Introducing Financial Services on ONDC: Opportunities & Challenges for Digital Lenders

– Shreshtha Barman | finserv@vinodkothari.com

Introduction

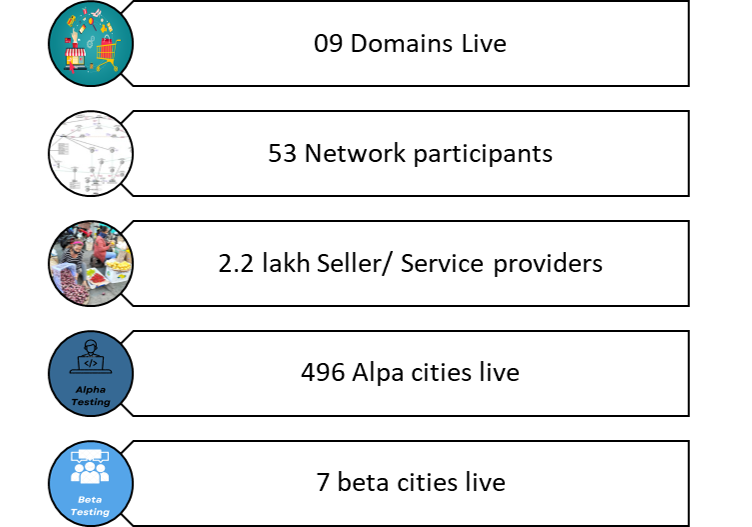

Inspired by the success of UPI, the Government undertook the mission of democratising the digital e-commerce space in India by the launch of Open Network and Digital Commerce (hereinafter referred to as “ONDC”). ONDC is a Section 8 company founded by the Quality Council of India and Protean eGov Technologies Limited. It was established by the Department of Industry and Internal Trade (DPIIT) as a set of open specifications that use open network protocols for the integration of different network participants in the ONDC ecosystem. The ONDC platform provides an opportunity for SMEs to participate in the e-commerce sector and minimise the concentration of e-commerce business to existing few dominant players. Below is a summarised view of the impact that ONDC has had –

Figure 1 – ONDC Impact[1]

ONDC now aims at leveraging its architecture for the provision of financial services in 4 domains namely credit, insurance, investments, and gift cards. Currently, gift cards that are exclusively redeemable on ONDC Network partnered with YES Bank are live on the network of ONDC. The product roadmap and pipeline of financial services are attached as available on the ONDC website.

Product Roadmap – Financial Services

| Credit | Insurance | Investments | Gift Cards |

| Unsecured Lending ●Phase 1 – Personal Loans and GST Based Invoice Loans ●Phase 2 – Purchase Finance (Consumer and Businesses) ●Phase 3 – Derived Data – Standardising alternate data to help financial institutions incorporate in their business rule engines ●Phase 4 – Digital flow for Partnerships and Public Limited Companies | Standalone Products ●Phase 1 – Health Insurance, Motor Insurance and Marine Insurance ●Phase 2 – Life Insurance | Mutual Funds – Phase 1 ●Equity, Debt and Hybrid Funds | ONDC Gift Card (Live on the network) ●Issued by a PPI licensed issuer to corporates ●Exclusively redeemable on the ONDC network buyer applications |

| Secured Lending (to be taken up post completion of unsecured lending phases) ●Gold Loans ●Vehicle Loans ●Home Loans | Group Products (to be taken up post completion of Phase 1 and 2) ●Embedded Insurance Offerings (Travel, Consumer Purchases etc.) ●Microfinance | Stocks & Bonds (Phase 2 – to be taken up post completion of Phase 1) ●Individual equities (digital opening of demat accounts) ●Corporate Bond Issuances | 3rd Party Gift Card – Single Purchase – Phase 1 ●Purchase of gift card happens on the ONDC network and redemption of the gift card happens outside of the ONDC network ●3rd Party Gift Card – Bulk Purchase – Phase 2 |

| Custom Products (to be taken up post completion of Phase 1 and 2) ●Crop Insurance ●Property, Fire, Theft ●Non Individuals | Gold – Phase 3 ●Digital Gold ●Physical Gold | ||

| Fixed Deposits – Phase 4 ●Banks / NBFCs |

Table 1 – Product Roadmap- Financial Services[2]

Pipeline – Financial Service Providers

| Credit | Insurance | Investments | Gift Cards |

| Buyer Applications ●EasyPay ●Rapidor ●Tata Digital ●Pay Nearby ●Indialends ●Mobikwik ●Fi ●Sarvagram | Buyer Applications ●Insurance Dekho ●Antworks ●Cliniq 360 ●Gibl ●RFL Insurance ●Turtlemint ●Policy Bazaar ●Policy X | Buyer Applications ●Paytm ●Paisabazaar ●Liquid ●Mirae Asset ●Bharat Nxt ●MyFi Fintech Advisory ●Sub-K ●Yes Bank | Issuer Partners for ONDC Gift Card ●Yes Bank ●Omnicard |

| Seller Applications ●DMI ●Aditya Birla Capital ●Karnataka Bank ●Kotak Mahindra ●Tata Capital ●Northern Arc ●Ugro Capital ●FT Cash ●Faircent | Seller Applications ●Aditya Birla Insurance ●Bajaj Insurance ●Kotak Insurance ●New India Assurance ●Star Health ●SBI General Insurance ●HDFC Ergo ●ICICI Lombard ●Universal Sompo | Seller Applications ●MF Utilities (MFU) |

Table 2 – Pipeline- Financial Service Providers[3]

This article focuses on how ONDC Network can be leveraged by Financial institutions for providing credit services, applicability of the DL guidelines, challenges and opportunities thereto.

ONDC Ecosystem – Network Participants

ONDC aims at providing a common public digital infrastructure for LSPs and lenders with the aim to reduce operational costs and expand reach. In the first phase, ONDC plans to enter the credit sector by providing unsecured personal loans as well as GST-based invoice loans to merchants. This is a logical step in its evolution from an e-commerce public infrastructure provider.

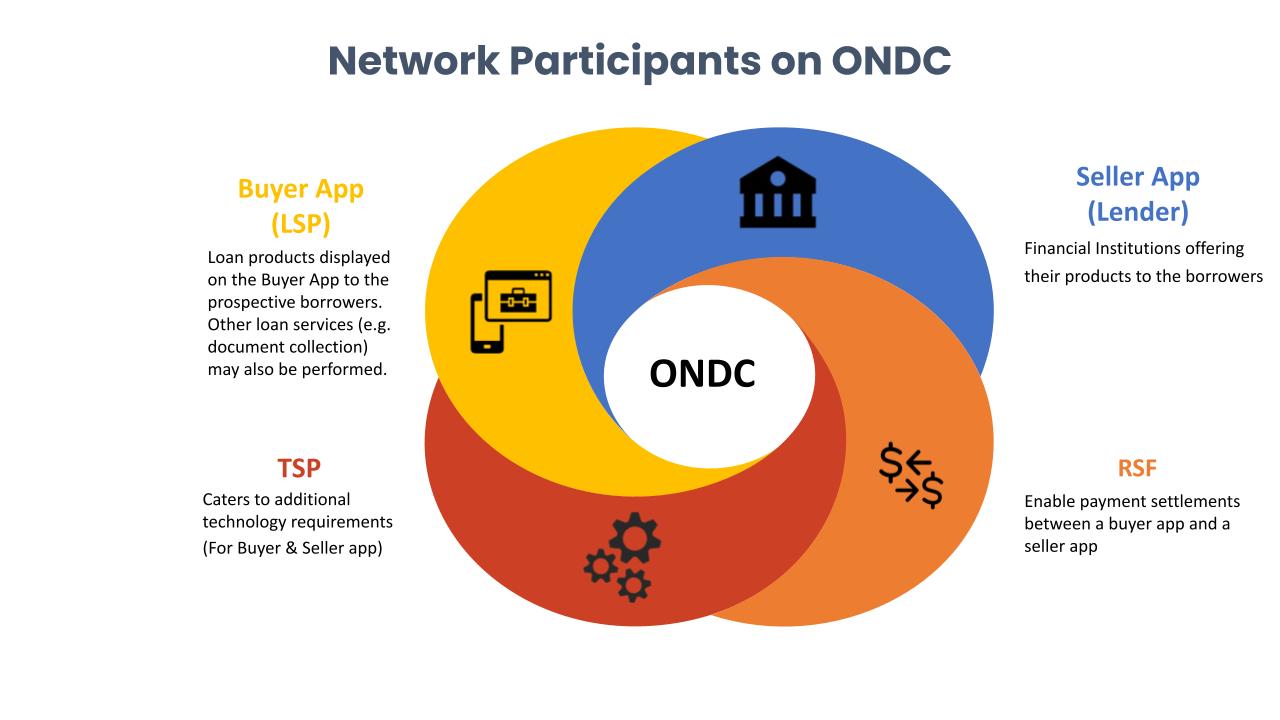

As has been the approach in the e-commerce sector, ONDC aims at the establishment of an ecosystem of LSPs (Buyer App), Lenders/ Lending App, technology service providers (TSP) and Reconciliation Service Framework (RSF ) (collectively ‘network participants’) to facilitate the low-cost distribution of financial products, the promotion of network discipline to guarantee an equitable and inclusive marketplace, and the creation of a technological environment that fosters financial product innovation under close supervision. The ONDC provides the underlying technology/ technology standards that allow the Buyer App to navigate, compare, and provide borrowers the facility to select from the wide choice of quotes (loan terms, interest rate, etc.) given by seller apps (lenders).

Network participants on the platform for providing financial services

- Seller apps (RBI licensed lenders) providing the finance send quotes to the borrowers on the buyer app on receipt of information from the buyer app followed by the collection of information of the borrower from Account Aggregator (AA) and credit bureaus

- Buyer App which onboards the borrowers/merchants and collects the information and send the same to the various seller apps

- Technology Service Provider (TSP)

- Reconciliation Service Framework (RSF)

Figure 2 – Network participants of ONDC framework

Borrowers interact with the Buyer Apps (LSPs) which connect them to Lenders/ Lender Apps and the lending transaction takes place among the borrowers and lenders based on a loan-specific agreement executed among them. The Buyer App may provide additional loan facilitation services (such as collecting borrower information for KYC, credit underwriting, etc.). In this entire transaction, the ONDC is an entirely passive element merely providing the underlying technology. The borrowers do not interact with ONDC, nor are they on boarded onto it as Network Participants.

Whether lending using ONDC is digital lending?

It is crucial to understand whether the lending on the ONDC platform will be considered as digital lending as per the RBI Digital lending guidelines, in order to understand the compliance applicable on the participants.

Para 2.3 of the RBI digital lending guidelines defines Digital Lending as

“A remote and automated lending process, largely by use of seamless digital technologies for customer acquisition, credit assessment, loan approval, disbursement, recovery, and associated customer service.”

As per the above definition, lending on the ONDC platform by the lender (seller app) to the borrower (on buyer app) will be considered digital lending as the lending process on ONDC is substantially automated using various back-to-back digital technologies. Besides, the architecture facilitates deploying seller (lender) apps having the capability of algorithmically sanctioning loans[4].

Is ONDC an LSP?

ONDC, however, will neither be considered an LSP nor a DLA as it doesn’t act as an agent or provide lending services on behalf of the lender (seller app) nor does it interact with the borrowers. ONDC platform merely provides a digital space or technology that facilitates discoverability and interaction of the lender apps registered on the network with those of the LSP (Buyer App). While the lenders are expected to execute an onboarding agreement and obey the rules of the ecosystem there is no contractual relationship between ONDC and the lender/ lender app for its promotion or for sourcing of borrower/ customer.

In the given case, the buyer app helps in loan facilitation, solicitation and customer acquisition, loan disbursal, and other important aspects of loan sourcing and disbursement for the Seller app (lenders) on the platform, thereby providing the facility of the Lending Service Provider (LSP) as per the digital lending guidelines. Further, the buyer app also provides the user interface which facilitates the digital lending between the borrower and the selling app (lenders). Hence the buyer app in the given case will be considered as both the LSP and DLA as per the Digital lending guidelines and ensure compliance with the same to the extent applicable to Lending Service Provider.

The seller app (lender) will also ensure adherence to the digital lending guidelines with respect to the disclosure of Annualised Percentage Rates (APR), penal charges, Key Facts Statements(KFS), collection, storage, and confidentiality of the personal information of the borrower sourced from the buyers’ app and reporting of the digital lending transaction to the CICs.

Network participants need to follow ONDC governance norms regarding disclosures required to be made on their respective websites, confidentiality of financial data of the borrowers, redressal grievance mechanism to name a few.

Applicability of NBFC-P2P Directions

Whether ONDC should be considered a P2P Lending Platform under the RBI Peer to Peer Lending Platform (Reserve Bank) Directions, 2017? This is an important question to consider for deciding whether licensing norms and other compliances apply to ONDC and the network participants.

ONDC merely acts as an underlying technology provider that enables a decentralised platform where LSP/ Buyer Apps can search, present and allow borrowers to select lenders. It is not ONDC which acts as the P2P intermediary that sources borrowers and lenders and performs the matchmaking among them. Hence, ONDC cannot be considered as Peer to Peer Lending platform and does not require registration with the RBI.

The buyer apps, however, help in soliciting borrowers on their respective apps for the lenders, and as per the RBI Peer to Peer Lending Platform (Reserve Bank) Directions, 2017 they appear to be P2P lending platforms. However, buyer apps cannot be considered as a P2P lending platform as platforms used for regulated entities are exempt from being considered as P2P platforms. Since seller apps joining as network participants are licensed by RBI, they are not required to adhere to the P2P guidelines mentioned above.[5]

Challenges and Advantages

For a digital lender peddling largely unsecured personal loans, credit assessment, and KYC/ AML compliances are its major operational elements in terms of time, cost, and infrastructure. Digital Lenders are also mandated by the RBI to conduct due diligence, monitor, and conduct periodic reviews of their LSPs with respect to the lending services availed. Expansion of the borrower base and making available a standardised set of technologies are the obvious advantages of the ONDC ecosystem; we however, need to more closely assess the pros and cons of the ONDC with regard to the major operational aspects of a digital lender:

Credit Assessment

ONDC has onboarded RBI licensed Account Aggregators (AAs) that lenders may leverage to access the economic information of the borrowers and in terms of invoice financing lenders will also be able to access returns provided by the GST portal.

There is an RBI mandate upon lenders to utilise the credit information supplied by credit bureaus in their credit assessment procedure. From the loan journey flow shared by the ONDC It is unclear as to whether credit bureau integration can happen via the platform itself or whether lenders must set up or continue to use their own infrastructure to submit or draw credit information from the Bureaus.

KYC and Customer Due Diligence

There are two options for KYC verification that are integrated with the platform. The borrower by the buyer app may allow the lender to either perform Aadhar OTP-based e-KYC or Aadhar pull from Digilocker.

Certain challenges for the lender, however, remain in this area as Aadhar OTP-based e-KYC may only be undertaken by lenders or their LSPs having AUA/ KUA licence, and in order to have a licence the lender must satisfy the UIDAI that they either have or will put into place the necessary infrastructure. It is to be seen whether being onboarded onto ONDC having access to the TSPs will enable lenders/ LSPs to obtain such licence more smoothly.

Also, in case of Aadhar OTP based e-KYC, V-CIP needs to be undertaken within a year of lending as per the RBI KYC Master Directions. Conducting V-CIP, of course, also has significant infrastructure cost and operational difficulties associated with it. It will be much welcome if ONDC can also provide public infrastructure or integrate TSPs who may reduce such cost and operational burden upon the lenders.

Due Diligence of LSP

As we have discussed earlier, the lending on the ONDC assumes the form of digital lending with the buyer apps acting as the DLA/ LSP. Hence, the requirement under para 9 of the RBI Digital lending guidelines on digital lenders to carry out the enhanced due diligence of LSP with respect to the technical abilities, data privacy policies and storage systems, fairness in conduct with borrowers and ability to comply with regulations and statutes continue to apply to lenders and LSPs on ONDC. Annex XIII of the SBR Master Directions on ‘Managing Risks and Code of Conduct in Outsourcing of Financial Services by NBFCs’[6] also requires lenders to evaluate the capability of their outsourced service providers as well as ensure the confidentiality and security of borrower data shared.

Now, while commercial and lending transactions are within the remit of the Lenders, LSPs, and borrowers without ONDC playing an active role; the ONDC does set the rules for the ecosystem. This includes prescribing technical, governance and role-based operational standards (e.g. system uptime/ availability, network security, grievance redressal measure, etc.) that participants need to meet or risk being jettisoned from the ecosystem. The ONDC also at its sole discretion may carry out period audits to ensure ‘good behaviour’ on the part of the participants.

Such policy on the part of ONDC may support some of the burden that lenders need to carry in terms of due diligence and periodic review of their LSPs. A well-structured governance policy and consistent implementation of such policy shall go a long way in this regard. It must, however, be noted that responsibility over the actions of their LSP will continue to be borne by the lenders.

Conclusion

“There is a tide in the affairs of men / Which, taken at the flood, leads on to fortune”

The ONDC ecosystem is an ambitious Government initiative in the financial services space and it may just have come at the opportune moment when the state of information technology, demand for financial services, and the readiness to adopt technology for such purposes are at their most conducive levels. While we have examined in this article some of the significant regulatory issues faced by lenders on the system, it is the level of participation that will make or break the system and in this regard, ease of integration, operational resilience, degree of data protection and privacy measures will play an enormous role. There is promise and we hope this ecosystem does flourish.

[1] Source:- www.ondc.org, last viewed in November 2023

[2] Source: www.ondc.org (last viewed in November 2023)

[3] Source: https://resources.ondc.org/financial-services, (last viewed in November, 2023)

[4] Refer to our detailed FAQs on the Digital Lending Regulations here – https://vinodkothari.com/2022/08/faqs-on-digital-lending-regulations/

[5] A detailed examination of the NBFC-P2P guidelines is available in our report here – https://vinodkothari.com/2023/02/p2p-lending-in-india-report/

[6] Draft of the new framework for financial services outsourcing has been published. Read our discussion paper on it here – https://vinodkothari.com/2023/11/draft-framework-for-financial-services-outsourcing/

Leave a Reply

Want to join the discussion?Feel free to contribute!