16 NBFCs identified as Upper Layer entities for bank-like compliances

– Anita Baid, Vice-President, VKCPL | finserv@vinodkothari.com

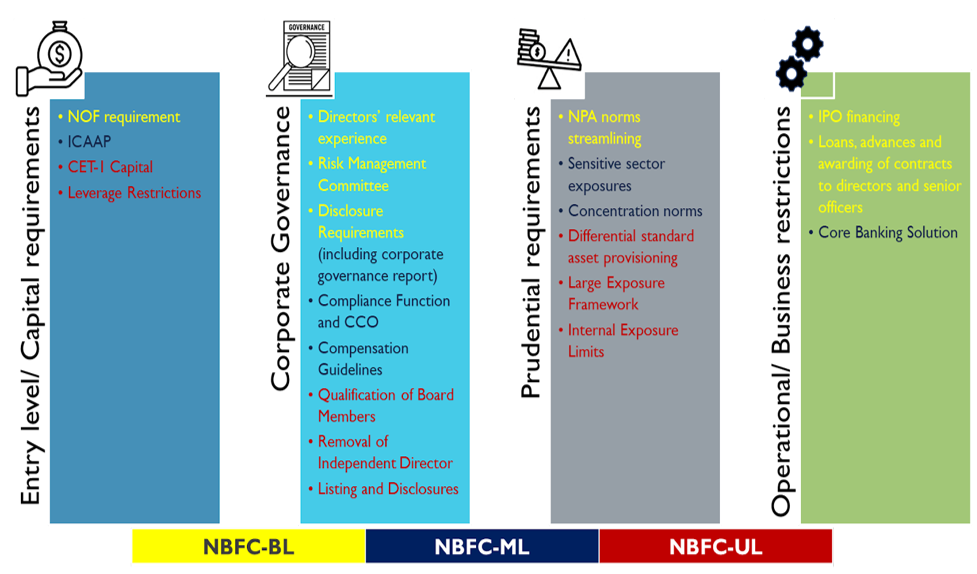

In line with the guidance given in the Scale Based Regulatory Framework of the RBI[1], the new regulatory framework is effective from October 1, 2022. Just one day before D-day, the RBI on September 30, has kickstarted the new regulatory version for NBFCs by identifying 16 of the 9472 odd NBFCs[2], as NBFCs constituting the Upper Layer. These entities have been asked to migrate to a bank-like regulatory system. The first step upon this identification would be to put in place a Board approved policy for the adoption of the enhanced regulatory framework applicable to NBFC-UL. Further, these entities will prepare a glide path of compliance within three months, i.e. by December 30, 2022 and the glide path itself will have two years of adherence time, i.e. by September 30, 2024.

| Our resources on the SBR Framework can be read here- https://vinodkothari.com/sbr/ In-house Training on SBR Framework for NBFC-ML/UL – https://vinodkothari.com/2022/09/in-house-training-on-sbr-framework-for-nbfc-ml-ul/ |

The list of 16 entities includes 5 housing finance companies, 10 investment and credit companies, and 1 CIC. Out of the 16, 5 companies are deposit-taking, and the rest are non-deposit taking. One of the 16 is a private company and around 6 companies are not equity-listed; one of them is even on the verge of getting delisted[3]. As per the SBR framework, these companies may have to go public by listing itself within 3 years.

NBFCs lying in the Upper Layer are subjected to regulations applicable to the lower level, that is NBFC-Middle Layer and NBFC-Base Layer. Hence, the additional regulations applicable on NBFC-Ml shall automatically be applicable for NBFC-UL as well, such as restriction on loans and advances to directors, senior officers, their relatives and related parties, adherence to compensation guidelines, implementation of compliance function and appointment of chief compliance officer, enhanced disclosure requirements, adoption of core financial services solution. The additionality of regulations that will be applicable to NBFC-UL only includes the following:

| Common Equity Tier 1 | NBFC-UL shall maintain Common Equity Tier 1 capital of at least 9% of Risk Weighted Assets. In this regard, it must ensure compliance with RBI circular dated 19 April, 2022 dealing with Capital requirements for NBFC-UL[4]. |

| Leverage Restrictions | In addition to CRAR, NBFC-UL shall also be subject to leverage requirements to ensure that their growth is supported by adequate capital, among other factors. A suitable ceiling for leverage is to be prescribed. Hence, the NBFCs must adhere to the leverage requirement as and when prescribed by RBI. |

| Differential standard asset provisioning | NBFC-UL shall be required to hold differential provisioning towards different classes of standard assets. The RBI has issued a circular on ‘Provisioning for Standard assets by Non-Banking Financial Company – Upper Layer’ on June 06, 2022[5]. Accordingly, it is required to follow the provisions of the said circular. |

| Large Exposure Framework | The RBI has issued the Large Exposures Framework on April 19, 2022[6]. Accordingly, Companies classified as NBFC-UL would have to adhere to the Large Exposures Framework issued by RBI. |

| Internal Exposure Limits | In addition to the limits on internal SSE exposures, the Board of the NBFC-UL shall determine internal exposure limits on other important sectors to which credit is extended. Further, NBFC-UL shall put in place an internal Board approved limit for exposure to the NBFC sector. |

| Qualification of Board Members | Board members shall be competent to manage the affairs of the NBFC. The composition of the Board should ensure mix of educational qualification and experience within the Board. Specific expertise of Board members will be a prerequisite depending on the type of business pursued by the NBFC. Accordingly, NBFC-UL should undertake a review of its Board composition to ensure the same. |

| Listing and Disclosures | NBFC-UL shall be mandatorily listed within 3 years of identification as NBFC-UL. Disclosure requirements shall be put in place on the same lines as applicable to a listed company even before the actual listing, as per Board approved policy of the NBFC. Accordingly, for those NBFC-UL that are not listed, necessary arrangements should be made for listing within the next 3 years. |

| Removal of Independent Director | NBFC-UL shall be required to report to the supervisors in case any Independent Director is removed/ resigns before completion of his normal tenure. |

[1] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12179&Mode=0

[2] According to RBI data as on January 2022

[3] As per the approved Resolution Plan, the equity shares of Piramal Capital & Housing Finance Limited are to be delisted from the stock exchanges as envisaged in the approved Resolution Plan.

[4] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12296&Mode=0

[5] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12329&Mode=0

[6] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12298&Mode=0

Leave a Reply

Want to join the discussion?Feel free to contribute!