Special Liquidity Facility for Mutual Funds

/0 Comments/in Capital Markets, Financial Services, RBI /by Vinod Kothari ConsultantsBy Anita Baid (finserv@vinodkothari.com)

[Posted on April 27, 2020 and updated on April 30, 2020]

The Reserve Bank of India (RBI) has been vigilantly taking necessary measures and steps to mitigate the economic impact of Covid-19 and preserve financial stability. The capital market of our country has also been exposed to the disruption. The liquidity strains on mutual funds (MFs) has intensified for the high-risk debt MF segment due to redemption or closure of some debt MFs. This was witnessed when Franklin Templeton Mutual Fund[1] announced the winding up of six yield-oriented, managed credit funds in India, effective April 23, citing severe market dislocation and illiquidity caused by the coronavirus. Sensing the need of the hour and in order to ease the liquidity pressures on MFs, RBI has announced a special liquidity facility for Mutual Funds (SLF-MF)[2] of Rs. 50,000 crore.

Under the SLF-MF, the RBI shall conduct repo operations of 90 days tenor at the fixed repo rate. The SLF-MF is on-tap and open-ended, wherein banks shall submit their bids to avail funding on any day from Monday to Friday (excluding holidays) between 9 AM and 12.00 Noon. The scheme shall be open from April 27, 2020 till May 11, 2020 or up to utilization of the allocated amount, whichever is earlier. An LAF Repo issue will be created every day for the amount remaining under the scheme after deducting the cumulative amount availed up to the previous day from the sanctioned amount of Rs. 50,000 crores. The bidding process, settlement and reversal of SLF-MF repo would be similar to the existing system being followed in case of LAF/MSF. Further, the RBI will further review the timeline and amount, depending upon market conditions.

As per the press release, the RBI will provide funds to banks at lower rates and banks can avail funds for exclusively meeting the liquidity requirements of mutual funds in the following ways:

- extending loans, and

- undertaking outright purchase of and/or repos against the collateral of investment grade corporate bonds, commercial papers (CPs), debentures and certificates of Deposit (CDs) held by MFs.

Accordingly, the funds availed by banks from the RBI at the repo window will be used to extend loans to MFs, buy outright investment grade corporate bonds or CPs or CDs from them or extend the funds against collateral through a repo.

The RBI has further vide its notification dated April 30, 2020, extended the regulatory benefits under the SLF-MF scheme to all banks, irrespective of whether they avail funding from the RBI or deploy their own resources under the scheme. Banks meeting the liquidity requirements of MFs by any of the aforesaid methods, shall be eligible to claim all the regulatory benefits available under SLF-MF scheme without the need to avail back to back funding from the RBI under the SLF-MF.

It is important to note that in terms of regulation 44(2) of the SEBI (Mutual Funds) Regulations, 1996[3], a MF shall not borrow except to meet temporary liquidity needs of the MFs for the purpose of repurchase, redemption of units or payment of interest or dividend to the unit holders and, further, the mutual fund shall not borrow more than 20% of the net asset of the scheme and for a duration not exceeding six months.

As per the aforesaid SEBI regulations, MFs should normally meet their repurchase/redemption commitments from their own resources and resort to borrowing only to meet temporary liquidity needs. Therefore, under the SLF-MF scheme as well banks will have to be judicious in granting loans and advances to MFs only to meet their temporary liquidity needs for the purpose of repurchase/redemption of units within the ceiling of 20% of the net asset of the scheme and for a period not exceeding 6 months. While banks will decide the tenor of lending to /repo with MFs, the minimum tenor of repo with RBI will be for a period of three months.

Similar to the incentives given to the banks in case of LTRO schemes, the following shall be available for banks extending funding under the SLF-MF-

- the liquidity support availed under the SLF-MF would be eligible to be classified as held to maturity (HTM) even in excess of 25% of total investment permitted

- Exposures under this facility will not be reckoned under the Large Exposure Framework (LEF)

- The face value of securities acquired under the SLF-MF and kept in the HTM category will not be reckoned for computation of adjusted non-food bank credit (ANBC) for the purpose of determining priority sector targets/sub-targets

- Support extended to MFs under the SLF-MF shall be exempted from banks’ capital market exposure limits.

The RBI’s move is much needed to ease the liquidity stress on the MF industry. However, as has been seen in the TLRTO 2.0 auctions, banks are taking a cautious approach before using this facility provided by RBI. However, it is expected that this will ensure easing of liquidity and also boost investor sentiment.

[1] With assets worth more than Rs 86,000 crore as of the end of March, Franklin Templeton is the ninth largest mutual fund in the country

[2] https://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=49728

[3] Last updated on March 6, 2020- https://www.sebi.gov.in/legal/regulations/mar-2020/securities-and-exchange-board-of-india-mutual-funds-regulations-1996-last-amended-on-march-06-2020-_41350.html

Restructuring of debt securities not to be treated as default, clarifies SEBI

/1 Comment/in RBI, SEBI /by Vinod Kothari Consultants-Financial Services Division (finserv@vinodkothari.com)

Unprecedented crises call for unprecedented measures; the good thing is that all regulators are responding soon enough to the need for tweaking regulations, valuation rules, provisioning norms, accounting norms, and so on, to allow companies to adjust themselves to the new world that we are being ushered in.

SEBI has come up with a Circular no SEBI/HO/IMD/DF3/CIR/P/2020/70 dated 23rd April, 2020[1] (Circular), to the effect that mutual funds will not have to treat restructuring of a debt security as a case of “default”. With this, the funds have been able to avert having to make as much as 50% provision for what was deemed as a case of default.

It is notable that there have been court rulings whereby companies have evoked the “force majeure” clause to seek breather to repayment of debt securities[2].

Given the sensitiveness of the situation, this Circular has come as breather for a lot of financial sector entities, especially the ones actively engaged in securitisation, and ofcourse mutual funds. This write-up intends to first set a context to the Circular and then discuss the potential impact of the Circular.

Deemed Default in Case of Restructuring and Valuation Rules

A circular on valuation of money market and debt securities[3] issued by SEBI stated that “Any extension in the maturity of a money market or debt security shall result in the security being treated as “Default”, for the purpose of valuation”.

As per the valuation norm, mentioned above, mutual funds are required to take a haircut on the value of debt securities declared as default. In this regard, AMFI[4] has issued benchmarks for haircuts, based on which the valuation agencies are required to consider haircut as high as 50%, thereby reducing the value of the securities to half.

This circular turned out to be a major stumbling block for the mutual funds while extending the tenure of PTC transactions vis-à-vis the RBI’s moratorium on term loans in the wake of COVID 19 pandemic. The same has been discussed at length in the following section.

Restructuring of Pass Through Certificates

On March 27, 2020, the Reserve Bank of India (RBI) introduced COVID-19 Regulatory Package[5] which provided for moratorium on payment of instalments for term loans falling due between 1st March, 2020 and 31st May, 2020[6]. The moratorium has to be extended to all the loans, irrespective of whether they have been sold off by the originators by way of securitisation or direct assignment.

The moratorium as per the RBI’s framework, forced the originators to alter the payout structures originally agreed with the investors under PTC/ DA transactions, so as to pass on effect of moratorium to the investors as well. However, the problem arose when the matter was placed before mutual funds. The mutual funds are major investors in PTCs, representing approximately 43% of securitisation issuances in India[7]. The mutual funds became wary of any extension or modification in the terms of the PTCs, due to apprehensions on valuation losses due to reasons discussed earlier in this write-up.

This created a deadlock between the originators and mutual funds (as investors). On one hand, there was a pressure on the originators to extend moratorium across all the borrowers, on the other hand, the mutual funds were apprehensive in accepting the revised terms due to a potential valuation loss.[8]

Considering the situation, the SEBI issued the Circular to address the issues with respect to valuation of debt securities.

Restructuring of Debentures

Restructuring by deferral of the maturity is something that may be done in case of debentures as well. Debentures may have been (a) private placed; or (b) publicly offered. The former is the more common route for mutual funds to invest.

Any change in the terms of issue amounts to modification of rights of debenture-holders. There is no provision under the Companies Act or SEBI regulations dealing with modification of rights of debenture-holders. Therefore, such modification can be done subject to and in accordance with the terms of issue.

Typically, in case of private placement, the consent of debenture-holders, either directly or through the debenture trustees, is required to be obtained. On the part of the Company, the power to modify the terms usually reside with the Board of Directors or are delegated by the Board to a Committee or a person or persons.

In case of publicly offered debentures, in addition to obtaining the above mentioned consent, compliance with provisions of SEBI LODR Regulations is also required to be ensured.

How can Debenture Issuers Make Use of the SEBI Circular?

- The restructuring must be solely on account of the COVID crisis. It should be possible to demonstrate that the asset pool or ALM arrangement, but for the impact of the crisis, was adequate enough to take care of the scheduled maturity of the bond.

- It should be possible to demonstrate that the underlying asset cover still remains healthy, and conditions such as asset cover etc. are benign complied with.

- The necessary formalities of obtaining required consents must have been done.

If these conditions are fulfilled, a bond issuer may be able to get the consent of the investors without the investors having to provide deep haircuts on account of a deemed default.

Specific Provisions of the Circular

- An extension of term of a security would not be considered as a default only when the valuation agency is of a view that such delay in payment or extension of maturity has arisen solely due to COVID-19 pandemic lockdown and/or in light of the moratorium permitted by the RBI.

- In case of difference in the valuation of securities provided by two valuation agencies, the conservative valuation i.e. the lower of the two values shall be accepted.

- The relief from attraction of provision of default shall be limited to the period the moratorium is in operation.

- AMCs shall continue to be responsible for true and fairness of valuation of securities.

Conclusion

Due to the obvious outcome of reduction in value of the assets, the mutual funds, as investors of debentures or PTCs, had been rejecting the proposals of issuers/originators/servicers as the case maybe with respect grant of moratorium to the borrowers. Mostly the Mutual Funds which are major investors in PTCs have been denying the grant of moratorium benefit to the borrowers owing to the reduction in value of AUM that would follow. With introduction of this Circular, the problem of taking deep haircuts on the value on account of deemed default stand resolved.

Mutual Funds are now expected to give a green signal on grant of moratorium by lenders. This would help to finally meet the objective of providing relief to the country at the time of the current crisis.

[1] https://www.sebi.gov.in/legal/circulars/apr-2020/review-of-provisions-of-the-circular-dated-september-24-2019-issued-under-sebi-mutual-funds-regulations-1996-due-to-the-covid-19-pandemic-and-moratorium-permitted-by-rbi_46549.html

[2] Our write-up dealing with Force Majeure clauses in agreements may be referred here: http://vinodkothari.com/2020/03/covid-19-and-the-shut-down-the-impact-of-force-majeure/

[3] https://www.sebi.gov.in/legal/circulars/sep-2019/valuation-of-money-market-and-debt-securities_44383.html

[4] https://docs.utimf.com/v1/AUTH_5b9dd00b-8132-4a21-a800-711111810cee/UTIContainer/Standard%20Hair%20Cut%20matrix__AMFI20190606-110846.pdf

[5] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11835&Mode=0

[6] Our detailed FAQs relating to the moratorium may be viewed here: http://vinodkothari.com/2020/03/moratorium-on-loans-due-to-covid-19-disruption/

[7] http://vinodkothari.com/2020/01/shadow-banking-in-india/

[8] Issue discussed at length in a virtual conference organised by Indian Securitisation Foundation: Agenda and minutes may be referred on the following links:

http://vinodkothari.com/2020/04/virtual-conference-on-impact-of-rbis-moratorium-on-ptc-transactions/

http://vinodkothari.com/2020/04/minutes-of-the-isf-virtual-conference/

Introduction to Commercial Paper

/0 Comments/in Financial Services, RBI /by Vinod Kothari ConsultantsThe Great Lockdown: Standstill on asset classification

/0 Comments/in Covid-19, Financial Services, Financial services/ NBFCs/Fin-tech - Covid-19, RBI, UPDATES /by Vinod Kothari Consultants– RBI Governor’s Statement settles an unwarranted confusion

Timothy Lopes, Executive, Vinod Kothari Consultants

Background

In the wake of the disruption caused by the global pandemic, now pitted against the Great Depression of 1930s and hence called The Great Lockdown[1], several countries have taken measures to try and provide stimulus packages to mitigate the impact of COVID-19[2]. Several countries, including India, provided or permitted financial institutions to grant ‘moratorium’, ‘loan modification’ or ‘forbearance’ on scheduled payments of their loan obligations being impacted by the financial hardship caused by the pandemic.

The RBI had announced the COVID-19 Regulatory Package[3] on 27th March, 2020. This package permitted banks and other financial institutions to grant moratorium up to 3 months beginning from 1st March, 2020. We have covered this elaborately in form of FAQs.[4]

However, there was ambiguity on the ageing provisions during the period of moratorium. That is to say, if an account had a default on 29th February, 2020, whether the said account would continue to age in terms of days past due (DPD) as being in default even during the period of moratorium. Our view was strongly that a moratorium on current payment obligation, while at the same time expecting the borrower to continue to service past obligations, was completely illogical. Such a view also came from a judicial proceeding in the case of Anant Raj Limited Vs. Yes Bank Limited dated April 6, 2020[5]

However, the RBI seems to have had a view, stated in a mail addressed to the IBA, that the moratorium did not affect past obligations of the customer. Hence, if the account was in default as on 1st March, the DPD will continue to increase if the payments are not cleared during the moratorium period.

Would the doses of TLTRO really nurse the financial sector?

/0 Comments/in NBFCs, RBI /by Vinod Kothari Consultants-Kanakprabha Jethani | Executive

Vinod Kothari Consultants P. Ltd

Background

In response to the liquidity crisis caused by the covid-19 pandemic, the Reserve Bank of India (RBI) through a Press Release Dated April 03, 2020[1] announced its third Targeted Long Term Repo Operation (TLTRO). This issue is a part of a plan of the RBI to inject funds of Rs. 1 lakh crores in the Indian economy. Under the said plan, two tranches of LTROs of Rs. 25 thousand crores each have already been undertaken in the months of February[2] and March[3] respectively. This move is expected to restore liquidity in the financial market, that too at relatively cheaper rates.

The following write-up intends to provide an understanding of what TLTRO is, how it is supposed to enhance liquidity and provide relief, who can derive benefits out of it and what will be its impact. This article further views TLTROs from NBFCs’ glasses to see if they, being financial institutions, which more outreach than banks, avail benefit from this operation.

Meaning

LTRO is basically a tool to provide funds to banks. The funds can be obtained for a tenure ranging from 1 year to 3 years, at an interest rate equal to one day repo. Government securities with matching or higher tenure, would serve as a collateral. Usually, the interest rate of one day repo is lower than that of other short term loans. Thus, banks can avail cheaper finance from the RBI.

Banks will have to invest the amount borrowed under TLTROs in fresh acquisition of securities from primary or secondary market (Specified Securities) and the same shall not be used with respect to existing investments of the bank.

In the current LTRO, the RBI has directed that atleast 50% of the funds availed by the bank have to be invested in investment grade corporate bonds, commercial papers and debentures in the secondary market and not more than 50% in the primary market.

Why were the existing measures not enough?

Ever since the IL&FS crisis broke the liquidity supply chain in the economy, the RBI has been consistently putting efforts to bring back the liquidity in the financial system. For almost a year, the RBI kept cutting the repo rate, hoping the cut in repo rates increases banks’ lending power and at the same time reduces the interest rate charged by them from the customers. Despite huge cuts in repo rates, the desired results were not visible because the cut in repo rates enhanced banks’ coincide power by a nominal amount only.

Another reason for failure of repo rate cuts, as a strategy to reduce lending rates, was that repo rate is one of the factors determining the lending rate. However, it is not all. Reduction in repo rates did affect the lending rate, but the effect was overpowered by other factors (such as increased cost of funds from third party sources) and thus, the banks’ lending rates did not reduce actually.

Further, various facilities have been introduced by the RBI to enhance liquidity in the system through Liquidity Adjustment Facility (LAF) which includes repo agreements, reverse repo agreements, Marginal Standing Facility (MSF), term repos etc.

- Under LAF, banks can either avail funds (through a repurchase agreement, overnight or term repos) or extend loans to the RBI (through reverse repo agreements). Other than providing funds in the time of need, it also allows the banks to safe-keep excess funds with the RBI for short term and earn interest on the same.

- Under MSF (which is a new window under LAF), banks are allowed to draw overnight funds from the RBI against collateral in the form of government securities. The rate is usually 100 bps above the repo rate. The amount of borrowing is limited to 1% of Net demand and Term Liabilities (NDTL).

- In case of term repos, funds can be availed for 1 to 13 days, at a variable rate, which is usually higher than the repo rate. Further, the funds that can be withdrawn under such facility shall be limited to 0.75% of NDTL of the bank.

Although these measures do introduce liquidity to the financial system, they do not provide banks with ‘durable liquidity’ to provide a seamless asset-liability match, based on maturity. On the other hand, having funds in hand for a year to 3 years definitely is a measure to make the maturity based assets and liabilities agree. Thus, giving banks the confidence to lend further to the market.

Bits and pieces to be taken care of

The TLTRO transactions shall be undertaken in line with the operating guidelines issued by the RBI through a circular on Long Term Repo Operations (LTROs)[4]. A few points to be taken care of are as follows:

- The RBI conducts auctions (through e-Kuber platform) for extending such facility. Banks have to bid for obtaining funds from such facility. The minimum bid is to be of Rs. 1 crore and the allotment shall be in multiples of Rs. 1 crore.

- The investment in Specified Securities is to be mandatorily made within 30 days of availment of funds. In case the bank fails to deploy funds availed under TLTRO within 30 days, an incremental interest of repo rate plus 200 basis points shall be chargeable, in addition to normal interest, for the period the funds remain un-deployed.

- The banks will have to maintain the amount of specified securities in its Hold-to-Maturity (HTM) portfolio till the maturity of TLTRO i.e. such securities cannot be sold by banks until the term of TLTRO expires. Further, in case bank intends to hold the Specified Securities after the term of TLTRO expires, the same shall be allowed to be held in banks’ HTM portfolio.

Impact

The TLTRO operation of the RBI is expected to bring about a relief to the financial sector. The LTRO auctions conducted recently received bids amounting to several times the auction amount. Thus, a clear case of extreme demand for funds by banks can be seen. Although, the recent auctions are yet to reap their fruits, the major benefits that may arise from this operation are as follows:

- The liquidity in the banking system will get increased. Resultantly, the banks’ lending power would increase. Thus, injecting liquidity into the entire economy.

- Since, the marginal cost of funds of the banks will be based on one-day repo transactions’ rate, the same shall be lower as compared to other funding options of similar maturity. A reduced cost of funds for the banks will compel banks to lend at lower rates. Thus, making the short-term lending cheaper.

The picture from NBFCs’ glasses

Barely out of the IL&FS storm, the shadow bankers had not even adjusted their sails and were hit by another crisis caused by the covid-19 disruption. While the RBI is introducing measures for these lenders to cope with the crisis such as moratorium on repayment instalments[5], stay on asset reclassification based on the moratorium provided etc. The liquidity concerns of NBFCs remain untouched by these measures.

Word has it, the TLTRO is expected to restore liquidity in the financial system. Only banks can bid under LTRO auctions and avail funds from the RBI. This being said, let us look at how an NBFC would fetch liquidity from this.

Banks would use the funds availed under TLTRO transactions to invest in Specified Securities of various entities. Let us assume a bank avails funds of Rs. 1 crore under LTRO. Out of the funds availed, the bank decides to invest 50% in Specified Securities of companies in non-financial sector and 50% in entities in financial sector. Assuming that the entire 50% portion is invested in Specified Securities of 20 NBFCs equally. Each NBFC gets 2.5% of the funding availed by the Bank.

In the primary market

For the purchase of Specified Securities through primary market, the question of prime importance is whether it is feasible for an NBFC to come up with a fresh issue in the current scenario of lockdown. It is not feasible for an NBFC to plan an issue, obtain a credit rating, and get done with all other formalities within a period of 30 days. Thus, the option of fresh issue would generally be ruled out. Primary issues in pipeline may get banks as their investors. However, existence of such issues in pipeline are very low at present.

If an NBFC decides to go for private placement and gets it done within a span of say around a week, it can succeed in getting fresh liquidity for its operations. However, looking at the bigger picture, the restriction of investing only in investment grade securities bars the banks from investing in NBFCs which have lower rating i.e. usually the smaller NBFCs (more in number though). So the benefit of the scheme gets limited to a small number of NBFCs only. Thus, the motive of making liquidity reach the masses gets squashed.

In the secondary market

Above was just a hypothetical example to demonstrate that only a fraction of funds given out under LTRO would actually be used to bring back liquidity to the stagnant NBFC sector. It is important to note here that the liquidity is being brought back through purchase of securities from the secondary market, which does not result in introduction of any additional money to the NBFCs for their operations.

The liquidity enhancement in secondary market would also be limited to Specified Securities of investment grade. Thus, as already discussed, only the bigger size NBFCs would get the benefit of liquidity restoration.

Conclusion

The TLTRO is a measure introduced by the RBI to enhance liquidity in the system. Although it provides banks with liquidity, the restrictions on the use of availed funds bar the banks to further pass on the liquidity benefit. As for NBFCs, the benefit is limited to making the securities of the NBFCs liquid and the introduction of fresh liquidity to the NBFC is likely to be minimal.

Further, the benefit is also likely to be limited to bigger NBFCs, destroying the motive of making liquidity reach to the masses. A few enhancements to the existing LTRO scheme, such as directing the banks to ensure that the investment is not concentrated in a few destinations or prescribing concentration norms might result in expanding liquidity reach to some extent and would create a chain of supply of funds that would reach the masses through the outreach of such financial institutions.

News Update:

The RBI Governor in his statement on April 17, 2020[6], addressed the problem of narrow outreach of liquidity injected through TLTRO and announced that the upcoming TLTRO (TLTRO 2.0) would come with a specification that the proceeds are to be invested in investment grade bonds, commercial paper, and non-convertible debentures of NBFCs only, with at least 50 per cent of the total amount availed going to small and mid-sized NBFCs and MFIs. This is likely to ensure that a major portion of the investments go to the small and mid-sized NBFCs, thus expanding the liquidity outreach.

[1] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=49628

[2] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=49360

[3] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=49583

[4] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=49360

[5] Our detailed FAQs on moratorium on loans due to Covid-19 disruption may be referred here: http://vinodkothari.com/2020/03/moratorium-on-loans-due-to-covid-19-disruption/

[6] https://rbidocs.rbi.org.in/rdocs/Content/PDFs/GOVERNORSTATEMENTF22E618703AE48A4B2F6EC4A8003F88D.PDF

Our write-up on stay on asset classification due to covid-19 may be referred here: http://vinodkothari.com/2020/04/the-great-lockdown-standstill-on-asset-classification/

Our other write-ups on NBFCs may be referred here: http://vinodkothari.com/nbfcs/

RBI granted moratorium on term loans: Impact on securitisation and direct assignment transactions

/1 Comment/in Financial Services, Financial services/ NBFCs/Fin-tech - Covid-19, RBI, Securitisation /by Vinod Kothari ConsultantsAbhirup Ghosh

In response to the stress caused due to the pandemic COVID-19, the regulatory authorities around the world have been coming out relaxations and bailout packages. Reserve Bank of India, being the apex financial institution of the country, came out a flurry of measures as a part of its Seventh Bi-Monthly Policy[1][2], to tackle the crisis in hand.

One of the measure, which aims to pass on immediate relief to the borrowers, is extension of moratorium on term loans extended by banks and financial institutions. We have in a separate write-up[3] discussed the impact of this measure, however, in this write-up we have tried to examine its impact on the securitisation and direct assignment transactions.

Securitisation and direct assignment transactions have been happening extensively since the liquidity crisis after the failure of ILFS and DHFL, as it allowed the investors to take exposure on the underlying assets, without having to take any direct exposure on the financial intermediaries (NBFCs and HFCs). However, this measure has opened up various ambiguities in the structured finance industry regarding the fate of the securitisation or direct assignment transactions in light of this measure.

Originators’ right to extend moratorium

The originators, will be expected to extend this moratorium to the borrowers, even for the cases which have been sold the under securitisation. The question is, do they have sufficient right to extend moratorium in the first place? The answer is no. The moment an originator sells off the assets, all its rights over the assets stands relinquished. However, after the sale, it assumes the role of a servicer. Legally, a servicer does not have any right to confer any relaxation of the terms to the borrowers or restructure the facility.

Therefore, if at all the originator/ servicer wishes to extend moratorium to the borrowers, it will have to first seek the consent of the investors or the trustees to the transaction, depending upon the terms of the assignment agreement.

On the other hand, in case of the direct assignment transactions, the originators retain only 10% of the cash flows. The question here is, will the originator, with 10% share, be able to grant moratorium? The answer again is no. With just 10% share in the cash flows, the originator cannot alone grant moratorium, approval of the assignee has to be obtained.

Investors’ rights

As discussed above, extension of moratorium in case of account sold under direct assignment or securitisation transactions, will be possible only with the consent of the investors. Once the approval is placed, what will happen to the transactions, as very clearly there will be a deferral of cash flows for a period of 3 months? Will this lead to a deterioration in the quality of the securitised paper, ultimately leading to a rating downgrade? Will this lead to the accounts being classified as NPAs in the books of the assignee, in case of direct assignment transactions?

Before discussing this question, it is important to understand that the intention behind this measure is to extend relief to the end borrowers from the financial stress due to this on-going pandemic. The relief is not being granted in light of any credit weakness in the accounts. In a securitisation or a direct assignment, the transaction mirrors the quality of the underlying pool. If the credit quality of the loans remain intact, then there is no question of the securitisation or the direct assignment transaction going bad. Similarly, we do not see any reason for rating downgrade as well.

The next question that arises here is: what about the loss of interest due to the deferment of cash flows? The RBI’s notification states that the financial institutions may provide a moratorium of 3 months, which basically means a payment holiday. This, however, does not mean that the interest accrual will also be suspended during this period. As per our understanding, despite the payment suspension, the lenders will still be accruing the interest on the loans during these 3 months – which will be either collected from the borrower towards the end of the transaction or by re-computing the EMIs. If the lenders adopt such practices, then it should also pass on the benefits to the investors, and the expected cash flows of the PTCs or under the direct assignment transactions should also be recomputed and rescheduled so as to compensate the investors for the losses due to deferment of cash flows.

Another question that arises is – can the investors or the trustee in a securitisation transaction, instead of agreeing to a rescheduling of cash flows, use the credit enhancement to recover the dues during this period? Here it is important to note that credit enhancements are utilised usually when there is a shortfall due to credit weakness of the underlying borrower(s). Using credit enhancements in this case, will reduce the extent of support, weaken the structure of the transaction and may lead to rating downgrade. Therefore, this is not advisable.

We were to imagine an extreme situation – can the investors force the originators to buy back the PTCs or the pool from the assignee, in case of a direct assignment transaction? In case of securitisation transactions, there are special guidelines for exercise of clean up calls on PTCs by the originators, therefore, such a situation will have to be examined in light of the applicable provisions of Securitisation Guidelines. For any other cases, including direct assignment transactions, such a situation could lead up to a larger question on whether the original transaction was itself a true sale or not, because, a buy-back of the pool, defies the basic principles of true sale. Hence, this is not advisable.

[1]https://rbidocs.rbi.org.in/rdocs/Content/PDFs/GOVERNORSTATEMENT5DDD70F6A35D4D70B49174897BE39D9F.PDF

[2] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11835&Mode=0

[3] http://vinodkothari.com/2020/03/moratorium-on-loans-due-to-covid-19-disruption/

Moratorium on loans due to Covid-19 disruption

/65 Comments/in Covid-19, Financial services/ NBFCs/Fin-tech - Covid-19, NBFCs, RBI, Securitisation /by Vinod Kothari ConsultantsTeam Financial Services, Vinod Kothari Consultants P Ltd.

This version dated 14th April, 2020. We shall continue to develop this further based on the text of notification and the clarifications, if any, issued by the RBI.

We are also gratefully obliged to see that the page has received attention and comments from several borrowers. We submit, humbly, that the page is primarily for guidance of lenders.]

To address the stress in the financial sector caused by COVID-19, several measures have been taken by the RBI as a part of its Seventh Bi-monthly Policy[1]. Further, the RBI has come up with a Notification titled COVID 19 package[2]. These measures are intended to mitigate the burden on debt-servicing caused due to disruptions on account of COVID-19 pandemic. These measures include moratorium on term loans, deferring interest payments on working capital and easing of working capital financing. We have tried to provide our analysis of the measures taken by RBI in form of the following FAQs.

Further, in this regard the Ministry of Finance has also issued FAQs on RBI’s scheme for a 3-month moratorium on loan repayment.

Legal/contractual nature of the Moratorium

1. Has the RBI granted a compulsory moratorium?

No, the lending institutions have been permitted to allow a moratorium of three months. This is a relaxation offered by RBI to the lending institutions. Neither is it a guidance by the RBI to the lenders, nor is it a leeway granted by the RBI to the borrowers to delay or defer the repayment of the loans. Hence, the moratorium will actually have to be granted by the lending institution to the borrowers. The RBI has simply permitted the lenders to grant such moratorium.

2. Who are the lending institutions covered by the moratorium requirement?

All commercial banks (including regional rural banks, small finance banks and local area banks), co-operative banks, all-India Financial Institutions, and NBFCs (including housing finance companies and micro-finance institutions) have been permitted to allow the moratorium relaxation to its borrowers.

3A. Is this the first time such a moratorium or relaxation has been granted by the RBI?

During the demonetisation phase in November 2016, a 60 day relaxation was offered to small borrowers accounts for recognition of an asset as sub-standard. Our detailed analysis on the same can be viewed here- http://vinodkothari.com/wp-content/uploads/2017/03/Interpreting_the_2_months_relaxation_for_asset_classification.pdf

3B. Has there been similar relaxation provided by other jurisdictions across the globe?

India is not the only country to grant a moratorium during this time of crisis. Several other countries have granted a moratorium in varying terms. A table showing the details of moratoriums granted globally may be read here http://vinodkothari.com/2020/04/the-great-lockdown-standstill-on-asset-classification/

4. What is meant by moratorium on term loan?

Moratorium is a sort of granting of a ’holiday’- it is a repayment holiday where the borrower is granted an option to not pay during the moratorium period. It is a restructuring of the terms of the loan with the mutual consent of the lender and the borrower. The consent of the lender will be in the form the lender’s circular or notice – see below. The consent of the borrower may be obtained by a “deemed consent unless declined” option.

For example, in case the instalment falls due on April 01, 2020, and the lender has granted a moratorium of 3 months from a specific date, say April 1, 2020, then the revised due date for repayment shall be July 1, 2020.

Scope and implementation of the moratorium

5. From what date can the moratorium be granted?

The lenders are permitted to grant a moratorium of three months on payment of all instalments falling due between March 1, 2020 and May 31, 2020. The intention is to shift the repayment dates by three months. Therefore, the moratorium should start from the due date, falling immediately after 1st March, 2020, against which the payment has not been made by the borrower.

For example, if an instalment was due on 15th March, 2020, but has remained unpaid so far, the lender can impose the moratorium from 15th March, 2020 and in that case, revised due date shall be 15th June, 2020

6. Will the moratorium be applicable in case of new loans sanctioned after March 1, 2020 during the lockdown period?

Technically, new loans sanctioned after March 1, 2020 are not covered under the press release since it mentioned about loans outstanding as on March 1, 2020. However, based on the RBI circular it can be inferred that the Lending Institution may at its own discretion extend the benefit to such borrowers in case the loan instalments of such new loans are falling due between March 1, 2020 and May 31, 2020.

7. Is the moratorium on principal or interest or both?

The repayment schedule and all subsequent due dates, as also the tenor for loans may be shifted by three months (or the period of moratorium granted by the lending institution). Instalments will include payments falling due from March 1, 2020 to May 31, 2020 in the form of-

(i) principal and/or interest components;

(ii) bullet repayments;

(iii) Equated Monthly instalments;

(iv) credit card dues.

8A. What shall be the moratorium period?

Lending Institutions may use their discretion to allow a moratorium of upto three months. It is not necessary to provide a compulsory moratorium of three months- it can be less than three months as well. Practically, we envisage that all lenders shall grant a moratorium to all borrowers across board for 3 months.

However, a moratorium beyond three months shall be considered as restructuring of loan.

8B. Can NBFCs grant extensions for loans where the last EMI falls due after May 31st?

9. Reading the language of the RBI Notification strictly, it says: “lending institutions” are permitted to grant a moratorium of three months on payment of all instalments1 falling due between March 1, 2020 and May 31, 2020. [Para 2]. The notification nowhere refers to the payments which had already fallen due before March 1. Therefore, will those payments continue to age during the moratorium period? For example, will something which is 30 DPD will become 120 DPD?

As per the contents of the letter dated March 31, 2020 written by RBI to IBA, any amount which was overdue on 29th Feb, 2020, there is no moratorium with respect to those amounts, and therefore, the existing IRAC norms will continue to apply. The RBI contends that there was no disruption in February, and therefore, one cannot bring disruption as the basis for not paying what had fallen due before March 1.

However, in our view, such an interpretation will be completely counter-intuitive. The whole intent behind the moratorium is the disruption in the system due to an externality. If the borrower had an instalment which was 30 days past due on 1st March, it cannot be contended that he will have difficulty in paying his current dues but will have no difficulty in paying what had already become due. But for the systemic disruption, it could well have been that the borrower would have cleared all his dues.

The meaning of the moratorium is that payments do not fall due during the period of the moratorium – whether current or past. Therefore, the moratorium period cannot result into ageing of the past dues. Of course, if the past dues are an overdue rate, the overdue rate may continue. But for the purpose of counting DPD, the moratorium period will have to be excluded.

Taking any other interpretation will frustrate the very purpose of the moratorium. By rules of appropriation, whatever the borrower pays between March 1 and May 31 would have first gone towards clearing his overdues. Hence, a moratorium on the current dues should apply to the existing dues as well.

There has been a ruling of the Delhi High court in Anantraj Limited vs Yes Bank order dated 6th April, 2020 in response to a writ petition, where the court has also stated that there will be no transformation of a standard account into an NPA, since before an account becomes an NPA, it has to pass through SMA 1 and SMA 2, and as per RBI’s own admission, there will be no downgradation of the status due to the moratorium. In essence, the Delhi High court seems to be holding the same view as expressed by us above. Our analysis of the judgement can be read here- http://vinodkothari.com/2020/04/moratorium-on-asset-classification-of-past-due-accounts/

10. How will the moratorium impact the existing loan tenure?

In case a moratorium is granted, the RBI circular states that the repayment schedule for such loans as also the residual tenure, will be shifted across by three months after the moratorium period.

However, in certain cases of long tenure loans (say, home loans), the additional burden on the borrower due to the accrued interest (and interest on such interest) would cause the amount to swell so much that paying the accumulated interest in one go may not be feasible. This may require the lender to convert the accrued interest also into instalments. Converting such accrued interest into manageable instalments is the lender’s prudential call, and should not be taken as a case of restructuring, since the total tenure is going beyond 3 months over the original term.

11. Will the interest accrue during the moratorium period?

Yes, the moratorium is a ‘payment holiday’ however, the interest will definitely accrue. The accrual will not stop.

12. Will there be delayed payment charges for the missing instalments during the moratorium period?

Overdue interest is charged in case of default in payment. However, during the moratorium, the payment itself is contractually stopped. If there is no payment due, there is no question of a default. Therefore, there will be no overdue interest or delayed payment charges to be levied.

13. Which all loans shall be considered eligible for the relaxation?

All term loans outstanding as on March 1, 2020 are eligible to claim the relaxation. Also, there may be a deferment of interest in case of working capital facilities sanctioned in the form of cash credit/overdraft and outstanding as on March 1, 2020.

14. Is the moratorium applicable to the following:

(a) Personal loans

The moratorium is applicable to all term loans and working capital facilities (refer para 5 and 6 of the Statement on Developmental and Regulatory Policies). Therefore, the lender may extend the benefit of the moratorium or deferment of interest to lending facilities in the nature of term loans as well as revolving lines of credit, a.k.a. working capital facilities, as the case may be.

(b) Overdraft facilities

Overdraft facilities allow the account-holder to withdraw more money than what is held in the account. It is a kind of short-term loan facility, which the account-holder shall be required to repay within a specified period of time or at once, depending on the terms of arrangement with the bank. Thus, in case repayment is to be made within a specified tenure , the same qualifies to be term-loan and moratorium shall be applicable on EMIs of such overdraft facility.

(c) An unsecured personal loan extended by a lender through prepaid cards for making payments at partner merchant PoS

Such unsecured personal loans may be repayable in the form of EMIs or a bullet repayment. As discussed above, if repayment is made over a period of time, moratorium is applicable. In case of bullet repayments as well, moratorium may be granted.

(d) Invoice financing

Invoice financing can be of 2 types- (a) Factoring and (b) Asset-based invoice financing.

In case of factoring, the factor purchases the receivables of an entity and pays the amount of receivables reduced by a certain percentage (factoring fee) to the entity. Thereafter, the factor is responsible to recover the money from the debtor of such entity. There is no moratorium in case of commercial invoices.

Another device commonly used is invoice financing i.e. asset-based invoice financing, which allows a vendor to avail a credit facility against the security of receivables. Since the underlying here is the commercial receivable, for which there is no moratorium, the same is not covered by the moratorium as being discussed.

(e) Payday loans

Payday loans are unsecured personal credit facilities obtained by salaried individuals against their upcoming pay-cheques. The amount of such facilities is usually limited to a certain part of the borrower’s upcoming salary.

In case of such loans, the repayment term, though very short, is pre-determined and is payable from out of the salary of the individual. As there is no deferral of salary payments, we are of the view that there is no case of disruption here.

(f) Loan against turnover

These loans are extended by the lenders on the basis of expected turnover of a merchant, mostly on e-commerce websites. The intent is to finance the day-to-day business needs of the borrower in order to attain the expected turnover. Thus, such loans are essentially working capital loans. As already discussed, moratorium may be allowed on working capital loans.

(g) Long-term loans

These kinds of loans have a pre-specified term, which is usually greater than 3 years. Needless, to say, being term loans, moratorium shall be allowed on such loans. Such loans are usually secured and may cover the following kinds of loans:

- Housing loans

- Equipment finance loans

- Personal loans

- Two-wheeler loans

- Auto-finance loans

(h) Gold loans

The applicability of the Notification to gold loans is quite interesting. Most gold loans have a bullet repayment term. In addition, some gold loans induce a customer to make payment of interest on a regular basis, and offer a concessional rate of interest should the customer pay interest on a regular basis. The following situations may explain the applicability of the Notification to gold loans:

- If the bullet repayment is due during the Moratorium period, the loan will be eligible for the moratorium, and the borrower may make the bullet repayment at the end of the moratorium period.

- If the bullet repayment is due after the Moratorium period, the moratorium has no impact on the loan. There is no question of any extension of the loan term, as there were no payments due during the disruption period.

- If there is interest payment during the moratorium period, and the customer has opted for the same, the customer will get holiday from the interest payment during the moratorium period, and the customer will still be eligible for the lower rate of interest.

15. How will the moratorium be effective in case of working capital facilities?

The working capital facilities have been allowed a deferment of three months on payment of interest in respect of all such facilities outstanding as on March 1, 2020. The accumulated interest for the period will be paid after the expiry of the deferment period.

16. Is it possible for the Lender to not provide a moratorium?

Technically, certainly yes. However, borrowers may take advantage of the Ministry of Law circular that the COVID disruption is a case of “force majeure” and FMC does not result in a contractual breach. Hence, lenders will be virtually forced into granting the same.

17. Is the lending institution required to grant the moratorium to all categories of borrowers?

Since the grant of the moratorium is completely discretionary, the lending institution may grant different moratoriums to different classes of borrowers based on the degree of disruption on a particular category of borrowers. However, the grant of the moratorium to different classes of borrowers should be making an intelligible distinction, and should not be discriminatory.

18. Can the lender revise the interest rate while granting extension under the moratorium?

The intent of the moratorium is to ensure relaxation to the borrower due to the disruption caused. However, increase in interest rate is not a relief granted and hence should not be practised as such.

19. Can the moratorium period be different for different loans of the same type? For example, a lender grants a moratorium of 3 months for all loans which are 60-89 DPD, and a moratorium of 2 months for all loans which are 30 -59 DPD as on the effective date.

The moratorium is essentially granted to help the borrowers to tide over a liquidity crisis caused by the corona disruption. In the above example, the scheme seems to be to get over a potential NPA characterisation, which could not be the intent of the relaxation.

20. Will the grant of different moratorium periods be regarded as discrimination by the NBFC?

An NBFC may assess where the disruption is likely to adversely impact the repayment capacity of the borrower and take a call based on such assessment. For example in case of farm sector borrowers and daily wage earners, the disruption will be maximum. However, a salaried employee may not be facing any impact on their repayment capacity.

21. Can a borrower prevail upon a lending institution to grant the moratorium, in case the same has not been granted the lending institution?

The grant of the moratorium is a contractual matter between the lender and the borrower. There is no regulatory intervention in that contract.

22. Can the borrower pay in between the moratorium period?

It is a relief granted to the borrower due to disruption caused by the sudden lockdown. However, the option lies with the borrower to either repay the loan during this moratorium as per the actual due dates or avail the benefit of the moratorium.

23. Will such payment be considered as prepayment?

This will not be considered as prepayment and there will not be any prepayment penalty on the same.

24. Is the moratorium applicable to financial lease transactions?

Financial leases are akin to loan transactions and have rental payouts similar to EMIs in case of a term loan. Hence, lessors under a financial lease may confer the benefit of the moratorium under the RBI circular.

25. Is the moratorium applicable to operating lease transactions?

Operating leases are not considered as financial transactions and hence, they shall not be covered under the RBI circular for granting moratorium. However, lessors may, in their wisdom, grant the benefit of moratorium. Note that the NPA treatment in case of operating leases is not the same as in case of loans.

Refer to our various articles on leasing here.

26. A loan was in default already as on 1st March, 2020. The lender has various security interests – say a mortgage, or a pledge. Will the lender be precluded from exercising security interest during the holiday period?

The moratorium is only for what instalments/payments were due from 1st March 2020 upto the period of moratorium conferred by the lender (so, 31st May, in case of a 3 month moratorium). The same does not affect payment obligations that have already fallen due before 1st March. Hence, if there was a default, and there were remedies available to the lender as on 1st March already, the same will not be affected.

However, note that for using the powers under the SARFAESI Act, the facility has to be characterised as non-performing. Unless the facility was already a non-performing loan, the intervening holiday will defer the NPA categorisation. In that case, the use of SARFAESI powers will be deferred until NPA categorisation happens.

Modus operandi for giving effect to the moratorium

27. What are the actionables required to be taken by the lending institution to grant the moratorium?

The RBI Notification dated 27th March, 2020, para 8 mentions about a board-approved policy. Accordingly, the lending institution may put in place a policy. The Policy should provide maximum facility to the concerned authority centre in the hierarchy of decision-making so that everything does not become rigid. For instance, the extent of moratorium to be granted, the types of asset classes where the moratorium is to be granted, etc., may be left to the relevant asset managers.

Further, the instructions in the notification must be properly communicated to the staff to ensure its implementation.

You may refer to the list of actionables here.

28. The RBI has mentioned about a Board-approved policy. Obviously, under the present scenario, calling of any Board-meeting is not possible. Hence, how does one implement the moratorium?

Please refer to our article here as to how to use technology for calling board meetings.

29. In case the lender intends to extend a moratorium, will it require consent of the borrower and confirmation on the revised repayment schedule?

Based on the policy adopted by the lending institution, the moratorium may be extended to all borrowers or only those who approach the lender in this regard. However, the revised terms must be communicated to the borrower and the acceptance must be recorded.

An option may be provided to the borrower for opting the moratorium. In case the borrower fails to respond or remains silent, it may be considered as deemed confirmation on the moratorium. In case of acceptance by the borrower to opt for moratorium, including deemed acceptance, the revised terms shall be shared which should be accepted by the borrower- either electronically or such other means as per the respective lending practice. Further, the PDC or NACH should not be presented for encashment as per the existing terms.

However, in case the borrower has not opted for the moratorium by his action or otherwise has expressly denied the option, the PDC and NACH shall be encashed as per the existing terms and necessary action can be initiated by the lender in case of dishonour.

30. Is the lender required to obtain fresh PDCs and NACH debit mandates from the borrowers?

An option may be provided to the borrower for opting the moratorium. In case the borrower fails to respond or remains silent, it may be considered as deemed confirmation on the moratorium. In such a case the PDC or NACH should not be presented for encashment as per the existing terms.

However, in case the borrower has not opted for the moratorium by his action or otherwise has expressly denied the option, the PDC and NACH shall be encashed as per the existing terms and necessary action can be initiated by the lender in case of dishonour.

31. In case the payment has been made by a borrower for the installment due for the month of March 2020, does the lender need to refund the same?

The payments already received may not be considered for the purpose of passing the moratorium relaxation. The lenders have their discretion, but appropriately, these payments may either be regarded as payment of principal as on 1st March, 2020, duly discounted for the time lag between 1st March and the actual repayment date, or the payment already made by the borrower may just be excluded from the moratorium. For example, if the payments fell due on 7th March, and by 15th March, 80% of the payments have already been made, the same may just be excluded from the holiday, thereby granting holiday only for the payments due on 15th April and 15th May.

NPA classification and restructuring

32. What will be the impact on the NPA classification on the following loans:

- Standard as on March 1, 2020

- NPA as on March 1, 2020

- Showing signs of distress as on March 1, 2020

In case of standard loan, the moratorium period will not be considered for computing default and hence, it will not result in asset classification downgrade. Our views in this regard have been discussed elaborately above.

As per the FAQs issued by the MoF, it is clear that the benefit of moratorium is available to all such accounts, which are standard assets as on 1st March 2020. Hence, loans already classified as NPA shall continue with further asset classification deterioration during the moratorium period in case of non-payment.

In case of assets showing signs of distress as on March 1, 2020, the moratorium may still be extended since they are classified as standard asset. Further, the asset classification of account which has been classified as SMA should not further be classified as a NPA in case the installment is not paid during the moratorium period and the classification as SMA should be maintained. [Refer our detailed response in Q9 above]

33. Effectively, are we saying the grant of the moratorium is also a stoppage of NPA classification?

The RBI contends that there was no disruption in February, and therefore, one cannot bring disruption as the basis for not paying what had fallen due before March 1. The benefit of the moratorium is not applicable for the amounts which were already past due before March 01, 2020..

34. Is grant of moratorium a type of restructuring of loans?

The moratorium/deferment is being provided specifically to enable the borrowers to tide over the economic fallout from COVID-19. Hence, the same will not be treated as change in terms and conditions of loan agreements due to financial difficulty of the borrowers.

35. What will be the impact on the loan tenure and the EMI due to the moratorium?

Effectively, it would amount to extension of tenure. For example, if a term loan was granted for a period of 36 months on 1st Jan 2020, and the lender grants a 3 months’ moratorium, the tenure effectively stands extended by 3 months – so it becomes 39 months how.

Since there is an accrual of interest during the period of moratorium, the lender will have to either increase the EMIs (that means, recompute the EMI on the accreted amount of outstanding principal for the remaining number of months), or change the last EMI so as to compensate for the accrual of interest during the period of the moratorium. Since changing of EMIs have practical difficulties (PDCs, standing instructions, etc.), it seems that the latter approach will be mostly used.

36. How will the deferment of interest in the case of working capital facilities impact the asset classification?

Recalculating the drawing power by reducing margins and/or by reassessing the working capital cycle for the borrowers will not result in asset classification downgrade.

The asset classification of term loans which are granted relief shall be determined on the basis of revised due dates and the revised repayment schedule.

37. Will the delayed payment by the borrower due to the moratorium have an impact on its CIBIL score?

The moratorium on term loans, the deferring of interest payments on working capital and the easing of working capital financing will not qualify as a default for the purposes of supervisory reporting and reporting to credit information companies (CICs) by the lending institutions. Hence, there will be no adverse impact on the credit history of the beneficiaries.

Impact of moratorium on corporate borrowers

37A. What will be the impact of the moratorium on the corporate borrowers? If the corporate borrower is having a secured loan with the bank, and due to the moratorium, the tenure gets extended, is it a case of modification requiring “modification of charge” within the meaning of the Companies Act?

Answer should be in the negative, for the following reasons:

- 79 provides for “modification in the terms or conditions or the extent or operation of any charge”. There is no modification in the terms of the charge, or the extent or operation of the charge. The charge is on the same property; the exposure amount also does not change by the very fact of the moratorium.

- The modification is not a result of a unique transaction between the lender and the borrower, which needs to be publicly intimated. The moratorium is the result of an external event, which the public at large is expected to be aware of.

- The moratorium is not a case of restructuring of the debt that requires any kind of regulatory reporting by the borrower. The moratorium is the result of a force majeure event.

Taking the view that the resulting extension of tenure is a case of moratorium will make thousands of borrowers file modification, which is both perfunctory and unnecessary.

37B. Under Part A of Schedule III of LODR Regulations, a corporate debt restructuring is to be deemed to be a material event requiring reporting to the stock exchanges. Is the moratorium-related restructuring a case of corporate debt restructuring?

Answer should be negative once again. This restructuring is not a result of a credit event. It is result of a force majeure.

Impact of the Moratorium on accounting under IndAS 109

38. Where there are no repayments during the moratorium period, is it proper to say that the loan will be taken to have “defaulted” or there will be credit deterioration, for the purposes of ECL computation?

The provisions of para 5.5.12 of the IndAS 109 are quite clear on this. If there has been a modification of the contractual terms of a loan, then, in order to see whether there has been a significant increase in credit risk, the entity shall compare the credit risk before the modification, and the credit risk after the modification. Sure enough, the restructuring under the disruption scenario is not indicative of any increase in the probability of default.

39. There are presumptions in para B 5.5.19 and 20 about “past due” leading to rebuttable presumption about credit deterioration. What impact does the moratorium have on the same?

The very meaning of “past due” is something which is not paid when due. The moratorium amends the payment schedule. What is not due cannot be past due.

40. Will the effective interest rate (EIR) for the loan be recomputed on account of the modification of tenure?

The whole idea of the modification is to compute the interest for the deferment of EMIs due to moratorium, and to compensate the lender fully for the same. The IRR for the loan after restructuring should, in principle, be the same as that before restructuring. Hence, there should be no impact on the EIR.

41. What will be the impact of the moratorium for accounting for income during the holiday period?

As the EIR remains constant, there will be recognition of income for the entire Holiday period. For example, for the month of March, 2020, interest will be accrued. The carrying value of the asset (POS) will stand increased to the extent of such interest recognised. In essence, the P/L will not be impacted.

42. If the moratorium is a case of “modification of the financial asset”, is there a case for computing modification gain/loss?

As the EIR remains constant, the question of any modification gain or loss does not arise.

43. Does the “modification of the financial asset”call for impairment testing?

The contractual modification is not the result of a credit event. Hence, the question of any impairment for this reason does not arise.

Impact in case of securitisation transactions

44. There may be securitisation transactions where there are investors who have acquired the PTCs. The servicing is with the originator. Can the originator, as the servicer, grant the benefit of the moratorium? Any consent/concurrence of the trustees will be required? PTC holders’ sanction is required?

Servicer is simply a servicer – that is, someone who enforces the terms of the existing contracts, collects cashflows and remits the same to the investors. Servicer does not have any right to confer any relaxation of terms to the borrowers or restructure the facility.

While the moratorium may not amount to restructuring but there is certainly an active grant of a discretionary benefit to the borrowers. In our view, the servicer by himself does not have that right. The right may be exercised only with appropriate sanction as provided in the deed of assignment/trust deed – either the consent of the trustees, or investor’ consent.

45. Irrespective of whether the moratorium is granted with the requisite consent or not, there may be some missing instalments or substantial shortfall in collections in the months of April, May and June. Is the trustee bound to use the credit enhancements (excess spread, over-collateralisation, cash collateral or subordination) to recover these amounts?

As we have mentioned above, the grant of the moratorium by the servicer will have to require investor concurrence or trustee consent (if the trustee is so empowered under the trust deed/servicing agreement). Assuming that the investors have given the requisite consent (say, with 75% consent), the investors’ consent may also contain a clause that during the period of the moratorium, the investors’ payouts will be deemed “paid-in-kind” or reinvested, such that the expected payments for the remaining months are commensurately increased.

This will be a fair solution. Technically, one may argue that the credit enhancements may be exploited to meet the deficiency in the payments, but utilisation of credit enhancements will only reduce the size of the support, and may cause the rating of the transaction to suffer. Therefore, investors’ consent may be the right solution.

Impact in case of direct assignment transactions

46. There may be direct assignment transactions where there is an assignee with 90% share, and the assignor has a 10% retained interest. Can the assignor/originator, also having the servicer role, grant the benefit of the moratorium? Any consent/concurrence of the assignee will be required?

In our view, the 10% retained interest holder cannot grant the benefit without the concurrence of the 90% interest holder.

47. What will be the impact of the moratorium on the assignee?

Once again, as in case of securitisation transactions, if the grant of the moratorium takes place with assignee consent, the assignee may agree to give the benefit to the borrowers. In that case, the assignee does not have to treat the loans as NPAs merely because of non-payment during the period of the moratorium.

Impact in case of co-lending transactions

48. In case of a co-lending arrangement, can the co-lenders grant differential benefit of the moratorium?

Since the grant of moratorium is discretionary, the co-lenders may intend to grant different moratorium periods to the same borrower. However, that could lead to several complications with respect to servicing, asset classification etc. Hence, it is recommended that all the parties to the co-lending arrangement should be in sync.

[1] https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR21302E204AFFBB614305B56DD6B843A520DB.PDF

[2] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11835&Mode=0

Our other write-ups relating to covid-19 disruption can be read here- http://vinodkothari.com/covid-19-incorporated-responses/

Other write-ups on NBFCs can be read here- http://vinodkothari.com/nbfcs/

Moving to contactless lending, in a contact-less world

/0 Comments/in Financial Services, Financial services/ NBFCs/Fin-tech - Covid-19, Fintechs and Payment and Settlement Systems, NBFCs, RBI /by Vinod Kothari Consultants-Kanakprabha Jethani (kanak@vinodkothari.com)

Background

With the COVID-19 disruption taking a toll on the world, almost two billion people – close to a third of the world’s population being restricted to their homes, businesses being locked-down and work-from home becoming a need of the hour; “contactless” business is what the world is looking forward to. The new business jargon “contactless” means that the entire transaction is being done digitally, without requiring any of the parties to the transaction interact physically. While it is not possible to completely digitise all business sectors, however, complete digitisation of certain financial services is well achievable.

With continuous innovations being brought up, financial market has already witnessed a shift from transactions involving huge amount of paper-work to paperless transactions. The next steps are headed towards contactless transactions.

The following write-up intends to provide an introduction to how financial market got digitised, what were the by-products of digitisation, impact of digitisation on financial markets, specifically FinTech lending segment and the way forward.

Journey of digitisation

Digitisation is preparing financial market for the future, where every transaction will be contactless. Financial entities and service providers have already taken steps to facilitate the entire transaction without any physical intervention. Needless to say, the benefits of digitisation to the financial market are evident in the form of cost-efficiency, time-saving, expanded outreach and innovation to name a few.

Before delving into how financial entities are turning contactless, let us understand the past and present of the financial entities. The process of digitisation leads to conversion of anything and everything into information i.e. digital signals. The entire process has been a long journey, having its roots way back in 1995, when the Internet was first operated in India followed by the first use of the mobile phones in 2002 and then in 2009 the first smartphones came into being used. It is each of these stages that has evolved into this all-pervasive concept called digitisation.

Milestones in process of digitisation

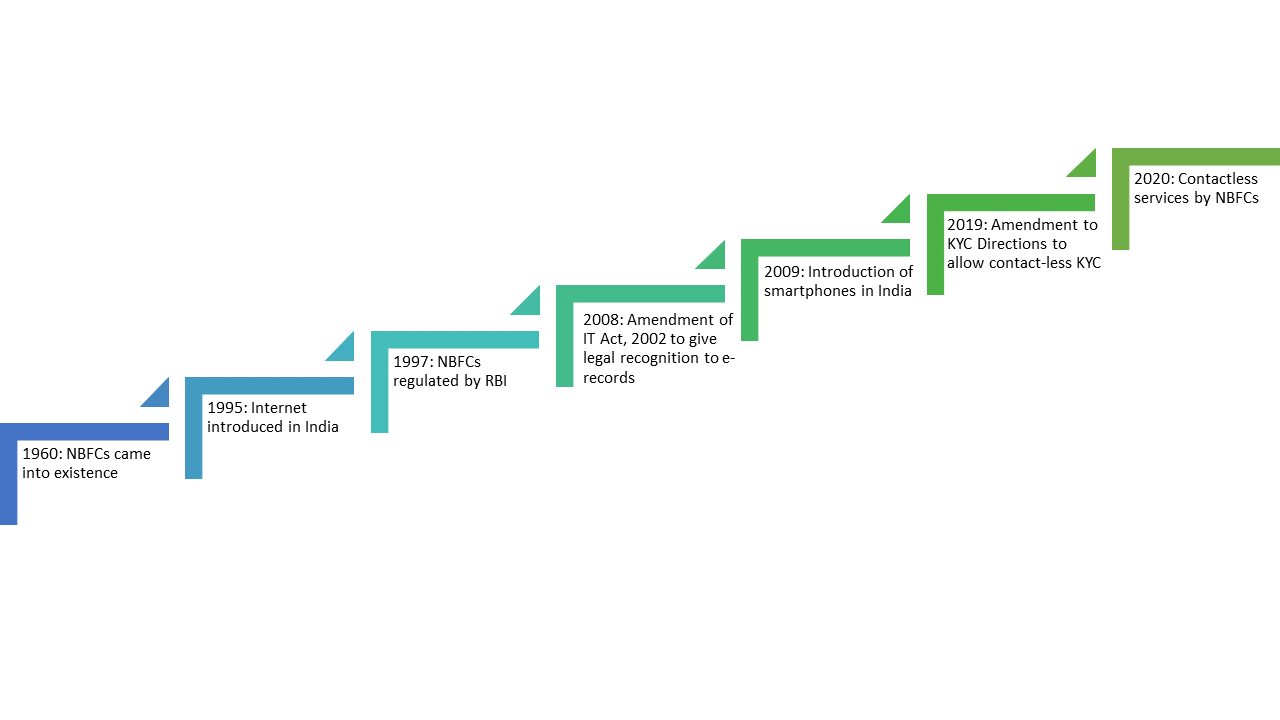

The process of digitization has seen various phases. The financial market, specifically, the NBFCs have gone through various phases before completely guzzling down digitization. The journey of NBFCs from over the table executions to providing completely contactless services has been shown in the figure below:

From physical to paperless to contactless: the basic difference

Before analysing the impact of digitisation on the financial market, it is important to understand the concept of ‘paperless’ and ‘contactless’ transactions. In layman terms, paperless transactions are those which do not involve execution of any physical documents but physical interaction of the parties for purposes such as identity verification is required. The documents are executed online via electronic or digital signature or through by way of click wrap agreements.

In case of contactless transactions, the documents are executed online and identity verification is also carried out through processes such as video based identification and verification. There is no physical interaction between parties involved in the transaction.

The following table analyses the impact of digitisation on financial transactions by demarcating the steps in a lending process through physical, paperless and contactless modes:

| Stages | Physical process | Paperless process | Contactless process |

| Sourcing the customer | The officer of NBFC interacts with prospective applicants | The website, app or platform (‘Platform’) reaches out to the public to attract customers or the AI based system may target just the prospective customers | Same as paperless process |

| Understanding needs of the customer | The authorised representative speaks to the prospects to understand their financial needs | The Platform provides the prospects with information relating to various products or the AI system may track and identify the needs | Same as paperless process |

| Suggesting a financial product | Based on the needs the officer suggests a suitable product | Based on the analysis of customer data, the system suggests suitable product | Same as paperless process |

| Customer on-boarding | Customer on-boarding is done upon issue of sanction letter | The basic details of customer are obtained for on-boarding on the Platform | Same as paperless process |

| Customer identification | The customer details and documents are identified by the officer during initial meetings | Customer Identification is done by matching the details provided by customer with the physical copy of documents | Digital processes such as Video KYC are used carry out customer identification |

| Customer due-diligence | Background check of customer is done based on the available information and that obtained from the customer and credit information bureaus | Information from Credit Information Agencies, social profiles of customer, tracking of communications and other AI methods etc. are used to carry out due diligence | Same as paperless process |

| Customer acceptance | On signing of formal agreement | By clicking acceptance buttons such as ‘I agree’ on the Platform or execution through digital/electronic signature | Same as paperless process |

| Extending the loan | The loan amount is deposited in the customer’s bank account | The loan amount is credited to the wallet, bank account or prepaid cards etc., as the case may be | Same as paperless process |

| Servicing the loan | The authorised representatives ensures that the loan is serviced | Recovery efforts are made through nudges on Platform. Physical interaction is the last resort | Same as paperless process. However, physical interaction for recovery may not be desirable. |

| Customer data maintenance | After the relationship is ended, physical files are maintained | Cloud-based information systems are the common practice | Same as paperless process |

The manifold repercussions

The outcome of digitisation of the financial markets in India, was a land of opportunities for those operating in financial market, it has also wiped off those who couldn’t keep pace with technological growth. Survival, in financial market, is driven by the ability to cope with rapid technological advancements. The impact of digitisation on financial market, specifically lending related services, can be analysed in the following phases:

Payments coming to online platforms

With mobile density in India reaching to 88.90% in 2019[1], the adoption of digital payments have accelerated in India, showing a rapid growth at a CAGR of 42% in value of digital payments. The value of digital payments to GDP rose to 862% in the FY 2018-19.

Simultaneously, of the total payments made up to Nov 2018, in India, the value of cash payments stood at a mere 19%. The shift from cash payments to digital payments has opened new avenues for financial service providers.

Need for service providers

With everything coming online, and the demand for digital money rising, the need for service providers has also taken birth. Services for transitioning to digital business models and then for operating them are a basic need for FinTech entities and thus, there is a need for various kinds of service providers at different stages.

Deliberate and automatic generation of demand

When payments system came online, financial service providers looked for newer ways of expanding their business. But the market was already operating in its own comfortable state. To disrupt this market and bring in something new, the FinTech service providers introduced the idea of easy credit to the market. When the market got attracted to this idea, digital lending products were introduced. With time, add-ons such as backing by guarantee, indemnity, FLDG etc. were also introduced to these products.

Consequent to digital commercialization, the need for payment service providers also generated automatically and thus, leading to the demand for digital payment products.

Opportunities for service providers

With digitization of non-banking financial activities, many players have found a place for themselves in financial markets and around. While the NBFCs went digital, the advent of digitization also became the entry gate to other service providers such as:

Platform service providers:

In order to enable NBFCs to provide financial services digitally, platform service providers floated digital platforms wherein all the functions relating to a financial transaction, ranging from sourcing of the customer, obtaining KYC information, collating credit information to servicing of the customer etc.

Software as a Service (SaaS) providers: