Strategic Disinvestment in Public Sector

The Economic Survey 2020-21 had laid a significant emphasis on the importance of utilising private-industry expertise to its optimal level- the same has also been reflected in the Finance Bill, 2021. The Bill proposes to facilitate strategic disinvestment of public sector company by relaxing the provisions of section 2(19AA) and section 72A of the Income Tax Act, 1961 (‘Act’) for amalgamations and demergers by PSUs.

Extant Conditions under the IT Act, 1961

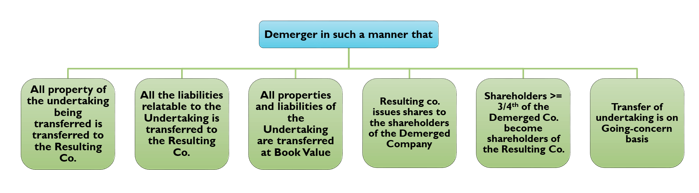

The extant provisions of section 2(19AA) of the Act defines that “demerger”, in relation to companies, means the transfer by a demerged company of its one or more undertakings to any resulting company. It further enlists certain conditions, which if fulfilled render the demerger as tax-neutral for all parties involved. It provides that an arrangement shall be termed as a “demerger” if:

Section 72A, on the other hand lays down conditions relating to carry forward and set off of accumulated loss and unabsorbed depreciation allowance in amalgamation or demerger. However, such exemption is subject to fulfilment of certain conditions, viz.

While tax neutrality and the carry forward of losses acts as a motivator of entering into such transactions, fulfilment of such conditions is not ensured in all cases. Hence, with a view to motivate PSUs to enter into such disinvestment arrangements, the Finance Bill, 2021 has introduced to bring certain relaxations to the table, discussed below-

Proposals under Budget 2021

The Union Budget, 2021 proposes the following relaxations to the PSUs-

- Change in the definition of demerger as provided u/s 2 (19AA) of the Income Tax Act, 1961

The Finance Bill, 2021 proposes to insert an explanation in the definition of demerger provided u/s 2 (19AA) to clarify that the reconstruction or splitting up of a PSU shall be deemed to be a demerger, if:

- Such reconstruction or splitting up has been made to transfer an asset of the demerged company to the resultant company; and

- the resultant company is a PSU on the appointed date[1] indicated in the scheme approved by the Government or any other body authorised under the provisions of the Companies Act, 2013 or any other Act governing such PSUs in this behalf; and

- fulfils such other conditions as may be notified by the Central Government in the Official Gazette

As a result, PSUs shall not be required to follow the stringent conditions of section 2 (19AA), and be entitled to avail the benefit of tax-neutrality. Effective from 01.04.2021, this proposed amendment will be applicable to demergers effected on and from 01.04.2021.

- Proposed Amendments in section 72A of the IT Act

Amendments proposed in section 72A (1) propose to extend the benefit the extend the benefit of set off and carry forward of losses to PSUs and erstwhile PSUs. The Union Budget, 2021 proposes to-

- Substitute clause (c) to provide that the provision of section 72(A) (1) shall also apply in case of amalgamation of one or more PSU, or companies with one or more PSUs;

- To insert a clause (d) to provide that section 72A (1) shall also be applicable to amalgamation of an erstwhile PSU, if

- the share purchase agreement entered into under strategic disinvestment restricted immediate amalgamation of the said public sector company;

- the amalgamation is carried out within five year from the end of the previous year in which the restriction on amalgamation in the share purchase agreement ends

- To insert a proviso to clause (d) to provide that in case of amalgamation involving an erstwhile PSU, allowance for unabsorbed depreciation of the amalgamated company shall not be more than the accumulated loss and unabsorbed depreciation of PSU as on the date on which the PSU ceases to be a public sector company as a result of strategic disinvestment.

Similar to amendments in section 2(19AA), These amendments will also take effect from 1st April, 2021 and will accordingly apply to the assessment year 2021-22 and subsequent assessment years.

Way Forward

It is likely that a significant number of PSUs will intend to opt for business arrangements, in view of the relaxations provided. With a view to encourage reorganisation and involvement of private-expertise, the proposed amendments are expected to act as a catalyst to the disinvestment targets, to achieve optimal utilisation of resources.

[1] The date on which the Scheme shall be reflected in the books of the companies.

Leave a Reply

Want to join the discussion?Feel free to contribute!