Roads to Riches: A snapshot of InvITs in India

Simrat Singh – corplaw@vinodkothari.com | finserv@vinodkothari.com

Introduction

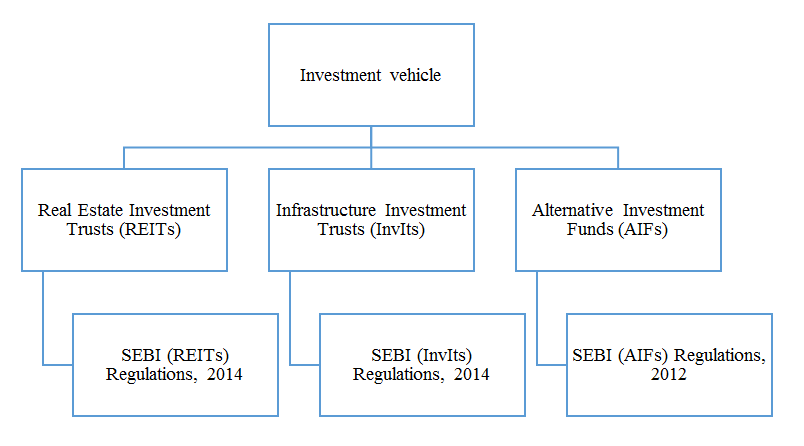

An Infrastructure Investment Trust (InvIT) is a pooled investment vehicle designed to facilitate collective investment in infrastructure assets. It allows investors to earn returns from assets such as roads, power plants, and telecom towers without direct ownership. Structured as a trust, InvITs generate revenue through various avenues such as toll collections, power tariffs and lease payments etc depending upon the underlying asset class. This mode of investment provides investors with a stable income stream through regular dividends while offering potential capital appreciation.

InvITs attract both institutional and retail investors seeking long-term, predictable returns, making them a crucial instrument in bridging the funding gap for infrastructure development. By serving as an efficient alternative to traditional financing methods, they contribute significantly to the sector’s growth and sustainability.

This article explores the progress of InvITs in India, examining the key asset classes they encompass, emerging asset categories, and a brief overview of the regulatory framework governing their operations.

InvITs: Journey so far

Since the launch of India’s first InvIT, the IRB InvIT Fund, in March 2016, InvITs have evolved significantly. Since FY 2020, InvITs have mobilized a remarkable ₹129,267 crore, helping bridge a portion of the USD 1.4 trillion investment required in infrastructure to achieve India’s goal of a $5 trillion economy by 2030.

Source: SEBI’s statistics on Fund raising by REITs and InvITs

InvITs have emerged as a viable investment avenue for those seeking long-term, stable returns. Foreign investors hold a substantial share of equity in InvITs, reflecting the strong global interest in India’s infrastructure sector. However, retail participation remains limited due to a lack of awareness and high ticket size. As of September 30, 2024, the total AUM of InvITs stood at ₹5.87 lakh crore. Calculating returns on InvITs can be challenging, especially for privately placed InvITs, due to the lack of readily available data. However, when it comes to capital appreciation in publicly listed InvITs, returns have generally been unimpressive (a glimpse of this is shown in the chart below which has been prepared after analysing the listing price and the price as on 1.04.2024 of units of Public InvITs). This is primarily because investors in these units prioritize steady income through interest and dividend payments over capital gains. At this juncture, it will be interesting to note that out of the 25 registered InvITs in India, only 5 have had public issues.

Overview of asset classes under InvITs

Legally, any asset listed under the Ministry of Finance notification dated October 7, 2013, can be included in an InvIT. However, in practice, as of March 31, 2024, InvITs primarily manage assets worth ₹5.87 lakh crore in the following categories and in the following proportions:

Source: CareEdge Ratings

After reviewing the websites and placement memorandums of all the InvITs registered in India, we can categorize them based on the following asset classes in which they operate:

| Sr. No. | Name of InvIT | Underlying asset class |

| 1 | Digital Fibre Infrastructure Trust | Telecom & data transmission |

| 2 | Altius Infra Trust | |

| 3 | Capital Infra Trust | Roads |

| 4 | Highways Infra trust | |

| 5 | IRB InvIT Fund | |

| 6 | Shrem Invit | |

| 7 | Roadstar Infra Investment Trust | |

| 8 | Interise Trust | |

| 9 | Oriental InfraTrust | |

| 10 | Nxt-Infra Trust | |

| 11 | Maple Infrastructure Trust | |

| 12 | IRB Infrastructure Trust | |

| 13 | Indus Infra Trust | |

| 14 | Cube Highways Trust | |

| 15 | Athaang Infrastructure Trust | |

| 16 | Anantham Highways Trust | |

| 17 | Powergrid Infrastructure Investment Trust | Power transmission |

| 18 | IndiGrid Infrastructure Trust | |

| 19 | Energy Infrastructure Trust | Pipeline infrastructure |

| 20 | TVS Infrastructure Trust | Warehousing |

| 21 | NDR InvIT Trust | |

| 22 | Intelligent Supply Chain Infrastructure Trust | |

| 23 | Sustainable Energy Infra Trust | Renewable energy |

| 24 | Anzen India Energy Yield Plus Trust | |

| 25 | SchoolHouse InvIT | Educational infrastructure |

Revenue generation mechanisms by asset class

Telecom

Telecom InvITs, such as Digital Fibre Infrastructure Trust (DFIT) and Altius Infra Trust, generate revenue by leasing telecom infrastructure to operators. DFIT, for instance, owns and operates fiber optic networks leased to large companies like Reliance Jio. It also earns interest income from its 51% stake in Jio Digital Fibre Private Limited (JDFPL). Altius generates revenue through long-term Master Service Agreements (MSAs), including rental charges, location premiums and infrastructure expansion fees. These structured agreements ensure predictable cash flows, enhancing the financial resilience of telecom InvITs.

Power Transmission

One of the major players in this sector, Powergrid Infrastructure Investment Trust (PGInvIT) generates revenue through long-term Transmission Service Agreements (TSAs), typically spanning over 35 years. These agreements ensure stable income by collecting transmission charges from power distribution companies (DISCOMs) and state electricity boards. Revenue is pooled and managed by the Central Transmission Utility of India Limited, reducing counterparty credit risks and ensuring timely payments.

Road Infrastructure

One of the most popular and growing asset class, road InvITs generate income through:

- Toll Collections: Vehicles pay toll charges for road usage.

- Annuity payments: The government or contracting authority makes periodic payments for a specified period to ensure steady cash flows.

- Hybrid models: A combination of toll income and government annuities under the Hybrid Annuity Model.

For example, National Highways Infra Trust (NHIT), backed by the National Highways Authority of India (NHAI), monetizes highway assets under the Built-Operate-Transfer (BOT) model. NHIT raised ₹46,000 crore through InvIT issuances, providing investors with steady income while enabling NHAI to reinvest in new projects.

Warehousing

Warehousing InvITs in India generate revenue primarily through long-term lease agreements with logistics companies, e-commerce firms, and manufacturers. These leases often follow a triple net lease, ensuring stable cash flows.

- TVS Infrastructure Trust manages 10.6 million square feet of Grade A warehousing and leases these assets to major corporations such as Amazon and Nestlé.

- NDR InvIT Trust reported a 5.65% revenue growth in Q3 FY 2025, with a 98% occupancy rate.

- Intelligent Supply Chain Infrastructure Trust, sponsored by Reliance Retail, follows a similar leasing model.

Pipeline Infrastructure

As on date there is only one InvIT which operates pipeline assets and it generates revenue through tariff-based gas transportation fees, regulated by the Petroleum and Natural Gas Regulatory Board. This InvIT secures long-term contracts and capacity reservation fees, ensuring stable revenue. They also benefit from interconnection fees with third-party pipelines, expanding income streams.

Educational Infrastructure

SchoolHouse InvIT, India’s first educational asset focused InvIT, earns revenue by leasing school and student housing properties to educational institutions under long-term agreements (15-30 years). The triple net-lease model, where tenants cover maintenance, property tax, and insurance, ensures minimal revenue leakage.

Overview of regulatory landscape for InvITs

The SEBI (Infrastructure Investment Trusts) Regulations, 2014 (‘InvIT Regulations’) categorize InvITs into three types. The key conditions related to their issuance, distribution, and borrowings are summarized in the table below:

| Feature | Public | Private Listed | Private Unlisted |

| Mode of initial offer | Public issue | Private placement | Private placement |

| Minimum asset value | Rs. 500 Cr. | Rs. 500 Cr. | Rs. 500 Cr. |

| Minimum initial offer size | Rs. 250 Cr. | Rs. 250 Cr. | Rs. 250 Cr. |

| Listing requirement | Mandatory | Mandatory | Not permitted |

| Minimum subscription in initial offer from any investor | INR 10,000 – INR 15,000 | INR 1 Crore / 25 Crore | INR 1 Crore / 25 Crore |

| Distribution requirement | At least 90% of NDCF ; at least once every six months | At least 90% of NDCF; at least once every year | At least 90% of NDCF; at least once every year |

| Permitted investors | Can invite funds from public as well (subject to minimum public float as per Reg 14(1A) | Institutional investors and body corporates, whether Indian or foreign | Institutional investors and body corporates, whether Indian or foreign |

| Borrowing limit | Up to 25% of asset value – no approval required More than 25% but up to 49% of asset value:Obtain credit ratingApproval of unit holders More than 49% but up to 70% of asset value:AAA ratingRecord of at least 6 distributions.Approval of unit holders. (75%) | As per trust deed | |

| Number of investors | Minimum 20 | Minimum 5 and maximum 1,000 | Minimum 5 and maximum 1,000 |

Lock-in requirements for sponsors.

To ensure that sponsors maintain a minimum stake in the investment, Regulation 12 of the InvIT Regulations outlines the following lock-in requirements based on a gliding platform approach.

| Minimum holding period | Lock-in requirement |

| For a period of 3 years from listing. (Units in excess of 15% to be locked in for a period of 1 year from listing) | 15% of total Units |

| From the beginning of 4th year and till the end of 5th year from the date of listing | 5% of total Units or Rs. 500 crores, whichever is lower |

| From the beginning of 6th year and till the end of 10th year from the date of listing | 3% of total Units of the InvIT or Rs. 500 crores, whichever is lower |

| From the beginning of 11th year and till the end of 20th year from the date of listing | 2% of total Units of the InvIT or Rs. 500 crores, whichever is lower |

| after completion of the 20th year from the date of listing | 1% of total Units of the InvIT or Rs. 500 crores, whichever is lower |

Applicability of the Listing Regulations, 2015

Regulation 26G of the InvIT Regulations specifies the applicability of certain provisions of the Listing Regulations to InvITs, with necessary modifications. These provisions includes:

- Constitution of the following:

- Audit Committee

- Nomination and Remuneration Committee

- Stakeholder Relationship Committee

- Risk Management Committee

- Limits on maximum number of Directorships

- Appointment and qualification of Independent Directors

Conclusion

InvITs have significantly transformed India’s infrastructure investment landscape, providing an alternative financing mechanism that bridges the funding gap while offering investors stable returns. Their evolution from road and power transmission assets to emerging categories like warehousing, pipeline infrastructure, and educational institutions highlights their growing versatility. Despite challenges such as limited retail participation and moderate capital appreciation in public InvITs, the segment continues to attract institutional investors, particularly foreign investors, signaling strong confidence in India’s infrastructure sector.

As the regulatory framework evolves to enhance transparency, governance, and investor confidence, InvITs are poised to play an even greater role in India’s economic growth. By enabling long-term capital infusion into essential infrastructure projects, they not only support the nation’s $5 trillion economy vision but also ensure sustainable development across key sectors. Looking ahead, increased awareness, improved accessibility, and regulatory refinements could unlock further potential for InvITs, making them a more attractive and robust investment avenue in the years to come.