SEBI’s move to allow stock options to independent directors – Whether a threat to independence?

Aanchal Kaur Nagpal (corplaw@vinodkothari.com)

It is said that when morality has a fight against profit, it is rarely that profit loses. Humans are always looking for more and quite often give in to their greed. This is the underlying rationale when it comes to safeguarding the independence of an independent director– to cut off anything that would lure them to compromise the interests of the company.

At the same time, given the crucial role they play in corporate governance and the increasing expectations for ensuring a balance between stakeholders’ interests and ensuring an independent insider’s view on the company’s affairs, they need to be sufficiently compensated for the time they spend and the risk-taking they do as directors.

While adequate compensation is crucial, there is a fine line to be drawn between ‘compensation’ and ‘pecuniary interest’. A balance is required to be maintained where IDs are paid remuneration in fair proportion to the value they bring to an organization while also not compromising their ability to pass an independent judgement.

Currently, IDs receive remuneration in the form of sitting fees and profit-linked commission[1] subject to certain limits. Currently, they are not permitted to receive stock options under the Companies Act as well as LODR regulations. It is felt that a stock option will put the ID to a position of a shareholder, and there may, therefore, be an alignment of the interest of the IDs with those of the shareholders. This is presumed to threaten the independence of IDs. However, SEBI, vide its Consultation Paper on Review of Regulatory Provisions related to Independent Directors dated 1st March, 2021[2] (Consultation Paper) , has proposed a radical change to the conventional remuneration structure of IDs in India by allowing stock options to be granted to IDs.

In this article, the author attempts to analyse whether SEBI’s move to allow grant of options to IDs as a form of their remuneration, will truly threaten the sanctity of their independence.

We have analyzed the Consultation Paper at length in our article.

Law regarding ESOPs to IDs in India

As discussed above, ESOPs are not permitted to be granted to independent directors. The prohibition comes from both – the Companies Act as well as LODR regulations. According to regulation 17(6)(d), Independent directors shall not be entitled to any stock option. As per section 149(9) of the Companies Act, 2013, notwithstanding anything contained in any other provision of this Act, but subject to the provisions of sections 197 and 198, an independent director shall not be entitled to any stock option and may receive remuneration by way of fee provided under sub-section (5) of section 197, reimbursement of expenses for participation in the Board and other meetings and profit related commission as may be approved by the members.

Therefore, it is established, that currently, Indian laws expressly and absolutely prohibit granting stock options to independent directors. Further, voting power of more than 2% being held by an ID along with his/her relatives is also prohibited. However, this is in case of listed entities and prescribed unlisted public companies.

The problem regarding remuneration to IDs vs remuneration to EDs

Remuneration to IDs

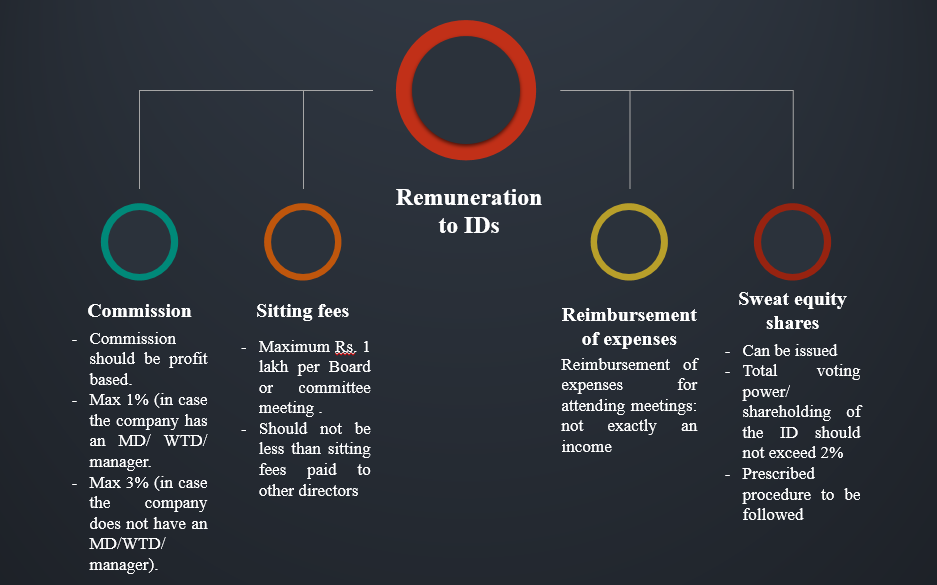

Currently, the following provisions are existent with respect to remuneration to IDs –

- According to section 149(9) of the Companies Act, 2013,

Notwithstanding anything contained in any other provision of this Act, but subject to the provisions of sections 197 and 198, an independent director shall not be entitled to any stock option and may receive remuneration by way of fee provided under sub-section (5) of section 197, reimbursement of expenses for participation in the Board and other meetings and profit related commission as may be approved by the members.

- As per section 197(5) of the Companies Act, 2013 read with rule 4 of the sitting fees to any director for attending Board or Committee meetings or for any other purpose, as may be decided by the Board, should not exceed Rs. 1 lakh. Further, IDs should not be paid sitting fees that is less than that paid to other directors.

- As per section 197(1)(ii) of the Companies Act, 2013,

The remuneration payable to directors who are neither managing directors nor whole-time directors shall not exceed, –

(A) one per cent. of the net profits of the company, if there is a managing or whole-time director or manager;

(B) three per cent. of the net profits in any other case.

- A director or manager may be paid remuneration either by way of a monthly payment or at a specified percentage of the net profits of the company or partly by one way and partly by the other.

The diagram below sums up remuneration that may be paid to an ID:

Thus, the sources of remuneration to IDs have been limited along with further restrictions to the amount of remuneration permitted to be paid. Whereas in case of executive directors, the permissible amount of remuneration is much higher along with lesser restrictions.

The role of both counterparts is paramount and none of the two can undermine the role of the other. However, the compensation received by IDs has been lower than that paid to executive directors. Although the latter are involved in the day to day management of a company’s affairs, the former pitch in their rich expertise, knowledge and unbiased view. Therefore, there should be a way to align or proportionate the remuneration drawn by IDs with executive directors.

However, on the contrary, executive directors are included in the definition of ‘officer in default’ and have a higher liability than that of IDs.

International Practices

As per the Cadbury Committee Report,

On fees, there is a balance to be struck between recognising the value of the contribution made by nonexecutive directors and not undermining their independence. The demands which are now being made on conscientious non-executive directors are significant and their fees should reflect the time which they devote to the company’s affairs. There is, therefore, a case for paying for additional responsibilities taken on, for example, by chairmen of board committees. In order to safeguard their independent position, we regard it as good practice for non-executive directors not to participate in share option schemes and for their service as non-executive directors not to be pensionable by the company.

According to National Foundation for Corporate Governance[3]

To secure better effort from non-executive directors, companies should: • Pay a commission over and above the sitting fees for the use of the professional inputs. The present commission of 1% of net profits (if the company has a managing director), or 3% (if there is no managing director) is sufficient. • Consider offering stock options, so as to relate rewards to performance. Commissions are rewards on current profits. Stock options are rewards contingent upon future appreciation of corporate value. An appropriate mix of the two can align a non-executive director towards keeping an eye on short term profits as well as longer term shareholder value.

UK

According to UK Corporate Governance Code[4] (para 34),

Remuneration for all non-executive directors should not include share options or other performance-related elements.

In exceptional cases where equity is granted, companies should gain shareholder approval prior to grant and the acquired shares should be held for at least 1 year from the director’s departure from the Board.[5]

Thus, in UK, the same is discouraged and not prohibited. The UK Corporate Governance Code represents key corporate governance recommendations of best practice for companies and does not have a statutory force.

The International Corporate Governance Network allows equity-based remuneration to non-executive directors. [6]

Australia

As per Australian Corporate Governance Principles and Recommendations – (only recommendatory and not mandatory)

Equity-based remuneration to non-executive directors: it is generally acceptable for non-executive directors to receive securities as part of their remuneration to align their interests with the interests of other security holders. However, nonexecutive directors generally should not receive options with performance hurdles attached or performance rights as part of their remuneration as it may lead to bias in their decision-making and compromise their objectivity.

France

According to the Corporate Governance Code of listed corporations by Afep-Medef[7], the principles for determination of compensation of non-executive directors, state that it is not desirable to award variable compensation, stock options or performance shares to non-executive directors. If, despite this, such awards are granted, then the Board must justify the reasons for this and the director cannot be considered to be independent.

USA

In USA, no express guidelines were found to prohibit share options to independent directors.

However, compensation policies of various companies filed with the SEC include stock options, restricted stock units and equity compensation granted to independent directors or outside directors (directors that are not employees of the Company).

Policies can be viewed here –

- https://www.sec.gov/Archives/edgar/data/1382911/000119312510046002/dex101.htm#:~:text=A%20person%20who%20is%20an,after%20the%20Public%20Trading%20Date

- https://www.sec.gov/Archives/edgar/data/1500217/000119312511005952/dex1045.htm#:~:text=Cash%20Compensation.,for%20service%20on%20the%20Board.&text=An%20Independent%20Director%20serving%20as,of%20%2410%2C000%20for%20such%20service

- https://www.sec.gov/Archives/edgar/data/1651308/000110465918039210/a18-14700_2ex10d5.htm

- https://www.sec.gov/Archives/edgar/data/1375151/000137515113000005/exhibit103-independentdire.htm

- https://www.sec.gov/Archives/edgar/data/1016281/000119312512105896/d290680dex1024.htm

- https://www.sec.gov/Archives/edgar/data/1002047/000119312512275547/d328654dex1065.htm

- https://www.sec.gov/Archives/edgar/data/1419625/000119312516706728/d76087dex1026.htm

What can be seen is that global governance norms have mixed views with respect to stock options to IDs.

Are IDs really independent in the first place?

There are various contentions that can question whether IDs are in fact independent at all.

Appointed by the Board

IDs are appointed by the Board of Directors. Although the appointment requires the approval of the shareholders as well, IDs are nominated by the Board or the Nomination Committee. The nomination is then recommended to the shareholders for their approval. Additionally, where promoters hold majority stake in a company, such appointment may be approved and dominated by them. Thus, expecting and ID to be independent of persons who are in fact behind his/ her appointment is a question in itself. Thus, if an ID truly requires to be independent, then he/ she should be appointed by an independent third party. Various changes have also been proposed with respect to appointment, reappointment and removal of IDs, which have been discussed in our article at length.

Profit related commission

IDs are paid commission that should be related to the profit. Thus, their income is dependent on the progress/ growth of the Company making the independent director ‘interested’ in the Company.

The cons of ESOPs

While the global precedence does not expressly prohibit ESOPs, there still lies an anomaly whether ESOPs would make an ID interested in a company.

Additional methods for fair compensation are needed on one hand but on the other, the independence of an ID cannot be compromised. If ESOPs are granted, IDs will become interested as shareholders and would dwell upon the short-term prosperity of a company since share price at the end of the vesting period would be what would matter to them. They would therefore compromise a long-term return along with interest of other stakeholders. There would be too much pressure on short-term performance mostly compromising the long-term good of the company.

Profit related commission to IDs

Profit related commission is contingent in nature and is a way of sharing risks and rewards. Such commission depends and is proportionate to the profitability of the other party and thus aligns the interests of the parties involved the arrangement.

Indian laws allow IDs to be paid by way of profit related commission. The same can be paid up to a maximum of 1% of the profits of the company in that financial year. This means that the amount of income of the ID, in the form of commission, will directly depend on the amount of profit in that financial year. If the company performs better in a particular financial year, the profit will be higher and in turn the proportionate commission of the ID in that financial year will be higher. This shows that the interests of the ID will be rather short term than long term. The ID will only be concerned about the short-term performance of the company for the years he is an ID since his income would be directly dependent on the same, irrespective of any event hampering or damaging the Company in the long run. Therefore, the permissible form of remuneration to IDs by Indian laws, in reality, adversely affects the independence of an ID.

Profit related commission versus ESOPs

Consequently, there arises a question on how the defense of independence can be used against ESOPs alone if IDs are allowed to receive profit related commission.

ESOPs, as compared to commission, would be a better way to remunerate IDs, when it comes to protecting the interests of Company. Where profit related commission makes the ID interested in the short term performance of the Company, ESOPs provide a longer performance goal. Stock options ensure a balance between the short term and medium term performance of a company.

Profit related commission depends directly on the immediate preceding year (i.e. just one year) while ESOPs depend on a relatively longer time frame (more than one year at the least- tenure of the ESOPs can be decided and controlled by the company).

Thus, if companies are allowed to pay profit related commission to IDs, restrictions on allow ESOPs are unwarranted considering the fact that the latter would be a preferred option to align the interests of the IDs with the medium term performance of a company.

Here, the intention behind granting such ESOPs would be to enable IDs to focus on the medium term/ long term performance of the company rather than retention which is usually the rationale behind ESOPs.

However, the maximum limit for granting such ESOPs as well as maximum shareholding should be monitored to avoid IDs from holding huge stakes in companies. Further, ESOPs with longer vesting periods should be allowed, where the exercise period falls after the expiry of tenure of the ID, to ensure ID’s focus on the long term growth of the company.

SEBI’s Consultation Paper to allow stock options –

SEBI contended that linking remuneration to profit or performance linked commission ensures that IDs have ‘skin-in-the-game’ which may encourage short-termism and lead to conflicts between the interests of the IDs and the overall interest of the Company. A better approach would be to instead permit ESOPs to IDs with a long vesting period (say, 5 years,) as this would ensure alignment of interests of the company and IDs. The rationale is that remuneration to IDs should be on the basis of their value and time-commitments to the company, without linking the same to the profits thereof. This would lead to IDs getting a fixed fee, without having any stake in the long-term growth of the company.

Additionally, the limit on the sitting fees to IDs, is also proposed to be increased.

Accordingly, recommendations will be sent to MCA for modification of the existing remuneration structure under the Companies Act as well.

Conclusion

Thus, SEBI is headed in the right direction to allow ESOPs to IDs and is highly welcomed. This would ensure that IDs are rightly compensated for the value they offer while also ensuring that long term interest. However, various checks should be placed by regulators for monitoring the same so as to safeguard the independence of the ID.

[1] While the existing requirement under sections 149(9) and 197(3) of the Companies Act, in case of remuneration to non-executive directors, was to pay them upto a percentage of profits, the amendments made by CAA 2020 (section 32) have delinked the compensation and the profits, permitting companies to pay remuneration by way of “minimum remuneration”, that is, irrespective of adequacy of profits (proviso to section 149(9) inserted and amendment to section 197(3))

[2] https://www.sebi.gov.in/reports-and-statistics/reports/mar-2021/consultation-paper-on-review-of-regulatory-provisions-related-to-independent-directors_49336.html

[3] http://www.nfcg.in/UserFiles/ciicode.pdf

[4] https://www.frc.org.uk/getattachment/88bd8c45-50ea-4841-95b0-d2f4f48069a2/2018-UK-Corporate-Governance-Code-FINAL.PDF

[5] You may check pay pratices in Europe through this report- https://infokf.kornferry.com/rs/494-VUC-482/images/191206-KF%20-%20NED%20report%202019%20-%20LR%20SPREAD%20mail.pdf

[6] https://www.icgn.org/sites/default/files/ICGN%20NED%20Guidelines%20%282010%29_%20Oct%202013print2_0.pdf

[7] https://afep.com/wp-content/uploads/2018/06/Afep-Medef-Code-revision-June-2018-ENG.pdf

Leave a Reply

Want to join the discussion?Feel free to contribute!