Covered bonds and the COVID disruption

/0 Comments/in Bond Market, Capital Markets, Covered Bonds, Financial Services /by Vinod Kothari Consultants-Vinod Kothari

Last year, the European Covered Bonds Council celebrated 250th anniversary of covered bonds[1]. That year also marked a substantial increase in global volumes of covered bonds issuance, which had been flat for the past few years. However, no one, joining the 250 years’ celebration, would have the COVID disruption in mind

With a history of more than 250 years now, covered bonds would have withstood various calamities and disruptions, both economic and natural, over the years. Covered bonds have not seen defaults over all these years. Will they be able to sustain the COVID disruption as well, given the fact that the major countries where they have been used extensively, have all suffered COVID casualties or infections, in varying degrees? In addition to the challenging credit environment, covered bonds will also be put to another question – does this device of refinancing mortgages in Europe hold the answer to sustaining continuous funding of home loans, thereby mitigating the impact of the crisis?

While, over the years, the instrument has been talked about (and less practiced) in lots of jurisdictions over the world, EU countries are still the bastion for covered bonds. About 82% of the world’s Euro 2.50 trillion dollar outstanding covered bonds are issued by EU entities.

European banks’ dependence on covered bond funding

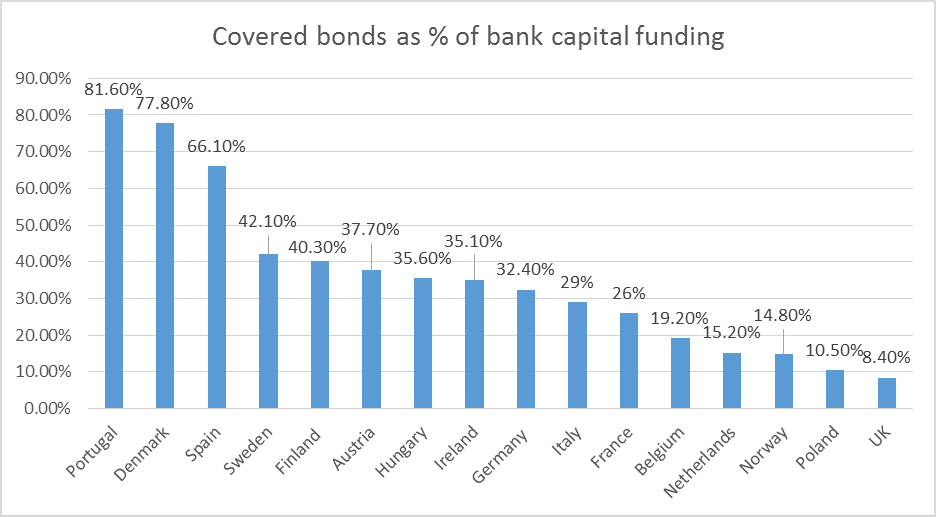

European banks have a substantial dependence on covered bonds. Germany, where covered bonds have widely been regarded as a “fixture of German banking”, account for nearly 32% of the total capital market funding. In some countries, albeit with smaller bank balance sheets, the number goes up to as high as 78 – 81% [See Graph].

Figure 1 source: https://www.spglobal.com/_media/documents/spglobalratings_spglobalratings-coveredbondsprimer_jun_20_2019.pdf

If covered bonds were to prove resilient to the crisis, the investors’ confidence in these bonds, which have so had several regulatory privileges such as lower risk weights, will stand justified. On the other hand, if the bonds were to prove as brittle as some of their issuing banks, the claim to 250 years of unblemished vintage will be put to question.

Robustness of covered bonds

Covered bonds have a dual recourse feature – the issuer, and the underlying pool, in that order. Covered bonds are generally issued by mortgage-lending banks in Europe. Therefore, a default of covered bonds may occur only the issuing banks face the risk of default. Even if that were to happen, the extent of over-collateralisation in the cover pool may be sufficient to hold the bondholders safe. The recourse that the bondholders have against the loan pool is further strengthened by inherent support in a mortgage loan in form of the LTV ratio.

After the Global Financial Crisis and the introduction of Basel III norms, the capital of EU banks has generally strengthened. Data published by European Central Bank shows that European banks have a common equity tier 1 [CET 1] ratio of about 14.78%, as against the regulatory minimum of 4.5%. Therefore, the issuer banks seem to be poised to withstand pressure on the performance.

Past instances of default

Robustness of covered bonds is not the only factor which has kept them standing over all these years – another very important factor is sovereign support. European sovereigns have been sensitive to the important of covered bonds as crucial to maintain the flow of funds to the housing sector, and hence, they have tried to save covered bonds from defaulting.

In the period 1997 to 2019, out of covered bonds, there have been 33 instances of default by covered bond issuers, in various other on-balance sheet liabilities. However, these issues did not default on their covered bonds[2].

There are several regulatory incentives for covered bonds. Central banks permit self-issued covered bonds to be used as collateral for repo facilities. ECB also permits covered bonds as a part of its purchase program. In addition, there are preferential risk weights for capital requirements.

Rating downgrades in covered bonds correlate with sovereign downgrades

Rating agency Moody’s reports [16th April, 2020 report][3] that the potential for rating downgrades for covered bonds was strongly correlated with the ratings of sovereigns. “for countries with Aaa country ceilings, the average 12-month downgrade rate between 1997 and 2019 was 6.5% for covered bonds and 15.5% for covered bond issuers. However, in countries with lower country

ceilings, representing lower sovereign credit quality, the average 12-month downgrade rate increased to 24% for covered bonds and 25% for covered bond issuers”.

Rating agency Fitch also had a similar observation – stating that the rating downgrades for covered bonds were mostly related to sovereign downgrades, as in case of Greece and Italy.

Risk of downgrades in covered bonds

Risk of downgrades in covered bonds arises mainly from 2 reasons: weakening health of issuer banks, and quality of the underlying mortgage pools. Mortgage pools face the risks of reducing property prices, strain on urban incomes and increase in unemployment levels, etc. Over-collateralisation levels remain a strength, but unlike in case of MBS, covered bonds lean primarily on the health of the issuer banks. As long as the bank in question has adequate capital, the chances that it will continue to perform on covered bonds remain strong.

At the loan level, LTV ratios are also sufficiently resilient. Moody’s report suggests that in several jurisdictions, the LTV ratios for European covered bonds are less than 60%.

Additionally, in several European jurisdictions, the regulatory requirement stipulate non-performing loans either to be replaced by performing loans, or not to be considered for the purpose of collateral pool.

Unused notches of rating upliftment

A covered bond rating may rise by several notches, because of a combination of factors, including issuer resolution framework, jurisdictional support, and collateral support[4]. Either because of the strength of the pool, or because of the legislation support, or because of both. However, in any case the issuer’s credit rating is already strong, say, AAA, the notching up that could potentially have come has not been used at all. This is what is referred to as “unused notches”.

In order to assess the ability of covered bonds to withstand the pressure on the issuer bank’s rating will be the extent of unused notches of rating upliftment. In a report dated 25th March, 2020[5], rating agency S&P gave data about unused notches of rating upliftment of covered bonds in several jurisdictions. These ranged between 1 to 6 in many countries, thus pointing to the ability of the covered bond issuances to withstand rating pressures.

Conclusion

We are at the cusp of the disruption in global economies caused by the COVID pandemic. Any assessment of the impact of the crisis on capital market instruments may verge on being speculative. However, current signals are that the 250 years of history of performance does not face the risk of a collapse.

Links to our other resources on covered bonds –

http://vinodkothari.com/wp-content/uploads/Introduction-to-Covered-Bonds-by-Vinod-Kothari.pdf

vinodkothari.com/wp-content/uploads/covered-bonds-article-by-vinod-kothari.pdf

[1] 29th August, 1769, Frederick the Great of Prussia signed an order permitting the issuance of a landowners’ cooperative. It was in 1770 that the first German pfandbrief was issued. Going by this, the 250th anniversary should actually be this year.

[2] See Moody’s report here: https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBS_1117861

[3] https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBS_1221857

[4] Rating agency Standard and Poor’s, for example, considers at least 2 notches for resolution framework, three notches for jurisdictional support, and four notches for collateral support.

[5] https://www.spglobal.com/ratings/en/research/articles/200325-global-covered-bonds-assessing-the-credit-effects-of-covid-19-11402802

New CSR avenues, innovative bonds and much more in the Social Stock Exchange package!

/0 Comments/in Capital Markets, Corporate Laws, SEBI /by Vinod Kothari ConsultantsTimothy Lopes, Executive, Vinod Kothari Consultants

– with updates as on 30-07-2022

In the Union Budget of 2019-2020 the Hon’ble Finance Minister proposed “to initiate steps towards creating an electronic fund raising platform – a Social Stock Exchange (‘SSE’) – under the regulatory ambit of Securities and Exchange Board of India (‘SEBI’) for listing social enterprises and voluntary organizations working for the realization of a social welfare objective so that they can raise capital as equity, debt or as units like a mutual fund.”

A Working Group was subsequently formed on 19th September, 2019 to recommend possible structures and mechanisms for the SSE. We have tried to analyse and examine what the framework would look like based on global SSEs already prevalent in a separate write up.

On 1st June, 2020, the Working Group on Social Stock Exchange published its report for public comments. In this write up we intend to analyse the recommendations made by the working group along with its impact.

The idea of a Social Stock Exchange

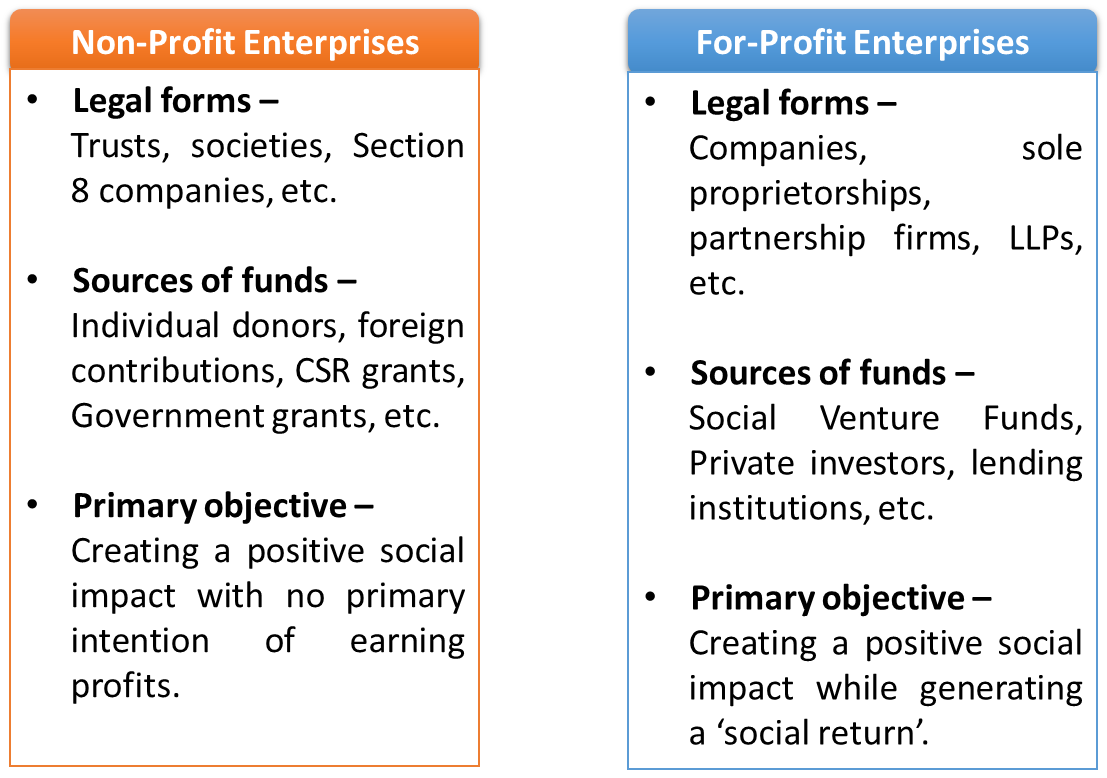

Social enterprises in India exist in large numbers and in several legal forms, for e.g. trusts, societies, section 8 companies, companies, partnership firms, sole proprietorships, etc. Further, a social enterprise can be either a For-Profit Enterprise (‘FPE’) or a Non-Profit Enterprise (‘NPO’). The ultimate objective of these enterprises is to create a social impact by carrying out philanthropic or sustainable development activities.

Certain gaps exist for social enterprises in terms of funding, having a common repository able to track these entities and their performance. The sources of funding for social enterprises have been philanthropic funding, CSR, impact investing, government agencies, etc.

and their performance. The sources of funding for social enterprises have been philanthropic funding, CSR, impact investing, government agencies, etc.

Funding is important in terms of the effectiveness of NPOs in creating an impact. The funding, however, is contingent upon demonstration of impact or outcomes.

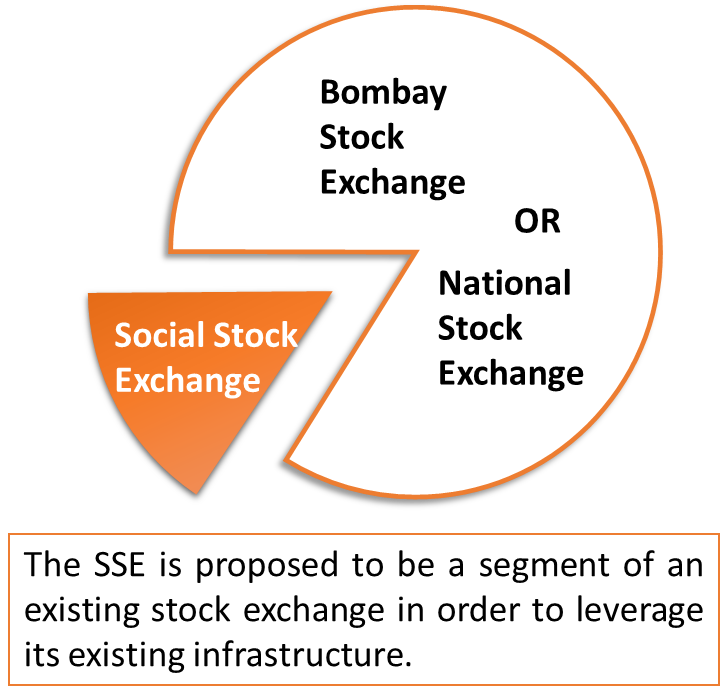

Here comes the idea and role of a social stock exchange. An SSE proposed to be set up is intended to fill the gaps not only in terms of funding, but also to put in place a comprehensive framework that creates standards for measuring and reporting social impact.

Who is eligible to be listed on the SSE?

The SSE is intended for listing of social enterprises, whether for-profit or non-profit. Listing would unlock the funds from donors, philanthropists, CSR spenders and other foundations into social enterprises.

There is no new legal form recommended by the working group which a social enterprise will have to establish in order to get listed. Rather, the existing legal forms (trusts, societies, section 8 companies, etc.) will enable a NPO or FPE to get listed through more than one mode.

Is there any minimum criteria for listing on the SSE?

In case of NPOs, the minimum reporting standards recommended to be implemented, require the NPO to report that it has received donations/contributions of at least INR 10,00,000 in the last financial year.

Further, in case of FPEs, it must have received funding from any one or more of the impact investors who are members of the Impact Investors Council. Certain eligibility conditions for equity listings would also apply in case of FPEs, as per the SEBI’s Issue of Capital, Disclosure Requirements (ICDR).

The working group has requested SEBI to look into the following aspects of eligibility and recalibrate the existing thresholds in the ICDR:

- Minimum Net Worth;

- Average Operating Profit;

- Prior Holding by QIBs, and;

- Criteria for Accredited Investor (if a role for such investors is envisaged).

Listing, compliance and penalty provisions must be aptly stringent to prevent any misuse of SSE platform by FPEs.

What is a social enterprise? Is the term defined?

Social enterprises broadly fall under two forms – A For-Profit Enterprise and a Non-Profit Enterprise.

For-Profit Enterprise – A FPE generally has a business model made to earn profits but does so with the intent of creating a social impact. An example would be creating innovative and environmental friendly products. FPEs are generally in the form of Companies.

Non-Profit Enterprise – NPOs have the intention of creating a social impact for the better good without expecting any return on investment. These are generally in the form of trusts, societies and Section 8 companies. These entities cannot issue equity. The exception to this is a section 8 company which can issue equity shares, however, there can be no dividend payment.

The working group defines a social enterprise as a class or category of enterprises that are engaging in the business of “creating positive social impact”. However, the group does not recommend a legal/regulatory definition but recommends a minimum reporting standard that brings out this aspect clearly, by requiring all social enterprises, whether they are FPEs or NPOs, to state an intent to create positive social impact, to describe the nature of the impact they wish to create, and to report the impact that they have created. There will be an additional requirement for FPEs to conform to the assessment mechanism to be developed by SEBI.

Therefore, an enterprise is “social” not by virtue of satisfying a legal definition but by virtue of committing to the minimum reporting standard.

Since there would be no legal definition to classify as a social enterprise, a careful screening process would be required in order to enable only genuine social enterprises to list on the exchange.

Who are the possible participants of the SSE?

What are the instruments that can be listed? What are the other funding structures? What is the criteria for listing?

In case of Section 8 companies, there is no restriction on issue of shares or debt. However, there is no dividend payment allowed on equity shares. Further, there is no real regulatory hurdle in listing shares or debt instruments of Section 8 companies. However, so far listing of Section 8 companies is a non-existent concept, as these avenues have not been utilized by Section 8 companies apparently due to their inherent inability to provide financial return on investments.

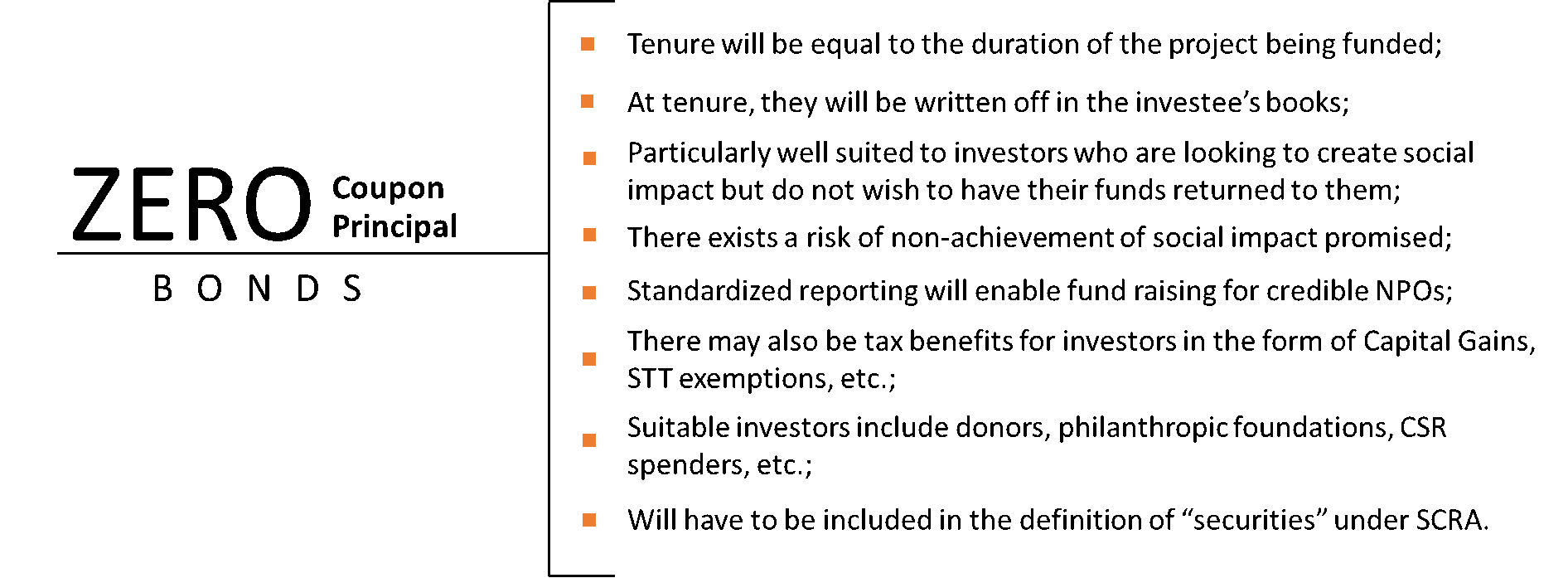

The working group recognises that trusts and societies are not body corporates under the Companies Act, and hence, in the present legal framework, any bonds or debentures issued by them cannot qualify as securities under the Securities Contracts (Regulation) Act 1956 (SCRA).

In this regard the working group suggests introducing a new “Zero Coupon Zero Principal” Bond to be issued by these entities. The features and other specifics of these bonds are discussed further on in this write up.

Further, it is recommended that FPEs can list their equity on the SSE subject to certain eligibility conditions for equity listings as per the SEBI’s Issue of Capital, Disclosure Requirements (ICDR) and social impact reporting.

Funding structures and other instruments are discussed further on in the write up.

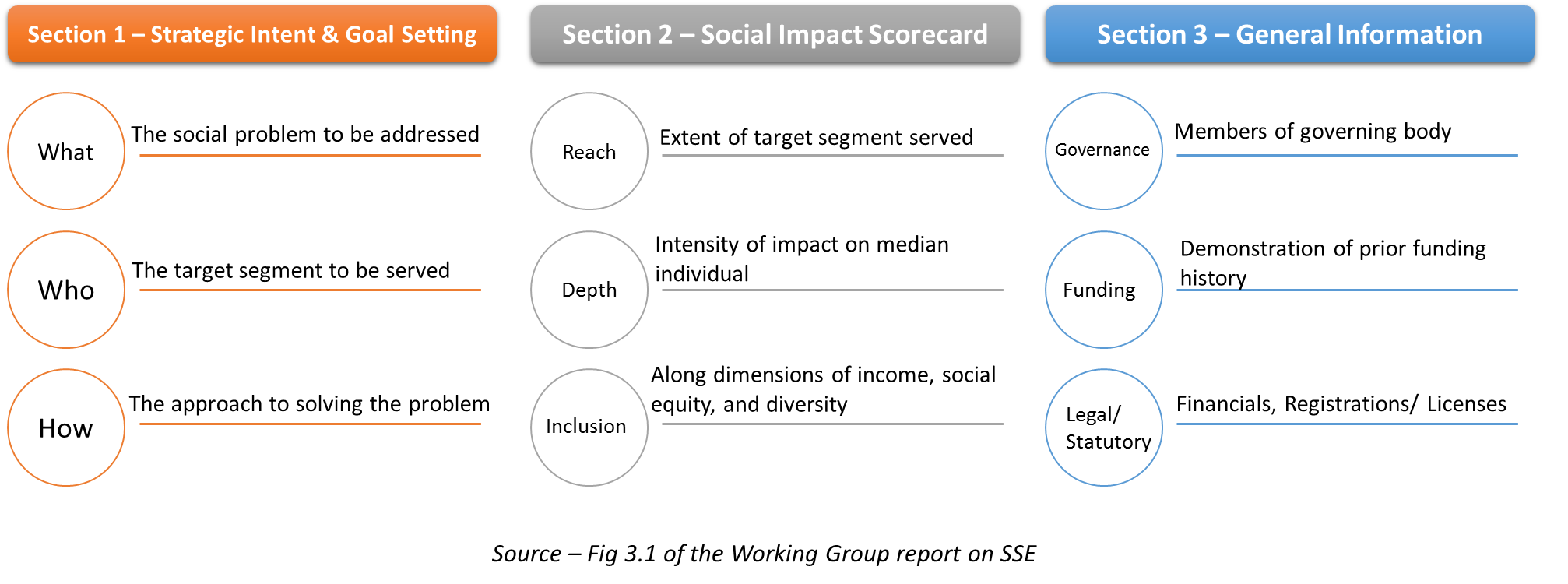

What are the minimum reporting standards?

One of the important pre-requisites to listing on the SSE is to commit to the minimum reporting standards prescribed. The working group has laid down minimum reporting standards for the immediate term to be implemented as soon as the SSE goes live. The minimum reporting standards broadly cover the areas shown in the figure below –

The details of the minimum reporting standard are stated in Annexure 2 to the working group report. The working group states in its report that over time, the reporting requirements can begin to incorporate more rigour in a graded and deliberate manner.

Overall, it seems as though the reporting framework at the present stage is sufficient to measure performance and identify truly genuine social enterprises. The framework sets a benchmark for reporting by NPOs and FPEs and will provide the requisite comfort to investors.

Innovative bonds and funding structures

The SSE’s role is clearly not limited to only listing of securities and trading therein. The working group has recommended several innovative funding mechanisms for NPOs that may or even may not end up in creation of a listable security. Following are the highlights of the proposed structures –

1. Zero coupon zero principal bonds –

The exact modalities of this instrument are yet to be worked out by SEBI.

2. Mutual Fund Structure –

- Under this structure, a conventional closed-ended fund structure is proposed wherein the Mutual Fund acts as the intermediary and aggregates capital from various individual and institutional investors to invest in market-based instruments;

- The returns generated out of such fund is will be channelled to the NPOs who in turn will utilise the funds for its stated project;

- The principal component will be repaid back to the investors, while the returns would be considered as donations made by them;

- There could also be a specific tax benefit arising out of this structure;

- The other benefit of this structure is that the role of the intermediary can be played by existing AMCs.

3. The Social/ Development Impact Bond/ Lending Partner Structure –

These bonds are unique in a way that they returns on the bonds are linked to the success of the project being funded. This is similar to a structured finance framework involving the following –

- Risk Investors/ Lenders (Banks/ NBFCs) – Provide the initial capital investment for the project;

- Intermediary – Acts as the intermediating body between all parties. The intermediary will pass on the funds to the NPO;

- NPO (Implementing Agency) – will use the funds for achieving the social outcomes promised;

- 3rd party evaluator – An independent evaluator who will measure and validate the outcomes of the project;

- Outcome Funder – Based on the third party evaluation the outcome funders will pay the Principal and Interest to the risk investors/ lending partners in case the outcome of the project is successful. In case the outcome is not successful the outcome funders have the option to not pay the risk investors/ lending partners.

Although banks may not be looking into risky lending, the structure provides incentive to the bank in the form of Priority Sector Lending (PSL) qualification. In order to meet their PSL targets, banks may choose to lend under this structure.

4. Pay-for-success through grants –

This structure is where a new CSR aspect comes in. The working group recommends a structure which is similar to the pay-for-success structures stated earlier however, this required the CSR arm of a Company to select the NPO for implementation of the project. The CSR funds are then kept in an escrow account earmarked for pay-for-success, for a pre-defined time period over which the impact is expected to be created (say 3 years).

The initial capital required by the NPO to achieve the outcomes, will be provided by an interim funding partner (typically a domestic philanthropic organization, and distinct from the third-party evaluator).

If the CSR funder finds that the NPO has achieved the outcomes, then it pays out the CSR capital from the escrow account partly to the interim funding partner (similar to the earlier mentioned pay-for success structures), and partly to the NPO in the form of an accelerator grant up to 10% of the program cost in case the NPO exceeds the pre-defined outcome targets. The grant to the NPO is designed to provide additional support for non-programmatic areas such as research, capacity building, etc.

If the CSR funder finds that the NPO has not achieved the outcomes, then it either rolls over the CSR capital in the escrow account (if the pre-defined time period is not yet over), or routes the CSR capital to items provided under Schedule 7 of the Companies Act such as the PM’s Relief Fund (if the pre-defined time period is over).

An avenue for Corporate Social Responsibility

The implementation of the SSE will provide a new platform, not just for CSR spending but also a trading platform for trading in a “CSR certificates” between corporates with excess CSR expenditure and those with a deficit in a particular year.

Investment in securities listed on the SSE are likely to qualify as CSR expenditure. However, necessary amendments in the Companies Act, 2013 will also be required to permit the same to qualify as CSR expenditure. The working group has made the necessary policy recommendations in its report.

Trading platform for CSR spending –

India is one of the only countries that has mandated CSR spending. In a particular year, a Company may fail to meet its required spending obligations owing to several reasons. The High Level Committee on CSR had recommended the transfer of unspent CSR funds to a separate account and the said amount should be spent within 3 years from the transfer failing which the funds would be transferred to a fund specified in Schedule VII. The necessary provisions were inserted by the Companies (Amendment) Act, 2019, however, the same is yet to be notified.

The working group has proposed a new model that could solve the issue of unspent CSR funds. It is recommended that CSR Certificates [may be negotiable instruments, somewhat similar to Priority Sector Lending Certificates (PSLCs)], be enabled to be bought and sold on a separate trading platform. This will allow Companies which have unspent CSR funds to transfer these funds to those Companies that have spent excess for CSR in a particular year. This in turn motivates Companies to spend more than the minimum required CSR amount in a particular year.

The certificates are recommended to have a validity of 3-5 years but may be used only once. In order to avoid any profit making on excess CSR spends, it is recommended that these transactions must involve only a flat transaction fee that gets charged to the platform and involves actual transfer of funds.

Further, the working group has recommended that If the platform as described above succeeds in facilitating the trading of CSR certificates, the government might then consider licensing private platforms that provide an auction mechanism for the trading of CSR certificates (similar to the RBI’s licenses for Trade Receivables Discounting Systems or TReDS). However, this would require additional clarifications on whether CSR certificates must have the status of negotiable instruments or not and on how companies are to treat any profits from the sale of such certificates.

Conclusion

The recommendations of the working group has given an expanded role to the SSE. The working group also attempted to address the role of the SSE in terms of COVID-19 by proposing the creation of a separate COVID-19 Aid Fund to activate solutions such as pay-for-success bonds which can be used to provide loan guarantees to NBFC-MFIs that wish to extend debt moratoriums to their customers.

Necessary changes in law have also been recommended, while several other tax incentives have been recommended by the working group.

The SSE framework seems to be interesting in the Indian context. Nevertheless, the implementation of the same is yet to be seen.

Developments taken place since the WG report

Subsequent to the Working Group Report published on 1st June, 2020, several developments have taken place relating to a framework for SSE. A Technical Group on SSE was constituted by SEBI on 21st September, 2020 which submitted its report on 6th May, 2021[1].

The key recommendations of the Technical Group (which built upon the recommendations of the WG) included recommendations relating to eligibility of social enterprise for SSE, on-boarding of NPOs and FPEs, various instruments available for NPOs and FPEs, offer document content for social enterprises, social venture funds, capacity building fund, social auditors, information repositories and disclosures on SSE.

Our article on the recommendations of the Technical Group can be viewed here.

Public comments were invited and received on the report of the Technical Group. Subsequent to this, SEBI in its Board meeting dated 28th September, 2021, discussed the agenda relating ‘Framework for Social Stock Exchange’[2] which was considered and approved and amendments to several regulations were proposed. Further, SEBI in its Board meeting dated 15th February, 2022, discussed the agenda relating to ‘Regulatory Framework for Social Stock Exchanges’[3] which was also considered and approved.

On 15th July, 2022[4], the Central Government in exercise of the powers conferred by sub-clause (iia) of clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 (‘SCR Act’) declared “zero coupon zero principal instruments” as “securities” for the purpose of the SCR Act.

Further, pursuant to these developments, on 25th July, 2022, SEBI has amended the following regulations to lay down a framework for SSE –

- Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015[5];

- Securities and Exchange Board of India (Alternative Investment Funds), 2012[6];

- Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018[7].

Amendments to other Acts (as proposed in the Working Group and Technical Group reports) that fall outside the purview of SEBI, such as the Companies Act, 2013, Income Tax Act, 1961, etc. are yet to be made.

[1] https://www.sebi.gov.in/reports-and-statistics/reports/may-2021/technical-group-report-on-social-stock-exchange_50071.html

[2] https://www.sebi.gov.in/sebi_data/meetingfiles/oct-2021/1633606607609_1.pdf

[3] https://www.sebi.gov.in/sebi_data/meetingfiles/feb-2022/1645691296343_1.pdf

[4] https://www.sebi.gov.in/legal/gazette-notification/jul-2022/declaration-of-zero-coupon-zero-principal-instruments-as-securities-under-the-securities-contracts-regulation-act-1956_60875.html

[5] https://www.sebi.gov.in/legal/regulations/jul-2022/securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-fifth-amendment-regulations-2022_61169.html

[6] https://www.sebi.gov.in/legal/regulations/jul-2022/securities-and-exchange-board-of-india-alternative-investment-funds-third-amendment-regulations-2022_61156.html

[7] https://www.sebi.gov.in/legal/regulations/jul-2022/securities-and-exchange-board-of-india-issue-of-capital-and-disclosure-requirements-third-amendment-regulations-2022_61171.html

PCG Scheme 2.0 for NBFC pooled assets, bonds and commercial paper

/0 Comments/in Bond Market, Financial Services, Financial services/ NBFCs/Fin-tech - Covid-19, Housing finance, NBFCs /by Vinod Kothari Consultants-Financial Service Division (finserv@vinodkothari.com)

Updated as on August 18, 2020

The write-up below covers version 2.0 of the Partial Credit Guarantee Scheme [PCG Scheme, or PCGS, or simply, the Scheme; version 2 is referred to herein as PCG 2.0 for the sake of distinction from its earlier version, which we refer to PCGS 1.0].

PCGS 1.0 was announced by the Finance Minister, during the Union Budget 2019-20, introducing a partial credit guarantee scheme so as to extend relief to NBFCs during the on-going liquidity crisis. The proposal laid down in the Budget was a very broad statement. On 13th August, 2019 the Ministry of Finance came out with a Press Release to announce the notification in this regard, dated 10th August, 2019, laying down specifics of the scheme.

PCGS 1.0 was only a moderate success, as literally no transactions were conducted under the Scheme until November, 2019. Various stakeholders[1] represented to the MOF to remove the bottlenecks in the structure. Subsequently, on 11th December, 2019, the Union Cabinet approved amendments[2] to the Scheme (Amendments).

The scheme, known as “Partial Credit Guarantee offered by Government of India (GoI) to Public Sector Banks (PSBs) for purchasing high-rated pooled assets from financially sound Non-Banking Financial Companies (NBFCs)/Housing Finance Companies (HFCs)”, is referred to, for the purpose of this write, as “the Scheme”.

PCGS 2.0 was introduced by the Finance Minister as a part of her Rs 20-lakh Crore stimulus package, announced on 13th May, 2020 to provide liquidity to NBFCs, HFCs and MFIs with low credit rating. The Union Cabinet approved the sovereign portfolio guarantee of up to 20% of first loss for purchase of Bonds or Commercial Papers (CPs) with a rating of AA and below (including unrated paper with original/ initial maturity of up to one year) issued by NBFCs/ MFCs/MFIs, by Public Sector Banks through an extension of the PCGS 1.0. PCGS 2.0 has been put in the form of FAQs as well as press-release on the website of the Ministry of Finance.

While PCGS 1.0 was intended to address the temporary liquidity crunch faced by solvent HFCs/ NBFCs, PCGS 2.0 is premised on the continuing problems faced by NBFCs/HFCs/MFIs. The Press Release of the GoI says: “COVID-19 crisis and consequent lockdown restrictions are likely to have a negative impact on both collections and fresh loan disbursements, besides a deleterious effect on the overall economy. This is anticipated to result not only in asset quality issues for the NBFC/ HFC/ MFI sector, but also low loan growth as well as higher borrowing costs for the sector, with a cascading effect on Micro, Small and Medium Enterprises (MSMEs) which borrow from them. While the RBI moratorium provides some relief on the assets side, it is on the liabilities side that the sector is likely to face increasing challenges. The extension of the existing Scheme will address the liability side concerns. In addition, modifications in the existing PCGS will enable wider coverage of the Scheme on the asset side also. Since NBFCs, HFCs and MFIs play a crucial role in sustaining consumption demand as well as capital formation in small and medium segment, it is essential that they continue to get funding without disruption, and the extended PCGS is expected to systematically enable the same.”

PCGS 2.0 covers both the asset side as well as the liability side. PCGS 1.0 was limited to the asset side, for guaranteeing the purchase of “pooled assets” from NBFCs. PCGS 2.0 covers the liability side as well – permitting banks to purchase CPs/ bonds issued by NBFCs/HFCs/MFIs (Finance Companies). Therefore, both the banks as well as Finance Companies will have to make a careful comparison between pool assignments, versus liability issuance. We intend to provide a comparative view of the same in our analysis below.

In this write-up we have tried to answer some obvious questions that could arise along with potential answers. This write-up should be read in conjunction with our earlier write ups on the PCGS 1.0 here.

Scope of applicability

- When does this scheme come into force?

The Scheme was originally introduced on 10th August, 2019 and has been put to effect immediately. The modifications in the Scheme were made applicable with effect from 11th December, 2019.

PCGS 2.0 was announced by the GoI vide a note dated 20th May, 2020.

- Currently, the Scheme has two distinct elements – purchase of asset pools, and purchase of CPs/bonds issued by finance companies. How do these different funding options compare for both the finance companies, and the investing banks?

PCGS 2.0 has added the CP/bond element into the Scheme basically for providing short-term, sovereign-guaranteed liquidity support for redeeming liabilities maturing within 6 months from the date of issue of the CP/bonds. Therefore, the CP/bond guarantee is essentially a liability management option.

On the other hand, the asset pool purchase gives ability to NBFCs to release liquidity locked in assets, and gives them long-term resources for on-lending.

CP is typically issued for a tenure upto 12 months. Bonds for the purpose of the Scheme are also short-term bonds, with a maturity of 9 to 18 months. Hence, in either case, the finance company is simply shifting its existing redemption liability by 9 to 18 months.

Asset pools will have a minimum rating requirement, whereas in case of short-term paper issuance, there is a maximum rating requirement. In fact, PSBs are allowed to purchase unrated paper as well, if the tenure is within 12 months.

A tabular comparison between pool purchases and paper purchase may run as follows:

| Pool Purchases | Paper Purchases | |

| Nature of the transaction | Sale of pool of loans by finance companies to PSBs. PSBs get a first loss guarantee from GoI | Acquisition of a pool of CP/bonds (paper) by PSBs, issued by finance companies. PSBs get a first loss guarantee from GoI |

| Eligible finance companies | NBFCs and HFCs. MFIs are not eligible | MFIs are also eligible |

| Purpose/purport of the transaction | The finance company refinances its pool, thereby releasing liquidity. The liquidity can be used for on-lending | The purported use of the funding is for meeting an imminent liability redemption. The issuance of the paper is connected with liabilities maturing within next 6 months.

The liability itself may be either repayment of a term loan, redemption of any debt security, or otherwise. |

| Rating requirement | Minimum rating of BBB+ | Maximum rating of AA. Unrated paper also qualifies |

| Tenure of the loans/paper | There is no stipulation of the tenure of the underlying loans. The guarantee is valid for a period of 24 months only. | Paper should have maturity of 9 to 18 months. |

| Extent of cover by GoI | 10% of the pool purchased by PSBs | 20% of the portfolio of paper purchased by the PSBs |

| Ramp up period | Loan pools may be acquired upto 31st March, 2021 | Paper may be acquired within 3 months |

| Impact on asset liability mismatch | Repayment of the pool is on a pass-through basis to the PSB. Hence, there is no ALM | Repayment will be on a bullet maturity basis. Hence, there will be an ALM issue. |

| Bankruptcy remoteness | Pool purchases take exposure on the underlying pool, and are therefore, bankruptcy-remote qua the NBFC. | Paper purchase is paper issued by the NBFC and hence, the PSB takes exposure in the issuer. |

2A. Will bonds or CPs issued in secondary market be eligible for purchase under the Scheme?

The Scheme specifically mentions that the bonds/CPs issued by financial companies shall be eligible assets to be purchased under the Scheme. The term ‘issue’ clearly indicates that the bonds/CPs shall be purchased from the primary market only.

- How long will this Scheme continue to be in force?

Originally, PCGS 1.0 was supposed to remain open for 6 months from the date of issuance of this Scheme or when the maximum commitment of the Government, under this Scheme, is achieved, whichever is earlier. However, basis the Amendments discussed above, the Scheme was extended till 20th June, 2020. The Amendments also bestowed upon the Finance Minister power to extend the tenure by upto 3 months.

PCGS 2.0 has two distinct elements – (a) Purchase of Pooled assets; (b) Purchase of bonds/CPs issued by Finance companies. For Part (a), that is, purchase of pooled assets, the Scheme is now extended to 31st March, 2021. For purchase of paper by the PSBs, the PSB has to acquire the paper within 3 months of the announcement. Taking the announcement date of the Scheme to be 20th May, the paper should be acquired by the PSBs within 20th August, 2020.

- Who is the beneficiary of the guarantee under the Scheme – the bank or the NBFC?

The bank (and that too, PSB only) is the beneficiary. The NBFC is not a party to the transaction of guarantee. This is true both for pool purchases as well as paper purchases.

- Does a bank buying pools from NBFCs/HFCs (Financial Entities) automatically get covered under the Scheme?

No. Since a bank/ Financial Entities may not want to avail of the benefit of the Scheme, the Parties will have to opt for the benefit of the guarantee. The bank will have to enter into specific documentation, following the procedure discussed below.

- In case of Paper Purchases, is the guarantee applicable to paper issued by different finance companies?

Yes. The guarantee is for a portfolio of finance company paper acquired by the PSB. For example, a PSB buys the following paper issued by different finance companies:

X Ltd bonds with maturity of 18 months Rs 200 crores

Y Ltd CP having maturity of 9 moths Rs 100 crores

C Ltd bonds having maturity of 12 moths Rs 450 crores

D Ltd CP having maturity of 6 months Rs 50 crores

Total portfolio Rs 800 crores

The bank may get the entire paper, adding to Rs 800 crores, guaranteed by GoI. The guaranteed amount is Rs 800 crores, and the maximum loss payable by the GoI is 20%, that is, Rs 160 crores.

- What is the relevance of pooling of paper, in case of paper purchases?

In case of paper purchases, the guarantee is on a pool of paper, that is, on an aggregate basis. In all such aggregation transactions, unless the pool becomes granular, the first loss guarantee may become highly inadequate.

For example, in the illustration taken in Q5 above, the loss is limited to Rs 160 crores, being 20% of the guaranteed amount. If the bonds issued by C Ltd default, Rs 450 crores would be in default, while the guarantee by the GoI will be only upto Rs 160 crores.

In the same case, had the total portfolio of Rs 800 crores were, say, to consist of 10 issuances of Rs 80 crores each, 2 out of the 10 issuers will be fully covered by the guarantee. Though the conditions of a binomial distribution are inapplicable in the present case (as the pool has a high level of correlation risk), but the probability of more than 2 defaults in a pool of 10 issues seems much lower than the probability of a major issuer out of a non-granular pool defaulting. Hence, PSBs, in their own interest, may want to build up a granular pool consisting of several issuers.

Of course, the ramp up time for all that is highly inadequate – only 3 months from the scheme announcement. From past experience, it should be clear that that much time is lost even in dissemination of understanding – from MOF to SIDBI to the PSBs, and more so because of communication difficulties in the present situation.

- What does the Bank have to do to get covered by the benefit of guarantee under the Scheme?

The procedural aspects of the guarantee under the Scheme are discussed below.

- Is the guarantee specifically to be sought for each of the asset pools acquired by the Bank or is it going to be an umbrella coverage for all the eligible pools acquired by the Bank?

The operational mechanism requires that there will be separate documentation every time the bank wants to acquire a pool from a financial entity in accordance with the Scheme. Hence it appears that the guarantee is for a pool from a specific finance company.

In case of paper purchases, the situation is different – there, the guarantee is for a pool of paper issued by different finance companies.

- How does this Scheme, relating to asset pool purchases, rank/compare with other schemes whereby banks may participate in originations done by NBFCs/HFCs?

The RBI has lately taken various initiatives to promote participation by banks in the originations done by NBFCs/ HFCs. The following are the available ways of participation:

- Direct assignments

- Co-lending

- Loans for on-lending

- Securitisation

Direct assignments and securitisation have been there in the market since 2012, however, recently, once the liquidity crisis came into surface, the RBI relaxed the minimum holding period norms in order to promote the products.

Co-lending is also an alternative product for the co-origination by banks and NBFCs. In 2018, the RBI also released the guidelines on co-origination of priority sector loans by banks and NBFCs. The guidelines provide for the modalities of such originations and also provide on risk sharing, pricing etc. The difficulty in case of co-origination is that the turnaround time and the flexibility that the NBFCs claimed, which was one of their primary reasons for a competitive edge, get compromised.

The third product, that is, loans for on-lending for a specific purpose, has been in existence for long. However, recent efforts of RBI to allow loans for on-lending for PSL assets have increased the scope of this product.

This Scheme, though, is meant to boost specific direct assignment transactions, but is unique in its own way. This Scheme deviates from various principles from the DA guidelines and is, accordingly, intended to be an independent scheme by itself.

The basic use of the Scheme is to be able to conduct assignment of pools, without having to get into the complexity of involving special purpose vehicles, setting enhancement levels only so as to reach the desired ratings as per the Scheme. The effective cost of the Financial Entities doing assignments under the Scheme will be (a) the return expected by the Bank for a GoI-guaranteed pool; plus (b) 25 bps. If this effectively works cheaper than opting for a similar rated pool on a standalone basis, the Scheme may be economically effective.

- How does this Scheme, relating to paper purchases, rank/compare with other schemes whereby PSBs may provide liquidity to NBFCs/HFCs/MFIs?

The Scheme should be compared with Special Liquidity Scheme for NBFCs/HFCs. From the skeletal details available [https://pib.gov.in/PressReleasePage.aspx?PRID=1625310], the Special Liquidity Scheme may allow an NBFC/HFC to issue debt instruments by a rating notch-up, based on partial guarantee given by the SPV to be set up for this purpose.

It may seem that the formation of the SPV as well as implementation of the Special Liquidity Scheme may take some time. In the meantime, if a finance company has immediate liquidity concerns for some maturing debt securities, it may use the PCG scheme.

However, a fair assessment may be that the PCGS 2.0 will be largely useful for pool purchases, rather than paper purchases. This is so because in case of paper purchases, the ramp up period of 3 months will elapse very soon, giving PSBs very little time to approach SIDBI for getting limits. In any case, the ramp up of the pool of paper has to happen first, before the PSB can get the guarantee. This may demotivate PSBs from committing to buy the paper issued by finance companies.

- Is the Scheme for Pool Purchases an alternative to direct assignment covered by Part B of the 2012 Guidelines, or is it by itself an independent option?

While intuitively one would have thought that the Scheme is a just a method of risk mitigation/facilitation of the DA transactions which commonly happen between banks and Financial Entities, there are several reasons based on which it appears that this Scheme should be construed as an independent option to banks/ Financial Entities:

- This Scheme is limited to acquisition of pools by PSBs only whereas direct assignment is not limited to either PSBs or banks.

- This Scheme envisages that the pool sold to the banks has attained a BBB+ rating at the least. As discussed below, that is not possible without a pool-level credit enhancement. In case of direct assignments, credit enhancement is not permissible.

- Investments in direct assignment are to be done by the acquirer based on the acquirer’s own credit evaluation. In case of the Scheme, the acquisition is obviously based on the guarantee given by the GoI.

- There is no question of an agreement or option to acquire the pool back after its transfer by the originator. The Scheme talks about the right of first refusal by the NBFC if the purchasing bank decides to further sell down the assets at any point of time.

Therefore, it should be construed that the Scheme is completely carved out from the DA Guidelines, and is an alternative to DA or securitisation. The issue was clarified by the Reserve Bank of India vide its FAQs on the issue[3].

- Is this Scheme applicable to Securitisation transactions as well?

Assignment of pool of assets can be happen in case of both direct assignment as well as securitisation transaction. However, the intention of the present scheme is to provide credit enhancements to direct assignment transactions only. The Scheme does not intend to apply to securitisation transactions; however, the credit enhancement methodology to be deployed to make the Scheme work may involve several structured finance principles akin to securitisation.

- In case of Paper Purchases, does the PSB have the benefit of security from underlying assets?

In case of CP, the same is unsecured; hence, the question of any security does not arise. In case of bonds, security may be obtained, but given the short-term nature of the instrument, and the fact that the security is mostly by way of a floating charge, the security creation may not have much relevance.

- Between a bond and a CP, what should a PSB/finance company prefer?

The obvious perspective of the finance company as well as the bank may be to go for the maximum tenure permissible, viz., 18 months. CP has a maturity limitation. Hence, the obvious choice will be to go for bonds.

- A finance company has maturity liabilities over the next few months. However, it has sufficient free assets also. Should it prefer to sell a pool of assets, or for a short-term paper issuance?

The question does not have a straight answer. In case the finance company goes for paper issuance, it keeps its assets still available, may be for using the same for a DA/securitisation transaction. However, from the viewpoint of flexibility in use of the funds, as also the elimination of ALM risk, a finance company should consider opting for the pool sale option.

16A. As per the Scheme documents pertaining to Paper Purchase, the issuance of Paper may be done for repaying liabilities. What is the construct of the term “liability”? Can it, for example, include payment to securitisation investors?

Securitisation is a self-liquidating liability which liquidates based on the pool cashflows. The issuer does not repay securitisation liability. However, the facility may otherwise be used for payment of any of the financial obligations of the issuer.

Risk transfer

- The essence of a guarantee is risk transfer. So how exactly is the process of risk transfer happening in case of pool purchases?

The risk is originated at the time of loan origination by the Financial Entities. The risk is integrated into a pool. Since the transaction is a direct assignment (see discussion below), the risk transfer from the NBFC to the bank may happen either based on a pari passu risk sharing, or based on a tranched risk transfer.

The question of a pari passu risk transfer will arise only if the pool itself, without any credit enhancement, can be rated BBB+. Again, there could be a requirement of a certain level of credit enhancements as well, say through over-collateralisation or subordination.

Based on whether the share of the bank is pari passu or senior, there may be a risk transfer to the bank. Once there is a risk transfer on account of a default to the bank, the bank now transfers the risk on a first-loss basis to the GoI within the pool-based limit of 10%.

- How does the risk transfer happen in case of paper purchase?

In case of paper purchase, the risk will arise in case of “failure to service on maturity”. As we discussed earlier, it is presumed that the paper will have a bullet maturity. Hence, if the finance entity is not able to redeem the paper on maturity, the PSB may claim the money from the GoI, upto a limit of 20% for the whole of the pool.

- Let us say, at the time of original guarantee for Paper Purchase, the Pool of paper had a total exposure of Rs 800 crores. Out of the same, Rs 100 crores has successfully been redeemed by the issuer. Is it proper to say that the guarantee now stands reduced to 20% of Rs 700 crores?

No. The guarantee is on a first loss basis for the whole pool, amounting to Rs 800 crores. Hence, the guaranteed amount will remain 20% of Rs 800 crores.

- What is the maximum amount of exposure, the Government of India is willing to take through this Scheme?

Under this Scheme, the Government has agreed to provide (a) 10% first loss guarantee to pool purchase; and (b) 20% guarantee for paper purchases. The total exposure of the Govt has been fixed at a cap of ₹ 10,000 crores.

With the 20% first loss cover in case of paper, it may be seem that the paper will eat the up the total capacity under the Scheme fast. However, as we have discussed above, we do not expect the paper purchases will materalise to a lot of extent in view of the ramp up time of 3 months.

- What does 10% first loss guarantee in case of Pool Purchase signify?

Let us first understand the meaning for first loss guarantee. As the name suggests, the guarantor promises to replenish the first losses of the financier upto a certain level. Therefore, a 10% first loss guarantee would signify that any loss upto 10% of the total exposure of the acquirer in a particular pool will be compensated by the guarantor.

Say for example, if the size of pool originated by NBFC N is Rs. 1000 crores, consisting of 1000 borrowers of Rs. 1 crore each. The terms of the guarantee say that the PSB may make a claim against the GoI once the PSB suffers a loss on account of the loan being 91 DPD or more.

Since the GoI is guaranteeing the losses suffered by the PSB, one first needs to understand the terms between the PSB and the finance company. Quite likely, the finance company will have to provide at least 2 pool level enhancements to lift the rating of the pool sold to the bank to the BBB+ level – excess spread, and some degree of over-collateralisation or first loss support. Hence, to the extent the loans in the pool go delinquent, but are taken care of by the excess spread present in the pool, or the over-collateralisation/first loss support available in the pool, there is no question of any loss being transferred to the PSB. If there is no loss taken by the PSB, there is no question of reaching out to the GoI for the guarantee. It is only when the PSB suffers a loss that the PSB will reach out to the GoI for making payment, in terms of the guarantee.

- When is a loan taken to have defaulted, in case of Pool Purchases, for the purpose of the Scheme?

Para D of the Scheme suggests that the loan will be taken as defaulted when the interest and/or principal is overdue by more than 90 days. It further goes to refer to crystallisation of liability on the underlying borrower. The meaning of “crystallisation of liability” is not at all clear, and is, regrettably, inappropriate. The word “crystallisation” is commonly used in context of floating charges, where the charge gets crystallised on account of default. It is also sometimes used in context of guarantees where the liability is said to crystallise on the guarantor following the debtor’s default. The word “underlying borrower” should obviously mean the borrower included in the pool of loans, who always had a crystallised liability. In context, however, this may mean declaration of an event of default, recall of the loan, and thereby, requiring the borrower to repay the entire defaulted loan.

- On occurrence of “default” as above, will be the Bank be able to claim the entire outstanding from the underlying borrower, or the amount of defaulted interest/principal?

The general principle in such cases is that the liability of the guarantor should crystallise on declaration of an event of default on the underlying loan. Hence, the whole of the outstanding from the borrower should be claimed from the guarantor, so as to indemnify the bank fully. As regards subsequent recoveries from the borrower, see later.

- Does the recognition of loss by the bank on a defaulted loan have anything to do with the excess spreads/interest on the other performing loans? That is to say, is the loss with respect to a defaulted loan to be computed on pool basis, or loan-by-loan basis?

A reading of para D would suggest that the claiming of compensation is on default of a loan. Hence, the compensation to be claimed by the bank is not to be computed on pool basis. However, any pool-level enhancement, such as excess spread or over-collateralisation, will have to be exhausted first.

- Can the guarantee be applicable to a revolving purchase of loans by the bank from the NBFC, that is, purchase of loans on a continuing basis?

No. The intent seems clearly to apply the Scheme only to a static pool.

- If a bank buys several pools from the same NBFC, is the extent of first loss cover, that is, 10%, fungible across all pools?

No. The very meaning of a first loss cover is that the protection is limited to a single, static pool.

- What will the 20% first loss guarantee in case of Paper Purchase signify?

The meaning of first loss guarantee will be the same in case of Paper Purchases, as in case of Pool Purchases. The difference is clearly the lack of granularity in case of Paper purchases, as the exposure is on the issuer NBFC, and not the underlying borrower.

Hence, if the issuer NBFC fails to redeem the paper on maturity, the PSB shall be entitled to claim payment from the guarantor.

- From the viewpoint of maximising the benefit of the guarantee in case of Pool Purchase, should a bank try and achieve maximum diversification in a pool, or keep the pool concentric?

The time-tested rule of tranching of risks in static pools is that in case of concentric, that is, correlated pools, the limit of first loss will be reached very soon. Hence, the benefit of the guarantee is maximised when the pool is diversified. This will mean both granularity of the pool, as also diversification by all the underlying risk variables – geography, industry or occupation type, type of property, etc.

- Is the same principle of pool diversification applicable to a Paper purchase also?

Yes, absolutely. The guarantee is a tranched-risk cover, upto a first loss piece of 20%. In case of all tranched risk cover, the benefit can be maximised only if the risk is spread across a granular pool.

- Can or should the Scheme be deployed for buying a single loan, or a few corporate loans?

First, the reference to pools obviously means diversified pools. As regards pools consisting of a few corporate loans, as mentioned above, the first loss cover will get exhausted very soon. The principle of tranching is that as correlation/concentricity in a pool increases, the risk shifts from lower tranches to senior tranches. Hence, one must not target using the Scheme for concentric or correlated pools.

- In case of Pool Purchases, on what amount should the first loss guarantee be calculated – on the total pool size or the total amount of assets assigned?

While, as we discussed earlier, there is no applicability of the DA Guidelines in the present case, there needs to be a minimum skin in the game for the selling Financial Entity. Whether that skin in the game is by way of a pari passu vertical tranche, or a subordinated horizontal tranche, is a question of the rating required for attaining the benefit of the guarantee. Therefore, if we are considering a pool of say ₹ 1000 crores, the originator should retain at least ₹ 100 crores (applying a 10% rule – which, of course, will depend on the rating considerations) of the total assets in the pool and only to the extent the ₹ 900 crores can be assigned to the purchasing bank.

The question here is whether the first loss guarantee will be calculated on the entire ₹ 1000 crores or ₹ 900 crores. The intention is guarantee the purchasing banks’ share of cash flows and not that retained by the originator. Therefore, the first loss guarantee will be calculated on ₹ 900 crores in the present case.

Scope of the GoI Guarantee

- In case of Pool Purchases, does the guarantee cover both principal and interest on the underlying loan?

The guarantee is supposed to indemnify the losses of the beneficiary, in this case, the bank. Hence, the guarantee should presumably cover both interest and principal.

- Does the guarantee cove additional interest, penalties, etc.?

Going by Rule 277 (vi) of the GFR, the benefit of the guarantee will be limited to normal interest only. All other charges – additional interest, penal interest, etc., will not be covered by the guarantee.

- In case of Paper Purchases, what all does the guarantee cover?

Once again, the guarantee seems to be for the maturiing amount, as also the accumulated interest.

- How do the General Financial Rules of the Government of India affect/limit the scope of the guarantee?

Para 281 of the GFR provides for annual review of the guarantees extended by the Government. The concerned department, DFS in the present case, will conduct review of the guarantees extended and forward the report to the Budget Division. However, if the Government can take any actions based on the outcome of the review is unclear.

Bankruptcy remoteness

- Does the transaction of assignment of pool from the Financial Entity to the bank have to adhere to any true sale/bankruptcy remoteness conditions?

The transaction must be a proper assignment, and should achieve bankruptcy remoteness in relation to the Financial Entity. Therefore, all regular true sale conditions should be satisfied.

- Can a Financial Entity sell the pool to the bank with the understanding that after 2 years, that is, at the end of the guarantee period, the pool will be sold back to the NBFCs?

Any sale with either an obligation to buyback, or an option to buy back, generally conflicts with the true sale requirement. Therefore, the sale should be a sale without recourse. However, retention of a right of first refusal, or right of pre-emption, is not equivalent to option to buy back. For instance, if, after 2 years, the bank is desirous of selling the pool at its fair value, the NBFC may have the first right of buying the same. This is regarded as consistent with true sale conditions.

- If off-balance sheet treatment from IFRS/Ind-AS viewpoint at all relevant for the purpose of this transaction?

No. Off balance sheet treatment is not relevant for bankruptcy remoteness.

- Is the Pool Purchase transaction subject to bankruptcy risk of the issuer finance company?

Yes, absolutely. There is no bankruptcy remoteness in case of paper purchases.

Short term bond instrument regulations

- What are the specific regulations to be complied with in case of PAPER issuance?

The issuing NBFC/HFC will have to comply with the provisions of Companies Act, 2013. Additionally, depending on the tenure and nature of the PAPER, the regulations issued by RBI for money market instruments shall also be applicable.

- Given the current regulatory framework for short term instruments, is it possible to issue unrated instruments with maturity less than 12 months?

As per the RBI Master Directions for Money Market Instruments, the issuers is required to obtain credit rating for issuance of CP from any one of the SEBI registered CRAs. Further, it is prescribed that the minimum credit rating shall be ‘A3’ as per rating symbol and definition prescribed by SEBI.

Similarly, in case of NCD issuance with tenure upto one year, there is a requirement to obtain credit rating from one of the rating agencies. Further, the minimum credit rating shall be ‘A2’ as per rating symbol and definition prescribed by SEBI.

Buyers and sellers

- Who are eligible buyers under this Scheme?

Both in case of Pool Purchases as also Paper Purchases, only Public Sector Banks are eligible buyers of assets under this Scheme. Therefore, even if a Private Sector Bank acquires eligible assets from eligible sellers, guarantee under this Scheme will still not be available.

This may be keeping in view two points – first, the intent of the Scheme, that is, to nudge PSBs to buy pools from Financial Entities. It is a well-known fact that private sector banks are, as it is, actively engaged in buying pools. Secondly, in terms of GFR of the GoI, the benefit of Government guarantee cannot go to the private sector. [Rule 277 (vii)] Hence, the Scheme is restricted to PSBs only.

- Who are eligible sellers under the Scheme in case of Pool purchases?

The intention of the Scheme is to provide relief from the stress caused due to the ongoing liquidity crisis, to sound HFCs/ NBFCs who are otherwise financially stable. The Scheme has very clearly laid screening parameters to decide the eligibility of the seller. The qualifying criteria laid down therein are:

- NBFCs registered with the RBI, except Micro Financial Institutions or Core Investment Companies

- HFCs registered with the NHB

- The NBFC/ HFC must have been able to maintain the minimum regulatory capital as on 31st March, 2019, that is –

- For NBFCs – 15%

- For HFCs – 12%

- The net NPA of the NBFC/HFC must not have exceeded 6% as on 31st March, 2019

- The NBFC/ HFC must have reported net profit in at least one out of the last two preceding financial years, that is, FY 2017-18 and FY 2018-19.

- The Original Scheme stated that the NBFC/ HFC must not have been reported as a Special Mention Account (SMA) by any bank during the year prior to 1st August, 2018. However, the Amendment even allows NBFC/HFC which may have slipped during one year prior to 1st August, 2018 shall also be allowed to sell their portfolios under the Scheme.

- Who are eligible issuers under the Scheme in case of PAPER purchases?

The intention of the Scheme is to provide relief from the stress caused due to the ongoing liquidity crisis, the eligible issuers are as follow:

- NBFCs registered with the RBI except Government owned NBFCs

- All MFIs which are members of a Self-Regulatory Organisation (SRO) recognized by RBI shall be eligible for purchase of Bonds/ CPs.

- HFCs registered with the NHB except Government owned HFCs.

- In case of pool purchases, can NBFCs of any asset size avail this benefit?

Apparently, the Scheme does not provide for any asset size requirement for an NBFC to be qualified for this Scheme, however, one of the requirements is that the financial institution must have maintained the minimum regulatory capital requirement as on 31st March, 2019. Here it is important to note that the requirement to maintain regulatory capital, that is capital risk adequacy ratio (CRAR), applies only to systemically important NBFCs.

Only those NBFCs whose asset size exceeds ₹ 500 crores singly or jointly with assets of other NBFCs in the group are treated as systemically important NBFCs. Therefore, it is safe to assume that the benefits under this Scheme can be availed only by those NBFCs which – a) are required to maintain CRAR, and b) have maintained the required amount of capital as on 31st March, 2019, subject to the fulfillment of other conditions.

- In case of issuance of bonds/commercial papers, is there a similar capital requirement?

There is no such condition in case of bond and CP issuance.

- In case of pool purchases, the eligibility criteria for sellers state that the financial institution must not have been reported as SMA-1 or SMA-2 by any bank any time during 1 year prior to 1st August, 2018– what does this signify?

As per the prudential norms for banks, an account has to be declared as SMA, if it shows signs of distress without slipping into the category of an NPA. The requirement states that the originator must not have been reported as an SMA-1 or SMA-2 any time during 1 year prior to 1st August, 2018, and nothing has been mentioned regarding the period thereafter.

Therefore, if a financial institution satisfies the condition before 1st August, 2018 but becomes SMA-1 or SMA-2 thereafter, it will still be eligible as per the Scheme. The whole intention of the Scheme is to eliminate the liquidity squeeze due to the ILFS crisis. Therefore, if a financial institution turns SMA after the said date, it will be presumed the financial institution has fallen into a distressed situation as a fallout of the ILFS crisis.

Eligible assets

- What are the eligible assets for the Scheme in case of Pool Purchases?

The Scheme has explicitly laid down qualifying criteria for eligible assets and they are:

- The asset must have originated on or before 31st March, 2019.

- The asset must be classified as standard in the books of the NBFC/ HFC as on the date of the sale.

- The original Scheme stated that the pool of assets should have a minimum rating of “AA” or equivalent at fair value without the credit guarantee from the Government. However, through the Amendment, the rating requirement has been brought down to BBB+.

- Each account under the pooled assets should have been fully disbursed and security charges should have been created in favour of the originating NBFCs/ HFCs.

- The individual asset size in the pool must not exceed ₹ 5 crore.

- The following types of loans are not eligible for assignment for the purposes of this Scheme:

- Revolving credit facilities;

- Assets purchased from other entities; and

- Assets with bullet repayment of both principal and interest

- Pools consisting of assets satisfying the above criteria qualify for the benefit of the guarantee. Hence, the pool may consist of retail loans, wholesale loans, corporate loans, loans against property, or any other loans, as long as the qualifying conditions above are satisfied.

- Should the Scheme be deployed for assets for longer maturity or shorter maturity?

Utilising the Scheme for pools of lower weighted average maturity will result into very high costs – as the cost of the guarantee is computed on the original purchase price.

Using the Scheme for pools of longer maturity – for example, LAP loans or corporate loans, may be lucrative because the amortisation of the pool is slower. However, it is notable that the benefit of the guarantee is available only for 2 years. After 2 years, the bank will not have the protection of the Government’s guarantee.

- If there are corporate loans in the pool, where there is payment of interest on regular basis, but the principal is paid by way of a bullet repayment, will such loans qualify for the benefit of the Scheme?

The reference to bullet repaying loans in the Scheme seems similar to those in DA guidelines. In our view, if there is evidence/track record of servicing, in form of interest, such that the principal comes by way of a bullet repayment (commonly called IO loans), the loan should still qualify for the Scheme. However, negatively amortising loans should not qualify.

- Is there any implication of keeping the cut-off date for originations of loans to be 31st March, 2019?

This Scheme came into force with effect from 10th August, 2019 and remained open till 30th June, 2020. The original Scheme also had this cut-off of 31st March, 2019.

Due to the extension, though the timelines have been extended by one year till 31st March, 2021, however, the cut off date has not changed. Therefore, in our view, this scheme will hold good only for long tenure loans, such as mortgage loans.

- Is there any maximum limit on the amount of loans that can be assigned under this Scheme?

Yes, the Scheme has put a maximum cap on the amount of assets that can be assigned and that is an amount equal to 20% of the outstanding standard assets as on 31st March, 2019, however, the same is capped to ₹ 5000 crores.

- Is there a scope for assigning assets beyond the maximum limits prescribed in the Scheme?

Yes, the Scheme states that any additional amount above the cap of ₹ 5,000 crore will be considered on pro rata basis, subject to availability of headroom. However, from the language, it seems that there is a scope for sell down beyond the prescribed limit, only if the eligible maximum permissible limit gets capped to ₹ 5,000 crores and not if the maximum permissible limit is less than ₹ 5000 crores.

The following numerical examples will help us to understand this better:

| Total outstanding standard assets as on 31st March, 2019 | ₹ 20,000 crores | ₹ 25,000 crores | ₹ 30,000 crores |

| Maximum permissible limit @ 20% | ₹ 4,000 crores | ₹ 5,000 crores | ₹ 6,000 crores |

| Maximum cap for assignment under this Scheme | ₹ 5,000 crores | ₹ 5,000 crores | ₹ 5,000 crores |

| Amount that can be assigned under this Scheme | ₹ 4,000 crores | ₹ 5,000 crores | ₹ 5,000 crores |

| Scope for further sell down? | No | No | Yes, upto a maximum of ₹ 1,000 crores |

- When will it be decided whether the Financial Entity can sell down receivables beyond the maximum cap?

Nothing has been mentioned regarding when and how will it be decided whether a financial institution can sell down receivables beyond the maximum cap, under this Scheme. However, logically, the decision should be taken by the Government of India of whether to allow further sell down and closer towards the end of the Scheme. However, we will have to wait and see how this unfolds practically.

- What are the permissible terms of transfer under this Scheme?

The Scheme allows the assignment agreement to contain the following:

- Servicing rights – It allows the originator to retain the servicing function, including administrative function, in the transaction.

- Buy back right – It allows the originator to retain an option to buy back its assets after a specified period of 12 months as a repurchase transaction, on a right of first refusal basis. Actually, this is not a right to buy back, it is a right of first refusal which the NBFC/ HFC may exercise if the purchasing bank further sells down the assets. See elsewhere for detailed discussion

Rating of the Pool in case of Pool Purchases

- The Scheme requires that the pool must have a rating of BBB+ before its transfer to the bank. Does that mean there be a formal rating agency opinion on the rating of the pool?

Yes. It will be logical to assume that SIDBI or DFS will expect a formal rating agency opinion before agreeing to extend the guarantee.

- The Scheme requires the pool of assets to be rated at least BBB+, what does this signify?

As per the conditions for eligible assets, the pool of assets to be assigned under this Scheme must have a minimum rating of “BBB+” or equivalent at fair value prior to the guarantee from the Government.

There may be a question of expected loss assessment of a pool. Initially, the rating requirement was pegged at “AA” or higher and there was an apprehension that the originators might have to provide a substantial amount of credit enhancement in order to the make the assets eligible for assignment under the Scheme. Subsequently, vide the Amendments, the rating has been brought down to BBB+. The originators may also be required to provide some level of credit enhancements in order to achieve the BBB+ rating.

Unlike under the original Scheme, where the rating requirement was as high as AA, the intent is to provide guarantee only at AA level, then the thickness of the guarantee, that is, 10%, and the cost of the guarantee, viz., 25 bps, both became questionable. The thickness of support required for moving a AA rated pool to a AAA level mostly is not as high as 10%. Also, the cost of 25 bps for guaranteeing a AA-rated pool implied that the credit spreads between AA and a AAA-rated pool were at least good enough to absorb a cost of 25 bps. All these did not seemed and hence, there was not even a single transaction so far.

But now that the rating requirement has been brought down to BBB+, it makes a lot of sense. The credit enhancement level required to achieve BBB+ will be at least 4%-5% lower than what would have been required for AA pool. Further, the spread between a BBB+ and AAA rated pool would be sufficient to cover up the guarantee commission of 25 bps to be incurred by the seller in the transaction.

Here it is important to note that though the rating required is as low as BBB+, but there is nothing which stops the originator in providing a better quality pool. In fact, by providing a better quality pool, the originator will be able to fetch a much lower cost. Further, since, the guarantee on the pool will be available for only first two years of the transaction, the buyers will be more interested in acquiring higher quality pools, as there could be possibilities of default after the first two years, which is usually the case – the defaults increase towards the end of the tenure.

57A. Will investment grade debt paper of NBFCs/HFCs/MFIs be determined without adjustments for the COVID scenario considering the grading may have been downgraded?

As per the Scheme, the rating of debt paper as on date of transaction would apply. In this regard, a circular issued by SEBI on March 30, 2020 maybe considered, which directs rating agencies to not consider delay in repayments owing to the lockdown as ‘default’. Thus, the rating issued by the credit rating agencies would already adjust the delays owing to COVID disruptions.

Risk weight and capital requirements

- Can the bank, having got the Pool guaranteed by the GoI, treat the Pool has zero% risk weighted, or risk-weighted at par with sovereign risk weights?

No. for two reasons –one the guarantee is only partial and not full. Number two, the guarantee is only for losses upto first 2 years. So it is not that the credit exposure of the bank is fully guaranteed

- What will be the risk weight once the guarantee is removed, after expiry of 2 years?

The risk weight should be based on the rating of the tranche/pool, say, BBB+ or better.

Guarantee commission

- Is there a guarantee commission? If yes, who will bear the liability to pay the commission?

As already discussed in one of the questions above, the Scheme requires the originators to pay guarantee commission of 25 basis points on the amount of guarantee extended by the Government. Though the originator will pay the fee, but the same will be routed through purchasing bank.

- The pool is amortising pool. Is the cost of 25 bps to be paid on the original purchase price?

From the operational details, it is clear that the cost of 25 bps is, in the first instance, payable on the original fair value, that is, the purchase price.

Invocation of guarantee and refund

- When can the guarantee be invoked in case of Pool Purchases?

The guarantee can be invoked any time during the first 24 months from the date of assignment, if the interest/ principal has remained overdue for a period of more than 90 days.

- When can the guarantee be invoked in the case of Paper Purchases?

There is no maximum time limit in case of Paper Purchases. Hence, the guarantee can be invoked upto maturity. The maximum maturity, of course, is limited to 18 months.

- In case of Pool Purchases, can the purchasing bank invoke the guarantee as and when the default occurs in each account?

Yes. The purchasing bank can invoke the guarantee as and when any instalment of interest/ principal/ both remains overdue for a period of more than 90 days.

- In case of PAPER Purchases, can the purchasing bank invoke the guarantee as and when the default occurs?

Assuming the instruments will have bullet repayment of principal, the answer is yes.

- To what extent can the purchasing bank recover its losses through invocation of guarantee?

When a loan goes bad, the purchasing bank can invoke the guarantee and recover its entire exposure from the Government. It can continue to recover its losses from the Government, until the upper cap of 10% of the total portfolio is reached. However, the purchasing bank will not be able to recover the losses if – (a) the pooled assets are bought back by the concerned NBFCs/HFCs or (b) sold by the purchasing bank to other entities.

- Within how many days will the purchasing bank be able to recover its losses from the Government?

As stated in the Scheme, the claims will be settled within 5 working days.

- In case of pool purchase, what will happen if the purchasing bank recovers the amount lost, subsequent to the invocation of guarantee?

If the purchasing bank, by any means, recovers the amount subsequent to the invocation of the guarantee, it will have to refund the amount recovered or the amount received against the guarantee to the Government within 5 working days from the date of recovery. However, if the amount recovered is more than the amount received as guarantee, the excess collection will be retained by the purchasing bank.

- In case of PAPER Purchase, what will happen if the purchasing bank recovers the amount lost, subsequent to the invocation of guarantee?

If the purchasing bank, by any means, recovers the amount subsequent to the invocation of the guarantee, it will have to refund the amount recovered or the amount received against the guarantee to the Government within 5 working days from the date of recovery. However, if the amount recovered is more than the amount received as guarantee, the excess collection will be retained by the purchasing bank.

Modus operandi

- What will be the process for a bank to obtain the benefit of the guarantee?

While the Department of Financial Services (DFS) is made the administrative ministry for the purpose of the guarantee under the Scheme, the Scheme involves the role of SIDBI as the interface between the banks and the GoI. Therefore, any bank intending to avail of the guarantee has to approach SIDBI.

- Can you elaborate on the various procedural steps to be taken to take the benefit of the guarantee?

The modus operandi of the Scheme is likely to be as follows:

- An NBFC approaches a bank with a static pool, which, based on credit enhancements, or otherwise, has already been uplifted to a rating of BBB+ or above level.