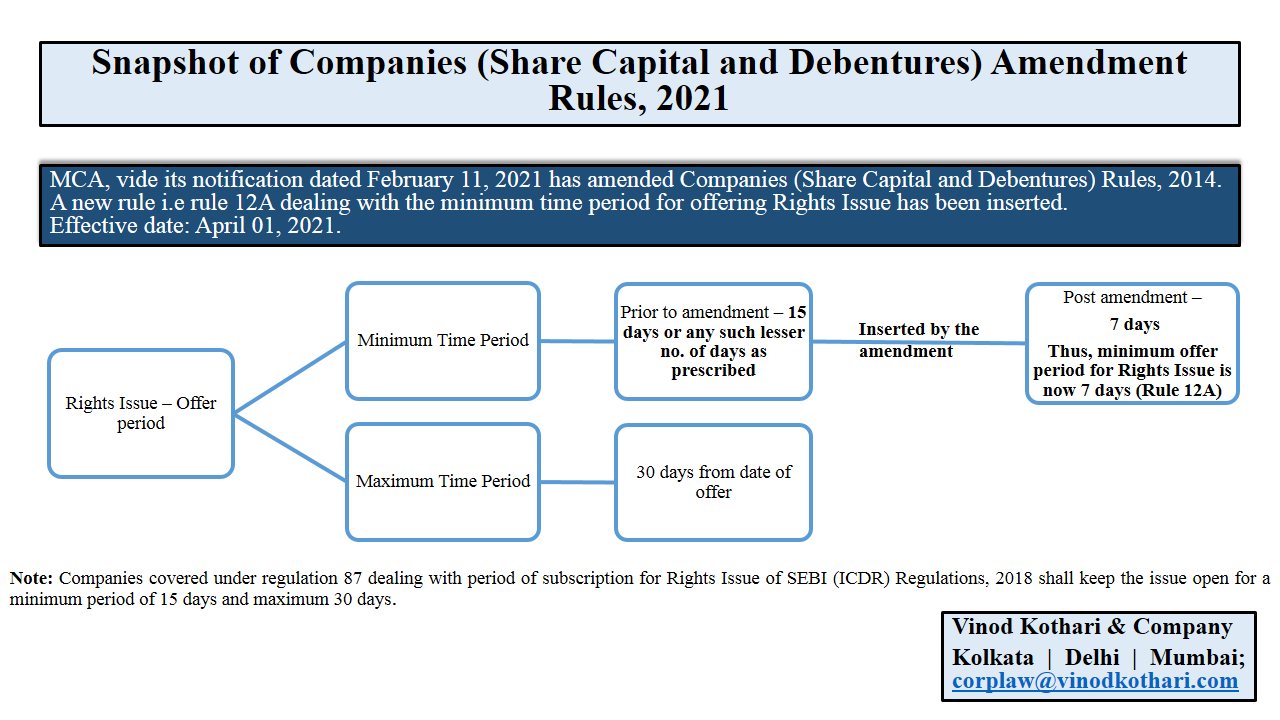

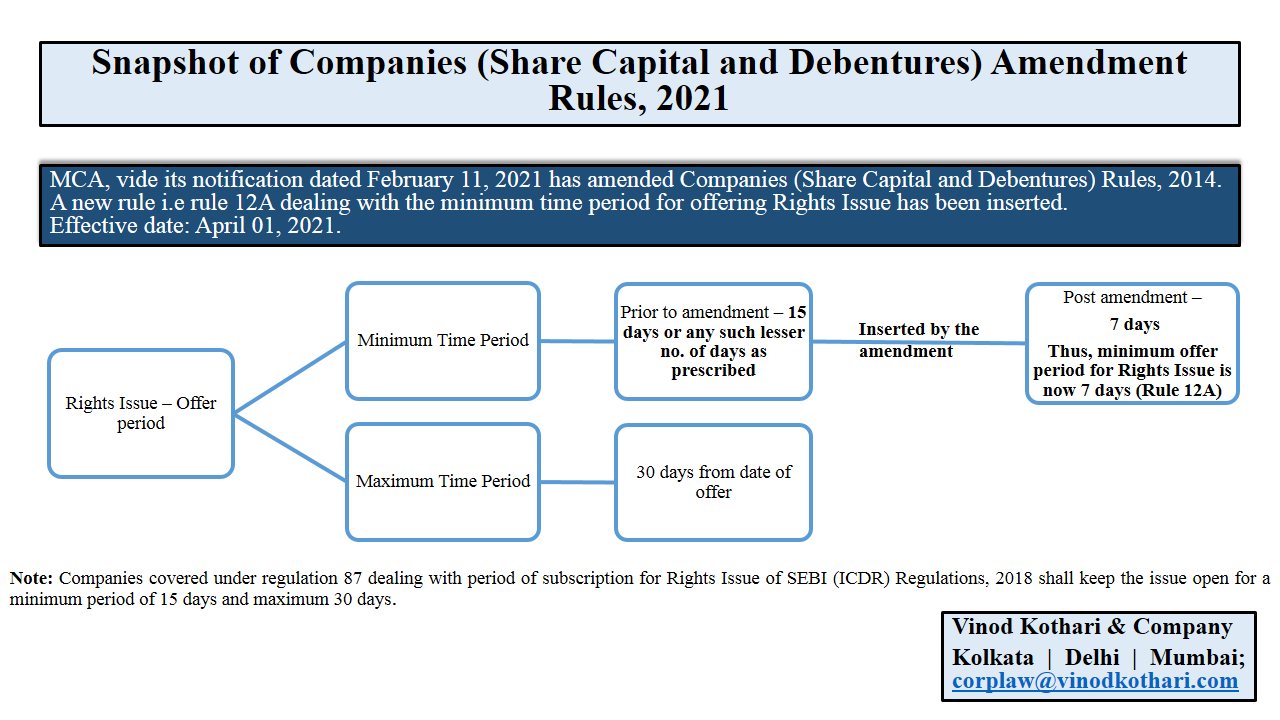

Snapshot of Companies (Share Capital and Debentures) Amendment Rules, 2021

Vinod Kothari & Company

Below is a short snippet on Companies (Share Capital and Debentures) Amendment Rules, 2021.

Vinod Kothari & Company

Below is a short snippet on Companies (Share Capital and Debentures) Amendment Rules, 2021.

The Ordinance additionally plugs gaps on differential rates in case of different mortgages

Aanchal Kaur Nagpal

aanchal@vinodkothari.com

Stamp duty computation, especially in case of complex transactions involving multiple transactions being given effect vide a single instrument, received the sanctity of Hon’ble Supreme Court (SC) in a landmark judgement in case of Controlling Revenue Authority v. Coastal Gujarat Power Ltd[1], where the SC upheld payment of separate stamp duty for different transactions involved interpreting Section 5 of Gujarat Stamp Act, 1958. Following the said judgement, Maharashtra stamp authorities rolled out a circular on September 28, 2015 informing the stand taken by SC; however, no amendment was carried out in Maharashtra Stamp Act, 1958.

Further, it was observed by the stamp authorities that in view of rate difference in case of stamp duty on equitable mortgage (mortgage by deposit of title deeds) as per article 6 (1) and simple mortgage as per article 40, parties played about the same in the instruments thereby creating difficulties in adjudication of amount of proper stamp duty chargeable for them.

The Maharashtra Stamp (Amendment and Validation) Ordinance, 2021 (‘Ordinance’) dated 9th February, 2021 amends Maharashtra Stamp Act, 1958 (‘Stamp Act’) to fill several gaps in the aforementioned provisions. The same have been discussed below –

Levy of stamp duty in case of mortgage is under the state list and thus the same will be governed by the respective state acts. In case of Maharashtra, the stamp duty chargeable in case of an equitable mortgage is less than that in case of a simple mortgage. Taking advantage of the said arbitrage, mortgage documents have been drafted in such a way that, even though the nomenclature of the document indicates an equitable mortgage, it attempts to cover even a simple mortgage. Thus, simple mortgages are disguised to indicate an equitable mortgage just to pay a lesser stamp duty. Such documents create difficulties in adjudication of amount of proper stamp duty.

Further, certain towns had been notified by the State of Maharashtra under the Transfer of Property Act to enable execution of agreement relating to an equitable mortgage. However, in cases of towns not notified, a person was forced to opt for execution of simple mortgage deed instead of an equitable mortgage, where stamp duty is higher in case of the former.

Owing to the above, the Act has been amended in order to align the stamp duty chargeable on the instruments of an equitable mortgage and simple mortgage deed under the articles 6 and 40, respectively.

| Particulars | Erstwhile stamp duty | Amended stamp duty | Remarks |

| Mortgage by deposit of title deeds under article 6(1) of schedule I | If amount secured by the deed is more than Rs. 5 lakhs, rate of stamp duty is 0.2% of the secured amount.

|

If amount secured by the deed is more than Rs. 5 lakhs, rate of stamp duty is 0.3% of the secured amount.

|

Rate of stamp duty has been increased from 0.2% to 0.3% in case of secured amount above Rs. 5 lakhs.

In case of secured amount below 5 lakhs, rate of stamp duty has not been changed.

|

| Pledge, hypothecation of movable property under article 6(2) of schedule I | If amount secured by the deed is more than Rs. 5 lakhs, rate of stamp duty is 0.2% of the secured amount.

|

If amount secured by the deed is more than Rs. 5 lakhs, rate of stamp duty is 0.3% of the secured amount.

|

Rate of stamp duty has been increased from 0.2% to 0.3% in case of secured amount above Rs. 5 lakhs.

In case of secured amount below 5 lakhs, rate of stamp duty has not been changed.

|

| Simple mortgage under article 40(b) of schedule I

When possession is not given or agreed to be given as aforesaid.

|

0.5% of the amount secured by such deed.

Minimum duty – Rs. 100 Maximum duty – Rs. 10 lakhs |

If the amount secured – less than Rs. 5 lakhs –0.1% of the amount secured. Minimum – Rs. 100.

If the amount secured is more than Rs. 5 lakhs – 0.3% of the amount secured. Maximum- Rs 10 lakhs

|

While the minimum and maximum amount of stamp duty has been kept the same, the ad valorem rate of duty has been divided into two instances. |

Amendments to stamp duty rates will be effective from the date of the notification i.e. 9th February, 2021.

Stamp duty is chargeable on an instrument rather than a transaction. However, the Finance Act, 2019 drew an exception to this principle in case of stamp duty on securities’ transactions, particularly in case of securities in demat form. Nevertheless, the general rule remains the same.

However, there can be a case where a single instrument embodies various matters. Section 5 of the Act deals with stamp duty in case of such instruments relating to several matters. As per the existing section, ‘any instrument comprising or relating to several distinct matters shall be chargeable with the aggregate amount of the duties with which separate instruments, each comprising or relating to one of such matters, would be chargeable under this Act.’

Therefore, if an instrument consists of various matters, stamp duty will be charged on such matters separately as would have been the case if such matters were executed under separate instruments. However, a lot of debates arose on what would ‘matters’ include- whether matters would only be restricted to ‘matters’ or would include ‘transactions’ as well.

The Gujarat Stamp Act, 1958, was amended to include instruments consisting of distinct transactions along with distinct matters.

The above question was also raised before the Gujarat High Court, where the Court held that that the stamp duty was payable on the instrument and not on the transactions. The High Court opined that there being only one instrument creating a mortgage by borrower in favour of the Security Trustee and since the relationship between the borrower and the Security Trustee is independent of relationship between the borrower and the lending Banks, the High Court took the view that the instrument did not involve either distinct matters or distinct transactions.

However, the Supreme Court held an opposing view in Controlling Revenue Authority v. Coastal Gujarat Power Ltd[2], where it adjudged that instruments under section 5 of the Gujarat Stamp Act would also include instruments containing distinct transactions.

The question before the Court was whether a single mortgage executed in favour of a

the security trustee for the benefit of several syndicated lenders would be treated as a single document or as multiple documents (equivalent to the number of syndicated lenders).

The Supreme Court concluded that the agreement shall be construed separately for each syndicated lender and stamped as such (i.e. multiple documents). It was opined that

It appears from the trustee document that altogether 13 banks lent money to the mortgagor, details of which have been described in the schedule and for the repayment of money, the borrower entered into separate loan agreements with 13 financial institutions. Had this borrower entered into a separate mortgage deed with these financial institutions in order to secure the loan there would have been a separate document for distinct transactions. On proper construction of this indenture of mortgage it can safely be regarded as 13 distinct transactions which falls under Section 5 of the Act.

The above view was also taken under The Member, Board of Revenue v. Arthur Paul Benthall, 1955 SCR 84[3].

Similar question was raised before the Bombay High Court in Navi Mumbai SEZ Pvt. Ltd. v. The State of Maharashtra & Ors.[4], where it was contended that a perusal of the two statutes (Gujarat Stamp Act and the Act) would evince that the difference between the two is that whereas in the Gujarat Act the phrase ‘or distinct transactions’ follows the phrase ‘several distinct matters’ at two places where the said phrase exists, in the Maharashtra Act the said phrase ‘or distinct transactions’ does not occur.

It was highlighted that section 5 of the Indian Stamp Act, 1899 is in pari materia with Section 5 of the Stamp Act in the State of Maharashtra. Further, the Bombay High court quashed the argument that the decision of the Supreme Court in Coastal Gujarat Power Limited’s case (supra) would not be binding while interpreting Section 5 of the Stamp Act in Maharashtra for the reason the phrase ‘distinct matters’ is equivalent to the phrase ‘distinct transactions’. The names are different but the two are identical.

The Court took guide of the judgement of the Madras High Court in The Board of Revenue, Madras v. Narasimhan & Anr.[5], AIR 1961 Mad 504, (1961) 2 MLJ 538, where it was held that that where more than one of the matters or things i.e. indentures, leases, bonds or deeds, thereby charged with any stamp duty should be engrossed on one piece of vellum, the duties should be charged on every one of such matters. For example, if several landlords, each severally interested in the piece of land mentioned against his name in the Schedule were to act collectively, the instrument would be chargeable with stamp duty by treating each underlying transfer of interest and then aggregating the amount of duties as would be chargeable if separate instruments were executed.

The Madras High Court in The Board of Revenue, Madras v. Narasimhan & Anr., pertaining to a document which was a multi-purpose document or multifarious document, held that the expression ‘distinct matters’ connotes ‘distinct transactions’ and for the purposes of levy of stamp duty under the Indian Stamp Act requires the identity of the parties in respect of the underlying transaction. The importance of the said decision is that the expression ‘distinct matters’ was treated to be the same as ‘distinct transactions’.

The Allahabad High Court in Ram Sarup v. Toti & Anr.[6] AIR 1973 P H 329, with reference to Section 5 of the Indian Stamp Act, 1899 also held that the expression ‘distinct matters’ is equivalent to ‘distinct transactions’.

As per Halsbury’s Law of England, 4th edition, volume 44, paragraph 613 at page 399:-

Therefore, to bring the provisions in line with the Gujarat Stamp Act and the Supreme Court Order, the Ordinance amends section 5 of the Stamp Act to include distinct transactions as well to bring absolute clarity. Thus, the amended section is as below –

Instruments relating to several distinct matters or transactions –

Any instrument comprising or relating to several distinct matters or transactions shall be chargeable with the aggregate amount of the duties with which separate instruments, each comprising or relating to one of such matters or transactions, would be chargeable under this Act.

The amendment to section 5 has been made effective retrospectively from 11th July, 2015, i.e. from the date of the decree of the Supreme Court.

The term distinct does not refer to matters or transactions that are totally different in nature. Transactions even of similar nature will be covered under section 5 as long as they are different in nature. The Supreme Court In Coastal Gujarat (supra) also held that section 5 deals only with the instrument which comprises more than one transaction and it is immaterial for the purpose whether those transactions are

of the same category or of different categories. It was immaterial for the purpose whether the underlying transactions are of the same category or of different categories.

The Ordinance has also added a new clause under article 6 which provides stamp duty in case of any instrument in the form of an equitable mortgage, pledge or hypothecation, which will be executed as a collateral or auxiliary or additional security and where the proper duty has been paid on the principal or primary security under the said article. Stamp duty in such cases will be a flat amount of Rs. 500 irrespective of the amount of security.

Similar provision already exists under article 40, where every instrument executed as a collateral or auxiliary or additional security, where stamp has already been paid on the principal security, is chargeable with a stamp duty of Rs. 200.

The Finance Act, 2019 inserted section 4(3) in the Indian Stamp Act, 1899, which provides that –

Notwithstanding anything contained in sub-sections (1) and (2), in the case of any issue, sale or transfer of securities, the instrument on which stamp-duty is chargeable under section 9A shall be the principal instrument for the purpose of this section and no stamp-duty shall be charged on any other instruments relating to any such transaction.

Thus, there lies an exemption if issue of securities is charged with stamp duty, then any other instrument relating to such transaction will be exempt to stamp duty. The exemption was erstwhile specifically mentioned in case of debentures secured by way of a mortgage deed, where stamp duty on debentures was exempt if the same had been paid on the mortgage deed. On an understanding of the exemption, in case secured debentures have been allotted against a collateral in the form of a mortgage deed, stamp duty may be paid only at the time of issue of debentures on the allotment list (principal instrument) providing for allotment of secured debentures and not on the security deed. However, companies do not avail this benefit and pay stamp duty on both the transactions/ matters considering it as distinct transactions.

Thus, increase in stamp duty on mortgage deed/ hypothecation may not have an impact on issue of debentures in demat mode due to exemption under section 4(3). However, section 4(3) does not make reference to section 9B (issue of securities in case of physical securities/ debentures) and thus the exemption may not be enjoyed by such debentures and they would feel the burden of the additional stamp duty on the security documents. (Maharashtra Stamp Act will not apply since levy of stamp duty in case of debentures is governed by the Central List and therefore Indian Stamp Act).

The Ordinance also clarifies that any stamp duty paid under section 5 and articles 6 and 40 of schedule I in accordance with any decree/judgement, will be deemed to be validly levied and collected as if the said provisions as amended by the Ordinance were continuously in force. Any suit or proceedings initiated against the stamp authorities for refund of excess stamp duty paid and no court can direct refund of such excess duty.

These amendments to the Stamp Act mainly relate to stamp duty in case of mortgage deeds, executed in case of consortium lending as a single instrument.

This will not have an impact where the rate of stamp duty is on an ad valorem basis with no maximum cap since the amount of stamp duty will any way be calculated on the total value of secured amount. However, making the amendment to section 5 effective retrospectively seems oppressive and burdensome to parties of such instruments. In case the instruments are not stamped in accordance with the said provisions, it may be required to be impounded before admitting as an evidence, where required.

[1] https://indiankanoon.org/doc/178953244/

[2] https://indiankanoon.org/doc/178953244/

[3] https://indiankanoon.org/doc/1553487/

[4]https://bombayhighcourt.nic.in/generatenewauth.php?bhcpar=cGF0aD0uL3dyaXRlcmVhZGRhdGEvZGF0YS9jaXZpbC8yMDE5LyZmbmFtZT1XUDIwMDg5MTkxMTA5MTkucGRmJnNtZmxhZz1OJnJqdWRkYXRlPSZ1cGxvYWRkdD0xNi8wOS8yMDE5JnNwYXNzcGhyYXNlPTExMDIyMTE1MTUwMg==

[5] https://indiankanoon.org/doc/1937173/

[6] https://indiankanoon.org/doc/1046533/

Our other resources on similar topic –

-Aanchal Kaur Nagpal (aanchal@vinodkothari.com)

While the Indian equity market has consistently shown a rigorous growth, the bond market in India has mostly been relatively lagging behind. The size and performance of the Indian bond market has been quite inappreciable as compared to the developed economies in the world. The COVID-19 pandemic further caused a turmoil in the market. Among the investor class, Foreign Portfolio Investors (FPI) are a major participant in the debt market contributing to approximately 10% of the total debt investment.

Source: CRISIL Yearbook on Indian Debt Market, 2018

Further, as depicted below, the investments by FPIs in debt market has not been a consistent or a straight line and has seen more downward trend than upward.

Source: NSDL

As on February 5, 2021, foreign investment in corporate bonds has only reached 25% of the total available limit[1]. Further, the proportion of FPI investment as a part of the total foreign investment in India, is constrained by various investment limits and regulatory requirements.

FPIs are allowed to invest in eligible government securities and eligible corporate bonds. In case of corporate bonds, the following restrictions are imposed –

FPIs are not permitted to make short term investments of more than 20% of their total investment in corporate bonds. The above cap was increased from 20% to 30% of the total investment of the FPI providing more flexibility to FPIs in making investment decisions.

Investment by any FPI, including related FPIs, cannot exceed 50% of any issue of a corporate bond. In case an FPI, including related FPIs breaches the same and invests in more than 50% of any single issue, it cannot make further investments in that issue until the condition is met.

FPIs can only invest in corporate bonds with a minimum residual maturity of 1 years, subject to the condition that short-term investments limit in corporate bonds.

However, there are certain securities that are exempt from the above restrictions –

The aforesaid exemption was introduced with the intent to further widen the scope of investment by FPIs. It not only allowed FPIs to make short term investments in the above debt instruments without any limit but also bring in more options for FPIs to invest without having to consider the single/group investor-wise limits

FPIs are allowed to invest in security receipts issued by ARCs to address the NPA issue of financial institutions. Further, debt instruments issued by a corporate debtor under CIRP have also been made eligible for FPI investment. This was done with the intent to revive corporate debtors under a resolution plan. Thus, RBI has allowed FPIs to invest in such securities that are in dire need of investment, while granting various exemptions to make them more attractive.

As per SEBI (Foreign Portfolio Investors) Regulations, 2019, amongst other eligible debt instruments, FPIs are allowed to invest in any debt securities or other instruments as permitted by RBI [Regulation 20(1) (g)].

Thus, RBI has the power to prescribe eligible debt securities for FPI investment.

As discussed, investment by FPIs in debt instruments issued by ARCs or an entity under the CIRP, are exempted from the short-term limit and minimum residual maturity requirement. In order to further promote investment by FPIs in corporate bonds, RBI, in its Statement on Developmental and Regulatory Policies dated 5th February, 2021[2], has proposed to extend similar exemptions to defaulted corporate bonds. Accordingly, FPI investment in defaulted corporate bonds are proposed to be exempted from the short-term limit and the minimum residual maturity requirement. For this purpose, detailed guidelines will be issued separately by RBI.

Defaulted debt securities refer to ‘non-payment of interest or principal amount in full on the pre-agreed date and shall be recognized at the first instance of delay in servicing of any interest or principal on such debt.

At present, FPIs are permitted to invest in defaulted debt securities only against repayment of amortising bonds. Now, RBI is intending to permit FPIs to invest in defaulted corporate bonds as fresh issues as well and in all other cases as well.

Existing provision on FPI investment in corporate bonds under default –

Investments by FPIs in corporate bonds under default [Para 15 of Operating Guidelines for FPIs[3]]

SEBI also issued an operational framework[4] for transactions in defaulted debt securities post redemption date along with obligations of Issuers, Debenture Trustees, Depositories and Stock Exchanges while permitting such transaction

However, the motive for FPIs for investing in such defaulted corporate bonds is still to be understood. Since defaulted debt securities refer to securities even with one-time defaults, corporate bonds with favourable future prospects or where the security against such bonds is sufficient and promising, may attract FPI investments. RBI’s intent behind this move is to deepen the financial market, bring better liquidity in defaulted debt securities and also provide an additional investment opportunity to FPIs. The detailed guidelines are awaited to be issued by RBI.

[1] Source: NSDL- https://www.fpi.nsdl.co.in/web/Reports/ReportDetail.aspx?RepID=1

[2] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=51078

[3]https://www.sebi.gov.in/sebi_data/commondocs/nov-2019/Operational%20Guidelines%20for%20FPIs,%20DDPs%20and%20EFIs%20revised_p.pdf

[4]https://www.sebi.gov.in/legal/circulars/jun-2020/operational-framework-for-transactions-in-defaulted-debt-securities-post-maturity-date-redemption-date-under-provisions-of-sebi-issue-and-listing-of-debt-securities-regulations-2008_46912.html

Our articles on related topics-

Carries out certain clarificatory modifications.

By CS Aisha Begum Ansari, Assistant Manager, Vinod Kothari & Company aisha@vinodkothari.com

Securities and Exchange Board of India (‘SEBI’) had specified the formats for disclosures under Regulation 7 of SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’) on 11th May, 2015[1] and thereafter revised the formats on 16th September, 2015[2].

SEBI has revisited the formats and carried out further modifications to align the format with amendments in the PIT Regulations and certain edits for clarification purpose, vide circular dated 9th February, 2021[3] with immediate effect.

This article provides a gist of the amendments carried out in the formats. Before discussing the amendments, a brief synopsis of various disclosure requirements under regulation 7 of PIT Regulations is as under:

| Form | Relates to | Applicable to | Disclosure requirement | Time limit |

| Form B | Initial disclosure | KMP/ director/ promoter/ member of the promoter group | Disclose the holdings in the company as on the date of appointment or becoming a promoter | Within 7 days of appointment or becoming a promoter |

| Form C | Continual disclosure | Promoter/ member of the promoter group/ designated person/ director | Disclose the number of securities traded, if the value of securities traded exceeds Rs. 10 lakhs in a calendar quarter (whether in one transaction or series of transactions) | Within 2 trading days of such transaction.

|

| Form D (Indicative format) | Disclosure by Connected Person (event based) | Other connected persons | Disclose the holdings and trading in the securities of the company | As determined by the company |

Details of amendment in the formats

The major amendments in the revised formats under PIT Regulations are as under:

| Form | Field in the Form | Erstwhile format | Revised format | Remarks |

| Form B | Field w.r.t. “Category of Persons” | The details were sought from promoters, directors, KMPs and such other person mentioned in regulation 6(2) | The details will be sought from promoters, members of the promoter group, directors, KMPs, immediate relatives and such other person mentioned in regulation 6(2) | Members of the promoter group is added in the revised format to align with regulation 7. |

| Form C

|

Field w.r.t. “Category of Persons” | The details were sought from promoters, directors, employees and such other person mentioned in regulation 6(2) | The details will be sought from promoters, members of the promoter group, designated persons, directors, immediate relatives and such other person mentioned in regulation 6(2) | Members of the promoter group and designated persons are added in the revised format to align it with regulation 7. |

| Form C | Newly inserted: Note (ii) under sub-heading-1[4] | No particular note regarding value of transaction | The note explains that the value of transaction excludes taxes, brokerage and any other charges. | Regulation 7(2)(a) of the Regulations states that the concerned person is required to give disclosure, if the value of the securities traded exceeds Rs. 10 lakhs in a calendar quarter.

The note is provided to clarify that the value of securities is exclusive of taxes, brokerage and other charges. |

| Form D | Newly inserted: Note (ii) under sub-heading-1[5] | No particular note regarding value of transaction | The revised format defines the value of transaction which excludes taxes, brokerage, any other charges. | Regulation 7(3) of the Regulations states that the connected person is required to give disclosure as and when required by the company.

The note is provided to clarify that the value of transaction to be disclosed should be exclusive of taxes, brokerage and other charges. |

| Form B, C and D

|

Sub-field w.r.t “Type of Security” under the following Fields:

a. Securities held prior to acquisition/ disposal b. Securities acquired/ disposed c. Securities held prior to acquisition/ disposal |

The format sought the details of the following securities:

a. Shares b. Warrants c. Convertible debentures, etc. |

Details will be now sought for the following securities:

a. Shares b. Warrants c. Convertible debentures d. Rights entitlements, etc. |

SEBI, vide circular dated 22nd January, 2020[6], introduced the concept of dematerialized rights entitlements. Pursuant to the circular, the rights entitlement are also traded on the secondary market platform of the stock exchange.

Thus, SEBI has added the requirement to give details of rights entitlement. |

| Form C and D | Sub-field w.r.t. “Transaction type” under the Field “Securities acquired/ disposed” | The format sought the nature of transaction which included:

a. Buy b. Sale c. Pledge d. Revocation e. Invocation |

The options for nature of transaction will now include:

a. Purchase b. Sale c. Pledge d. Revocation e. Invocation f. Others (to be specified) |

The transaction can be other than purchase, sale or pledge of securities, e.g. gift of securities. Accordingly, the person will have to specify the nature of transaction in the disclosure. |

| Form C and D | Newly inserted: Field w.r.t. “Exchange on which the trade was executed” under sub-heading- 1 | No field for details of stock exchange | In the revised format, a new field has been inserted to mention the stock exchange on which the securities were traded. | In the earlier format, there was a field to mention the stock exchange on which derivatives were traded, but not for the trade in securities. The new insertion is made to align the format for trading in securities with that of trading in derivatives. |

Conclusion and actionables

The revised formats issued by SEBI will reflect the information of trade in more appropriate manner and is surely a welcome move.

The listed companies will be required to amend the Forms annexed to their Code of Conduct for Prevention of Insider Trading in order to align them with the revised formats.

Further, SEBI vide circular dated 9th September, 2021[7], automated the continual disclosures under regulation 7(2) of the Regulations by providing the manner of system driven disclosures. Pursuant to the circular, the listed companies will be required to comply with existing system for giving disclosure till March 31, 2021. Accordingly, the listed entities will have to amend the Form C annexed to their Code of Conduct and continue to give disclosure in the said form till 31st March, 2021.

Our other material can be accessed through the below links:

http://vinodkothari.com/2019/02/guide-to-pit-documentation/

http://vinodkothari.com/2019/07/highlights-of-2nd-amendment-to-pit-regulations/

http://vinodkothari.com/2020/07/recent-amendments-in-pit-regulations/

[1] https://www.sebi.gov.in/legal/circulars/may-2015/disclosures-under-sebi-prohibition-of-insider-trading-regulations-2015_29783.html

[2] https://www.sebi.gov.in/legal/circulars/sep-2015/revised-disclosure-formats-under-sebi-prohibition-of-insider-trading-regulations-2015_30680.html

[3] https://www.sebi.gov.in/legal/circulars/feb-2021/revised-disclosure-formats-under-regulation-7-of-sebi-prohibition-of-insider-trading-regulations-2015_49068.html

[4] Details of change in holding of securities of promoter, member of the promoter group, designated person or director and immediate relatives of such persons and other such persons as mentioned in Regulation 6(2) under Form C

[5] Details of trading in securities by other connected persons as identified by the company under Form D

[6] https://www.sebi.gov.in/legal/circulars/jan-2020/streamlining-the-process-of-rights-issue_45753.html

[7] https://www.sebi.gov.in/legal/circulars/sep-2020/automation-of-continual-disclosures-under-regulation-7-2-of-sebi-prohibition-of-insider-trading-regulations-2015-system-driven-disclosures_47523.html

-Sikha Bansal & Megha Mittal

While in general, in order to classify a transaction as a related party transaction, one needs to first determine whether the parties involved are ‘related parties’; however, in a recent case Phoenix Arc Private Limited v. Spade Financial Services Limited & Ors.[1] (‘Ruling’), the Hon’ble Supreme Court (‘SC’) has deduced ‘relationship’ between the parties on the basis of the underlying transactions.

The SC has read the definitions of ‘financial creditor’ and ‘related party’ (in relation to the corporate debtor) under sections 5(7) and section 5(24), respectively, of Insolvency and Bankruptcy Code, 2016 (‘Code’), in light of the ‘collusive arrangements’, ‘and ‘extensive history demonstrating interrelationship’ among the parties. Broadly put, it was held that the board/directors of these companies were ‘acting’ under the pervasive influence of common set of individuals, having ‘deeply entangled’ interrelationships. Besides, the SC refused to entertain the entities as financial creditors, as the debt was merely an eye-wash, arising out of sham and collusive transactions.

Therefore, the Ruling, in a way, uses ‘smoke’ to trace if there is a ‘fire’. The presence of collusion, entangled interrelationships, etc. have been seen as indicators suggesting that the parties were in fact ‘related’ and are thus ineligible to occupy seats in the committee of creditors.

This article touches upon the significant aspects of the Ruling, including how this ‘smoke-test’ used by the SC can act as a precedent in interpreting the provisions of the Code, specifically those relating to related parties.

The Economic Survey 2020-21 had laid a significant emphasis on the importance of utilising private-industry expertise to its optimal level- the same has also been reflected in the Finance Bill, 2021. The Bill proposes to facilitate strategic disinvestment of public sector company by relaxing the provisions of section 2(19AA) and section 72A of the Income Tax Act, 1961 (‘Act’) for amalgamations and demergers by PSUs.

The extant provisions of section 2(19AA) of the Act defines that “demerger”, in relation to companies, means the transfer by a demerged company of its one or more undertakings to any resulting company. It further enlists certain conditions, which if fulfilled render the demerger as tax-neutral for all parties involved. It provides that an arrangement shall be termed as a “demerger” if:

Section 72A, on the other hand lays down conditions relating to carry forward and set off of accumulated loss and unabsorbed depreciation allowance in amalgamation or demerger. However, such exemption is subject to fulfilment of certain conditions, viz.

While tax neutrality and the carry forward of losses acts as a motivator of entering into such transactions, fulfilment of such conditions is not ensured in all cases. Hence, with a view to motivate PSUs to enter into such disinvestment arrangements, the Finance Bill, 2021 has introduced to bring certain relaxations to the table, discussed below-

The Union Budget, 2021 proposes the following relaxations to the PSUs-

The Finance Bill, 2021 proposes to insert an explanation in the definition of demerger provided u/s 2 (19AA) to clarify that the reconstruction or splitting up of a PSU shall be deemed to be a demerger, if:

As a result, PSUs shall not be required to follow the stringent conditions of section 2 (19AA), and be entitled to avail the benefit of tax-neutrality. Effective from 01.04.2021, this proposed amendment will be applicable to demergers effected on and from 01.04.2021.

Amendments proposed in section 72A (1) propose to extend the benefit the extend the benefit of set off and carry forward of losses to PSUs and erstwhile PSUs. The Union Budget, 2021 proposes to-

Similar to amendments in section 2(19AA), These amendments will also take effect from 1st April, 2021 and will accordingly apply to the assessment year 2021-22 and subsequent assessment years.

It is likely that a significant number of PSUs will intend to opt for business arrangements, in view of the relaxations provided. With a view to encourage reorganisation and involvement of private-expertise, the proposed amendments are expected to act as a catalyst to the disinvestment targets, to achieve optimal utilisation of resources.

[1] The date on which the Scheme shall be reflected in the books of the companies.