Vinod Kothari and Company; corplaw@vinodkothari.com

Updated as on 23rd March, 2020

All companies and LLPs must have, by now, got mailers from the Ministry of Company Affairs about COVID-19 preparedness, and the need to file a web based form CAR 2020 i.e. Company Affirmation of Readiness towards COVID 19.

The MCA circular is nothing but a disaster management step from the Ministry, imploring upon all companies and LLPs to get sensitised to the need for handling this colossal challenge to humanity, India included. It will be an ironical travesty if the filing of the form is taken as a compliance requirement.

Therefore, in our view, what matters is the preparedness itself, not so much the task of having the so-called policy or the filing of the form itself.

However, the country has a few lakhs of companies, and the affirmation of preparedness by filing this form will be expected from all the companies. Hence, there is understandably a barrage of questions from clients and others.

We at Vinod Kothari & Company will be happy to contribute in our own little way; hence, if companies/LLPs have questions around this Form, we have thought it apt to put them down into this small guidance. We wish and pray that all of you stay safe during this challenging time.

1. Whether the Advisory has any statutory backing?

Let us not even think of this as emanating from some power under the law. Neither do we have to search for such a power, nor question it. As human beings, not every action of ours arises out of legal obligations. It is a simple step by the Ministry towards sensitisation of the corporate sector, towards fulfilling an urgent social and human obligation.

2. What are the steps being suggested through the Advisory?

Companies and LLPs are being advised to put in place an immediate plan to implement a ‘work from home’ policy as a temporary measure.

3. What is the object of having such a plan?

The object of having such a plan is to ensure social distancing as advised by WHO and other public health authorities in the recent outbreak of COVID-19 which is required for preventing the rapid spread and transmission of the disease at community level.

4. My company does not have any permanent employees. Am I still required to adhere to this policy?

If there are no permanent employees, it is all peace as far as your company is concerned. Go and file the form and say you have taken necessary steps.

5. Whether the companies and LLPs will have to frame a written ‘work from home’ policy?

The Advisory suggests to have a plan to implement the work from home policy for the employees. In our view, the same is not required to be a written or formal policy. The word “policy” here should mean the steps to be taken by the organisation to provide the facility of working from home to its employees and the manner/ procedure to be followed to ensure the same. If there is a policy, typically, the policy is applied to all employees covered by it without discrimination. Further, the process and manner to be followed shall be different from organisation to organisation. Accordingly, in case of companies, the decision may be taken at management level, while in case of others, by the head of the organisation.

6. What all does a work from home policy include?

As we said above, we are not envisaging this to be a formal document. However, please do consider the following:

- Who all can be permitted to work from home – for those who have to be present, whether there is rotational or staggered presence?

- What will be the weekly and daily working hours?

- Whether necessary equipment or software is in place for working from home?

- Whether there will be any revision in compensation and benefits paid to the employees?

- Whether employees have adequate internet connection required for the job?

- What level of dedication and concentration is expected from employees during working hours?

- What will be the method of marking attendance or absence?

- Who will review work of whom and how?

- Revision in employees code of conduct

- How to maintain and ensure confidentiality of information

- Installation of necessary software for group discussions or meetings

- To educate remote employees on basic security policies as for example use of VPN is a secure channel and better than public network

- Establishment of virtual employee allowance or reimbursements for expenses such as internet, phone, electricity and other utilities

- Strict adherence to do’s and don’ts issued by public health authorities from time to time

- Date of implementation of this policy- with immediate effect till 31st March, 2020 (tentative date, maybe extended depending upon the situation)

7. The circulars are being addressed to CEOs/directors. Is the action required to be taken at board/CEO level?

First of all, the actions expected are urgent – therefore, please do not wait for any formal processes or board resolutions. Whoever is in charge of putting administrative allocations may take such steps. Looking at the seriousness, it is expected that senior management is involved. However, it does not matter if there is any formal ratification or issue of circular, unless the organisation expects such formal internal documents.

8. Till what time the work from home policy to be adopted?

Till 31st March, 2020. The same shall be reviewed by the appropriate authorities based on the evolving situation.

9. What is the form CAR all about?

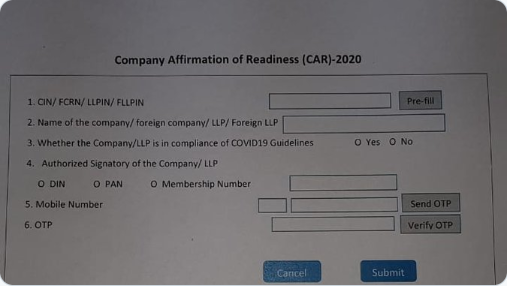

It is a web form deployed on 23rd March, 2020 by the Ministry. The same is a simple web based form requiring only an OTP based verification and does not require any digital signature for affirming or denying the adoption of work from home policy.

10. Is there a fee for filing form CAR?

There is no fee for filing the form. Seriously, we don’t even imagine there can be a fee.

11. Who will require to file the said form?

All companies and LLPs are expected to file the said form. There is no exclusion or exemption for OPCs, private companies or small companies. However, looking at the language of the applicability, partnership firms and proprietorship concerns have been kept outside the purview of filing CAR, 2020.

12. What is the timeline to file?

The web form CAR, 2020 is deployed on the MCA portal on 23rd March, 2020. Initially, the advice suggested to file it on the same day, however, later it was clarified that the same can be filed till 30th March, 2020.

13. What kind of information/ data to be reported?

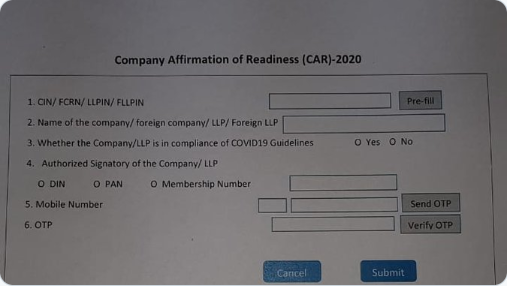

As per the twitter handle of the Hon’ble Minister of Finance and Corporate Affairs the possible format of the form shall contain the following:

- CIN/ FCRN/ LLPIN/ FLLPIN

- Name of the company/ foreign company/ LLP/ Foreign LLP

- Whether the company/ LLP is in compliance of COVID 19 Guidelines?

- Authorised Signatory of the company/ LLP

- DIN/ PAN/ Membership No. of the Authorised Signatory

- Mobile No.

- OTP

The step to step guide on filing CAR 2020 has been issued by MCA on 22nd March, 2020. The same can be viewed here.

14. Whether foreign company/ LLPs are also required to follow the Advisory?

The Advisory suggests all companies/ LLPs to file the form. The intent seems to include all the companies/ LLPs incorporated in India or companies/ LLPs not incorporated in India but having operations/ physical presence in India. The contents of the Form as provided in Query 9 above suggest the same.

15. What do the COVID 19 Guidelines mean?

There is no definition as such. However, it should mean the Advisory itself issued by the Govt. from time to time. One may refer to pages such as https://www.mygov.in/covid-19/?cbps=1.

16. Who is the Authorised Signatory of the company/ LLP for authenticating the form?

As referred to above, it seems that the authorised signatory may be a director, CS, CFO or any other person authorised to file the form. However, who is eligible to give such authority is not clear. In our view, in case of companies which have given general authority to the CS/ any director/ CFO to file necessary forms with the regulatory authorities from time to time, such authorised persons may file the form. In case of others, the same may be filed by the MD/ head of the organisation who looks after the day to day affairs or any person authorised by such MD/ head of the organisation. Once again, we suggest there need not be a formal flow of authorisation, such as a resolution, for filing the form.

17. Whether the mobile no. has to be a registered mobile no.?

Since the form is an OTP verified form, the OTP is sent on the mobile no of the person who is authenticating the form and the same is prefilled on providing details of the authorised person.

18. What are the consequences of non- filing?

There is no penalty for non-filing of the form. Further the Advisory is not coming from any statutory requirement but out of a social obligation only, non- filing of the same may not lead to any penal consequences.

19. The Authorised Signatory may be the compliance officer. But how does the compliance officer certify the preparedness across the company, with so many locations?

The authorised signatory is not taking the burden upon himself. The signatory may, in turn, get confirmations from those who are involved, say, the HR head or similar positions.

20. In view of the lockdown/ shutdowns announced by the state governments for various places in India, does it mean lockout of operations by the corporate houses and giving leaves altogether?

Please note that shutdown does not mean shutdown of operation. Therefore, it still means work from home. The whole intent of shutdown is to control movement and not to control work.

21. Are the companies mandatorily required to file form CAR?

As per the information uploaded on MCA’s website, the filing of the form is on voluntary basis. Therefore, the company/ LLP (s) may take a call on filing. However, if one throws a question on whether they are required to take steps to combat COVID-19 by following government guidelines, please note that we have no doubt on answering this is positive. Everyone including the companies and LLPs are mandatorily required to take steps during this health emergency.