

× | √ | × | ||

| 6. | Other unlisted companies | Private Placement | √

25% of value of outstanding debentures |

√

10% of the value of outstanding debentures |

√ | √ |

[1] http://www.mca.gov.in/Ministry/pdf/Circular_25032020.pdf

[2] This table includes analysis of provisions of DRR and DRF as per CA, 2013 and amendments introduced vide MCA notification dated 16th August, 2019 and 5th June, 2020.

Erstwhile provisions- Provisions before amendment vide MCA circular dated 16th August, 2019

Amended provisions- Provisions after including amendments introduced vide MCA circular 5th June, 2020

[1] https://www.mca.gov.in/Ministry/pdf/ShareCapitalRules_16082019.pdf

FAQs on IEPF

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsInjeti Srinivas’s Committee: Changes recommended in provisions of Corporate Social Responsibility

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA, UPDATES /by Vinod Kothari ConsultantsProvisions relating to DVR & DRR- stands amended

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsAmendments introduced in Companies (Share Capital and Debentures) Amendment Rules, 2019

by Smriti Wadehra (smriti@vinodkothari.c0m)

The recent Notification of Ministry dated 16th August, 2019 has amended the provisions of Companies (Share Capital and Debentures) Rules, 2014 with respect to quantum of holding of equity shares with differential voting rights by a Company and provisions pertaining to creation of debenture redemption reserve. The amended provisions are applicable from the date of notification in the e-gazette i.e. 16th August, 2019.

Differential Voting Rights

SEBI in its Board Meeting dated 27th June, 2019 proposed insertion of the provisions of DVRs in SEBI ICDR Regulations. The proposal was w.r.t inter alia to cap the total voting rights of superior rights shareholders (including ordinary shares) at 74% of the total voting power. The respective amendments are still awaited. Meanwhile, the Ministry vide the aforesaid Notification amended the provisions under CA, 13 related to DVRs. The Notification has escalated the limit of DVR shares in the Company from 26% of total post-issue paid up equity capital of the Company to 74% of the total voting power.

The erstwhile provisions of the Companies (Share Capital and Debentures) Rules, 2014 permitted issuance of equity shares with differential rights subject to compliance of conditions mentioned in Rule 4(1) of the said Rules. One of criterion for issuance of equity shares with differential rights by a Company was that shares with differential rights should not exceed 26% of total post-issue paid up equity capital of the Company at any point of time. However, the amendment has increased this limit to 74% of the total voting power at any point of time. Notably, this is another significant highlight of the amendment that the erstwhile cap of 26% was based on the post-issue paid up equity capital which has now been changed to 74% of the voting power.

Further, in this regard, condition on companies issuing shares with differential rights having consistent track record of distributable profits for the last three years have been done away with.

Debenture Redemption Reserve

The erstwhile provisions of Section 71(4) read with Rule 18(1)(c) of the Companies (Share Capital and Debentures) Rules, 2014 required every company issuing redeemable debentures to create a debenture redemption reserve (“DRR”) of at least 25% of outstanding value of debentures for the purpose of redemption of such debentures. Apart from creation of DRR, such companies were required to either deposit, before April 30th each year, in a scheduled bank account, a sum of at least 15% of the amount of its debentures maturing during the year ending on 31st March of next year or invest in one or more securities enlisted in Rule 18(1)(c) of Debenture Rules.

Under the erstwhile framework, the following classes of companies were required to comply with the provisions relating to DRR:

- NBFCs registered with RBI under section 45-IA of RBI Act, 1934 issuing debentures through public issue;

- Other listed companies coming up with public issue or private placement;

- Unlisted companies issuing debentures on private placement basis.

With a view to liberalise the legal framework surrounding issuance of debentures by NBFCs, the FinMin proposed Union Budget of 2019-20 proposed to scrap off the requirement of creation of DRR for publicly issued debentures also so as to motivate NBFCs. Subsequently, the MCA came out with notification to amend the Companies (Share Capital and Debentures) Rules, 2014.

The amended provisions has exempted NBFCs registered with RBI and HFCs registered with National Housing Bank from creation of DRR in case of public issue of debentures. Further, the requirement of listed companies to create DRR has been done away with. The amended Rules have also lowered down the quantum of funds to be transferred to DRR by unlisted companies. However, as a flipside to the exemptions granted, the MCA has knowingly or unknowingly, unsettled an otherwise settled matter on creation of debenture redemption fund as per Rule 18(7).

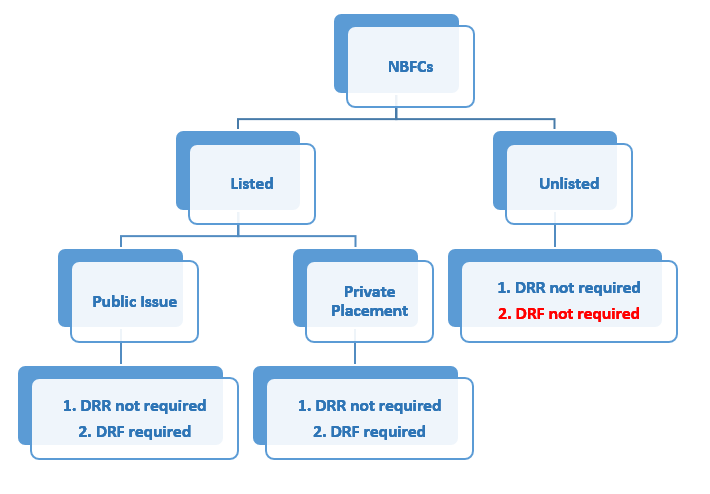

Under the erstwhile provisions required creation of debenture redemption fund only by those companies on which DRR was applicable. However, under the current set of rules, the requirement to create DRF will apply to all listed companies, other than AIFIs or other FIs as per the clause of section 2(72). This new rule applies even to NBFCs.

It is pertinent to note that until now, NBFCs were required to create debenture redemption reserve only for publicly issued debt securities. However, under the new rule, all listed NBFCs will have to create a DRF even in case of private placement of debentures. This change in the rules seems to be contradicting the intention of proposal in the Union Budget.

The intention of the proposal was to promote NBFCs to explore Bond markets more often for fund raising, however, the language of the new rule has jeopardised the existing cases of debenture issuances, let alone be new debenture issuances. Considering the ongoing liquidity crisis, the entire financial system is going through, the implications of this requirement could be severe.

Creation of DRR is somewhat a liberal requirement then creation of DRF, this is because, where the former is merely an accounting entry, the latter is investing of money out of the Company and the fact the new rule casts an exemption from the first and not from the second makes the situation a bit awkward. Therefore, where there is no requirement even for annually conserving a part of their profits, the requirement of creating a fund out of the same becomes completely illogical.

Hence, in our view, the amendments have actually slashed the expectation to relax issuance of debentures by NBFCs and on the other hand has also taken away the available exemption to the NBFCs for not creating DRF in case of issuance of debt securities through private placement. The actual intent of the amendment would have been to reduce the requirement of DRR from somewhat say 25% to 10%, however, in a completely unexpected move, the requirement for parking liquid funds, in form of a debenture redemption fund (DRF) has been extended to all bond issuers except unlisted NBFCs (which are hardly any in India), irrespective of whether they are covered by the requirement of DRR or not.

In this regard, the notification also fails to clarify the basic question that is whether the requirement will be applicable to debentures/bonds already issued, before the date of the notification or only after the date of notification. Though, the language suggest that the same shall be applicable on debentures due for redemption after the date of notification, i.e. for debentures maturing during the year ending on 31st March, 2020. However, in our view, one should try to create a DRF for the debentures maturing within 31st March, 2020 itself. Lastly needless to say, the MCA notification needs to be considered immediately.

A brief analysis of the amendments are discussed below:

Applicability of DRR and Debenture Redemption Fund

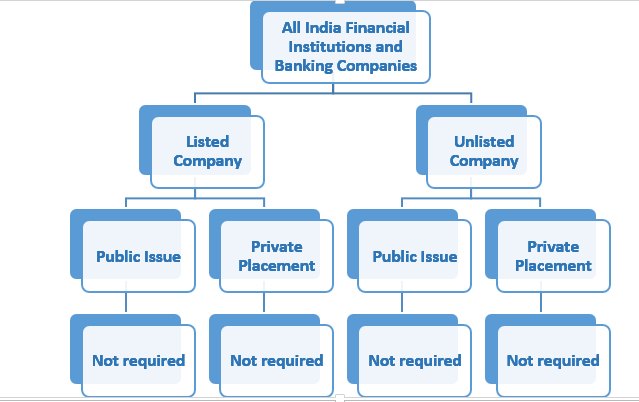

a) All India Financial Institutions and Banking Companies

b) NBFCs registered with RBI under section 45-IA of RBI Act, 1934 and Housing Finance Companies registered with National Housing Bank

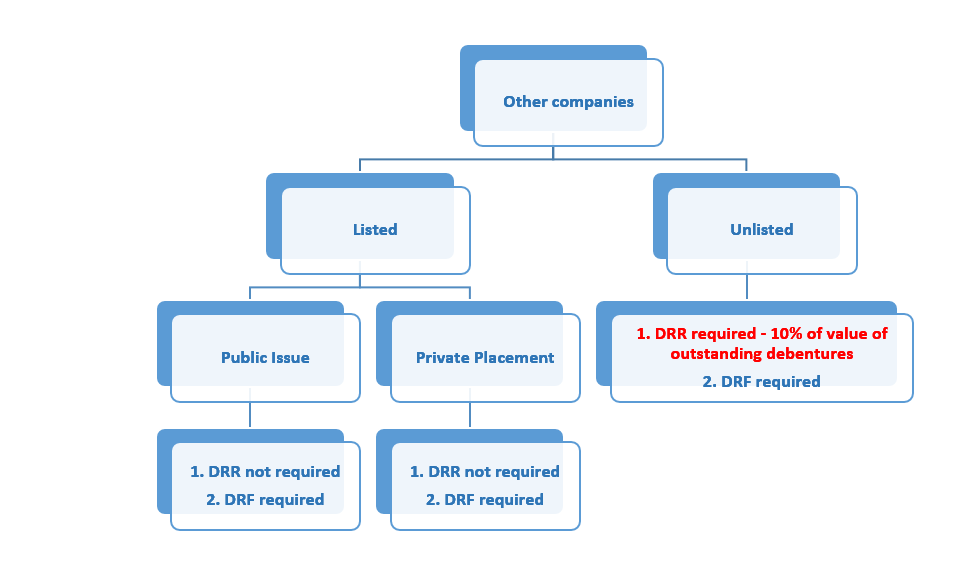

- Other companies

Synopsis of amendments in DRR provisions

| Sl. No. | Particulars | Type of Issuance | DRR as per erstwhile provisions | DRR as per amended provisions | DRF as per erstwhile provisions | DRF as per amended provisions |

| 1. | All India Financial Institutions | Public issue/private placement

|

× | × | × | × |

| 2. | Banking Companies | Public issue/private placement

|

× | × | × | × |

| 3.

|

Listed NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 and HFC registered with National Housing Bank

|

Public issue | √

25% of value of outstanding debentures |

× | √ | √ |

| Private Placement

|

× | × | × | √ | ||

| 4. | Unlisted NBFCs registered with RBI under section 45-IA of the RBI Act, 1934 and HFC registered with National Housing Bank

|

Private Placement

|

× |

× |

× |

× |

| 5.

|

Other listed companies

|

Public Issue

|

√

25% of value of outstanding debentures

|

× | √ | √ |

| Private Placement

|

√

25% of value of outstanding debentures

|

× | √ | √ | ||

| 6. | Other unlisted companies | Private Placement | √

25% of value of outstanding debentures

|

√

10% of the value of outstanding debentures |

√ | √ |

Provisions updated as on 5th June, 2020 maybe viewed here

Commencement of certain sections under Companies (Amendment) Act, 2019

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws /by Vinod Kothari Consultants-Phase II

by Smriti Wadehra (smriti@vinodkothari.com)

The Companies (Amendment) Bill, 2019 was introduced on 25th July, 2019 which received President’s assent on 31st July, 2019 and became the Companies (Amendment) Act, 2019. The Companies (Amendment) Act, 2019 is a combination of Companies (Amendment) Ordinance, 2019 introduced on 21st February, 2019 and 9 out of 20 proposed changes which were proposed by the Ministry on 5th November, 2018. There were two additional amendments which were not covered by the Ordinance and proposed changes.

The Companies (Amendment) Act, 2019 notified 43 sections out of which 31 sections were effective from 2nd November, 2018. Other sections were to be notified by the Ministry by way of separate commencement notification. Accordingly, the Ministry on 14th of August, 2019 further notified 10 section to be effective from the date of notification. A brief synopsis of the amendments are provided below:

| Section No. of Companies (Amendment) Act, 2019 | Section No. of Companies Act, 2013 | Particulars | Amendment | Impact / Rermarks | Actionable for companies |

| 6 | 26 | Matters to be stated in prospectus | 1. Substitution of word “registration” with “filing” in sub-section (4), (5) and (6)

2. Omission of Registrar’s power to not register a prospectus for non-fulfilment of requirements of section 26

|

Seems to be a change in the terminology. | – |

| 7 | 29 | Public offer of securities to be in dematerialised form | 1. Omission of word “public” in sub-section(1)(b)

2. Insertion of new clause to provide such class or classes of unlisted companies as may be prescribed, the securities shall be held or transferred only in dematerialised form in the manner laid down in the Depositories Act, 1996 and the regulations made thereunder |

Pursuant to the amendment, all companies falling under such class of companies as may be prescribed has to mandatorily issue securities only in demat form.

In the absence of the Rules, this change seems to include private companies, small companies and OPC as well. However, the new clause comes with a proviso that states that the Ministry will come out with revised Rules prescribing thresholds for companies (which may include private companies) which requires issuance compulsorily in dematerialized form.

Further, there remain certain other grey areas which shall be clear only once the revised Rules in this regard are out. These include: · whether this requirement will be made applicable only for new issues of capital by companies; or · Will require all existing shares also to be dematerialised.

|

However, whether the same will be applicable to companies having prescribed thresholds which may include private companies, small companies, section 8 companies, OPCs etc.

The actionables can be determined only once the Rules are in place.

|

| 8 | 35 | Civil liability for mis-statements in prospectus

|

To give effect to the amendment introduced in section 26, the term registration has been substituted with filing in this section also.

|

Mere linking of amendment in different sections. | – |

| 14- clause (i), (iii) and (iv) | 90(4A), (9A) and (11) | Register of significant beneficial owners in a company | 1. Every company has to take necessary steps to identify an individual who is a significant beneficial owner in relation to the company and require him to comply with the provisions of this section

2. Government to come out with Rules in this regard

|

The existing provisions casted an obligation on the SBO to come and declare to the reporting company, however, the amendment indicates that nin addition to sending BEN-4 notices to the shareholders, the reporting company may also be required to go out on an investigation spree even in cases where it does not have a reason to believe about the presence of an SBO.

Further, the amendment also indicates that the SBO Rules shall be revised in this regard which is expected to provide the clarity on the actionables. |

SBO determination is a collaborative exercise which the Company and SBO has to ensure.

Accordingly, as a result of this change, companies may need to send letters, notices and any other type of correspondence in addition to those cases where it was obligated to send notices to entities holding more than 10% shareholding in the Company.

In any event, the medium and extent of this new exercise will be clear once the MCA comes out with revised rules in this regard. Also, considering the commencement of the said amendment has been made effective from 14th August, 2019, surely the same is to be used by the companies for identification of subsequent SBO, if any, which are identified, as the first round of identification has already been done.

However, what necessary steps are to be taken by the Company for identification of SBO requires clarity.

|

| 20 | 132 | Constitution of National Financial Reporting Authority | 1. NFRA to perform its functions through such divisions as may be prescribed;

2. Each division of the National Financial Reporting Authority shall be presided over by the Chairperson or a full-time Member authorised by the Chairperson;

3. There shall be an executive body of the National Financial Reporting Authority consisting of the Chairperson and full-time Members of such Authority for efficient discharge of its functions as specified in the section;

4. NFRA may debar a member or firm: I. being appointed as an auditor or internal auditor or undertaking any audit in respect of financial statements or internal audit of the functions and activities of any company or body corporate; or II. performing any valuation as provided under section 247, for a minimum period of 6 months or such higher period not exceeding 10 years as may be determined by the Authority

|

Amendment notifies constitution of NFRA | – |

| 31 | 212 | Investigation into affairs of Company by SFIO | Pursuant to investigation report of SFIO, if fraud is reported, the Government may make an application to NCLT for disgorgement of profits/assets. Further, there will be unlimited personal liability on officers/person/entity benefitted

|

The amendment proposes disgorgement of properties of officers in default in case of corporate frauds. | – |

| 33 | 241 | Application to Tribunal for relief in cases of oppression, etc.

|

1. Application for oppression has to be made before the Principal Bench of Tribunal by certain class of companies to be prescribed by Ministry;

2. New sub-section (3) has been inserted which provides that where Central Govt is of the opinion that there exists: a) Fraud, misfeasance, negligence or default in management or breach of trust; or b) Business is not being conducted as per business principles c) Company is being managed by person who is likely to cause serious injury or damage to the business d) Business is being carried out with the intent to defraud creditors, members or any other person or prejudicial to public interest The Government may initiate a case against such person and refer the same to the Tribunal and inquire into the case to record a decision as to whether or not such person is a fit and proper person to hold the office of director or any other office connected with the conduct and management of any company.

|

The law was silent of the fact that what does “matters prejudicial to public interest” with regard to section 242(2) means. The amendment list down matters where Central Government may make application against the Company to Tribunal for conducting business prejudicial to the interest of the Company.

The erstwhile provisions of section 398(1)(b) of the 1956 Act it was enough to establish that there was a likelihood of affairs being conducted in a prejudicial manner to the interest of Company. However, the amended provisions of Act clearly lays down situatiobs where interest of the Company can be prejudicial affected. |

– |

| 34 | 242 | Powers of Tribunal

|

Pursuant to the application made to Tribunal in sub-section 241(3), the Tribunal shall record its decision stating therein specifically as to whether or not the respondent is a fit and proper person to hold the office of director or any other office connected with the conduct and management of any company

|

Tribunal on application being made by Central Government determine whether oppression/mismanagement is being conducted in the Company and record reasons whether an officer is fit and proper for managing the Company. | – |

| 35 | 243 | Consequence of termination or modification of certain agreements

|

The person who is not a fit and proper person pursuant to sub-section (4A) of section 242 shall not hold the office of a director or any other office connected with the conduct and management of the affairs of any company for a period of 5 years from the date of the said decision. Further shall not be entitled to any compensation for loss of office.

However, CG may, with the leave of the Tribunal, permit such person to hold any such office before the expiry of the said period of five years. |

Explicit prohibition on officers in default from holding similar office for a period of 5 years. | – |

| 37 | 272 | Petition for winding up

|

The amendment omits reference of clause (e) of section 271(1) from sub-section (3) of section 272.

|

The Registrar shall be entitled to present a petition for winding up under section 271, except on the grounds specified in clause (a) which provides that the Company must have resolved by way of a SR that the Company would be wound up by the Tribunal.

Reference of clause providing that Tribunal may file a petition under 272 if it is of the opinion that it is just and equitable that company should be wound up has been done away with.

|

– |

| 38 | 398 | Provisions relating to filing of applications, documents, inspection etc in electronic form.

|

The term “prospectus” has been omitted from clause (f) of sub-section (1) which provides for registration of prospectus by Registrar. | Seems to be a change in the terminology. | – |

Our other articles of interest can be read here –

Analysis of Companies (Amendment) Act, 2019

/0 Comments/in Accounting and Taxation, Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsHighlights of Companies (Amendment) Bill, 2019

/1 Comment/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari Consultantsby Vinod Kothari

The Companies (Amendment) Bill, 2019 has been placed before the Parliament[1] on 25th July, 2019. While the Bill, 2019 is largely to enact into Parliamentary law the provisions already promulgated by way of Presidential Ordinance, the Bill also brings some interesting changes.

The key feature of the Bill is to replace the existing system of judicial prosecution for offences by a departmental process of imposition of penalties. As a result, while the monetary burden on companies may go up, but offenders will not be having to face criminal courts and the stigma attached with the same.

Some of the other highlights of the changes are as follows:

Dematerialisation of securities may now be enforced against private companies too

It is notable that amendments were made by the Companies (Amendment) Act, 2017 effective from 10th September, 2018 effective from 2nd October, 2018, whereby all public unlisted companies were required to ensure that the issue and transfer of securities shall henceforth be done in dematerialised mode only. This provision alone had brought about major cleansing of the system, as in lots of cases, shareholding records included men of straw.

However, the reality of India’s corporate sector is private companies, constituting roughly 90% of the total number of incorporated companies.

The provision of section 29 is now being extended to all companies, public and private. This means, that the Govt may now mandate dematerialisation for shares of private companies too. Whether this requirement will be made applicable only for new issues of capital by private companies, or will require all existing shares also to be dematerialised, remains to be seen, but if it is the latter, the impact of this will be no lesser than “demonetisation-2” at least for the corporate sector. Evidently, all shareholders of all private companies will have to come within the system by getting their holdings dematerliaised.

CSR is now mandatory, and unspent amounts will go to PM’s Funds

When the provision for corporate social responsibility was introduced by Companies Act 2013, the-then minister Sachin Pilot went public to say, the provision will follow what is globally known as “comply or explain” (COREX). That is, companies will not be mandated to spend on CSR – the board report will only give reasons for not spending.

Notwithstanding the above, over the last few months, registry offices have sent show-cause notices to thousands of companies for not spending as required, disregarding the so-called reasons given in the Board report.

Now, the rigour being added takes CSR spending to a completely different level:

- If companies are not able to spend the targeted amount, then they are required to contribute the unspent money to the Funds mentioned in Scheduled VII, for example, PM’s National Relief Fund.

- Companies may retain amounts only to the extent required for on-going projects. There will be rule-making for what are eligible on-going projects. Even in case of such on-going projects, the amount required will be put into a special account within 30 days from the end of the financial year, from where it must be spent within the next 3 years, and if not spent, will once again be transferable to the Funds mentioned in Schedule VII.

- Failure to comply with the provisions makes the company liable to a fine, but very seriously, officers of the company will be liable to be imprisoned for upto 3 years, or pay a fine extending to Rs 5 lacs. Given the fact that the major focus of the Injecti Srinivas Committee Report, which the Ordinance tried to implement, was to restrict custodial punishment only to most grave offences involving public interest, this by itself is an outlier.

Unfit and improper persons not to manage companies

The concept of undesirable persons managing companies was there in sections 388B to 388E of the Companies Act, 1956. These sections were dropped by the recommendations of the JJ Irani Committee. Similar provisions are now making a comeback, by insertions in sections 241 to 243 of the Act. These insertions obviously seem a reaction to the recent spate of corporate scandals particularly in the financial sector. Provisions smacking similar were recently added in the RBI Act by the Finance Bill.

The amendment in section 241 empowers the Central Govt to move a matter before the NCLT against managerial personnel on several grounds. The grounds themselves are fairly broadly worded, and have substantial amplitude to allow the Central Govt to substantiate its case. Included in the grounds are matters like fraud, misfeasance, persistent negligence, default in carrying out

obligations and functions under the law, breach of trust. While these are still criminal or quasi-criminal charges, the notable one is not conducting the business of the company on “sound business principles or prudent commercial practices”. Going by this, in case of every failed business model, at least in hindsight, one may allege the persons in charge of the management were unfit and improper.

Once the NCLT has passed an order against such managerial person, such person shall not hold as a director, or “any other office connected with the conduct and management of the affairs of any

Company”. This would mean the indicted person has to mandatorily take a gardening leave of 5 years!

Disgorgement of properties in case of corporate frauds

In case of corporate frauds revealed by investigation by SFIO, the Govt may make an application to NCLT for passing appropriate orders for disgorgement of profits or assets of an officer or person or entity which has obtained undue benefit.

[1] https://www.prsindia.org/sites/default/files/bill_files/Companies%20%28Amendment%29%20Bill%2C%202019_0.pdf

Applicability of NFRA Rules on overseas subsidiaries and associates: Conflict between the Rules and FAQs

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsPammy Jaiswal

Partner, Vinod Kothari and Company

Background

National Financial Reporting Authority (‘NFRA’) being a quasi-judicial authority has been empowered by the Central Government to independently regulate and monitor the accounting and auditing standards (‘A&AS’). The intent of NFRA is to oversee the quality of A&AS of large entities as mentioned under Rule 3 (1) of the NFRA Rules.

Evidently NFRA intends to oversee the A&AS of large entities in terms of being listed or the size of the company or being functionally different entities like electricity companies or insurance companies, etc. Such entities have the presence of its subsidiaries and associates all around the world which may be contributing materially in terms of Rule 3 (1) (e) of the NFRA Rules to the net worth and turnover of the Indian parent entity.

While the last date for filing one time return by bodies corporate is approaching fast i.e. 31st July, 2019, there seems to a lot of ambiguity in the applicability of the NFRA Rules.

This note has been prepared with the intent to showcase the conflict between the provisions of the Companies Act, 2013 (‘Act’) read with its allied Rules and the FAQs issued by NFRA.

Various Provisions of the Act applying to bodies corporate

- Applicability section of the Act

The first section of the Act laying down the applicability of the Act clearly mentions the following under clause (f) of sub-section (4) – “such body corporate, incorporated by any Act for the time being in force, as the Central Government may, by notification, specify in this behalf, subject to such exceptions, modifications or adaptation, as may be specified in the notification.”

This provision makes it very clear that the Ministry of Corporate Affairs (‘MCA’) has been vested with the powers of applying the provisions of the Act to any bodies corporate. Further, the provision is also quite clear that such body corporate may be either incorporated under the Act or any other Act. This implies that even for foreign companies, the MCA has the power to apply the provisions of the Act subject to the changes as may be notified.

- Definition of the term body corporate

Section 2 (11) defines the term ‘body corporate’ to include a company incorporated outside India. Here also, the intent of law is explicitly clear to cover the bodies corporate governed by foreign laws.

- Chapter 22 of the Act

Section 379 (2) of the Act provides that a foreign company which is substantially owned and controlled by an Indian citizen or by an Indian company is required to comply with the provisions of the Act as mentioned thereunder.

Areas of conflict

While the consolidated financial statements of the Indian parent entities include the accounts of the subsidiaries and associates also, it cannot be argued that the quality of auditing and accounting is anywhere less relevant than the A&AS of the Indian parent. Therefore, it seems in fitness of things under clause (e) of Rule 3 (1) of the NFRA Rules to include foreign subsidiary and associates if they fulfil the condition of materiality under the said Rules (foreign subsidiaries and associates whose income or net worth exceeds 20% of the consolidated income and net worth of the Indian parent [‘material subsidiaries and associates]).

However, the FAQs[1] issued by NFRA have taken a different stand altogether with respect to the applicability of the NFRA Rules. It states that only those material subsidiaries and associates are covered under the scope which are having place of business in India.

While it sounds very surprising that if this wouldn’t have been the case, the condition of the foreign subsidiaries and associates which has an Indian parent, doing business back in India is very unlikely.

In any event, if merely by not having a business in India absolves the material subsidiaries and associates from the overview of the NFRA that would frustrate the whole intent and objective of the NFRA and allow such subsidiaries and associates to escape from the regulation of NFRA by virtue of the additional clause in the FAQs.

It seems that this condition of having business in India should have either be mixed with section 379 of the Act which talks about foreign companies having business in India or should may have actually been intended to be referred to the Indian parent’s business in India.

Further, if the question is one of jurisdiction as of how the Act extends its application to foreign bodies corporate not having business in India is concerned, it may be noted that section 1 (4) of the Act allows the Central Government to extend the provision of Act to bodies corporate, and it may therefore, it may be construed that in a manner of speaking is actually extended to foreign bodies corporate which have a business connection in India by virtue of having an Indian parentage.

Conclusion

One of the major questions in front of the stakeholders is the jurisdiction of NFRA which the FAQs have seemingly restricted to bodies corporate having place of business in India. However, considering the other provisions of the Act, it is quite clear that NFRA has been constituted not only to govern the auditors registered in India but also those in abroad as MCA has left number of provisions open under the Act which applies to bodies corporate.

If one interprets the applicability of NFRA on Indian bodies corporate, the whole intent and object of setting this regulatory body will get frustrated.

Related articles –

- http://vinodkothari.com/2019/07/faqs-on-national-financial-reporting-authority-nfra-rules-2018/

- http://vinodkothari.com/wp-content/uploads/2019/07/MCA-Notifies-NFRA-Rules.pdf