New avatar of DPT-3 requires aging details for exempted deposits

– Also burdened with irrelevant deposit related details

– Payal Agarwal, Senior Executive (payal@vinodkothari.com)

The format of the “return on deposits” and on “exempted deposits”, that is, form DPT-3 has been amended pursuant to the notification of the Companies (Acceptance of Deposit) Amendment Rules, 2022 (“Amendment Rules”) on 29th August, 2022. While the same has been made applicable immediately, the revised format will be actually relevant for the filing of form DPT-3 for FY 2022-23, since the due date for filing DPT-3 for FY 2021-22 has already expired on 30th June, 2022. It is interesting to note that while most of the changes pertain to the “return of deposits”, the same does not have any practical significance in India. However, there is specifically one addition w.r.t. the money received by a company, but not considered as deposit, i.e., exempted deposits.

Additional information on particulars of “deposits”

The following changes have been made with respect to the information on the –

- Whether deposits have been accepted from the public – A radio button for choosing yes/ no has been inserted.

- Particulars of charge – The erstwhile format required details of the charge created in favour of deposit holders. The revised format requires to specify the number of charges and the SRN of the form filed for creation of such charges. This facilitates direct linking of the form, to enable system based verification.

- SRN of GNL form in which DPT-1 is filed – A company receiving deposits is required to provide an advertisement or circular for providing information about the company to the prospective depositors, in form DPT-1. Such information is required to be filed with the ROC in GNL-1. The SRN of the GNL form is required to be provided in the revised form itself. This again, will facilitate system based verification.

- Additional attachments – The copy of trust deed and list of depositors is required to be attached. Please note that the same, though not included earlier in the format itself, was required to be attached as a mandatory attachment, as also required in the help kit to DPT-3.

- Certification by statutory auditor – In terms of Rule 16 of the Deposit Rules, the statutory auditor is required to certify the return of deposits. Earlier, the statutory auditor’s certificate was attached with the form. In the revised format, the statutory auditor’s certification will be included in the form itself. The following statement has been included in the format to that effect –

“I hereby duly certify that the amount specified in ‘Particular of deposits’ and ‘Particulars of liquid assets’ is correct and in line with the relevant provisions of the Companies Act, 2013.”

We would like to clarify that the requirement of auditor’s certification does not arise for return of exempted deposits.

Additional information with respect to particulars of “exempted deposits”

The particulars of receipt of money or loan by a company, but not considered as deposits, that is to say, the exempted deposits, remains the same. The disclosures have been made more comprehensive. The revised format requires reporting of the following with respect to the “exempted deposits” received by the company –

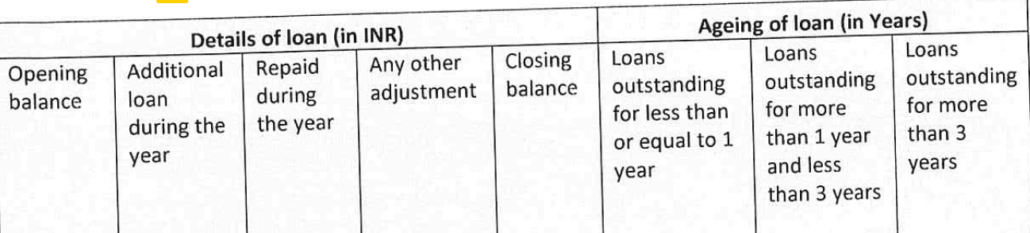

In our view, the term “loan” has been used in a generic sense for receipt of money in any form, within the meaning of exempted deposits. The erstwhile format required disclosure of only the “closing balance” as at the end of the financial year. However, the revised format requires disclosure of the complete movement of funds, beginning with the opening balance, any addition/ repayment during the year, other adjustments, if any, (this may include writing-off of the liabilities, change in terms etc), along with the closing balance. Additionally, the aging schedule of these loans is required to be provided in the form itself.

Renewal of existing loans in the same/ new terms amounts to a new deposit?

Let us assume the case of X Ltd, which has accepted short-term loans from its group companies for a period of 6 months, in the month of January, 2021. In this case, the aging schedule of this deposit will be ‘less than or equal to 1 year’. On or before the expiry of the current loans, that is, before June, 2021, the loan gets renewed for a further period of 9 months. In this case, the question may arise as to whether the aging schedule of such loans will fall under the bracket of ‘less than or equal to 1 year’ or ‘more than 1 year and less than 3 years’.

One may contend that the renewal for further period amounts to a new loan and not the continuation of the existing loans. However, please note that in this case no repayment was made between the expiry of the tenure of the loans availed initially and the subsequent renewal. Therefore, another convincing view that can be taken is that the same cannot be taken to mean a new receipt altogether and should be ideally reported as a change in the aging schedule.

The increased disclosures in the revised format brings no such actionable on the part of the reporting company, except that the reporting columns get increased. There does not seem to be a significant change at present, and more towards aligning the existing requirements with respect to acceptance of deposits in one form.

Our other resources on deposits –

In case of exempted deposits, if there is no outstanding loan as on 31.03.2023 whether we need to make the entry of the same stating the opening balance and any change during the year.

Kindly clarify whether we need to file if we have nil outstanding in the books as on 31.03.2023.

Hi,

In the present case, we understand that there was an outstanding loan balance at the beginning of the year which was eventually paid off during the year. Therefore, for the purpose of reporting the same and looking at the requirement of the form DPT-3, in our view, the same should be filed wherein the details of outstanding loan balance at the beginning of the year and loan eventually paid off to be provided along with the ageing details.

Thanks for the clarification. Further, kindly clarify is there was no outstanding at the beginning of the year as CP was issued during the year and the same was repaid during the year, There the outstanding at the beginning of the year was NIL and outstanding as on 31,03,2023 is alos NIL. Then is the same required to be reported in Form DPT-3.

There are three columns in the aging of the loan (in years), and under the subheading form, it states loans outstanding for a particular number of years. What exactly do we need to write?

As per our reading auditor certificate is not mandatory for exempted deposits.

But when our CS department try to file the form DPT 03 then they says that auditor certificate is mandatory for Exempted Deposits also.

Please guide us with some legal etc. because we have only exempted deposits covered under Rule 2(1)(c). Because so we can show our CS department.

Our DPT 03 is for FY 2021-22 and we are already late.

Vikas, though a plain reading of the revised e-form DPT-3 coupled with the reading and interpretation of the erstwhile DPT-3 surely gives an impression that there is no need for the statutory auditor to affix his DSC (previous version of DPT-3 required attaching the statutory auditor certificate) but the mechanics of the new e-form DPT-3 is such that without affixation of statutory auditor’s DSC, the form will not be filed/uploaded with MCA. This is definitely a glitch and the intention of MCA, I reckon was not the same please.

What does ageing schedule here means?? it needs to be mentioned in years.

Having the same query. If there are more than one type of loan in same category of loan with different ageing period. then how can the disclosure be made in that column