Archive for month: June, 2020

Limits on creeping acquisition by promoters increased during COVID-19 crises

/0 Comments/in Corporate Laws, Covid-19, SEBI, UPDATES /by Vinod Kothari ConsultantsShaifali Sharma | Vinod Kothari and Company

Introduction

SEBI has been taking several proactive measures to relax fund raising norms and thereby making it easier for companies to raise capital amid the COVID-19 pandemic. With a view to further facilitate fund raising by the companies, SEBI vide its notification dated June 16, 2020[1], has relaxed the obligation for making open offer for creeping acquisition under Regulation 3(2) of the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (Takeover Code).

The relaxation allows creeping acquisition upto 10% instead of the existing 5%, for acquisition by promoters of a listed company for the financial year 2020-21. The relaxation is specific and limited to acquisition by way of a preferential issue of equity shares and therefore excludes acquisitions through transfers, block and bulk deals etc. Also recently, SEBI in its Board Meeting[2] held on June 25, 2020 has proposed to provide an additional option to the existing pricing methodology for preferential issue under which the minimum price for allotment of shares will be volume weighted average of weekly highs and low for twelve weeks or two weeks, whichever is higher.However, this new rule shall apply till December 31, 2020 with 3 years lock-in condition for allotted shares. Further, by way of the same notification, SEBI has also relaxed the provisions of voluntary open offer where an acquirer together with PAC will be eligible to make voluntary offer irrespective of any acquisition in the previous 52 weeks from the date of voluntary offer, this will promote investments into various companies in future.

This article tries to discuss on whether the relaxation given by SEBI to the promoters are as encouraging as it seems to be, when connected with the pricing norms for preferential issue under the SEBI (Issue of Capital and Disclosures Requirement) Regulations, 2018 (‘ICDR Regulations’) and how the new pricing methodology proposed by SEBI can leverage the situation.

What is Creeping Acquisition?

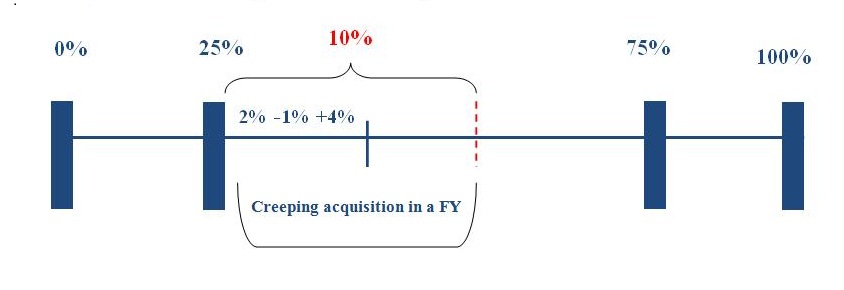

Creeping acquisition, governed by Regulation 3(2) of the Takeover Code, refers to the process through which the acquirer together with PAC holding more than 25% but less than 75%, to gradually increase their stake in the target company by buying up to 5% of the voting rights of the company in one financial year. Any acquisition of further shares or voting rights beyond 5% shall require the acquirer to make an open offer. Further, for the purpose of creeping acquisition, SEBI considers gross acquisitions only notwithstanding any intermittent fall. The same is projected in Figure 1 below. Also, in all cases, the increase in shareholding or voting rights is permitted only till the 75% non-public shareholding limit.

Figure 1: Creeping acquisition limit increased from 5% to 10%

Rationale for easing the norms of Creeping Acquisition

While the companies are currently struggling to manage their cash flows due to the financial challenges faced on account of COVID-19, the amendment will allow companies to raise funds from promoters to tide over their difficulties for the financial year 2020-21. This revision will also boost the sagging stock market and help sustain the stock prices of the company.

Promoters, on the other hand, owning 25% or more of the shares or voting rights in a company will be able to increase their shareholdings up to 10% in a year versus the previously allowed threshold limit of 5%.

Permutations and Combinations of Creeping Acquisition during FY 2020-21

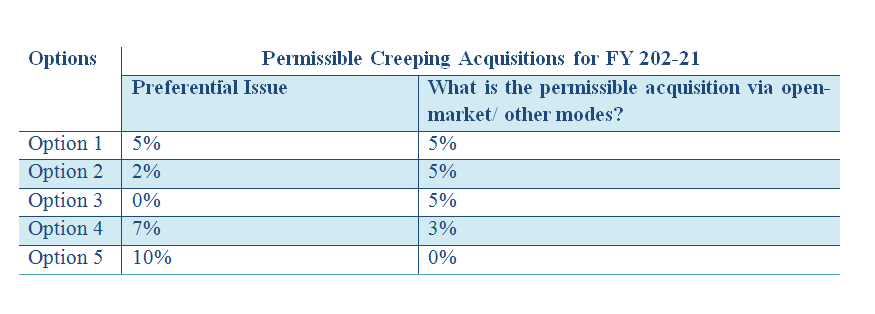

Since the enhanced 10% limit applies only in case of acquisition under preferential issue, the total acquisition of 10% may be achieved by any of the following combinations:

Option 1: Acquire upto 5% shares via open-market purchase or any other form and the remaining 5% shares can be acquired through subscribing to a preferential issue.

Option 2:Acquire 10% shares through preferential issue

Accordingly, in a block of 12 months of financial year 2020-21, if the promoterwants to acquire share through open market, bulk deals, block deals or in any other form, the 5% threshold shall remain in force and additional 5% can be acquired through preferential issue.

Identified below are the permitted acquisitions through open market, transfers or other forms in case promoter opts for preferential issue:

Whether the relaxation in open offer is actually encouraging when read with the pricing norms under ICDR Regulations?

As stated above, the relaxation can be availed only in the cases where the investments are done undera preferential issue. Regulation 164 of the SEBI (Issue of Capital and Disclosures Requirement) Regulations, 2018 (‘ICDR Regulations’) deals with the pricing norms under preferential issue. It provides that the issue price in cases where the shares have been listed for more than 26 weeks on a recognized stock exchange as on the relevant date, the issue price has to be higher of the following:

- the average of the weekly high and low of the volume weighted average price of the related equity shares quoted on the recognized stock exchange during the twenty six weeks preceding the relevant date; or

- the average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on a recognized stock exchange during the two weeks preceding the relevant date.

The computation of the prices as per the above stated regulation will lead to a wide gap between the pricing at the beginning of the twenty-six week period and the current price when the company raises funds.

During this time of stock market crises, the stock prices of many companies have dropped sharply from their respective all-time high values recorded 6 months back. Further, in the cases where the market price is lower than the minimum price calculated as per ICDR Regulations for preferential issue, the promoters will be discouraged to acquire shares under preferential allotment as they will end up paying higher values.

Due to the challenges faced by the economy in view of COVID-19, the trading prices of the listed companies have gone down sharply. Accordingly, the price determined under ICDR Regulations may not be a motivating factor for the promoters to subscribe to the additional shares though, elimination of the costs involved in a public offer may compensate the same.

However, to curb the above situation, SEBI in its Board meeting held on June 25, 2020, has proposed an additional option to the existing pricing methodology for preferential issuance as under:

In case of frequently traded shares, the price of the equity shares to be allotted pursuant to the preferential issue shall be not less than higher of the following:

- the average of the weekly high and low of the volume weighted average price of the related equity shares quoted on the recognized stock exchange during the twelve weeks preceding the relevant date; or

- the average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on a recognized stock exchange during the two weeks preceding the relevant date.

The new option will consider the weighted average price of equity shares preceding 12 weeks instead of the preceding 26 weeks and therefore reflect the accurate price during the pandemic period. This may prove to be the solution to above crises,making fundraising through preferential issue easier for the corporates and simultaneously encouraging the promoters as well to infuse funds.

Compliances for preferential issue to promoters under PIT Regulations

Considering the fact that promoter is one of the designated person as per the SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’), the companies, in addition to the procedural requirements for preferential issue prescribed under the Companies Act, 2013, ICDR Regulations and other applicable laws, shall also comply with the provisions of PIT Regulations.

Closure of trading window in case of preferential allotment

Designated persons and their immediate relatives shall not trade in securities when the trading window is closed. The trading restriction period shall apply from the end of every quarter till 48 hours after the declaration of financial results.

Further, the trading window shall also be closed when the compliance officer determines that a designated person (DP) or class of designated persons can reasonably be expected to have possession of unpublished price sensitive information (UPSI). Therefore, the trading window shall be closed and communicated to all DPs as soon as the date/notice of board meeting to approve issue of share via preferential allotment is finalized upto 2nd trading day after communication of the decision of the Board to the Stock Exchanges.

Accordingly, promoter/ class of promoters acquiring shares under preferential issue shall conduct all their dealings in the securities of the company only in a valid trading window i.e. once the trading widow is open subject to the pre-clearance norms prescribed under PIT Regulations and the Code of Conduct for prevention of insider trading of the Company.

Concluding Remarks

Given the lack of liquidity in the market, the proposed amendments maybe seen as an opportunity for target companies to raise capital from its promoters. Further, promoters can also infuse funds through equity issuance and will be able to increase their shareholding in the target company without the formalities of making the open offer.

Having said that since the market might take some time to recover, this relaxation provides a gateway for promoters to avoid open offer requirements which would otherwise have involved compliance burden on the promoter. However, the pricing factor may seem to be the only hindrance or a demotivation for actually availing this relaxation which seems to be resolved through the new pricing method proposed by SEBI in its Board meeting.

[1]To view the notification, click here

[2]https://www.sebi.gov.in/media/press-releases/jun-2020/sebi-board-meeting_46929.html

Other reading materials on the similar topic:

- ‘SEBI revisits Takeover Code’ can be viewed here

- ‘Takeover Code 2011’ can be viewed here

- ‘Decoding Takeover Code’ can be viewed here

- Our other articles on various topics can be read at: http://vinodkothari.com/

Email id for further queries: corplaw@vinodkothari.com

Our website: www.vinodkothari.com

Our Youtube Channel: https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

Fifty years of global securitization

/1 Comment/in Financial Services, Securitisation /by Vinod Kothari Consultants– Vinod Kothari

Some people love it; some love to hate it, and some just live it. No matter which one of the clubs one belongs to, but there is no doubt that securitization is a major financial phenomenon.

Year 2020 marks 50 years of the inaugural mortgage-backed pass-through transaction done in 1970 by Ginnie Mae. Securitization has turned fifty.

The world is not in exactly right environment to do either a champagne party or otherwise – however, one should not gloss over the massive change that securitization has made, to the financial landscape of the world, over these five decades. Irrespective of the jury verdict on whether it was responsible for the Global Financial Crisis, the fact is that it had such a major impact that its short-lived absence from the scene could put world’s financial system into doldrums. And now, there are regulators’ reports looking at this very instrument with optimism to lead the recovery out of the COVID disruption.

To commemorate 50 years of securitization, we propose to bring an anthology of write-ups by senior securitization professionals, particularly those who have seen its boom and bust. The write-ups may be along the following lines:

- Historical write-ups, recounting the development of early MBS by the agencies, the way it was perceived then and major economists’ remarks about this instrument

- Contribution of securitization to mortgage markets globally, particularly in mortgage availability and affordability

- Contribution of securitization to financial inclusion, making smaller and community lenders reach out to capital markets through larger intermediaries

- Securitization and emerging markets

- Lessons learnt from the GFC and how regulatory systems have evolved thereafter

- Legal robustness of securitization – has it proved itself over decades of crises?

- Off-balance securitization – development of accounting standards over the years, and does off-balance sheet securitization have any relevance left?

- Significant risk transfers and capital relief

- Market reports from major countries.

List of Chapters

For a work-in-progress list of Chapters, see here.

Publication details

The anthology is proposed to be a compilation in e-book form. We will be in touch with some publishers to seek interest in publication.

Structure of the Chapters

The anthology will be collaborative effort of several leading authors, experts, researchers and practitioners from all over the world. Each of the contributors are leading luminaries in their own field. So while substantial discretion will be used by the contributors, some pointers for contributors are as follows:

- This e-book will hopefully have a very long shelf-life. Hence, the stance of the write-ups is not contemporaneous state of the market. Rather, the write-ups trace developments over time, to identify trends. The contributors deploy their wisdom to think of the trends that will continue, wither away, or strengthen. The commemorative is all about continuity and change.

- We are wanting to minimise current market data or statistics, for reasons discussed above.

- Each of the write-ups may provide a larger, macro view before narrowing down on micro aspects.

- One of our very important objectives is to have the contribution of securitization to development of financial markets, financial inclusion, stability and robustness of systems, etc. It is not merely a historical account, but an important document on lessons to be learnt, and to provide a place from where one may look at the decades to come.

- For scholars/practitioners who have been watching the industry grow over the years, if there are details of one’s personal association with the industry – as to how it developed and changed over time – that may of interest to readers. This may be added with generalisation of the market.

Invitation for contributions

Needless to say, it is a massive project – it has to be collaborative. We need the support of scholars, authors, stakeholders – those who have been practising, teaching, consulting or regulating securitization over the years. Hence, if you are one such contributor, or you know one who may be such a contributor, your contribution/assistance is most welcome.

For interest in contribution to the anthology, please do write to timothy@vinodkothari.com. Please indicate your background, proposed contents, length of the article, etc. After hearing from us positively, you may start writing your article, for submissions by end of August, 2020.

Sponsoring/advertising opportunities

From our side, this project is completely non-pecuniary. We just felt that we can steer this effort which may be valuable for a long time.

However, this project will involve massive research effort, editing, and production. Hence, there may be substantial expense.

If you want to sponsor in any manner, or want to put up a befitting advertisement about your company/products, the same is welcome. Please feel free to discuss with finserv@vinodkothari.com.

Timeline for publication

Tentatively, we may put the e-publication in public domain by November, 2020.

Comparison between the proposed and existing regulatory framework for HFCs

/0 Comments/in Housing finance /by Vinod Kothari Consultants– Henil Shah and Harshil Matalia (finserv@vinodkothari.com)

The Finance Act, 2019 amended the provisions of National Housing Bank, 1987 w.e.f August 09, 2019 thereby shifting the power to govern Housing finance Companies (HFCs) from National Housing Bank (NHB) to the Reserve Bank of India (RBI). Later, the RBI in its press release dated August 13, 2019 stated that HFCs shall be considered as a separate category of NBFCs.

A regulatory framework governing HFCs was long awaited. With a view to bring uniformity in the regulatory framework for HFCs and NBFCs, the RBI on 17th June, 2020 issued the report containing proposed changes in the regulatory framework for HFCs. The same is open for public opinions till 15th July,2020.

We have compared the proposed guidelines for HFCs with the existing guidelines.

| Sr. No. | Current Provisions Applicable to HFCs | Proposed Provisions | Remarks |

| Defining the phrase ‘providing finance for housing’ or ‘housing finance’ | |||

| 1 | The NHB Directions defined the term “housing finance company” as a company incorporated under the Companies Act, 1956 which primarily transacts or has as one of its principal objects, the transacting of the business of providing finance for housing, whether directly or indirectly. However, the term ‘providing finance for housing’ or ‘housing finance’ was not formally defined.

There was a NHB Circular dated September 26, 2011 which provided an illustrative list of loans which can be classified as housing/ non housing loans- 1. Loans to individuals or group of individuals including co-operative societies for construction/ purchase of new dwelling units. |

It has been proposed to define ‘Housing Finance” or “providing finance for housing” to mean financing, for purchase/ construction/ reconstruction/ renovation/ repairs of residential dwelling units, which includes:

a. Loans to individuals or group of individuals including co-operative societies for construction/ purchase of new dwelling units. |

The proposed list is largely similar to the illustrative list prescribed by NHB earlier. However, the list prescribed as ‘qualifying asset’ for HFCs seems to focus more on individual borrowers. It has also excluded the following- a. Loans for shopping complexes, markets and such other centers catering to the day to day needs of the residents of the housing colonies and forming part of a housing project b. Loans provided to the bodies constituted for undertaking repairs to houses; c. Investment in the guarantee/non-guaranteed bonds and debentures of NHB/HUDCO in the primary market, provided investment in non-guaranteed bonds is made only if guaranteed bonds are not availableThe idea behind laying out the periphery of ‘housing loans’ is to ensure consistency and certainty in ‘principality’ of business of the HFCs. Only such loans, which “qualify” as “housing loans” would be treated as “qualifying assets” for the purpose of determining “principality” of business of the entity, as we see below. Specifically, loans given for furnishing dwelling units, loans given against mortgage of property for any purpose other than buying/ construction of a new dwelling unit/s or renovation of the existing dwelling unit/s, have been regarded as non-housing loans. An entity which falls short of such qualifying assets below 50% cannot be regarded as HFC. This provision is also expected to minimise the practice of giving mortgage loans (LAP-type loans) by HFCs, which would often be granted to meet working capital requirements, etc. of other entities and not for housing purposes; thereby restricting the portfolio deviations of the HFC. |

| Defining ‘principal business’ and ‘qualifying assets’ for HFCs | |||

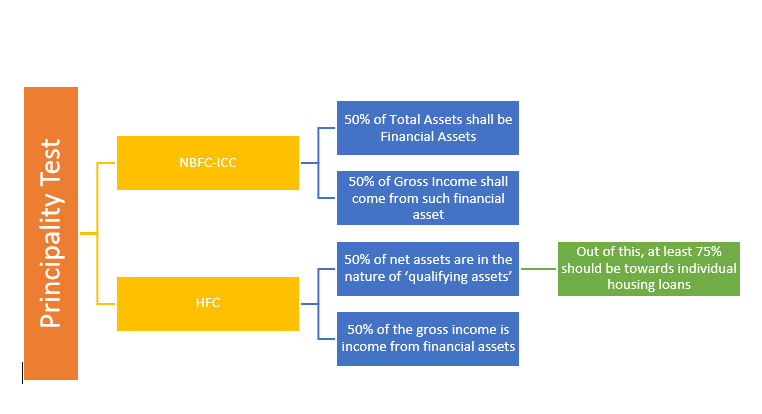

| 2 | The term ‘principal business’ was not referred in NHB Act prior to the amendment vide Finance Act . Further, for the purposes of registration, NHB was recognizing companies as HFCs if such company has, as one of its principal objects, transacting of the business of providing finance for housing (directly or indirectly) | The principality test for HFCs has been proposed as follows (both these tests are required to be satisfied as the determinant factor for principal business): (a) Not less than 50% of net assets are in the nature of ‘qualifying assets’ of which at least 75% should be towards individual housing loans as prescribed. Here, net assets shall mean total assets other than cash and bank balances and money market instruments (b) Not less than 50% of the gross income is income from financial assetsQualifying Assets refer to ‘housing finance’ or ‘providing finance for housing’ as mentioned above |

With the amendment to NHB Act, there was a need to define the term ‘principal business’ for HFCs. The concept of ‘qualifying asset’ is similar to that in case of NBFC-MFIs wherein they are specifically focused on micro lending. Though in spirit the HFCs would primarily focus on housing loans only however, the HFCs offering home loans along with other related products would now be required to maintain the principality of individual housing loans.

The requirement of minimum concentration towards ‘individuals’ is a new concept and possibly to protect the HFCs from systemic exposures. Further, principality is to be differentiated from ‘ordinary’ – that is, the guidelines do not prohibit the HFCs from providing non-housing loans- it limits the same. The remaining 50% can be extended in the form of non-housing loans, including LAP. An HFC which falls short of such qualifying asset criteria has to get registration as NBFC-ICC – consequentially, all laws applicable to such NBFC-ICC shall apply to the HFC. |

| Classification of HFCs as Systemically Important and Non-systemically Important entities | |||

| 3 | As per the current scenario a common set of regulations are applicable for all HFCs irrespective of asset size and ownership | In order to introduced a graded approach as applicable to NBFCs in general the proposed changes tend to classify HFCs if following categories:

1. All deposit taking HFCs (HFCs-D) irrespective of asset size and all non-deposit HFCs (HFCs-ND) with asset size of over INR 500 crores as systemically important HFCs; |

The existing regulations for HFCs are similar to NBFCs. The larger HFCs may continue with existing regulations under NHB regulations or be harmonised with NBFC-SI regulations. However, there are separate regulations for deposit taking NBFCs which might become applicable on deposit taking HFCs as well. For the non-systemically important HFCs, it is proposed to bring the regulations at par with Master Directions for NBFC-ND-non-SI |

| Minimum Net Owned Fund Requirement | |||

| 4 | For a company to commence or carry a principal business of housing finance it shall have a minimum net owned fund of INR 10 Crore. | Minimum net owned fund (NOF) requirement is proposed to be increased from 10 Crore to 20 crore.

Existing HFC shall be given a time period of 1 year to reach NOF of INR 15 Crore and another 1 year to reach INR 20 Cr minimum NOF mark |

The increased capital requirement is to strengthen the capital base of the HFCs.

However, as compared to an NBFC the NOF requirement is very high. The registration requirement for both NBFC-ICC and HFC will also be the same- they will have to apply to the RBI. An important question that will arise here is that why should an entity register as an HFC- given the fact that even an NBFC-ICC can extend housing loan, one would have to consider the various factors to carry on housing finance as a principle activity under an HFC or non principal activity under an NBFC-ICC. As per the provisions of section 29A and 2(d) of the NHB Act read along with the RBI guidelines issued in this regard, an HFC will have to satisfy the principality of 50% housing loans as well as 75% loans to individuals. |

| Harmonising definitions of Capital (Tier I & Tier II) with that of NBFCs | |||

| 5 | Tier- I Capital is defined under Para 2(1)(zf) of HFCs Master Directions as: “Tier-I capital” means owned fund as reduced by investment in shares of other housing finance companies and in shares, debenture, bonds, outstanding loans and advances including hire purchase and lease finance made to and deposits with subsidiaries and companies in the same group exceeding, in aggregate, ten percent of the owned fund;Tier- I Capital is defined under Para 2(1)(zg) of HFCs Master Directions as: “Tier-II capital” includes the following:- (i) preference shares (other than those compulsorily convertible into equity); (ii) revaluation reserves at discounted rate of fifty five percent; (iii) 10[general provisions (including that for standard assets) and loss reserves to the extent these are not attributable to actual diminution in value or identifiable potential loss in any specific asset and are available to meet unexpected losses, to the extent of one and one fourth percent of risk weighted assets]; (iv) hybrid debt; (v) subordinated debt to the extent the aggregate does not exceed Tier-I capital; |

As per Para 3 (xxxii) and 3 (xxxiii) of Master Directions for NBFC-ND-SI

“Tier I Capital” means owned fund as reduced by investment in shares of other non-banking financial companies and in shares, debentures, bonds, outstanding loans and advances including hire purchase and lease finance made to and deposits with subsidiaries and companies in the same group exceeding, in aggregate, ten per cent of the owned fund; and perpetual debt instruments issued by a non-deposit taking non-banking financial company in each year to the extent it does not exceed 15% of the aggregate Tier I Capital of such company as on March 31 of the previous accounting year; “Tier II capital” includes the following: (a) preference shares other than those which are compulsorily convertible into equity; (b) revaluation reserves at discounted rate of fifty five percent; (c) General provisions (including that for Standard Assets) and loss reserves to the extent these are not attributable to actual diminution in value or identifiable potential loss in any specific asset and are available to meet unexpected losses, to the extent of one and one fourth percent of risk weighted assets; (d) hybrid debt capital instruments; (e) subordinated debt; and (f) perpetual debt instruments issued by a non-deposit taking non-banking financial company which is in excess of what qualifies for Tier I Capital, to the extent the aggregate does not exceed Tier I capital. |

It is proposed to align the definitions of capital (both Tier I and Tier II) of HFCs with that of NBFC, specifically PDIs shall form part of HFCs capital (both Tier I and Tier II) component on the same lines as NBFCs. However, with the following differences-

1.PDIs shall be treated as Tier I/ Tier II capital only by HFCs-ND-SI |

| Public Deposits | |||

| 6 | Public deposits is defined under Para 2(1)(y) of the NHB Directions, 2010 | Subject to alignment of Public deposit provisions of HFC with NBFC following shall be: Additions to the existing exemptions from public deposits: 1. Rehabilitation Industries Corporation of India Ltd. 2. Corporation established by or under any Statute; or a cooperative society registered under the Cooperative Societies Act of any StateDeletion from the list of exemptions applicable to HFCs 1. Japan Bank for International Cooperation (JBIC) 2. Kreditanstalt fur Wiederaufbau (KfW) In addition to changes pursuant to the alignment, any amount received by the HFCs from NHB or any public housing agency shall be exempted |

There are no major changes arising from the alignment of definitions of public deposits, however it seems that at the time of alignment this may be taken care off. |

| Liquidity Risk framework and LCR | |||

| 7 | Under the present scenario HFCs are required to follow Guideline for Asset Liability Management System issued by NHB via Policy Circular No. 35 dated 11th October, 2011 | Guidelines for Liquidity risk management framework (LRM) and liquidity coverage ratio (LCR) as notified by the RBI on 04th November, 2019 applicable to NBFCs shall be extended to HFCs-ND with asset size of more than 100 crores and all HFCs-D subject to supervisory review of internal controls required to put in place by HFCs (Refer our presentation on LRM here- http://vinodkothari.com/2019/11/liquidity-risk-framework/) | Actionable from the Liquidity Risk Management Framework:

1. HFCs will be required to edit the current ALM policy or adopt a new LRM framework. However question arises in relation to the applicability of LCR as same is applicable in NBFCs-D and NBFC-ND-SI with asset size of 5000 crore or more whereas the its proposed to extended the guidelines in case of HFCs to all the HFCs-D and HFCs-ND-SI with asset Size of INR 100 crore or more. RBI may look into difference in applicability criteria while notifying the same. |

| Group entities Engaged in real estate business | |||

| 8 | Current provisions applicable to HFC does not contain any restrictions relating to double financing. | HFCs exposure to the below mentioned activity shall be mutually exclusive: 1. Group company in real estate business or 2. Lend to retail individual home buyers in the project of group entitiesAny direct or indirect exposure in group entity shall be limited 15% of owned funds for a single entity in the group and 25% of owned fund for all such group entities. As regards to extending of loans to individuals, who chose to buy housing units from entities in the group, Arm’s length principle shall be followed in letter and spirit |

The proposition is that HFC can either undertake an exposure on the group company in real estate business or lend to retail individual home buyers in the projects of group entities, but not do both. The laguage of the notification is not very clear that it is referrring to internal group or external group as well- our view is that the restriction should not be just for internal group but also for external group.

Further, the limit on ‘Group Exposure’ seems to include both housing and non-housing loans to such group entity. Also, the limits are more stringent than the existing concentration norms, which provide the limit for lending and investment of upto 25% of the owned fund to a single party and 40% of its owned fund to a single group of parties. There is an exemption in the existing concentration norms for investment and lending to group comanies to the extent it has been reduced from the owned funds. Hence, the limit of 15% and 25% may not be relvant if the HFC has already knocked off the exposure from its owned funds. This must be clarified by the RBI. Since, the intent is to stop double finance that is to say ongoing exposure should not be there on both- in case funding has been extended to the builder then already the flat is funded, however, after construction once the loan is repaid by the builder, the individual may be given loan for the flat- this should not be regarded as double financing. In case of loans to individual, the HFC must satisfy the arms’ length requirement for retail loans to group’s customers. This mutual exclusion clause does not seems to apply to companies outside group and their retail customers – but in case the intent is to bar double financing, the external group companies must also be included. |

| Monitoring of frauds | |||

| 9 | Applicable as per NHB policy circular No. 92 dated February 05, 2019 | Applicable as per Master Direction – Monitoring of Frauds in NBFCs (Reserve Bank) Directions, 2016. | HFCs should comply with the master directions for monitoring of frauds, however all reports in the formats given in Master Directions may continue to be forwarded to NHB, New Delhi. |

| 10 | Chapter IV para 2 – Frauds committed by unscrupulous borrowers: Frauds committed by unscrupulous borrowers including companies, partnership firms/proprietary concerns and/or their directors/partners, Group of Associations, Trusts etc. by various methods including the following: (a) Diversion of funds outside the borrowing units, (b) lack of interest or criminal neglect on the part of borrowers, their partners, etc., (c) due to managerial failure leading to the unit becoming sick and due to laxity in effective supervision over the operations in borrowal accounts on the part of the HFC functionaries rendering the advance difficult of recovery. |

As per Master Directions: Frauds committed by unscrupulous borrowers including companies, partnership firms/proprietary concerns and/or their directors/partners by various methods including the following: (a) Fraudulent discount of instruments; (b) Fraudulent removal of pledged stocks/disposing of hypothecated stocks without the NBFCs knowledge/inflating the value of stocks in the stock statement and drawing excess finance; (c) Diversion of funds outside the borrowing units, lack of interest or criminal neglect on the part of borrowers, their partners, etc. and also due to managerial failure leading to the unit becoming sick and due to laxity in effective supervision over the operations in borrowal accounts on the part of the NBFC functionaries rendering the advance difficult of recovery. |

Same as earlier. However, additionally the following 2 points would be henceforth applicable: (a) Fraudulent discount of instruments; (b) Fraudulent removal of pledged stocks/disposing of hypothecated stocks without the NBFCs knowledge/inflating the value of stocks in the stock statement and drawing excess finance. |

| 11 | Chapter VI para 2(iii) – Quarterly Review of Frauds: All the frauds involving an amount of INR. 50 lakh and above should be monitored and reviewed by the Audit Committee of the Board of HFCs. The periodicity of the meetings of the Committee may be decided according to the number of cases involved. However, the Committee should meet and review as and when a fraud involving an amount of INR. 50 lakh and above comes to light. |

As per Master Directions:

All the frauds involving an amount of INR 1 crore and above should be monitored and reviewed by the Audit Committee of the Board (ACB) of NBFCs. The periodicity of the meetings of the Committee may be decided according to the number of cases involved. However, the Committee should meet and review as and when a fraud involving an amount of INR 1 crore and above comes to light. |

Limit of INR 50 lakh would be increased to INR 1 crore as per Master Directions. |

| 12 | Chapter – VII – Provisioning Pertaining to Fraud Accounts | No such provisioning requirement under master directions. | The Master directions as applicable to NBFCs do not provide for any specific provisioning requirement pertaining to the account classifed as fruad. |

| Information Technology Framework | |||

| 14 | As per NHB policy circular No. 90 dated June 15, 2018: Information Technology framework for HFCs is categorised into 2 parts: Section A – For public deposit accepting HFCs and HFCs not accepting public deposit with asset size INR 100 crore and above; Section B – HFCs not accepting public deposit with asset size below INR 100 crore. |

As provided under Master Direction – Information Technology Framework for the NBFC Sector where:

Section A would apply to Systemically important HFCs; |

Currently applicability of IT framework for HFCs is segregated based on asset size of INR 100 crores. However, henceforth the applicability would be based on asset size of INR 500 crores, i.e. by segregating HFCs into systemically and non-systemically important category. |

| 15 | Para 5.4 – Periodicity of IS Audit: The periodicity of IS audit should ideally be based on the size and operations of the HFC but may be conducted at least once in two years. |

As per Master Directions – The periodicity of IS audit should ideally be based on the size and operations of the HFC but may be conducted at least once in a year. | All HFCs would be required to conduct IS audit at least once in a year as per Master Directions. This however is recomendatory. |

| Securitization | |||

| 16 | No guidelines prescribe by NHB | Provisions of Annex XXII of NBFC-ND-SI Directions, 2016 shall be extended to cover the HFCs | In the absence of any specific guidelines, the HFCs were already complying with the RBI guidelines on securitization and direct assignment. This would avoid any confusion in terms of the applicability of the securitisation guidelines. However, the existing RBI guidelines are also proposed to undergo amendments |

| Lending against Shares | |||

| 17 | Under the current ambit of HFC provisions there are no guidelines in place for lending against the security of shares by HFCs | Provisions as specified in Para 22 of NBFC-ND-SI Directions, 2016 shall mutatis mutandis be applicable to the HFCs | HFCs would be required to comply with the following while lending against shares: 1. Maintain Loan to Value (LTV) ratio of 50% at all times. Any shortfall would require to be made good within 7 working days. 2. In case where lending is being done for investment in capital markets, accept only Group 1 securities as collateral for loans of value more than INR 5 lakh. 3. Report on-line to stock exchanges on a quarterly basis, information on the shares pledged in their favour, by borrowers for availing loans in format as given in Annex V of Master Directions.. |

| Managing Risks and Code of Conduct in Outsourcing of Financial Services | |||

| 18 | There are no guidelines have been prescribed for HFCs with regard to outsourcing of Financial Services | Provisions of Annex XXV of NBFC-ND-SI Directions, 2016 shall be extended to cover the HFCs | HFCs will have to comply with the guidelines for outsourcing of financial services |

| Foreclosure charges | |||

| 19 | As per NHB policy circular No. 36 dated October 18, 2010 and NHB policy circular No. 43 dated October 19, 2011

HFCs should not charge pay-payment levy or penalty on pre-closure of housing loans under the following situations. 1. Where the housing loan is on floating interest rate basis and the loan is preclosed through any source. |

No foreclosure charges/prepayment penalties shall be levied on any floating rate term loan sanctioned for purposes other than business to individual borrowers with or without co-obligants. It is proposed to extend these instructions to HFCs. | There are no regulations prescribed for HFCs for not levying the foreclosure charge for non-housing loans such as in case of term loans availed for other than business purpose. Hence, it is proposed to extend these instructions to HFCs as well. This would ensure uniformity with regard to repayment of various term loans by borrowers. Though the language is not very clear and hence, it seems that the foreclosure charges shall be waived off for all floating rate term loans to individual borrowers, including housing loans as well. |

| Implementation of Indian Accounting Standards | |||

| 20 | NBFCs as covered in rule 4 of the Companies (Indian Accounting Standards) Rules, 2015 are required to comply with IndAS.

As per the Rule 2(1)(g) of the above mentioned rules, all the HFCs are covered under the definition of NBFCs thereby required to comply with IndAS. The RBI has also provided guidance on implementation of Indian Accounting Standards by NBFCs (including HFCs). |

RBI instructions issued vide circular dated 13th March, 2020 on implementation of IndAS to be extended to HFCs | The RBI circular was applicable to NBFCs as covered in rule 4 of the Companies (Indian Accounting Standards) Rules, 2015 which already includes HFCs under the definition of NBFCs.

However, there was confusion wrt its applicability on HFCs. The proposed change further clarifies the applicability of the said RBI circular to HFCs. Our write-up on implementation of IndAs for NBFCs may alos be refereed here– http://vinodkothari.com/2020/03/guidance-on-implementation-of-ind-as-by-nbfcs/ |

Our other write-ups may be viewed here:

High Level Forum (EU) makes recommendations to further boost securitisation market

/0 Comments/in Financial Services, Securitisation /by Vinod Kothari ConsultantsData shows that the European securitisation market never rebounded after the 2008 crisis, even after the implementation of STS framework. Securitisation however, plays a key role in boosting the capital markets. This role has been recognised by the High Level Forum (EU) in its final report released on 10th June, 2019.

Seven recommendations were made by the HLF with respect to securitisation. The intent is to ultimately boost securitisation markets and help it pick up in the years to come.

In this write up, the author attempts to explain in brief the recommendations with respect to securitisation of the High Level Forum.

Presentation on Securitisation Basics

/0 Comments/in Financial Services, Securitisation /by Vinod Kothari ConsultantsWebinar on RBI discussion paper on Governance in Commercial Banks in India

/2 Comments/in Uncategorized /by Vinod Kothari ConsultantsDate: 22nd June, 2020 at 05:00 pm, India time. Will run for about 90 mins.

Speaker: FCS Vinita Nair, Senior Partner, Vinod Kothari & Company

Background:

Effective Corporate Governance practices at banks plays a significant role in the banking sector and the economy as a whole. The banking industry in India witnessed governance failures in the past which seems to have triggered the need for the regulator to re-look at the governance guidelines for commercial banks in India.

RBI on 11th June, 2020 issued a discussion paper on the guidelines for Governance in Commercial Banks in India.

Scope of the webinar:

We intend to discuss the proposals put forth in the discussion paper in this webinar (expected duration around 90 mins) and comparing the proposed requirements with the existing ones.

- Scope and applicability;

- Overall responsibilities of the Board of Directors;

- Duties of director;

- Understanding and managing Conflict of Interest for banks;

- Structure, composition and role of Board Committees;

- Risk Governance Framework – The three lines of defence;

- Separation of ownership from Management;

- Whistle-blower mechanism.

Where:

On the internet, via Google Meet / Zoom Meeting

Please note that the webinar has a maximum capacity of 50, including the host, and entry is on first-come-first-enter basis.

Whether interactive:

Yes. Participants may post queries, either in advance or at the time of webinar. Participants may, based on feasibility, also be allowed to speak.

For registration:

Kindly mail with relevant details on – shaifali@vinodkothari.com.

Knowledge Resources:

HFC Regulations Harmonised with NBFC Regime

/7 Comments/in Housing finance, NBFCs /by Vinod Kothari Consultants-Anita Baid (anita@vinodkothari.com)

Introduction

In 2019, pursuant to the amendments proposed by the Finance Act, 2019, it was proposed to shift the regulations of Housing Finance Companies (HFCs) from National Housing Bank (NH) to the Reserve Bank of India (RBI). Further, the RBI had in its press release[1] stated that HFCs will be treated as one of the categories of Non-Banking Financial Companies (NBFCs) for regulatory purposes with effect from August 09, 2019. It was expected that the RBI shall carry out a review of the extant regulatory framework applicable to HFCs and come out with revised regulations in due course, and till such time HFCs shall continue to comply with the directions and instructions issued by NHB.

In this regard, the RBI has undertaken a review and has identified a few changes which are proposed to be prescribed for HFCs[2]. While certain guidelines in the NBFC Master Directions is proposed to be made straight away applicable to HFCs, in some other cases, changes have been proposed to ensure a seamless shift in the regulations. Most of these regulations are not new to the world at large, banks and NBFCs are already complying with the guidelines issued by the RBI on similar lines. The scope has now been extended to include HFCs under its ambit.

Some of the major changes proposed by the new regulator have been discussed herein below-

Defining the phrase ‘providing finance for housing’ or ‘housing finance’

The NHB Directions defined the term “housing finance company” [section 2(d)] as a company incorporated under the Companies Act, 1956 which primarily transacts or has as one of its principal objects, the transacting of the business of providing finance for housing, whether directly or indirectly. However, the term ‘providing finance for housing’ or ‘housing finance’ was not formally defined. It has been proposed to define the said terms to mean financing, for purchase/ construction/ reconstruction/ renovation/ repairs of residential dwelling units. Further, an illustrative list has been provided to determine the loans that would fall under the category of housing finance.

There was a NHB Circular dated September 26, 2011[3] which provided an illustrative list of loans which can be classified as housing/ non housing loans. The comparative table showing the difference is provided herein below:

| Illustrative list prescribed in 2011 | Proposed list of ‘Qualifying Asset’ |

| a. Loans to individuals or group of individuals including co-operative societies for construction/ purchase of new dwelling units.

b. Loans for purchase of old dwelling units. c. Loans to individuals for purchasing old/new dwelling units by mortgaging existing dwelling units. d. Loans for purchase of plots for construction of residential dwelling units provided a declaration is obtained from the borrower that he intends to construct a house on the said plot, with the help of bank/HFC finance or otherwise, within a period of three years from the availment of the said loan. e. Loans for renovation/ reconstruction of existing dwelling units. f. Lending to professional builders for construction of residential dwelling units. g. Lending to public agencies including state housing boards for construction residential dwelling units. h. Loans to corporates/ Government (through loans for employee housing) i. Loans for construction of educational, health, social, cultural or other institutions/ centers, which are part of a housing project and which are necessary for the development of settlements or townships; j. Loans for shopping complexes, markets and such other centers catering to the day to day needs of the residents of the housing colonies and forming part of a housing project; k. Loans for construction meant for improving the conditions in slum areas for which credit may be extended directly to the slum-dwellers on the guarantee of the Government, or indirectly to them through the State Governments; l. Loans given for slum improvement schemes to be implemented by Slum Clearance Boards and other public agencies; m. Loans provided to the bodies constituted for undertaking repairs to houses; n. Investment in the guarantee/non-guaranteed bonds and debentures of NHB/HUDCO in the primary market, provided investment in non-guaranteed bonds is made only if guaranteed bonds are not available |

a. Loans to individuals or group of individuals including co-operative societies for construction/ purchase of new dwelling units.

b. Loans to individuals for purchase of old dwelling units. c. Loans to individuals for purchasing old/ new dwelling units by mortgaging existing dwelling units. d. Loans to individuals for purchase of plots for construction of residential dwelling units provided a declaration is obtained from the borrower that he intends to construct a house on the plot within a period of three years from the date of availing of the loan. e. Loans to individuals for renovation/ reconstruction of existing dwelling units. f. Lending to public agencies including state housing boards for construction of residential dwelling units. g. Loans to corporates/ Government agencies (through loans for employee housing). h. Loans for construction of educational, health, social, cultural or other institutions/centres, which are part of housing project in the same complex and which are necessary for the development of settlements or townships; i. Loans for construction of houses and related infrastructure within the same area, meant for improving the conditions in slum areas for which credit may be extended directly to the slum-dwellers on the guarantee of the Government, or indirectly to them through the State Governments; j. Loans given for slum improvement schemes to be implemented by Slum Clearance Boards and other public agencies; k. Lending to builders for construction of residential dwelling units |

The proposed list is similar to the illustrative list prescribed by NHB earlier. However, the list prescribed as ‘qualifying asset’ for HFCs seems to focus more on individual borrowers. It has also excluded the following-

- Loans for shopping complexes, markets and such other centers catering to the day to day needs of the residents of the housing colonies and forming part of a housing project

- Loans provided to the bodies constituted for undertaking repairs to houses;

- Investment in the guarantee/non-guaranteed bonds and debentures of NHB/HUDCO in the primary market, provided investment in non-guaranteed bonds is made only if guaranteed bonds are not available

Specifically, loans given for furnishing dwelling units, loans given against mortgage of property for any purpose other than buying/ construction of a new dwelling unit/s or renovation of the existing dwelling unit/s, have been regarded as non-housing loans. This was mentioned in the 2011 circular as well.

The idea behind laying out the periphery of ‘housing loans’ is to ensure consistency and certainty in ‘principality’ of business of the HFCs. Only such loans, which “qualify” as “housing loans” would be treated as “qualifying assets” for the purpose of determining “principality” of business of the entity, as we see below.

An entity which falls short of such qualifying assets below 50% cannot be regarded as HFC. This provision is also expected to minimise the practice of giving mortgage loans (LAP-type loans) by HFCs, which would often be granted to meet working capital requirements, etc. of other entities and not for housing purposes; thereby restricting the portfolio deviations of the HFC. The specific definition of housing finance would avoid confusion and ensure better governance as well as reporting for HFCs.

Defining principal business and qualifying assets

The amendment to section 29 A of the NHB Act vide Finance Act, 2019 provided as follows:

(1) Notwithstanding anything contained in this Chapter or in any other law for the time being in force, no housing finance institution which is a company shall commence housing finance as its principal business or carry on the business of housing finance as its principal business without—

(a) obtaining a certificate of registration issued under this Chapter; and

(b) having the net owned fund of ten crore rupees or such other higher amount, as the Reserve Bank may, by notification, specify.

Prior to the amendment in Finance Act, the term ‘principal business’ was not referred in NHB Act. Further, for the purposes of registration, NHB was recognizing companies as HFCs if such company had, as one of its principal objects, transacting of the business of providing finance for housing (directly or indirectly). With the aforesaid amendment to NHB Act, there was a need to define the term ‘principal business’ for HFCs. The principal business criteria for NBFCs is well known- an NBFC must have financial assets more than 50% of its total assets and income from financial assets must be more than 50% of the gross income. The same has been proposed to be extended to HFCs as well along with the concept ‘qualifying assets’ which would mean asset qualifying as ‘housing finance’ or ‘providing finance for housing’

The principality test for HFCs has been proposed as follows (both these tests are required to be satisfied as the determinant factor for principal business):

- Not less than 50% of net assets are in the nature of ‘qualifying assets’ of which at least 75% should be towards individual housing loans as prescribed. Here, net assets shall mean total assets other than cash and bank balances and money market instruments

- Not less than 50% of the gross income is income from financial assets

The RBI has also proposed the following timeline for achieving the aforesaid principality:

| Timeline | At least 50% of net assets as qualifying assets i.e., towards housing finance | At least 75% of qualifying assets towards housing finance for individuals |

| March 31, 2022 | 50% | 60% |

| March 31, 2023 | – | 70% |

| March 31, 2024 | – | 75% |

The concept of ‘qualifying asset’ is similar to that in case of NBFC-MFIs wherein they are specifically focused on micro lending. Though in spirit the HFCs would primarily focus on housing loans only however, the HFCs offering home loans along with other related products would now be required to maintain the principality of individual housing loans. Further, the requirement of minimum concentration towards ‘individuals’ is a new concept and possibly to protect the HFCs from systemic exposures. Though the guidelines do not intend to prohibit the HFCs from providing non-housing loans, however, it limits the same. The remaining 50% can be extended in the form of non-housing loans, including LAP. An HFC which falls short of such qualifying asset criteria has to get registration as NBFC-ICC and consequentially, all laws applicable to such NBFC-ICC shall apply to the HFC.

Classifying HFCs into SIs and NSIs

At present, HFC regulations are common for all HFCs irrespective of their asset size and ownership. It is proposed to issue HFC regulations by classifying them as systemically important and non-systemically important.

- Non-deposit taking HFCs (HFC-ND) with asset size of ₹500 crore & above and all deposit taking HFCs (HFCD), irrespective of asset size, will be treated as systemically important HFCs-

- The larger HFCs may continue with existing regulations under NHB regulations or be harmonised with NBFC-SI regulations

- However, there are separate regulations for deposit taking NBFCs which might become applicable on deposit taking HFCs as well

- Non-deposit taking HFCs with asset size below ₹500 crore will be treated as non-systemically important HFCs (HFC-non-SI)-

- For the non-systemically important HFCs, it is proposed to bring the regulations at par with Master Directions for NBFC-ND-non-SI

The existing regulations for HFCs are similar to NBFCs. The intention is to bring the non-systemically important HFCs at par with NBFC-NSI and hence, the applicability of the existing Master Directions for NBFC-ND-NSI can be extended to HFC-non-SI as well.

Minimum Net Owned Fund (NOF)

It is proposed to increase the minimum NOF for HFCs from the current requirement of ₹10 crore to ₹20 crore. For existing HFCs the glide path would be to reach ₹15 crore within 1 year and ₹20 crore within 2 years.

The increased capital requirement is to strengthen the capital base of the HFCs. However, as compared to an NBFC the NOF requirement is very high. The registration requirement for both NBFC-ICC and HFC will also be the same, since both will have to apply to the RBI.

An important question that will arise here is that why should an entity register as an HFC- given the fact that even an NBFC-ICC can extend housing loan, one would have to consider the various factors to carry on housing finance as a principle activity under an HFC or non-principal activity under an NBFC-ICC. As per the provisions of section 29A and 2(d) of the NHB Act (mentioned earlier) read along with the RBI guidelines issued in this regard, an HFC will have to satisfy the principality of 50% housing loans as well as 75% loans to individuals.

Double Financing

In order to address concerns on double financing due to lending to construction companies in the group and also to individuals purchasing flats from the latter, it is proposed to provide the option to the concerned HFC to choose to lend only at one level. The proposition is that HFC can either undertake an exposure on the group company in real estate business or lend to retail individual home buyers in the projects of group entities, but not do both. The language of the notification is not very clear that it is referring to internal group or external group as well, however, it seems that the restriction should not be just for internal group but also for external group.

In case the HFC decides to take any exposure in its group entities (lending and investment) directly or indirectly, such exposure cannot be more than

- 15 per cent of owned fund for a single entity in the group and

- 25 per cent of owned fund for all such group entities.

The aforesaid limit on ‘Group Exposure’ seems to include both housing and non-housing loans to such group entity. Also, the limits are more stringent than the existing concentration norms, which provide the limit for lending and investment of upto 25% of the owned fund to a single party and 40% of its owned fund to a single group of parties. There is an exemption in the existing concentration norms for investment and lending to group companies to the extent it has been reduced from the owned funds. Hence, the limit of 15% and 25% may not be relevant if the HFC has already knocked off the exposure from its owned funds. This must be clarified by the RBI.

Since, the intent is to stop double finance that is to say ongoing exposure should not be there on both- in case funding has been extended to the builder then already the flat is funded, however, after construction once the loan is repaid by the builder, the individual may be given loan for the flat- this should not be regarded as double financing.

As regards to extending loans to individual, it is required that the HFC must satisfy the arms’ length requirement for retail loans to group’s customers. However, this mutual exclusion clause does not seems to apply to companies outside group and their retail customers – but in case the intent is to bar double financing, the external group companies must also be included.

Foreclosure Charges

In case of NBFCs, no foreclosure charges/pre-payment penalties is levied on any floating rate term loan sanctioned for purposes other than business to individual borrowers with or without co-obligors.

In case of HFCs, the foreclosure penalty is waived off in case of housing loans depending on the category of borrower and the source of funds for prepayment. The probable scenarios are provided herein below:

| Rate of Interest | Borrower/ Co-borrower | Source of pre-closure funding | Levy of foreclosure

charges / prepayment penalty |

| Fixed*

|

Individual | Own source ** | No |

| Borrowed Funds | Yes | ||

| HUF/Sole Proprietor/Company/Firm | Own source ** | No | |

| Borrowed Funds | Yes | ||

| Floating | Individual | Own source ** | No |

| Borrowed Funds | |||

| HUF/Sole Proprietor/Company/Firm | Own source ** | Yes | |

| Borrowed Funds | |||

| Dual Rate/ Special Rate

(Combination of fixed and floating) |

Individual | Own source ** | Pre-closure norms applicable to fixed/floating rate shall apply depending on whether at the time of pre-closure, the loan is on fixed or floating rate.

|

| Borrowed Funds | |||

| HUF/Sole Proprietor/Company/Firm | Own source ** | ||

| Borrowed Funds |

*Fixed rate loan is one where the rate is fixed for the entire tenure of the loan.

**The expression “own sources” for the purpose means any source other than by borrowing from a bank/HFC/NBFC and/or a financial institution.

There are no regulations prescribed for HFCs for not levying the foreclosure charge for non-housing loans such as in case of term loans availed for other than business purpose. Hence, it is proposed to extend these instructions to HFCs as well. This would ensure uniformity with regard to repayment of various term loans by borrowers. Though the language is not very clear and hence, it seems that the foreclosure charges shall be waived off for all floating rate term loans to individual borrowers, including housing loans as well.

Other provisions to be made applicable to HFCs

- It is proposed to align the definitions of capital (both Tier I and Tier II) of HFCs with that of NBFCs. It is proposed to align the definitions of capital (both Tier I and Tier II) of HFCs with that of NBFC, specifically PDIs shall form part of HFCs capital (both Tier I and Tier II) component on the same lines as NBFCs. However, with the following differences-

- PDIs shall be treated as Tier I/ Tier II capital only by HFCs-ND-SI

- PDIs or any other debt capital instrument in the nature of PDIs already issued by HFCs-D and HFCs-non-SI shall be reckoned as Tier I/Tier II for a period not exceeding 3 year

Further, since HFCs are treated as a category of NBFCs for regulatory purposes, investments in shares of other HFCs and also in other NBFCs (whether forming part of group or not), shall be reduced from the Tier I capital to the extent it exceeds, in aggregate along with other exposures to group companies, ten per cent of the owned fund of HFC.

- It is proposed to align the definition of public deposit as given under RBI Master Direction with an addition that any amount received by HFCs from NHB or any public housing agency shall also be exempt from the definition of public deposit.

- It is proposed to extend the Liquidity Risk Management (LRM) guidelines to all non-deposit taking HFCs with asset size of ₹100 crore & above and all deposit taking HFCs. There is however, no mention about the applicability of LCR framework. It seems that the same shall also be extended to HFCS with asset size of ₹5000 crore or more in a phased manner. The LRM framework was recently introduced for NBFCs in November, 2019[4] and the extension to HFCs would require similar actionable.

- It is proposed to make the fraud reporting directions applicable to HFCs in place of present guidelines issued by NHB. However, the reporting requirement shall continue to be submitted to the NHB itself. The limits for quarterly review by Audit Committee would also be revised to that applicable on NBFCs, that is, ₹1crore as against the existing ₹50 lacs for HFCs.

- It is proposed that the Information Technology (IT) Framework for NBFCs shall be extended to HFCs and the existing guidelines issued by NHB in this regard would be withdrawn. The existing IT framework for HFCs were categorised into two parts- for public deposit accepting HFCs and HFCs not accepting public deposit with asset size Rs. 100 crore and above; and for HFCs not accepting public deposit with asset size below Rs. 100 crore. However, the proposed applicability of IT framework would be on the basis of classification as systemically important or non-systemically important HFC.

- It is proposed to bring all HFCs (systemically important and non-systemically important) under the ambit of guidelines on securitisation transaction as applicable to NBFCs, which is proposed to undergo amendments. In the absence of any specific guidelines, the HFCs were already complying with the RBI guidelines on securitization and direct assignment. This would avoid any confusion in terms of the applicability of the securitisation guidelines.

- It is proposed to extend instructions applicable to NBFCs to lend against the collateral of listed shares to HFCs as well, who do not have any guidelines in this regard at present.

- It is proposed to extend the guidelines with regard to outsourcing of Financial Services for NBFCs, to all HFCs.

- It has been proposed that the RBI instructions on Implementation of Indian Accounting Standards will be extended to HFCs. The RBI circular was applicable to NBFCs as covered in rule 4 of the Companies (Indian Accounting Standards) Rules, 2015 which already includes HFCs under the definition of NBFCs. However, there was confusion wrt its applicability on HFCs. The proposed change further clarifies the applicability of the said RBI circular to HFCs.

Harmonizing the regulations

There are certain major differences between extant regulations of the HFCs and that for NBFCs. It is being proposed to harmonise these regulations in a phased manner over a period of two to three years:

- Capital requirements (CRAR and risk weights)

The minimum CRAR prescribed for HFCs currently is 12% and which was to be progressively increased to 14% by March 31, 2021 and to 15% by March 31, 2022. Further, the risk Review of extant regulatory framework for Housing Finance companies (HFCs) weights for assets of HFCs are in the range of 30% to 125% based on asset classification, LTV, type of borrower, etc. However, for NBFCs, the minimum CRAR is 15% and risk weights are broadly under 0%, 20% and 100% categories.

- Income Recognition, Asset Classification and Provisioning (IRACP) norms

The major differences in provisioning norms applicable to standard, substandard and doubtful assets in HFCs’ books. In case of standard loans, the HFCs are required to create a provision ranging from 0.4% to 2% and for substandard the requirement is 15%, whereas, in case of NBFC-ND-SI, the provision is 0.4% for standard and 10% for sub-standard.

- Norms on concentration of credit / investment

The credit concentration norms for NBFCs and HFCs are similar. NBFCs enjoy certain exceptions in this regard which was also introduced for HFCs in 2018.

- Limits on exposure to Commercial Real Estate (CRE) & Capital Market (CME)

The limits prescribed for HFCs for exposure to CRE by way of investment in land & building shall not be more than 20% of capital fund and for CME shall not be more than 40% of net worth total exposure of which direct exposure should be 20% of net worth. However, there are no limits prescribed for NBFCs.

- Regulations on acceptance of Public Deposits

- Period of public deposit (12 months to 120 months for HFCs against 12 months to 60 months for NBFCs),

- Ceiling on quantum of deposit (3 times of NOF for HFCs against 1.5 times for NBFCs with minimum investment grade rating),

- Interest on premature repayment of deposits (ranging from 1% to 4% below prescribed rate for HFCs as against 2% to 3% below prescribed rate for NBFCs depending upon duration and prescription of rate),

- Maintenance of liquid assets (13% for HFCs against 15% for NBFCs), etc.

Conclusion

Though HFCs are now another form of NBFCs, the RBI draft proposes to carve out a slightly separate set of rules for the HFCs in certain cases. Further, the proposed harmonisation of regulations will be done over a period of two years and till such time the HFCs will follow the extant NHB norms. Thus enabling the HFCs a breather period and to ensure seamless transition.

Other relevant articles-

- http://vinodkothari.com/2017/05/hfc-investment-to-get-a-major-boast-by-ameet-roy-23rd-february-2017/

- http://vinodkothari.com/2018/06/it-framework-for-the-hfcs/

- http://vinodkothari.com/wp-content/uploads/Corporate_Governance_Standards_for_HFCs.pdf

[1] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=47871

[2] https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/HFC7B2AB6B6997544B88136D80AC3C094F9.PDF

[3] https://www.nhb.org.in/Regulation/polcir-41.pdf

[4] Our snapshot on the same can be read here- https://vinodkothari.com/wp-content/uploads/2019/11/Liquidity-risk-framework.pdf

A point by point comparative of the existing in proposed guidelines may be viewed here: