Contra trade restrictions – traversing out of PAN to common control

Anushka Vohra | Senior Manager

corplaw@vinodkothari.com

Introduction

The SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’) impose certain restrictions and obligations on the DPs, one of which is contra trade restriction.

The DPs and their immediate relatives are restricted from entering into contra trade which refers to opposite trades executed viz. buy / sale within a shorter period of time usually within a period of 6 months with an intent to book short term profits. Where contra – trade is executed in violation of the restriction, the profit earned is to be disgorged for remittance to the IPEF.

In case of an individual DP (promoters / directors / etc. as recognized by the listed company), the immediate relatives also have certain obligations under the Regulations as their trades may be said to be influenced by the DPs. Similarly, in case of non-individual DPs (promoters), there may be other promoters and persons belonging to the promoter group who may act in concert with a particular non-individual promoter.

Having said that, it is important to understand the intent of contra trade, whether the same would apply individually on DPs based on trades executed against their PAN or the same would apply jointly on DPs and their immediate relatives or the entire promoter group inter-se. The same has been a matter of discussion in various Informal Guidance (‘IG’) of SEBI. We discuss the same briefly along with other illustrations.

Informal Guidance

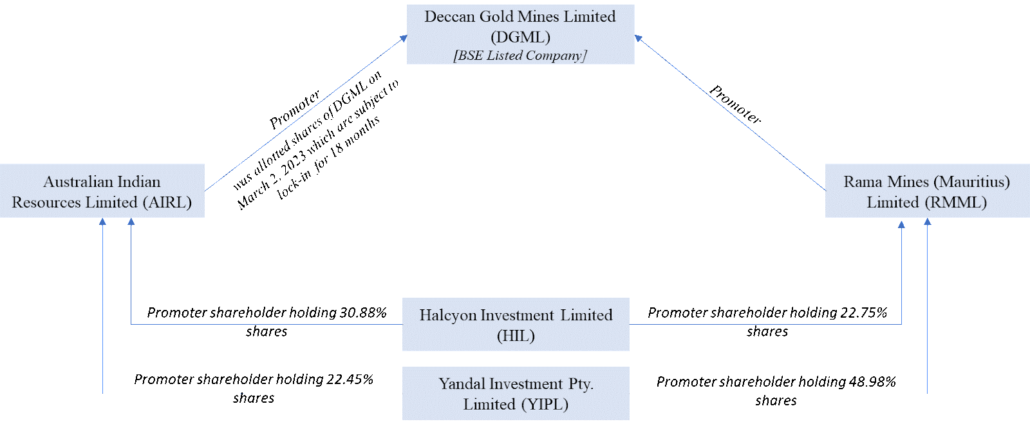

Generally, the concept of Persons Acting in Concert (‘PACs’) is used in the Takeover Code and under the PIT Regulations, the perspective so far has been PAN based. In the recent IG in the matter of Deccan Gold Mines Ltd[1], SEBI in its interpretative letter has given the view that contra trade restrictions would apply on the promoter group jointly, given the case in hand. The facts of the case have been represented diagrammatically below.

We see that the listed company is being held by two corporate promoters, which in turn are held by common shareholders. Here, RMML intended to sell its shareholding in open-market within 6 months of the allotment made to AIRL.

Since there is common control in both the promoter entities, it was stated that contra-trade restriction would apply jointly on both.

Intent of contra-trade

The intent of contra trade, as also mentioned above is to ensure that the persons who are privy to UPSI do not make short term profits in the securities of the listed company. For instance, if a DP has bought a security of the listed company in anticipation of a rise in prices that might be caused by the UPSI, such DP cannot sell such security within 6 months of the purchase. While trades can be executed by different DPs having different PAN, however where a single person is the “driving force” (as cited by the SAT in Shubhkam Ventures (I) Private Limited v. SEBI[2], it cannot be said that the persons acted in their individual capacity.

There have been instances in the past where SEBI has given the view that contra trade restrictions apply individually on DPs. The view seems to be supported by the interpretation of clause 10 of Schedule B of the Regulations, which states that:

The code of conduct shall specify the period, which in any event shall not be less than six months, within which a designated person who is permitted to trade shall not execute a contra trade. XXX

Previously, in 2020, in the matter of Raghav Commercial Ltd[3], SEBI in its interpretative letter took the view that the contra trade restrictions apply to trades made by promoters individually and not the entire promoter group.

Taking the case of individual DPs, in the matter of Star Cement Limited[4], while answering the question on applicability of contra trade restrictions – whether individually or to the entire promoter group, SEBI cited the above clause 10 stating that the same applies individually.

Reference of the above case was taken in 2019 in the matter of Arvind Limited[5], where contra trade restrictions were said to apply individually on DP through PAN, disregarding who took the trading decision. Our detailed article on the same can be read here.

The current case makes it quite clear that the facts of the case have to be considered to analyze whether there is a single person taking trading decision.

Let us take several other examples to understand the intent of contra trade.

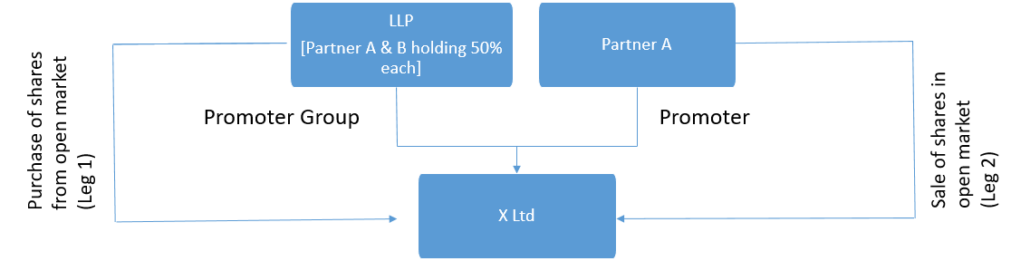

1.

Whether Leg 2 will be contra to Leg1? Here we see that significant stake i.e. 50% is being held by Partner A (promoter of X Ltd) in the LLP. The trades of LLP can be said to be influenced by the decision of Partner A. This can be a case of common control and therefore Leg 2 becomes contra to Leg 1.

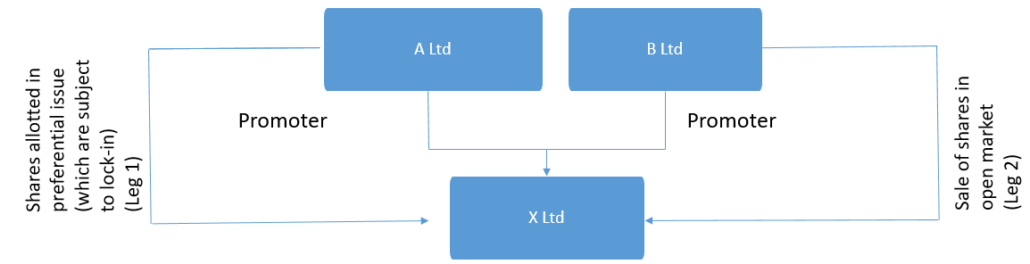

2.

In this case, we will have to see who is behind A Ltd and B Ltd. If both A Ltd and B Ltd are held by the same set of shareholders, Leg 2 would become contra to Leg 1.

Further, there are certain exemptions w.r.t. contra-trade restrictions that have been prescribed in the PIT Regulations and also in SEBI FAQs.

As per PIT Regulations, contra trade shall not apply for trades pursuant to exercise of stock options. SEBI Faqs further elaborate on the same stating that, in respect of ESOPs, subscribing, exercising and subsequent sale of shares, so acquired by exercising ESOPs (hereinafter “ESOP shares”), shall not attract contra trade restrictions.

Further trades pursuant to any non- market transaction is exempted (SEBI Faqs).

The rationale behind exemption is that for stock options and non-market transactions, the exercise price / purchase price is predetermined. The selling transaction pursuant to exercise of stock options or pursuant to acquisition of shares in non-open market is not influenced by purchases made basis some UPSI. The exercise price / acquisition price is already decided by the company.

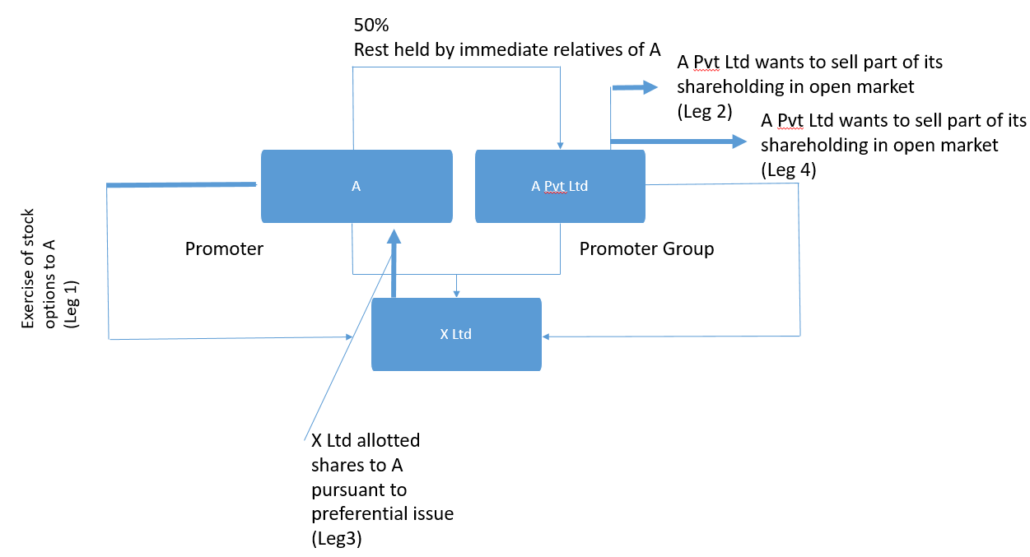

Let us understand another example.

3.

In the above case, it is evident that A is the decision maker for A Pvt Ltd. Here, Leg 2 is not contra to Leg 1.Leg 4 is contra to Leg 3 as there is no exemption provided.

Often, it is also interpreted that contra-trade is applicable share wise. To take an example, suppose; first – stock options are acquired by a DP, second – open market purchase is done, third – stock options are sold (all three within a period of 6 months). Here, it is interpreted that third would not be contra to first and second. This is a wrong interpretation, as the moment the DP makes any open market purchase or already has the company’s shares in portfolio, the immunity w.r.t. selling shares acquired pursuant to exercise of stock options is lost. One cannot differentiate between the shares as what is important to establish for contra-trade is the intention to make short term profits. Such intention, also, is evident when trading decisions are made by a single person, irrespective of the different individuals executing trades.

Global scenario

Contra-trade is understood by different names in other jurisdictions. It is referred to as short swing in the US and reversal trade in some jurisdictions.

- United States – Securities Exchange Commission Act, 1934[6]

Section 16(b) deals with prohibition on short-swing trades by beneficial owner, director, or officer of the companies. The section reads as under:

“For the purpose of preventing the unfair use of information which may have been obtained by such beneficial owner[7], director, or officer by reason of his relationship to the issuer, any profit realized by him from any purchase and sale, or any sale and purchase, of any equity security of such issuer (other than an exempted security) or a security-based swap agreement involving any such equity security within any period of less than six months, unless such security or security-based swap agreement was acquired in good faith in connection with a debt previously contracted, shall inure to and be recoverable by the issuer, irrespective of any intention on the part of such beneficial owner, director, or officer in entering into such transaction of holding the security or security based swap agreement purchased or of not repurchasing the security or security-based swap agreement sold for a period exceeding six months.XXX”

- China – Securities Law of the People’s Republic of China[8]

Article 41 and 42 deals with contra trade restrictions. It reads as under:

Article 41 A shareholder that holds five percent of the shares issued by a company limited by shares shall, within three days from the date on which the number of shares held by him reaches this percentage, report the same to the company, which shall, within three days from the date on which it receives the report, report the same to the securities regulatory authority under the State Council. If the company is a listed company, it shall report the matter to the stock exchange at the same time.

Article 42 If the shareholder described in the preceding article sells, within six months of purchase, the shares he holds of the said company or repurchases the shares within six months after selling the same, the earnings so obtained by the shareholder shall belong to the company and be recovered by the board of directors of the company. However, a securities company that has a shareholding of not less than five percent due to purchase of the remaining shares in the capacity of a company that underwrites as the sole agent shall not be subject to the restriction of six months when selling the said shares.

If the company’s board of directors fails to comply with the provisions of the preceding paragraph, the other shareholders shall have the right to require the board of directors to comply.

If the company’s board of directors fails to comply with the provisions of the first paragraph and thereby causes losses to the company, the directors responsible therefore shall bear joint and several liabilities for the losses.

Concluding remarks

We had earlier in our article (supra) given the view that contra-trade should be seen jointly and not individually, considering the intent. To establish violation of PIT Regulations, one has to go beyond tracking trades based on PAN. It is important to know the decision maker behind the trades, in order to establish a clear nexus. It would be important to see whether such a view was taken by SEBI because of the case in hand or is it reflective of a new trend i.e. position of common control.

Link to our PIT Resource centre: Click here

[1] https://www.sebi.gov.in/enforcement/informal-guidance/oct-2023/in-the-matter-of-rama-mines-mauritius-ltd-under-sebi-prohibition-of-insider-trading-regulations-2015_78308.html

[2] https://www.sebi.gov.in/satorders/subhkamventures.pdf

[3] https://www.sebi.gov.in/sebi_data/commondocs/sep-2020/SEBI%20let%20Raghav%20IG_p.pdf

[4] https://www.sebi.gov.in/sebi_data/commondocs/jul-2018/StarCementGuidanceletter_p.pdf

[5] https://www.sebi.gov.in/sebi_data/commondocs/nov-2019/Inf%20Gui%20letter%20by%20SEBI%20Arvind_p.pdf

[6] https://www.govinfo.gov/content/pkg/COMPS-1885/pdf/COMPS-1885.pdf

[7] Every person who is directly or indirectly the beneficial owner of more than 10% of any class of any equity security (other than exempted security) [Ref. 16(a)(1)]

[8] http://www.npc.gov.cn/zgrdw/englishnpc/Law/2007-12/11/content_1383569.htm#:~:text=Article%201%20This%20Law%20is,of%20the%20socialist%20market%20economy.

Leave a Reply

Want to join the discussion?Feel free to contribute!