AT1 Bonds: Death before it is due?

– Abhirup Ghosh | abhirup@vinodkothari.com

Additional Tier 1 bonds which are known by many names – AT1 bonds or Contingently Convertible Bonds (CoCo Bonds) or Perpetual Bonds, are capital structure instruments. Every liability instrument in corporate finance is essentially a capital structure instrument, that is, it is somewhere in the order of priority for its loss absorbency feature, but some of the instruments are high in the order of priorities, and therefore, their placing in the capital structure is commonly not a matter of concern. However, AT1 bonds are placed just after common equity, and therefore, if equity has suffered a meltdown, AT1 bonds will be next to be hit.

This article examines the life and death of AT1 bonds.

Why this article?

The AT 1 Bonds, have been on the news once again, as FINMA (the Swiss financial regulator) wrote off $17 billion worth AT 1 Bonds of Credit Suisse bank as it arranged a takeover of the bank by UBS. In a press release[1] to justify this write-off, the FINMA mentioned that it has placed reliance on the terms of the instrument which allowed the regulatory authority to write off the AT 1 bonds on happening of ‘Viability Event’, in particular, if extraordinary government support is granted. Extracts from the press release are provided below:

The AT1 instruments issued by Credit Suisse contractually provide that they will be completely written down in a “Viability Event”, in particular if extraordinary government support is granted. As Credit Suisse was granted extraordinary liquidity assistance loans secured by a federal default guarantee on 19 March 2023, these contractual conditions were met for the AT1 instruments issued by the bank.

This decision to write off was made a part of the Emergency Ordinance on Additional Liquidity Assistance Loans and the Granting of Federal Default Guarantees for Liquidity Assistance Loans by the Swiss National Bank to Systemically Important Banks[2].

As a result, the investment made by the holders of AT1 bonds was reduced to naught by the decision of the regulator.

Within a span of three years, this was the third instance of writing off of AT 1 bonds issued by a bank of significant relevance in their respective jurisdiction. Shortly before this incident, the AT 1 bonds and Tier 2 bonds of Silicon Valley Bank UK were written off along with common equity in the process of it being acquired by HSBC Bank UK, as informed in a statement by the Bank of England[3]. In 2020, the AT 1 bonds of Yes Bank were written down completely. Our earlier writeup on this issue can be viewed here.

However, in the case of Yes Bank and now Credit Suisse, the AT 1 bondholders were the first to take the losses, despite the presence of equity shareholders, and the latter not being wiped out completely. A person of a rational mind would always find it difficult to digest that equity shares, which is placed lowest in terms of priority, gets priority over a class of instrument that should ideally rank higher.

These however, were not the only instances where AT 1 bonds were written off or the investors in the AT 1 bondholders were put into trouble, for instance, in 2019, the Chinese Bank of Jinzhou announced its decision to skip payment of a year’s interest to its investors of the CoCo bonds[4] to protect its financial health. In 2017, when Bank Santander acquired Banco Popular for Euro 1 to prevent its collapse, AT 1 bonds worth USD 1.44 bn were written off in Spain[5].

| Yes bank AT 1 bonds saga continues After the write-off of AT 1 bonds issued by the Yes Bank, several retail and institutional investors challenged the decision to write off and filed petition at the Bombay High Court. The Bombay HC vide its ruling in January 2023 invalidated the decision to write off stating: Yes Bank stood reconstituted on March 13, 2020, upon the Notification of the final Yes Bank Ltd. Reconstruction Scheme, 2020. After the bank was reconstituted, the Administrator could not have taken such a policy decision of writing off the debentures…..Nor the RBI had authorized him to do so. The Final Reconstruction Scheme also did not authorize Administrator to write off the AT-1 bonds. It appears that Administrator exceeded his powers and authority in writing off AT-1 bonds after the bank was reconstructed. However, the Bank challenged the decision and took the matter in front of the Supreme Court, and in March 2023, the Supreme Court extended a stay on the decision of the Bombay HC, stating that writing off the AT 1 bonds was an “extreme step” and sought clarifications from the Bank and the RBI with respect to the legal provisions that allowed them to do so. |

For the ones who are not familiar with the concept of the AT 1 bonds, the concept was introduced as part of banking reforms in the form of Basel III, after the Global Financial Crisis of 2008, in order to support the capital of the banks and prevent the need for governments to bail-out failing banks. These instruments are hybrid in nature and possess characteristics of both equity and debt. During the good times of the issuer, the investors enjoy the benefits of debt and earn regular coupons against their investments, however, as the tide turns for the issuers, the investors are exposed to equity-like risks, and their investments can either be converted to equity or worse, be written off. The characteristics of these bonds have been discussed at length later on in this write-up.

Given the additional risks these instruments pose, usually, the investors are compensated in form of higher coupons, as compared to other debt papers issued by the issuers.

The investors are usually warned about the downsides in the offer documents typically clearly and boldly, however, in good times, the investors quite often disregard such warnings, especially as it gives the investors an opportunity to earn extra over other fixed-income alternatives.

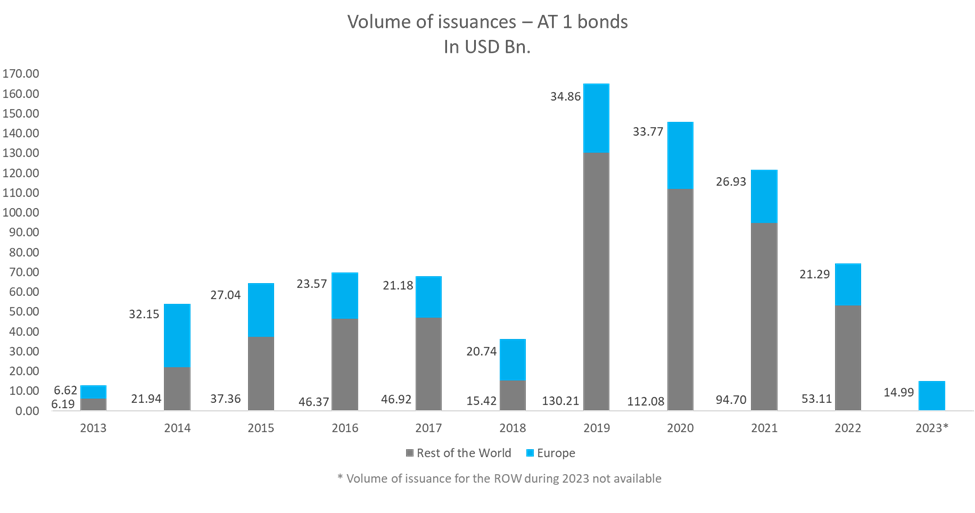

Globally, the market for AT 1 bonds is significant in size. In Europe alone, the volume of AT 1 bonds outstanding was estimated to be USD 275 bn[6] as on Mar 2023. Further, the trend of issuances over the past few years has been presented in the graphic below.

Components of capital under the Basel framework

The Basel framework formulates the capital requirements for banks across the world. The regulators of respective jurisdictions adopt the standards laid down in the framework, and modify that in line with the macroeconomic environment of the country.

The framework provides for three major components of the capital:

- Common Equity Tier 1 or CET 1;

- Additional Tier 1 or AT 1; and

- Tier 2

Between the three classes of capital instruments, in terms of seniority, Tier 2 is the senior most, followed by AT 1 and CET 1 is the junior most, however, all of these are subordinated to all other claims against the bank, including claims of depositors and general creditors.

The characteristics and contents of each of the aforementioned have been tabularised below for a quick reference:

| CET 1 | AT 1 | Tier 2 |

| (1) Common shares issued by the bank that meet the criteria for classification as common shares for regulatory purposes; (2) Stock surplus (share premium) resulting from the issue of instruments included CET 1; (3) Retained earnings; (4) Accumulated other comprehensive income and other disclosed reserves; (5) Common shares issued by consolidated subsidiaries of the bank and held by third parties (ie minority interest) that meet the criteria for inclusion in CET 1; and (6) Regulatory adjustments applied in the calculation of CET 1. | (1) instruments issued by the bank that meeting the criteria for inclusion in AT 1 and not included in CET 1 (2) stock surplus (share premium) resulting from the issue of instruments included in AT 1 capital; (3) instruments issued by consolidated subsidiaries of the bank and held by third parties that meet the criteria for inclusion in AT 1 capital and are not included in CET 1; (4) regulatory adjustments applied in the calculation of Additional Tier 1 Capital. | (1) instruments issued by the bank that meet the criteria for inclusion in Tier 2 capital (and are not included in Tier 1 capital); (2) stock surplus (share premium) resulting from the issue of instruments included in Tier 2 capital; (3) instruments issued by consolidated subsidiaries of the bank and held by third parties that meet the criteria for inclusion in Tier 2 capital and are not included in Tier 1 capital. See CAP10.20 to CAP10.26 for the relevant criteria; (4) certain loan-loss provisions (5) regulatory adjustments applied in the calculation of Tier 2 capital. |

As may have been noticed, the definitions of both AT 1 and Tier 2 refers to certain instruments which fulfil the respective criteria laid down for each of the two categories. Click here for the conditions to be fulfilled by an instrument to qualify for either AT 1 or Tier 2 capital, as laid down in the Basel framework.

The following table brings out the key similarities and dissimilarities between these two type of instruments:

| Particulars | AT 1 instrument | Tier 2 instrument |

| Paid-in | Must be issued and paid-in | Must be issued and paid-in |

| Seniority of claims | Subordinated to depositors, general creditors, and subordinated debt | Subordinated to depositors, and general creditors. Therefore, superior to the AT 1 instruments. |

| Security or guarantee cover | Not possible | Not possible |

| Maturity | Has to be perpetual in nature, with no fixed maturity | Minimum tenure of 5 years. Where the remaining tenure is not more than 5 years, the recognition in the regulatory capital will be amortised on a straight-line basis, that is, the book value of the instrument will be discounted in the following manner: Remaining tenure Discount <= 1 year 100% 1 – 2 years 80% 2 – 3 years 60% 3 – 4 years 40% 4 – 5 years 20% > 5 years 0% |

| Callability | Callable at the option of the issuer, after a period of 5 years, however, subject to fulfillment of certain conditions which includes regulatory approval. | Similar |

| Repayment of principal | Cannot be done without the prior approval of the regulator | As per the terms of the tenure, subject to the minimum tenure being met, and conditions of callability are met where there is a prepayment on the part of the issuer. |

| Dividend/ coupon discretion | The issuer has the right to cancel any distribution or payment of dividends or coupons at its own discretion. Such cancellation cannot be treated as an event of default. Further, such cancellation must impose any restriction on the issuer with respect to distributions/ payments, except for distributions to be made to the equity holders | The issuer does not have the right to cancel dividends/ coupons on such instruments. |

| Loss absorption | The instruments are expected to absorb losses on a going concern basis – that is the instruments can be written down or converted into common equity on the happening of pre-specified triggers or point of non-viability. The pre-specified trigger happens when the CET 1 falls below a certain limit. Here either the instrument can be converted into equity or written down, which would have the following effects: (a) Claim of the instrument at the time of liquidation would stand reduced (b) Amount to be repaid on the exercise of the call would stand reduced (c) Partial or full reduction of coupon/ dividend payment on the instrument The point of non-viability is when the regulator feels that the bank has become non-viable without a write-off or conversion to equity of the said bonds or a public sector infusion of capital happens. The regulations require that before any public sector capital infusion, these bonds must be either written off or converted into equity. | These instruments can be written off or converted into common equity only upon the bank hitting the point of non-viability. |

Though the characteristics of both AT 1 and Tier 2 bonds allow the regulators to write off the bonds, the instances of Tier 2 bonds being written off are fewer, because, technically, they are still above AT 1 and CET 1, and usually losses do not reach that level. However, in the case of SVB UK[8], and Lakshmi Vilas Bank[9], in India, even Tier 2 capital was written off (in the case of LVB, the bank did not have any AT 1 bonds).

Therefore, when it comes to the question of legality, the terms of the issuance of these bonds and the regulatory framework, as it stands, allow the regulatory authorities to write off. But what about the question of morality, especially when the wealth of the equity holders is not written off completely?

What attracts the investors?

Just the most primitive instinct that has attracted investors at all times, in all places, and of all levels of sophistication – higher yield! Since these bonds are riskier than other fixed-income alternatives, they offer higher coupons.

Given the complexities attached to this instrument, institutional investors are major investors in these, globally, and that is how it ideally should be. But it is not an alien concept for retail investors either. In India, the AT 1 bonds issued by Yes Bank, were heavily subscribed by retail investors. But it is hard to comprehend that such retail investors actually understand the risks they are exposing themselves to by investing in these bonds. In fact, when the AT 1 bonds of Yes Bank were written off completely, some of the retail investors contended that they were misguided by the employees of the banks to invest in such papers instead of fixed deposits for better yields. A significant number of such retail investors were retired senior citizens who mostly relied on income from fixed deposits for their livelihood. As a result, a lot of such investors lost their entire life savings due to such a move. Soon after this, the Securities and Exchange Board of India debarred retail investors from making investments in these papers[10].

The impact on the market, and an attempt to calm the investors down

This write-off immediately sent investors across the globe into a frenzy and raised several questions about the credibility of such instruments, and it was visible in the value of these bonds as well. Invesco’s AT1 Capital Bond Exchange Traded Fund, which tracks the value of AT 1 debt issued by banks, was trading at a 15% low[11]. Market experts feared that this could potentially change the way instruments are priced in the future. However, the uncertainties in the market prompted some of the regulators around the world to step in and attempt to restore the investors’ confidence in the instrument.

The European Central Bank and the European Banking Authority issued a press release on 20th March 2023[12] stating that common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier One be required to be written down. Extracts:

The European banking sector is resilient, with robust levels of capital and liquidity.

The resolution framework implementing in the European Union the reforms recommended by the Financial Stability Board after the Great Financial Crisis has established, among others, the order according to which shareholders and creditors of a troubled bank should bear losses.

In particular, common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier One be required to be written down. This approach has been consistently applied in past cases and will continue to guide the actions of the SRB and ECB banking supervision in crisis interventions.

Additional Tier 1 is and will remain an important component of the capital structure of European banks.

A similar statement was also issued by the Bank of England[13]:

The UK’s bank resolution framework has a clear statutory order in which shareholders and creditors would bear losses in a resolution or insolvency scenario. This was the approach used for the recent resolution of SVB UK, in which all of SVB UK’s Additional Tier 1 (AT1) and T2 instruments were written down in full and the whole of the firm’s equity was transferred for a nominal sum of £1.

AT1 instruments rank ahead of CET1 and behind T2 in the hierarchy. Holders of such instruments should expect to be exposed to losses in resolution or insolvency in the order of their positions in this hierarchy.

The Bank welcomes the comprehensive set of actions taken yesterday by the Swiss authorities in order to ensure financial stability. The UK banking system is well capitalised and funded, and remains safe and sound.

In Asia, the Monetary Authority of Singapore[14] also sang the same tune. Extracts of the press release in this regard:

The Monetary Authority of Singapore (MAS) said today that in exercising its powers to resolve a financial institution (FI), it intends to abide by the hierarchy of claims in liquidation. This means that equity holders will absorb losses before holders of Additional Tier 1 (AT1) and Tier 2 capital instruments.

2. Creditors who receive less in a resolution compared to what they would have received had the FI been liquidated would be able to claim the difference from a resolution fund that would be funded by the financial industry.

3. The creditor compensation framework will also apply in the exceptional situation where MAS departs from the creditor hierarchy in order to contain the potential systemic impact of the FI’s failure or to maximise the value of the FI for the benefit of all creditors as a whole.

4. MAS’ resolution framework is in line with the Financial Stability Board’s Key Attributes of Effective Resolution Regimes for Financial Institutions.

5. AT1 bonds in Singapore are offered in the wholesale market, which is only for institutional investors, accredited investors, or transactions in denominations of at least S$200,000. No prospectus for the offering of AT1 bonds to retail investors has been registered with MAS.

6. As with other investment products, FIs that offer or distribute AT1 bonds are expected to make accurate and clear disclosures of key product features and risks to investors. Investors should understand the risks and rewards, and exercise due care in their selection of investment products.

Conclusion

Recent incidents in the world of finance, of course, exceptional in nature and rare in occurrence, might have resulted in the death of these AT1 bonds, arguably even before the death was due. While that is something that we have examined in this article, we need to understand that an investor investing in AT1 bonds, or similar subordinated instruments, is eventually taking a call on whether the thickness of support available for equity or other subordinated instruments is sufficient, in view of the likelihood and severity of losses to the issuer, for the term for which the instrument has been issued. Therefore, the minimal factors which explain the vulnerability of any structured instrument, are:

- the size of equity or other subordinated instruments ranking below the instrument in question;

- the tenure of the instrument, because the probabilities and imponderabilities increase over longer period; and

- the concentricity and volatility in the assets of the issuer, so as to have higher prospects of shocks.

These factors will continue to drive investors to invest in any financial instrument, not just AT 1 bonds, going forward.

[1]FINMA Press Release on the reasons for writing off the AT 1 bonds: https://www.finma.ch/en/~/media/finma/dokumente/dokumentencenter/8news/medienmitteilungen/2023/03/20230323-mm-at1-kapitalinstrumente.pdf?sc_lang=en&hash=821DB4A410097CE21C86C97030BE5022

[2]Ordinance on Additional Liquidity Assistance Loans and the Granting of Federal Default Guarantees for Liquidity Assistance Loans from the Swiss National Bank to Systemically Important Banks: https://www.newsd.admin.ch/newsd/message/attachments/76289.pdf

[3] https://www.bankofengland.co.uk/news/2023/march/boe-statement-uk-creditor-hierarchy

[4] https://www.wsj.com/articles/ailing-chinese-bank-stops-paying-coupons-on-coco-bonds-11567424965

[5] https://www.reuters.com/article/uk-bancopopular-bondholders-valuation-idUKKBN1FT1CJ

[6] https://www.economist.com/the-economist-explains/2023/03/21/what-are-additional-tier-1-bonds

[7] https://www.wsj.com/articles/at1-bank-bonds-credit-suisse-risky-6785b012

[8] ibid

[9]https://economictimes.indiatimes.com/markets/bonds/lakshmi-vilas-bank-writes-down-tier-2-bonds-worth-rs-320-crore/articleshow/79433388.cms

[10]https://www.sebi.gov.in/legal/circulars/oct-2020/issuance-listing-and-trading-of-perpetual-non-cumulative-preference-shares-pncps-and-innovative-perpetual-debt-instruments-ipdis-perpetual-debt-instruments-pdis-commonly-referred-to-as-additi-_47805.html

[11]https://www.businessinsider.in/stock-market/news/coco-bonds-fall-sharply-over-credit-suisse-deal/articleshow/98814233.cms

[12]SRB, EBA and ECB Banking Supervision statement on the announcement on 19 March 2023 by Swiss authorities: https://www.eba.europa.eu/srb-eba-and-ecb-banking-supervision-statement-announcement-19-march-2023-swiss-authorities

[13] Bank of England Statement: UK creditor hierarchy: https://www.bankofengland.co.uk/news/2023/march/boe-statement-uk-creditor-hierarchy

[14]https://www.mas.gov.sg/news/media-releases/2023/mas-statement-on-additional-tier-1-instruments-issued-by-singapore-banks

Leave a Reply

Want to join the discussion?Feel free to contribute!