SEBI proposes to liberalise norms for REITs & InvITs

By Simran Jalan (simran@vinodkothari.com)

Introduction

Infrastructure Investment Trusts (InvITs) is an innovative vehicle that allows investors to invest in infrastructure assets. It was established with an objective of easing out the liquidity crunch in the infrastructure space. Real Estate Investment Trusts (REITs) has been one of the most important vehicles for making collective investments in commercial real estate. Emanating in the USA in 1960s as a tax transparent collective investment vehicle, REITs subsequently have been used by several other countries, and have done remarkably well.

The Securities Exchange Board of India (SEBI) had notified the SEBI (Infrastructure Investment Trusts) Regulations, 2014[1] (InvITs Regulations) and SEBI (Real Estate Investment Trusts) Regulations, 2014[2] (REITs Regulations) on September 26, 2014. With the introduction of these regulations and fast-growing cities needing more investments in commercial properties and infrastructures, it was expected that there will be a surge in these collective investment vehicles in India. However, the current scenario depicts a different story. Till date, only 3 InvITs have issued and listed their units raising approximately Rs. 10,000 crores and 1 REIT is in the process of making a public offer. Despite various relaxations given by the market regulator to these investment vehicles, they failed to attract investors.

Therefore, to gear up the market for REITs and InvITs and to increase the participants in this sector, SEBI has issued a consultation paper[3] with a proposal to amend regulations pertaining to REITs and InvITs. In this write up we intend to discuss the amendments proposed by SEBI.

Snapshot of proposed changes

For REITs

- Reduction in the minimum subscription in an initial offer and follow-on offer

- Reduction in the trading lot for the purposes of trading of publicly listed REITs.

Reduction in the minimum allotment and trading lot for publicly issued REITs:

| Particulars | Regulation No. | Current regulatory framework | Proposed Change |

| Minimum Subscription | Regulation 14(14) | In the case of a REIT issue, the minimum subscription from any investor under both the initial offer and follow-on public offer, shall not be less than two lac rupees. | The minimum application is proposed to be revised as follows:

a. At the time of initial/follow-on issue, the minimum application and allotment lot shall be of 100 units and the value of one such lot shall be within the range of Rs. 15,000– Rs. 20,000. b. Allotment shall be made in multiples of a lot. c. After initial listing, a trading lot shall also be of 100 units. |

| Trading Lot | Regulation 16(4) | Trading lot for the purpose of trading of units of the REITs on the designated stock exchange is rupees one lac. |

Rationale

REITs were introduced to make a significant contribution to the growth of capital market with wider investor participation. The existing regulatory framework currently limit the retail participation to a minimum subscription of Rs. 2 lacs and trading lot to Rs. 1 lac. Considering the stable nature of the instrument and the intention to invite retail participation in the market, the SEBI has proposed to relax the minimum subscription requirements.

Further, it is proposed that the trading lot for existing publicly issued and listed units shall be reduced by the Stock Exchanges within 6 months from the date of the notification the regulations.

This proposal of SEBI is a welcoming change. This reduction in the minimum subscription requirements could potentially attract retail investors to this space.

For InvITs

- Reduction in the minimum subscription in an initial offer and follow-on offer.

- Reduction in the trading lot for the purposes of trading of publicly listed InvITs.

- Increase in the leverage limit for InvITs.

- New regulatory structure for privately placed unlisted InvITs.

Reduction in the minimum allotment and trading lot for publicly issued InvITs:

| Particulars | Regulation No. | Current regulatory framework | Proposed Change |

| Minimum Subscription | Regulation 14(4)(c) | The minimum subscription from any investor in initial and follow-on offer shall be ten lac rupees. | The minimum application is proposed to be revised as follows:

a. At the time of initial/follow-on issue, the minimum application and allotment lot shall be of 100 units and the value of one such lot shall be within the range of Rs. 15,000– Rs. 20,000. b. Allotment shall be made in multiples of a lot. c. After initial listing, a trading lot shall also be of 100 units. |

| Trading Lot | Regulation 16(9)(b) | The trading lot for the purposes of trading of publicly listed units, on the designated stock exchange shall be five lac rupees. |

Rationale

Similar in case REITs, SEBI has also reduced the minimum subscription requirements for InvITs as well.

The amendment proposed by SEBI is a welcoming amendment as it invites more and more exposure to the sector. A robust InvITs market will also serve as a much needed alternate source of financing for the infrastructure companies.

Increase in the leverage limit for InvITs:

| Particulars | Regulation No. | Current regulatory framework | Proposed Change |

| Limit of aggregate consolidated borrowings | Regulation 20(2) | The aggregate consolidated borrowings and deferred payments of the InvIT [holdco and the SPV(s)], net of cash and cash equivalents shall never exceed forty-nine per cent of the value of the InvITs assets. | The limit of aggregate consolidated borrowings of the InvITs, holdco and SPV(s), net of cash and cash equivalents has been proposed to increase from 49% to a maximum of 70% of the value of InvIT assets. |

| Approval of unit holders and Credit Rating | Regulation 20(3) | If the aggregate consolidated borrowings and deferred payments of the InvIT, net of cash and cash equivalents exceed twenty-five per cent of the value of the InvIT assets, for any further borrowing-

a) Credit rating shall be obtained from a credit rating agency registered with the Board; b) Approval of unit holders shall be obtained in a manner specified in regulation 22. |

If the aggregate consolidated borrowings and deferred payments of the InvIT, net of cash and cash equivalents exceed twenty-five per cent of the value of the InvIT assets, for any further borrowing-

a) the approval of 75% unit holders who are not related is required to be obtained. b) the credit rating of consolidated debt and project debt to be AAA or equivalent from a credit rating agency registered with the board. |

| Approval of unit holders | Regulation 22(4)(b) | Any transaction, other than any borrowing, value of which is equal to or greater than twenty-five per cent of the InvIT assets requires approval from unit holders where votes cast in favour of the resolution shall be more than votes cast against the resolution. | |

| Minimum track record of continuous distribution | No extant provision. | Post listing, there must be a minimum track record of atleast 3 years of continuous distribution. | |

| Disclosure requirements | No extant provision. | The InvITs which are increasing their leverage beyond 49% are required to make the following additional disclosures:

a) Financial results on quarterly basis along with specific details of debt service coverage ratios and interest service coverage ratios; and b) Quarterly valuation of assets. |

Rationale

SEBI in its Board Meeting on 18th September, 2017, had allowed REITs and InvITs to raise debt capital by issuing debt securities. The overall debt limit for InvITs was set at 49% of its total value of assets. Where the debt to be raised exceeds 25% of the total assets of the fund, an ordinary resolution has to be obtained from the unit holders of the fund.

However, the leverage restriction in case of InvITs differs largely from that imposed on other alternative investment funds. Most of the funds are allowed to raise debt to the extent of 70% of the total assets of the fund. Due to this, InvITs were providing low incremental returns as compared to other alternative investment avenues, therefore, making it less attractive as an investment opportunity.

In order to remove the differences, the SEBI, in the concept paper, has proposed to increase the leverage restriction to 70%. In general, the alternative investment vehicles with good cash flows are leveraged between 70%-80% of the value of the assets. The current restriction acts as a deterrent for the system. Further, InvITs consists of the infrastructure assets which provide a stable and long-term cash flows. Therefore, the increase in the leverage shall not adversely impact the risk profile of the InvITs.

This extension of cap of raising debt will also reduce the InvITs’ heavy dependence on capital, which will subsequently reduce the frequency of issuing fresh units. This will attract long term investors to the market as well, who primarily look at stability of the investments made.

Though the proposed change may look like a relaxation to the InvITs, however, the same comes with a catch. Under the extant provisions, in case the aggregate borrowing exceeds twenty five percent of the total assets, for any further borrowing, the trust is required to obtain a consent of majority of unitholders. However, SEBI has proposed that in case the aggregate borrowing exceeds twenty five percent of the total assets, for any further borrowing, the trust is required to obtain a consent of 3/4th of the unitholders. This may be a burden on the trusts to obtain consent of 3/4th of the unit holders for raising debt beyond 25%.

New regulatory structure for privately placed unlisted InvITs

Section 16(1) of the InvITs Regulations prescribes that:

“It shall be mandatory for units of all InvITs to be listed on a recognized stock exchange having nationwide trading terminals, whether publicly issued or privately placed”

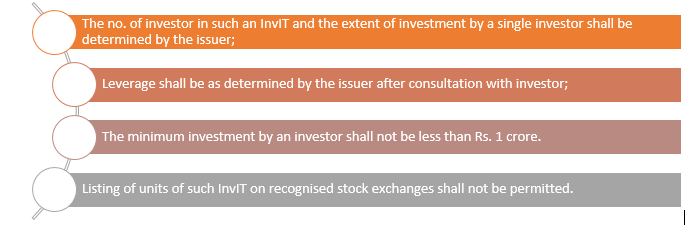

SEBI had received various representations for relaxing the regulatory framework for the privately placed InvITs. One of it being, removal of mandatory listing requirement. Therefore, to provide flexibility to InvITs so as to satisfy the varying needs of private pools of capital, SEBI has proposed to provide a separate framework for issuing privately placed unlisted InvITs. The framework is proposed to provide the following provisions:

The other provisions shall be same as that of the privately placed listed InvITs. Further, the existing privately placed listed InvITs may choose to migrate to the proposed framework for private unlisted InvITs provided they obtain approval of more than 90% of their unitholders by value. Also, the InvIT desiring to migrate shall provide an exit opportunity to dissenting unitholders. Conversely, a privately placed unlisted InvIT may choose to list its units on stock exchanges after complying with the regulatory requirements.

Rationale

Infrastructure sector is the key driver for the Indian economy. This sector continues to significantly contribute to India’s growth story. InvIT is a structure which facilitates channelling of private capital in infrastructure sector. The success of InvITs is crucial to availability of finance for Indian infrastructure. SEBI has proposed the amendment to provide sufficient flexibility to the InvITs to meet the ever-increasing demands for investment in infrastructure sector. Therefore, this amendment is expected to increase the participants in the InvITs sector.

Conclusion

The REITs and InvITs markets have evolved substantially in the global scenario and these investment vehicles have gained immensely in terms of their market capitalisation. However, the market for REITs and InvITs are still at a nascent stage in India. SEBI is taking several initiatives to foster the growth of this market. Hopefully, these proposed amendments will be accelerate the growth of the REITs and InvITs market in India.

[1] https://www.sebi.gov.in/legal/regulations/dec-2017/sebi-infrastructure-investment-trusts-regulations-2014-last-amended-on-december-15-2017-_38450.html

[2] https://www.sebi.gov.in/legal/regulations/dec-2017/sebi-real-estate-investment-trusts-regulations-2014-last-amended-on-december-15-2017-_38449.html

[3] https://www.sebi.gov.in/reports/reports/jan-2019/consultation-paper-for-amendment-of-sebi-infrastructure-investment-trusts-regulation-2014-and-sebi-real-estate-investment-trusts-regulation-2014_41840.html

Our presentation on Real Estate Investment Trusts can be viewed here – https://vinodkothari.com/2021/09/reit/

Leave a Reply

Want to join the discussion?Feel free to contribute!