– Vinod Kothari and Abhirup Ghosh (finserv@vinodkothari.com)

The European financial regulators are working on a new funding instrument whereby banks and primary lenders can raise refinance against their portfolio of SME loans, by issuing a bond which is directly linked with such portfolios, called European Secured Notes (ESNs). ESNs are a dual recourse instrument, following the time-tested structure of covered bonds.

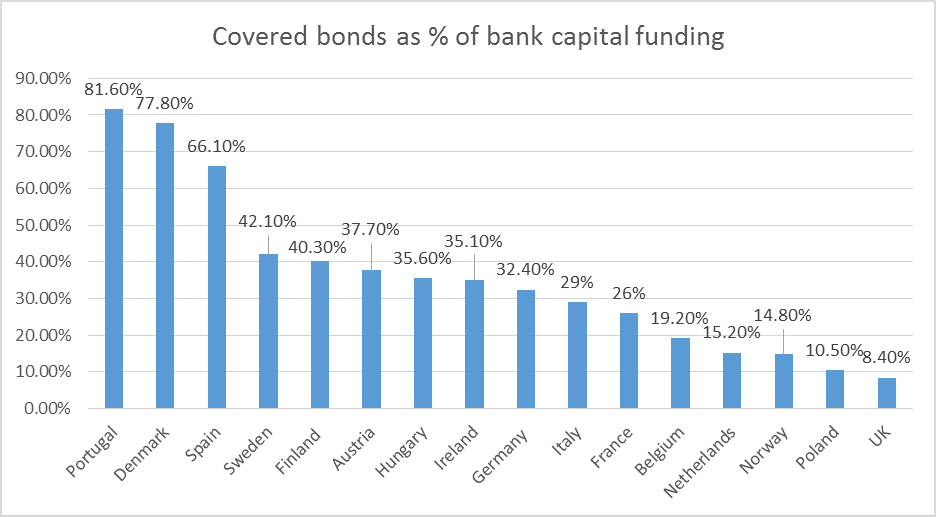

Covered bonds, developed more than 250 years ago in Europe, use dual recourse structure. The first recourse, against the issuer, is prone to the risk of bankruptcy of the issuer. In that situation, the investors have recourse against the assets of the issuer, and that recourse is made immune from other bankruptcy claims or priorities. This ring-fencing is granted either by explicit legislation, or by use of contract law flexibility. Covered bonds are currently used, to an overwhelming extent, for prime residential mortgage loans. Given their bankruptcy-protected asset backing, covered bonds allow the issuer to get a rating higher than the issuer’s own default rating. This phenomenon, called “notching up”, may cause the ratings on the bonds to go up over the rating of the issues by some 6 to 9 notches.

European regulators are trying to build on the methodology of covered bonds to see if a similar instrument can be used by banks to refinance their SME loan pools.

Development of European Secured Notes:

There have been past instances, sporadically, of dual recourse bonds, on lines similar to ESNs,. A notable instance was Commerzbank’s SME-backed structured covered bond programme established in 2013 but fully repaid in 2018[1]. Besides this, there were several issuances in France, though they are no longer used.

There has been a multi-issuer platform called French “Euro secured Note issuer” (ESNI), established in 2014 and supported by the Banque de France. Though the programme was open to all French and European Banks, only four French banks opted for this. There were around 20 issuances totalling to over Euro 10 Bn. Banque de France acted as the monitor for the asset quality of the SME loans. It used its internal rating model to examine the assets and score them. The scoring, in combination with haircuts on such assets established the minimum over-collateralisation level.

The Italian regulators also proposed to come up with an enabling regulatory framework to permit domestic issuers to issue Obbligazioni Bancarie Collateralizzate (OBC); however, this seems to have been stranded into oblivion.

Similar efforts were made by the Spanish regulators when they amended the covered bonds framework in 2015.

The work done all this while might have been the inspiration for the European Commission when it proposed the use of ESN as a financial instrument backed by SME loans and infrastructure loans, to be used by banks, as a part of the Capital Markets Union proposals in 2017[2].

Subsequently, the Commission requested a report from the European Banking Authority to set out probable structures of ESNs, which was issued in July 2018[3].

It was originally meant to be kept on the backburner until 2024, however, with the COVID 19 pandemic, the European Parliament asked the European Commission to accelerate the introduction of ESNs to help financing the recovery from the pandemic.

In April 2021, the ESN Task Force, that is, ECBC along with EMF, issued the ESN Blueprint[4]. It appears that ESNs may be rolled out ahead of the original implementation schedule.

Structure of ESNs

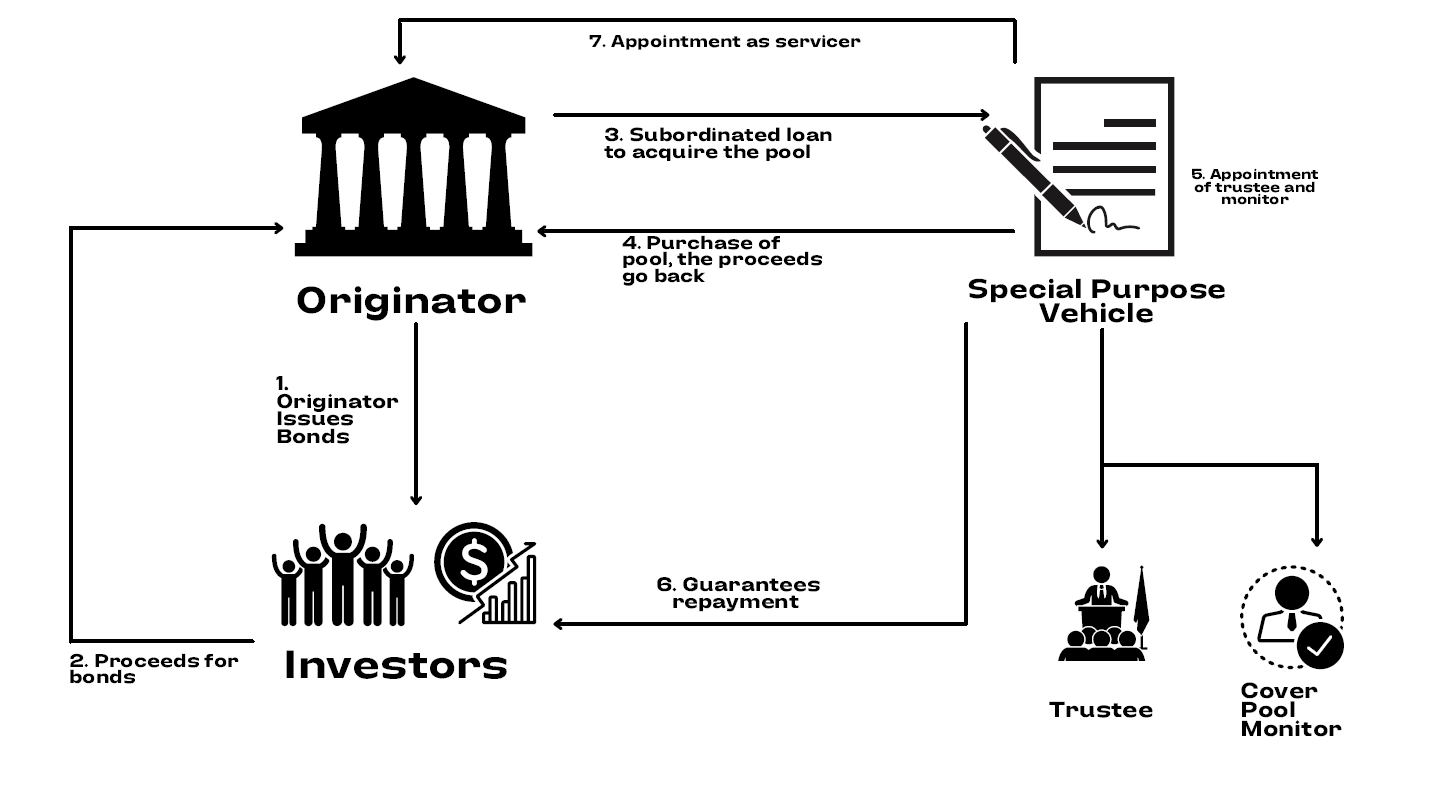

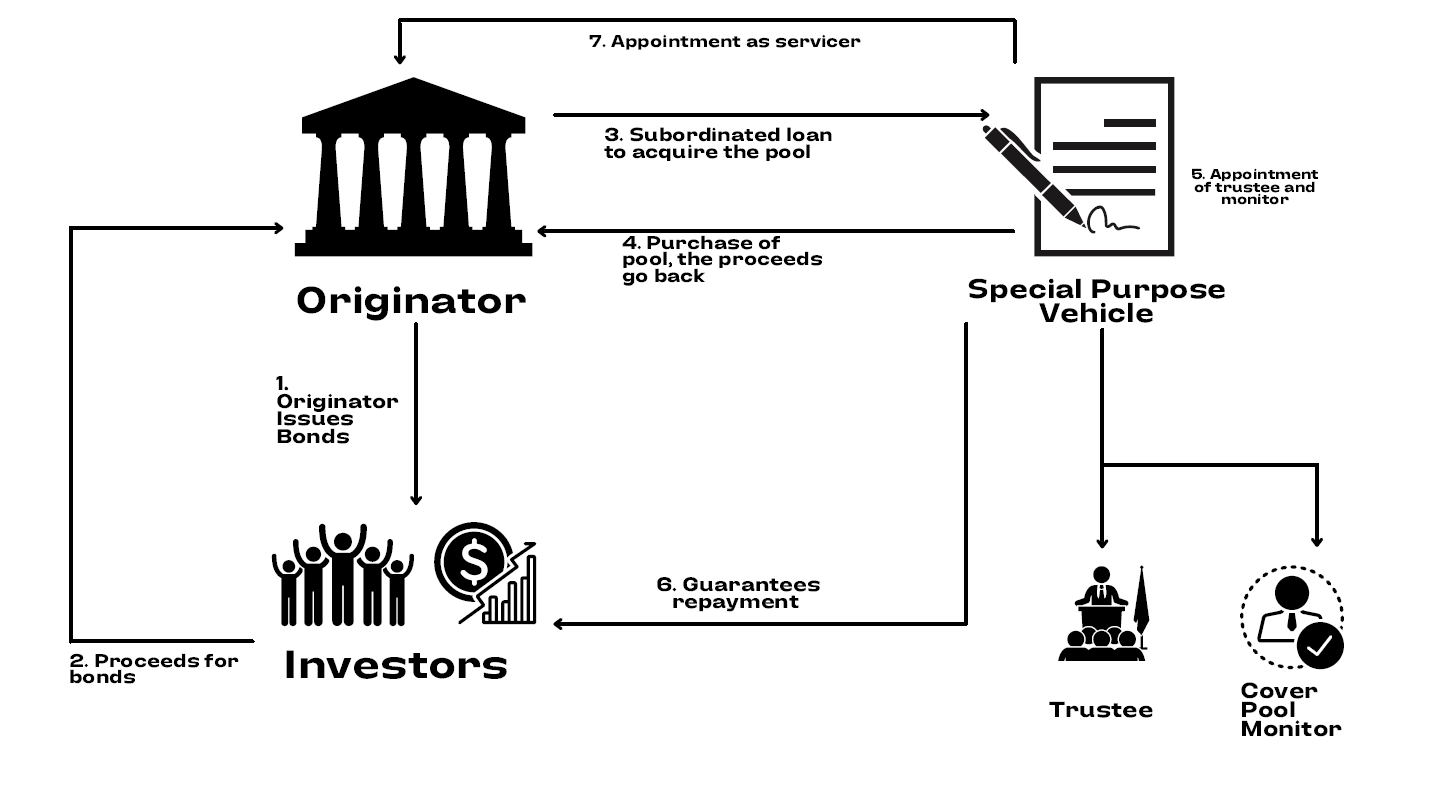

Originally, at the time of conceptualisation, there were two structures which were contemplated:

- A structure that mirrors the structure of covered bonds,

- A structure that mirrors the structure of ABS

However, EBA suggested the first structure in its report.

The key recommendations of the EBA on the structure are as follows:

- Dual recourse – The bond must grant the investor a claim on the covered bond issuer, and if it fails to pay, a priority claim on the cover pool limited to the fulfilment of the payment obligations. Further, if the cover pool turns to be insufficient to fulfil the payments, the investor shall have recourse back to the insolvency estate of the issuer, which shall rank pari passu with the claims of the unsecured creditors.

- Segregation of cover assets – The next important suggestion was with respect to the segregation of cover assets. The segregation of assets could be either be achieved through registration of the cover pool into a cover register or by transferring them to a special purpose vehicle (SPV). Note that registration of covered bonds is required by several European jurisdictions, as well as Canada.

- Bankruptcy-remoteness of the covered bond: The legal/ regulatory framework should facilitate the bankruptcy-remoteness by not requiring acceleration of payments in case of issuer default.

- Administration of the covered bond programme after the issuer’s insolvency or resolution: The legal/regulatory covered bond framework should provide that upon issuer’s default or resolution the covered bond programme is managed in an independent way and in the preferential interest of the covered bond investor.

- Composition of cover pool: The cover pool should comprise of non-defaulted SME loan and leasing exposures. Further, the pool should be dynamic. Given the high risk associated with SME loans, the EBA recommended incorporating strict eligibility criteria at both loan and pool levels in the form of:

- selected SME exposures

- sufficient granularity,

- concentration limit,

- quality standards.

- Coverage principles and legal/regulatory overcollateralization: The claims against the cover pool should not exceed the receivables arising out of the cover pool. Further, the EBA considered a minimum over-collateralisation must be prescribed for SME ESNs. In this regard, the EBA recommended a minimum over-collateralisation of 30%.

Use of capital market instruments for refinancing SME loans:

“SMEs are important actors in economic growth and transformation, creating positive value for the economy and contributing towards sustainable and balanced economic growth, employment and social stability”[5]. The use of capital market instruments for refinancing SME loans has been engaging the attention of policymakers and regulators alike. The extent of penetration of bank finance to SMEs is far from optimal, and additionally, there are gaping differences across geographies.

Direct access of SMEs to capital markets for debt funding is quite limited, since most of the SMEs do not have the size to be able to attract the attention of institutional investors in the capital market. An OECD-World Bank report notes that “individual SMEs issuances do not easily align with the risk appetite and prudential requirements of institutional investors.”[6] On the other hand, institutional investors may easily participate in bonds or similar instruments which refinance or repackage SME lenders’ loan portfolios. The aforesaid OECD-World Bank report envisages 4 types of capital market instruments for SME refinancing –corporate bonds issued by SME lenders, securitisation of SME loans, SME covered bonds, and SME loan & bond funds, as collective investment schemes.

Issuance of bonds by banks, for on-lending to SMEs or refinancing SME loan portfolios, is quite common in many countries. Such bonds are, however, linked with the performance and rating of the issuer bank.

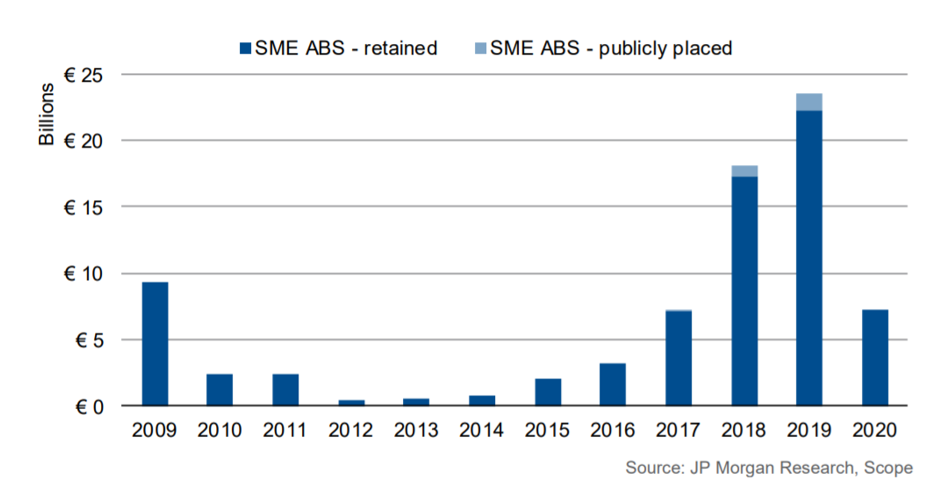

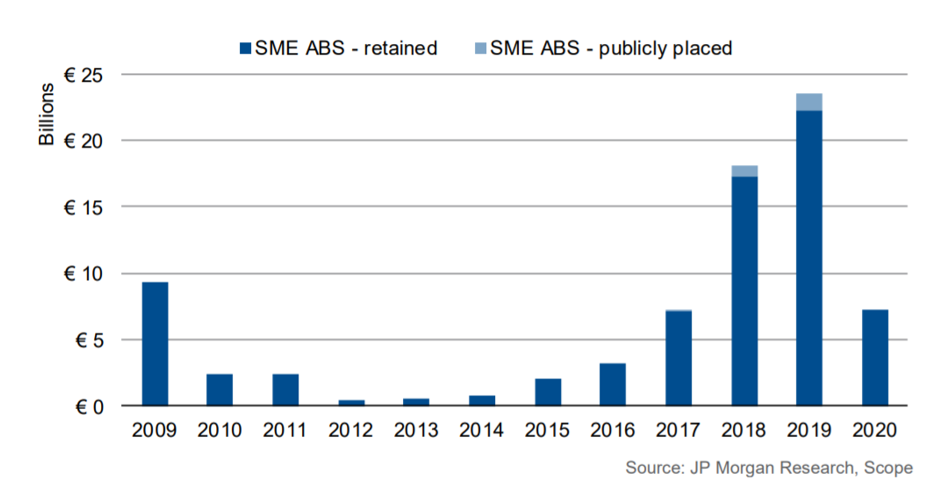

As for securitisation of SME loans, the overall contribution of SME loans as an asset class in the global securitisation volumes will be in the region of 2%, which obviously dwarfs in comparison to popular asset classes such as residential mortgage loans. Post the GFC, several European jurisdictions have used securitisation of SME loans, but looking at the huge proportion of retained securitisations (see Graph below), it is quite evident that such activity was motivated by the objective of refinancing by ECB. This low volume is despite the fact that asset backed securitisation is the most natural choice to fund SME loans through capital market, as they provide three benefits:

- Provide funding to the banks

- The assets move off the books of the originator, depending on the structure

- Can be tailor made to the specifications of the investor

- Regulatory capital relief

In the recent times, SME ABS issuances in Europe peaked in 2019, of which almost 97% were issued in retained format.

Source: Scope Ratings[7]

Outside of Europe, Korea and India have seen several securitisations of SME loan pools.

Relevance of dual recourse instrument for SME funding

Covered bonds are mostly supported by legislation to provide bankruptcy protection in European jurisdictions. In several other jurisdictions, the flexibility of the common law structure is utilised for providing bankruptcy protection. However, the essential premise in either case is the same –which is the ability of the cover pool to be a backstop for redemption of the bonds, in the event of failure of the issuer to pay them. Therefore, the pool of assets have to be liquid and robust to be able to pay off the bondholders.

There is substantial difference between mortgage pools backing up covered bonds, and SME loans. SME loans have lesser granularity, heterogeneity, and higher historical default rates. The servicing of SME loans from the viewpoint of ongoing collections is also not as easy as in case of mortgage loans. However, these will be ultimately be the factors that would have to be borne in mind by the rating agencies while sizing up the level of over-collateraliation and fixing the level of rating notch-ups for SME-loan-backed covered bonds. As a matter of principle, if there is a market for securitisation of SME loans as demonstrated by recent global transactions, a covered bond structure only tries to marry the benefits of securitisation and corporate bonds. Hence, introducing covered bonds backed by SME loans may be the right idea.

The robustness of covered bond with a history of over 250 years is explained, other than by the legislative protection, by the good quality of the cover pool. The transparency of loan-level performance data of SME loans is much lesser than mortgage loans. Even more importantly, the question is the ability and liquidity of the cover pool, given the insolvency of the issuer, to redeem the bonds. SME loans do not have as liquid secondary market, and the migration of servicing to an alternate servicer makes the liquidity of such loan pools even more difficult. The layering of a credit guarantee support by credit guarantee schemes, which exist practically in every jurisdiction in the world, could also be considered as a credit support.

Should there be a legislative bankruptcy protection, which removes these loan pools completely from the bankruptcy estate and makes the same available to covered bond investors only? This question becomes a complicated one, involving inter-creditor rights. Insolvency for other creditors becomes deeper if there are more bankruptcy-protected instruments.

The urgency for ESNs is also a part of the post-Covid worries of regulators all over the world, and clearly, SMEs are seen as a huge agent of post-Covid revival. However, the need for availability of more liquidity for SMEs has always been crucial. Therefore, the introduction of SME-loan-backed covered bonds may be an agenda items for countries outside of Europe too.

[1] https://www.scoperatings.com/ScopeRatingsApi/api/downloadstudy?id=dfa74ad6-f1ca-4860-a916-bc0638846bb1

[2] https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52017DC0292

[3] https://www.eba.europa.eu/sites/default/documents/files/documents/10180/2087449/6fe04a31-ec0b-4ea1-9508-258ad2cf72d8/EBA%20Final%20report%20on%20ESNs.pdf

[4] https://hypo.org/app/uploads/sites/3/2017/05/ECBC-ESN-Blueprint-April-2021.pdf

[5] IOSCO Report, 2015, titled SME Financing Through Capital Markets, at https://www.iosco.org/library/pubdocs/pdf/IOSCOPD493.pdf

[6] https://www.oecd.org/g20/topics/development/WB-IMF-OECD-report-Capital-Markets-Instruments-for-Infrastructure-and-SME-Financing.pdf, page 46

[7] https://www.scoperatings.com/ScopeRatingsApi/api/downloadstudy?id=dfa74ad6-f1ca-4860-a916-bc0638846bb1

Our other resources on Covered Bonds:

https://vinodkothari.com/2021/07/covered-bonds-the-story-of-the-indianised-version-of-a-global-instrument/

https://vinodkothari.com/covered_bonds-2/

https://www.youtube.com/watch?v=XyoPcuzbys4