Moving to contactless lending, in a contact-less world

-Kanakprabha Jethani (kanak@vinodkothari.com)

Background

With the COVID-19 disruption taking a toll on the world, almost two billion people – close to a third of the world’s population being restricted to their homes, businesses being locked-down and work-from home becoming a need of the hour; “contactless” business is what the world is looking forward to. The new business jargon “contactless” means that the entire transaction is being done digitally, without requiring any of the parties to the transaction interact physically. While it is not possible to completely digitise all business sectors, however, complete digitisation of certain financial services is well achievable.

With continuous innovations being brought up, financial market has already witnessed a shift from transactions involving huge amount of paper-work to paperless transactions. The next steps are headed towards contactless transactions.

The following write-up intends to provide an introduction to how financial market got digitised, what were the by-products of digitisation, impact of digitisation on financial markets, specifically FinTech lending segment and the way forward.

Journey of digitisation

Digitisation is preparing financial market for the future, where every transaction will be contactless. Financial entities and service providers have already taken steps to facilitate the entire transaction without any physical intervention. Needless to say, the benefits of digitisation to the financial market are evident in the form of cost-efficiency, time-saving, expanded outreach and innovation to name a few.

Before delving into how financial entities are turning contactless, let us understand the past and present of the financial entities. The process of digitisation leads to conversion of anything and everything into information i.e. digital signals. The entire process has been a long journey, having its roots way back in 1995, when the Internet was first operated in India followed by the first use of the mobile phones in 2002 and then in 2009 the first smartphones came into being used. It is each of these stages that has evolved into this all-pervasive concept called digitisation.

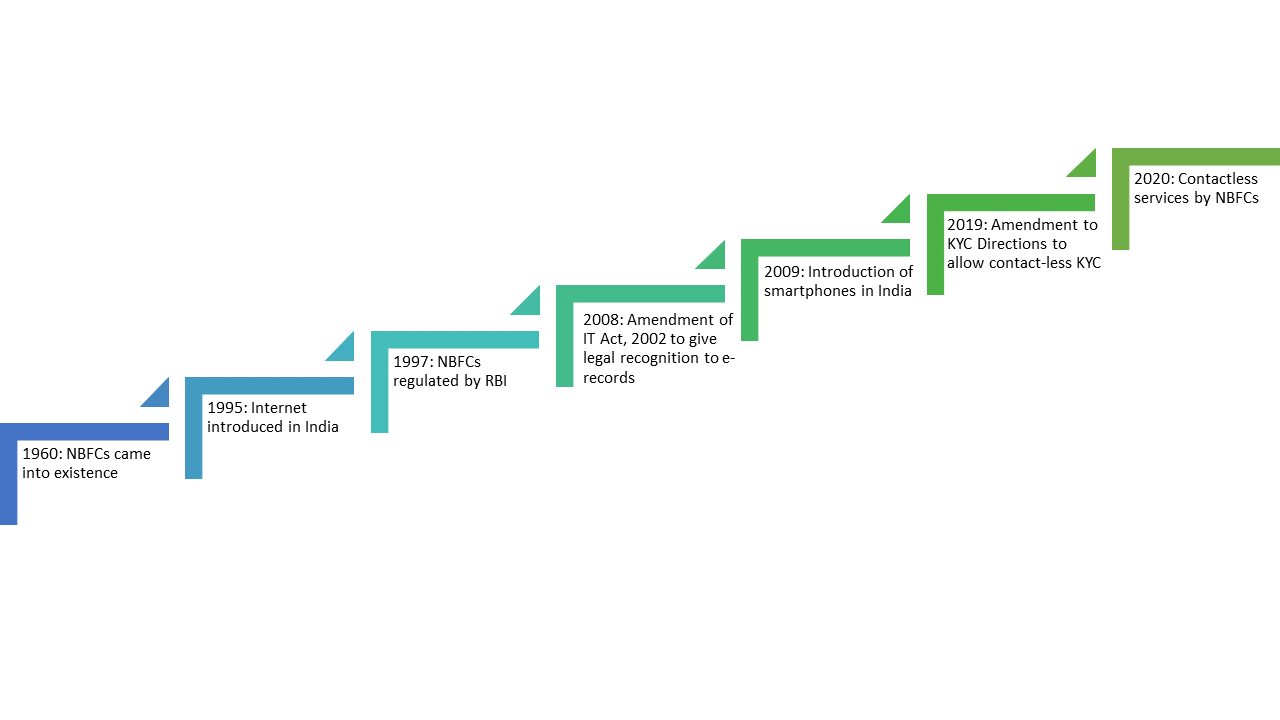

Milestones in process of digitisation

The process of digitization has seen various phases. The financial market, specifically, the NBFCs have gone through various phases before completely guzzling down digitization. The journey of NBFCs from over the table executions to providing completely contactless services has been shown in the figure below:

From physical to paperless to contactless: the basic difference

Before analysing the impact of digitisation on the financial market, it is important to understand the concept of ‘paperless’ and ‘contactless’ transactions. In layman terms, paperless transactions are those which do not involve execution of any physical documents but physical interaction of the parties for purposes such as identity verification is required. The documents are executed online via electronic or digital signature or through by way of click wrap agreements.

In case of contactless transactions, the documents are executed online and identity verification is also carried out through processes such as video based identification and verification. There is no physical interaction between parties involved in the transaction.

The following table analyses the impact of digitisation on financial transactions by demarcating the steps in a lending process through physical, paperless and contactless modes:

| Stages | Physical process | Paperless process | Contactless process |

| Sourcing the customer | The officer of NBFC interacts with prospective applicants | The website, app or platform (‘Platform’) reaches out to the public to attract customers or the AI based system may target just the prospective customers | Same as paperless process |

| Understanding needs of the customer | The authorised representative speaks to the prospects to understand their financial needs | The Platform provides the prospects with information relating to various products or the AI system may track and identify the needs | Same as paperless process |

| Suggesting a financial product | Based on the needs the officer suggests a suitable product | Based on the analysis of customer data, the system suggests suitable product | Same as paperless process |

| Customer on-boarding | Customer on-boarding is done upon issue of sanction letter | The basic details of customer are obtained for on-boarding on the Platform | Same as paperless process |

| Customer identification | The customer details and documents are identified by the officer during initial meetings | Customer Identification is done by matching the details provided by customer with the physical copy of documents | Digital processes such as Video KYC are used carry out customer identification |

| Customer due-diligence | Background check of customer is done based on the available information and that obtained from the customer and credit information bureaus | Information from Credit Information Agencies, social profiles of customer, tracking of communications and other AI methods etc. are used to carry out due diligence | Same as paperless process |

| Customer acceptance | On signing of formal agreement | By clicking acceptance buttons such as ‘I agree’ on the Platform or execution through digital/electronic signature | Same as paperless process |

| Extending the loan | The loan amount is deposited in the customer’s bank account | The loan amount is credited to the wallet, bank account or prepaid cards etc., as the case may be | Same as paperless process |

| Servicing the loan | The authorised representatives ensures that the loan is serviced | Recovery efforts are made through nudges on Platform. Physical interaction is the last resort | Same as paperless process. However, physical interaction for recovery may not be desirable. |

| Customer data maintenance | After the relationship is ended, physical files are maintained | Cloud-based information systems are the common practice | Same as paperless process |

The manifold repercussions

The outcome of digitisation of the financial markets in India, was a land of opportunities for those operating in financial market, it has also wiped off those who couldn’t keep pace with technological growth. Survival, in financial market, is driven by the ability to cope with rapid technological advancements. The impact of digitisation on financial market, specifically lending related services, can be analysed in the following phases:

Payments coming to online platforms

With mobile density in India reaching to 88.90% in 2019[1], the adoption of digital payments have accelerated in India, showing a rapid growth at a CAGR of 42% in value of digital payments. The value of digital payments to GDP rose to 862% in the FY 2018-19.

Simultaneously, of the total payments made up to Nov 2018, in India, the value of cash payments stood at a mere 19%. The shift from cash payments to digital payments has opened new avenues for financial service providers.

Need for service providers

With everything coming online, and the demand for digital money rising, the need for service providers has also taken birth. Services for transitioning to digital business models and then for operating them are a basic need for FinTech entities and thus, there is a need for various kinds of service providers at different stages.

Deliberate and automatic generation of demand

When payments system came online, financial service providers looked for newer ways of expanding their business. But the market was already operating in its own comfortable state. To disrupt this market and bring in something new, the FinTech service providers introduced the idea of easy credit to the market. When the market got attracted to this idea, digital lending products were introduced. With time, add-ons such as backing by guarantee, indemnity, FLDG etc. were also introduced to these products.

Consequent to digital commercialization, the need for payment service providers also generated automatically and thus, leading to the demand for digital payment products.

Opportunities for service providers

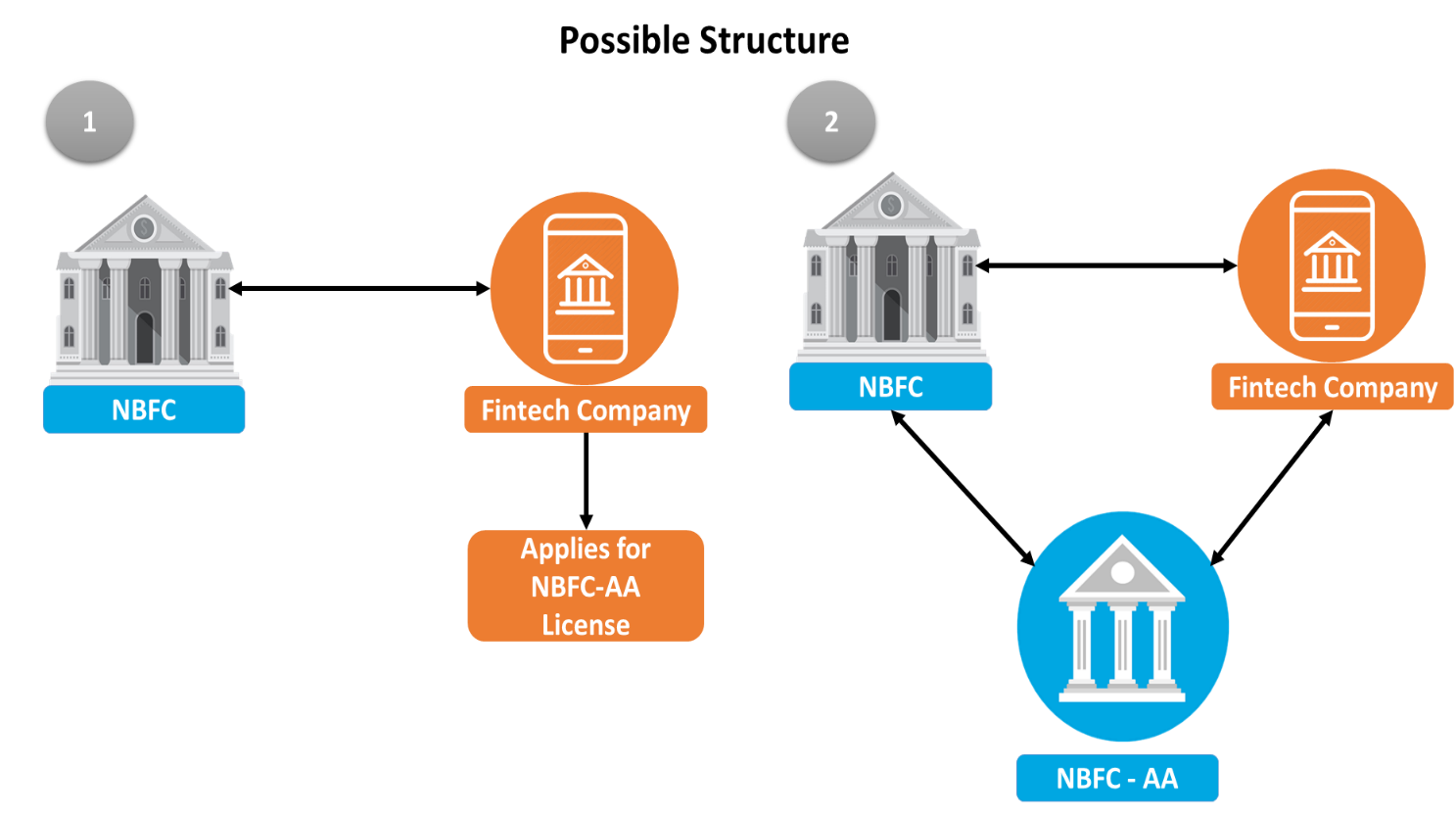

With digitization of non-banking financial activities, many players have found a place for themselves in financial markets and around. While the NBFCs went digital, the advent of digitization also became the entry gate to other service providers such as:

Platform service providers:

In order to enable NBFCs to provide financial services digitally, platform service providers floated digital platforms wherein all the functions relating to a financial transaction, ranging from sourcing of the customer, obtaining KYC information, collating credit information to servicing of the customer etc.

Software as a Service (SaaS) providers:

Such service providers operate on a business model that offers software solutions over the internet, charging their customers based on the usage of the software. Many of the FinTech based NBFCs have turned to such software providers for operating their business on digital platforms. Such service providers also provide specific software for credit score analysis, loan process automation and fraud detection etc.

Payment service providers:

For facilitating transactions in digital mode, it is important that the flow of money is also digitized. Due to this, the demand for payment services such as payments through cards, UPI, e-cash, wallets, digital cash etc. has risen. This demand has created a new segment of service providers in the financial sector.

NBFCs usually enter into partnerships with platform service providers or purchase software from SaaS providers to digitize their business.

Heads-up from the regulator

The recent years have witnessed unimaginable developments in the FinTech sector. Innovations introduced in the recent times have given birth to newer models of business in India. The ability to undertake paperless and contactless transactions has urged NBFCs to achieve Pan India presence. The government has been keen in bringing about a digital revolution in the country and has been coming up with incentives in forms of various schemes for those who shift their business to digital platforms. Regulators have constantly been involved in recognising digital terminology and concepts legally.

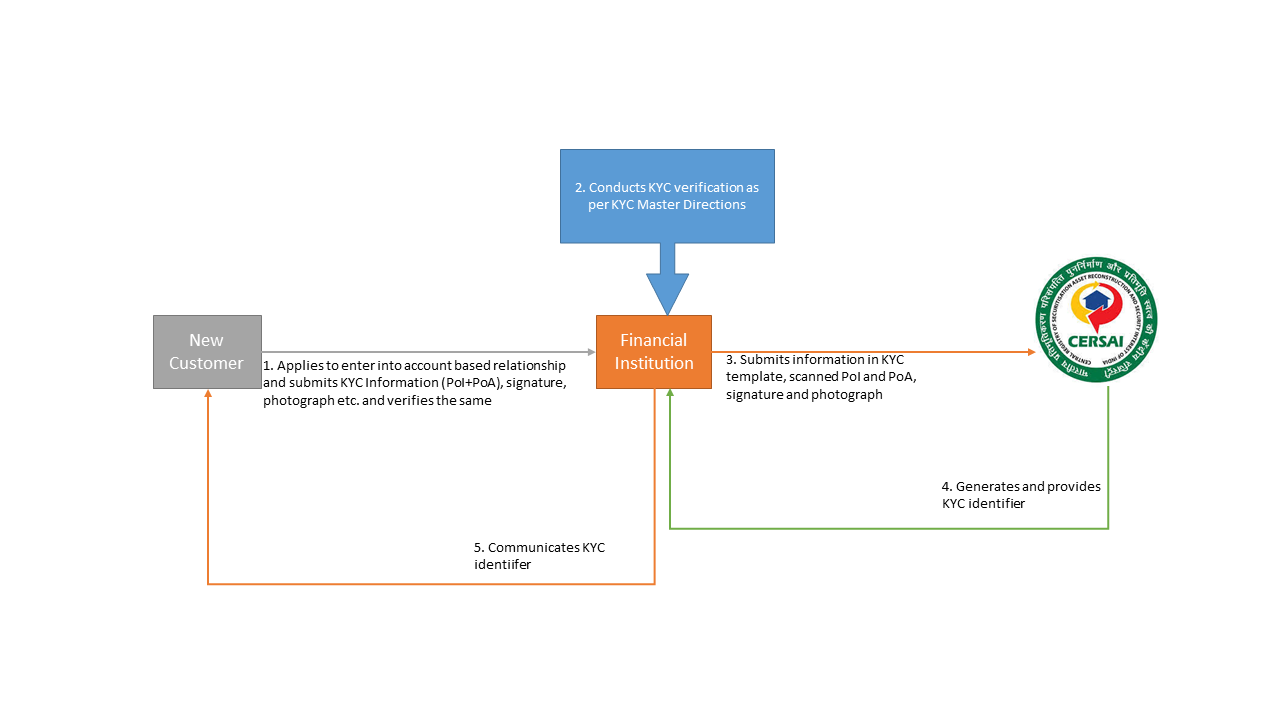

In Indian context, innovation has moved forward hand-in-hand with regulation[2]. The Reserve Bank of India, being the regulator of financial market, has been a key enabler of the digital revolution. The RBI, in its endeavor to support digital transactions has introduced many reforms, the key pillars amongst which are – e-KYC (Know Your Customer), e-Signature, Unified Payment Interface (UPI), Electronic NACH facility and Central KYC Registry.

The regulators have also introduced the concept of Regulatory Sandbox[3] to provide innovative business models an opportunity to operate in real market situations without complying with the regulatory norms in order to establish viability of their innovation.

While these initiatives and providing legal recognition to electronic documents did bring in an era of paperless[4] financial transactions, the banking and non-banking segment of the market still involved physical interaction of the parties to a transaction for the purpose of identity verification. Even the digital KYC process specified by the regulator was also a physical process in disguise[5].

In January 2020, the RBI gave recognition to video KYC, transforming the paperless transactions to complete contactless space[6].

Further, the RBI is also considering a separate regime for regulation of FinTech entities, which would be based on risk-based regulation, ranging from “Disclosure” to “Light-Touch Regulation & Supervision” to a “Tight Regulation and Full-Fledged Supervision”.[7]

Way forward

2019 has seen major revolutions in the FinTech space. Automation of lending process, Video KYC, voice based verification for payments, identity verification using biometrics, social profiling (as a factor of credit check) etc. have been innovations that has entirely transformed the way NBFCs work.

With technological developments becoming a regular thing, the FinTech space is yet to see the best of its innovations. A few innovations that may bring a roundabout change in the FinTech space are in-line and will soon be operable. Some of these are:

- AI-Driven Predictive Financing, which has the ability to find target customers, keep track on their activities and identify the accurate time for offering the product to the customer.

- Enabling recognition of Indian languages in the voice recognition feature of verification.

- Introduction of blockchain based KYC, making KYC data available on a permission based-decentralised platform. This would be a more secure version of data repository with end-to-end encryption of KYC information.

- Introduction of Chatbots and Robo-advisors for interacting with customers, advising suitable financial products, on-boarding, servicing etc. Robots with vernacular capabilities to deal with rural and semi-urban India would also be a reality soon.

Conclusion

Digital business models have received whole-hearted acceptance from the financial market. Digitisation has also opened gates for different service providers to aid the financial market entities. Technology companies are engaged in constantly developing better tools to support such businesses and at the same time the regulators are providing legal recognition to technology and making contactless transactions an all-round success. This is just the foundation and the financial market is yet to see oodles of innovation.

[1] https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=19417

[2] https://www.bis.org/publ/bppdf/bispap106.htm

[3] Our write on Regulatory Sandboxes can be referred here- http://vinodkothari.com/2019/04/safe-in-sandbox-india-provides-cocoon-to-fintech-start-ups/

[4] Paperless here means paperless digital financial transactions

[5] Our write-up on digital KYC process may be read here- http://vinodkothari.com/2019/08/introduction-of-digital-kyc/

[6]Our write-up on amendments to KYC Directions may be read here: http://vinodkothari.com/2020/01/kyc-goes-live-rbi-promotes-seamless-real-time-secured-audiovisual-interaction-with-customers/

[7] https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/WGFR68AA1890D7334D8F8F72CC2399A27F4A.PDF