– Team Finserv | finserv@vinodkothari.com

Call it Trump relief! The RBI announced relief measures on the 14th Nov to help the exporters of certain specified items, who may have availed export credit facilities from a regulated lender, whereby all regulated entities (REs) “may” provide a moratorium, from 1st September 2025 to 31st December, 2025. The grant of such a relief shall be based on a policy, consisting of the criteria for grant of the subject relief, and such criteria shall be disclosed publicly. Not only this, REs shall also make a fortnightly disclosure of the reliefs granted to eligible borrowers on a RBI format on Daksh portal.

The Reserve Bank of India (Trade Relief Measures) Directions, 2025 (‘Directions’) are applicable to NBFCs and HFCs as well. This is accompanied with amendment to Foreign Exchange Management (Export of Goods and Services) (Second Amendment) Regulations, 2025 for extension of the period for both realization/repatriation of export value (from 9 to 15 months) and the shipment of goods against advance payment (from 1 to 3 years).

Highlights:

- Whether your company grants an export credit or not, if your borrower is the one who has availed export credit for export of specified goods or services, the borrower may approach you for the moratorium.

- Are you bound to grant the moratorium? Answer is, no. However, basis a policy which is publicly hosted, you will consider the eligibility of the borrower. The relevant factors on which the eligibility will be examined may also form a part of the policy, and ideally, should include the extent of dependence on exports of specified items to the USA, tariff-based disruption in the cashflows, alternative markets and transitioning possibilities, etc.

- Effective: Immediately.

- Actionables: (a) Framing of policy to consider the eligibility of affected borrowers; (b) Hosting the policy on public website; (c) Creating mechanism for receiving and transmission of borrower requests for the moratorium and giving timely responses to the same (d) RBI fortnightly reporting.

What is the intent?

To mitigate the disruptions caused by global headwinds, and to ensure the continuity of viable businesses.

Tariff impositions by the USA are likely to impact several exporters. There may be a ripple effect on penultimate sellers or other segments of the economy as well, but the intent of the Trade Relief Directions seems limited to the direct exporters only.

Which all regulated entities are covered?

The Directions are applicable to following entities:

- Commercial Banks

- Primary (Urban) Co-operative Banks, State Co-operative Banks and Central Co-operative Banks

- NBFCs

- HFCs

- All-India Financial Institutions

- Credit Information Companies (only with reference to paragraph 16 of these Directions).

Does it matter whether the RE in question is giving export credit facilities or not? In our view, it does not matter. The intent of the Directions is to mitigate the impact of trade disruptions. Of course, the borrower in question must be an exporter, must have an export credit facility outstanding as on 31st Aug 2025, and the same must be standard.

If these conditions are met, then the RE which holds the export credit, as also other REs (of course, the nexus between the trade disruption and the servicing of the credit facility will have to be seen) should consider the borrower for the purpose of grant of relief.

Relief may or may not be granted.

Policy on granting relief

The consideration of the grant of relief will be based on a policy.

Below are some of the brief pointers to be incorporated in the policy:

- Purpose and Scope: define which loan products, sectors, or borrower categories are covered; effective period for granting relief

- Eligibility Criteria for borrowers

- Assessment criteria for relief requests received from the borrowers

- Authority responsible for approving such request

- Relief measures that can be offered to borrowers

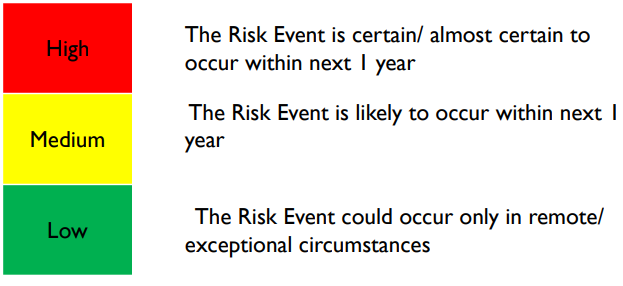

- Impact on asset classification and provisioning

- Disclosure Requirements

- Monitoring and Review: Authority which is responsible for monitoring such accounts; periodicity of review

How is the assessment of eligible borrowers to be done?

In our view, the relevant information to be obtained from the candidates should be:

- Total export over a relevant period in the past, say 3 years

- Break up of export of “impacted items” and other item

- Of the above, exports to the USA

- Gross profit margin

- Impact on the cashflows

- Information about cancellation of export orders from US importers

- Any damages or other payments receivable from such importers

- Any damages or other payments to be made to the penultimate suppliers

- Alternative business strategies – repositioning of markets, alternative buyer base, etc

- Cashflow forecasts, and how the borrower proposes to pay after the Moratorium Period.

What sort of lending facilities are covered?

Please note the following from the preamble: “mitigating the burden of debt servicing brought about by trade disruptions caused by global headwinds and to ensure the continuity of viable businesses”. Therefore, clearly, the relief intended here is one where “trade disruptions” create such a burden on debt servicing, which may impact the viability of the business.

From this, it implies that the entity in question must be a business entity, and the loan in question should be a business loan.

In our thinking, the following facilities seem covered:

- Export credits of all forms, including packing credit, funded as well as unfunded, letters of credit, etc.

- Buyer’s credit or facilities for inward acquisitions/purchases by an exporter

- Cash credits, overdrafts or working capital related facilities, intended for export business of impacted items.

- Term loans relating to an impacted business

- Loans against property, where the end use is working capital

Eligible and ineligible borrowers:

Eligible borrowers:

- Borrowers who have availed credit for export

- Borrower had an outstanding export credit facility from a RE as of August 31, 2025 (However, in case the borrower has a sanctioned facility pending disbursement as on Aug 31, the same shall not be eligible)

- Borrower with all REs was/were classified as ‘Standard’ as on August 31, 2025

In our view, the following borrowers/ credit facilities are not eligible for the relief:

- Individuals or borrowers who have not borrowed for business purposes

- Home loans or loans against specific assets or cashflows, where the debt servicing is unconnected with the cash flows from an export business

- Loans against securities or against any other financial assets

- Gold loans, other than those acquired for business purposes

- Car loans, loans against commercial vehicles or construction equipment, unless the borrower is engaged in export business and the cashflows have a nexus with such business

- Borrower is engaged in exports relating to any of the sectors specified

- Borrower accounts which were restructured before August 31, 2025

- Accounts which are classified as NPA as on August 31, 2025

Consider a borrower who is not an exporter himself, but an ancillary supplier, supplying to a trading house. Will such a penultimate exporter be covered by the Relief Directions? In our view, the answer is negative, as the “eligible borrowers” are defined to mean an exporter.

Impacted items and impacted markets

The list of impacted items broadly covers a wide spectrum of manufacturing and export-oriented sectors, including marine products, chemicals, plastics, rubber, leather goods, textiles and apparel, footwear, stone and mineral-based articles, jewellery and precious metals, metal products, machinery, electrical and electronic equipment, automobiles and auto components, medical and precision instruments, and furniture and furnishing items.

Is it mandatory that the borrower shall be exporting to USA? While the Directions do not specifically mandate that the borrower shall be exporting to the USA, the concerned REs should, as part of their assessment, evaluate whether the borrower genuinely requires such relief measures and, in our view, should consider the extent to which the borrower depends on exports of the specified items to the USA.

Why have HFCs been covered?

Generally speaking, the servicing of home loans is not supposed to be based on business cashflows, and therefore, the impact of trade disruptions on servicing of a home loan does not seem easy to establish.

However, HFCs grant other credit facilities too, including LAP or business loans. Therefore, there is no carve out for HFCs as such. HFCs are also expected to prepare the policy referred to above and be sensitive to requests from impacted borrowers.

Is the moratorium retrospective?

Yes, clearly, the moratorium is retrospective, as it covers the period from 1st September to 31st December. This is the range over which the moratorium may be granted; of course, the decision as to how much moratorium, within the above maximum range, is warranted in the particular case, is that of the lender. Let us call the agreed moratorium as the Moratorium Period.

If the moratorium is granted from 1st Sept., then any payments which were due for the period covered by the Moratorium Period will not be taken as having fallen due. This will have significant impact on the loan management systems:

- Considering that we are already in the middle of November, the day count for any payments due during the part of the Moratorium Period will be set to zero. In other words, day count will stop during the Moratorium Period. Thus, if an account was showing a DPD status of 60 days as on Aug 31, 2025, the DPD count will remain at a standstill till the moratorium period is over.

- However, in case a borrower has made payment during the moratorium period, will the DPD count decrease or will it remain the same?

The RBI Directions state that the days past due (DPD) count during the moratorium period will be excluded. However, this does not imply that a borrower who makes payments during this period should be denied the corresponding benefit. In our view, if a payment is received from the borrower, the DPD count should accordingly be reduced.

- Any payments already made during the part of the Moratorium Period already elapsed may be taken towards principal, or may be held to be adjusted against the future dues of the borrower, after the Moratorium Period. This should also, appropriately, be captured in the policy.

- Further, for accounts for which the CIC reporting has already been done on or after Aug 31, 2025, and the lender decides to extend the moratorium benefit, it must be ensured that the DPD count is revised so as to reflect the status as on Aug 31, 2025.

Do lenders have to necessarily grant moratorium, or grant partial interest/principal relief?

The RBI Directions do not mandate REs from granting such relief measures. Accordingly, the concerned RE will need to assess individual cases based on the sectors, the need for such relief and the extent to which such relief may be granted.

Lenders may grant full moratorium during the Moratorium Period, or may grant relief as may be considered appropriate.

Do lenders take positive actions, or simply respond to borrower requests?

The lenders must establish a policy for granting such relief measures prior to extending any relief, as the authority to do so will be derived from this policy. As discussed above, the discretion to grant relief rests with the concerned RE; therefore, each request submitted by a borrower must be evaluated on an individual basis.

For this purpose, the following information must be obtained from the borrowers seeking relief:

- The concerned sector and how the same has been impacted necessitating such relief

- Information relating to the current financial condition of the business of the borrower

- Facilities taken and outstanding with other REs

Non-compounding of interest during the Moratorium Period:

Para 9 (iii) provides that while interest will accrue during the Moratorium Period, but the interest shall be simple, that is, shall not be compounded.

This may require REs to tweak their loan management systems to stop the compounding of interest during the Moratorium Period.

However, the actual population of affected borrowers for a particular RE may be quite limited. Hence, REs may do manual or spreadsheet-based adjustments for affected borrowers, instead of making adjustments to their LMS itself.

Recomputation of facility cashflows after Moratorium:

During the moratorium period, as per the RBI directive, the lender can only accrue simple interest. Accordingly, the IRR of the credit facility will have a negative impact unlike the covid moratorium where the compound interest loss was compensated by the central government.

Further, it has also been provided that the accrued interest may be converted into a new term loan which shall however be repayable in one or more installments after March 31, 2026, but not later than September 30, 2026. Accordingly, the accrued interest should anyhow be received by September 30, 2026.

Similar moratoriums in the past

- Moratorium on loans due to COVID-19 disruption: Refer to our write-up here.

- Moratorium 2.0 on term loans and working capital: Refer to our write-up here.

Our write-ups on similar topics: