SEBI to provide debenture holders the right to object material related party transactions

Complicates approval process for closely held High Value Debt Listed Entities

– Vinita Nair, Senior Partner | vinita@vinodkothari.com

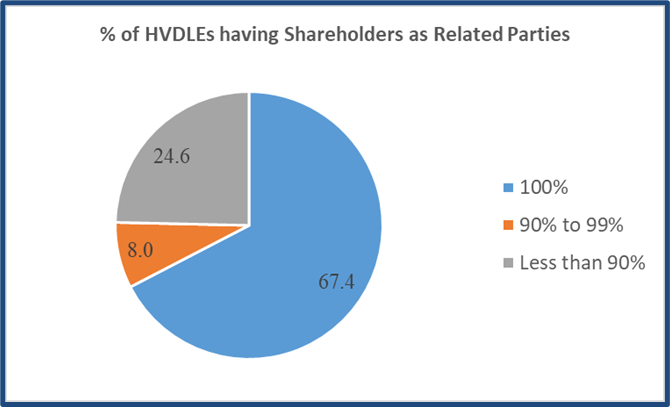

SEBI continues to tighten the regulatory regime for debt listed entities as it aims to promote corporate bond market. After equating debt listed entities with outstanding value of listed non-convertible debt securities of Rs. 500 crore and above with equity listed entities for the purpose of corporate governance norms, SEBI proposes a stricter approval regime for Related Party Transactions (‘RPTs’) under Reg. 23 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘LODR’) vide Consultation paper on review of Corporate Governance norms for a High Value Debt Listed Entity (‘HVDLE’)[1]. This has been rolled out just before the corporate governance provisions become applicable on a mandatory basis effective from April 1, 2023. The composition of 138 HVDLEs, in terms of shareholding pattern, as on March 31, 2022 was as under: