SEBI revises framework for green debt securities

– Alignment with international standards and avoidance of greenwashing

– Payal Agarwal and Shreya Salampuria | corplaw@vinodkothari.com

Sustainability labeled bonds, more popularly known as GSS+ bonds, are looked upon as one of the primary means of raising funds towards sustainable development. The same has been discussed in Sustainable finance and GSS+ bonds: State of the Market and Developments. India is also not oblivious to the concept of GSS+ bonds, and companies in India have also been issuing such bonds, in one or more forms.

The issuance of green debt securities (“GDS”) in India was initially formalized through a circular issued by SEBI in 2017 in this regard, later absorbed under the SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 (“ILNCS Regulations”) read with Chapter IX of the Operational Circular on the same. The regulatory framework for GDS in India has since been reviewed, and following a Consultation Paper on Green and Blue Bonds as a mode of Sustainable Finance (“Consultation Paper”) dated 4th August, 2022, SEBI, in its meeting dated 20th December, 2022 (“Board Meeting”) has approved amendments to the existing regulatory framework for GDS issuance. The press release of the Board Meeting reads as “in the backdrop of increasing interest in sustainable finance in India as well as around the globe, and with a view to align the extant framework for green debt securities with the updated Green Bond Principles (GBP) recognised by IOSCO, SEBI undertook a review of the regulatory framework for green debt securities.”

Pursuant to the review of the regulatory framework for GDS, the following has been notified –

- Expanding the scope of GDS through amending its definition vide notification of SEBI (ILNCS) Amendment Regulations, 2023 (“Amendment Regulations”)

- Guidance on avoidance of green-washing through introduction of Chapter IX-A to the existing Operational Circular, and

- Enhancement of disclosure requirements and mandating third-party reviewers through amendments to existing Chapter IX of the Operational Circular.

In this write-up, we intend to discuss the revised regulatory framework for GDS issuance in India.

Applicability of the revised framework

The Amendment Regulations are effective immediately, and therefore, the amended definition of GDS can be referred to for all issuances on or after 2nd February, 2023. The greenwashing guidelines notified through Ch IX-A of the Operational Circular are applicable to all existing and proposed issuances of GDS. The amended Ch IX of the Operational Circular, issued on 6th February, 2023 is worded as follows –

“The provisions of this circular shall come into force for all issues of green debt securities launched on or after April 1, 2023.”

Looking at the language of the applicability clause, it seems that the enhanced disclosure requirements will not apply to the existing continuing issuance of GDS and shall be restricted only to such issuances that are launched on or after 1st April, 2023. In respect of the past issuances whose proceeds have not yet been utilized completely, the erstwhile disclosure requirements will continue to be applicable.

Further, it has to be noted that the regulatory framework as being discussed here is applicable only to such issuances of GDS that are proposed to be listed on the stock exchanges in India. In case of issuances that are proposed to be listed on international markets, the general compliances with respect to bonds issuance as per the Companies Act, 2013 and specific compliances as may be applicable in the jurisdiction in which such bonds are proposed to be listed, should apply.

Amplifying definition of GDS

GDS are debt securities being in the nature of ‘use of proceeds’ bonds, and the categories of projects for which the same can be utilized is explicitly provided in the definition of the same in terms of clause (q) of Reg 2(1) of ILNCS Regulations. The definition is exhaustive and no other category of project suffices the meaning of GDS unless the same specifically falls within the categories specified in the definition.

The new categories of projects/ assets inserted through the Amendment Regulations are –

(iii) climate change adaptation including efforts to make infrastructure more resilient to impacts of climate change and information support systems such as climate observation and early warning systems,

XXX

(viii) pollution prevention and control (including reduction of air emissions, greenhouse gas control, soil remediation, waste prevention, waste reduction, waste recycling and energy efficient or emission efficient waste to energy) and sectors mentioned under the India Cooling Action Plan launched by the Ministry of Environment, Forest and Climate Change,

(ix) circular economy adapted products, production technologies and processes (such as the design and introduction of reusable, recyclable and refurbished materials, components and products, circular tools and services) and/or eco efficient products,

(x) blue bonds which comprise of funds raised for sustainable water management including clean water and water recycling, and sustainable maritime sector including sustainable shipping, sustainable fishing, fully traceable sustainable seafood, ocean energy and ocean mapping,

(xi) yellow bonds which comprise of funds raised for solar energy generation and the upstream

industries and downstream industries associated with it,

(xii) transition bonds which comprise of funds raised for transitioning to a more sustainable form of operations, in line with India’s Intended Nationally Determined Contributions.

The new additions are mostly in alignment with the Green Bond Principles issued by ICMA (“GBP”) and India’s Nationally Determined Contributions towards achieving net zero targets. On the proposal to include “transition bonds” as one of the sub-categories of GDS, it was noted by members of CoBoSAC that “the said proposal is in line with India’s vision to move towards a greener economy by achieving the climate targets determined by India in the Paris Climate Deal in COP 21 in 2015 and again revised at the COP 26 at Glasgow in 2021.

Appointment of independent third party reviewer/ certifier

Under the existing requirements, an issuer was required to disclose the details of the independent third party reviewer/ certifier, if any, appointed by such issuer. Further, utilization of proceeds was required to be verified by an external auditor, to verify the internal tracking method and the allocation of funds towards the projects/ assets, from the GDS proceeds.

However, the amended Ch IX mandates the GDS issuer to appoint an independent third party reviewer/ certifier, and disclose the same in the offer document. The independent third party reviewer/ certifier is required to be appointed for the following purposes in relation to the GDS issuance and monitoring –

- Pre-issue support – for reviewing/certifying the processes including project evaluation and selection criteria, project categories eligible for financing by GDS.

- Post-issue support – Post-issue management of the use of proceeds from GDS and verification of the internal tracking and impact reporting

Applicability on a “comply or explain” basis

For a period of two years starting 1st April, 2023, the aforesaid requirement is applicable on a ‘comply or explain’ basis. ‘Comply or explain’ would mean that the issuer shall endeavor to comply with the provisions and achieve full compliance by two years from the date of issuance of the circular. In case the entity is not able to achieve full compliance with the provisions till such time, the issuer shall in its annual report, explain the reasons for such non-compliance/ partial compliance and the steps initiated to achieve full compliance.

Who can act as a third-party reviewer?

The Operational Circular does not provide any criteria subject to which one qualifies to be appointed as an independent third party reviewer. Any person having the requisite technical knowledge and expertise to perform the functions as aforesaid may be qualified to act as such reviewer. A list of external reviewers who have contributed to, and confirmed that they will voluntarily align with the ICMA’s voluntary Guidelines for External Reviewers consistent with any regulatory obligations is provided on the website of ICMA (neither investigated nor recommended by ICMA). A list of verifier organizations approved by Climate Bonds Standards Board can be accessed here.

Safeguarding investors or compliance burden?

While the mandatory requirement of a third party reviewer would result in increased reliability on the green activities of the issuer, a question may arise as to whether the increased compliance requirement can be looked upon as a burden by the entities proposing to issue listed GDS, and therefore, prove as a deterrent to the GDS market in India?

On a perusal of the offer document issued by a few GDS issuers in India, it has been noted that although the appointment of third party reviewer was not mandatory under the extant applicable laws, GDS issuers have been appointing and obtaining assurance from such third party reviewers. For example, Yes Bank and State Bank of India have appointed the services of KPMG as disclosed in their offer document; Indian Renewable Energy Development Agency Ltd (IREDA) has appointed the services of Emergent Ventures India Pvt. Ltd. Further, most of the GDS issuances in India are listed on one or more international stock exchanges including the international branches of BSE and NSE, being India International Exchange (India INX) and NSE International Exchange (NSE IFSC). For getting the GSS+ bonds listed on such international exchanges, the issuer is required to be compliant with one or more of the internationally recognized frameworks, being –

a) International Capital Market Association Principles/Guidelines

b) Climate Bonds Standard

c) ASEAN Standards

d) European Union Standards/Taxonomy

e) Any framework or methodology specified by a competent authority in India

f) Other international standards

The disclosures available in respect of each of the bond issuances listed on these stock exchanges demonstrate the existence of an independent third party reviewer/ certifier providing certification in accordance with one or more internationally recognised frameworks. Therefore, in our view, the mandatory requirement of a third party reviewer is not likely to cause a significant impact on the existing GDS issuances.

Broadening disclosure requirements

In view of the nature of GDS, certain disclosures are required to be made by a GDS issuer in the offer document, in addition to what is already required in case of plain vanilla debt instruments. Further, presence of public funds cast a continuing obligation on the issuer to report the utilisation of proceeds in accordance with the terms of the offer document. These continual disclosures are required to be provided by the GDS issuer as a part of the Annual Report and/ or financial statements. The disclosure requirements are specified under Chapter IX of the Operational Circular. Following the recommendations given in the Consultation Paper, Chapter IX has been updated in order to align the disclosure requirements to the GBP.

The amended disclosures include the following –

Details of decision-making process followed for determining eligibility of project(s)

An issuer of GDS is required to disclose details with respect to the decision-making process followed by the same for the purpose of determining eligibility of the projects/ assets proposed to be funded through the proceeds of GDS in the offer document. It currently requires disclosure of the following –

- Process followed for determining eligibility of the projects/ assets in terms of Reg 2(1)(q) of ILNCS Regulations;

- Criteria making the projects/ assets eligible for using the GDS proceeds; and

- Environmental sustainability objectives of the proposed green investment

Since the environmental sustainability objectives of the proposed issue are already disclosed in the offer document under a separate head, the same has been omitted from the present head. Further, the following additional details wrt decision-making process is required –

- Details of taxonomies, green standards or certifications both Indian and global, if any, referenced and the alignment of projects with said taxonomies, related eligibility criteria, and exclusion criteria, if applicable.

There are various taxonomies, green standards or certifications, both in Indian as well as international context, that may be referenced to, while determining the eligibility of a project/ asset for qualifying within the “green” category. For example, in India, the IGBC Rating (Indian Green Building Council), GRIHA (Green Rating for Integrated Habitat Assessment) are standards that rate efficient and green buildings; standards on air and water quality issued by Central Pollution Control Board; standards developed by Bureau of Indian Standards (BIS) on energy efficiency and renewable energy sources (IS/ISO/IEC 13273-2 : 2015), ECO Mark Scheme, Indian Standards on Sustainable Packaging etc. BIS is also developing a Sustainability framework for Standards formulation.

Various jurisdictions around the world have already developed/ are in the process of developing their own green/ sustainability taxonomies (refer image below).

Apart from the jurisdiction-specific taxonomies, there are various other global taxonomies/ standards that can be referred to for determining eligibility of one or more “green” sectors. Examples include LEED rating system for green buildings, relevant standards issued by International Organisation for Standardisation (ISO) such as ISO 50001 – Energy management systems, ISO 14001 – Environmental Management System etc; or specific labeled bonds certification such as Climate Bonds Standard and Certification Scheme.

In case any of such standards are referred to by the issuer, the alignment of projects with said taxonomies, related eligibility criteria, and exclusion criteria is also required to be disclosed in the offer document.

- Details of the alignment of the objective of the issue with the India’s Intended Nationally Determined Contributions in case of the proceeds raised through issuance of transition bonds

In case of transition bonds, the proceeds are expected to be utilised towards one or more of the NDCs declared by India. Therefore, where GDS is issued in the form of transition bonds, the offer document shall disclose the alignment of the same with the NDCs of India.

Details of the intended types of temporary placement of the unallocated and unutilised GDS proceeds

The offer document shall also contain disclosure with respect to the intended types of temporary placement of the unallocated and unutilised proceeds of GDS, as aligned with GBP. This may have been done with the intent to avoid the chances of greenwashing by the issuers, through temporary placement of GDS proceeds in such activities that may be harmful to the environment.

Further, where such temporary placement is made out of the unallocated and unutilised proceeds of GDS issuance, the same is also required to be disclosed in the Annual Report and financial results of the issuer on an ISIN-basis.

Vide the amendments, the issuer is only required to disclose the intended types of temporary placement, however, no guidance exists as on date on the eligible types of temporary placement, and duration up to which GDS proceeds can be temporarily placed towards other activities.

Details related to the perceived social and environmental risks and proposed mitigation plan associated with the project(s) proposed to be financed/ refinanced through GDS proceeds

GBP recommends issuers to provide complementary information on processes by which the issuer identifies and manages perceived social and environmental risks associated with the relevant project(s). Similar disclosure has been adopted by SEBI with regard to the GDS issuance. Through such disclosure, an investor is made fully aware of the risks the proposed project may be exposed to, and the preparedness of the issuer towards mitigating such risks, if they arise in the course of the project.

While the proposed mitigation plan is made a part of the initial disclosures under the offer document, the details of deployment of such mitigation plan towards the perceived social and environmental risks is required to be disclosed in the Annual Report on an annual basis.

Impact Reporting

The issuer is also required to report on the environmental impact of the projects financed by GDS proceeds, on a project-by-project basis. Reporting standards or taxonomies followed by the issuer with regard to reporting of environmental impact, if any, shall also be disclosed. This, in turn, has to be backed by the review/ certification of an independent third party, as discussed above.

Guidance may be obtained from the Handbook on Harmonised Framework for Impact Reporting published by ICMA as compiled by a Technical Working Group of multilateral development banks, international financial institutions, and other relevant key industry players. Yes Bank publishes Green Bond Impact Report in line with GBP, similarly the impact reporting of Adani group companies can be referred to in the Green Bond Information Report published by the same. Globally, reference may be made of IFC Green Bond Impact Report, Apple’s Annual Green Bond Impact Report, NAD Bank’s Green Bond Impact Report etc to name a few.

Disclosures of major elements of BRSR

The amended Operational Circular also requires the issuers of GDS to disclose certain elements of Business Responsibility and Sustainability Reporting (BRSR) in the Annual Report. Disclosure is required of elements of Principle 6 of the NGRBC principles on which BRSR is based, requiring “businesses to respect and make efforts to protect the environment”. This includes details on an entity’s energy consumption, water consumption, GHG emissions, waste management etc.

While the requirement of BRSR is currently applicable on top 1000 listed entities based on market capitalisation, in terms of Reg 34 of the Listing Regulations, every issuer of GDS, irrespective of falling within the aforesaid threshold, will be required to provide the aforesaid disclosures. Therefore, a GDS issuer will also be required to prepare itself to implement BRSR, to the extent applicable to the same.

Further, apart from the enhanced disclosure requirements, the stated responsibilities of the issuer has been revised to require them to comply with the SEBI circular SEBI/HO/DDHS/DDHS-RACPOD1/P/CIR/2023/020 dated February 03, 2023 on “Dos and don’ts relating to green debt securities to avoid occurrences of greenwashing”.

Avoidance of greenwashing

Greenwashing is defined as the practice of channeling proceeds from green bonds towards projects or activities having negligible or negative environmental benefits. SEBI raised concerns over the malpractice of greenwashing by issuers in the Consultation Paper. Greenwashing by issuers may also lead to significant reputational risk for socially conscious investors seeking to diversify their investment portfolios by investing in environmental, social and governance (ESG) practices. In view of the same, a new chapter IX-A has been introduced under the existing Operational Circular prescribing the Dos and don’ts relating to green debt securities to avoid occurrences of greenwashing.

This requires the issuer of GDS to ensure the following –

- Continuous monitoring of whether the path undertaken towards a more sustainable form of operations is resulting in reduction of the adverse environmental impact and contributing towards a sustainable economy, as envisaged in the offer document.

- Prohibition on utilisation of funds for purposes that would not fall under the definition of GDS. The same may seemingly include the temporary placement of GDS proceeds as well.

- Prohibition on use of misleading labels, hiding trade-offs or cherry picking data from research to highlight green practices while obscuring unfavourable information

- Maintenance of highest standards associated with GDS issuance while adhering to the rating assigned with it.

- Quantifying the negative externalities associated with the utilization of proceeds of GDS

- Prohibition on making untrue claims giving false impression of certification by a third-party entity.

Disclosure of breaches to GDS investors

The GDS issuer, in the event of utilization of proceeds for purposes other than the categories mentioned in the definition of GDS under ILNCS Regulations is required to disclose the same to the investors. Further, in the event the majority of debenture-holders require so, the issuer is obligated to undertake early redemption of such GDS.

A question may arise as to whether this would require the issuer to call a meeting of the GDS investors, or otherwise, seek no-objection towards the continued utilization of the proceeds raised from GDS or whether the obligation of the issuer shall be deemed to be fulfilled only on disclosing the breach on its part. In our view, the latter could not have been the intent of the law in requiring the issuer to undertake early redemption, if so required by the GDS investors. Rather, the issuer is obligated to seek the approval of the investors through legally recognised means, towards deciding on the future course of action.

State of GDS market in India

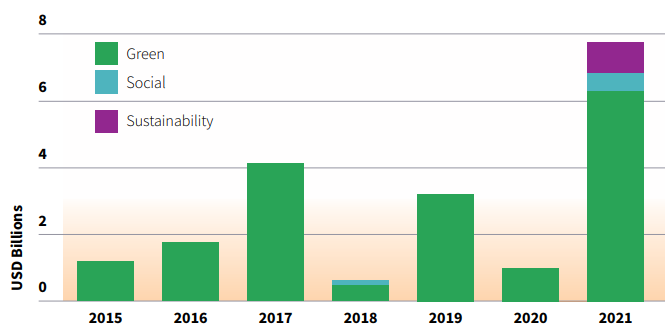

The importance of “finance” in the development of a sustainable economy cannot be overlooked, and therefore, green finance remains the need of the time. GDS serves as a source of raising such finance. India is a late-comer in the green bonds market, with its first issuance by Yes Bank in the year 2015. A report by Climate Bonds Initiative states 2021 as a landmark year for thematic debt in India, with non-financial corporates taking the lead in such issuances.

As per SEBI’s data on GDS, as on 14th September, 2022, a total of 15 GDS issuances are outstanding in the Indian market, amounting to approximately Rs. 4500 crores in volume. This does not include GDS listed on international stock exchanges.

India’s GDS markets are expected to reach new heights during 2023 with the debutante sovereign green bonds issued by the Govt of India as well as Indore Municipal Corporation’s latest issuance, both of which had been over-subscribed. A recent report by Fitch Ratings states that as of January 2023, GSSS bonds accounted for $20 billion or 3.8% of the country’s overall corporate bond market. The reasons for such low volume of green debt issuances are heavy concentration in specific sectors, especially energy as well as issuances prominently in rupee-denominated bonds, instead of in dollars.

RBI has also been taking regulatory initiatives and has recently announced the issuance of guidelines on acceptance of green deposits, disclosure framework on Climate-related Financial Risks, and Guidance on Climate Scenario Analysis and Stress Testing.

Our other resources on ESG and sustainability can be accessed at – https://vinodkothari.com/resource-center-on-business-responsibility-and-sustainable-reporting/

Leave a Reply

Want to join the discussion?Feel free to contribute!