Extended disclosure u/r 30A w.r.t. Agreements

-Anushka Vohra | corplaw@vinodkothari.com

Companies often enter into various agreements with third parties, which may / may not be in the normal course of business and for which approval of shareholders is not mandated by law. Likewise, the promoters, directors of companies may enter into various agreements with third parties, to which the company is not a party. Such agreements may have the impact on control / management of the company. This becomes crucial in case of companies where public interest is involved. SEBI has vide SEBI (Listing Obligations and Disclosure Requirements) (Second Amendment) Regulations, 2023 (‘Amendment’) inter-alia inserted Reg. 30A and clause 5A of Para A Part A to Sch. III (Amended Regulation) which requires disclosure of certain agreements to the stock exchange(s) and in the annual report of the listed entity, which may have an impact on the control / management of the listed entity or imposes restriction / creates any liability on the listed entity.

There is an existing requirement of disclosing agreements viz. shareholder agreements, JV agreements, family settlement agreements, which are not in the normal course of business and to the extent that they impact the management and control of the listed entity, to the stock exchange(s). With the insertion of the aforesaid regulations, the extent of disclosure has quite largely increased. Obligation has been cast on several people to disclose to the listed entity, agreements that they have entered into- either among themselves or with third parties, which may (i) impact the control and management of the listed entity; (ii) impose restriction / create any liability on the listed entity.

This brings us to several questions on what agreements are required to be disclosed? How will the agreements that otherwise warrant confidentiality, be disclosed to the stock exchange(s)? In this article, we shall be discussing about the extended scope of disclosure w.r.t. agreements.

Current regulatory requirement viz-a-viz the Amended Regulation

Clause 5 of Para A Part A of Sch. III requires disclosure of shareholder agreements, joint venture agreements, family settlement agreements, which are binding and not in the normal course of business, to the extent that they impact the management and control of the listed entity.

SEBI circular on continuous disclosure requirements, requires the listed entity to provide certain information w.r.t. agreements as mentioned above, viz. name of parties with whom agreement is entered with, whether such party is a related party, etc.

The shareholder agreements are generally incorporated in the AoA of the company and amendment in AoA requires approval of the shareholders by way of special resolution. Listed entities that allot securities by way of preferential issue also enter into share subscription agreement with the investor(s). Listed entities require approval of shareholders by way of special resolution for issuing securities on preferential basis. There are numerous other agreements that are entered into by shareholders – for example, SHAs, SPAs, buy-back agreements, performance-related agreements, liquidity preferences, etc. These may be entered into between JV partners, family members, strategic investors, etc. These agreements may or may not be having the listed entity as a party or even a confirming party. However, these agreements pertain to management or control of the listed entity and therefore, may require disclosure in terms of Clause 5A.

The Amended Regulation imposes an obligation on:

a. shareholders, promoters, promoter group entities, director, KMP, related parties of-

i. the listed entity / its holding / subsidiary / associate

b. to disclose to the stock exchange(s), agreements entered into by them – inter se or with third party;

c. which directly / indirectly / potentially impacts or the purpose and effect of which is to impact, change in management and control of the listed entity; or

d. impose a restriction / liability on the listed entity.

SEBI in its Consultation Paper on Strengthening Corporate Governance at Listed Entities by empowering shareholders emphasized on the need for requiring disclosure of agreements to which the listed entity is not a party stating that there have been instances where promoters enter into binding agreements with third parties and the fact is not disclosed to the listed entity and to the stock exchange(s).

Agreements that require disclosure

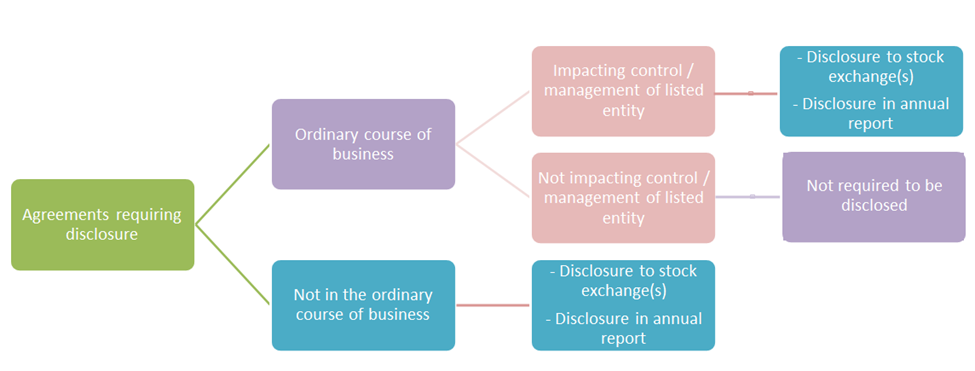

As per the language of the Amended Regulation, agreements that are not in the ordinary course of business are presumed to impact the management or control of the listed entity or impose any restriction or create any liability upon the listed entity and are thus required to be disclosed. In case of agreements that are in the ordinary course of business, disclosure will be required if they directly / indirectly / potentially impact or the purpose or effect is to impact the management or control of the listed entity. Imposing restriction or creation is liability is not be seen for agreements that are in the ordinary course of business.

Agreements in the ordinary course of business, not defined in the Reg, would be the agreements that are necessary for the general operations of the listed entity. For instance, supply agreements, purchase agreements, exclusivity agreements, area allocation agreements, non-compete agreements, cartelisations, agreements to reward some KMPs with ESOPs or bonuses not forming part of the terms of employment, etc.

This aside, we may take the following examples of some common agreements:

- Pledge agreement b/w promoter(s) / promoter group & bank

It is a common practice of pledging the shareholding held by the promoters / promoter group to secure loans from banks. The pledge agreement has clauses w.r.t. invocation of pledge in case of default by the promoter / promoter group. Invocation of pledge would result in change in shareholding and also change in control / management and may require disclosure u/r 30A.

The Listing Regulations currently require approval of shareholders by way of special resolution where a listed entity disposes of its shares in its material subsidiary resulting in reduction of its shareholding to less than or equal to 50%. In other words, approval of shareholders by way of special resolution will have to be obtained before the promoter / promoter group of the listed entity (where the listed entity is material subsidiary of the promoter / promoter group) pledges any shareholding held in the listed entity.

- Share Purchase Agreement by acquirer under the Takeover Code

The acquirer may acquire shares of a target company by entering into a share purchase agreement with the promoters of the target company. As per Reg. 3(1) of the Takeover Code, if pursuant to such acquisition, the acquirer is entitled to acquire 25% or more of the shareholding or voting rights of the target company (taken together with the shares or voting rights already held), the acquirer has to make a public announcement of open offer to the public shareholders. This public announcement has to be made on the same day of executing of the agreement.

That is, in such a case, the acquirer has to disclose to the shareholders about execution of such agreement. However, the Takeover Code does not entail any obligation on the target company to disclose such agreement to the shareholders or the stock exchanges(s). Under Reg. 30A r/w clause 5A, the target company may be required to disclose such agreement to the stock exchange(s).

- Loan agreement

Loan agreements with banks / financial institutions generally have negative covenants to assure the credit worthiness of the borrower and that the borrower can repay the loan to its lender.

Such negative covenants may include restriction of borrowing / investment limits of the listed entity.

- Supply agreement

Agreements such as supply agreement, purchase agreement are for the business operations of a listed entity and would therefore not require disclosure. This was clarified in the proposal in the consultation paper.

What has to be disclosed is also an important question. While the language of the provision suggests disclosing the entire agreement, however, the agreement may have confidential information. Disclosing the relevant extract seems to be more logical and practical.

Additional duty on the board of directors / audit committee

The purpose & effect test as required in case of related party transactions is also required to be undertaken for determining agreements that have the purpose & effect of impacting control / management of the listed entity.

This would cast additional duty on the board of directors / audit committee. As in the case of related party transaction framework, the words ‘purpose’ and ‘effect’ have to be read jointly i.e. there should be a purpose to impact and that purpose should impact the control / management of the listed entity.

Other disclosure

As per newly inserted Part G to Sch. V, information disclosed under clause 5A of Para A Part A of Sch. III is required to be disclosed in the annual report of the listed entity. That is, agreements disclosed under para 5A during a financial year will require to be disclosed in the annual report for the Fy ending.

In case of existing agreements, the listed entity is required to disclose the number of agreements that subsist as on the date of notification of clause 5A to para A of part A of schedule III i.e as on June 14, 2023, their salient features, including the link to the webpage where the complete details of such agreements are available, in the Annual Report for the financial year 2022-23 or for the financial year 2023-24.

Requirements in global jurisdictions

Referring to parallel provision in the UK Listing Rules. The same seems to cover only those agreements to which the company is a party.

LR 10.1.4 reads as under:

This chapter is intended to cover transactions that are outside the ordinary course of the listed company’s business and may change a security holder’s economic interest in the company’s assets or liabilities (whether or not the change in the assets or liabilities is recognised on the company’s balance sheet

Rule 704(31) provides for disclosure of loan agreements entered into by the issuer or any of its subsidiaries that contain a specified condition, and the breach of this specified condition will be an event of default. The Rule reads as under:

(31) When the issuer or any of its subsidiaries enters into a loan agreement or issues debt securities that contain a specified condition, and the breach of this specified condition will be an event of default, an enforcement event or an event that would cause acceleration of the repayment of the principal amount of the loan or debt securities, significantly affecting the operations of the issuer or results in the issuer facing a cash flow problem:—

(a) the details of the specified condition; and

(b) the level of these facilities that may be affected by a breach of such specified condition.

Concluding remarks

The Amended Regulation has a very wide interpretation, covering disclosure of almost all agreements since all business agreements have some or other covenants imposing restrictions on the listed entity. The board of directors will have to carefully analyze the agreements which are otherwise in the ordinary course of business but directly / indirectly / potentially impact the control / management of the listed entity.

Read our other resources on LODR Second Amendment Regulations, 2023

- SEBI prescribes thresholds for determining material events, stringent approval for sale of undertaking and more

- Stricter framework for sale, lease or disposal of undertaking by a listed entity

- Getting material on “material” events and information

- Powerpoint presentation on SEBI LODR (Second Amendment) Regulations, 2023

- FAQs on LODR Second Amendment Regulations, 2023

Leave a Reply

Want to join the discussion?Feel free to contribute!