Digital lending Balloon: Navigating the path to growth

-Dayita Kanodia, Executive finserv@vinodkothari.com

“Ignoring technological change in a financial system based upon technology is like a mouse starving to death because someone moved their cheese.” – Chris Skinner[1]

Unprecedented growth of the sector

From pawnbrokers lending money in exchange for collateral to the use of sophisticated technologies to carry out credit underwriting, the landscape of lending business has evolved significantly in the last century. Today, it is hard to find a financial institution which is carrying on business without digitising any aspect of its lending process. With rapid advancements in cloud computing, artificial intelligence, and blockchain, as well as faster and more affordable internet connectivity, it is safe to say that the brick and mortar model for lending business will soon be a matter of the past.

The Global Digital Lending Market is valued at USD 11.33 Billion in the year 2022 and is anticipated to reach a value of USD 30.77 Billion by the year 2030. [2]

This growth can be attributed to the proliferation of smartphones and to increasing digitalization. There was a need for better customer experience, government actions to safeguard digital lending along with greater visibility and options for borrowers and lenders.

The rising investments in the banking and financial sector are aiding the growth of the digital lending industry. Further, the use of Artificial Intelligence (AI) and Machine Learning (ML) have led to rapid success of the digital lending market.[3] The accelerated push towards the adoption of digital tools makes technology the key enabler of the digital lending market.

Global Scenario

As mentioned above, the Global Digital Lending Market is anticipated to reach a value of USD 30.77 Billion by the year 2030 exhibiting a Compound Annual Growth Rate (CAGR) of 13.30% over the forecast period 2022 to 2030.

This growth can be attributed to the increased usage of digital solutions across banking operations to streamline business processes while improving the overall functionality and efficiency of the banking sector. Moreover, the growing preference for online banking facilities through apps are also aiding the market growth.

Region- wise segmentation of digital lending market

North American[4] economies led the market due the presence of major digital lending providers across the North American countries and is thus expected to drive market growth in the region. The region has also been an early adopter of the latest and advanced technologies. As a result, the demand for digital, end-to-end financial solutions has always been on the higher side in North America. A large mobile workforce in the region is particularly prompting financial institutions in the region to digitize their services and enhance customer experience.

On similar footings Asia Pacific is expected to exhibit a significant growth rate. China’s online lending sector has seen rapid growth in the past decade owing to an increasing number of players in the market. Again, the government of Japan is launching programs to inculcate cashless behaviors in citizens and launched an initiative to increase cashless payments to 40% by 2025.

Digital lending Market in India

Over the years, the digital lending market in India has significantly expanded and it is expected that 40% of the lending will be through digital channels by 2027.[5]

The Indian digital lending market has seen unprecedented growth in recent years and the growth has been such that by 2030, digital lending is set to account for 60% of the total Indian fintech market.[6]

Private sector banks and NBFCs with 55 per cent and 30 per cent share respectively are the dominant entities in the digital lending ecosystem. This prominent role of NBFCs in fostering digital mode of lending is reflective of the flexible regulatory regime meant for NBFCs.

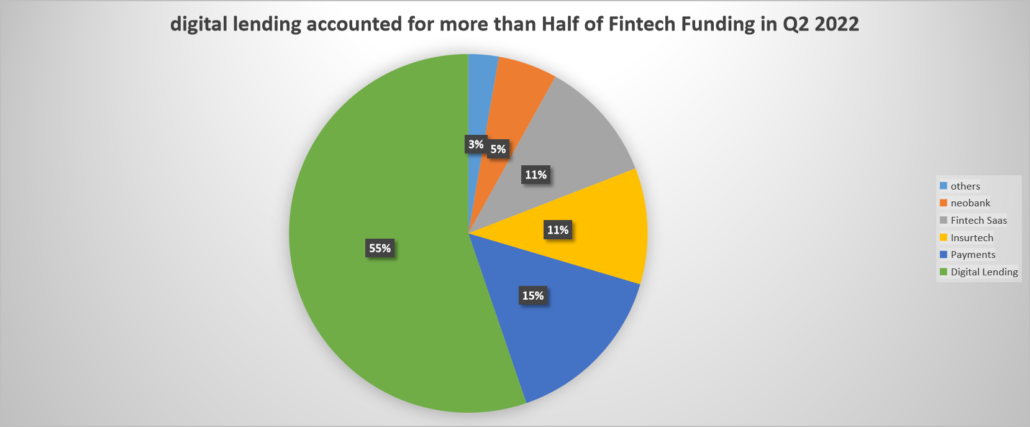

Personal loan, SME loan, Two-Wheeler loan, Car loan and Home loan are the most preferred digital loans in india. With the third wave of the global pandemic raging at the beginning of 2022, we saw a 50 per cent increase in digital adoption, aided by a large degree of internet penetration in the context of India. Further, digital lending accounted for more than half of Fintech funding in Q2 2022.

Moreover, the Fintech sector in India has seen a funding of $8.53 Bn (in 278 deals) in FY22.[7]

Will this balloon burst ?

This article has discussed how the digital lending industry has been continuously growing, however the question which arises is – whether this ever increasing balloon ever burst? And if yes then when?

The World Bank’s projections for global economic growth are 1.7% in 2023 and 2.7% in 2024. Further, the US, China, and Europe- three of the world’s biggest economies, show signs of weaker growth, and the overall global economy seems to be reaching close to a recession.[8] It looks like a global recession is slowly approaching the economy. Recession generally makes the lenders cautious about giving out loans and at the same time the borrowers find it very difficult to repay what they had previously borrowed. While answering the above questions with conviction is not possible as of now this recession could therefore act as a ‘nail’ that would ultimately lead to the balloon bursting.

Way Forward

Things are expected to look up in 2023 for financial entities globally and especially in India as new initiatives such as open banking, and account aggregator strive to drive greater credit enablement and foster a symbiotic relationship between incumbents and financial institutions.

Amid the growing popularity of online loans, RBI came up with the digital lending guidelines which came into effect in the beginning of September, 2022. These measures are aimed at protecting consumers and thereby include a restriction on fintechs and other unregulated entities from issuing loans, having a mandatory cooling off period which allows borrowers to exit digital loans, and making it compulsory to have a customer’s consent before increasing their credit limit. These guidelines are expected to have overall positive impact with increased clarity for the borrower on the terms of the loan which in turn should ensure higher growth as borrowers continue to build trust and come out of the informal lending sector.

Banks are taking note of the increasing popularity of digital loans by using algorithms, artificial intelligence, and their own analysis to assess a customer’s creditworthiness and gradually build up a credit history by using their platforms. They are stuck in a situation where they can no longer ignore it nor can they do it.

Concluding remarks

It is expected that digital lending will gather more steam in the coming years and will make the borrowing process even more convenient. Over 190 million Indian adults don’t have any kind of bank account thereby representing a huge opportunity. It is predicted that digital lending fintechs will continue to thrive and grow in the upcoming years as credit penetration increases especially in developing economies such as India. It is imperative for digital lenders to capitalize on new technological advancements that can help fasten certain procedures and turn-around times.

[1] independent commentator on financial markets and fintech.

[2] https://www.vantagemarketresearch.com/industry-report/digital-lending-market-1542

[3]Article on the use of AI in lending-https://vinodkothari.com/2023/04/impact-of-artificial-intelligence-in-the-lending-ecosystem/

[4] https://www.mordorintelligence.com/industry-reports/digital-lending-market

[5]https://www.experian.in/wp-content/uploads/2021/06/Experian-Invest-India-Report-A-Review-of-Indias-Credit-Ecosystem.pdf

[6] ibid.

[7] https://www.investindia.gov.in/sector/bfsi-fintech-financial-services

[8]https://economictimes.indiatimes.com/industry/banking/finance/banking/why-is-the-global-economy-nearing-recession-in-2023/articleshow/97857098.cms

Leave a Reply

Want to join the discussion?Feel free to contribute!