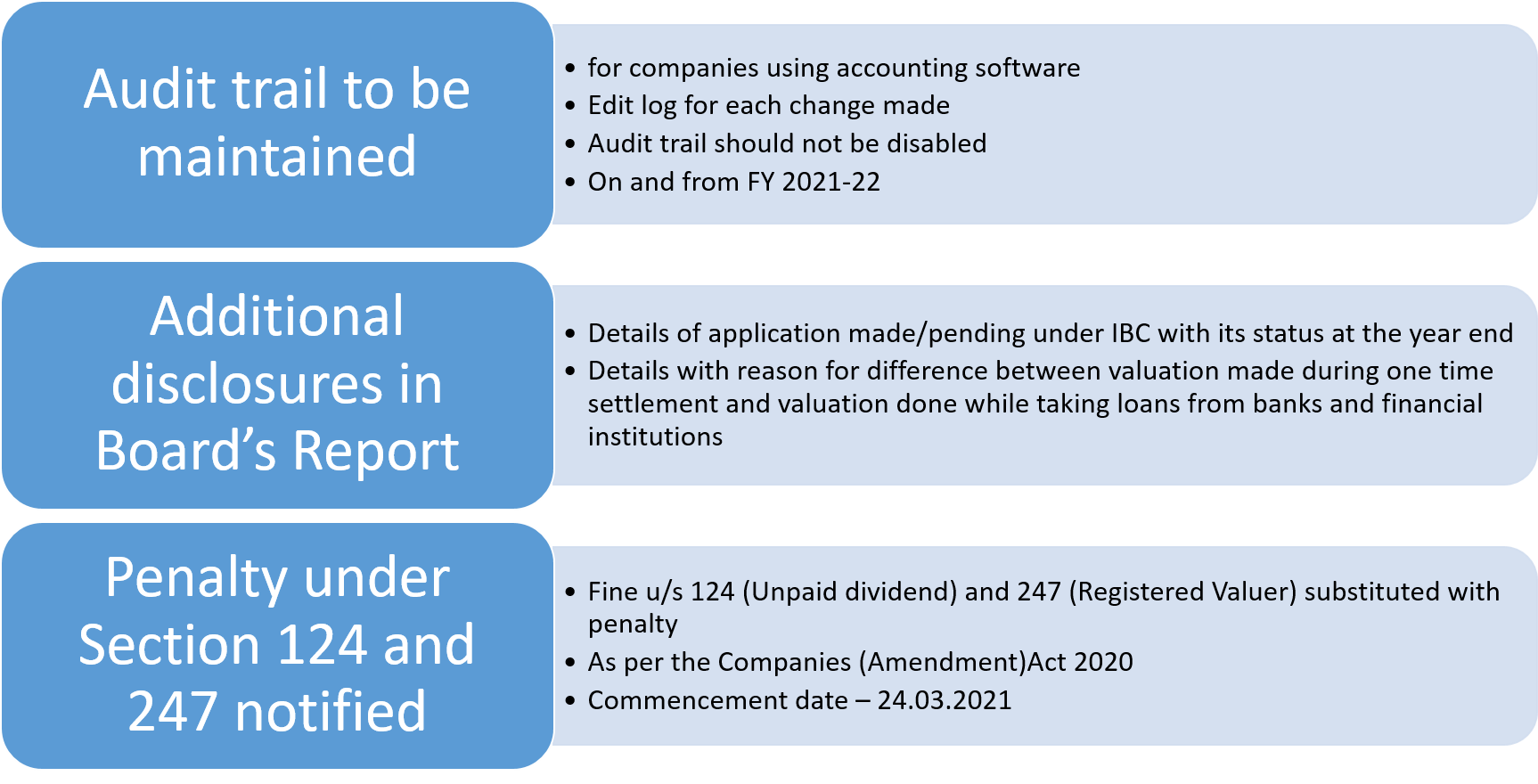

-The amendments to be applicable from FY 2021-2022 onwards!

Shreya Masalia and Harsh Juneja | Executives

With the ever-increasing stringency in the regulatory framework and disclosure requirements under various provisions of law, MCA, vide notification dated March 24, 2021[1] has further prescribed a list of numerous additional disclosure required in the financial statements by amending schedule III to the Companies Act, 2013. The amendments have been brought to bring more transparency by providing for various disclosures including dealing with struck off companies, details of benami property, undisclosed income etc. which shall be applicable from FY 2021-22.

Since the amendments have been brought in Division I, II and III of Schedule III, accordingly, the same will be applicable to the companies which need to comply with the Companies (Accounting Standards) Rules, 2006 as well as the Companies (Indian Accounting Standards) Rules, 2015 including NBFCs.

This Article is an attempt to cover all the major new inclusions that the companies will have to disclose henceforth.

Disclosures to be made to the notes of the Balance sheet under various Divisions of Schedule III

- Statement on changes in equity

Prior to the amendment, the companies including NBFCs required to prepare financial statements as per IND AS were required to disclose only balance at the beginning and end of the reporting period along with changes during the current year. Post the amendments in Sch. III, disclosure shall be made regarding the changes in equity due to prior period errors and restated balance at the beginning of the reporting year and similarly disclose the same for the previous reporting period. Additionally, the details of other equity shall also be given for prior reporting period.

- Disclosure of shareholding of all promoters

Currently, only the shareholding of the shareholders holding more than 5% of the shares is required to be disclosed in the Balance Sheet. After the amendments, a company shall now be required to disclose the shareholding of all promoters. The details shall include change in shareholding taken place during the year. The meaning of the promoter has to be taken from the definition provided in the Act which is different from the definition provided in the SEBI (ICDR) Regulations, 2009. This change has been made to all companies covered under all three Divisions of schedule III.

- Loans and advances to promoters, directors, key managerial persons (KMP) & related parties

Where the company makes any loan and advances to the promoters, directors, KMPs and other related parties either jointly or severally and such loan/ advances so given are either in the nature of a loan/ advance repayable on demand or without any specific terms or period of repayment, the details of such loans shall be disclosed separately in the financial statements along with the amount of loan and % to total loans and advances. The related parties are those parties as defined under sec. 2(76) of the Act.

It is pertinent to note here that while related party disclosures are already required under applicable accounting standards, this may, to some extent, tantamount to be an overlapping of disclosures.

- Ageing Schedule of trade payables and trade receivables

Companies that failed to make payment to companies under MSME Act, 2006 or which had made any delayed payments to MSME were required to disclose the principal and interest due at the end of the FY, amount of interest paid for delay in payment in the current year, interest accrued and unpaid during the year and amount of interest further remaining to be paid in succeeding years in their balance sheet.

Companies covered under all 3 divisions will henceforth be required to provide ageing schedule for trade payables due for the periodicity of 1 year, 1-2 year, 2-3 year & more than 3 years. These include trade payables to MSMEs, disputed dues to MSMEs, and other dues and disputed dues. Similarly, disclosures shall also be made where no due date of payment is specified. Information for unbilled dues is also required to be disclosed separately.

Similarly, companies will also be required to disclose the ageing schedule of its trade receivables i.e. including undisputed and disputed trade receivables considered good and doubtful with ageing classified as less than 6 months, 6 months to 1 year, 1-2 years, 2-3 years and 3 years or more along with disclosures separate disclosure for information of unbilled dues. These undisputed and disputed trade receivables which are further categorized into good and doubtful.

- Disclosure related to funds borrowed from banks and financial institutions

Where the company has borrowings from banks or financial institutions on the basis of security of current assets, it shall disclose whether the quarterly returns or statements of current assets filed by it with the banks or financial institutions are in agreement with the books of accounts. Further, where there is any material mismatch/ discrepancies between the two, then a summary of reconciliation and reasons of material discrepancies needs to be adequately disclosed. This amendment shall be applicable to all the companies covered under the scope of three Divisions of Schedule III. It clearly states that an auditor must find the differences between these statements filed by the company with the books of accounts and if there is any difference, then a reconciliation statement needs to be prepared.

In addition to the above, where funds borrowed by a company from a bank or a financial institution for a specific purpose has not used for the same purpose, a disclosure providing details of utilisation of funds shall also be required to be provided.

- Revaluation of property

The reconciliation of gross and net carrying amount of both intangible and tangible assets at the beginning and end of the reporting period, along with other separate disclosures related to additions, disposals, acquisitions, depreciation, impairment, etc shall also disclose separately details related to the amount of change due to revaluation, where there is a change of more than 10% in aggregate of the net carrying amount of the asset.

The company is also required to disclose whether the plant, property or equipment has been revalued by a registered valuer as defined under rule 2 of Companies (Registered Valuers and Valuation) Rules, 2017.

- Disclosure of Ratios

The amendment requires the companies covered under division I and II of schedule III to disclose the following ratios:

(a) Current Ratio,

(b) Debt-Equity Ratio,

(c) Debt Service Coverage Ratio,

(d) Return on Equity Ratio,

(e) Inventory turnover ratio,

(f) Trade Receivables turnover ratio,

(g) Trade payables turnover ratio,

(h) Net capital turnover ratio,

(i) Net profit ratio,

(j) Return on Capital employed,

(k) Return on investment.

The company shall explain the items included in the numerator and denominator for computing the above ratios and an explanation shall be provided for any change in the ratio by more than 25% as compared to the preceding year. To note, amongst these, various ratios such as current ratio, debt-equity ratio, net profits ratio, etc. were required to be disclosed by equity listed entities in their Board’s report under Management Discussion and Analysis Report as per regulation 34(3) r.w. Schedule V to SEBI( Listing Obligations and Disclosure Requirements), 2015.

In addition to the above, NBFCs that need to comply with Ind AS covered under division III of schedule III are required to disclose the following ratios:

(a)Capital to risk-weighted assets ratio (CRAR)

(b) Tier I CRAR

(c) Tier II CRAR

(d) Liquidity Coverage Ratio

However, as per annex XVI of Master Direction – NBFC-ND-SI and NBFC-DI Directions, 20163 , all deposit taking NBFCs and NBFC – non-deposit taking having asset size of INR 500 crore are already required to disclose their CRAR, tier I CRAR and tier II CRAR as a part of their balance sheet. Similarly, NBFCs as covered under para 15B read with annex III of Master Direction – NBFC-ND-SI and NBFC-DI Directions, 2016 are already required to provide disclosures related to LCR in the prescribed format.

Though these amendments are aimed at increasing disclosure requirements, this addition seems more repetitive in nature rather than being informational.

Disclosures required in an attempt to curb money laundering

- Details of Benami Property held

Where any proceedings have been initiated or pending against the company for holding any benami property, the company shall disclose various details of the property including the reasons of not disclosing the same in the books of accounts, details of the proceedings against the company including its nature, status and the views of the company on the same. This amendment covers the companies under the scope of all three divisions of schedule III.

- Relationship with Struck off Companies

Where the company has any transaction with companies struck off under section 248 of the Act, or under section 560 of the Companies Act, 1956, it shall disclose the name of struck off company, the nature of transactions with this company, balance outstanding and relationship with the struck off the company. The transaction can be in the nature of investment in securities, receivables, payables, shareholding of the struck-off company in the company and any other outstanding balances.

- Disclosures related to conduit lending and borrowing

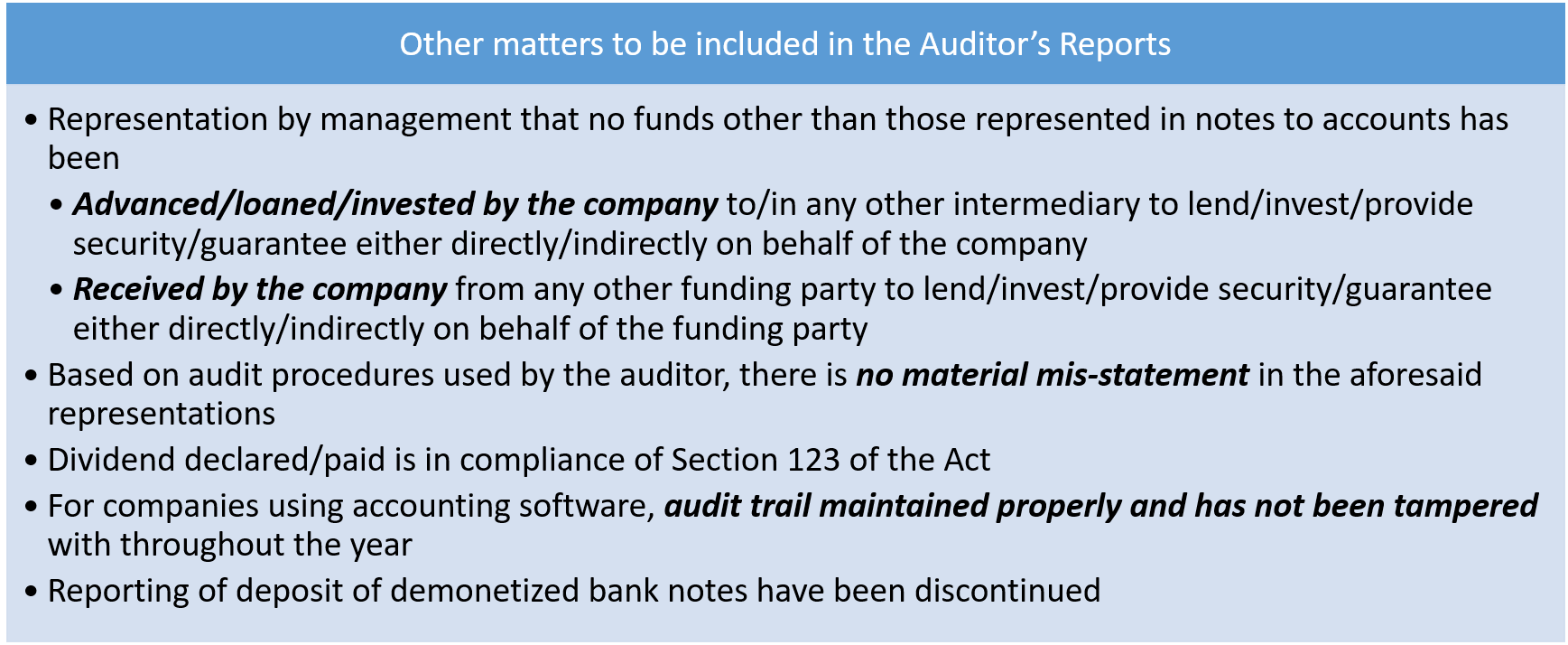

The amendments in the Companies (Audit and Auditors) Rules, 2014 dated March 24, 2021[2] requires the management of the company to give a representation that, except as otherwise disclosed in the notes to accounts, the company has neither employed nor is itself acting as a “conduit entity” for any financial transaction. To align schedule III with the same, additional disclosures are required to be made by the company w.r.t. disbursement of funds by way of advance, loan, investment, guarantee or security by the company to any person/ entity being an ultimate beneficiary through any intermediary. Similarly, disclosure shall also be made about any receipt of funds in the aforesaid manners by the company as an intermediary for further disposal of the same to any person/ entity being ultimate beneficiary. The details shall include the date, amount, details of the intermediary and the ultimate beneficiary including a declaration to the effect that it is in compliance with the Foreign Exchange Management Act, 1999 and Companies Act, 2013 and does not violate the provisions of Prevention of Money Laundering Act, 2002 in respect to the aforesaid transactions.

For an in-depth understanding of the concept and the amendment, refer our separate article[3] covering various aspects of the same.

- Wilful Defaulter

A company categorized as a wilful defaulter by any bank or financial institution will be required to disclose details regarding the date of declaration as a wilful defaulter and the amount and nature of defaults.

- Title deeds of property not held in the company’s own name

If any the title deed of any immovable property (other than in case of lease where the agreement is duly in favour of lessee) is not held in the name of the company, the details related the same is required to be disclosed in the financial statements. This disclosure shall not be required for properties held on lease where the lease agreements are duly executed. In case of joint holding of such property, the disclosure shall be made to the extent of the company’s share thereon.

The details of the disclosure includes the gross carrying value, name of the person in whose name property is held, whether such person is a promoter/ director or relative of promoter/director or an employee of the company, since when the property is held by the person and details for the same. If such property is under dispute the same shall also be disclosed.

Other miscellaneous disclosures:

- Depending upon the Total income of the company the financial statements are to be mandatorily rounded off to the nearest unit as mentioned in the schedule. Prior to the amendment, the same was to be adopted on a voluntary basis for companies preparing their financials as per Companies (Accounting Standards) Rules, 2006 and the nearest unit was based on the turnover of the company. The amendment aligns all the divisions of schedule III making it mandatory for all companies to round off their financial statements based on their total income.

- In case of revaluation of any plant, property & equipment, the disclosure w.r.t the fact that the valuation has been done by a registered valuer as defined under the Companies (Registered Valuers and Valuation) Rules, 2017.

- Disclosures related to ageing of capital work in progress (CWIP) and any other CWIP which has exceeded its originally planned cost or completion schedule. Details of projects where activity has been suspended shall be disclosed separately.

- Disclosures related to ageing of intangible assets and along with any other intangible asset which has exceeded its originally planned cost or completion schedule. Details of projects where activity has been suspended shall be disclosed separately.

- Details and reasons of pending registration of creation/ or satisfaction of charge with the Registrar of Companies beyond statutory time period.

- A company in non-compliance with the number of layers prescribed under clause (87) of section 2 of the Act read with Companies (Restriction on Number of Layers) Rules, 2017 shall disclose the same.

- A disclosure to effect that the books of accounts of the company are in accordance with the approved scheme of arrangement and accounting standards in case the competent authority has approved the same.

Disclosures to be given in the Profit and Loss statements:

- Disclosures related to CSR

Where the company is covered under section 135 of the Companies Act, 2013 (Act), the disclosures shall be made similar to the disclosures in the Board’s Report as required under then Act. In addition to that, a disclosure regarding the details of related party transactions such as, contribution to a trust controlled by the company in relation to CSR expenditure as per relevant Accounting Standards shall also be made.. Where a provision is made with respect to a liability incurred by entering into a contractual obligation, the movements in the provision during the year should be shown separately. The term “provision” shall be construed as a liability. The provision shall be estimated on the basis of past CSR events already conducted by the company.

- Details of Crypto Currency or Virtual Currency

Where the company has traded or invested in Crypto Currency or Virtual Currency during the financial year, the following needs to be disclosed:

(a) profit or loss on transactions involving Crypto currency or Virtual Currency

(b) amount of currency held as at the reporting date,

(c) deposits or advances from any person for the purpose of trading or investing in Crypto Currency/ virtual currency.

The Amendment has now mandated the companies to prepare a separate set of accounts for all their transaction involving Crypto Currency or Virtual Currency.

- Undisclosed Income

Details of any transactions not recorded in the books of accounts that has been surrendered or disclosed as income during the year in the tax assessments under the Income Tax Act, 1961, shall be disclosed unless there is immunity for disclosure under any scheme. Further, the company shall also state whether the previously unrecorded income and related assets have been properly recorded in the books of account during the year.

Conclusion

As discussed above, the intent of law seems to bring more transparency in reporting by corporates. Though certain disclosures may lead to repetition of information in various places, to avoid the same cross referencing may be done. Surely, the amendments will curb the problem of inadequacy of information in the books of accounts of the company.

[1] http://www.mca.gov.in/Ministry/pdf/ScheduleIIIAmendmentNotification_24032021.pdf

[2] http://www.mca.gov.in/Ministry/pdf/AuditAuditorsAmendmentRules_24032021.pdf

[3] http://vinodkothari.com/2021/03/changes-in-auditors-report-and-financial-statements-to-reveal-camouflaged-financial-transactions/