Emission law amendments: Laying the framework for Carbon trading market in India

– Payal Agarwal, Vinod Kothari & Company (payal@vinodkothari.com)

This version: 23rd December, 2022

The Energy Conservation (Amendment) Bill, 2022 (“Bill”) seeks to provide a regulatory framework for carbon markets in India. The Bill was passed in the Lok Sabha on 8th August, 2022, and has been passed in the Rajya Sabha on 12th December, 2022. The President’s asset is all that is required to bring the carbon markets within the statutory framework of India. However, there is still a long way to go before carbon markets are implemented in India, which will require notification of the procedures and rules governing the same. Further, the carbon markets in other countries are still developing in a phased manner, identifying the gaps in the existing system and modifying accordingly. India cannot be an exception to the same. However, the concept of “carbon credits” is not unknown to India since there are several entities in the country which are already generating tons of carbon credits. This article seeks to delve upon the legal aspects of carbon credits markets around the world, the consequences of not exporting the same, and the tax implications upon sale of the generated credits. As we study the existing carbon markets around the world, some learnings from these markets may be taken into consideration for the developing carbon market in India.

Key terms

Carbon credits

Carbon credits, as the name suggests, are the credits earned by a company, due to reduction in the emissions of carbon di-oxide or other greenhouse gas. These credits provide a right to the bearer to offset emissions equivalent to the credits earned. The emission reductions are compared against a calculated baseline, and the project participant is issued credits equivalent to the metric tonnes of emissions reduced. Various nomenclature is used for such credits around the world, in the name of the standard or scheme within which the same is registered.

Emissions trading Schemes

The right to offset emissions in the form of carbon credits is treated as a commodity. The markets in which this commodity is traded are known as carbon markets, and the mechanism governing the same is known as emissions trading schemes (ETS). The ETS usually works on a “cap-and-trade” model, wherein, a cap is fixed on the maximum emission allowance, and the entities regulated by the ETS are permitted to buy the shortfall, if any or sell the excess allowances to the other entities, as the case may be.

Legal aspects of carbon markets

Carbon credits obtained a global recognition through Kyoto Protocol, the international agreement that aimed to reduce the emissions of carbon dioxide and other greenhouse gases, in order to reduce the increasing peril of global warming and climate change[1]. Gradually, various countries around the world came up with their own laws on carbon markets in the form of ETS. Below, we discuss each of them in detail.

Kyoto Protocol

Article 17 of the Kyoto Protocol permitted its signatories to participate in emissions trading for the purposes of fulfilling their commitments towards climate change, as specified under Article 3 of the same.

The Conference of the Parties shall define the relevant principles, modalities, rules and guidelines, in particular for verification, reporting and accountability for emissions trading. The Parties included in Annex B may participate in emissions trading for the purposes of fulfilling their commitments under Article 3. Any such trading shall be supplemental to domestic actions for the purpose of meeting quantified emission limitation and reduction commitments under that Article. (Article 17, Kyoto Protocol)

Further, Article 12 of the Kyoto Protocol provides for the establishment of Clean Development Mechanism (CDM). Under the CDM, emission reduction projects of developing countries can earn saleable Certified Emission Reduction credits (CERs), which may be purchased by the developed countries towards offset of their commitments to the Kyoto Protocol.

Domestic ETS

As discussed above, the countries may either operate their own domestic emission trading schemes towards their climate change commitments or may participate in the CDM. As per the International Carbon Action Partnership (ICAP), there are 25 ETS currently in force and some ETS are under development. Some countries have their own ETS such as the US, Canada, Mexico, UK, European Union, Japan, China etc to name a few.

Below we provide a comparative summary of some of the ETS currently operating around the world.

| Particulars | EU ETS | China National ETS | Korea ETS | Swiss ETS | New Zealand ETS |

| Commencement | 2005 | 2021 | 2015 | 2008 | 2008 |

| Sectors covered | Domestic Aviation, Industry, Power | Power | Waste, Domestic Aviation, Buildings, Industry, Power | Domestic Aviation, Industry, Power | Forestry, Waste, Domestic Aviation, Transport, Buildings, Industry, Power |

| Emissions covered | CO2, N2O, PFCs | CO2 | CO2, CH4, N2O, PFCs, HFCs, SF6 | CO2, NO2, CH4, HFCs, NF3, SF6, and theoretically PFCs | CO2, CH4, N2O, SF6, HFCs, and PFCs |

| Applicability | Varies across sectors | Annual emissions of 26,000 tCO2 in any year between 2013-2019 | Companies emitting more than 125,000 tCO2/year, and facility emissions in excess of 25,000 tCO2/year | Varies across sectors | Varies across sectors |

| Reporting | Annual self-reporting | Annually at the end of April | Annual reporting | Annual monitoring report | Annual Emissions Return |

| Verification | Independent accredited verifiers | Provincial ecological authorities | Third party verifier | Random third-party verifications | Self-reporting supplemented with official audits |

| Consequences of violation | excess emissions penalty of EUR 100 (USD 118.27) for each tonne of CO2 | failures in reporting are subject to a fine of CNY 10,000 to 30,000 (USD 1,449 to 4,347) | penalty shall not exceed three times the average market price of allowances of the given compliance year or KRW 100,000 (USD 87.42)/tonne. | penalty for failing to surrender sufficient allowances is set at CHF 125/tCO2 (USD 136.77/tCO2) | cash penalty of three times the current market price for each unit. Further, specific penalties for other violations |

| Trading platform | European Energy Exchange (EEX) | Shanghai Environment and Energy Exchange (SEEE) | Korea Exchange (KRX) | Swiss Emissions Trading Registry | NZX (New Zealand Exchange) and European Energy Exchange (EEX) |

| Market participation | Compliance and non-compliance entities | Covered entities | Compliance entities, market makers and emissions trading brokers | Compliance entities and non-compliance entities | Any individual or organisation holding account with NZ ETS Registry |

| Use of international credits | Qualitative and quantitative restrictions till 2020. Not permitted from 2021. Allowances in Swiss and EU ETS are interchangeable. | Sufficient data not available | Use of international credits are allowed subject to qualitative criteria | Since 2021, international credits cannot be used. Further, the allowances under Swiss ETS and EU ETS are interchangeable. | International units have become ineligible since 2015. Limited international linking possible in future |

Carbon markets in India

Presently, there are no official/ formal carbon markets in India. The Bill[2] marks the first step towards a statutory inclusion of the concept of carbon trading in India, however, the intricacies of the same are left to the discretion of the Central Government. Having said that, the existing market-based approaches in India to increase energy efficiency and renewable energy includes the Perform Achieve and Trade (PAT) Mechanism and the Renewable Energy Certificate (REC) scheme. We will briefly discuss each of these below.

a. Perform Achieve and Trade (PAT) mechanism

Perform Achieve and Trade (PAT) scheme is a flagship programme of Bureau of Energy Efficiency (BEE). It is a market-based mechanism towards reduction in usage of energy of the high energy-intensive industries within the identified sectors (13 sectors identified across 6 cycles). The designated consumers (DCs) within the identified sectors are allocated Specific Energy Consumption (SEC) targets, and upon overachievement of the targets (i.e., use of energy below the permitted targets), units in the form of Energy Saving Certificates (ESCerts) are issued. The ESCerts can be traded in the power exchanges of India, Power Exchange of India Limited (PXIL) and Indian Energy Exchange (IEX). The press release of the Ministry of Power dated 8th June, 2021 provides a figure of energy savings of about 17 MTOE (Million Tonnes of Oil Equivalent) resulting in mitigation of about 87 million tonnes of CO2, per year. However, there is a continued surplus supply and muted demand of ESCerts leading to a fall in the prices of ESCerts.

b. Renewable Energy Certificate (REC) scheme

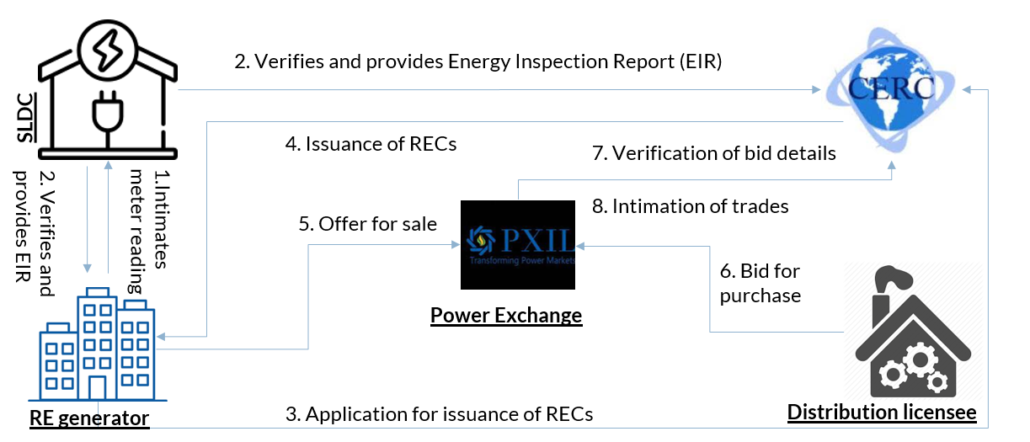

REC is a market-based instrument notified with the intent of promotion of electricity production from renewable sources of energy, also known as clean energy. The primary governing legislation is the Electricity Act, 2003 which casts the responsibility on the State Electricity Regulatory Commission (SERC) to specify a percentage of the total electricity generation to be sourced through renewable energy, known as renewable purchase obligations (RPO). To facilitate trading in renewable energy, the REC mechanism has been devised by the Central Government. The RECs can also be traded only in the power exchanges of India. The brief procedure for the same is as given below –

Process of issuance and trading of RECs

The existing market mechanisms are solely based on energy-efficiency and use of clean energy. The Bill is yet to undergo several rounds of approvals before its enforceable enactment, bringing a formal carbon market in India. Further, the signing of a Memorandum of Understanding (Mou) by the Govt of Gujarat with the EPIC India and J-PAL for collaboration towards the launch of the first carbon trading market of India in Gujarat, has been in news. Currently, the voluntary low-carbon projects in India are generally registered with the international mechanisms such as CDM or voluntary standards such as Verified Carbon Standards (VCS), Gold Standards (GS) etc.

India’s presence in international carbon markets

At present, the only avenue for carbon trading for the Indian participants is through the international markets. India ranks second in terms of the projects registered with CDM for generation of carbon credits in the form of CERs, with China leading the world. As on 30th June, 2022, the proportion of Indian CERs is expected to be around 11% of the total CERs generated in the CDM, as per the CDM Registry. The participation in international voluntary markets is also remarkable. According to the global VCM Dashboard, India has the highest volume of non-retired credits in the world, followed by China. The voluntary carbon credits of India amounts to approximately 108,110,266 tCO2e worth of CO2 emissions offsets.

“No export” policy for carbon credits: what India stands to lose?

With the passing of the Bill in Lok Sabha paving way for carbon markets in India, also came an announcement from the Hon’ble Cabinet Minister (Power, New & Renewable Energy), reported in the news, “Carbon credits are not going to be exported. No question. These credits will have to be generated by domestic companies, bought by domestic companies.” The ban has not been made effective yet and the details of the ban are not known. Nevertheless, India is not the only country to think of such a ban, countries like Papua New Guinea, Indonesia, and Uruguay have also in the recent past, banned the export of the credits produced domestically. The reason for this is the concern against the non-fulfilment of the Nationally Determined Contribution (NDC), committed under the binding Paris Agreement[3].

India is reportedly the largest exporter of carbon credits in the world. A recent webinar by the Trade Promotion Council of India (TPCI) with eminent panelists from the relevant areas of practice, reports that “India is one of the largest beneficiaries of total world carbon trade through CDM, claiming about 31%. The country has generated approximately 30 million carbon credits, the second highest transacted volumes in the world. Further, the carbon credit market in India is set for accelerated growth, touching US$ 10 billion over the next two years, according to an estimate by ICF International.” Further, a study by Deloitte, named India’s Turning Point, published in August, 2021, claims that India has a potential to earn USD 11 trns through export of decarbonisation over a short period of time.

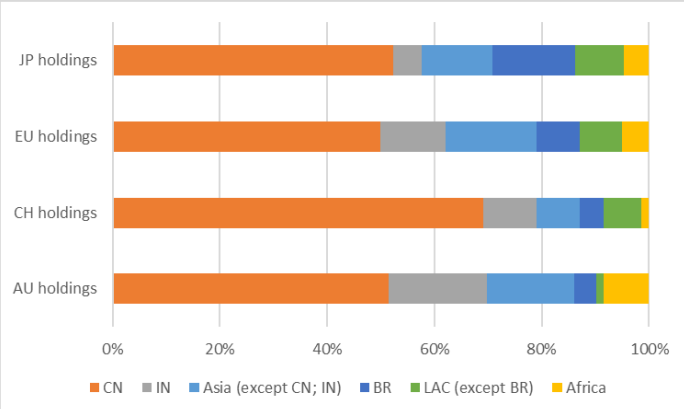

The ‘Volumes and types of unused Certified Emission Reductions (CERs)’, by the Perspectives Climate Group and Zurich University of Applied Sciences- School of Management and Law, published during the second half of 2021 on the international carbon markets indicates that India is the largest CER originating country in the world, after China. As per the said report, the total volume of CERs generated by India as a host country and held in the domestic registries of foreign countries is depicted in the chart below –

Holdings of CERs in foreign registries by host country type Source –Volume and types of unused CERs

China is the host country of both the majority of used (0.6bn) and unused CERs (0.4bn), followed by India with 0.15bn used CERs and 0.1bn unused CERs. On the basis of the information available, it may be said that at present, the majority of carbon credits generated by the Indian participants, are retired by way of exports to the other countries. The foreign currency earnings are a major incentive for the active participation of the private sector in decarbonisation.

In focus: Renewable energy projects

The Voluntary Carbon Market Update 2022 H1 shows that nature-based solutions and renewable energy activities lead issuances of carbon credits, jointly representing nearly 80% of all issuances in H1 2022. The VCM Dashboard shows that the highest volume of non-retired credits of India comprises the renewable energy projects – solar, wind and hydro. Other project types such as waste management and afforestation. Further, compared on a country basis, India has the highest number of registered renewable energy projects generating carbon credit units.

A commentary by the officials of International Energy Agency (IEA) and NITI Aayog puts how India has a great potential in clean energy solutions, and how important it is to access the international markets for the same. Excerpts from the commentary is reproduced below –

“A transition to clean energy is a huge economic opportunity. India is particularly well placed to become a global leader in renewable batteries and green hydrogen. These and other low-carbon technologies could create a market worth up to $80 billion in India by 2030. Support from the international community is essential to help shift India’s development onto a low-carbon path.”

Tax implications on carbon credits

The tax implication on the sale of carbon credits has been a matter of debate, and therefore, attracts judicial interference. However, the Finance Act, 2017, had put a standstill to the discussions with the notification of section 115BBG of the Income Tax Act, 1961. Vide the insertion of the said section, carbon credits have been made taxable at a specifically notified rate of 10%, with no allowance towards deduction of any expenses thereof. It is noteworthy that for the purpose of this section, carbon credits have been defined to mean such emission reduction units as validated by the UNFCC. The exact text is reproduced below –

“Explanation.—For the purposes of this section, “carbon credit” in respect of one unit shall mean reduction of one tonne of carbon dioxide emissions or emissions of its equivalent gases which is validated by the United Nations Framework on Climate Change and which can be traded in market at its prevailing market price.”

Therefore, there exists a grey area on whether the carbon credits traded in voluntary markets not validated under UNFCC will be taxed in a manner different from section 115BBG. Further, with the national carbon market coming into picture, the section will require amendment so as to facilitate the taxation of carbon credits traded in the Indian carbon markets.

Another tax implication attracts upon the “supply” of carbon credits, being “goods” within the meaning of GST laws. Under the erstwhile VAT laws, the position with respect to taxability of carbon credits as goods was cleared vide the notification dated 13.01.2010.

“A careful examination of the product called Certified Emission Reductions (CERs) commonly known as carbon credits shows that it is a certificate having market value. There are people/entities who are willing to sell and others who are willing to purchase such certificates. The intrinsic nature and value of carbon credits coupled with their free transferability makes the said product a marketable commodity. The said product is therefore covered under the definition of the term “goods” as it figures in sub-section (1) of Section 2 of DVAT Act, 2004.”

Under the existing GST laws, a clarificatory circular issued by the Department dated 1st March, 2018 clarifies that tradable certificates such as priority sector lending certificates (PSLCs) are taxable to GST as “goods”. Subsequently, another departmental circular dated 6th June, 2018, further clarified that such certificates will fall within the HSN Code in the range of 4907 and currently attracts levy of GST at the rate of 12%. As discussed before, most of the carbon credits generated by Indian participants are currently exported outside India, and therefore, the same is exempt from GST being an “exempt supply”.

Suggestions for the carbon markets

The proposal of a national carbon market in India has been in talks for a while now, and with the passing of the Bill in Lok Sabha, one step forward has been taken towards making the same a reality. Some suggestions may be extracted from the operationalised carbon markets around the world in designing the proposed carbon market. Please note that the intricacies of the Indian carbon markets are not known yet, therefore, the suggestions are based on the existing market mechanisms and learnings from ETS of other countries around the world. Below we list down our suggestions –

- Compatibility with the international units – The units of carbon credits should be such which is easily interchangeable with its international counterparts. As discussed earlier, India has high potential for export of carbon credits and therefore, the compatibility will help the credit importing countries to prefer purchase of carbon credits from Indian entities.

- 24*7 trading – The existing RECs and ESCerts trade on a periodic basis. On the contrary, it is suggested that the carbon credits market be made available for trading on a regular basis. Regular trading will benefit both buyers and sellers to take advantage of the price. Further, a 24*7 trading will facilitate international trades as the time differences will not have any impact.

- Restricted export instead of complete prohibition – It may be too early to comment on the proposed ban on the exports of carbon credits, given the complete facts are not yet known. However, considering the fulfilment of climate commitments of India on one hand, and supporting its economy on the other, the author is of the view that exports of carbon credits should not be completely prohibited. Reasonable quantitative restrictions may be put on the same, or alternatively, minimum obligation to be offset in the national markets may be prescribed. This will motivate organisations to engage in more low-carbon activities, so as to fulfil their obligations on one hand, and gain foreign exchange earnings through export of surplus.

- Flexibility with certainty – While prices may be left to be fixed by the demand-supply mechanism, the mechanisms should be designed such that the credit generating companies have a certainty of sale of the credits. To this end, a government fund may be created to purchase the excess offsets, if any, remaining at the end of the compliance period.

- Long-term environmental benefits – The eligibility criteria of the projects should be designed in such a manner so as to ensure that the project actually reaps environmental benefits and the benefits outweigh the deterioration, if any. Benefits should be long-term atleast, if not perennial.

Conclusion

There are various studies and reports to show how decarbonisation presents a great opportunity for India towards building its green economy. India needs to tap its potential of decarbonisation to the full extent possible, and the actions of the government should be directed towards incentivising the private sector towards full participation in the mission. This does not only help the country in achieving its climate goal, but also provides chances for economic growth.

This article has been written for the August edition of Windpro magazine.

Our other resources on BRSR and sustainability can be accessed here.

[1] Climate change has become a global concern, and has extended beyond the literature and actions of environmentalists, to the corporate boardrooms as well. See Directors’ Liability on Climate Change: Why Boards should be bothered. Also see Corporate responsibility towards climate change: UK leads regulatory measures

[2] See Emission law amendments to trigger carbon credit trading in India

[3] See India to ban carbon credit export until climate targets are met, reported in Seneca ESG

Leave a Reply

Want to join the discussion?Feel free to contribute!