List of Disclosures Requirements Applicable to NBFCs

| Srl No | Particular | Clause Reference | Remarks |

| List of Disclosure in Annual Report – As per RBI Direction | |||

| 1 | NBFCs shall disclose in their annual reports the details of the auctions conducted during the financial year including the number of loan accounts, outstanding amounts, value fetched and whether any of its sister concerns participated in the auction. | Para 27(4) (d)-Loans against security of single product – gold jewellery | Applicable for Gold loan business |

|

2

|

Non-deposit taking NBFC with asset size of ₹ 500 crore and above issuing PDI, shall make suitable disclosures in their Annual Report about : | Annex XVII | |

| (i) Amount of funds raised through PDI during the year and outstanding at the close of the financial year; (ii) Percentage of the amount of PDI of the amount of its Tier I Capital; (iii) Mention the financial year in which interest on PDI has not been paid in accordance with clause 1(viii) above. |

Terms and Conditions Applicable to Perpetual Debt Instruments (PDI) for Being Eligible for Inclusion in Tier I capital | Applicable for NBFCs issuing PDIs | |

| 2A | Details of all material transactions with related parties shall be disclosed in the annual report along with policy on dealing with Annual Report | Para 4.3 – Annex IV, Master Directions | |

| 2B | (i) Remunerarion of Directors (Para 4.5) (ii) a Management Discussion and Analysis report |

Para 4.3 – Annex IV, Master Directions | |

| Disclosure in Financial Statements- as per RBI Direction | |||

|

3

|

Disclosure in the balance sheet | ||

| The provision towards standard assets need not be netted from gross advances but shall be shown separately as ‘Contingent Provisions against Standard Assets’ in the balance sheet. | Master Directions Para 14 | ||

| Every applicable NBFCshall separately disclose in its balance sheet the provisions made as per these Directions without netting them from the income or against the value of assets.

The provisions shall be distinctly indicated under separate heads of account as under:- |

Master Direction Para 17 (1) and (2) | ||

| In addition to the above every applicable NBFCshall disclose the following particulars in its Balance Sheet: (i) Capital to Risk Assets Ratio (CRAR); (ii) Exposure to real estate sector, both direct and indirect; and (iii) Maturity pattern of assets and liabilities. |

Master Direction Para 17 (5) | ||

| 4 | Indicative List of Balance Sheet Disclosure for non-deposit taking NBFCs with Asset Size ₹500 Crore and Above and Deposit Taking NBFCs (hereinafter called as Applicable NBFCs) | Annex XIV | Please refer Annex XIV |

|

5

|

Disclosures to be made by the Originator in Notes to Annual Accounts | Guidelines on Securitisation Transactions | |

| The Notes to Annual Accounts of the originating NBFCs shall indicate the outstanding amount of securitised assets as per books of the SPVs sponsored by the NBFC and total amount of exposures retained by the NBFC as on the date of balance sheet to comply with the MRR. These figures shall be based on the information duly certified by the SPV’s auditors obtained by the originating NBFC from the SPV. These disclosures shall be made in the format given in Appendix 2. | |||

|

6

|

LRM Framework | ||

| An NBFC shall publicly disclose information (Appendix I) on a quarterly basis on the official website of the company and in the annual financial statement as notes to account that enables market participants to make an informed judgment about the soundness of its liquidity risk management framework and liquidity position. | Guidelines on Liquidity Risk Management | Please refer Appendix I | |

|

7

|

LCR Disclosure Standards | ||

| NBFCs in their annual financial statements under Notes to Accounts, starting with the financial year ending March 31, 2021, shall disclose information on LCR for all the four quarters of the relevant financial year. The disclosure format is given in the Appendix I. | Data must be presented as simple averages of monthly observations over the previous quarter (i.e., the average is calculated over a period of 90 days). However, with effect from the financial year ending March 31, 2022, the simple average shall be calculated on daily observations. | ||

| NBFCs should provide sufficient qualitative discussion (in their annual financial statements under Notes to Accounts) around the LCR to facilitate understanding of the results and data provided. | Please refer Appendix I (Part B) | ||

|

8

|

Schedule to the balance sheet | Master Direction Clause 19 | |

| Every applicable NBFC shall append to its balance sheet prescribed under the Companies Act, 2013, the particulars in the schedule as set out in Annex IV. | |||

|

9

|

Participation in Currency Options | Master Direction Clause 83 | |

| Disclosures shall be made in the balance sheet regarding transactions undertaken, in accordance with the guidelines issued by SEBI. | |||

|

10

|

Participation in Currency Futures | Master Direction Clause 94 | |

| Disclosures shall be made in the balance sheet relating to transactions undertaken in the currency futures market, in accordance with the guidelines issued by SEBI. | |||

|

11

|

Disclosure for Restructured Accounts | Master Direction Annex VII | |

| With effect from the financial year ending March 2014 NBFCs shall disclose in their published annual Balance Sheets, under “Notes on Accounts”, information relating to number and amount of advances restructured, and the amount of diminution in the fair value of the restructured advances as per the format given in Appendix – 4 | |||

| 12 | Disclosures relating to fraud in terms of the notification issued by Reserve Bank of India | ||

|

14

|

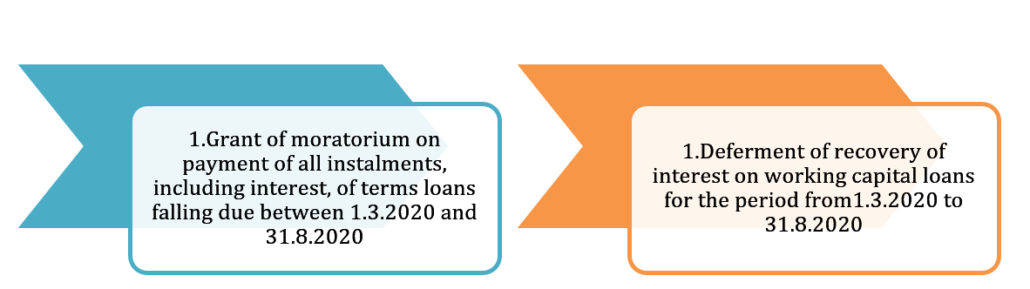

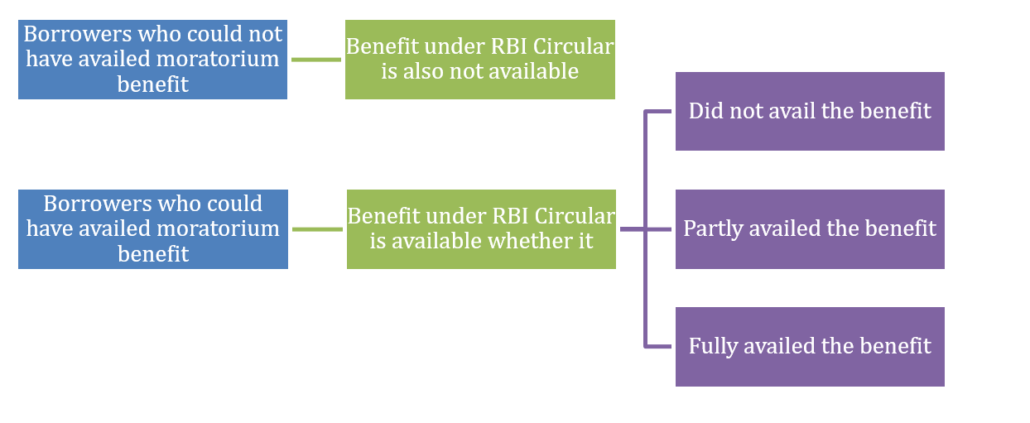

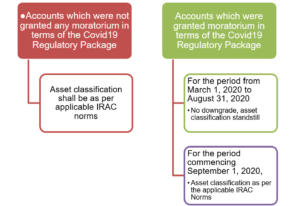

Moratorium Circular | ||

| The lending institutions shall suitably disclose the following in the ‘Notes to Accounts’ while preparing their financial statements for the half year ending September 30, 2020 as well as the financial years 2019-20 and 2020-2021:

(i) Respective amounts in SMA/overdue categories, where the moratorium/deferment was extended, in terms of paragraph 2 and 3; (ii) Respective amount where asset classification benefits is extended. (iii) Provisions made during the Q4FY2020 and Q1FY2021 in terms of paragraph 5; (iv) Provisions adjusted during the respective accounting periods against slippages and the residual provisions in terms of paragraph 6. |

Para 10 COVID19 Regulatory Package – Asset Classification and Provisioning | ||

|

15

|

Disclosure under sector – Restructuring of Advances, Circular | ||

| NBFCs shall make appropriate disclosures in their financial statements, under ‘Notes on Accounts’, relating to the MSME accounts restructured under these instructions as per the following format:

No. of accounts restructured Amount (₹ in million) |

Micro, Small and Medium Enterprises (MSME) sector – Restructuring of Advances | ||

|

16

|

Lending institutions publishing quarterly statements shall, at the minimum, make disclosures as per the format prescribed in Format-A | Para 52 of Resolution Framework for COVID-19-related Stress | In the financial statements for the quarters ending March 31, 2021, June 30, 2021 and September 30, 2021 |

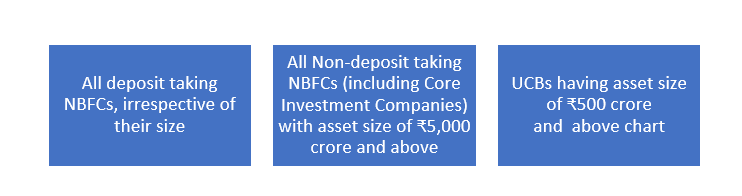

| 16A | (i) registration/ licence/ authorisation, by whatever name called, obtained from other financial sector regulators; (ii) ratings assigned by credit rating agencies and migration of ratings during the year; (iii) penalties, if any, levied by any regulator; (iv) information namely, area, country of operation and joint venture partners with regard to joint ventures and overseas subsidiaries and (v) Asset-Liability profile, extent of financing of parent company products, NPAs and movement of NPAs, details of all off-balance sheet exposures, structured products issued by them as also securitization/ assignment transactions and other disclosures |

Para 73 – Master Directions (Ref. Annexure XIV) | |

| Other Disclosure | |||

| 17 | Report on-line to stock exchanges on a quarterly basis, information on the shares pledged against LAS, in their favour, by borrowers for availing loans | 22 of Master Directions | In format as given in Annex V for Master Direction. |

| 18 | Quarterly statement to RBI on change of directors, and a certificate from the Managing Director of the applicable NBFC that fit and proper criteria in selection of the directors has been followed | 72 of Master Direction | The statement must be sent 15 days of the close of the respective quarter. The statement for the quarter ending March 31, shall be certified by the auditors |

| 19 | On a quarterly basis, NBFCs shall report “total exposure” in all cases where they have assumed exposures against borrowers in excess of the normal single / group exposure limits due to the credit protections obtained by them through CDS, guarantees or any other permitted instruments of credit risk transfer | Para 8 of Guidelines for Credit Default Swaps – NBFCs as users | |

| Website Disclosure | |||

|

20

|

Public disclosure | ||

| An NBFC shall publicly disclose information (Appendix I) on a quarterly basis on the official website of the company that enables market participants to make an informed judgment about the soundness of its liquidity risk management framework and liquidity position. | Guidelines on Liquidity Risk Management | Please refer Appendix I | |

| 21 | NBFCs are required to disclose information on their LCR every quarter | Para 6 LCR Framework | To be made on website |

| Additional Disclosures w.r.t. COVID-19 | |||

| 22 | Lending institutions publishing quarterly financial statements shall, at the minimum, shall make disclosures in their financial statements for the quarters ending September 30, 2021 and December 31, 2021. The resolution plans implemented in terms of Part A of this framework should also be included in the continuous disclosures required as per Format-B prescribed in the Resolution Framework – 1.0. | As per format prescribed in Format-X | |

| 23 | The number of borrower accounts where modifications were sanctioned and implemented in terms of Clause 22 above, and the aggregate exposure of the lending institution to such borrowers may also be disclosed on a quarterly basis, | ||

| 24 | The credit reporting by the lending institutions in respect of borrowers where the resolution plan is implemented under Part A of this window shall reflect the “restructured due to COVID-19” status of the account | ||