Differential Standard Asset Provisioning for NBFC-UL

-RBI issues new guidelines on provisioning for standard assets

-Kumari Kirti | finserv@vinodkothari.com

The function of NBFCs as a supplemental route of credit intermediation alongside banks and its contribution to supporting real economic activity are well known. Within the financial sector, the NBFCs have grown significantly in terms of scale, complexity, and interconnectedness over time. Many companies have expanded to the point where they are systemically significant, necessitating the alignment of the regulatory framework for NBFCs in light of their shifting risk profile.

To address the same, RBI vide its circular dated October 22, 2021[1] has introduced Scale Based Regulation (SBR) for all NBFCs and has classified NBFCs in four layers- Base, Middle, Upper and Top layer.

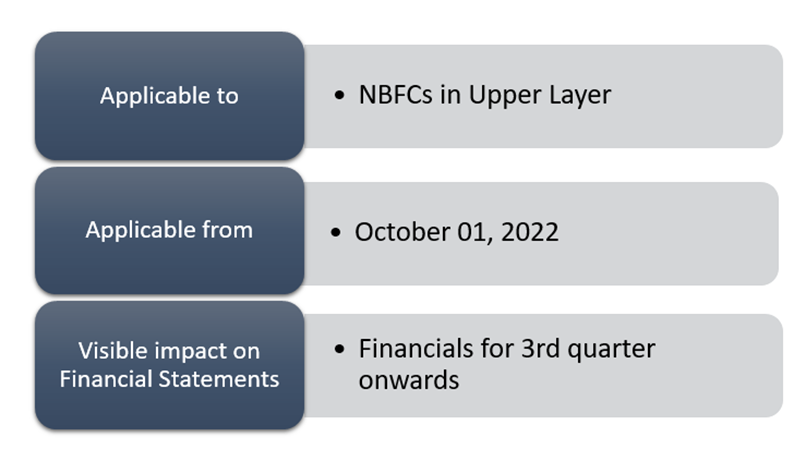

Through the said circular, RBI has directed that the NBFCs in the Upper Layer (NBFC-UL) shall be required to hold differential provisioning towards different classes of standard assets. Accordingly, RBI vide its Circular dated June 6, 2022[2], has issued guidelines on differential provisioning for NBFC-UL which shall be effective from October 01, 2022 (‘Circular’). The impact of this Circular will be visible on the quarterly financials to be prepared for the quarter ending December 2022 and onwards.

Category of Standard Assets and Provisioning Rates

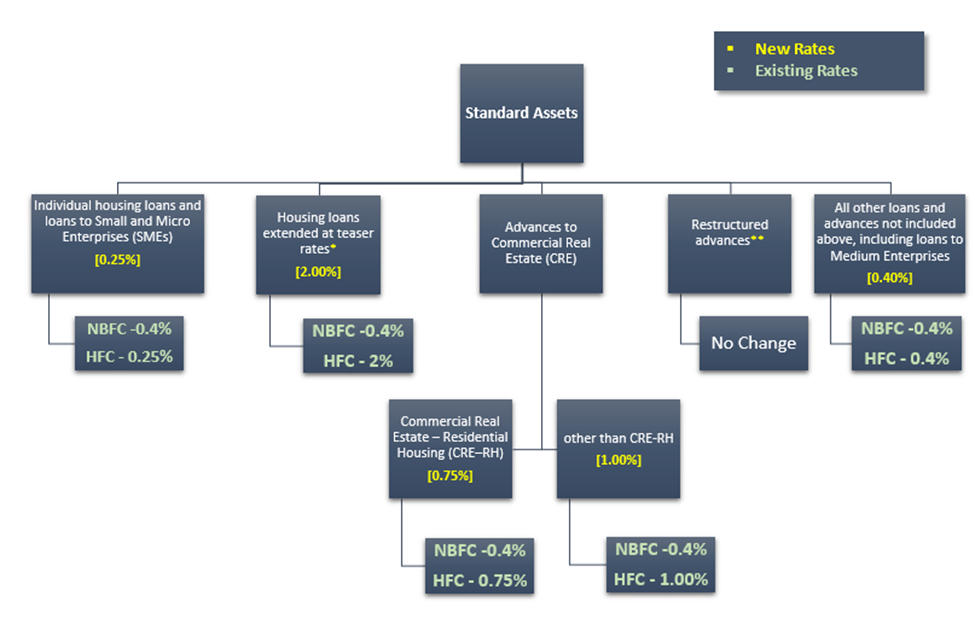

RBI vide its new Guideline has directed NBFCs-UL to make provisions on different classes of assets which are in line with regulation for banks. The provision rates have been decided based on expected credit losses in future.

Certain loan exposures pose more systemic risk on the NBFC and hence, even if the same falls under the standard asset category, the quantum of expected losses may be more for them. In respect of such loan assets like the loan to builders for real estate projects, the exposure would be sensitive to the movement in real estate prices and there is a correlation with the real estate market. Accordingly, RBI has provided for a higher rate of provision in order to set aside a buffer to absorb likely losses. In some cases like loans to small and micro units or individual housing loans, given that the default rate is lower, the provisioning requirement has also been kept at a lower rate.

However, Systemically important NBFCs are currently subject to a flat rate of 0.40% as standard asset provision. A comparison on rates of provision is provided hereunder.

With effect from October 01, 2022, the NBFC-UL will have to ensure that provisions on its different class of loan assets is being maintained at following rates:

*It will decrease to 0.40 per cent after 1 year from the date on which the rates are reset at higher rates (if the accounts remain ‘standard’)

** As stipulated in the applicable prudential norms for restructuring of advances

Note: For HFCs, the provisioning requirements have been provided in the RBI’s Master Directions for Housing Finance Companies dated February 17, 2021.[3]

For restructured assets, the prudential norms or the specific RBI notification permitting the restructuring usually provide for differential provisioning requirements- the same has been recognised as standard asset provision under the Circular as well.

Further, current credit exposures arising on account of permitted derivative transactions will be subject to the same provisioning requirements (0.40%) as the concerned counterparties’ loan assets in the ‘standard’ category.

In respect of above mentioned category of assets, RBI has provided following definitions/clarifications:

1. Micro, Small and Medium Enterprises (MSME) – The definition shall be as per the RBI’s Circular on ‘Credit flow to Micro, Small and Medium Enterprises Sector’[4]. The differential provisioning of 0.25% would be applicable only for loans to small and micro enterprises, whereas medium enterprises would continue with the extant provisioning requirement of 0.40%.

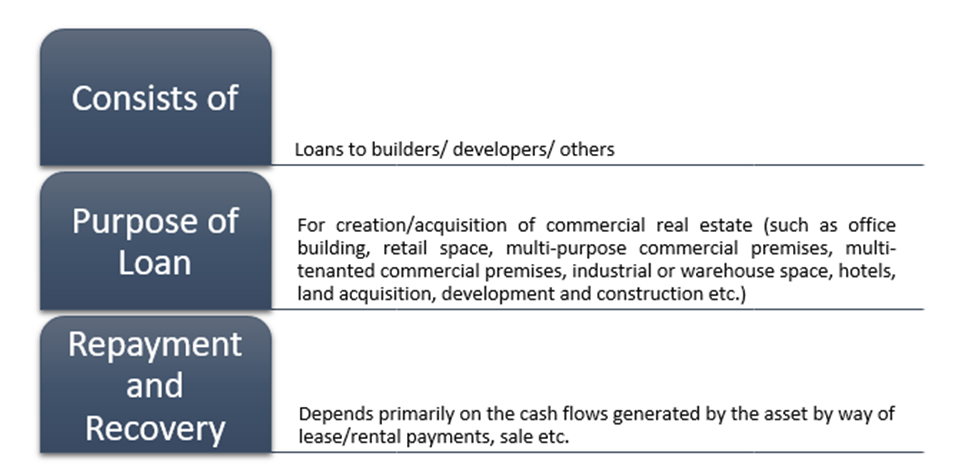

2.Commercial Real estate (CRE)

“Commercial Real Estate (CRE) would consist of loans to builders/ developers/ others for creation/acquisition of commercial real estate (such as office building, retail space, multi-purpose commercial premises, multi- tenanted commercial premises, industrial or warehouse space, hotels, land acquisition, development and construction etc.) where the prospects for repayment, or recovery in case of default, would depend primarily on the cash flows generated by the asset by way of lease/rental payments, sale etc. Further, loans for third dwelling unit onwards to an individual will be treated as CRE exposure.”

The definition can be broken down into the following components:

The CRE is further divided into 2 categories-

| Commercial Real Estate – Residential Housing (CRE–RH) | Commercial Real Estate (CRE) Sector (other than CRE-RH) |

| Loans for Residential housing projects (except for captive consumption) | Loans for Non-Residential Commercial Real Estate |

| Includes loans for Integrated housing projects comprising some commercial spaces. Condition: Commercial area for said project must not exceed 10% of the total Floor Space Index (FSI) | If the commercial area exceeds 10% of the total FSI, the entire loan will be classified in this category. |

3.Housing Loan extended at Teaser Rate – Housing loans having comparatively lower rates of interest in the first few years after which the rates of interest are reset at higher rates.

4.Current Credit Exposure – Sum of the gross positive mark-to-market value of all derivative contracts with respect to a single counterparty, without adjusting against any negative marked-to-market values of contracts with the same counterparty.

Treatment of standard asset provisioning for regulatory capital and computation of NNPA

Para 2 of RBI Circular dated March 13, 2020 on Implementation of Indian Accounting Standards states that the NBFCs with networth Rs. 250 crore and above are required to hold impairment allowance as required under Ind AS 109. Additionally, NBFCs are also required to maintain provision required under Income Recognition, Asset Classification and Provisioning (IRACP) (including standard asset provisioning).

Where impairment allowance under Ind AS 109 is lower than the provisioning required under IRACP (including standard asset provisioning), NBFCs shall appropriate the difference from their net profit or loss after tax to a separate ‘Impairment Reserve’.

The RBI in its circular dated June 06, 2022 has provided that the NBFC-UL should include the provisions in respect of standard assets in computation of the prudential floor[5]. The prudential floor is to be calculated on a cumulative basis for all the loan assets of the NFBC and hence, the standard asset provisioning shall also be included. However, the said provisions shall not be reckoned while calculating net NPAs.

Therefore, if an entity is required to create Impairment Reserve, the shall neither be reduced from the GNPAs to arrive at the NNPA, nor shall it form part of the capital (as per the 13th March 2020 circular of RBI on Implementation of Indian Accounting Standards), leading to a double whammy for the entity in question.

Conclusion

These guidelines are one of the many steps of RBI to address regulatory arbitrage available to large NBFCs having operations commensurate with that of banks. For this purpose, RBI has prescribed that NBFCs in the Upper Layer be subjected to differential standard asset provisioning which are in line with that of Banks.

[1] https://rbidocs.rbi.org.in/rdocs/notification/PDFs/NT1127AD09AD866884557BD4DEEA150ACC91A.PDF

[2] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12329&Mode=0

[3] https://rbidocs.rbi.org.in/rdocs/notification/PDFs/MD10007CE48ADE2FB4BF981444FE1349E3B71.PDF -Para 12.1

[4] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11934&Mode=0

[5] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11818&Mode=0 – Para 2

To read more articles on scale based regulations, click here.

Leave a Reply

Want to join the discussion?Feel free to contribute!