Some relief in RBI stance on lenders’ round tripping investments in AIFs

– Team Finserv | finserv@vinodkothari.com

The Reserve Bank of India on 19th December 2023 issued a notification[1] imposing a bar on all regulated entities[2] (REs) with respect to their investments in AIFs. We had covered the same in our earlier write-up. The Circular has already created some bloodshed as several banks took a hit in their Q3 results. Though late, yet welcome, the RBI has now come with some relief by a March 27 2023 circular. The following Highlights are based on the original circular, as amended by the March 27th circular :-

What has the RBI done?

- Prohibited all regulated entities (REs), including banks, cooperative banks, NBFCs and All India Financial Institutions from making investments in Alternative Investment funds (AIFs), if the AIF has made any investment in a “debtor company”, other than by way of equity shares of the debtor company. Hence, if the AIF has made investment by way of bonds, structured capital instruments, etc., issued by a debtor company, the bar as above will apply.

- Debtor company means a company in which the RE currently has or previously had a loan or investment exposure anytime during the preceding 12 months

- The bar applies immediately, that is, effective 19th Dec 2023. No further investments to be made.

- If investments already exist, the RE shall exit within 30 days, that is, by 18th Jan., 2024. Hindsight clearly shows that for most regulated entities, there was no way to cause exit, as AIF investments are evidently illiquid. Hence, most regulated entities took a hit on their P/L.

- Further, if an RE has made an investment in an AIF, and the AIF invests in a debtor company, the RE shall make an exit within 30 days.

- Investment by REs in the subordinated units of any AIF scheme with a ‘priority distribution model’ subject to full deduction from RE’s capital funds. See further discussion on priority distribution model below.

What was the intent?

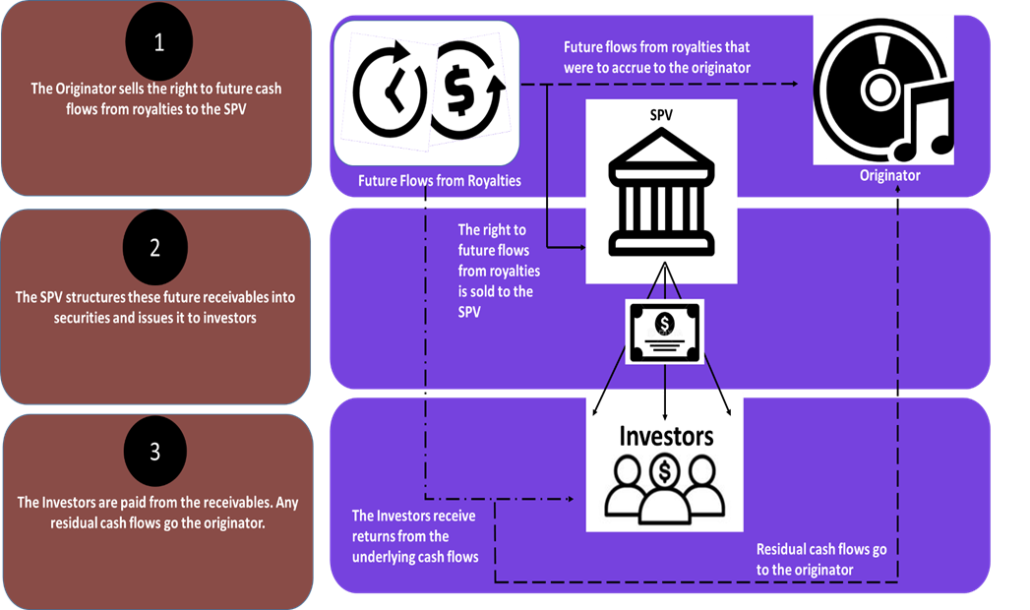

- Since several REs have affiliated AIFs, routing the money through AIFs to borrowers might have led to ever greening. That is, the AIF would invest the money into a debtor company, and consequently, the debtor company would keep its account as a performing asset. In essence, the AIF was acting as a stopover in the process of round tripping of the money back to a debtor company, from where it will be used to pay off the lender.

What will be the impact of the Circular?

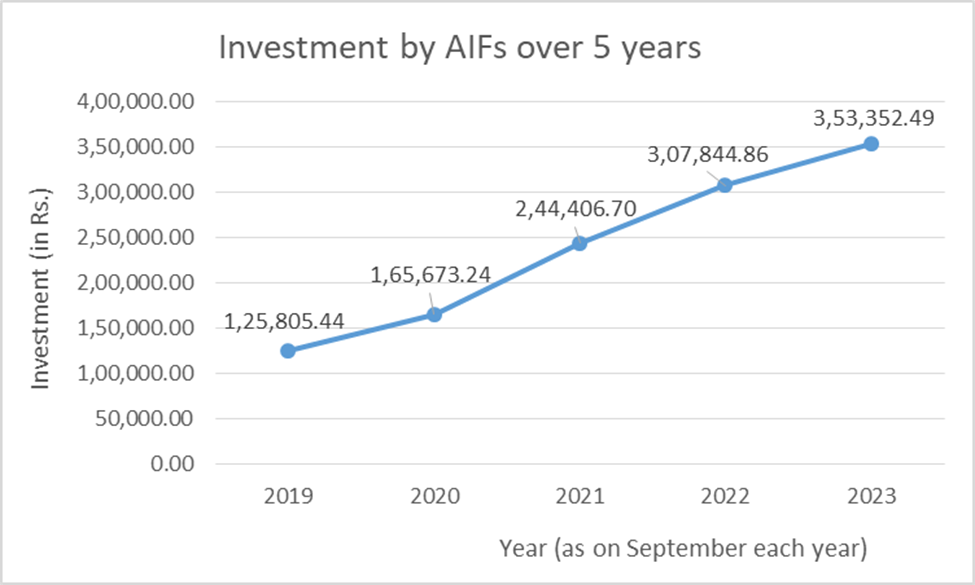

- Most of the larger REs have affiliated AIFs. Flow of funds to them from the RE would stop completely.

- The sweep of the circular is wide and non-discriminatory. Not only affiliated AIFs, but any AIF in general will be dried of funding from REs. While the bar is only for those AIFs which have invested in “debtor companies”, it will be practically tough for REs to avoid overlapping investments. Given the severe implications of a breach, compliance-sensitive REs will avoid investing in AIFs.

- There is an immediate disinvestment pressure on AIFs, as there may be overlapped investments. AIFs’ assets are mostly illiquid – ensuring exit to RE investors may be tough. In many cases, there are lock-in restrictions as well.

- Not only has the RBI expressed concerns, SEBI also issued a consultation paper for enhancement of trust in the AIF ecosystem, citing use of AIFs for regulatory arbitrage. See our write up on the SEBI proposals.

Direct or indirect investments:

- As the Circular is driven by concerns of round-tripping, widening the circuit by creating more stop-overs does not help. For example, if a lender invests in an AIF, which invests in an intermediate entity, which in turn invests in a debtor entity, the trail of the money is clear. Likewise, the lender may be making an indirect investment in an AIF.

- However, where there is no round-tripping of the money to a “debtor company”, there should be no concern. For example, if a lender makes a loan to an entity, where an AIF of the group has also made investments, there is no flow of money from the lender to the AIF, for the purpose of the downstream investment by the AIF into the debtor company.

Investments through mutual funds and FOFs exempt:

- The 27th March circular exempts instances where investments are made by lenders into mutual funds or FoFs, and those in turn have some exposure in either an AIF or in a debtor entity.

Priority distribution model or structured AIFs

- In addition to the concerns on downstream investments by AIFs in debtor companies, the RBI also had concerns on the so-called structured AIFs or AIFs with a distribution waterfall. Whether AIFs can at all have a priority distribution waterfall is currently under SEBI examination and SEBI has stopped AIFs from using structured distribution schemes (by way of accepting fresh commitment or making investment in a new investee company) . However, several existing schemes have such models.

- If a lender makes an investment in the subordinated units of a structured AIF scheme such investments will get deducted from the regulatory capital of the lender. The March 27 circular now clarifies that the deduction will be equally from Tier 1 and Tier 2 capital. Further, it also clarifies that the subordinated exposures in the AIF schemes could be in the form of subordinated exposures, including investment in the nature of sponsor units.

Concern areas

- Ideally, the bar should have been limited to affiliated AIFs. Affiliated AIFs could have been defined appropriately – for example, a related party, or where the investment manager, or sponsor is a related party of the RE. Extending the bar to all AIFs is quite far from the intent of the circular – which is, admittedly, to curb evergreening. It is difficult to see how unrelated AIFs can be used by an RE to evergreen, as investment decisions of these AIFs are not exercised by the investors.

- Ideally, the bar should have been limited only to Cat 1 and Cat 2 AIFs. Cat 3 AIFs, widely known as hedge funds, typically play in equity long/short strategies, or do other leveraged trades. REs find such investment a useful way to diversify their funds into hedge funds. Hedge fund investments are common by institutional investors all over the world; an outright curb on these investments by REs is, once again, beyond the stated intent. Notably, given the wide range of investments that Cat 3 AIFs make, avoiding an overlap with the RE’s borrowers will be quite impractical.

- Practical implementation of this circular, if at all a RE invests in an AIF, will be quite tough. AIFs will have to share their potential investment list, which will be against any investment manager’s choice. Assuming there is an overlapped investment, the RE will have to exit within 30 days, which will create liquidity issues for AIFs, in addition to challenging the lock-in restrictions.

- Most of the regulated entities took a provision in the 3rd quarter. The 27th March circular of the RBI gives some relief by saying that the provision will be required only to the extent of the downstream investment in a debtor entity.

In our view, there is a need to review the regulatory mechanism for AIFs, as currently, AIFs are being used as instruments of regulatory arbitrage.

[1] https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12572&Mode=0

[2] Commercial Banks (including Small Finance Banks, Local Area Banks and Regional Rural Banks), Primary (Urban) Co-operative Banks/State Co-operative Banks/ Central Co-operative Banks, All-India Financial Institutions, Non-Banking Financial Companies (including Housing Finance Companies)

Other articles related to the topic:

- RBI bars lenders’ investments in AIFs investing in their borrowers

- AIFs ail SEBI: Cannot be used for regulatory breach

- SEBI’s standard approach, standardising valuation for AIFs

- Comparison between non-deposit accepting NBFC – Investment and Credit Company (NBFC-ND-ICC), Core Investment Company (CIC) and an Alternative Investment Fund (AIF)

- Snippet on credit of existing & issue of new units of AIFs in demat form

- SEBI amends framework for Large Value Funds