Carbon credit markets: building the ecosystem for trading in India

– Payal Agarwal, Manager (payal@vinodkothari.com)

The consequences of climate change and the need for a positive climate action need no introduction in the present world. What once remained a matter of concern for the so-called “environmental activists”, gradually traveled their way to the government as countries committed towards achieving “net zero”. Climate action requires involvement of the masses, and therefore, the government is coming up with new regulatory devices towards developing climate action on a large scale.

India is no exception to the same, and following the footsteps of other countries, has proposed to develop a compliance mechanism and domestic market for carbon credits in India. Regulatory inclusion is provided to carbon credits in India by way of an amendment to the Energy Conservation Act, 2001 (“ECA”). Carbon credits are a form of emission trading schemes (ETS), that incentivize the reduction in emissions, against the offsetting of higher emissions by other market participants. A brief comparison of the domestic ETS in other parts of the world, and the existing emissions trading markets in India can be referred to at Emission law amendments: Laying the framework for Carbon trading market in India.

Regulatory framework on Carbon Credits in India

Following the Energy Conservation (Amendment) Bill, 2022 placed and passed by both Houses of Parliament on 8th August, 2022 and 12th December, 2022 respectively, the Energy Conservation (Amendment) Act, 2022 (“Amendment Act”) was notified on 19th December, 2022, providing, among other things, powers to the Central Government to specify the carbon credit trading scheme. After a series of consultations and discussions with relevant stakeholders, in exercise of such powers conferred on the Central Government, the Ministry of Power (‘MoP’) has notified the Carbon Trading Scheme, 2023 (“Scheme”) on 28th June, 2023. The Scheme notifies a legislative ecosystem for the development of the procedural aspects of the carbon trading and markets in India.

Entities covered under the Scheme

The Scheme will be applicable to “registered entities”. The definition of “registered entities” has been inserted vide the Amendment Act as –

“registered entity” means any entity, including designated consumers, registered for carbon credit trading scheme specified under clause (w) of section 14;”

The Scheme further provides that these entities are required to be registered with the Grid Controller of India.

The list of the designated consumers has been provided under the Schedule to ECA, further amended vide notification dated 6th June, 2023. However, the definition refers to “any entity” and therefore, entities not covered under the Schedule may also voluntarily register themselves for the issuance of carbon credit certificates.

Obligated and non-obligated entities

The Scheme further classifies the “registered entities” as “obligated entities” and “non-obligated entities”. Obligated entities (‘OEs’) would mean registered entities that are notified under the compliance mechanism, whereas, non-obligated entities (‘non OEs’) would mean registered entities that can purchase carbon credit certificates on a voluntary basis.

While the definition of non-obligated entities refers to only “purchase” and not “sale” of the carbon credit certificates on a voluntary basis, however, it is understood that these entities will be able to engage in opportunistic selling of purchased/ acquired carbon credits, unless the upcoming detailed procedure states otherwise.

Legislative ecosystem for carbon trading in India

The sectors and obligated entities covered under the compliance mechanism as well as the targets for the energy consumption shall be notified by the MoP along with the GHG emission intensity targets to be notified by the Ministry of Environment, Forest and Climate Change.

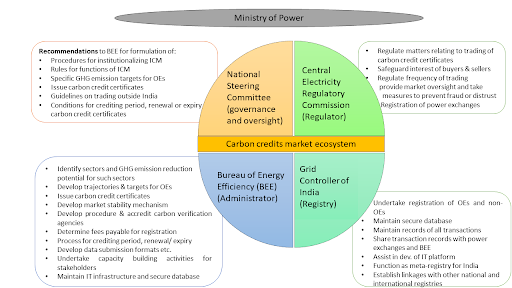

The regulatory ecosystem of Indian Carbon Markets (‘ICM’) along with their respective functions can be understood by the figure below –

The Power Exchanges shall serve as a platform for the trading of the carbon credit certificates, and shall be regulated by the CERC. Currently, there are 3 power exchanges active in the country, viz., Indian Electricity Exchange (IEX), Power Exchange of India (PXIL) and Hindustan Power Exchange (HPX).

Intricacies of trading on ICM

The Scheme is only a preparatory step towards the establishment and functioning of Indian carbon markets. With the notification of the Scheme, while the legislative ecosystem has been laid, on which the markets will operate in near future, however, the compliance mechanism and the detailed procedure of acquisition and trading of the carbon credit certificates still remains a work in progress. Several regulations and details are yet to follow.

Closing Remarks

The country is witnessing a slew of regulatory interventions and proposals aimed at curbing the nuisances of climate change. However, these interventions are still at a very nascent stage so as to comment on the efficiency and effectiveness of the measures. With an aim to create and support a mass movement towards various environmental concerns, the Government has also released the draft of the Green Credit Programme Implementation Rules recently. The objective of the Programme is to incentivise the voluntary environmental actions of various stakeholders through a competitive market based approach, however, the schematics of the Programme and the incentives it is proposing to create are still uncertain.

Our other resources on carbon credits and sustainability can be accessed here – https://vinodkothari.com/resource-center-on-business-responsibility-and-sustainable-reporting/

I am excited to know how to work carbon credit market in India with aim to achieve net zero emission target 2070