Mandatory listing for further bond issues

“Listed once, always go for listing” to apply for new bond issues; optional for existing unlisted issuances

Vinita Nair | Vinod Kothari & Company | corplaw@vinodkothari.com

June 29, 2023 (updated on September 21, 2023)

Background

SEBI approved the proposal for mandatory listing of debentures/ NCDs, in its Board meeting held on June 28, 2023, for all listed entities having outstanding listed NCDs as on December 31, 2023. Effective Jan. 1, 2024, such listed entities will have to now mandatorily list each of its subsequent issuance of NCDs on the stock exchanges.

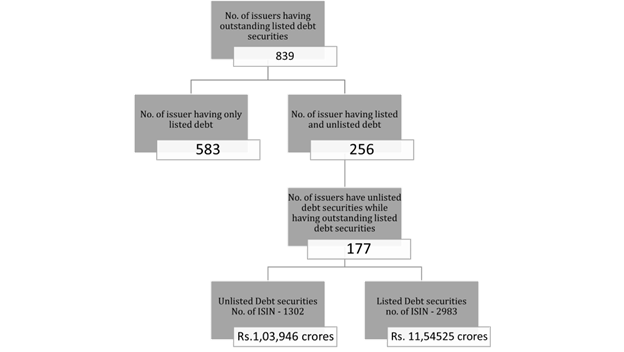

Aimed at better information flow and liquidity considerations, the move is said to be inspired by data analysis carried out by SEBI, as discussed in its Consultation Paper dated February 09, 2023, basis the information obtained from the depositories. Succinctly, the snapshot of unlisted bond issues by listed companies (it seems that the data of unlisted bond issuances by unlisted companies is not available), as on January 31, 2023, is as follows:

This would mean roughly 8% of all bond issuances by listed companies are outstanding, excluding bond issues by completely unlisted entities, which may be insignificant for the purpose of analysis.

Read more →