Archive for month: March, 2021

Risk-based Internal Prescription for Audit Function

/0 Comments/in Financial Services, NBFCs, RBI /by Vinod Kothari ConsultantsQasim Saif | Executive (finserv@vinodkothari.com)

Updated as on June 11, 2021

Introduction

It is a well-known fact that an independent and effective internal audit function is of special importance to all corporates for mitigation of their risk. And it has increased importance for a financial sector entity as it provides for reasonable assurance to the board and its senior management regarding the quality and effectiveness of the entity’s internal control, risk management, and governance framework.

Given the current relatively uncertain economic environment which has put significant pressure on debt servicing capabilities of corporates and businesses, there is a need to critically examine the existing portfolio and take an account of the related risk management and accounting practices.

This on-going stressed situation coupled with the uncertain economic environment and the increased global regulatory watch requires financial institutions to critically evaluate the quality of their regulatory submissions, risk model, capital adequacy, and conduct in the financial markets.

In recent times, Non-Banking Financial Companies (NBFCs) / Urban Co-operative Banks (UCBs) have grown in size and have become systemically important in the economy given their increased participation in the financial credit market. Just like banks, NBFCs and UCBs face similar risks by virtue of being engaged in financial intermediation activities, hence, it makes sense that their internal audit systems should also broadly align while keeping in mind the principle of proportionality.

Applicability

Earlier this year, RBI had issued RBIA Framework for Strengthening Governance Arrangements for commercial banks, local area banks, small finance banks, and payment banks on 7th January 2021[1].

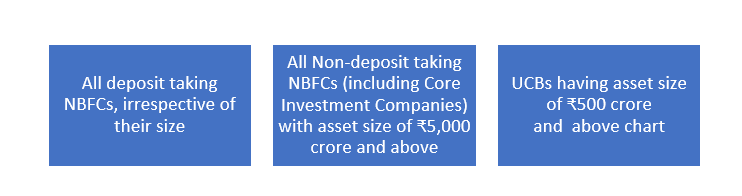

To increase focus on the risk management function of NBFCs/UCBs, the RBI on 3rd February 2021[2] issued a circular prescribing the requirement for Risk-Based Internal Audit (RBIA Framework). The requirements prescribed under the circular are to be implemented by 31st March 2022.The said circular is applicable on-

The framework for NBFCs and UCBs draws largely from the framework for banks.

The circulars clearly indicates that RBI is now accepting a more stringent attitude towards risk management and audit, specifically given the challenges faced due to Covid -19. It seems like Covid-19 acted as a wake-up alarm to increase focus on risk management and its mitigation by financial sector entities.

Applicability on Housing Finance Companies (HFCs)

The RBI circular did not specifically state the applicability of RBIA Framework on HFCs. Hence the same was open for interpretation by the stakeholders and so there were 2 different school of thoughts on this. First is that since HFCs are also a class of NBFCs so the circular should also be applicable on HFCs. However, a counter interpretation was that the Master Direction for Housing Finance Company (which assembles all applicable regulations at one place) which was notified on February 17, 2021[3] (after the given 3rd February circular), did not include compliance with RBIA Framework. Accordingly, the coverage of the RBIA Framework did not seem to be applicable on HFCs. The interpretation by the stakeholders resultied in diverse practices in the market.

However, RBI on 11th June, 2021 has issued a circular stating “On a review, it has been decided that the provisions of the aforesaid circular (circular dated 3rd February, 2021) shall be applicable to all deposit taking HFCs, irrespective of their size and non-deposit taking HFCs with asset size of ₹5,000 crore and above.

Considering the above clarification from RBI, HFCs shall now be required to be undertake Risk Based Internal Audit and put in place RBIA framework by June 30, 2022.

Risk Based Internal Audit: A Sub-set of Risk Management Framework

An essential characteristic of an effective RBIA Framework would be that it should be a connecting link between various components of risk management framework and should provide for reasonable assurance that organisation’s internal controls, risk management, and governance related systems and processes are adequate to deal with risk faced by it.

The internal audit function should ideally be targeted towards contributing to the overall improvement of the organization’s governance, risk management, and control processes using a systematic and disciplined approach.

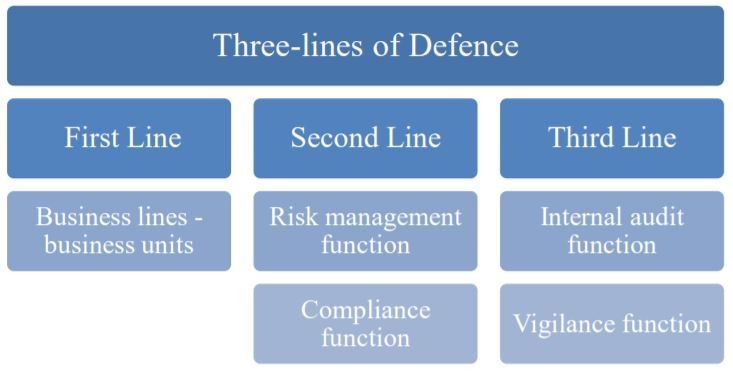

The circular provides that internal audit function is an integral part of sound corporate governance and is considered as the third line of defence. The inference for different lines of defence for risk management may be drawn from the RBIA circular for Banks, which provides as follows-

Based on the recent developments and emerging trends, the focus areas for robust internal audit should ideally inter-alia the following components-

The internal audit function in NBFCs/UCBs has generally been concentrated on accounting requirements and regulatory compliance etc. However, considering the market developments, testing limited to these factors may not be sufficient. Therefore, the current framework includes, above aspects along with, an evaluation of the risk management systems and control procedures in various areas of operations. This will help in anticipating areas of potential risks and mitigating such risks.

The RBIA should be conducted based on a RBIA plan which is required to be formulated after considering the elements of risk management framework of the entity.

Actionable

As mentioned above, reasonable amount of time is provided to NBFCs/UCBs to prepare for effective implementation of the RBIA Framework, that is, by 31st March 2022. However, though the requirements are to be complied by the end of next financial year, the preparedness for the same must be initiated immediately. A list of actionable on the part of NBFCs/UCBs has been provided below for reference:

Role and responsibilities of functionaries

It is a well understood notion that to get a particular task done, a fixed responsibility centre should be set-up, this enables proper implementation and also increases the efficiency of the implementation. Considering the same RBI has prescribed for responsibilities of senior management, Board and Audit committee to ensure proper implementation of RBIA Framework. The allotted role and responsibilities shall be as follows-

Board of Directors / Audit Committee of Board

The Board of Directors (the Board) / Audit Committee of Board (ACB) of NBFCs/UCBs shall have the primary responsibility of overseeing the internal audit function in the organization. The major responsibility of the Board and ACB would be to establish and further review the RBIA systems.

The RBIA policy is to be formulated with the approval of the Board and would be disseminated widely within the organization. The policy should be consistent with the size and nature of the business undertaken, the complexity of operations and should factor in the elements of internal audit. The ACB and Board would further review the performance of RBIA and shall also formulate and maintain a quality assurance and improvement program that covers all aspects of the internal audit function.

Senior Management

The senior management shall be responsible for implementation of the systems established by the board and ACB.

The senior management shall ensure adherence to the internal audit policy guidelines as approved by the Board and development of an effective internal control function that identifies, measures, monitors, and reports all risks faced. The senior management shall ensure audit reports is placed before the ACB/Board. Further, a consolidated position of major risks faced by the organization shall be presented at least annually to the ACB/Board, based on inputs from all forms of audit.

The senior management shall also be responsible for establishing a comprehensive and independent internal audit function that should promote accountability and transparency. It shall ensure that the RBIA Function is adequately staffed with skilled personnel of right aptitude and attitude who are periodically trained to update their knowledge, skill, and competencies.

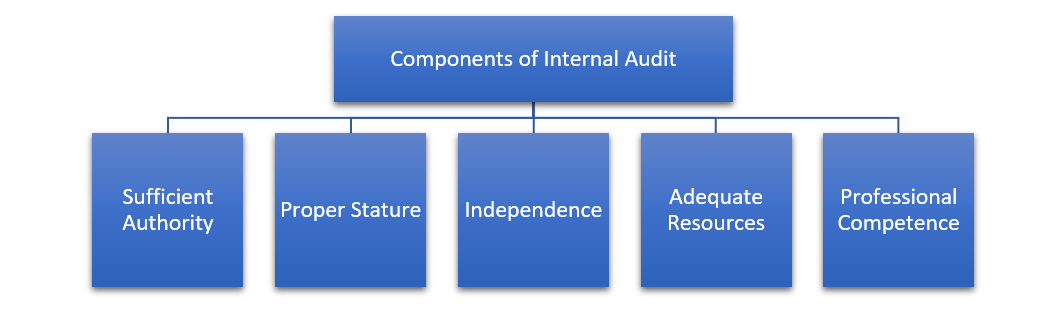

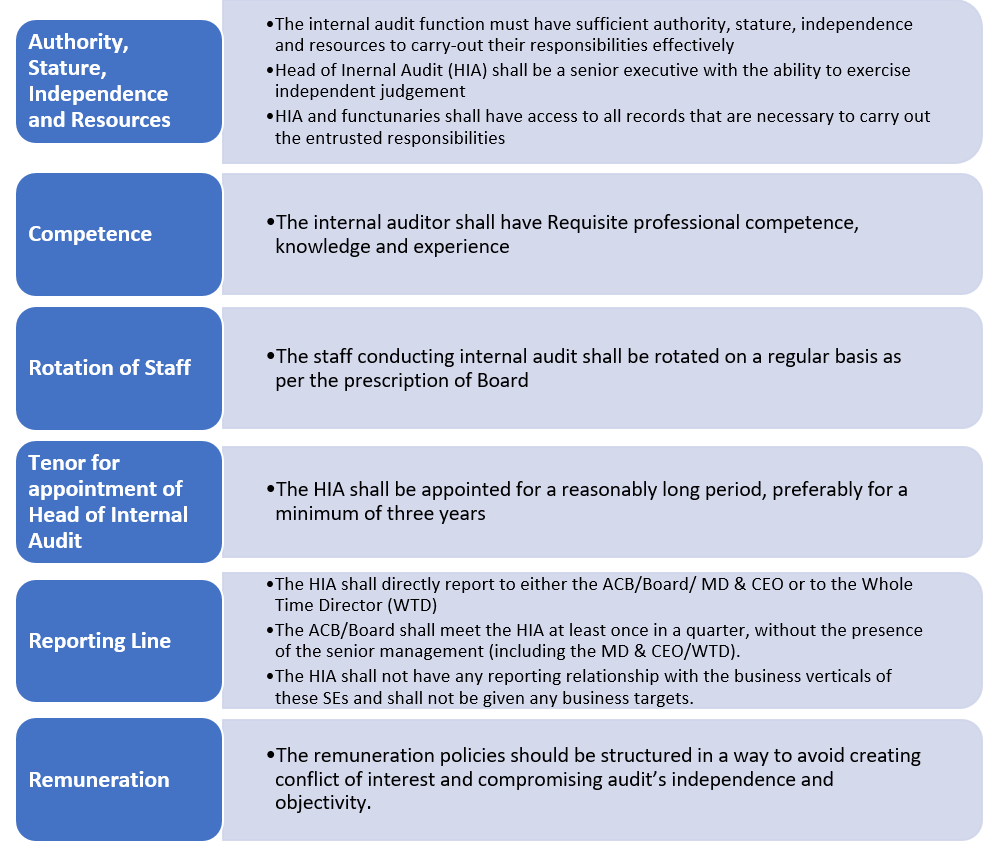

Internal Audit Function: Major Elements

The RBIA Framework broadly provides for a comprehensive internal audit function the major elements and their requirements are summarised as follows-

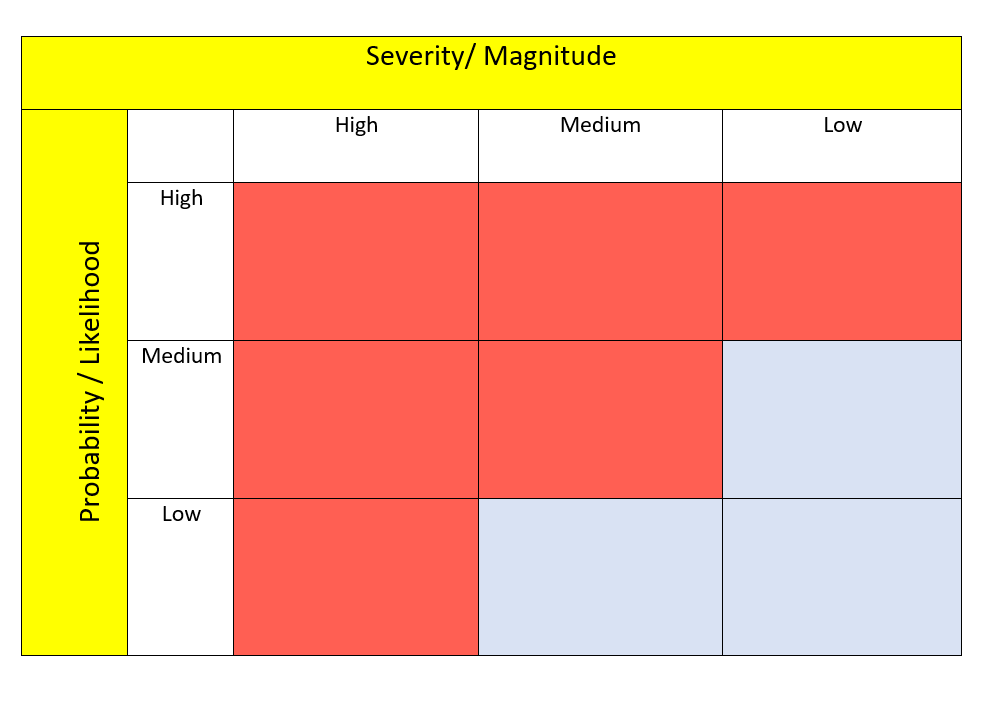

Risk Matrix

A risk matrix is a matrix that is used during risk assessment to define the level of risk by considering the category of probability or likelihood as against the category of consequence severity. This is a simple mechanism to increase visibility of risks and assist in management decision making.

The circular requires that the RBIA function should consider risk matrix while setting up action plan. Further, certain risk mentioned shall be given enhanced attention during the RBIA, the matrix and areas of focus are marked red in graph below-

Outsourcing of the Internal Audit Function

The internal audit function cannot be outsourced. However, where required, experts including former employees can be hired on a contractual basis subject to the ACB/Board being assured that such expertise does not exist within the audit function of the NBFC/UCB. Any conflict of interest in such matters shall be recognised and effectively addressed.

Monitoring and follow up

Monitoring and follow-up actions form an integral part of entire internal control system to ensure effective functioning of the procedures. Accordingly, the process as well as findings under the RBIA Framework should be regularly monitored. The said responsibility lies with the Board and Senior Management, as discussed above.

[1] https://www.rbi.org.in/scripts/NotificationUser.aspx?Id=12011&Mode=0

[2] https://rbidocs.rbi.org.in/rdocs/PressRelease/PDFs/PR10365F8B4F9BF8FE4A209F3BD7FD1D62B7D9.PDF

[3] Our write up on the topic “RBI consolidates directions for Housing Finance Companies http://vinodkothari.com/2021/02/rbi-consolidates-directions-for-housing-finance-companies/”

[4] Our write up on the top “Risk management policy” https://vinodkothari.com/2021/10/risk-management-policy-a-tool-of-risk-management/

Fragmented framework for perfection of security interest

/0 Comments/in Case laws, Credit and security interests, Insolvency and Bankruptcy, Resolution /by Vinod Kothari ConsultantsIntroduction An interesting question of law came up for consideration by way of appeal before National Company Law Appellate Tribunal (NCLAT) in Volkswagen Finance Private Limited v. Shree Balaji Printopack Pvt. Ltd.[1] The brief facts of the case involved a car financing company, which extended a car loan to the corporate debtor. The car financier […]

Conflicting provisions on CSR applicability under CA, 2013 & CSR Rules

/0 Comments/in Corporate Laws /by Vinod Kothari ConsultantsCSR Rules require further tailoring to fit

CS Ajay Kumar K V | Vinod Kothari and Company

Corporate Social Responsibility (‘CSR’) framework in India has always been adaptive to changing times and has witnessed quite an evolution. The basic idea behind the CSR provisions was to promote responsible and sustainable business philosophy at a broad level and to encourage companies to come up with innovative ideas and robust management systems to address social and environmental concerns of the local area and other needy areas in the country.

Despite the evolution and series of amendments, certain provisions in the Companies (Corporate Social Responsibility Policy) Rules, 2014 (‘CSR Rules’) continue to conflict with the requirements under section 135 of the Companies Act, 2013 (‘CA, 2013‘). This article discusses two of such conflicting provisions relating to CSR applicability.

As per Section 135 (1) of Companies Act, 2013, CSR provisions were originally applicable to companies meeting the thresholds of INR 500 crore net worth or INR 1000 crore turnover or INR 5 crore net profit during any financial year. The meaning of the term ‘any financial year’ was clarified by MCA to imply any of the three preceding financial years. This was amended vide the Companies (Amendment) Act, 2017 (‘CAA, 2017’) thereby shifting the applicability on companies meeting any of the aforesaid criteria during the immediately preceding financial year, on the basis of recommendation made by High-Level Committee on Corporate Social Responsibility (‘HLC-CSR’)1. Further, in terms of Section 384 (2) of CA, 2013 CSR provisions are applicable to foreign companies as well.

Conflicting provision under CSR Rules

-

On Applicability [Rule 3 (1)]

Rule 3 (1) of CSR Rules provides that a company including its holding or subsidiary, and a foreign company defined in Section 2 (42) of CA, 2013 fulfilling the criteria specified under Section 135 (1) of CA, 2013 are required to comply with CSR related provisions.

Section 135 (1) is absolutely clear on the applicability par. Therefore, the intent to include holding and subsidiary company of a company that meets the criteria is unclear. If the holding or subsidiary company independently meets the criteria specified under Section 135 (1), only then it will be required to comply with CSR related provisions. The applicability cannot be linked with applicability of the Section 135 (1) to the holding or subsidiary company.

-

Cessation of Applicability [Rule 3 (2)]

In terms of Section 135 (1) read with Section 135 (5), companies meeting the aforesaid criteria during the immediately preceding financial year are required to constitute CSR Committee and spend in every financial year, at least 2% of the average net profits of the company made during the three immediately preceding financial years. Consequently, companies not meeting any of the aforesaid criteria during the immediately preceding financial year are not required to ensure CSR related compliances[1].

However, Rule 3 (2) continues to provide a time frame of 3 consecutive financial years as an eligibility to discontinue ensuring compliance under Section 135. The said provisions have become redundant after enforcement of CAA, 2017. Relevant extract of HLC-CSR is as under:

“The Companies (Amendment) Act, 2017 has amended the eligibility criteria as being based on financial parameters of the ‘immediately preceding’ financial year instead of three immediately preceding financial years prevalent until then. Rule 3(2) of the Companies (CSR Policy) Rules, 2014 specifies that companies which cease to be eligible under Section 135(1) of the Act for three consecutive financial years shall not be required to comply with provisions of Section 135.

In view of the 2017 amendment, Rule 3(2) is redundant. “

Power of Central Government to revise thresholds

The Report of the Company Law Committee in 2019[2] based on the experience gained from the industry recommended the revision of the net worth/ turnover/ net profit thresholds specified in Section 135(1) from time to time to suit the changing requirements of the economy. The extracts of the committee note were;

“The Committee noted the merit in ensuring that static financial thresholds do not come in the way of corporate-driven socio-economic development and environmental conservation. In order to keep such revision process timely, the Committee recommended insertion of suitable provisions in the Section 135(1), which would enable the Central Government to enhance such limits by way of rules.”

However, the provisions of the Companies Act, 2013 do not provide for enabling power to the Central Government to revise the statutory thresholds framed 8 years back.

Conclusion

Prior to enforcement of CAA, 2017, the applicability was required to be ascertained based on the net-worth, turnover and net profits during any of the three preceding financial years. Therefore, Rule 3(2) of CSR Rules also provided a similar timeline for determining inapplicability of the CSR related provisions.

However, pursuant to amendment in Section 135 (1) by way of CAA, 2017 the Company is required to ascertain applicability by referring to the net-worth, turnover and net profits during the immediately preceding financial year. Accordingly, the inapplicability provided in Rule 3 (2) also was required to be aligned with amended Section 135 (1). Despite the deletion recommended by HLC-CSR, the provisions reflect under CSR Rules. Accordingly, companies need not wait till deletion of Rule 3 (2) as the same is anyways redundant post enforcement of amendment made in Section 135 (1).

Further, Rule 3 (1) of CSR Rules does not provide any additional clarity on the applicability and should be suitably amended. Lastly, enabling power to review static thresholds may also be inserted in Section 135 (1) of CA, 2013.

[1] https://www.mca.gov.in/Ministry/pdf/CSRHLC_13092019.pdf

[2] https://www.mca.gov.in/Ministry/pdf/CLCReport_18112019.pdf

Our other material on CSR can be accessed through the below link:

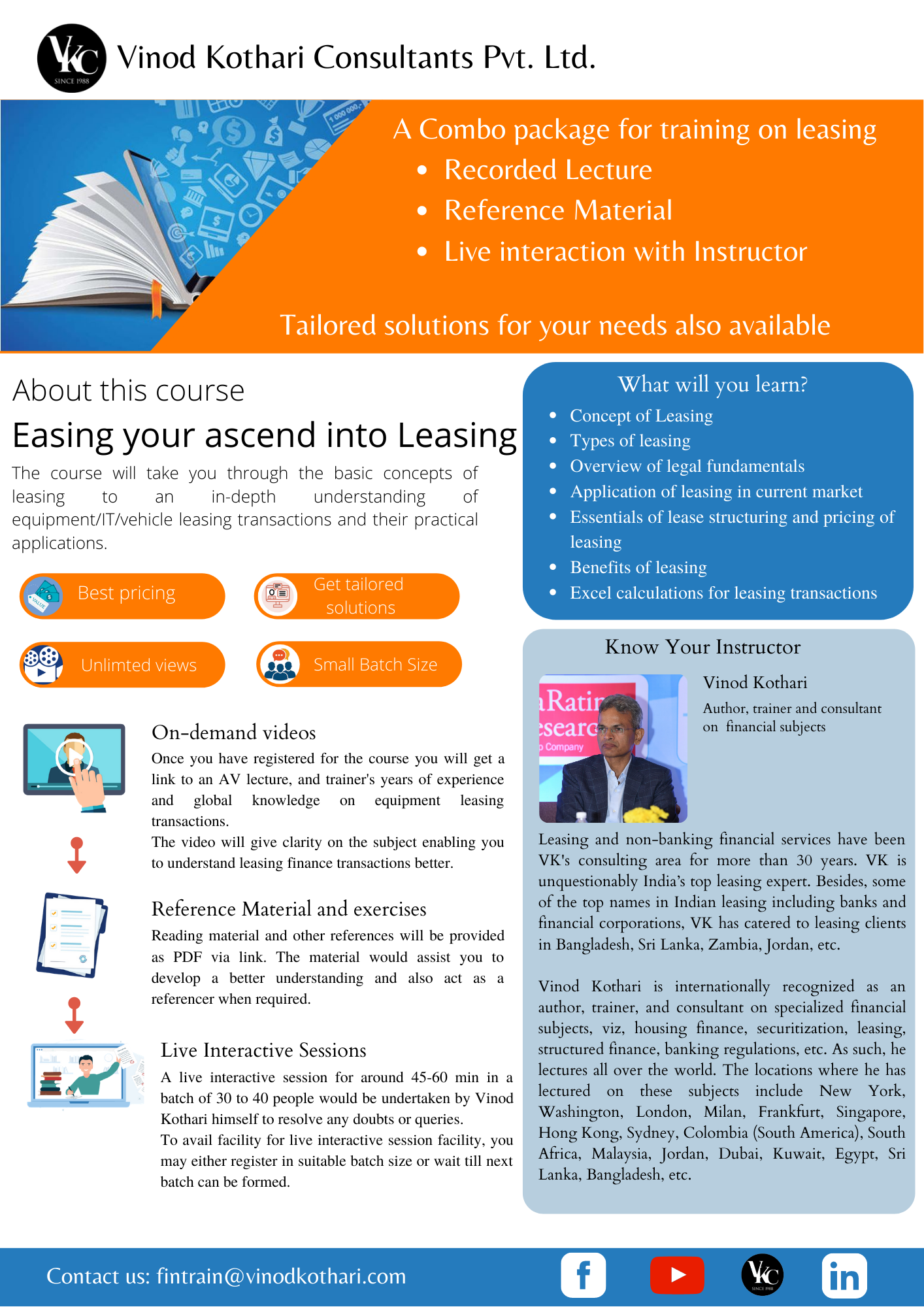

Easing your ascend into Leasing

/0 Comments/in Leasing and Asset Financing /by Vinod Kothari ConsultantsVehicle financing: multiple security interest registrations and the impact of non-registration

/0 Comments/in Uncategorized /by Vinod Kothari ConsultantsOur video on the topic by Mr. Vinod Kothari can be viewed here

Our video on the topic by Mrs. Sikha Bansal can be viewed here

For more articles, visit http://vinodkothari.com/bankruptcy-code/

Introduction to Covered Bonds

/0 Comments/in Financial Services /by Vinod Kothari ConsultantsCovered Bonds have the potential to disrupt the traditional financing market. This presentation provides a basic understanding of covered bonds. It deals with the concept of covered bonds, the history of origination of the concept, features, and benefits of covered bonds and how they differ from corporate bonds and MBS.

Our video on the topic may be viewed here: https://www.youtube.com/watch?v=XyoPcuzbys4

Other write-ups:

http://www.vinodkothari.com/wp-content/uploads/covered-bonds-article-by-vinod-kothari.pdf

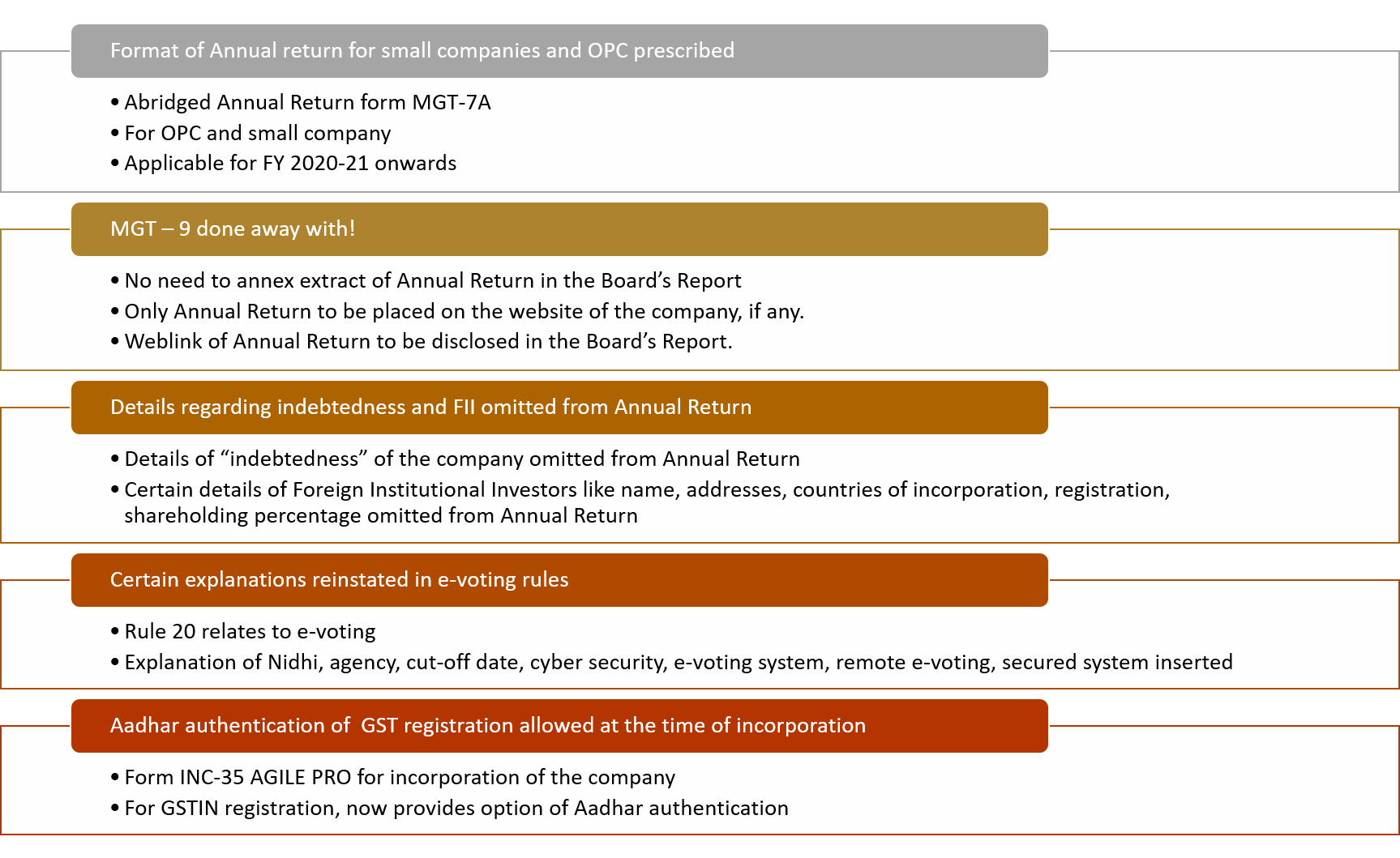

MCA notifies abridged annual return for small companies after 4 years

/2 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsCarries out corrective changes in MGT Rules

By CS Aisha Begum Ansari, Assistant Manager, Vinod Kothari & Company

Introduction

Four years after proposing amendment in Section 92 (1) of Companies Act, 2013 (‘Act’), Ministry of Corporate Affairs (MCA) notified the amendment in Companies (Amendment) Act, 2017[1] with effect from March 5, 2021.

The aforesaid amendment provided for following under Section 92 (1) & (3):

- Empowering Central Government to prescribe an abridged form of annual return for One Person Company (OPC) and Small Companies[2];

- Deletion of requirement to furnish details of indebtedness in the annual return;

- Deletion of requirement to furnish details indicating names, addresses, countries of incorporation, registration and percentage of shareholding of Foreign Institutional Investors;

- Doing away with the requirement of annexing extract of annual return to the Board’s report and mandating companies to place a copy of annual return on their website and provide the link of the same in the Board’ report.

While the amendment in relation to point 4. above was already notified with effect from August 28, 2020; MCA notified amendment in Companies (Management and Administration) Rules, 2014[3] (‘MGT Rules’) giving companies the option to annex extract of annual return in case of inability to place a copy of annual return on the website. Section 92 (3) of the Act post amendment did not provide any specific power to prescribe rules, however, MCA had amended Rule 12 of MGT Rules.

Further, in 2016 while amending MGT rules[4] in relation to voting by electronic means, MCA inadvertently deleted the explanations provided in sub-2 of Rule 20 that defined terms viz, agency, cut-off date, remote e-voting etc.

Corrective amendments in MGT Rules

MCA, on 5th March, 2021[5] notified amendments in MGT Rules to carry out corrective changes and to insert format of abridged annual return subsequent to notification of amendment in Section 92 (1) of the Act. The synopsis of the amendments are as mentioned below:

Insertion of abridged annual return in Form MGT-7A and revision of Form MGT-7

Rule 11(1) of MGT Rules have been substituted prescribing separate format of annual return for OPC and small companies which shall be filed in Form No. MGT-7A from the financial year 2020-21 onwards. Other companies to continue to file annual return in Form MGT-7.

MCA has also revised the format of Form MGT-7 for filing the annual return by companies other than OPC and small companies.

Form MGT-7 v/s Revised Form MGT-7

| Sr. No. | Para & Field No. | Information required in revised Form MGT-7 which was not required under erstwhile Form MGT-7

(For Companies other than OPC & Small Companies) |

| 1. | Para IV Field (i) (d) | 1. Bifurcation of shares held in demat and physical form.

2. Requirement of mentioning ISIN of equity shares of the Company; |

| 2. | Para IV Field (iv) | Following rows are deleted:

1. Secured Loans (including interest outstanding/accrued but not due for payment) excluding deposits; 2. Unsecured Loans (including interest outstanding/accrued but not due for payment) excluding deposits; 3. Deposit. |

| 3. | Certification part | Following new certification are required to be confirmed, (seems relevant only for private companies).

1. The company has not, since the date of the closure of the last financial year with reference to which the last return was submitted or in the case of a first return since the date of incorporation of the company, issued any invitation to the public to subscribe for any securities of the company. 2. Where the annual return discloses the fact that the number of members, (except in case of one person company), of the company exceeds two hundred, the excess consists wholly of persons who under second proviso to clause (ii) of sub-section (68) of section 2 of the Act are not to be included in reckoning the number of two hundred. |

Revised Form MGT-7 and Form MGT-7A

| Sr. No | Para & Field No. | Information required to be provided in Form MGT-7A which was not required under Form MGT-7

(For OPC & Small Companies) |

| 1. | Para I Field vi | Whether Form is filed for OPC or Small Co. [New Insertion]

|

| 2. | Para III | Particulars of associate companies including joint ventures. (not applicable for OPC) [Substituted by deleting holding and subsidiary Companies] |

| 3. | Para IV (ii) | Details of shares/Debentures Transfer since closure date of last financial year (or in the case of the first return at any time since the incorporation of the Company) (not applicable for OPC-Newly Inserted) |

| 4. | Para IV (iv) | Securities (other than shares and debentures) (not applicable to OPC-Newly Inserted) |

| 5. | Para VIII Field A | Members/Class/Requisitioned/CLB/NCLT/Court Convened Meetings (not applicable to OPC-Newly Inserted) |

| 6. | Para VIII Field B | Board Meetings (not applicable for OPC-Newly Inserted) |

| 7. | Para VIII Field C | Attendance of Directors (not applicable for OPC-Newly Inserted) |

| 8. | New attachment | List of Directors [Newly Inserted] |

| 9. | Certification part | Following new certification are required to be confirmed.

1. The company has not, since the date of the closure of the last financial year with reference to which the last return was submitted or in the case of a first return since the date of incorporation of the company, issued any invitation to the public to subscribe for any securities of the company. 2. Where the annual return discloses the fact that the number of members, (except in case of one person company), of the company exceeds two hundred, the excess consists wholly of persons who under second proviso to clause (ii) of sub-section (68) of section 2 of the Act are not to be included in reckoning the number of two hundred (seems relevant only for small companies). |

| 10. | Information not required to be provided in Form MGT-7A which was required in Form MGT-7 | 1. Whether shares listed on recognized Stock Exchange(s);

2. CIN of the Registrar and Transfer Agent; 3. Details of stock split/consolidation during the year (for each class of shares); 4. Secured Loans (including interest outstanding/accrued but not due for payment) excluding deposits; 5. Unsecured Loans (including interest outstanding/accrued but not due for payment) excluding deposits; 6. Deposit; 7. Details of directors and key managerial personnel; 8. Committee Meetings; 9. Number of CEO, CFO and Company secretary whose remuneration details to be entered |

Deletion of extract of annual return

Realizing that amended Section 92(3) of the Act did not provide any prescriptive power to MCA, Rule 12 has been substituted to provide that Annual Return is required to be filed with the Registrar upon payment of specified fees. While, the requirement to file Annual Return with the Registrar along with timelines has been provided in Section 92 (4), Rule 12 still provides a generic statement.

So, the positions stands clarified that companies will be required to upload the annual return on the website, if any, and provide the link thereof in the Board’s report.

Explanations relating to e-voting restored

Rule 20 of MGT Rules deals with voting through electronic means wherein it mandates the companies whose equity shares are listed on recognized stock exchange and who have not less than 1000 members to provide the facility of e-voting to the members in the general meeting. It exempted Nidhi companies from the requirement of providing e-voting facility to its members.

The original text of Rule 20 explained the following terms:

- Agency

- Cut-off date

- Cyber security

- Electronic voting system

- Remote e-voting

- Secured system

- Voting by electronic means

The above terms were omitted vide Companies (Management and Administration) Amendment Rules, 2016[6]. MCA has restored the same with the present amendment. Accordingly, the cut-off date will be not earlier than seven days before the date of general meeting, which was previously specified in the Rules.

Conclusion

The present amendment brings clarity and settles all questions relating to annual return and e-voting. Annexing extract of annual return is past. Whole of the annual return in Form MGT-7 or Form MGT – 7A as applicable, is required to be uploaded on the website of the company and web-link of the same to be provided in the Board’s Report.

[1]http://ebook.mca.gov.in/notificationdetail.aspx?acturl=TTbtgoimZaEriqvC1uq63cVI1aUKrmySF7pn3LWSIhRnwlDT+xFtqSRh8eE9YDYmTZpXWl/g6A+Dx/OT8agtKUclWEhfgK03TlnWLOuiGw6K1VTDhD8p3mpQTiLgy2ewBHNyAHD0wK1NTYvNTxvKE72myo++ycxQaipOFSzBIY4coKGinwHEcAFWj2Fn6hr6

[2] “small company” means a company, other than a public company whose paid-up share capital does not exceed two crore rupees and turnover as per profit and loss account for the immediately preceding financial year does not exceed twenty crore rupees

[3]http://ebook.mca.gov.in/notificationdetail.aspx?acturl=6CoJDC4uKVUR7C9Fl4rZdatyDbeJTqg3z9mihm9CxHHzu82fmWlMKzy8jPS04vbR

[4]http://ebook.mca.gov.in/notificationdetail.aspx?acturl=6CoJDC4uKVUR7C9Fl4rZdatyDbeJTqg3DZ3eKuS27Ryli2KQpdUJBX7LNlkBrkXwnB0Mo6W4iI/tFsp4nH5DYuXMxD09O4auZIWA0g9jbZU=

[5] https://www.mca.gov.in/Ministry/pdf/CompaniesMgmtAdminAmndtRules_05032021.pdf

[6]http://ebook.mca.gov.in/notificationdetail.aspx?acturl=6CoJDC4uKVUR7C9Fl4rZdatyDbeJTqg3DZ3eKuS27Ryli2KQpdUJBX7LNlkBrkXwnB0Mo6W4iI/tFsp4nH5DYuXMxD09O4auZIWA0g9jbZU=

Our other videos and write-ups may be accessed below:

Relating to above topics:

YouTube:

https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

Other write-up relating to corporate laws:

http://vinodkothari.com/category/corporate-laws/