Abhirup Ghosh | abhirup@vinodkothari.com

It is not uncommon to have Indianised version of global dishes when introduced in India, and we are very good in creating fusion food. We have a paneer pizza, and we have a Chinese bhel. As covered bonds, the European financial instrument with over 250 years of history were introduced in India, its look and taste may be quite different from how it is in European market, but that is how we introduce things in India.

It is also interesting to note that regulatory attempts to introduce covered bonds in India did not quite succeed – the National Housing Bank constituted Working Group on Securitisation and Covered Bonds in the Indian Housing Finance Sector, suggested some structures that could work in the Indian market[1] and thereafter, the SEBI COBOSAC also had a separate agenda item on covered bonds. Several multilateral bodies have also put their reports on covered bonds[2].

However, the market did not wait for regulators’ intervention, and in the peak of the liquidity crisis of the NBFCs, covered bonds got uncovered – first slowly, and now, there seems to be a blizzard of covered bond issuances. Of course, there is no legislative bankruptcy remoteness for these covered bonds.

There are two types of covered bonds, first, the legislative covered bonds, and second, the contractual covered bonds. While the former enjoys a legislative support that makes the instrument bankruptcy remote, the latter achieves bankruptcy remoteness through contractual features.

To give a brief understanding of the instrument, a standard covered bond issuance would reflect the following:

- On balance sheet – In case of covered bonds, both the cover pool and the liability towards the investor remains on the balance sheet of the issuer. The investor has a recourse on the issuer. However, the cover pool remains ring fenced, and is protected even if the issuer faces bankruptcy.

- Dual recourse – The investor shall have two recourses – first, on the issuer, and second, on the cover pool.

- Dynamic or static pool – The cover pool may be dynamic or static, depending on the structure.

- Prepayment risk – Since, the primary exposure is on the issuer, any prepayment risk is absorbed by the issuer.

- Rating arbitrage – Covered bonds ratings are usually higher than the rating of the issuer. Internationally, covered bonds enjoy upto a maximum of 6-notch better rating than the rating of the issuer.

Therefore, covered bond is a half-way house, and lies mid-way between a secured corporate bond and the securitized paper. The table below gives comparison of the three instruments:

| |

Covered bonds |

Securitization |

Corporate Bonds |

| Purpose |

Essentially, to raise liquidity |

Liquidity, off balance sheet, risk management,

Monetization of excess profits, etc. |

To raise liquidity |

| Risk transfer |

The borrower continues to absorb default risk as well as prepayment risk of the pool |

The originator does not absorb default risk above the credit support agreed; prepayment risk is usually transferred entirely to investors. |

The borrower continues to absorb default risk as well as prepayment risk of the pool |

| Legal structure |

A direct and unconditional obligation of the issuer, backed by creation of security interest. Assets may or may not be parked with a distinct entity; bankruptcy remoteness is achieved either due to specific law or by common law principles |

True sale of assets to a distinct entity; bankruptcy remoteness is achieved by isolation of assets |

A direct and unconditional obligation of the issuer, backed by creation of security interest. No bankruptcy remoteness is achieved. |

| Type of pool of assets |

Mostly dynamic. Borrower is allowed to manage the pool as long as the required “covers” are ensured. From a common pool of cover assets, there may be multiple issuances. |

Mostly static. Except in case of master trusts, the investors make investment in an identifiable pool of assets. Generally, from a single pool of assets, there is only issuance. |

Dynamic. |

| Maturity matching |

From out of a dynamic pool, securities may be issued over a period of time |

Typically, securities are matched with the cashflows from the pool. When the static pool is paid off, the securities are redeemed. |

From out of a dynamic pool, securities may be issued over a period of time. |

| Payment of interest and principal to investors |

Interest and principal are paid from the general cashflows of the issuer |

Interest and principal are paid from the asset pool |

Interest and principal are paid from the general cashflows of the issuer. |

| Prepayment risk |

In view of the managed nature of the pool, prepayment of loans does not affect investors |

Prepayment of underlying loans is passed on to investors; hence investors take prepayment risk |

Prepayment risk of the pool does not affect the investors, as the same is absorbed by the issuer. |

| Nature of credit enhancement |

The cover, that is, excess of the cover assets over the outstanding funding. |

Different forms of credit enhancement are used, such as excess spread, subordination, over-collateralization, etc. |

No credit enhancement. Usually, the cover is 100% of the pool principal and interest payable. |

| Classes of securities |

Usually, a single class of bonds are issued |

Most transactions come up with different classes of securities, with different risk and returns |

Single class of bonds are issued. |

| Independence of the ratings from the rating of the issuer |

Theoretically, the securities are those of the issuer, but in view of bankruptcy-proofing and the value of “cover assets”, usually AAA ratings are given |

AAA ratings are given usually to senior-most classes, based on adequacy of credit enhancement from the lower classes. |

There is no question of independent rating. |

| Off balance sheet treatment |

Not off the balance sheet |

Usually off the balance sheet |

Not applicable. |

| Capital relief |

Under standardized approaches, will be treated as on-balance sheet retail portfolio, appropriately risk weighted. Calls for regulatory capital |

Calls for regulatory capital only upto the retained risks of the seller |

Not applicable |

This article would briefly talk about the issuance of Covered bonds world-wide and in India, and what are the distinctive features of the issuances in India.

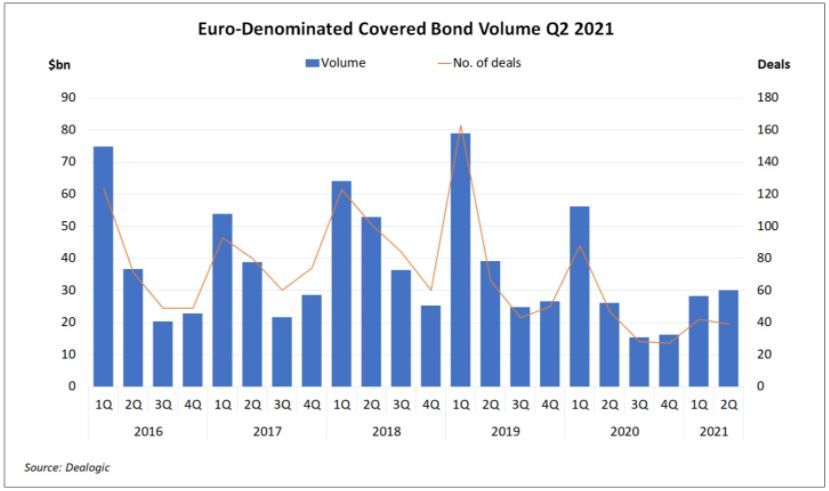

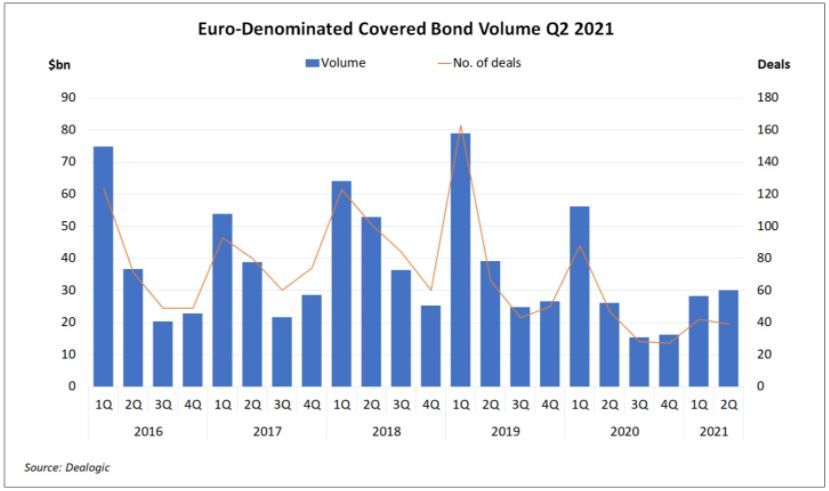

Global volume of Covered Bonds

Since most volumes for covered bonds came from Europe, there has been a decline due to supply side issues. This is evident from the latest data on Euro-Denominated Covered bonds Volume. The performance in FY 2020 and FY 2021 has been subdued mainly due to COVID-19. Though, the volumes suffered significantly in the Q3 and Q4 of FY 20, but returned to moderate levels by the beginning of FY 2021.

The figure below shows Euro-Denominated Covered bond Issuances until Q2 2021.

Source: Dealogic[3]

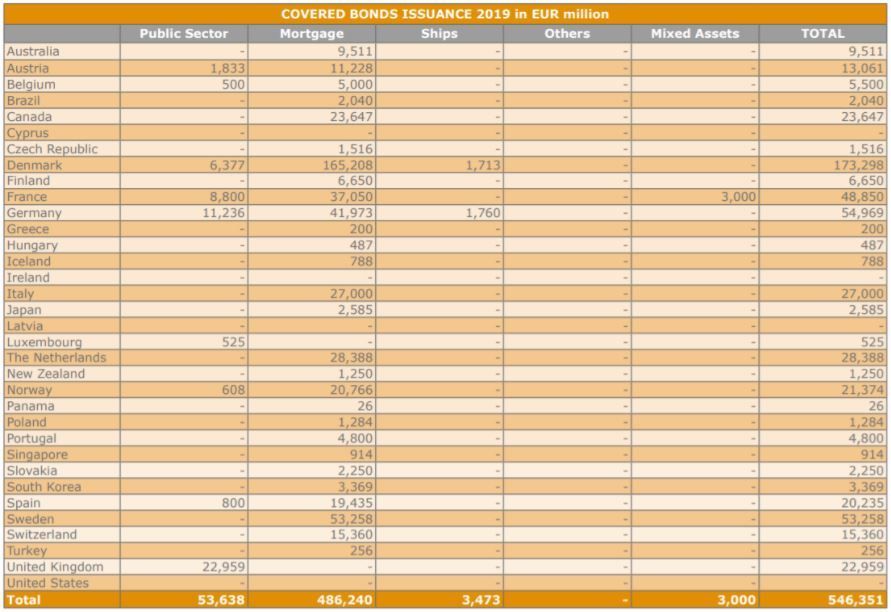

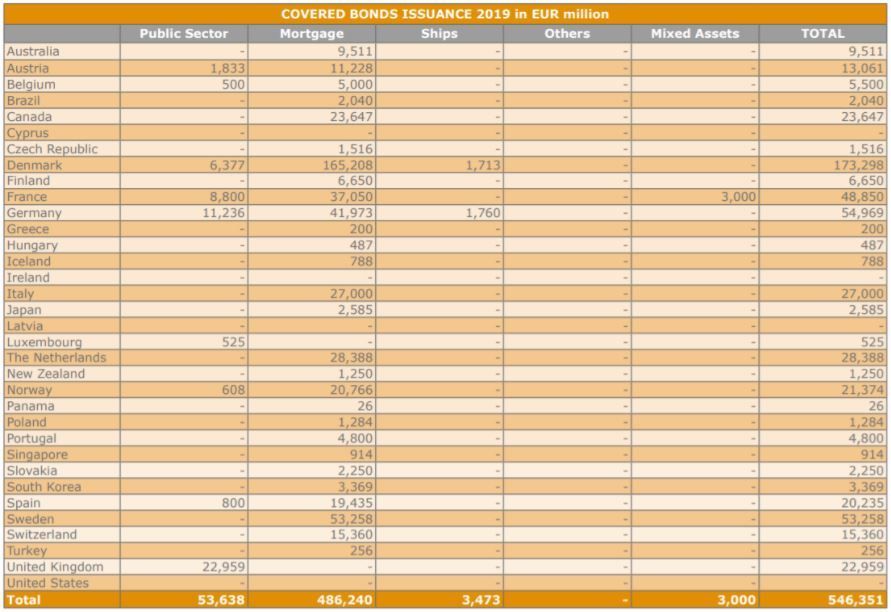

Countries like Denmark, Germany, Sweden continues to be dominant markets for covered bond issuances. The countries in the Asia-Pacific region like Japan, Singapore, and Australia continues to report moderate level of activities. In North America, Canada represents all the whole of the issuance, with no issuances in the USA.

The tables below would show the trend of issuances in different jurisdictions in 2019 (latest available data):

Source: ECBC Factbook 2020[4]

Covered Bonds in India

In India, the struggle to introduce covered bonds started way back in 2012, when the National Housing Bank formed a working group[5] to promote RMBS and covered bonds in the Indian housing finance market. Though the outcome of the working group resulted in some securitisation activity, however, nothing was seen on covered bonds.[6]

Some leading financial institutions attempted to issue covered bonds in the Indian market, but they failed. Lastly, FY 2019 witnessed the first instance of covered bonds, which was backed by vehicle loans.

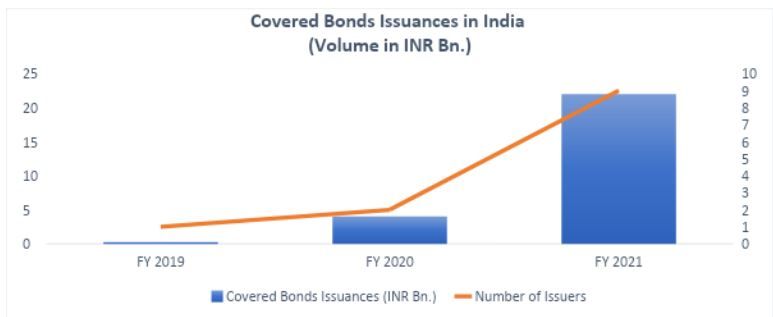

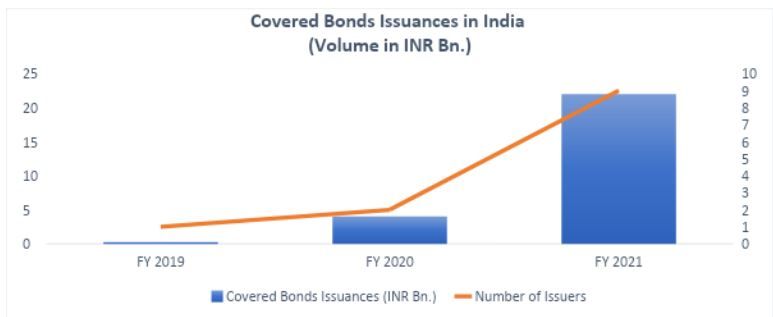

In India, issuance of covered bonds witnessed a sharp growth in FY 2021, as the numbers increased to INR 22 Bn, as against INR 4 Bn in FY 2020. Even though the volume of issuances grew, the number of issuers failed to touch the two-digit mark. The issuances in FY 2021 came from 9 issuers, whereas, the issuances in FY 2020 were from only 2 issuers. Interestingly, all were non-banking financial companies, which is a stark contrast to the situation outside India.

The figure below shows the growth trajectory of covered bonds in India:

Source: ICRA, VKC Analysis

The growth in the FY 2021 was catapulted by the improved acceptance in Indian market in the second half of the year, given the uncertainty on the collections due to the pandemic, and the additional recourse on the issuer that the instrument offers, when compared to a traditional securitisation transaction.

Almost 75% of the issuances were done by issuers have ‘A’ rating, the following could be the reasons for such:

- Enhanced credit rating – In the scale of credit ratings, ‘A’ stands just above the investment grade rating of ‘BBB’. Therefore, it signifies adequate degree of safety. With an earmarked cover pool, with certain degree of credit enhancements and, covered bonds issued by these entities fetched a much better credit rating, going up to AA or even AAA.

- AUM – FY 2021 was a year of low level of originations due to the pandemic. As a result, most of the financial sector entities stayed away from sell downs, which is evident from the low of level of activity in the securitisation market, as they did not want their AUM to drop significantly. In covered bonds, the cover pool stays on the books, hence, allowing the issuer to maintain the AUM.

- Better coupon rate – Improved credit ratings mean better rates. It was noticed that the covered bonds were issued 50 bps – 125 bps cheaper than normal secured bonds.

The Indian covered bonds market is however, significantly different from other jurisdictions. Traditionally, covered bonds are meant to be long term papers, however, in India, these are short to medium term papers. Traditionally covered bonds are backed by residential mortgage loans, however, in India the receivables mostly non-mortgages, gold loans and vehicle loans being the most popular asset classes.

In terms of investors too, the Indian market has shown differences. Globally, long term investors like pension funds and insurance companies are the most popular investor classes, however, in India, so far only Family Wealth Offices and High Net-worth Individuals have invested in covered bonds so far.

Another distinct feature of the Indian market is that a significant share of issuances carry market linked features, that is, the coupon rate varies with the market conditions and the issuers’ ability to meet the security cover requirements.

But the most important to note here is that unlike any other jurisdiction, covered bonds don’t have a legislative support in India. In Europe, the hotspot for covered bonds, most of the countries have legislations declaring covered bonds as a bankruptcy-remote instruments. In India, however, the bankruptcy-remoteness is achieved through product engineering by doing a legal sale of the cover pool to a separate trust, yet retaining the economic control in the hands of the issuer until happening of some pre-decided trigger events, and not with the help of any legislative support. In some cases, the legal sale is done upfront too.

Considering the importance and market acceptability of the instrument, rating agencies in India have laid down detailed rating methodologies for covered bonds[7].

Conclusion

Covered Bonds issued in India will not match most of the features of a traditional covered bond issued in Europe, however, the fact that finally the investors community in India has started recognizing it as an investment opportunity is very encouraging.

The real economics of covered bonds will come to the fore only when the market grows with different classes of investors, like the mutual funds, pension funds, insurance companies etc. in the demand side, which seems a bit far-fetched for now.

[1] A working group was constituted by the National Housing Bank to promote RMBS and Covered Bonds, the report of the working group can be viewed here: https://www.nhb.org.in/Whats_new/NHB%20Covered%20Bond%20Report.pdf

[2] In 2014-15, the Asian Development Bank appointed Vinod Kothari Consultants to conduct a Study on Covered Bonds and Alternate Financing Instruments for the Indian Housing Finance Segment

[3] https://www.icmagroup.org/resources/market-data/Market-Data-Dealogic/#14

[4] https://hypo.org/app/uploads/sites/3/2020/10/ECBC-Fact-Book-2020.pdf

[5] A working group was constituted by the National Housing Bank to promote RMBS and Covered Bonds, the report of the working group can be viewed here: https://www.nhb.org.in/Whats_new/NHB%20Covered%20Bond%20Report.pdf

[6] Vinod Kothari Consultants has been a strong advocate for a legal recognition of Covered Bonds in India. They were involved in the initiatives taken by the NHB to recognize Covered Bonds as a bankruptcy remote instrument in India.

[7] The rating methodology adopted by ICRA Ratings can be viewed here: https://www.icra.in/Rating/ShowMethodologyReport/?id=709

The rating methodology adopted by CRISIL can be viewed here: https://www.crisil.com/mnt/winshare/Ratings/SectorMethodology/MethodologyDocs/criteria/crisils%20criteria%20for%20rating%20covered%20bonds.pdf

—

Our Video on Covered Bonds can be viewed here <https://www.youtube.com/watch?v=XyoPcuzbys4>

Some resources on Covered Bonds can be accessed here –

Introduction to Covered Bonds by Vinod Kothari: http://vinodkothari.com/2015/01/introduction-to-covered-bonds-by-vinod-kothari/

The Name is Bond. Covered Bond. By Vinod Kothari: http://www.vinodkothari.com/wp-content/uploads/covered-bonds-article-by-vinod-kothari.pdf

NHB’s Working Paper on Covered Bonds: https://www.nhb.org.in/Whats_new/NHB%20Covered%20Bond%20Report.pdf