Leveling the playing field for all Microfinance Lenders

RBI proposes uniform regulatory framework for the Microfinance Sector ( finserv@vinodkothari.com )

The microfinance sector, in India, has proved to be fundamental for promoting financial inclusion by extending credit to low-income groups that are traditionally not catered to by lending institutions. The essential features of microfinance loans are that they are of small amounts, with short tenures, extended without collateral and the frequency of loan repayments is greater than that for traditional commercial loans. These loans are generally taken for income-generating activities, although they are also provided for consumption, housing and other purposes. There exist various market players in the microfinance industry viz. scheduled commercial banks, small finance banks, co-operative banks, various NBFCs extending microfinance loans and NBFCs-MFIs.

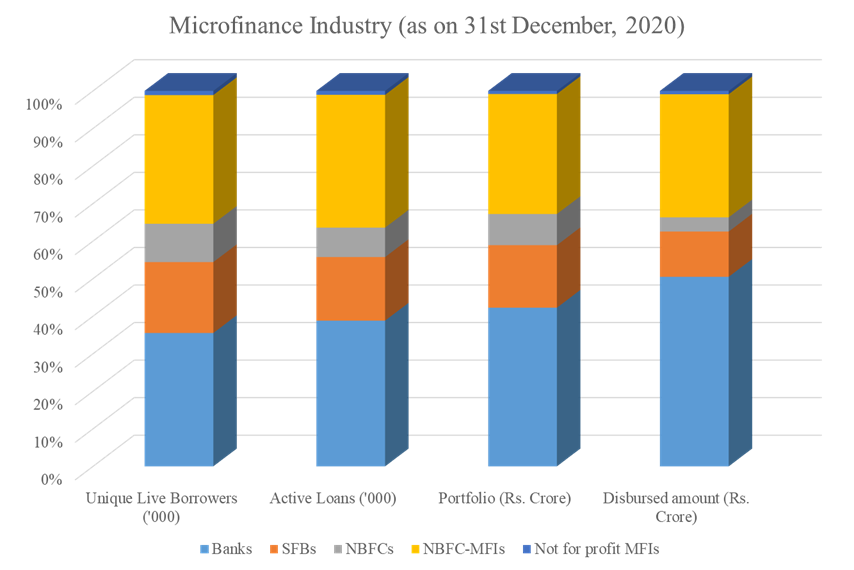

The microfinance industry has reached 6 crores of live borrowers base the end of the calendar year of 2020. Book size of the microfinance industry as on 31st December is 228,818 crore[1]. The sector grew by 16% from December 2019 to December 2020 (based on outstanding loan portfolio size) and has witnessed phenomenal growth over the last two decades.

Source- SIDBI Microfinance Pulse Report, April 2021

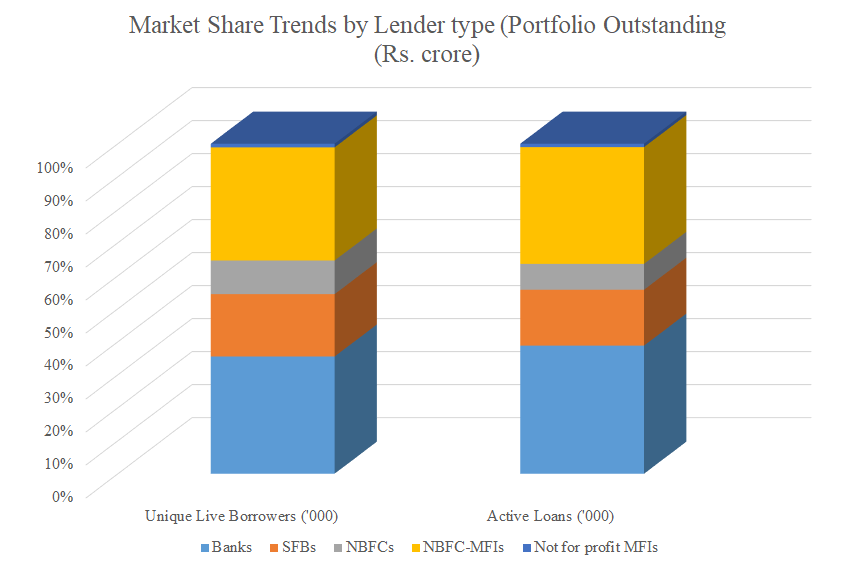

Source- SIDBI Microfinance Pulse Report, April 2021

While banks are leading by contributing 42% towards total portfolio outstanding and 39% towards active loans, NBFC-MFIs are the second highest contributors in the microfinance sector. When compared to the total portfolio size of all microfinance lenders, NBFC-MFIs only contribute to a little over 30% of the total size. However, the framework regulating microfinance has been made applicable solely to NBFC-MFIs (‘NBFC-MFI Regulations’ as provided under the respective Master Directions) while the other lenders that hold a lion’s share of the sector are not subjected to similar regulatory conditions/ restrictions. These include cap on multiple lending, ceiling on maximum lending amount, various customer protection measures etc. Absence of regulatory control has led to various problems such as multiple lending by borrowers resulting in overindebtedness, increased defaults, coercive recovery methods by lenders at the prejudice of borrowers etc.

As a solution to the same, RBI has issued a consultative paper on regulation of microfinance on June 14, 2021[2] (‘Consultation Paper’) with an intention to harmonise the regulatory frameworks for various regulated lenders (‘RE’s) in the microfinance space while also proposing a slew of changes to the existing norms for NBFC-MFIs and NBFCs.

RBI has invited comments, suggestions and feedback on the proposed regulation by July 31, 2021 from all stakeholders. The proposed norms intend to have uniform regulations applicable to microfinance loans provided by all entities regulated by the RBI and are aimed at protecting the microfinance borrowers from over-indebtedness as well as enabling competitive forces to bring down the interest rates by empowering the borrowers to make an informed decision. The key proposals of the Consultative Document have been discussed herein below in this article:

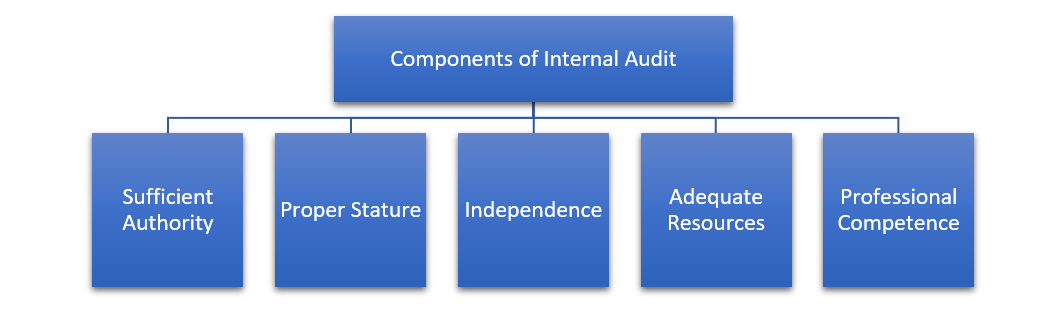

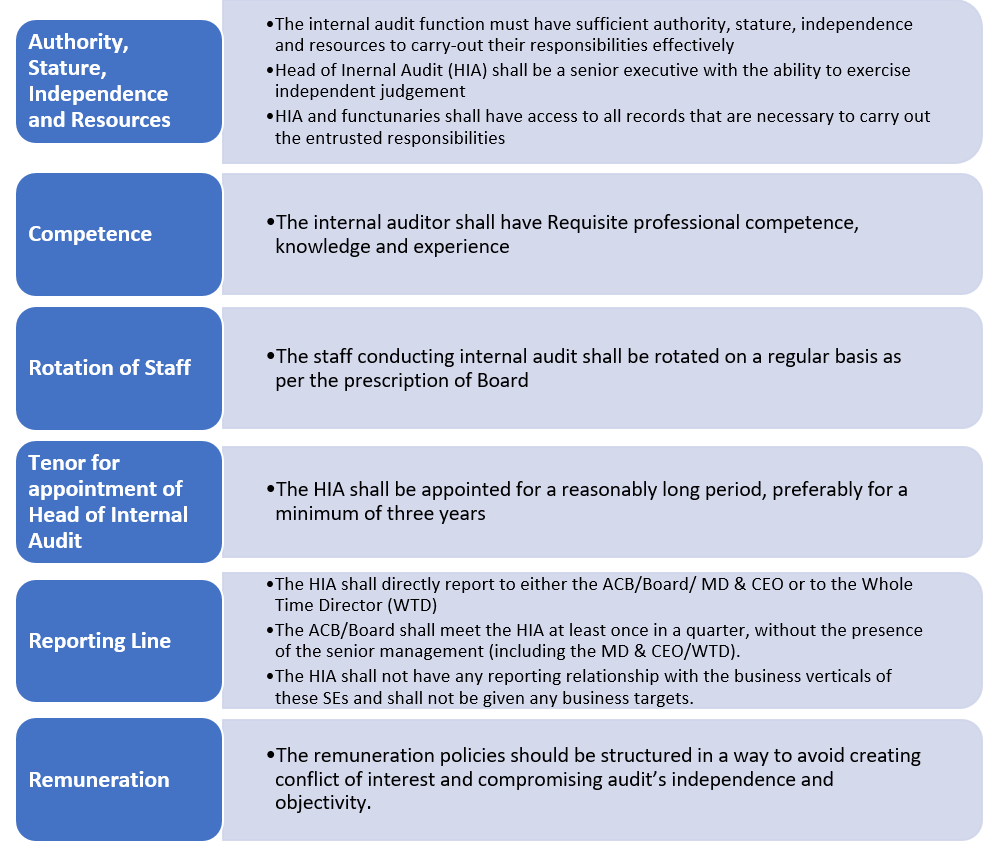

Regulations for all Microfinance Loans

MFIs encompass a host of financial institutions engaged in advancing loans to low-income groups. However, except NBFC-MFIs, none of the other entities are regulated by microfinance-specific regulations.

Resultantly, RBI has proposed to introduce a common regulatory framework for all microfinance lending institutions, irrespective of their form. The intent behind the same is to ensure that all lenders under the microfinance sector are subject to the same rules. This would not only protect borrower interest but also ensure that all lenders are operating on a level playing field thereby passing the benefit of competition to the ultimate borrower. Further, considering the total indebtedness of borrowers vis-a-vis their repayment capacity seems more fitting rather than indebtedness only from NBFC-MFIs.

Common definition of ‘Microfinance’ for all REs

RBI has proposed to revise the definition of ‘microfinance loans’ and in order to avoid over-indebtedness and multiple lending, the same is proposed to be applied uniformly to all entities regulated by the RBI (REs) and operating in the microfinance sector.

Annual Household Income Threshold

Common definition of microfinance borrowers

Under extant regulations for NBFC-MFIs, a microfinance borrower is identified by annual household income not exceeding ₹1,25,000 for rural and ₹2,00,000 for urban and semi-urban areas. In order to ensure a common definition, the said criteria for classification is proposed to be extended to all regulated entities (REs).

RBI has proposed to base the threshold on the income of the entire household rather than that of an individual, similar to the existing guidelines for NBFC-MFIs. The reason being that income in such households is usually assumed to be pooled.

For this purpose, ‘household’ shall mean a group of persons normally living together and taking food from a common kitchen. Even though the determination of the actual composition of a household shall be left to the judgment of the head of the household, more emphasis has been advised to be placed on ‘normally living together’ than on ‘ordinarily taking food from a common kitchen’. Note that a household differs from a family. Households include persons who ordinarily live together and therefore may include persons who are not related by blood, marriage or adoption but living together, while a family may comprise persons who are living apart from the household.

Methodology for assessment of household income

Assessment of household income in a predominant cash-based economy might pose certain difficulties. However, applying a uniform methodology may not be appropriate for such assessment, especially of low-income households, since the practice may differ based on the different types of borrowers and lenders. The same should be left at the discretion of the lender in the form of a policy. However, broad parameters/ factors may be provided. These can include deriving income from expenditure patterns, assessment of the borrower’s occupation and the ordinary remuneration flowing thereof, assessment of cash flows etc.

Criteria dropped from the existing definition –

- Absolute cap on the permissible amount of loan to be extended, is no longer relevant due to linking of loan to income in terms of debt-income ratio and therefore has been removed;

- Minimum tenure requirement is also to be be removed since longer tenures for larger loans will not be appropriate (since the absolute cap for amount of loans has been removed);

- The existing NBFC-MFI regulations require at least 50% of the total amount of loans extended by NBFC-MFIs to be given for income generation. This means part (i.e. maximum of 50 per cent) of the aggregate amount of loans may be extended for other purposes such as housing repairs, education, medical and other emergencies. However, aggregate amount of loans given to a borrower for income generation should constitute at least 50 per cent of the total loans from the NBFC-MF. It has been realised that while microfinance loans should ideally be used for income-generating activities, placing too much emphasis on the same may lead to borrowers availing informal and more expensive modes of lending for their other financial needs. Therefore, the said requirement not being conducive, has been proposed to be removed;

- Restriction on lending by two NBFC-MFIs to be dropped due to overall restriction in terms of debt-income ratio (discussed below).

Maximum Permissible level of indebtedness in terms of debt-income ratio

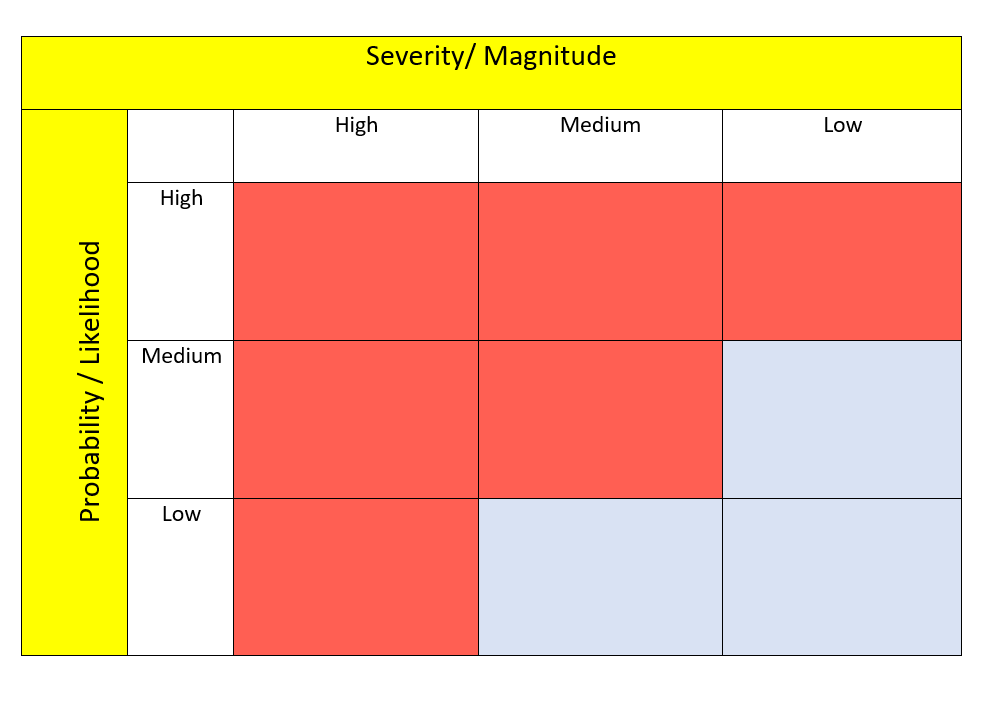

One of the major risks in microlending has been the issue of overborrowing, with nearly 35% of the borrowers having access to two or more lenders.(source PWC report)

It is proposed to link the loan amount to household income in terms of debt-income ratio. The payment of interest and repayment of principal for all outstanding loans of the household at any point of time is proposed to be capped at 50% of the household income i.e. total indebtedness of any borrower will not increase 50% of his/her total income. This has been proposed keeping in mind various factors such as –

- Low savings therefore taking into account that half of their income should be available to meet their other expenses necessary for survival

- Possibility of repayment towards other forms of informal lending from friends and family

- Likely inflation of income to avail higher loans.

However, individual REs will be permitted to adopt a conservative threshold as per their own assessments and Board approved policy. Since, the level of indebtedness for a particular borrower is proposed to be regulated, the current stipulation that limits lending by not more than two NBFC-MFIs to the same borrower will no longer be required.

Grandfathering of existing facilities

The aforesaid threshold shall become effective from the date of introduction of the proposed regulations. However, existing loans to the households which are not complying with the limit of 50% of the household income, shall be allowed to mature. Although, in such cases, no new loans will be provided to such households till the limit is complied with.

Collateral-free loans

Microfinance borrowers belong to the low income group and generally do have the available assets to be provided as collateral for availing financial facilities. The assets possessed by them are usually those that are essential for their survival and losing them in case of a default will be detrimental to their existence. Therefore, it has been proposed that to extend the collateral free nature of microfinance loans, as applicable to NBFC-MFIs, to all REs.

Prepayment Penalty

In case of NBFC-MFIs, the borrowers are allowed prepayment without charging any penalty. It has now been proposed that microfinance borrowers of all REs shall be provided with the right of prepayment without attracting penalty.

Repayment Schedule

As per the extant regulations, microfinance borrowers of NBFC-MFIs are permitted to repay weekly, fortnightly or monthly instalments as per their choice. With a view to keep the repayment pattern at the discretion of the borrowers that will suit their repayment capacity and/or preference, all REs will be required to provide repayment periodicity to such borrowers as per a Board approved policy.

Minimum NOF for NBFC-MFIs

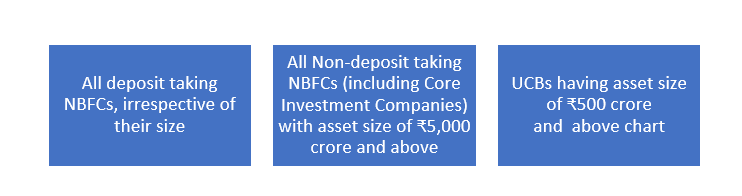

RBI had issued a Discussion Paper on ‘Revised Regulatory Framework for NBFCs – A Scale-Based Approach’ on January 22, 2021 proposing to revise the minimum net owned fund (NOF) limit for all NBFCs including NBFC-MFIs, from ₹2 crore to ₹20 crore.

At present, NBFC-MFIs are required to have a minimum NOF of ₹5 crore (₹2 crore for NBFC-MFIs registered in the North Eastern Region). RBI has sought the view of stakeholders whether the proposed minimum NOF of ₹20 crore for NBFCs under scale-based regulations is appropriate for NBFC-MFIs or not.

The evolution of regulatory framework for NBFCs may recall, the NOF requirement for NBFCs was Rs 25 lacs in 1990s. Then, it was increased to Rs 2 crores, Rs. 5 crores in case of NBFC-MFIs. The regulator is now proposing to increase the same to Rs 20 crores – a 10 fold increase. The underlying rationale is to have a stronger entry barrier, and to ensure that NBFCs have the initial capital for investing in technology, manpower and establishment. However, such a sharp hike in entry point requirement will keep smaller NBFCs out of the fray. Smaller NBFCs, especially NBFC-MFIs, have been doing a useful job in financial inclusion and having a stricter entrance will only prove to demotivate the sector. You may read further on the scalar based approach framework by RBI in our article here.

Revised Definition of ‘microfinance’ for ‘not for profit’ Companies

Section 8 companies engaged in micro-finance and not accepting public deposits, are exempt from obtaining registration under section 45IA of the RBI Act, 1934 as well as from complying with sections 45-IB (Maintenance of percentage of assets) and 45-IC (Reserve Fund).

The exemption is applicable to all not-for-profit NBFC-MFIs that meet the above criteria irrespective of their size. However, it has been proposed to bring Section 8 companies above a certain threshold in terms of balance sheet size (say, asset size of ₹100 crore and above) under the regulatory ambit of the RBI. This is because Section 8 companies are dependent on public funds including borrowings from banks and other financial institutions for their funding needs and any risk of failure in these companies will have a resultant impact on the financial sector.

Further, not-for profit MFIs operate in an almost similar manner to that of for-profit MFIs but the latter enjoys exemptions from various requirements. The mandatory requirement for registration will ensure that not-for-profit MFIs with considerably large asset size, are effectively regulated.

The revised criteria for exemption is proposed to be as under:

‘Exemption from Sections 45-IA, 45-IB and 45-IC of the RBI Act, 1934 shall be available to a micro finance company which is

- engaged in micro financing activities i.e. providing collateral-free loans to households with annual household income of ₹1,25,000 and ₹2,00,000 for rural and urban/semi urban areas respectively, provided the payment of interest and repayment of principal for all outstanding loans of the household at any point of time does not exceed 50 per cent of the household income;

- registered under Section 8 of the Companies Act, 2013;

- not accepting public deposits; and

- having asset size of less than ₹100’

Review of Specific Regulations for NBFC-MFIs

Qualifying Asset Criteria

In order to be classified as a ‘qualifying asset’, a loan is required to satisfy the following criteria:

- Loan which is disbursed to a borrower with household annual income not exceeding ₹1,25,000 and ₹2,00,000 for rural and urban/semi-urban households respectively;

- Loan amount does not exceed ₹75,000 in the first cycle and ₹1,25,000 in subsequent cycles;

- Total indebtedness of the borrower does not exceed ₹1,25,000 (excluding loan for education and medical expenses);

- Minimum tenure of 24 months for loan amount exceeding ₹30,000;

- Collateral free loans without any prepayment penalty;

- Minimum 50 per cent of aggregate amount of loans for income generation activities;

- Flexibility of repayment periodicity (weekly, fortnightly or monthly) at borrower’s choice.

The following changes have been proposed –

- The household income limits have been retained under the revised definition of microfinance loans and made applicable to all REs

- Absolute cap is no longer relevant due to linking of loan to income in terms of debt-income ratio

- Minimum tenure requirement to be removed since longer tenures for larger loans will not be appropriate (since the absolute cap for amount of loans has been removed)

- Collateral free loans and absence of prepayment penalty have been retained in the revised definition.

- The existing NBFC-MFI regulations require at least 50% of the total amount of loans extended by NBFC-MFIs to be given for income generation. This means part (i.e. maximum of 50 per cent) of the aggregate amount of loans may be extended for other purposes such as housing repairs, education, medical and other emergencies. However, aggregate amount of loans given to a borrower for income generation should constitute at least 50 per cent of the total loans from the NBFC-MF. It has been realised that while microfinance loans should ideally be used for income-generating activities, placing too much emphasis on the same may lead to borrowers availing informal and more expensive modes of lending for their other financial needs. Therefore, the said requirement not being conducive, has been proposed to be removed.

Limit of lending by two NBFC-MFIs

Owing to an overall restriction based on debt-income ratio of 50% for all REs, the restriction of lending by only two NBFC-MFIs to a borrower will be withdrawn.

Pricing of Credit by NBFC-MFIs

Given the vulnerable nature of the borrowers of microfinance loans, the NBFC-MFI regulations imposed an interest cap to prevent exorbitant interest rates charged to such borrowers.

The interest rate cap prescribes multiple ceilings rather than a single one. Accordingly, NBFC-MFIs have been permitted to charge interest with a maximum margin cap of 10% and 12% over and above the cost of funds, depending on the size of loan portfolio (₹100 crore threshold) or 2.75 times of the average base rate of five largest commercial banks, whichever is lower.

The latter criterion provides a linkage with the prevailing interest rate in the economy and ensures that higher borrowing costs for NBFC-MFIs with riskier business models are not transmitted to the end borrowers. Further, NBFC-MFIs are not permitted to levy any other charge except for a processing fee (capped at 1% of the loan amount) and actual cost of insurance to ensure that interest rate ceilings are not bypassed by NBFC-MFIs through other hidden charges.

However, the regulatory ceiling on interest rate is applicable only to NBFC-MFIs. Nearly 70% of the microfinance sector, comprising banks and small finance banks, is deregulated in terms of pricing. It has also been observed that an unintended consequence of creating a regulatory prescribed benchmark for the rest of the entities operating in the microfinance segment. Lenders, such as banks, though having a lower cost of funds, still charge a higher interest rate. This has led to borrowers being deprived of benefits of economies of scale and competition in the microfinance market.

The provision of such interest rate ceilings was suitable in an environment where NBFC-MFIs were the primary lenders. However, currently, as discussed, NBFC-MFIs contribute to only 30%. Proposing a fixed benchmark for interest rate in the microfinance industry may not be appropriate considering the differences in the cost of funds, financial or otherwise, among different types of entities.

Based on the above rationale, it has been proposed to remove such interest rate ceiling limits and align the interest rate model for NBFC-MFIs with that of regular NBFCs. NBFC-MFIs will now be permitted to adopt interest rates based on a Board approved policy while adhering to fair practice code to ensure disclosure and transparency. However, necessary regulation must also be put in place to avoid charging usurious interest rates. The intention is to enable the market mechanism to reduce the lending rates for the entire microfinance sector.

Fair Practice Norms

The above relaxation from interest rate ceiling, comes with its own set of fair practice norms to ensure transparency and protecting interests of borrowers.

- Disclosure of information on pricing

To allow borrowers to make an informed decision, REs will mandatorily be required to disclose pricing information by way of a standardised and simplified disclosure format (specified under table III of the Consultation Paper). Such information will enable borrowers to compare interest rates as well as other fees associated with a microfinance loan in a more readable and understandable manner. The pricing related fact sheet shall be provided to every prospective borrower before on-boarding.

- Board Policy for determining charges including interest rate

Boards of all REs will be required to frame suitable internal principles and procedures for determining interest rates and other charges to arrive at an all-inclusive usurious interest rate.

- Display of interest rates

All REs will be required to display the minimum, maximum and average interest rates charged by them on microfinance loans. The manner of display is still to be prescribed.

- Scrutiny by RBI

The above information will also be incorporated in returns submitted to RBI and shall be subjected to the supervisory scrutiny.

[1] Source- SIDBI Microfinance Pulse Report, April 2021

[2] https://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=51725