Group NBFCs’ assets to be aggregated for middle layer classification: RBI clarification

– Aanchal Kaur Nagpal, Manager | aanchal@vinodkothari.com

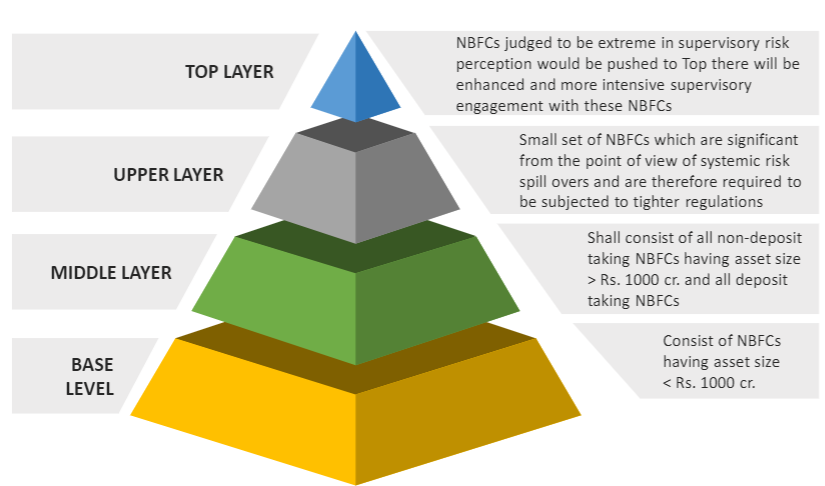

RBI vide notification dated October 11, 2022, has clarified that the assets of NBFCs forming part of a group will be aggregated for determination of the “middle layer” status of NBFCs. This clarification dates back to the 1st of October and therefore, as on the effective date of the SBR framework, NBFCs which, on a consolidated basis, have assets of Rs 1000 crores or above, will have to start adhering to the SBR framework as applicable to NBFC-ML.

Effective date

The Circular will be effective retrospectively from the date of applicability of the SBR Framework i.e. October 01, 2022.

Read more →