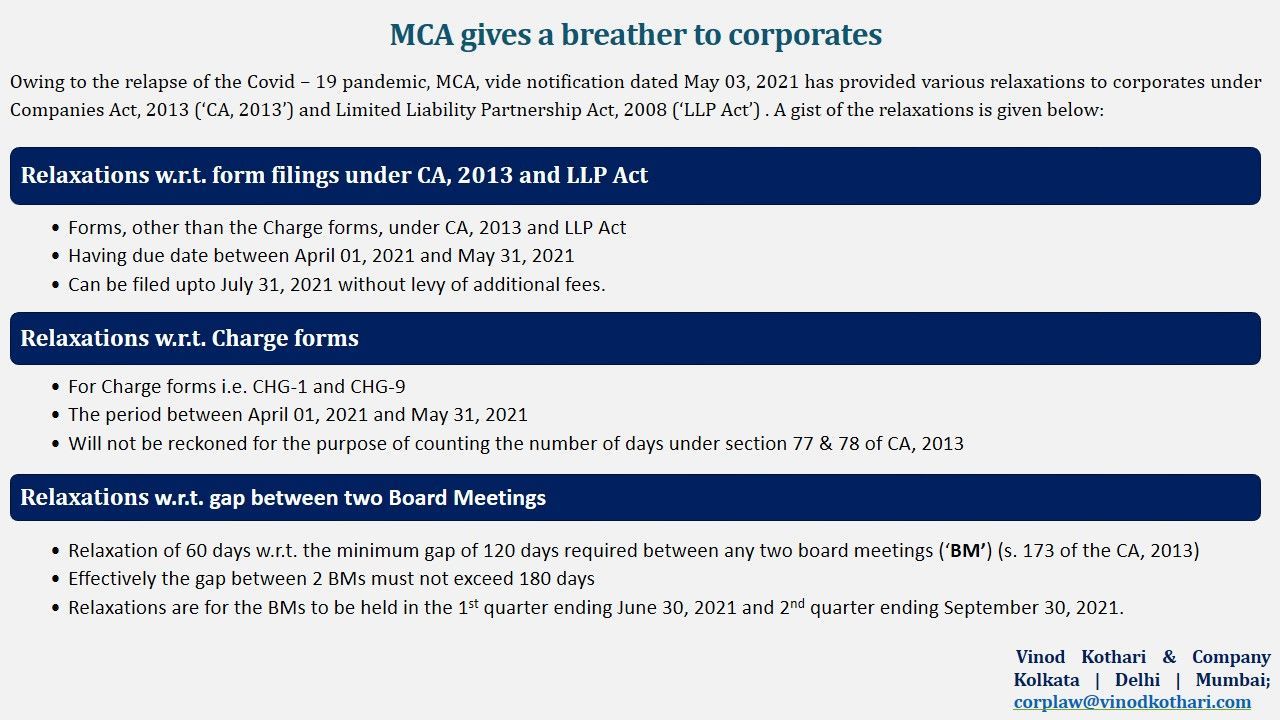

MCA extends relaxations amidst secondary wave of Covid-19

/0 Comments/in Corporate Laws, Corporate Laws - Covid-19, Covid-19, MCA /by StaffCSR – Accounting and taxation

/0 Comments/in Companies Act 2013, Corporate Laws, MCA /by Staff Loading...

Loading...

Changes in Auditors’ Report and Financial Statements to reveal camouflaged financial transactions

/1 Comment/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsTeam Corplaw, Vinod Kothari & Company [corplaw@vinodkothari.com]

[This version: 25th March, 2021]

Accountants and auditors will have to grapple with a ton of new details and disclosures while preparing financial statements and audit reports, come financial year 2021-22. MCA brought, vide separate notifications dated 24th March, 2021 amendments in the Companies (Audit and Auditors) Rules,2014 (“Audit Rules”), the Companies (Accounts) Rules, 2014 (“Accounts Rules”) and Schedule III of the Companies Act.

While Schedule III changes will require wide ranging disclosures [to be covered by a separate write up], the amendments in Audit Report Rules and Accounts Rules require the following new disclosures:

- Camouflaged lending or investment, that is, where out-bound or inbound loans, advances and investments are intended to be routed through a conduit entity, masking the identity of the ultimate beneficiary

- Compliance with respect to payment of dividend

- The need for accounting software to maintain an audit trail, that is, edit log, of the primary entries, possibly with a view to enable the detection of any changes in primary entries

- Gaps in valuations of securities, so as to reflect the valuations at the time of borrowing money, and at the time of OTS

We briefly discuss these.

Applicability – scope and date

- The changes as will be discussed below will be applicable on the Auditor’s Report and Board’s Report from the financial year 2021-22 and onwards.

- Since statutory audit is a mandatory requirement for all the companies, the changes in the Auditor’s Report shall be applicable on all companies.

- From the language of the amendments, it is apparent that the changes are applicable only for the annual financial statements; neither are they applicable to interim financial statements, nor to special purpose financial statements.

- An important question will remain whether the required management representation and the auditors’ check will pertain to transactions done during the financial year 2021-22 and thereafter, or does it pertain to opening balances of transactions as on 1st April, 2021. In absence of any suggestion as to retroactivity, it should be logical to assume that the required management representation and the auditors’ checking should pertain to the transactions done during the financial year.

- The changes in relation to Board Report shall be applicable on all the companies, since the Board Report is a mandatory requirement for all.

- The requirements of audit trail and edit log are applicable on companies maintaining their accounts in the electronic form. However, practically, all companies maintain accounts in electronic format, so the same can be said to be applicable on all companies.

Camouflaged lending and investment:

What is the offence?

The issue under consideration is “camouflaged investments”. By using the term camouflage investments, we mean those transactions which are undertaken by a company for some identified beneficiary. However, the transaction does not take place between the company and the ultimate beneficiary directly, but is masked by the inclusion of an intermediary acting as a conduit entity (an entity acting on the instructions of the company for channelizing the funds to any other entity identified by the company).

These transactions mask the identity of the real beneficiary. In a world where financial transactions are regularly used for carrying illicit transactions, money-laundering transactions or other suspicious activities, it is important that the trail of financial transactions is transparent. Hence, if the identification of the end beneficiary is consciously being masqueraded, there is a concern. The proposed amendments are a means to address this issue.

What is the MCA intending to do?

The MCA, vide the amendment notification, is aiming to unveil the ultimate beneficiary behind the camouflage financing. Though investment through “conduit entities” is not barred by law, the same needs to be adequately disclosed in the notes of accounts of the company. Therefore, MCA, vide its amendment notification, requires the management of the company to give a representation that, except as otherwise disclosed in the notes to accounts, the company has neither employed, nor is itself acting as a “conduit entity” for any financial transaction.

Is it illegal to have investments via conduits?

Several laws refer to indirect lending or investment –

- Sec 185 of the Act prohibits both direct and indirect loans, investments, guarantees or security to the directors and other specified entities.

- Under the FEMA Regulations, the definition of “foreign equity holder” includes those equity holders having minimum 51% of indirect equity holding

- Sec 186 (1) also refers to investment “through” one or more layers of subsidiaries, which is again a case of indirect investments.

- In many commercial transactions, it is understood that the recipient is acting as a conduit – for example, lending through a fintech platform

- Special purpose vehicles, which are well allowed to operate under various laws, are intended to be conduits only

- Use of conduits is commonplace practice in many commercial transactions

Hence, while it is not illegal on the face of it, the use of a masquerading entity camouflages the real nature of the financial transaction. It acts as a subterfuge and hence, creates opacity. In the context of PMLA, these transactions may also be hiding the real identity of the real beneficiary.

Hence, it is important to ensure that the identity of the real beneficiary, if so targeted by the lender or investor, is disclosed.

What sort of transactions will be covered?

There are several elements in the camouflage rule that need to be understood:

There are 3 legs of the transaction: a source transaction, a conduit or intermediary transaction, and an ultimate beneficiary transaction.

The source transaction may be

- Investments,

- Advances, or

- Loans

At the source stage, the money has come as a result of any borrowing, issue of shares or share premium or any other source or kind of funds. Since these expressions are wide enough, it does not matter what the source of the funds at the source level is.

The intermediary transaction may be by way of

- Loan or advance

- Investment

- Provision of any guarantee or security

The ultimate beneficiary is the end beneficiary of the source transaction.

The following points may be noted about the scope of the Camouflage rule:

- Commercial transactions are not covered: Notably, the transactions covered by the rule are financial transactions, in the nature of loans, advances or investments. Real sector transactions such as sales, purchases, services, including payment and collection services, etc., are not covered by the rule.

- Non-discretionary transactions as regards the intermediary: In order to attract the offence of the camouflage rule,the source must have identified the ultimate beneficiary. This is clear from the words: “identified in any manner whatsoever by or on behalf of the company”. Thus, if the intermediary had the discretion in identifying the beneficiary, this rule is not attracted. Hence, the identification of the beneficiary is done by the source, and without any discretion on the part of the intermediary.

- Pre-contemplated transfer to the ultimate beneficiary: Next important element is the existence of an understanding with the intermediary that the funds passing through the intermediary are intended by the ultimate beneficiary. This is clear from the words “with the understanding, whether recorded in writing or otherwise”. The form of the understanding or the formal nature of the understanding also doesn’t matter, but the understanding must have been there.

- Direct nexus: This suggests that the flow of funds from the source of the intermediary, and from intermediary to the ultimate beneficiary must be part of the same transaction, showing a clear nexus.

- The intent of camouflaging the chain financial transaction is present: It is only when the real nature of the transaction is sought to be garbed, and the transaction purports to be a financial transaction with the intermediary, whereas the real intent is to provide funding to the ultimate beneficiary. For example, if a special purpose vehicle collects money from the investors, it is evident on the face of the transaction that the money is intended to go to another beneficiary. There is no garbing of the identity of the end beneficiary. These transactions are explicit and transparent transactions. The whole intent of the camouflage rule is to eliminate opacity. If the transaction was itself transparent, the rule has no relevance at all.

There are several interconnected financial transactions that abound in the world of finance. Hence, it will remain a matter of intrigue as to what all transactions may be regarded as falling under the offence of the camouflage rule. There are several questions that arise in this respect:

- Does a time gap matter?

For instance, the transaction by the source to the intermediary happens on 1st of 1st month, and the transaction by the intermediary to the beneficiary happens on 1st of 4th month. There may be a suggestion as to the existence of an understanding between the parties, but the very fact that there is a gap of time between the two legs of the transactions helps to create some opacity. It may be noted that the whole purpose of the camouflage disclosures is to pierce through the opacity and create transparency. Hence, if the gap in timing is merely a device to create opacity, it should not matter.

- Does a change in nature of the instrument at the intermediary level matter?

For example, the transaction from the source to the intermediary may be by way of loans. The transaction from the intermediary to the ultimate beneficiary may be by way of investment in shares. The terms of the two investments obviously differ. The first may have a limited tenure. The second one may be perennial. The entire approach has to be driven by substance over form – if the substantive view of the transaction suggests the two inter-connected transactions being part of the same chain, it will be wise to disclose the same.

- Does the infusion of some extent of funds by the intermediary matter?

For example, the source may have contributed Rs 1000. The intermediary may add another Rs 100 of its own, and transfer Rs 1100. To the extent of Rs 1000, there may still be a chain financial transaction requiring disclosure, while the remaining Rs 100 may be an independent transaction by the intermediary.

- Does the existence of a trust or fiduciary or agency relationship matter?

There are numerous transactions where a servicing agent, collecting agent, paying agent, etc acts merely as a conduit. This is the explicit nature of the transaction itself. Same goes with fiduciary transactions where the trustee or fiduciary discloses on the face of it that the trustee is merely a stop-over. However, trusts with undisclosed principals, while doing financial transactions, may be hit by the rule.

Duty of the auditor

The provisions are not just casting a responsibility on the directors, but the auditors are also required to substantiate the statement of the directors by applying their audit procedures. While the auditors can have ways and means to identify the instances of “outward” surrogate lending well, how the auditors can assure there are no instances of “inward” surrogate lending will require some new auditing methods.

Reasons of such reporting requirement

The amendments can be looked upon as a way to ensure that the companies do not use masquerades for the purpose of distinguishing the identity of the ultimate beneficiary of the funds. These might be to also check the instances of money laundering and terrorism financing.

Impact of the change

Though no specific punishments have been specified, on a conjoint reading of Sections 447 and 448 of the Act, it seems that the directors may be liable for fraud in cases of active concealment of material information or making mis-statements deliberately.

Since the Auditors are required to substantiate that there are no material mis-statements made by the directors as aforesaid, where the auditor fails to prove his innocence, he might also be penalised in cases of material misstatement.

Other additional disclosures required to be made in the Auditor’s Report

Compliance of Section 123 of the Act with respect to declaration/payment of dividend

The amended Audit Rules require the auditor to report on compliance with Section 123 of the Act by the company where it has declared/paid dividend. This has been done to ensure that the companies pay dividend on the basis of their profits and satisfies all the necessary conditions, and not when the companies may be suffering losses and it is practically impossible to pay dividend to its members.

Proper maintenance of audit trail at all times during the financial year

The auditors are also required to report on the maintenance of the audit trails and edit logs by the companies who opt to maintain their books of accounts in electronic mode. A discussion of the same is given in the later part of the write-up.

Accounting in electronic form – maintenance of audit trail

With effect from 1st April, 2021 the companies that maintain their accounts electronically by means of accounting software shall be required to ensure that the software is capable of maintaining audit trail and edit logs, and the same is not disabled at any point of time. The auditors are also required to report on the proper maintenance of such systems as discussed earlier.

Impact of the change

The compulsory maintenance of audit trail is a way to ensure the fabrication of books and any subsequent overwriting in the books of accounts. Through the audit trails, any person scrutinising the books of accounts can very easily track what changes have been made to the accounts and can require the company to explain the reasons thereof.

Additional disclosures in the Board’s Report

Applications/proceedings under IBC

Vide the amendments, the directors will be required to report the applications initiated or proceedings pending under IBC. Though the language of the law is not very clear on this, the understanding is that the directors will be required to report on the applications initiated or the proceedings pending against the company. Where such an application or proceedings are pending, the Board’s Report is also required to contain the status of the same as at the end of the year.

Impact of the change

The aforesaid amendment may be said to be an additional reporting requirement to keep the members, the real owners of the company as well as other stakeholders of the company updated about the current status of the company. The “insolvency” is a serious matter and shall not come as a shock to the stakeholders of a company, when the same is announced publicly at a later point of time.

Diabolical valuations of assets

Another very interesting insertion in the Board’s report is the details including the reason for the differences between the valuations of the company done at the time of one-time settlement and that at the time of taking loans from banks or other financial institutions. This is with a motive to ensure why there is a difference in valuation of the assets of the company at the time of one-time settlements v/s at the time of borrowing funds from the banks and financial institutions.

Reason of the change

The change is to ensure that the company has not inflated the value of their books at the time of seeking loans from the banks and financial institutions, nor has it deflated the same at the time of proposing one-time settlement.

We understand that there may be various reasons for the differential valuation, like difference in time period and resultant depreciation, amortization etc, or due to varying market forces. Whatever be the reasons, the same needs to be adequately captured in the Board’s Report for the company.

[The version above is a work in progress and we will continue to develop it further. Please do come back to this page. Please feel free to post your comments/questions in the space below.]

FAQs on Minimum Remuneration to NEDs and IDs

/5 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsRemunerating in a lean year: Statutory amendments for minimum remuneration to independent directors now effective

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsPayal Agarwal | Executive (payal@vinodkothari.com)

Highlights

Introduction

Independent directors (IDs) are a crucial part of corporate governance structure; however, their remuneration is currently solely by way of sitting fees and a “profit-linked” commission[1]. Profit is something which is completely dependent on business models, a whole matrix of internal and external factors, and something like a Covid-crisis will evidently leave a whole lot of companies in India and elsewhere into the red. In these circumstances, how do companies remunerate independent directors, to reward them for the time they spend and the responsibilities they shoulder.

To resolve this difficulty, amendments were made vide the Companies (Amendment) Act, 2020.While most of the sections of the Amendment Act were made effective on 28th September 2020, the sections relating to remuneration of NEDs and IDs were not been made applicable since the same was required to be adequately supplemented by corresponding amendments in Schedule V of the Act as well. However, just before the Covid-ravished FY 2021 was to end, MCA has put into effect the amended sections 149(9) and Section 197(3) and simultaneously brought amendments in Schedule V of the Act.

Effects of the amendments

These amendments will enable companies to adequately remunerate their NEDs and IDs for their efforts. Contrary to the rigidity in the erstwhile provisions, which had a complete bar on payment of remuneration to NEDs and IDs in absence of profits, these amendments enable companies to pay minimum remuneration to NEDs and IDs even at times of losses/ inadequate profits. Note that there always was a provision for minimum remuneration in case of EDs.

Applicability

- Private companies are not covered by the ceilings of managerial remuneration. Hence, private companies are completely outside the purview of the restriction.

- Public companies, both listed and unlisted, will be covered by the amendment.

- The amendment is of enabling nature. It does not mandate companies to remunerate their NEDs and IDs. So, companies may, if they so desire, remunerate their IDs and NEDs in the year of inadequate profits, or losses.

- The amendment applies to all NEDs and IDs.

- The amendment pertains to the “profit-linked” commission. That does not mean the commission as originally proposed had to be profit-linked. Even if the commission was a fixed amount, it will still be covered by the ceiling given in second proviso to sec. 197 (1). Hence, any commission is necessarily profit-linked.

- The amendment is effective immediately. That means companies may make use of the amended provisions for FY 2020-21.

- The amendment does not lead to an automatic variation in the remuneration policy or shareholders’ resolution. In essence, the amendments are of enabling nature: within the ambit of the amended provisions, companies may take corporate action to remunerate their NEDs and IDs. The actions have to be taken by the companies in question, which may include remuneration policy, appropriate shareholder resolutions, etc.

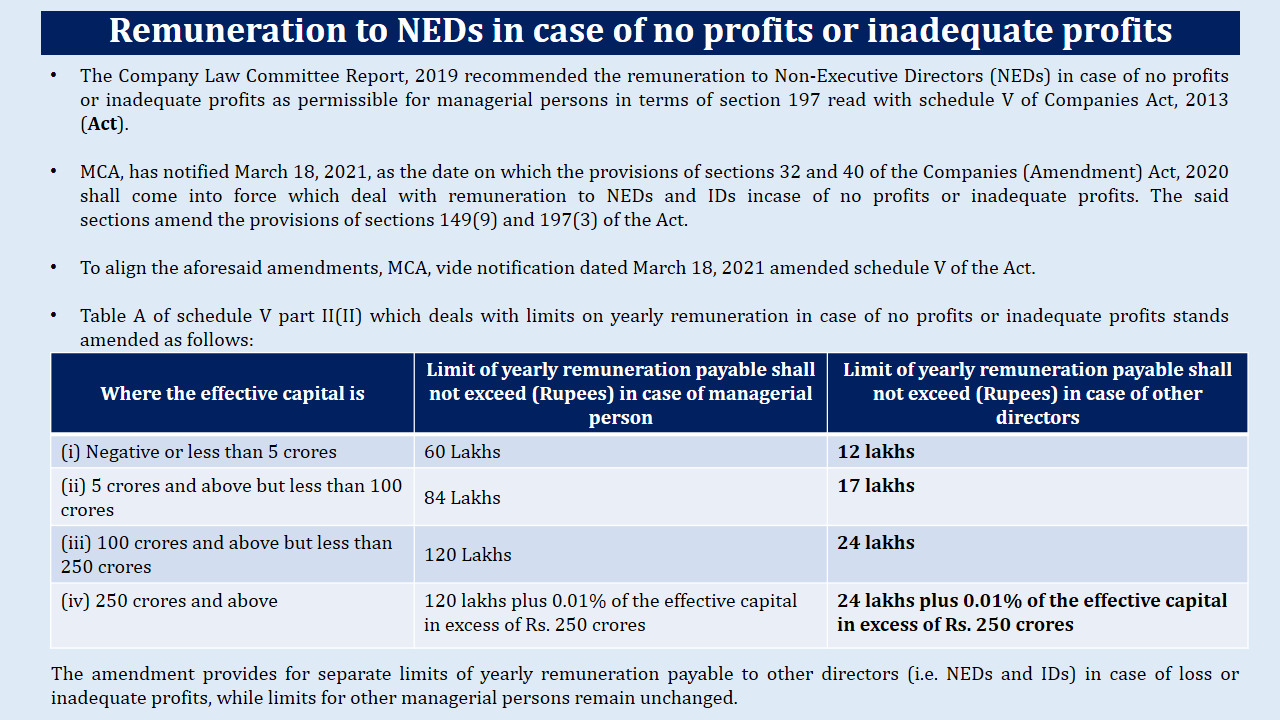

Amendments to Schedule V – maximum limits on remuneration of “other directors” specified

Part II of Schedule V of the Act deals with the remuneration of “managerial personnel”. In this connection, please note that “managerial personnel” refers to managing director, manager and whole-time director of the company. Now, with the present amendment to the Schedule, part II has become applicable on the “other directors” as well. The term “other directors” has been clarified in the amendment notification itself by way of an explanation which states,

“For the purposes of Section I, II and III (relevant parts that have been amended) the term “or other director” shall mean a non-executive director or an independent director.”

Section II of Part II of the Schedule specifies maximum remuneration that can be paid to a director, be it a managerial personnel or otherwise. For directors other than the managerial personnel, the remuneration has been specified at an amount almost 1/5th of that permissible to the managerial personnel.

The result of bringing IDs within the scope of Schedule V is that whereas the IDs would have been receiving very low remuneration in comparison to their roles and responsibilities in an organisation due to inadequacy of profits, the IDs will have a chance of getting a fair remuneration.

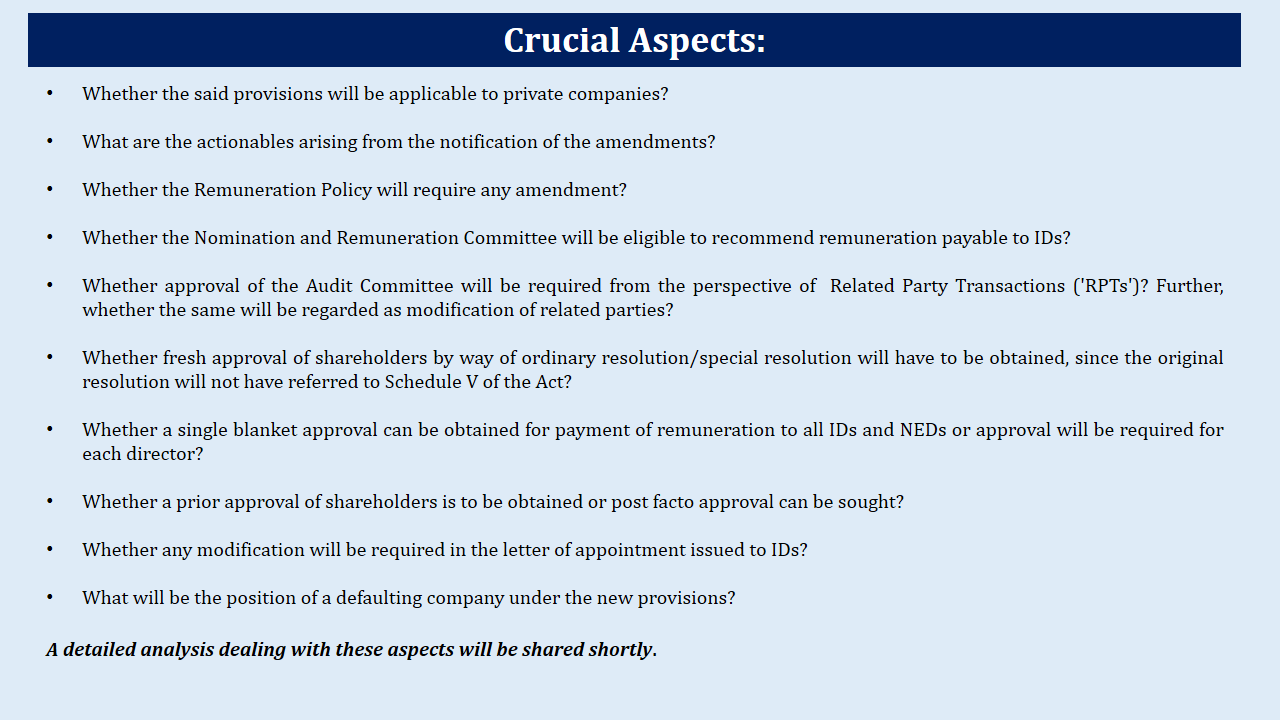

Questions relevant to the amendments

Various questions arise out of the amendments, such as –

- Will the amendments require modification in existing remuneration policy?

- Can the NEDs and IDs be paid remuneration in excess of those specified in Schedule V?

- Whether a single approval can suffice for the remuneration of all NEDs and IDs or such resolutions will have to be approved separately for the individual directors?

- Whether NRC will be eligible to recommend remuneration payable to IDs?

- Whether a prior approval of shareholders will be required or whether post facto approval may be obtained?

Answers to these and other relevant questions revolving around the aforesaid amendments has been dealt with in our detailed FAQs and can be accessed here.

Conclusion

The role of non-executive and IDs is very crucial to a company. The professional expertise of NEDs in their specific fields brings requisite value to a company. Considering the role played by IDs in effectively balancing the conflicting interest of the company and its stakeholders and bringing independent judgement to the Board’s decisions, it would be unfair if they are not paid adequately for the efforts put by them in the effective conduct of business.

Further, in the present scenario, amidst the economic breakdown worldwide, many companies may not be able to earn the profits as expected, or might be facing losses as well. In such circumstances, the aforesaid amendments were a necessity.

However, the erstwhile provisions had no scope of payment of remuneration to them in case of loss. With the aforesaid amendments coming into force, the companies will be able to compensate their non-executive and IDs well, even in case of no/inadequate profits.

Our other articles on the related topics can be read here –

[4] http://vinodkothari.com/2020/03/remunerating-neds-ids-in-low-profit-yrs/

[5] http://vinodkothari.com/wp-content/uploads/2019/09/Manangerial-Remuneration_IMTB-_26.08.pdf

[1] SEBI has recently in its consultation paper on review of regulatory framework applicable to IDs suggested that profit-linked commissions should be barred and shall be substituted by higher sitting fees or issue of stock options. Please refer to our article for broader understanding of the same.

Remuneration to NEDs in case of no/inadequate profits – snippet

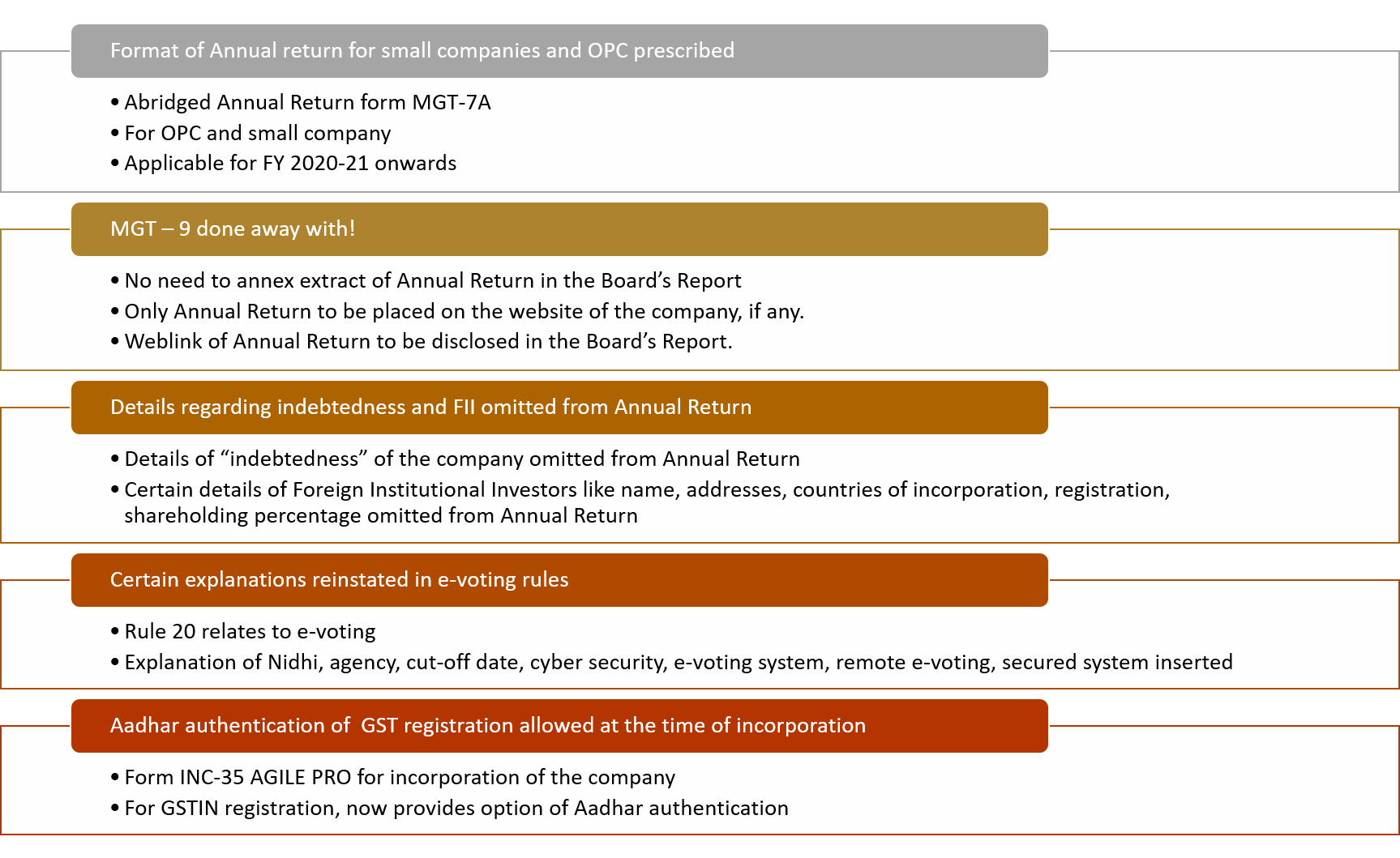

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsMCA updates brings changes to the Annual Return

/0 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA, Uncategorized /by Vinod Kothari ConsultantsESG concerns in corporate governance in India

/0 Comments/in Companies Act 2013, Corporate Laws, MCA, SEBI, Sustainability /by Vinod Kothari ConsultantsSikha Bansal, Partner (sikha@vinodkothari.com) and Payal Agarwal, Executive (payal@vinodkothari.com)

Introduction

ESG (where, E stands for Environment, S for Society, and G for Governance) is a term that has earned a lot of attention in the recent years. Related terms used are ESG investing, ESG reporting, ESG rating, etc. – all focussing on and circumscribing same factors.

The ESG analysis is sought as a measure of responsible investing, and goes beyond the traditional method of using only financial factors for evaluation of an investment or potential investment. ESG, in essence, recognises financial relevance of various non-financial elements which impact business in several ways. With sustainable development being the desirable result of whatever we do, efforts have been made to incorporate ESG issues in the analysis of the business performance as a whole.

In context of the same, we have tried identifying ESC concerns in India, in relation to corporate businesses. While in India, we have already something called ‘business responsibility reporting’, we need to see if this sufficiently captures the spirit of ESG and where it stands vis-à-vis global practices.

What is ESG?

Before we go on to the question why we need ESG, we need to understand what ESG, and also, why and how it has assumed so much of importance.

The emergence of ESG dates back to earlier years of 2000s. A report titled “Who Cares Wins: Connecting Financial Markets to a Changing World”[1], highlighted the emerging ESG issues and made several recommendations, including – (i) financial institutions should commit to integrating environmental, social, and governance factors in a more systematic way in research and investment processes, (ii) the companies a leadership role by implementing environmental, social and corporate governance principles and polices and to provide information and reports on related performance in a more consistent and standardised format, and (iii) investors shall explicitly request and reward research that includes environmental, social and governance aspects and to reward well-managed companies. Further, the report recommended that the financial analysts shall not only focus on ESG risks and risk management, but also consider ESG issues as a potential source of competitive advantage. The report also identified the following drivers through which good management of ESG issues can contribute to shareholder value creation[2].

Later, UNEP FI, in its 2005 Report[3], highlighted the distinction between ‘value-driven’ vs. ‘values-driven’ investment, and observes, “ESG considerations are capable of affecting investment decision-making in two distinct ways: they may affect the financial value to be ascribed to an investment as part of the decision-making process and they may be relevant to the objectives that investment decision-makers pursue.” This report noted that, the movement towards mainstream consideration of ESG issues in investment decision-making is a response of variety of factors, including, increasing evidence of the nexus between performance on ESG issues and financial performance, reputational concerns, consumer pressure, public opinion, introduction of corporate environmental reporting obligations, etc.[4]

Some institutional investors believed that environmental, social and governance (ESG) issues were not relevant to portfolio value, and were therefore not consistent with their fiduciary duties. However, in report titled “Fiduciary Duty in the 21st Century’[5], issued by UN agencies and PRI[6], it was clarified that the assumption is no longer supported, and that, failing to consider long-term investment value drivers, which include environmental, social and governance issues, in investment practice is a failure of fiduciary duty. The said report identifies critical importance of incorporating ESG standards into regulatory conceptions of fiduciary duty, for mainly three reasons – firstly, ESG incorporation is an investment norm; second, ESG issues are financially material; and thirdly, policy and regulatory frameworks are changing to require ESG incorporation.

Presently, there are several organisations, projects and reports focussing on ESG issues. These organisations may be governmental as well as independent. For instance, Global Reporting Initiative (GRI)[7] has formulated several standards[8] for sustainability reporting. See also, OECD (2017), Investment governance and the integration of environmental, social and governance factors.

Pillars of ESG

ESG, as stated above, has 3 pillars – Environmental, Social and Governance Each of these pillars comprises of several factors which would be a ‘parameter’ in ESG analysis.

- “environmental” pillar focusses on creating a sustainable environment, where parameters such as impact of a company’s activities on the climate, company’s liability towards the environment, creating eco-friendly products, etc are checked and measured;

- “social” aspect focusses on creating value for the society, by laying emphasis on the human rights issues, workplace health and safety, labour training and management, interaction with communities, customer relationship etc;

- “governance” aspect covers issues on the corporate governance of a company and has two main elements: corporate structures, and corporate behaviour.

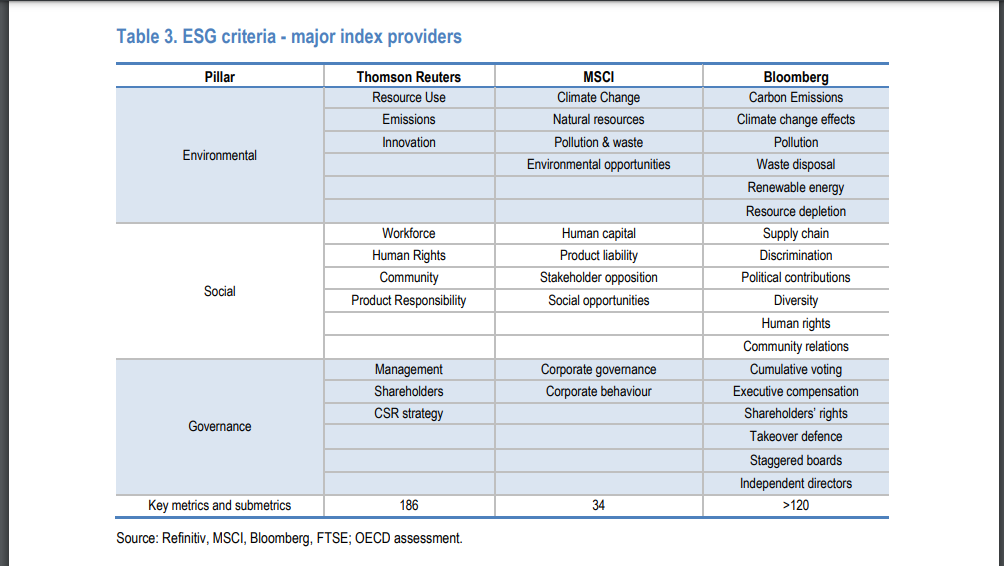

We have compiled a list of such factors[9] as below –

ESG Reporting

EU law requires large companies to disclose certain information on the way they operate and manage social and environmental challenges. EU’s directive, 2014/95/EU also called the non-financial reporting directive (NFRD), acknowledges that disclosure of non-financial information is vital for managing change towards a sustainable global economy by combining long-term profitability with social justice and environmental protection and lays down the rules on disclosure of non-financial and diversity information by large companies[10]. The Directive amends the accounting directive 2013/34/EU (by inserting Article 19a) so as to mandate inclusion of non-financial statement containing information to the extent necessary for an understanding of the undertaking’s development, performance, position and impact of its activity, relating to, as a minimum, environmental, social and employee matters, respect for human rights, anti-corruption and bribery matters, etc.

It further provides, “Where the undertaking does not pursue policies in relation to one or more of those matters, the non-financial statement shall provide a clear and reasoned explanation for not doing so.”

The EU has issued its guidelines to help companies disclose environmental and social information, and published guidelines on reporting climate-related information. Also, EU has also launched a public consultation on the review of the NFRD[11].

The OECD Report of 2017[12] compiles ESG reporting requirements (voluntary as well as mandatory) across the world by institutional investors, and by way of corporate disclosures. The report observes that the reporting requirements are usually voluntary (“comply or explain”) and are not prescriptive on the methods or metrics to be used.

The Financial Reporting Council (FRC) of UK released a discussion paper – “A Matter of Principles: The Future of Corporate Reporting” (2020). The discussion paper proposes a network of interconnected reports based on objectives rather than a single comprehensive annual report. The proposals include 3 reports – Business report, the full Financial Statements and a new Public Interest Report. It also focuses on widening the definition of materiality so that it does not remain limited to accounting standards only, but covers other wider range of activities that affect a company significantly. Section 6 of the this Report deals extensively with non-financial reporting, stated to include information relating to employees, suppliers, customers, the community, the environment and human rights.

In a study, “The consequences of mandatory corporate sustainability reporting: evidence from four countries (2015)”, it has been observed that even though the regulations often allowed companies, via comply or explain clauses, to choose not to make greater disclosure, there was a 30%-50% average increase in ESG disclosure as a result of the regulations being introduced (albeit from a low starting base). The greatest increase came in the first year of the regulations coming into force. All three types of disclosure – environmental, social and governance – increased. The findings, therefore, suggest that, contrary to popular belief that an increase in disclosure regulation imposes significant costs on companies and, therefore, has a negative impact on shareholders, the reality is that improved disclosure creates value for companies, not destroys it.

ESG Rating

Investors, institutional institutions, etc. would generally make use of ESG information for investment decisions through ESG ratings provided by ESG rating agencies[13]. This assessment and measurement often forms the basis of informal and shareholder proposal-related investor engagement with companies on ESG matters[14]. ESG factors can provide valuable insights into possible current and future environmental and social risks and opportunities for corporate entities, given the impact and dependence entities have on the environment and society. These ESG issues in turn have the potential to lead to a direct or indirect financial impact on the entity’s profits and investment returns[15].

See Boffo, R., and R. Patalano (2020), “ESG Investing: Practices, Progress and Challenges”, OECD Paris, for an elaborate discussion on ESG rating and indices and the methodologies adopted for the same. The paper also compiles ESG Criteria as used by major index providers as follows[16] –

Even though there are countries where ESG Reporting has been initiated as a voluntary or mandatory measure, the requirement of ESG rating has not been found to be mandated in any country by way of explicit regulations on the same. However, institutional investors, proxy advisor firms etc., are largely using these ratings while making investment decisions as part of making socially responsible investment.

ESG in Indian Context

The Indian legislation has been trying to cover the various aspects of ESG in a fragmented manner.

For instance, the board’s report shall disclose the conservation of energy, technology absorption, etc.[17] The aspects have to be dealt with in detail – the company shall disclose steps taken or impact on conservation of energy, steps taken to utilise alternate sources of energy, capital investment in energy conservation equipments, efforts towards technology absorption, etc. Besides, a director owes a fiduciary duty towards the community as well as for the protection of the environment[18]. Also, CSR activities include various socio-economic activities, required to be disclosed separately in the annual report[19]. However, the closest requirement is that of Business responsibility Reports (BRR) which has been mandated from ESG perspective only, as discussed below.

What is Business Responsibility Report (BRR)?

BRR or Business Responsibility Report can be said to be the foremost step in India in promoting non-financial reporting in India, on a mandatory basis. The initiative was one of the responses to India’s commitment towards the United Nations Guiding Principles on Business & Human Rights (UNGPs) and Sustainable Development Goals.

The BRR is based on the 9 principles in line with the ‘National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business’ (NVG)[20] issued by MCA. The guidelines state that the companies should not be just responsible but also socially, economically and environmentally responsible. Through such reporting, the guidelines expect that businesses will also develop a better understanding of the process of transformation that makes their operations more responsible. The NVG were further revised and the MCA formulated the ‘National Guidelines on Responsible Business Conduct’ (NGRBC)[21]. The said guidelines stipulated that the businesses should –

- conduct and govern themselves with integrity in a manner that is Ethical, Transparent and Accountable,

- provide goods and services in a manner that is sustainable and safe,

- respect and promote the well-being of all employees, including those in their value chains,

- respect the interests of and be responsive to all their stakeholders,

- respect and promote human rights,

- respect and make efforts to protect and restore the environment,

- when engaging in influencing public and regulatory policy, should do so in a manner that is responsible and transparent,

- promote inclusive growth and equitable development, and

- engage with and provide value to their consumers in a responsible manner.

The Securities and Exchange Board of India (SEBI), in 2012[22], through its listing conditions mandated the top 100 listed entities by market capitalisation to file BRR from ESG perspective. This was extended to top 500 companies in FY 2015-16[23]. The coverage has been extended to 1000 companies now[24]. In the year 2020, MCA issued Report of the Committee on the Business Responsibility Reporting, and SEBI issued a Consultation Paper on the format for Business Responsibility and Sustainability Reporting (BRSR, suggesting that BRR shall be renamed as BRSR). See our detailed analysis of the recommendations made in these reports.

See also, our earlier article on BRR. The eventual development in BRR framework is shown below –

BRR – Identifying ways to improve

ESG has no statutory definition, per se. We have tried identifying possible factors, based on various reports, indices, etc. which would reflect a holistic ESG perspective of an entity.

How effective is the present framework of BRR can be understood by way of the following table:

BRR vs ESG – Hits and Misses

| Hits | Misses |

| Climate change | Carbon emissions |

| Resource use , sustainable sourcing | Green building |

| Environmental protection and restoration | Biodiversity and land use |

| Renewable energy | Discharge of effluents |

| Water use | ————- |

| Energy efficiency | ————— |

| Clean tech | —————- |

| Safety of employees, customers | Privacy and data security |

| Skill upgradation training | Financial product liability |

| Labour management | ———— |

| Practice against child labour, sexual harassment, forced labour | ———— |

| Protection of human rights | ————- |

| Satisfactory redressal of customer complaints | ———— |

| Stakeholder engagement | ———— |

| Ethics and bribery | Board structure |

| Anti competitive behaviour | Executive pay |

| Unfair trade practices | Codes and values |

| —————– | Tax transparency |

Most of these gaps in the present BRR format are covered under the proposed BRSR. The BRSR has provisions for reporting on the carbon emissions of a company, discharge of other effluents by the company, and reporting relating to the privacy and data security of the customers etc. Also, the BRSR defines the scope of reporting for every item very precisely.

However, matters such as financial product liability and various aspects of governance still needs a dedicated space.

NSE Study of BRR Reporting in India

A study of NSE, while conducting the ESG analysis of Indian companies, has checked the disclosures provided under the BRR framework by the companies as part of its ESG analysis.

Some significant findings of the study has been pointed below:

- Among the nine principles, the least number of sample companies responded positively for disclosures on principle 7 (i.e., public advocacy). It had the lowest score on all four measures.

- One of the recurring reasons for not framing a policy on the principle 7 is that there is no specific/ formal policy on public advocacy. However, companies have stated that they indirectly covered aspects of principle 7 under other policies. This may be attributed to the fact that in India, advocacy, if at all done, is done in a non-transparent manner.

- The second worst response was with respect to the principles relating to ‘respect and promoting human rights’ and ‘engagement and providing value to customers and consumers’. Once again, probably, these concepts are yet to be assimilated in our system.

- Higher positive responses were found across principle 1 (ethics), principle 3 (employees), principle 4 (stakeholder), principle 6 (environment), and principle 8 (growth and equitable development – social responsibility). This can be attributed to the fact that some of these policies flow from various legal mandates in India. Hence, most companies have formal policies to comply with the law on these principles.

The study highlights that companies have largely scored better on policy disclosures followed by governance factor, compared to environment and social factors. This can be attributed to the fact that governance reforms have transformed into laws by various regulatory agencies within India, in the last two decades. Similarly, many policies have been mandated to be prepared by regulatory authorities. Hence, companies have scored higher on policy disclosure parameters.

Closing Thoughts

The BRR Reporting in India, in terms of key areas, goes a long way in presenting a holistic ESG scenario. Some structural changes in the extant format may facilitate better reporting.

Further, the Indian companies are found to perform well in the governance related matters, in comparison to the environmental and social factors, admittedly for the presence of various statutory requirements and regulatory supervision on the governance requirements of a company. However, the companies need to improve their environmental and social scores as well.

[1] December, 2004. The Report was a joint initiative of financial institutions which were invited by United Nations Secretary-General Kofi Annan to develop guidelines and recommendations on how to better integrate environmental, social and corporate governance issues in asset management, securities brokerage services and associated research functions. See also, “Who Cares Wins” : One Year On” – A Review of the Integration of Environmental, Social and Governance Value Drivers in Asset Management, Financial Research and Investment Processes, published by the International Finance Corporation.

[2] Refer, page 12 exhibit 9 of the said Report

[3] A legal framework for the integration of environmental, social and governance issues into institutional investment”

[4] Refer, page 24 of the said Report.

[5] The website is https://www.fiduciaryduty21.org/ . The report has been last updated in the year 2019.

[6] Principles of Responsible Investing (PRI) is a United Nations-supported initiative, launched in 2006 by UNEP Finance Initiative and the UN Global Compact.It is a network of international investors working together to put the six Principles for Responsible Investment into practice. The PRI were devised by the investment community and reflect the view that environmental, social and governance (ESG) issues can affect the performance of investment portfolios and therefore must be given appropriate consideration by investors if they are to fulfill their fiduciary (or equivalent) duty. In implementing the Principles, signatories contribute to the development of a more sustainable global financial system.

[7] GRI was founded in Boston in 1997 following public outcry over the environmental damage of the Exxon Valdez oil spill. The aim was to create the first accountability mechanism to ensure companies adhere to responsible environmental conduct principles, which was then broadened to include social, economic and governance issues. The first version of what was then the GRI Guidelines (G1) published in 2000 – providing the first global framework for sustainability reporting. The following year, GRI was established as an independent, non-profit institution. In 2016, GRI transitioned from providing guidelines to setting the first global standards for sustainability reporting – the GRI Standards.

[8] The GRI standards can be accessed here https://www.globalreporting.org/standards/

[9] The list is a compilation of the various factors identified by various organisations and reports such as, PRI, MSCI Research, NSE-SES report on ESG analysis of 50 Indian companies, etc.

[10] EU rules on non-financial reporting only apply to large public-interest companies with more than 500 employees. This covers approximately 6,000 large companies and groups across the EU.

[12] OECD (2017) Investment governance and integration of environmental, social and governance factors

[13] Some well- known ESG rating providers include: (a) Dow-Jones Sustainability Index, (b) S & P Global Ratings, (c) MSCI ESG Research etc.

[14] https://corpgov.law.harvard.edu/2017/07/27/

[15] S&P Global Ratings: Exploring Links To Corporate Financial Performance

[16] Source: Boffo, R., and R. Patalano (2020), “ESG Investing: Practices, Progress and Challenges”, OECD Paris

[17]Companies Act, 2013, section 134(3)(m), read with rule 8 of the Companies (Accounts) Rules, 2014

[18] Ibid, section 166.

[19] Ibid, section 135 read with Companies (Corporate Social Responsibility Policy) Rules, 2014.

[20] 2011. A refinement of earlier Corporate Social Responsibility Voluntary Guidelines 2009, released by the Ministry of Corporate Affairs in December 2009.

[21] 2019. See Press Release.

[22] CIR/CFD/DIL/8/2012 dated 13th August, 2012

[23] See update, and notification.

[24] See notification.

Ease of doing business: Debt listed companies slide down to unlisted companies

/11 Comments/in Amendments to the Companies Act 2013, Companies Act 2013, Corporate Laws, MCA /by Vinod Kothari ConsultantsCompanies with listed but privately placed debt paper not to be regulated as ‘listed company’.

FCS Vinita Nair | Senior Partner, Vinod Kothari & Company

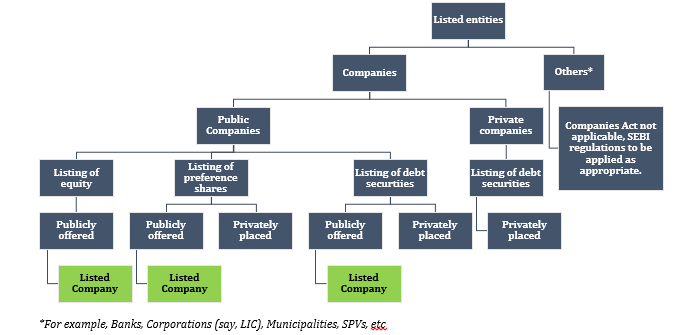

With an intent to promote listing of securities and bond market, Ministry of Corporate Affairs (MCA) in consultation with Securities and Exchange Board of India (SEBI), intended to exclude certain class of companies from the definition of ‘listed company’ as defined under Section 2 (52) of Companies Act, 2013 (CA, 2013). The existing provisions of CA, 2013 applicable to a listed company did not distinguish between private companies and public companies. As a result, private companies were unintendedly subject to similar compliance as a public company. A browse through the list of companies with listed privately placed debentures, shows private companies abound in the list[1]. On the other hand, public companies that listed debt securities on a private placement basis, were subject to similar compliances as a public company issuing debt securities to public.

Accordingly, one of major amendments proposed in Companies (Amendment) Act, 2020 (CAA, 2020) was to revisit definition of listed company and provide a suitable carve out to certain class of companies to be determined in consultation with SEBI.

The rationale behind the carve out, as explained in the Report of the Company Law Committee of November, 2019[2] was that private companies listing its debt securities on any recognized stock exchange were subject to more stringent regulations compared to unlisted private companies viz. appointment of auditors, independent directors, woman directors, constitution of board committees etc. that were dis-incentivizing private companies from seeking listing of their debt securities. This was also discussed in the Report of Company Law Committee in 2016[3] wherein the Committee, while acknowledging the anomaly in the definition of listed company, felt that while the definition of the term ‘listed company’ need not be modified, the thresholds prescribed for private companies for corporate governance requirements may be reviewed. Further, the Committee proposed that specific exemptions under Section 464 of CA, 2013 could also be given to listed companies, other than equity listed companies, from certain corporate governance requirements prescribed in the Act.

Currently, companies issuing non- convertible debt securities (NCDS) or non-convertible redeemable preference shares (NCRPS) on a private placement basis, list the same under SEBI (Issue and Listing of Debt Securities Regulations, 2008 (SEBI ILDS) and SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013 (SEBI ILNCRPS) respectively and are regarded as ‘listed company’ for the provisions of CA, 2013.

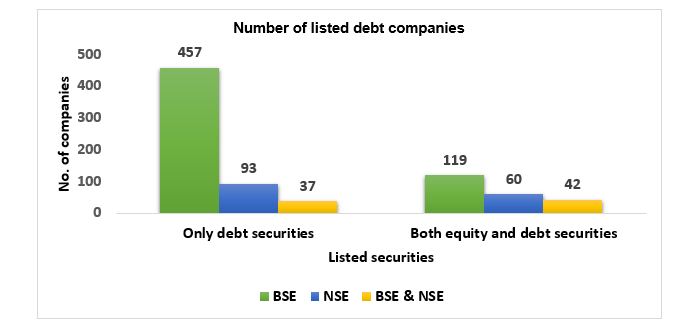

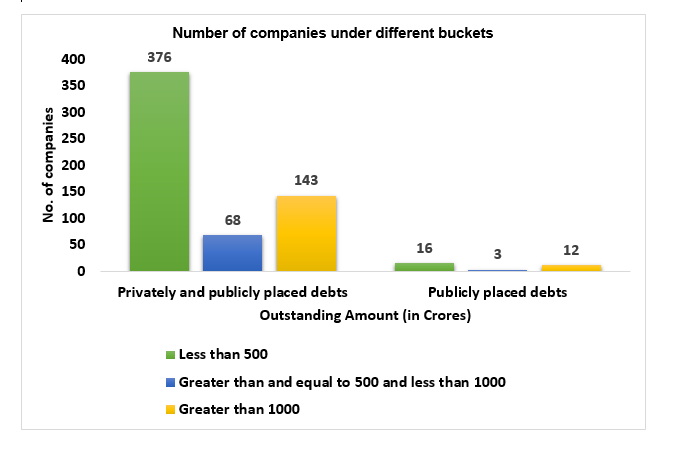

Total number of companies with listed debt

Number of companies, which come under different buckets as per the outstanding value of listed Debt Securities (as per face value) as on December 31, 2020

Present amendment

While the amendment made in Section 2 (52) in the definition of ‘listed company’ was notified with effect from January 22, 2021[4], the class of companies were pending to be prescribed. Ministry of Corporate Affairs (MCA) on February 19, 2021[5] notified Companies (Specification of Definition Details) Second Amendment Rules, 2021 effective from April 1, 2021 to insert Rule 2A excluding following class of companies from the definition of ‘listed company’ under CA, 2013

- Public companies with listed NCDS issued on private placement basis in terms of SEBI ILDS;

- Public companies with listed NCRPS issued on private placement basis in terms of SEBI ILNCRPS;

- Public companies with listed NCDS and NCRPRS issued on private placement basis in terms of SEBI ILDS and SEBI ILNCRPS respectively;

- Private companies with listed NCDS in terms of SEBI ILDS.

- Public companies with equity shares exclusively listed on stock exchanges in permissible foreign jurisdictions under Section 23 (3) of CA, 2013.

Point to note here is that companies with listed commercial papers were anyways outside the purview of listed companies as commercial papers are excluded from the definition of debentures.

Listed company post amendment

Post amendment, the definition of listed company will mainly comprise of public companies offering securities to public i.e. having listed equity shares in India (with or without ADR/GDR listed overseas), listed debt securities pursuant to public issue or listed NCRPS pursuant to public issue.

Compliances for listed company under CA, 2013

A listed company is required to ensure following additional compliances under CA, 2013:

| Amount in Rs/ Other specification | Section No. | Rule No. | Brief of the provision | Other thresholds under CA, 2013 |

| 1. Provisions/ exemptions applicable to all listed companies | ||||

| Exemption for creation of Debenture Redemption Reserve (DRR) | 71 | 18 (7) (b) (iii) (B) of SHA Rules | Listed NBFCs need not create DRR for privately placed and public issue of debentures. | Refer discussion below |

| Creation of Debenture Redemption Fund (DRF) | 71(4) | Rule 18(7)(b)(v) of SHA Rules as amended. | No requirement for creation of DRF by listed companies issuing debenture on private placement basis. | Refer discussion below |

| Annual return | 92 | 11 of MGT Rules

|

Company to file Annual Return certified by a PCS in Form MGT-8 | Applicable to Company with

|

| Records in electronic form | 120 | 27 of MGT Rules | Company may maintain records in electronic form.

Note: Whether companies other than those specified have the option to maintain in electronic form, is not clear. |

Company having not less than 1000 shareholders, debenture holders and other security holders. |

| Investigation by NFRA

|

132 | Rule 3(1)(b) of NFRA Rules | NFRA shall undertake investigation or conduct quality review of audit. |

|

| Statement in Board report indicating manner of Board evaluation | 134(3) | 8 (4) of AOC Rules

|

A statement indicating manner in which formal evaluation of Board, committee and individual directors has been done by Board needs to be included in Board’s report. | Public company having a paid up share capital of Rs. 25 crore or more calculated at the end of the preceding financial year. |

| Financial statements in electronic form | 136 | 11

of AOC Rules |

Financial statements may be sent in electronic format. | Public companies which have

|

| Internal auditor | 138 | 13

of AOC Rules |

Appointment of internal auditor or a firm of internal auditors to conduct internal audit. |

|

| Appt/ re-appt of Auditor | 139

(2) |

5 of ADT Rules

|

Restriction on term of appointment or reappointment of auditor. Rotation of Statutory Auditors mandatory. |

|

| Woman Director | 149

(1) |

3 of DIR Rules

|

Appointment of a Woman Director on the Board.

Any intermittent vacancy of a woman director shall be filled-up by the Board at the earliest but not later than immediate next Board meeting or three months from the date of such vacancy whichever is later. |

Public company having –

|

| Small shareholder director | 151 | 7 of DIR Rules

|

May appoint a small shareholder director suo moto or upon notice from shareholder. | – |

| Vigil mechanism | 177 | 7 of MBP Rules

|

Company to establish vigil mechanism for their directors and employees to report genuine concerns. |

|

| Disclosure in Board’s Report | 197

(12) |

5 of MR Rules

|

Disclosure in Board’s report regarding ratio of the remuneration of each director to the median employee’s remuneration and such other details as prescribed in the Rules. | – |

| Appointment of KMP | 203 | 8 of MR Rules | Appointment of whole-time key managerial personnel.

|

|

| Secretarial Audit Report | 204 | 9(2) of MR Rules

|

Shall annex with its Board’s report a secretarial audit report, given by a company secretary in practice |

|

| 2. Provisions applicable only to a listed public company | ||||

| Report on Annual General meeting | 121 | 31 of MGT Rules

|

Report on AGM to be filed with the Registrar in eForm MGT-15. | – |

| Independent Director | 149

(4) |

4 of DIR Rules

|

Atleast 1/3rd of total number of Board members shall be independent directors. |

|

| Constitution of certain committees | 177 & 178 | 6 of MBP Rules

|

Constitution of Audit Committee and Nomination and Remuneration Committee. |

|

With the present amendment, the class of companies provided above will not be required to ensure aforesaid compliances unless it meets other criteria/ thresholds prescribed for respective compliance.

As evident from the table above, a public company will hardly have any exemptions if it meets any of the thresholds specified. While the intent of exempting class of companies is benign, it will be of some benefit to public companies only if the other thresholds are also revised. While, the holy wish is for ease of doing business, static thresholds prescribed in 2013 needs to be revisited to assess the adequacy and the intent to regulate such class of companies. For e.g. public companies having paid up capital of 10 crore or borrowing of Rs. 50 crore is a very common phenomena.

Additionally, in case the sectoral regulator prescribes composition of committee or induction of independent directors or other corporate governance requirement, those will override the exemptions.

Applicability of DRR and DRF[6]

Section 71(4) read with Rule 18(1)(c) of the Companies (Share Capital and Debentures) Rules, 2014 (SHA Rules) requires every company issuing debentures to create a Debenture Redemption Reserve (DRR) of 10% (as the case maybe) of outstanding value of debentures for the purpose of redemption of such debentures.

Some class of companies as prescribed, has to either deposit, before April 30th each year, in a scheduled bank account, a sum of at least 15% of the amount of its debentures maturing during the year ending on 31st March of next year or invest in one or more securities enlisted in Rule 18(1)(c) of SHA (DRF).

Pursuant to the present amendment, it is important to ascertain applicability of creation of DRR and DRF in terms of CA, 2013. The exemption in relation to DRR and DRF was applicable to listed companies in case of private placement. While NBFCs continue to enjoy exemption even in case of unlisted companies, pursuant to the present amendment Non-NBFCs listing NCDS will not be eligible to avail the benefit of the said exemption and will be required to maintain DRR and DRF.

The intent of MCA at the time of amending Rule 18 of Companies (Share Capital and Debentures) Rules, 2014 was to extend the exemption to all listed companies i.e. companies having securities listed on stock exchange, in case of privately placed debentures, from maintenance of DRR and DRF.

The intent behind amending the definition of ‘listed company’ under 2 (52) was to reduce the compliance burden of debt listed entities that were regarded as listed entities merely by virtue of listing the privately placed debentures.

The amendment to the definition of ‘listed company’ was subsequent and the same has resulted in an anomaly as corresponding amendment has not been carried out in Rule 18 of SHA Rules. The intent behind mandating DRR and DRF requirement, in case of private placement, was for unlisted companies with unlisted debt and not for unlisted companies with listed debt.

This is surely a matter of representation to be made to MCA as the gap seems inadvertent and not intentional.

Applicability of Rule 9A of PAS Rules

Section 29 of CA, 2013 read with Rule 9A of Companies (Prospectus and Allotment of Securities) Rules, 2014 (PAS Rules)[7] effective from October 2, 2018 mandates unlisted public companies to issue the securities only in dematerialised form and facilitate dematerialisation of all its existing securities. Physical transfer of securities is prohibited for unlisted public companies. Compliance with the said provisions are exempt only in case of a Nidhi, Government company and wholly owned subsidiary.

Pursuant to amendment in the definition of listed company, public companies that were originally exempted from the requirements by virtue of being a listed company, will now be required to comply with Section 29 and Rule 9A.

Status under Listing Regulations and SEBI ILDS

‘Listed entity’ as defined under Reg. 2 (p) of SEBI (Listing Obligations and Disclosures Requirements) Regulations, 2015 (Listing Regulations) means an entity which has listed, on a recognised stock exchange(s), the designated securities issued by it or designated securities issued under schemes managed by it, in accordance with the listing agreement entered into between the entity and the recognised stock exchange(s).

The present carve out under CA, 2013 will not result in any carve out for compliances under Listing Regulations as Listing Regulations anyways provides separate set of compliances equity listed companies (Chapter IV) and only NCDS/NCRPS listed companies ( Chapter V) and those with equity and debt listed (Chapter VI).

Further, SEBI Circulars issued from time to time under SEBI ILDS are addressed to all listed entities who have listed their debt securities or issuers who propose to list their debt securities.

Status under PIT Regulations

SEBI (Prohibition of Insider Trading) Regulations, 2015 (PIT Regulations) does not define the term ‘listed company’, however, applies to listed company and securities of an unlisted company proposed to be listed. The definition of ‘proposed to be listed’ is as hereunder:

“proposed to be listed” shall include securities of an unlisted company:

(i) if such unlisted company has filed offer documents or other documents, as the case may be, with the Board, stock exchange(s) or registrar of companies in connection with the listing; or

(ii) if such unlisted company is getting listed pursuant to any merger or amalgamation and has filed a copy of such scheme of merger or amalgamation under the Companies Act, 2013.”

The term ‘listed company’ is not being defined under PIT Regulations and therefore, the definition under CA, 2013 should be referred pursuant to Reg. 2 (2) of PIT Regulations[8]. In that case, PIT Regulations will apply only in case of securities issued by a listed company or a company that is proposed to become a ‘listed company’. Accordingly, only debt/ NCRPS listed companies need not comply with requirements of PIT Regulations. SEBI should consider furnishing a clarification in this regard.

However, that is not the intent of law. If a security is listed, its price is subject to change and be impacted by price sensitive information. Accordingly, such exclusively debt/ NCRPS listed companies, on account of private placement of securities, should continue to comply with the requirements of PIT Regulations. SEBI may also consider furnishing a clarification in this regard.

Conclusion

While, the present amendment expands the originally envisaged carve out for private companies to public companies as well, given the other static thresholds prescribed under CA, 2013 public companies have little reason to rejoice. Exemption to comply with PIT Regulations may be a huge relief, however, there is a need for SEBI to clarify the position given the intent of law.

Further, it is very crucial that MCA revisits DRR and DRF related provision for privately placed NCDS and consider to relax the same especially for the benefit of Non-NBFCs. Lastly, suitability of the exemption in case of companies exclusively listed in foreign jurisdiction will be required to be evaluated after a certain lapse of time as the provisions have been recently inserted in CA, 2013.

Our other videos and write-ups may be accessed below:

YouTube:

https://www.youtube.com/channel/UCgzB-ZviIMcuA_1uv6jATbg

Other write-up relating to corporate laws:

http://vinodkothari.com/category/corporate-laws/

Our our Book on Law and Practice Relating to Corporate Bonds and Debentures, authored by Ms. Vinita Nair Dedhia, Senior Partner and Mr. Abhirup Ghosh, Partner can be ordered though the below link:

[1] https://www.bseindia.com/markets/debt/debt_instruments.aspx?curpage=4&select_alp=all&select_ord=1

[2] Ministry of Corporate Affairs, Government of India, ‘Report of the Companies Law Committee’

(November 2019) para 2.

[3] Ministry of Corporate Affairs, Government of India, ‘Report of the Companies Law Committee’

(February 2016) para 1.13.

[4] http://www.mca.gov.in/Ministry/pdf/CommencementNotification_23012021.pdf

[5] http://egazette.nic.in/WriteReadData/2021/225287.pdf

[6] Refer our write up ‘Easing of DRF’ and ‘Provisions relating to DVR & DRR- stands amended’ by CS Smriti Wadehra.

[7] Discussed in our write up ‘Physical to Demat: A move from opacity to transparency’.

[8] Words and expressions used and not defined in these regulations but defined in the Securities and Exchange Board of India Act, 1992 (15 of 1992), the Securities Contracts (Regulation) Act, 1956 (42 of 1956), the Depositories Act, 1996 (22 of 1996) or the Companies Act, 2013 (18 of 2013) and rules and regulations made thereunder shall have the meanings respectively assigned to them in those legislation.