BRSR Reporting: Actions and disclosures required for business sustainability

Abhishek Saraf, Manager and Payal Agarwal, Executive (corplaw@vinodkothari.com)

Background

The Business Responsibility and Sustainability Reporting (“BRSR”), originating from the MCA report on Business Responsibility Reporting, has found its way into the regulatory provisions by way of an amendment to the Regulation 34(2)(f) of the Listing Regulations[1], notified on 5th May, 2021. Further, SEBI vide circular dated 10th May, 2021 introduced the format of BRSR and the guidance note to enable the companies to interpret the scope of disclosures.

The BRSR will replace the existing BRR format w.e.f. FY 2022-23. For the FY 2021-22, the top 1000 listed entities may voluntarily submit the BRSR and from FY 2022-23 onwards, the same has to be submitted mandatorily. It is notable that the BRSR, though replacing BRR, is actually an extension of the existing BRR reporting While the BRSR has been made effective from FY 2022-23, it has to be understood that reporting is secondary, and needs to be backed by the company taking appropriate actions to ensure a positive report. Where the BRSR reporting of a company is negative, the same, though not a non-compliance of the regulatory provisions, will result in a negative impact on the minds of the stakeholders.

Basis of reporting requirements under BRSR

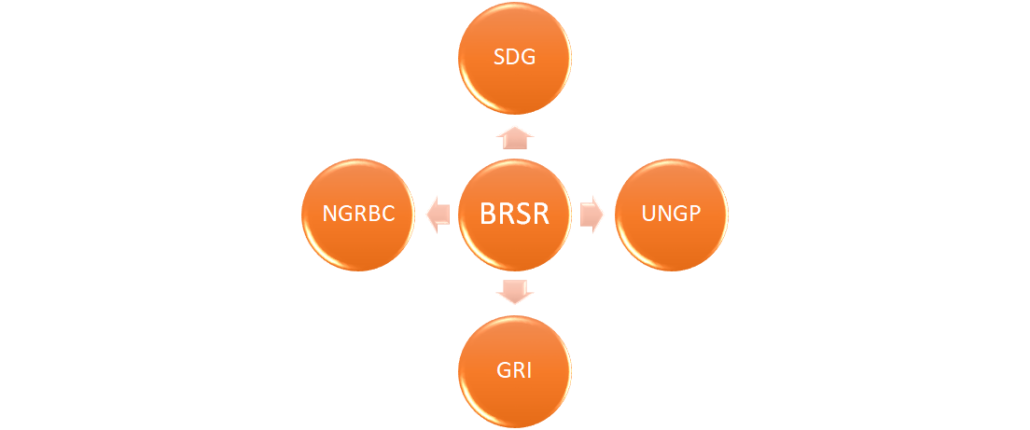

The base document behind which the BRSR has evolved is the extant BRR and National Guidelines on Responsible Business Conduct (NGRBC) principles, which itself emanates from Social Development Goals (SDGs). The MCA report objectifies BRSR to serve as “a single comprehensive source of non-financial sustainability information relevant to all business stakeholders – investors, shareholders, regulators, and public at large.”

Sustainable Development Goals (SDGs)

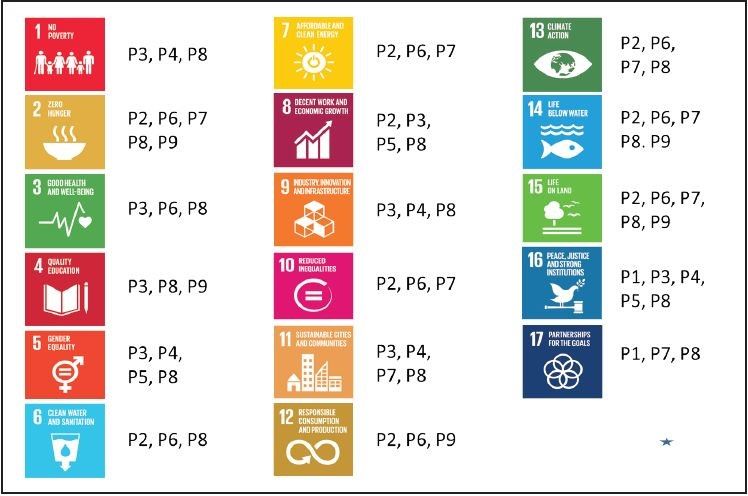

SDGs by the United Nations are the backbone of the Principles of the NGRBC, each of the 9 Principle which forms the very root of the BRSR reporting has been aligned with the 17 SDGs, which define the world we want. SDGs apply to all nations and mean, quite simply, to ensure that no one is left behind. The 17 SDGs are the 2030 Agenda for Sustainable Development, adopted by all the United Nations Member States in 2015, provides a shared blueprint for peace and prosperity for people and planet, now and into the future. SDGs are one of the good source of documents to gain understanding about the NGRBC Principles and their core elements which would help in providing a clarity about various disclosures under BRSR.

Source of Chart: The National Guidelines for Responsible Business Conduct 2018 (NGRBC) issued by Ministry of Corporate Affairs

The above chart demonstrates the indicative alignment between the SDGs and relevant Principles of the NGRBC.

The framework of BRSR has been designed with reference to various existing globally recognized and locally relevant non-financial reporting frameworks.

Alignment with ESG Concept

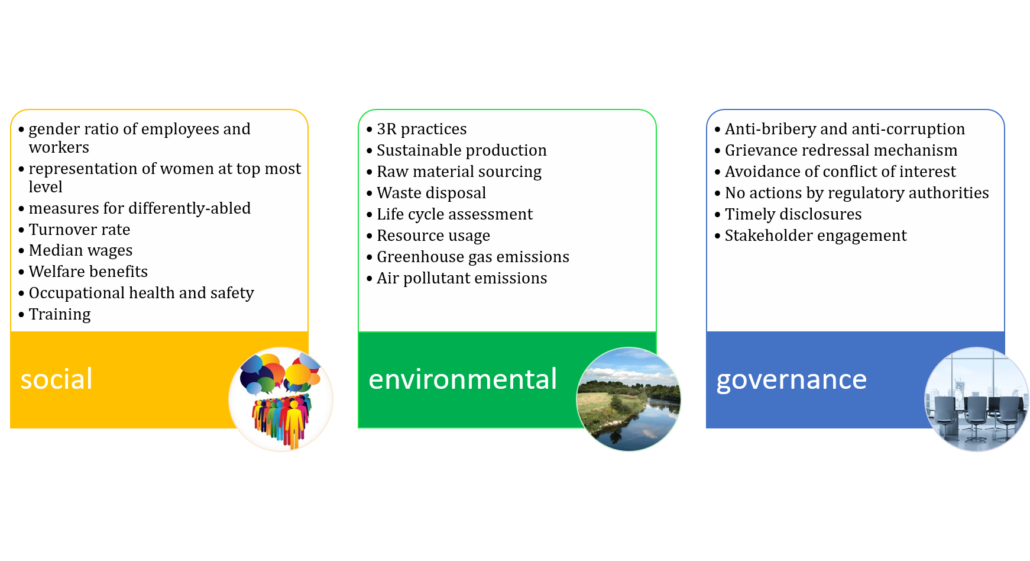

The underlying intent of the BRSR can be said to be seamless alignment of the various regulatory frameworks with the long term objectives and sustainability goals of the company, which are key requisites for the decision making process of various stakeholders.

BRSR has covered the Environmental, Social and Governance (ESG) and Sustainability aspects.

At the onset, the company shall be required to provide a statement highlighting ESG related challenges, targets and achievements. Companies shall be required to identify the probable risks and opportunities faced by it in the path of being a socially, environmentally aware and properly governed company.

Overview of BRSR Report

In this backdrop, let us examine the requirements a company needs to be aware of in order to ensure a positive report, and the technicalities that follow.

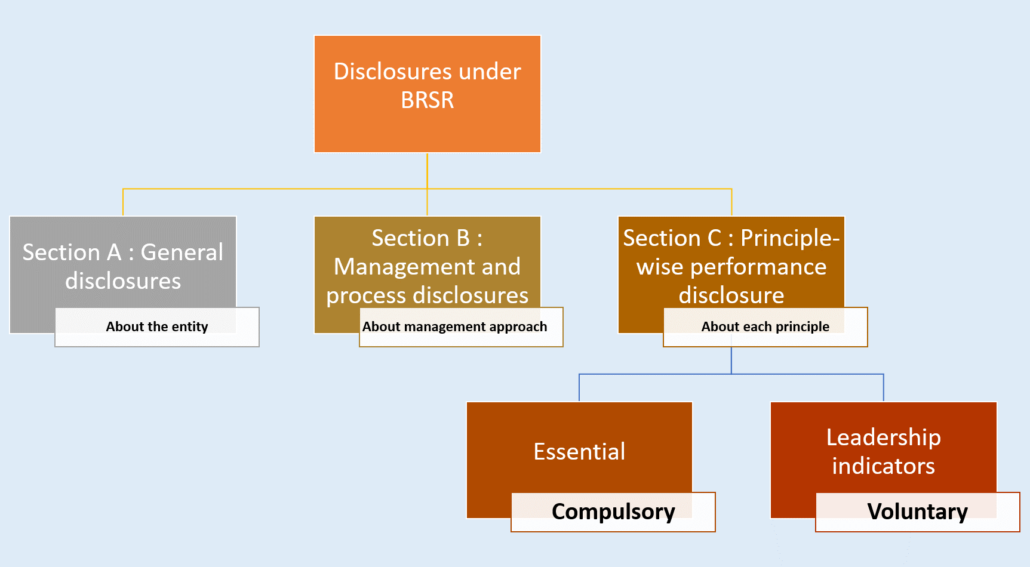

Before entering into the principle-wise discussion, the general structure of the reporting framework can be studied.

Regulators have put the onus of disclosing the details as per “Leadership” Indicators on the companies. A company disclosing the voluntary information will be seen as better governed, having a higher degree of ethical, social and environmental responsibility towards the stakeholders and the society.

Section A: General disclosures

The disclosures sought in this section are internal and mostly available with the reporting entities. Basic details such as name, CIN, registered office address, contact details, paid up capital, name and contact details of the person responsible for BRSR, details about the operations, products and turnover. Further details about the gender ratio of employees and workers, representation of women at the top management and turnover ratio of the employees have to be disclosed.

There are two particular disclosure requirements that will require the attention of the reporting entity while shifting from BRR to BRSR.

Clause 23: Complaints/Grievances on any of the principles (Principles 1 to 9) under the National Guidelines on Responsible Business Conduct:

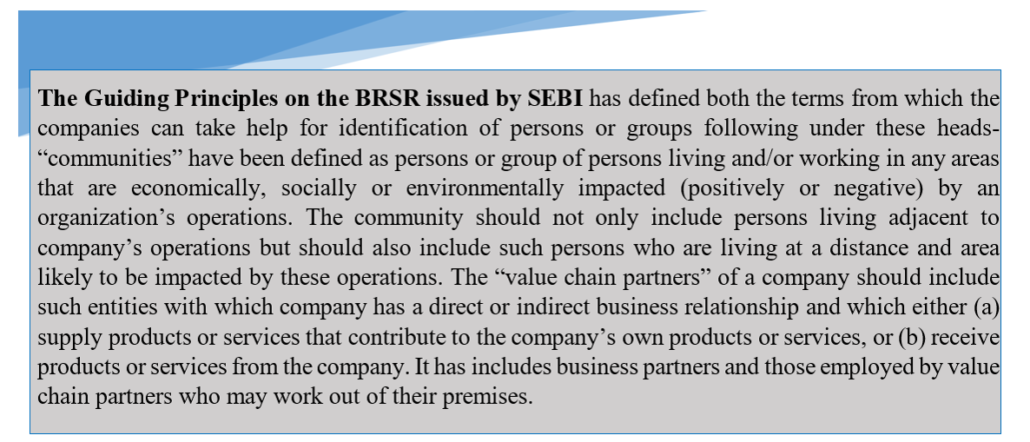

This will require the entities to undertake a number of exercise starting from identification of its various stakeholders and bifurcating them under different groups. NGRBC has explained the term ‘stakeholders’ as individual or group concerned or interested with or impacted by the activities of the businesses and vice-versa, now or in future. Typically, stakeholders of a business include, but is not limited to, its investors/ shareholders, employees (and their families), customers, communities, value chain members and other business partners, regulators, civil society actors, and media. Coming on the bifurcation of the stakeholders group, two of the following groups will require special attention and understanding by the companies to develop a grievance redressal mechanism: “communities” and “value chain partners”

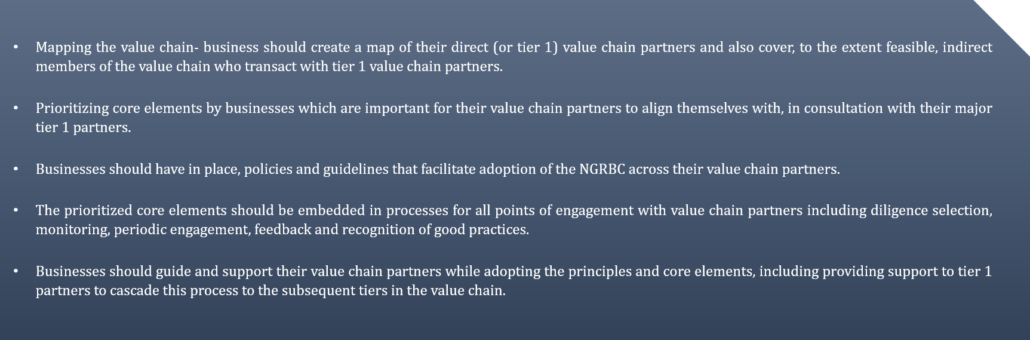

NGRBC also provides few suggestive steps to help the companies to identify and cover their value chain partners in the ESG framework. Such suggestive steps include:

Secondly, to formulate a grievance reporting and redressal mechanism in respect of each of the NGRBC principles. In the latter parts of the article, we will find that almost every principle requires the reporting entity to design a grievance redressal mechanism. The complaints/ grievances arising from those need to be disclosed here.

Clause 24: Overview of the entity’s material responsible business conduct issues

In this clause, the entity needs to identify and provide the details of high priority responsible business conduct and sustainability issues pertaining to environmental and social matters that present a risk or an opportunity to its business along with the rationale of identifying the risk/ opportunity, the approach of the entity to adapt or mitigate to such risk and also indicate the positive and negative impact of such risk or opportunity on the financials of the entity in qualitative terms (in case of previous years, impact can be disclosed in quantitative terms). An example of the material issue under this section can be impact of climate change on the business- risk arising from the same can include impact on operations, demand for products or services etc, while opportunities can include cost savings through resource efficiency, development of new products and services, access to new market etc. The term ‘sustainability’ for the purpose of this clause can be understood from the definition as given in NGRBC as the outcome achieved by balancing the social, environmental and economic impacts of business. It is the process that ensures that business goals are pursued without compromising any of the three elements.

Section B: Management and process disclosures

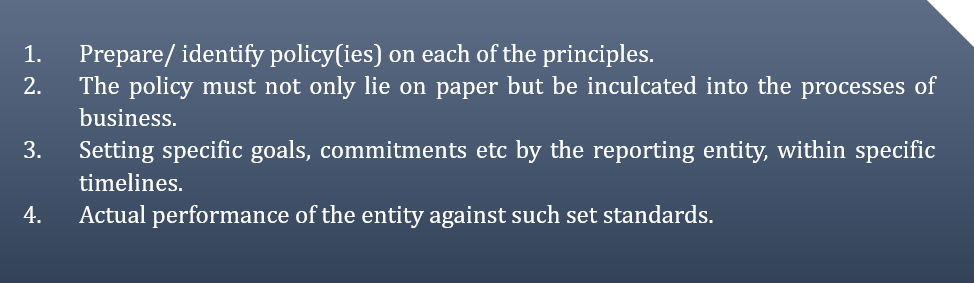

This section deals with the approach of management towards the NGRBC principles upon which the BRSR reporting is based upon. It will include the management to do the following–

It is important to note here that the company does not have to necessarily formulate a new policy(ies) altogether for each of the principles but existing policy(ies) or procedure(s) adopted in the company can also serve the purpose. On one hand, a policy may cover one or more principle and on the other hand, a Principle and its Core Elements may be covered by more than one policy.

A company may adopt the practice of framing a new single BRSR Policy containing policies and implementation procedure for all the 9 Principles and its core elements. On the other hand, the company may adopt different policy(ies) for each of the 9 Principle basis the core elements of the Principles such as Code of Conduct/Ethics Policy and Whistle Blower Policy can be adopted in respect of Principle 1 and Corporate Social Responsibility Policy in respect of Principle 8.

While setting specific goals, emphasis should be given to address those issues which arise out of the general conduct of the business. For example, companies involved in e-commerce or other cyber-related fields, should set data privacy and cyber security as one of their specific commitments. Companies involved in mining, or other industrial activities causing environmental damage may strive to attain maximum safeguards against environmental concerns.

The ESG matters affecting business conduct will require classification as –

| Challenges | Which ESG issues arise as a result of the activities of the company? |

| Targets | What is to be done to overcome the same? |

| Achievements | What are the positive implications of the company’s activities on the ESG issues? |

Review of the performance of the company against the NGRBC principles is a very crucial element since it will act as a pathfinder to the companies, highlighting where they are lacking and more emphasis should be given. As a means of effective review, the assessment may be carried out by an external agency. This is not a mandatory requirement, but suggestive to ensure better review of the company’s performance.

In addition to the above, under this section, company shall also disclose the details of the highest authority responsible for implementation and oversight of the policies and whether the company has delegated the responsibility of decision making related to sustainability issues to a Committee of Board/ any Director.

Having discussed the basics, let us proceed with the principle-wise disclosure and suggestive steps the reporting entity may take to fulfil the obligations of reporting in letter and spirit. We have tried to cover all the disclosure clauses that are more qualitative and require preparation by the companies, in contrast to the ones that are quantitative or where the information is readily available to the entity itself.

Principle 1 – Businesses should conduct and govern themselves with integrity, and in a manner that is ethical, transparent, and accountable

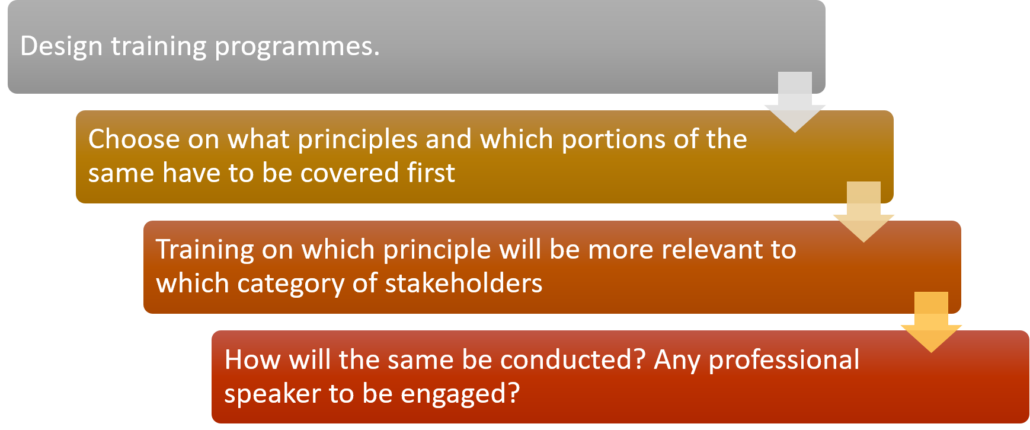

This principle is primarily based on SDG 17 – Partnerships for goals. A business comprises of people, ranging from its internal stakeholders being the employees, workers, senior management, board of directors, other key managerial personnel to external stakeholders being its investors, consumers, suppliers, other value chain partners etc. Therefore, the compliance of the principle by the business can be ensured if the same is complied with by the individuals related to the business jointly and severally. In such a case, it becomes imperative to conduct training and awareness programmes for the stakeholders. Training and awareness for the employees, workers, board members etc is basic responsibility of the organisation and the information therefore is sought under the “essential” indicators, whereas the programmes conducted for other value chain partners are an indication of “leadership” qualities of the entity.

This will require the companies to figure out the following –

Anti-bribery or Anti-corruption policy

Whereas the format only requires to disclose whether the companies have formulated an anti-bribery policy / anti- corruption policy, it is an important point to disclose whether the entities are considerate of issues such as bribery, corruption etc and take any step against the same. The primary legislation in India dealing with corruption is Prevention of Corruption Act, 1988. Though it does not mandate the companies to have a written policy against corruption, it provides safeguards to companies against the corrupt practices of its employees, when the company evidences that it has adequate safeguards to prevent the persons associated with it from undertaking such conducts of bribery or corruption.

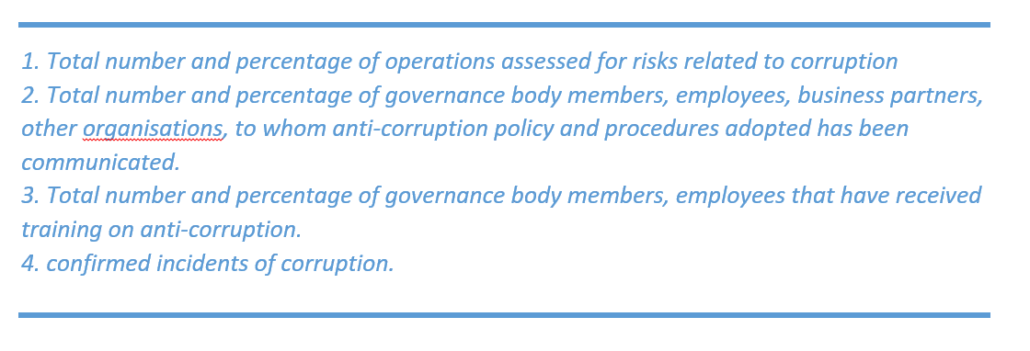

What can be adequate safeguards taken by the company? The companies may take reference of the GRI 205. It provides for the following reporting requirements –

Whereas anti-corruption policy is not mandated under the extant Indian laws, the companies may demonstrate their intolerance about corruption by including the same in their code of conduct, risk assessment policy, etc.

Principle 2 – Business should provide goods and services in a manner that is sustainable and safe

The Principle has its roots in UN Sustainable Development Goals which are part of United Nations’ 2030 Agenda for Sustainable Development. The Principle is developed from SDG 12 that sustainable production and consumption are interrelated, contributing to enhancing the quality of life and towards protecting and preserving earth’s natural resources.

This requires the entities to incur R&D and capital expenditure on such technologies that enhance the environmental and social impacts of its products. The entities shall give attention to the following –

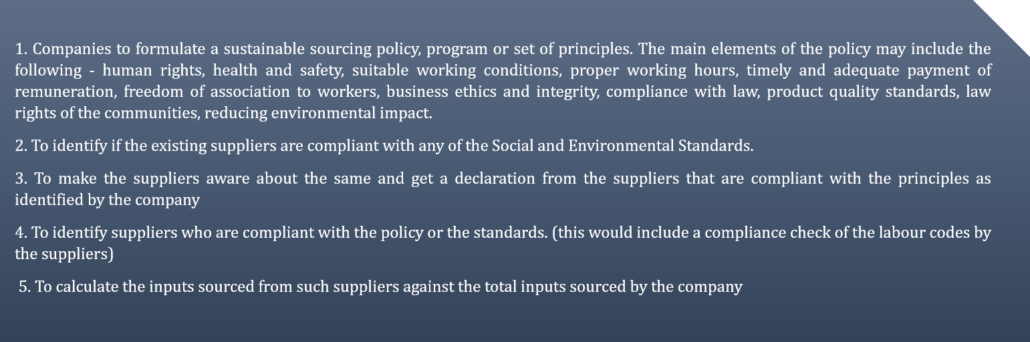

Sustainable sourcing

“Sustainable Sourcing” essentially refers to the integration of social, ethical and environmental performance factors into the process of selecting suppliers. There are various certification standards that may help in assessing whether the supplier fits the sustainability criteria, such as SA 8000, ISO 14001, OHSAS 18001, or relevant labels like Rainforest Alliance, Rugmark, Certified Sustainable Palm Oil from Roundtable on Sustainable Palm Oil, FSC 100%, FSC Recycled, and FSC Mix from Forest Stewardship Council, Better Cotton Standard System, FairTrade label etc.

The companies, to ensure a sustainable sourcing, shall take the following steps –

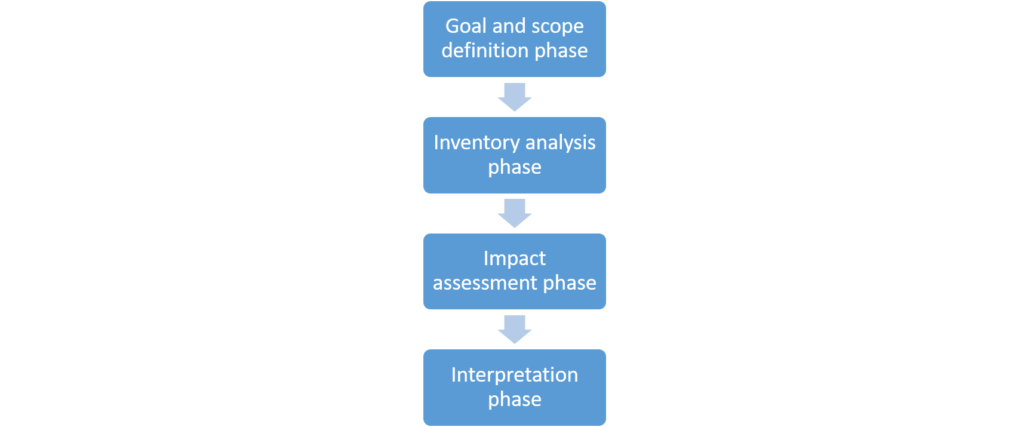

Life Cycle Assessments (LCA)

For companies willing to disclose their leadership strengths, Life Cycle Assessment (LCA) of the products are required to be done. Product Life Cycle refers to all the stages of a product from extraction or acquisition of raw materials through manufacturing and processing, distribution and transportation, use and reuse, recycling and disposal. In the case of services, it refers to all activities and processes from the design to delivery. The assessment of the same will require designing a boundary which can be –

- Cradle to Grave- full LCA from resource extraction to use phase to disposal phase,

- Cradle to Cradle- the last step is the recycling process,

- Cradle to gate- partial LCA from resource extraction to factory gate

The study of LCA are conducted in the following four phases –

For companies thinking of undertaking LCA, reference can be taken from ISO 14040 and ISO 14044. The UNEP’s Guidelines on Social LCA of products can also be helpful in this regard.

Principle 3 – Businesses should respect and promote the well-being of all employees, including those in their value chains

This Principle encompasses all policies and practices relating to equity, dignity and well being, and provision of decent work as indicated in SDG 8, of all the employees engaged in the value chain, without any discrimination and in a way that promotes diversity. The Principle recognizes that the well being of the employee also include the well being of his/her family.

Decent work, employment creation, social protection, rights at work and social dialogue represent integral elements of the new 2030 Sustainable Development. Furthermore, crucial aspects of decent work are broadly rooted in the targets of many of the other 16 goals.

Much of the disclosures sought under this Principle can be traced back to the employee welfare legislations proposed to be implemented in the country, viz.,

- The Code on Wages, 2019

- The Occupational Safety, Health and Working Conditions Code, 2020.

- The Code on Social Security, 2020

- The Industrial Relations Code, 2020

The information to be provided under this section are more or less quantitative and datas which are maintained by the companies for their different units, plants and offices. It shall be the responsibility of the Compliance Officer or the person authorised to oversee the implementation of the Principle to follow up with the concerned authorised person at various units, plants and offices to sensitize them on maintaining proper records and documents along with the help of HR of the Company.

It is to be noted that while the essential indicators requires the companies to provide disclosure w.r.t to safety, health, working conditions, payment of wages and benefits to employees and workers, while under the leadership indicators, companies are required to go a step further a provide the same information and details in relation to their value chain partners.

Principle 4 – Businesses should respect the interests of and be responsive to all its stakeholders

The most important step towards the fulfilment of this principle is identification of stakeholders. The United Nations Guiding Principles (“UNGP”) also demands the organisations to identify its stakeholders, particularly the disadvantaged, marginalised and vulnerable stakeholder group. Any organisation has a lot of stakeholders, from various perspectives – economic, social, environmental and likewise. While it may not be possible for a company to be cent percent responsive to all its stakeholders, it becomes mandatory for the company to identify its key stakeholders. As also pointed out in the National Voluntary Guidelines,

“The Principle, while appreciating that all stakeholders are not equally influential or aware, encourages businesses to proactively engage with and respond to those that are disadvantaged, vulnerable and marginalized.”

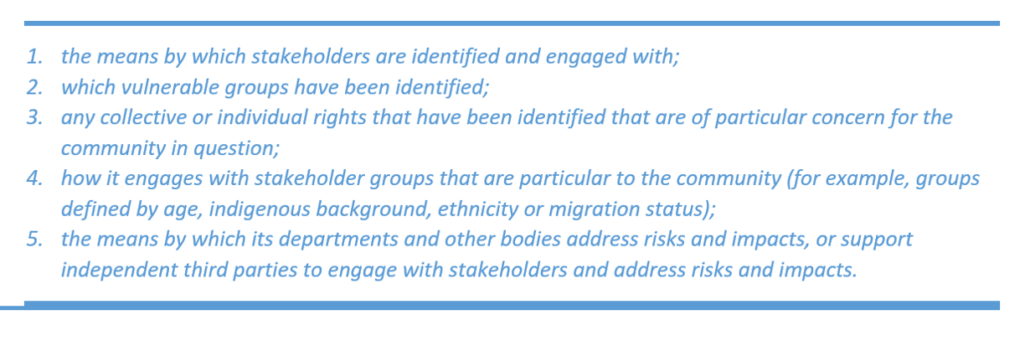

In this regard, GRI 413 recommends the following approach to be followed by management as means of effective stakeholder engagement –

Identifying key stakeholders is a step towards engaging with them. In the context of the responsibility to respect human rights, a key purpose of engagement with stakeholders is to ensure a full understanding of how the company’s actions and decisions can affect individuals and groups. The focus is therefore on stakeholders whose human rights can be negatively impacted. While the company engages with the stakeholders, efforts should be made to use such channels of communication which gives the parties a better way to respond effectively. The frequency of engagement will depend on the type of key stakeholder. The company will have to determine what should be the effective frequency to communicate with them. Where the engagements are event – based, the company may lay down a policy determining what events trigger a requirement of engagement. The engagement should provide some value, therefore the company will have to decide beforehand the defined scope of engagement with each stakeholder.

Identifying key stakeholders is a step towards engaging with them. In the context of the responsibility to respect human rights, a key purpose of engagement with stakeholders is to ensure a full understanding of how the company’s actions and decisions can affect individuals and groups. The focus is therefore on stakeholders whose human rights can be negatively impacted. While the company engages with the stakeholders, efforts should be made to use such channels of communication which gives the parties a better way to respond effectively. The frequency of engagement will depend on the type of key stakeholder. The company will have to determine what should be the effective frequency to communicate with them. Where the engagements are event – based, the company may lay down a policy determining what events trigger a requirement of engagement. The engagement should provide some value, therefore the company will have to decide beforehand the defined scope of engagement with each stakeholder.

While stakeholder engagement is an essential disclosure, the leadership indicator includes moving beyond only engagement with stakeholders, to involving consultations with them and even incorporating their consultations and modifying the entity’s processes and structures, wherever required.

Principle 5 – Businesses should respect and promote human rights.

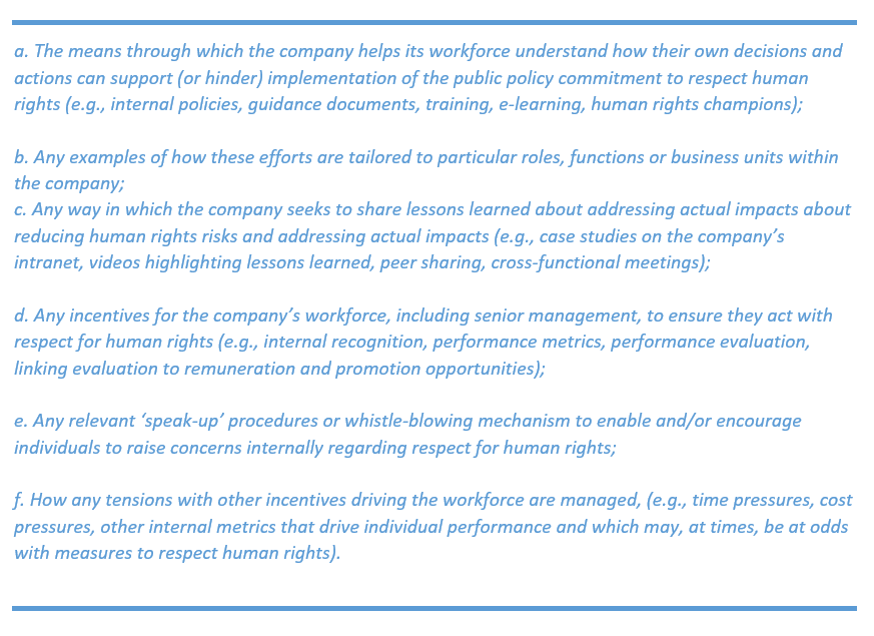

Human rights are the basic rights that every human being is supposed to have. Since the rights are of the humans themselves, it becomes very important that they are aware of their rights in order to claim the same. In this regard, the UNGP brings some guiding questions, finding answers to which can help an organisations’ management to imbibe the human rights in their culture. The questions have been listed below for reference –

These can definitely act as a guide to the organisations worldwide, India being no exception, in recognising the human rights in their organisation.

These can definitely act as a guide to the organisations worldwide, India being no exception, in recognising the human rights in their organisation.

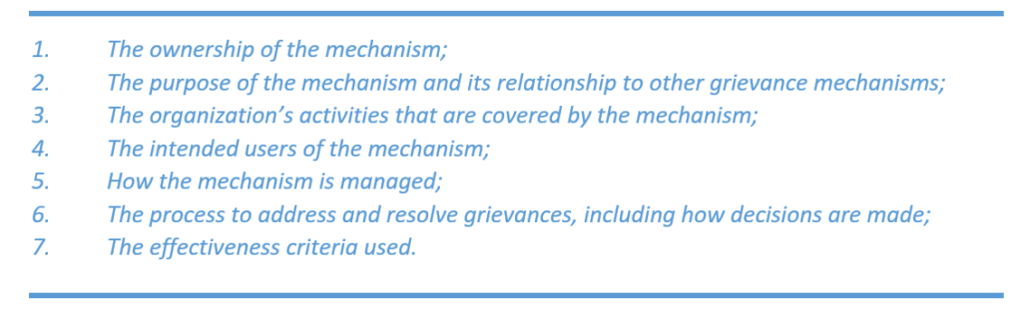

Addressing human rights involves resolving the concerns of associated people over the matters of human rights. Therefore, reporting entities are required to formulate an effective grievance redressal mechanism to address the human rights concerns.

Guidance can be sought from the GRI 102-3 disclosure which provides that an effective grievance resolution mechanism shall have the following identifiables –

There are various statutory requirements at present that deal with various human rights issues in its capacity. For example, the Code of Minimum Wages, 2019 specifies a ground wage rate below which wages cannot be paid by the employer. It seeks to regulate wage and bonus payments in all employments where any industry, trade, business, or manufacture is carried out.

Similarly, the Sexual Harassment at Workplace (Prevention, Prohibition and Redressal) Act, 2013 requires the organisations to constitute an Internal Complaints Committee as well as formulate an anti-sexual harassment policy as primary steps against the sexual harassment. Further, there are regulatory provisions in India that renders child labour illegal in the country.

The next actionable that arises is the assessment of compliance with human rights in the organisation and its various units. Human rights assessment, also known as human rights review, is defined to mean formal or documented assessment process that applies a set of human rights performance criteria (GRI 412). In this regard, the companies will have to ensure the following –

The importance of assessment lies in identifying the risks/ concerns and taking appropriate corrective actions for them. While an organisation’s self-assessment is a mandatory requirement, the entity can display its leadership traits if the same is assessing the human rights of its value chain partners as well. This would also include changes/ modification in the existing policies, processes, systems etc of the company to scale up with human rights.

Principle 6 – Businesses should respect and make efforts to protect and restore the environment

The Constitution of India under Part IVA (Art 51A-Fundamental Duties) casts a duty on every citizen of India to protect and improve the natural environment including forests, lakes, rivers and wildlife, and to have compassion for living creatures. Even though companies are not recognised as a citizen, it is ultimately a collection of citizens only. This makes a company equally obliged towards environment protection and restoration. This will require a reporting entity to –

Low carbon economy

The “low carbon economy” refers to the green ecological economy based on low energy consumption and low pollution. The term “Low Carbon Economy” was first published in a white paper for the British Department for Trade and Industry. Various initiatives are taken globally towards avoiding greenhouse gas emissions, lowering the carbon levels in the atmosphere, preventing global warming etc. In India, currently there is no legislation on “low carbon economy”, but the businesses may take a voluntary approach towards designing such projects thereby leaving a mark that others can follow towards making a sustainable environment.

Waste emission

Waste generation is hefty in a country like India, and its management is a key issue. In this regard, various legislations are already in force, be it –

The National Green Tribunal Act, 2010

The Air (Prevention and Control of Pollution) Act, 1981

The Water (Prevention and Control of Pollution) Act, 1974

The Environment Protection Act, 1986

The Hazardous Waste Management Regulations, etc.

GRI 306 serves as a comprehensive document for management approach towards waste management related disclosures, guidance and recommendations in matters relating to waste. Management approach disclosures require a narrative description of the causes of waste-related impacts and how the organization manages these impacts. Topic-specific disclosures require reporting information about the quantity of waste generated, its composition, and how it is recovered or disposed of.

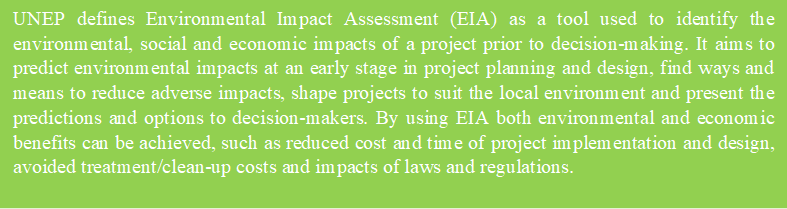

Environmental Impact Assessment (EIA)

Environmental Impact Assessment (EIA) is a process of evaluating the likely environmental impacts of a proposed project or development, taking into account inter-related socio-economic, cultural and human-health impacts, both beneficial and adverse.

Environment Impact Assessment in India is statutorily backed by the Environment Protection Act, 1986 which contains various provisions on EIA methodology & process.

Environment Impact Assessment Notification of 2006 has decentralized the environmental clearance projects by categorizing the developmental projects in two categories, i.e., Category A (national level appraisal) and Category B (state level appraisal).

Category A projects are appraised at national level by Impact Assessment Agency (IAA) and the Expert Appraisal Committee (EAC) and Category B projects are apprised at state level.

State Level Environment Impact Assessment Authority (SEIAA) and State Level Expert Appraisal Committee (SEAC) are constituted to provide clearance to Category B process.

Successful EIA will require the following reporting –

Principle 7 – Businesses, when engaging in influencing public and regulatory policy, should do so in a manner that is responsible and transparent

Principle 7 deals with the responsible engagement of business with the public at large. Besides the stakeholders with whom an entity is directly or indirectly associated, an organization has a greater responsibility towards the public at large whom it is influencing in some way or the other. Except for some large business entities, the corporates generally do not engage with the public directly. Instead, they prefer to be associated with large associations/ institutions/ trade and industry chambers. Therefore, in order to determine the degree of influence an organization has over the public, and the manner in which the influence is being exercised, it is necessary to look into the institutions with which they are associated.

While the organisation has to identify its top 10 affiliations based on the size of the institute (that is to say, the number of members in the institution), the GRI 102-3 disclosure provides certain extra reporting recommendations that the company should follow in order to assess its degree of association.

The reporting organization should include memberships maintained at the organizational level in associations or organizations in which it holds a position on the governance body, participates in projects or committees, provides substantive funding beyond routine membership dues, or views its membership as strategic.

Public policy advocacy

This comes as a part of leadership indicator, where the companies need to disclose whether they advocate any public policy. Public policy advocacy denotes influencing the public in a specific way towards a public matter, for example, child labour, women education, cleaner environment etc. If a company engages as such, there are two things that should be clear in the mind of the management (GRI 415) –

Principle 8 – Business should promote inclusive growth and equitable development

The Principle recognizes the value of the energy and enterprise of businesses and encourages them to innovate and contribute to the overall development of the country with a specific focus on disadvantaged, vulnerable and marginalized communities, as articulated in Section 135 of the Companies Act, 2013. The Principle also emphasizes the need for collaboration amongst businesses, government agencies and civil society in furthering this development agenda in line with SDG 17.

Social Impact Assessment (SIA)

It is mandatory to conduct a Social Impact Assessment (SIA) and prepare a Social Impact Management Plan for acquisition of land by government for its own use, hold and control or by public- private partnership or by private acquisition for public purpose. Details of the same has to be provided in BRSR if it was required to be conducted under applicable laws. The requirement comes from Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013.

Redressal of grievances of community

Community, or the “local community” , as envisaged in the MCA Report as well as the Guiding Principles, means – persons or groups of persons living and/or working in any areas that are economically, socially or environmentally impacted (positively or negatively) by an organization’s operations. The local community can range from persons living adjacent to an organization’s operations, to those living at a distance who are still likely to be impacted by these operations.

The formulation of grievance redressal mechanism will first require the reporting entity to identify the community to whom it is obliged.

The format requires reporting of the percentage of inputs procured from local suppliers, small producers and MSMEs. Small producers is a defined term under the Guiding Principles, to mean those where the owner herself or himself is a worker and includes informal and/or producers such as self-help groups and home-based workers as well as producer-owned entities such as cooperatives, producer companies. This is in extension to the duty of the business towards the growth of locality in which it operates and supporting small businesses and helping them grow.

In addition to these mandatory requirements, disclosures with respect to the beneficiaries of CSR is sought as a leadership indicator. Extensive reporting of CSR is not sought in the BRSR since the Annual Report on CSR as required under the provisions of Companies Act, 2013 already forms part of the Annual Report to which BRSR is also annexed.

Principle 9 – Businesses should engage with and provide value to their consumers in a responsible manner

Consumers are always a significant aspect of any business. However, many-a-times they are exploited by the business. Consumer protection, therefore, is an important matter of concern, if not in the developed nations of the United States, in India. The Consumer Protection Act, 2019 is the prime legislation in India, governing and working for the protection of consumers. The Competition Act, 2002 is another legislation working for the benefits of consumers and preventing exploitation by the business entities.

The Consumer Protection (E-Commerce) Rules, 2020 requires every e-commerce entity to establish an adequate grievance redressal mechanism having regard to the number of grievances ordinarily received by such entity from India, and appoint a grievance officer for consumer grievance redressal, and display the name, contact details, and designation of such officer on its platform. In this regard, “e-commerce entity” has been defined in the Rules to mean,

“e-commerce entity” means any person who owns, operates or manages digital or electronic facility or platform for electronic commerce, but does not include a seller offering his goods or services for sale on a marketplace e-commerce entity;

Except for sellers using the platform of any other e-commerce entity for selling their goods, all other entities using the electronic platform for e-commerce gets covered by the above requirements. The e-commerce market in India is expanding fast and is expected to grow a lot more in the coming years (see here).

Further, the responsibility of business is to provide safe goods to the consumers and also ensure a sustainable environment. In this regard, there are various mandatory information that needs to be mentioned in the packages of the products. For example, the Food Safety and Standards (Packaging and labelling) Regulations, 2011 requires various mandatory disclosures, with regard to the contents, date within which the product should be used, conditions in which such product should be kept to maintain its state, types of containers which should or should not be used for packaging, nutritional facts of the product., instructions to use for safe usage of product, etc. The Cigarettes and other Tobacco Products (Packaging and Labelling) Rules, 2008 mandates to put a warning on the packages of tobacco products that it causes cancer. The Recycled Plastics Manufacture and Usage Rules, 1999 (as amended) aims to put a ban on certain types of plastic bags, including single-use plastics. It requires the manufacturing agencies to mark/ codify the plastic bags.

Cyber risk

Another concern that is lifting its head in the consumer protection matters of India is cyber risk and data privacy. In this regard, Section 43A of the Information Technology Act, 2000 read with the Information Technology(reasonable security practices and procedures and sensitive personal data or information) Rules, 2011 requires every business in India, which collects, receives, possesses, stores, transmits, processes or can associate pretty much any other verb with personal information; directly under a contractual obligation with the provider of information, to have a privacy policy.

Data breaches are a significant issue in India. Much of our personal data is available with a lot of organisations, be it the Government, or telecom service providers, e-commerce entities or the like. Studies show that much of the data breaches are not publicly available, so the harsh reality remains hidden from the concerned. Therefore, the companies should voluntarily report data breaches so that the concerned can be atleast informed about the same. A report shows that the instances of data breaches increased to about 37% in the year 2020 as compared to 2019.

To address the issue of data breaches and data privacy, the Personal Data Protection Bill, 2019 was proposed. However, the same has not yet been enforced. Much of the regulatory provisions relating to cyber crime and data breaches remain on paper only.

Benefits of BRSR

The BRSR aims at not mere reporting, but the implementation of the NGRBC principles, thereby effectively addressing the ESG concerns. Efforts have been made to make most of the information quantifiable, thereby helping the entities in ease of reporting. On the other hand, wherever possible, the report requires the companies to disclose not only the fact of having adequate mechanisms in place, but also the description of the policies and mechanisms that the company implements. This ensures that a company remains ESG-compliant not only in letter, but spirit as well.

While the BRSR helps the stakeholders recognise a company’s commitment towards ESG parameters, it also helps the ESG-compliant company derive various benefits from the BRSR reaching the public, giving recognition to the company. In the near future, it may help a company in attracting talented personnel, responsible investors, increased access to capital, loyal consumers, value creation to shareholders and much more.

Business Responsibility Report (“BRR”) has been refurbished and given a new name Business Responsibility and Sustainability Reporting (“BRSR”). The disclosures to be made has undergone a change and several additions has been made. The disclosures in BRSR is from an Environmental, Social and Governance (“ESG”) perspective and are intended to enable businesses to engage more meaningfully with their stakeholders, and encourage them to go beyond regulatory financial compliance and report on their environmental and social impacts.

The road to BRSR began from Report[2] of the Committee on Business Responsibility Reporting by Ministry of Corporate Affairs (MCA) on 11th August 2020 wherein it had recommended several additions with an aim to make BRR one stop source for all non financial, sustainability reporting. To better reflect the intent and scope of reporting requirement, the Committee recommended the BRR to be called BRSR and the implementation of the reporting requirement be done in gradual and phased manner.

Conclusion

The growing salience of non- financial disclosures along with annual financial disclosures ensures that the business explicitly recognize their environmental and social responsibilities. As the sustainability disclosures grow in eminence, it is hoped that the information would be used by banks, credit rating agencies, and other financial institutions, along with financial information to assess credibility of a company/business.

It is to seen whether the BRSR gain acceptability and credence among global frameworks as a singular source of information for companies reporting in India, such that they serve as a primary document for assessment of businesses as it has been hoped by the regulators.

[1] Our article on the amendments can be read here .

[2] http://www.mca.gov.in/Ministry/pdf/BRR_11082020.pdf

Our other article on the topic can be read here –

- http://vinodkothari.com/2020/08/cartload-of-details-in-brsr-a-challenge-ahead-for-elaborate-reporting/

- http://vinodkothari.com/2020/08/brr-in-process-to-become-a-fully-loaded-electronic-form/

- http://vinodkothari.com/2021/03/esg-concerns-on-corporate-governance-in-india/

- http://vinodkothari.com/2020/01/expanding-brr-outreach/

- http://vinodkothari.com/wp-content/uploads/2020/01/Expanding-BRR-Outreach.pdf

Our resource center on Business Responsibility and Sustainable Reporting can be accessed here –

https://vinodkothari.com/resource-center-on-business-responsibility-and-sustainable-reporting/

Leave a Reply

Want to join the discussion?Feel free to contribute!