Comparative Analysis of provisions enabling majority shareholders to squeeze out minorities

Harshil Matalia, Executive, Vinod Kothari & Company

Introduction

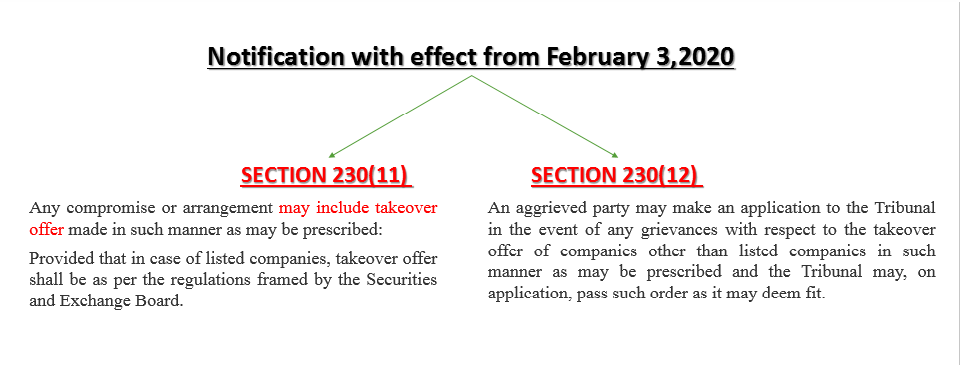

Squeezing out minority shareholders has gradually become an area of intense interest and scrutiny. With the recent set of notifications, Ministry of Corporate Affairs (MCA) has opened yet another way of squeezing out minority shareholders. The MCA has recently notified[1] sub section (11) and (12) of section 230 of the Companies Act, 2013 (‘Act’) on 3rd February, 2020 (effective from the date of notification itself), whereby power has been given to the majority shareholders holding atleast 3/4th of the share capital of the target company to enter into arrangement for acquisition of any part of the remaining shares of the target company.

While section 236 of the Act specifically provides for squeezing out of minority shareholders, the prerequisite of holding atleast 90% of the share capital is a challenge to implement. Whereas, with the notification, those holding atleast 75% can move ahead with the proposal before the NCLT via Scheme and can acquire the balance by offering a fair price determined by the Registered valuer.

The term ‘squeeze out’ reflects a situation whereby controller shareholders undertakes a transaction to forcibly acquire remaining shares of a company. There are number of methods provided in the Act through which minorities can be squeeze out by majorities, viz. reduction of share capital, consolidation of shares etc.

This write up is an attempt to analyse the implementation of the recently notified provisions and a brief comparison of the same with the existing options of squeezing out minority shareholders.

An Overview of Section 230

Section 230 of the Act provides for any compromise and arrangement between shareholders or creditors of a company with the company pursuant to a scheme. The company or any shareholder or creditor or liquidator (in case the company is under liquidation) can file application before the National Company Law Tribunal (NCLT) for the approval of the scheme of compromise or arrangement along with the documents as provided under rule 3 of the Companies (Compromises, Arrangements and Amalgamations ) Rule, 2016.

Approval from at least 90% of shareholder and creditors of applicant companies will enable the companies to get dispensation from the NCLT convened meeting, otherwise, dual approval as per section 230 (6) of the Act will be required, which is ‘majority of persons representing 3/4th in value.

Further, the Act also provides for sending of a copy of application to all the regulatory authorities, such as Registrar of Companies, Central Government (power delegated to Regional Director), Official Liquidator, Income Tax Authorities, Securities and exchange board of India (in case of listed companies), CCI and Reserve bank of India (in case of NBFC, for inviting their objection, if any on the proposed scheme. In consideration of all the respective Tribunal can allow the scheme. The scheme, once approved by the Tribunal, shall be binding on the company, all the shareholders, creditors, and in case of company being wound up, on the liquidator and the contributories of the company.

Proviso to section 230 (4) provides for right to object to the shareholder holding 10% of the share capital of company either individually or together with other shareholders; and the creditors holding 5% of the outstanding debt either individually or together with other creditors.

The enabling notifications[2] provides for ‘takeover offer’ by the shareholders holding at least 3/4th of the shares of a company to the remaining shareholders, which means shareholders holding 75% or more of the issued share capital of the a company can now enter into an arrangement with the target company to acquire remaining shares by offering them the price determined by the registered valuers. While the other compliance as set out in section 230 of the Act will remain same for the scheme involving takeover offer, the applicant shall additionally be required to deposit 50% of the offer price in a separate bank account after getting requisite approval from the shareholders and creditors but before getting approval from the Tribunal.

In addition to the right to object u/s 230 (4), further liberty has been given to the aggrieved party, other than listed companies, to make application before the NCLT in case of any grievances with the said takeover.

Analysis of acquisition of minority shareholding in terms of section 236

Section 236 empowers the registered holders holding at least 90% of the issued share capital of a company, either individually or along with person acting in concert, by virtue of:

- an amalgamation,

- share exchange,

- conversion of securities or

- for any other reason

to first intimate the company regarding their intention to buy the remaining shares or part thereof, then to make offer to the minority shareholders at a price determined by the registered valuer and finally getting the possession of the shares by depositing the amount equal to the value of shares to be acquired in a separate bank account. Alternatively, the minority shareholders may also offer the shares to the acquirer at a price determined on the basis of valuation by a registered valuer in accordance with prescribed rules.

However, in the practical scenario, the section fails to achieve its objective of releasing the minority shareholders as the section does not clarify whether upon receiving such an offer the minority shareholders or the Acquirer is obligated to sell or buy the shares, and no specific timelines have been prescribed for acceptance of such an offer or for the tender of shares. Further, the instance where the shares are held in demat form, has also not been considered.

The process under section 236 can be seen below:

Other methods of acquiring minority shares under the Act

Apart from the transactions mentioned above, there are several other methods available to implement squeeze out minority shareholders within the Act, such as consolidation of shares, reductions of share capital etc. out of which, most commonly used method is reduction of share capital. However, all the provisions have their own benefits and lacuna’s. The brief overview of the said transactions are as follows:

Consolidation of shares:

Consolidation of shares means consolidating nominal value of shares that results into decrease in the number of shares with increase in nominal value of each share. For example 100 shares of face value of Rs. 10 each may be consolidated into 1 share of face value of Rs 1000 each. Consolidation is also known as reverse stock split, which is the effective tool by which a company can restructure its capital and can eliminate minority holding with the approval of Tribunal in terms of section 61 (1) (b) of the Act and Rule 71 of the NCLT Rules, 2016.

Reduction of share capital:

A company limited by shares can reduce its share capital through: (a) reducing/extinguishing its liabilities on unpaid share capital; (b) with or without extinguishing or reducing its liabilities on any shares which is lost or is unrepresented by its existing assets; or (c) with or without extinguishing or reducing its liabilities on any shares which is in excess of its requirement. Section 66 of the Act provides for the reduction of capital by a company with the approval of Tribunal, only if it is not defaulted in repayment of any deposit accepted by it or interest thereon.

Acquiring Minority shareholding in terms of section 235:

An Acquirer/Transferee Company can acquire the shares of Transferor Company under a scheme or contract subject to the approval of holders of minimum 90% of value of shares other than shares already held by Transferee Company or its nominee or its subsidiary companies. Such approval is required to be obtained by Transferee Company within 4 months after making such offer. Upon receipt of the said approval, within 2 months from the expiry of the offer period, the Transferee Company shall give notice to dissenting shareholders by conveying its intention to acquire their shares and the dissenting shareholders may then approach NCLT for seeking remedy within one month from the date of such notice.

The entire process of acquiring the shares from the dissenting shareholders is extensive and time consuming for the acquirer. This makes the process of squeezing out dissenting shareholders unreasonably lengthy.

Conclusion

In conclusion, the notified section has added a way for unlisted companies to eliminate minorities smoothly vide scheme of arrangement which will further boost the dominance of majority over minority. On prima-facie view, one can say that the section seems to have covered the lacuna’s of other squeezing out provisions of the Act, however, the supervisory role of the respective regulatory authorities and the views to be taken by respective Tribunals will decide the materialisation of the notification.

Links to related write ups –

Takeover under Companies Act, 2013- http://vinodkothari.com/2020/02/takeover-under-ca-2013/

[1] http://www.mca.gov.in/Ministry/pdf/Notification_04022020.pdf