Evolution of concept of related parties and related party transactions

-Team Vinod Kothari and Company | corplaw@vinodkothari.com

Loading…

Loading…

Our Resource Centre on Related Party Transactions can be viewed here

-Team Vinod Kothari and Company | corplaw@vinodkothari.com

Loading…

Loading…

Our Resource Centre on Related Party Transactions can be viewed here

SEBI accepts WG proposal for detailed review

Ajay Kumar K V | Manager (corplaw@vinodkothari.com)

Related Party Transactions (‘RPTs’) involve conflict of interest and may consist of a potential means to transfer funds under the smoke screen of an unrelated party, however, for the benefit of certain related persons. Taking this fact into cognizance, SEBI constituted a Working Group in November 2019 to review the policy structure and gaps pertaining to RPTs in the SEBI (Listing Obligations and Disclosure Requirements) Regulations (‘Listing Regulations’), 2015 vis-à-vis the Indian Accounting Standards and the Companies Act, 2013 (‘Act’). The Working Group made recommendations on expanding the scope of RPs and RPTs, as well as enhancing disclosures before the audit committee (‘AC’), shareholders, and to the exchanges (‘SEs’).

Consequently, SEBI in its meeting held on 28th September 2021[1] considered and approved the amendments to Listing Regulations in line with the recommendations of WG. The decisions have been implemented vide two separate notifications.

SEBI, vide its notification dated November 9, 2021[2], amended Regulation 23 of the Listing Regulations thereby making significant changes in the definition of Related Parties (‘RPs’), RPTs including the approval mechanism for material RPTs, etc. A detailed analysis of the said amendment can be read here.

However, the provisions with respect to the information to be placed before AC and shareholders for seeking their approval, as well as half-yearly disclosures to stock exchanges were not made part of the aforesaid amendment. These amendments have been introduced vide SEBI circular SEBI/HO/CFD/CMD1/CIR/P/2021/662 dated 22nd November 2021[3] (‘SEBI Circular’).

The Circular broadly provides for the following –

The Circular takes effect from 1st April 2022 (while the disclosure is to be triggered in the first half-year of 2022-2023, i.e., for the half-year ended 30th September 2022.)

Various practical implications and considerations arising out of the prescriptions of the Circular are discussed in this write-up.

The Circular applies to listed entities which have listed their ‘specified securities’. Pursuant to the SEBI Listing Regulations 5th Amendment, a High Value Debt Listed Entity (‘HVDLEs’) is required to submit the disclosure on RTPs under Reg. 29(3) along with its standalone financial results for each half year.

HVDLEs are those listed entities which have listed its non-convertible debt securities and have an outstanding value of listed non-convertible debt securities of Rs. 500 crore and above as on 31st March 2021.

Thus, from the half-year ended 30th September 2022, HVDLEs are required to submit the disclosure of RPTs in the format prescribed in the SEBI Circular. Our detailed analysis of the amendments w.r.t HVDLEs can be read here.

The Act requires ‘relevant information’ to be placed before AC in case of omnibus approvals [refer, rule 6A of Companies (Meetings of Board and its Powers) Rules, 2014 (‘MPB rules’)]; however, relevant information has not been prescribed as such. While one may refer to section 188 read with rule 15 of the MPB rules which prescribes specific information to be placed before the board and shareholders for approval of RPTs. It would be counter-intuitive to say that the information which goes to the board for RPT approval would not go to AC. By obvious interpretation, all such information which rule 15 lists out, ought to be placed before AC as well.

SEBI Circular now specifically provides for minimum information to be placed before AC for consideration/approval of RPTs, including the items as listed below. The quantum of information to be placed before AC under the revised framework is more exhaustive than what is provided in rule 15. Also, while it is the obligation of the listed entity to place these information before AC, as a corollary, it appears equally incumbent on AC to demand such information from the entity.

It may also be important to note (as we discuss below), the notice sent to shareholders for seeking RPT approval shall consist of a “summary of information provided to the audit committee” as well. Hence, all such things which are placed before AC, shall also come before the shareholders, albeit in a summarised form.

The SEBI Circular has specifically listed out the details required to be placed before the Audit Committee and the Shareholders which has far-reaching impact on listed entities. It states that a summary of the information provided by the management of the listed entity to the Audit Committee while the RPT was placed before it for approval, shall also be given to the Shareholders while seeking their approval. The probable outcome of the same can be:

Another important change is that while placing information to the Shareholders, a statement that the valuation or other external report, if any, relied upon by the listed entity in relation to the proposed transaction will be made available through the registered email address of the Shareholders instead of making the same available for physical inspection at the registered office of the company which has been the existing practice.

The definition of RP as amended vide SEBI LODR Sixth Amendment Regulations, excluded acceptance of fixed deposits by Banks/NBFCs at the terms uniformly applicable/offered to all shareholders/public from the same, however, such transactions still require disclosure in the format specified by SEBI. This seems to be counter-productive as the intent of the law is to ensure that no transaction intended to benefit the RPs get away from the scrutiny of the Audit Committee and the Shareholders. To the paradox, even such transactions that have been executed 100% at par with public shareholders/customers of the company are also required to be disclosed by every listed company.

Some of the items are briefly discussed below:

Information to be placed before Board as per Section 188 read with Rule 15 of the Companies (Meetings of Board and its Powers) Rules, 2014

|

Information to be placed before shareholders as per Section 188 read sub-rule 3 of Rule 15 of the Companies (Meetings of Board and its Powers) Rules, 2014

|

Though rule 15, as stated above, does not explicitly state the details to be placed before Audit Committee except in case of Omnibus approval of RPTs under rule 6A of MBP Rules , it can be construed that the details to be placed before the Board of directors of the Company for approval of RPTs should be placed before the Audit Committee while seeking prior approval for RPTs by the listed entity.

On a careful analysis of the above, it can be seen that the capital market regulator has made the regulatory framework of RPTs more water-tight as compared to the existing norms under the Act. The listed entities shall now place exhaustive details before the Audit Committee and the Shareholders as compared to the norms for unlisted companies in the country.

The SEBI Working Group had in its report, provided a format for disclosure of RPTs on a half-yearly basis as specified under Reg. 23(9). So far, the listed entities have been preparing the disclosure as per the IND-AS 24 since the regulator had not specified a format for the disclosure of RPTs.

The SEBI has now prescribed a format for disclosure of RPTs as recommended by the Working Group. The notes to the disclosure format put forward significant questions on how listed companies will ensure compliance w.r.t RPTs.

The note 1 states, opening and closing balances, including commitments, to be disclosed for existing related party transactions even if there is no new related party transaction during the reporting period. This would mean that those transactions which are continuing in nature, even though there were no transactions during the reporting period shall be disclosed, including any commitments. The term ‘commitments’ would mean those arrangements where both the parties agree to perform their obligations under the contract.

In note 3, exemption has been granted to listed banks for disclosures with respect to related party transactions involving loans, inter-corporate deposits, advances or investments. However, the same has not been extended to listed NBFCs. This could lead to additional compliance burden for NBFCs even though they are engaged in the financial activities.

The note 9 states “Transactions such as acceptance of fixed deposits by banks/NBFCs, undertaken with related parties, at the terms uniformly applicable /offered to all shareholders/ public shall also be reported.”

SEBI had excluded acceptance of fixed deposits by Banks/NBFCs at terms uniformly applicable/offered to all shareholders/public from the definition of RPTs but had explicitly stated that such transactions shall be disclosed.

Having said that, one should interpret the said note in such a way that the requirement of disclosure is only for acceptance of deposits by Banks/NBFCs which have been excluded from the definition of RPTs and not any other transaction which have been availed by any related party at par with the general public.

The recent amendments to the Listing Regulations evidences the growing concern over the regulatory framework for RPTs. The definition of RPT has been widened to include a bunch of transactions that have never been in the radar when it comes to RPTs.

SEBI Circular also put forward new challenges for listed entities for ensuring absolute compliance of the revised regulatory framework for RPTs and few of the new requirements may bring concerns for NBFCs to ensure compliance. Furthermore, the disclosure requirements for RPTs under the Listing Regulations have been made more stringent and elaborative to enable enhanced public disclosure of RPTs.

[1] https://www.sebi.gov.in/media/press-releases/sep-2021/sebi-board-meeting_52976.html

[2] https://www.sebi.gov.in/legal/regulations/nov-2021/securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-sixth-amendment-regulations-2021_53851.html

[3] https://www.sebi.gov.in/legal/regulations/nov-2021/securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-sixth-amendment-regulations-2021_53851.html

[4] https://www.sebi.gov.in/legal/circulars/may-2021/format-of-compliance-report-on-corporate-governance-by-listed-entities_50338.html

Read our other articles on the subject: https://vinodkothari.com/article-corner-on-related-party-transactions/

Other Corporate Law articles: http://vinodkothari.com/corporate-laws/

Detailed analysis of the amendments in RPT framework pursuant to SEBI LODR (6th Amendment) Regulations, 2021: https://vinodkothari.com/2021/11/sebi-widens-the-sweep-of-related-party-provisions-drastically/

Article explaining the amendments in RPT framework with action points: http://vinodkothari.com/2021/11/sebi-notifies-stricter-norms-for-rpts/

Snapshot of SEBI LODR 6th Amendment Regulations 2021: https://vinodkothari.com/2021/11/snapshot-of-sebi-lodr-6th-amendment-regulations-2021/

Read our other articles on the subject: https://vinodkothari.com/article-corner-on-related-party-transactions/

Other Corporate Law articles: http://vinodkothari.com/corporate-laws/

Presentation on Amended SEBI Framework on Related Party Transactions: https://vinodkothari.com/2021/11/presentation-on-amended-sebi-framework-on-related-party-transactions/

Article explaining the amendments in RPT framework with action points: http://vinodkothari.com/2021/11/sebi-notifies-stricter-norms-for-rpts/

Snapshot of SEBI LODR 6th Amendment Regulations 2021: https://vinodkothari.com/2021/11/snapshot-of-sebi-lodr-6th-amendment-regulations-2021/

Read our other articles on the subject: https://vinodkothari.com/article-corner-on-related-party-transactions/

Other Corporate Law articles: http://vinodkothari.com/corporate-laws/

Presentation on Amended SEBI Framework on Related Party Transactions – https://vinodkothari.com/2021/11/presentation-on-amended-sebi-framework-on-related-party-transactions/

Detailed analysis of the amendments in RPT framework pursuant to SEBI LODR (6th Amendment) Regulations, 2021: https://vinodkothari.com/2021/11/sebi-widens-the-sweep-of-related-party-provisions-drastically/

Article explaining the amendments in RPT framework with action points: http://vinodkothari.com/2021/11/sebi-notifies-stricter-norms-for-rpts/

Read our other articles on the subject at https://vinodkothari.com/article-corner-on-related-party-transactions/

Other Corporate Law articles: http://vinodkothari.com/corporate-laws/

Presentation on Amended SEBI Framework on Related Party Transactions: https://vinodkothari.com/2021/11/presentation-on-amended-sebi-framework-on-related-party-transactions/

Detailed analysis of the amendments in RPT framework pursuant to SEBI LODR (6th Amendment) Regulations, 2021: https://vinodkothari.com/2021/11/sebi-widens-the-sweep-of-related-party-provisions-drastically/

Snapshot of SEBI LODR 6th Amendment Regulations 2021: https://vinodkothari.com/2021/11/snapshot-of-sebi-lodr-6th-amendment-regulations-2021/

Read our other articles on the subject: https://vinodkothari.com/article-corner-on-related-party-transactions/

Other Corporate Law articles: http://vinodkothari.com/corporate-laws/

Payal Agarwal, Executive, Vinod Kothari & Company ( payal@vinodkothari.com )

RBI has recently, vide its notification dated 23rd July, 2021 (hereinafter called the “Amendment Notification”), revised the regulatory restrictions on loans and advances given by banks to directors of other banks and the related entities. The Amendment Notification has brought changes under the Master Circular – Loans and Advances – Statutory and Other Restrictions (hereinafter called “Master Circular”). The Amendment Notification provides for increased limits in the loans and advances permissible to be given by banks to certain parties, thereby allowing the banks to take more prudent decisions in lending.

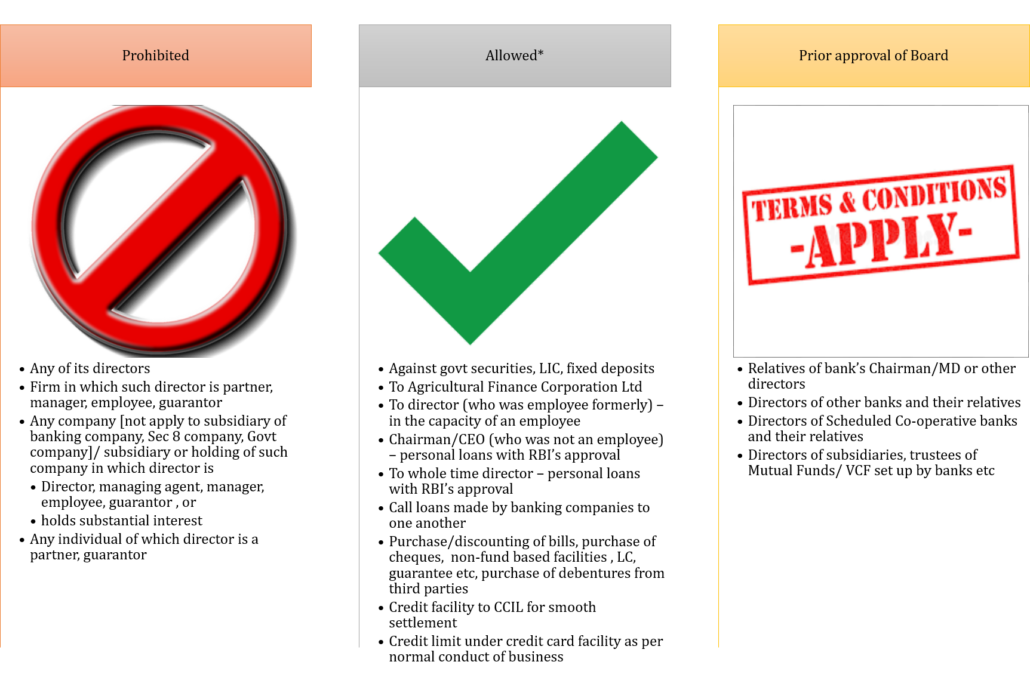

Section 20 of the Banking Regulation Act, 1949 (hereinafter called the “BR Act”) puts complete prohibition on banks from entering into any commitment for granting of loan to or on behalf of any of its directors and specified other parties in which the director is interested. The Master Circular is in furtherance of the same and specifies restrictions and prohibitions as below –

*since the same does not fall within the meaning of loans and advances for this Master Circular

The Master Circular further specifies some persons/ entities that can be given loans and advances upto a specified limit without the approval of Board, subject to disclosures in the Board’s Report of the bank. The Amendment Notification has enhanced the limits for some classes of persons specified.

| Serial No. | Category of person | Existing limits specified under Master Circular | Enhanced limits under Amendment Notification |

| 1 | Directors of other banks | Upto Rs. 25 lacs | Upto Rs. 5 crores for personal loans

(Please note that the enhancement is only in respect of personal loans and not otherwise) |

| 2 | Firm in which directors of other banks interested as partner/ guarantor | Upto Rs. 25 lacs | No change |

| 3 | Companies in which directors of other banks hold substantial interest/ is a director/ guarantor | Upto Rs. 25 lacs | No change |

| 4 | Relative(other than spouse) and minor/ dependent children of Chairman/ MD or other directors | Upto Rs. 25 lacs | Upto Rs. 5 crores |

| 5 | Relative(other than spouse) and minor/ dependent children of Chairman/ MD or other directors of other banks | Upto Rs. 25 lacs | Upto Rs. 5 crores |

| 6 | Firm in which such relatives (as specified in 4 or 5 above) are partners/ guarantors | Upto Rs. 25 lacs | Upto Rs. 5 crores |

| 7 | Companies in which relatives (as specified in 4 or 5 above) are interested as director or guarantor or holds substantial interest if he/she is a major shareholder | Upto Rs. 25 lacs | Upto Rs. 5 crores |

The Master Circular was released on 1st July, 2015, which is more than 5 years from now. Considering the inflation over time, the limits have become kind of vague and ambiguous and required to be revisited. Moreover, the population all over the world is facing hard times due to the Covid-19 outbreak. At this point of time, such relaxation can be looked upon as the need of the hour.

The Master Circular uses the term “substantial interest” to generally regulate in the context of lending to companies in which a director is substantially interested.

The relevant places where the term has been used are as below –

| Completely prohibited | Allowed with conditions | |

| Section 20(1) of the BR Act – for companies in which directors are substantially interested | Para 2.2.1.2. of Master Circular – for companies in which directors of other banks are substantially interested – upto a limit of Rs. 25 lacs without prior approval of Board

|

|

| Para 2.1.2.2. of Master Circular – for companies in which directors are substantially interested | Para 2.2.1.4. of Master Circular – for the companies in which the relatives of directors of any bank are substantially interested – upto Rs. 25 lacs without prior approval of Board | After amendment, the para stands modified as – for the companies in which the relatives of directors of any bank are major shareholders – upto Rs. 5 crores without prior approval of Board |

While the Amendment Notification itself provides for the meaning of “major shareholder”, the meaning of “substantial interest” for the purposes of the Master Circular has to be taken from Section 5(ne) of the BR Act which reads as follows –

The above definition provides for a maximum limit of shareholding as Rs. 5 lacs, exceeding which a company falls into the list of a company in which director is substantially interested. The net effect is that a lot of companies fall into the radar of this provision and therefore, ineligible to take loans or advances from banks.

However, the Amendment Notification provides an explanation to the meaning of “major shareholder” as –

“The term “major shareholder” shall mean a person holding 10% or more of the paid-up share capital or five crore rupees in paid-up shares, whichever is less.”

This eases the strict limits because of which several companies may fall outside the periphery of the aforesaid restriction. Having observed the meaning of both the terms it is clear that while ‘substantial interest’ lays down strict limits and therefore, covers several companies under the prohibition list, the term ‘major shareholder’ eases the limit and makes several companies eligible to receive loans and advances from the bank subject to requisite approvals thereby setting a more realistic criteria.

The BR Act was enacted about half a century ago when the amount of Rs. 5 lacs would have been substantial, but not at the present length of time. Keeping this in mind, while RBI has substituted the requirement of “substantial interest” to “major shareholder” in one of the clauses, the other clauses and the principal Act are still required to comply with the “substantial interest” criteria, thereby, keeping a lot of companies into the ambit of restricted/ prohibited class of companies in the matter of loans and advances from banks.

The Amendment Notification has the effect of inserting a new proviso to the extant Master Circular which specifies as below –

“Provided that a relative of a director shall also be deemed to be interested in a company, being the subsidiary or holding company, if he/she is a major shareholder or is in control of the respective holding or subsidiary company.”

This has the effect of including both holding and subsidiary company as well within the meaning of company by providing that a major shareholder of holding company is deemed to be interested in subsidiary company and vice versa.

The Amendment Notification allows the banks to lend upto Rs. 5 crores to directors of other banks provided the same is taken as personal loans. The meaning of “personal loans” has to be taken from the RBI circular on harmonisation of banking statistics which provides the meaning of personal loans as below –

Personal loans refers to loans given to individuals and consist of (a) consumer credit, (b) education loan, (c) loans given for creation/ enhancement of immovable assets (e.g., housing, etc.), and (d) loans given for investment in financial assets (shares, debentures, etc.).

Other terms used in the Amendment Notification such as “major shareholder” and “control” has also been defined. The meaning of “major shareholder” has already been discussed in the earlier part of this article. The meaning of “control” has been aligned with that under the Companies Act, 2013.

Overall, the Amendment Circular is a welcoming move by the financial market regulator. However, as pointed out in this article, several monetary limits under the BR Act have become completely incohesive and therefore, needs revision in the light of the current situation.

In our series of case studies on corporate laws, we present to you our first case study on Related Party Transactions. Readers and viewers are invited to share their views and solutions in the comment section below –

-Sikha Bansal & Megha Mittal

While in general, in order to classify a transaction as a related party transaction, one needs to first determine whether the parties involved are ‘related parties’; however, in a recent case Phoenix Arc Private Limited v. Spade Financial Services Limited & Ors.[1] (‘Ruling’), the Hon’ble Supreme Court (‘SC’) has deduced ‘relationship’ between the parties on the basis of the underlying transactions.

The SC has read the definitions of ‘financial creditor’ and ‘related party’ (in relation to the corporate debtor) under sections 5(7) and section 5(24), respectively, of Insolvency and Bankruptcy Code, 2016 (‘Code’), in light of the ‘collusive arrangements’, ‘and ‘extensive history demonstrating interrelationship’ among the parties. Broadly put, it was held that the board/directors of these companies were ‘acting’ under the pervasive influence of common set of individuals, having ‘deeply entangled’ interrelationships. Besides, the SC refused to entertain the entities as financial creditors, as the debt was merely an eye-wash, arising out of sham and collusive transactions.

Therefore, the Ruling, in a way, uses ‘smoke’ to trace if there is a ‘fire’. The presence of collusion, entangled interrelationships, etc. have been seen as indicators suggesting that the parties were in fact ‘related’ and are thus ineligible to occupy seats in the committee of creditors.

This article touches upon the significant aspects of the Ruling, including how this ‘smoke-test’ used by the SC can act as a precedent in interpreting the provisions of the Code, specifically those relating to related parties.