SEBI amends ICDR Regulations to relax certain FPO norms

Amendment of lock in requirements for excess promoter’s contribution seems unclear.

-By Aisha Begum Ansari, Assistant Manager,

Vinod Kothari & Company aisha@vinodkothari.com

Introduction

SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (“ICDR Regulations”) mandates that the promoters of the issuer company shall maintain ‘Minimum Promoters’ Contribution’ (“MPC”) which shall be locked-in for a stipulated period of time. However, the requirements of MPC and lock-in is not applicable if the funds are raised through following modes:

- Rights issue

- in case of a IPO/FPO – where the issuer does not have any identifiable promoter;

- in case of a FPO – on a condition that the equity shares of the issuer are frequently traded for a period of atleast three years and the issuer is dividend paying company.

SEBI, in its agenda of Board Meeting dated 16th December, 2020 to discuss amendment in ICDR Regulations[1] proposed to do away with the MPC and lock-in requirements for a listed company making an FPO, where shares are listed for past three years, without linking it to its dividend paying capacity.

The rationale for the proposed amendment was that an issuer raising funds through an FPO, is already a listed company and has fulfilled the obligation of MPC at the IPO stage. Further, all the information/ disclosures about the issuer is available in the public domain and the investors willing to subscribe in the FPO have sufficient knowledge to take an informed decision.

Thus, SEBI vide notification dated 8th January, 2021[2] issued SEBI (Issue of Capital and Disclosure Requirements) (Amendment) Regulations, 2021 (“Amendment Regulations”).

De-coding the Amendment Regulations:

-

Non-applicability of MPC requirement

SEBI substituted the existing clause (b) of regulation 112 of the ICDR Regulations, wherein it removed the criterion of dividend paying capacity as a determining factor for MPC and the subsequent lock-in requirements. It further inserted the additional compliance of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (hereinafter referred to as “LODR Regulations”) and that the issuer should have redressed at least 95% of the complaints received from the investors.

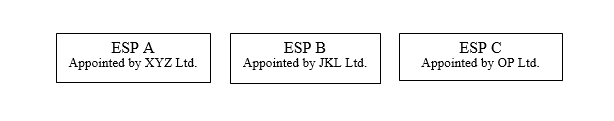

The said amendment can be understood with the help of following diagram:

-

Non-applicability of lock-in requirement

Regulation 115 of ICDR Regulations mandates that the certain portion of specified securities held by the promoters shall be locked-in for the periods stipulated in the said regulation.

SEBI, in its Board meeting, considered that if the MPC is done away with, the lock-in requirements may not arise. Therefore, SEBI deleted the existing proviso after clause (c) of regulation 115 of ICDR Regulations. However, deleting the said proviso has brought ambiguity in compliance with the lock-in requirements which is explained as under:

- The existing proviso after regulation 115(c) states that the excess promoters’ contribution as provided in the proviso to regulation 112(b) shall not be subject to lock-in.

- Clause (a) of sub-regulation (1) of regulation 113 which deals with MPC states that the promoters shall contribute either

- upto 20% of the proposed issue size; or

- upto 20% of the post-issue capital

- The existing proviso to regulation 112(b) states that if the promoters subscribe in excess of the higher of the two options mentioned above, then the price for such excess subscription shall be determined in terms of pricing guidelines for preferential issue under regulation 164 or the issue price, whichever is higher.

Since, the promoters were contributing in excess of the option given to them, SEBI exempted the lock-in requirements for such excess subscription.

Now suppose, if the promoters subscribe to 5% of the issue size, even if the MPC requirement is not applicable to them, whether such contribution shall be subject to lock-in? And if yes, the lock-in shall be applicable for what period?

Pursuant to the proviso after regulation 115(c) being deleted, following interpretations arise:

Interpretation 1: Such subscription shall not be required to be locked-in at all, since the intention of SEBI, as mentioned in the agenda of Board Meeting, was to do away with the lock-in requirement.

Interpretation 2: Such subscription shall be required to be locked-in for a period of 1 year, because such subscription is in excess of MPC i.e. it is in excess of zero contribution required and as per regulation 115(b), the excess promoters’ contribution shall be under lock-in for a period of 1 year.

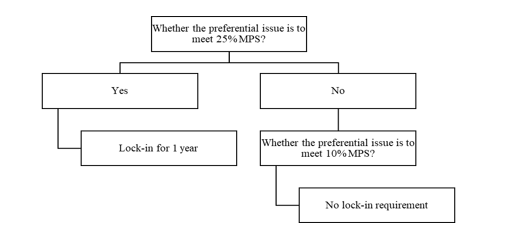

This can be understood with the following diagram:

-

Non-applicability of lock-in requirements in case of equity shares issued on a preferential basis pursuant to any resolution of stressed assets or a resolution plan.

SEBI, in its agenda of Board Meeting dated 16th December, 2020 to discuss recalibration of threshold for Minimum Public Shareholding norms, enhanced disclosures in Companies which undergo CIRP[3], proposed to do away with the lock-in requirements of equity shares issued on a preferential basis pursuant to any resolution of stressed assets under a framework specified by RBI or a resolution plan approved under IBC, 2016.

The rationale for the proposed amendment was that as per rule 19A(5) of Securities Contracts (Regulations) Rules, 1957[4], if the minimum public shareholding (hereinafter referred to as “MPS”) falls below 10% due to CIRP, such listed companies are required to bring MPS to at least 10% within a period of 18 months and to 25% within 3 years from the date of such fall.

As per regulation 167(4), the equity shares issued on a preferential basis pursuant to any resolution of stressed assets or a resolution plan, shall be locked-in for a period of one year. Thus, any allotment to the Resolution Applicant (RA) is locked in for a period of one year. Such lock-in of shares does not facilitate dilution of promoter shareholding to achieve MPS requirement.

Therefore, SEBI inserted the new proviso after regulation 167(4) whereby it relaxed the lock-in requirement of specified securities to the extent to achieve 10% public shareholding. This can be understood with the following diagram:

Conclusion:

Even though SEBI has tried to relax the MPC and lock-in requirements in case of issue of specified securities pursuant to FPO and resolution of stressed assets or a resolution plan, it has created ambiguity in the relaxation of lock-requirements in case of excess promoters’ contribution in case of FPO. SEBI should review the Amendment Regulations and undo the deletion of existing proviso after regulation 115(c) of ICDR Regulations to retain the exemption.

Table containing the relevant provisions of ICDR Regulations before and after the amendment.

| Before Amendment | After Amendment |

| Chapter IV: Further Public Offer, Part III: Promoters’ Contribution | |

| Regulation 112: Requirement of minimum promoters’ contribution not applicable in certain cases | |

| The requirements of minimum promoters’ contribution shall not apply in case of:

a) an issuer which does not have any identifiable promoter; b) where the equity shares of the issuer are frequently traded on a stock exchange for a period of at least three years and the issuer has a track record of dividend payment for at least three immediately preceding years: Provided that where the promoters propose to subscribe to the specified securities offered to the extent greater than higher of the two options available in clause (a) of sub-regulation (1) of regulation 113, the subscription in excess of such percentage shall be made at a price determined in terms of the provisions of regulation 164 or the issue price, whichever is higher. Explanation: The reference date for the purpose of computing the annualised trading turnover referred to in the said Explanation shall be the date of filing the draft offer document with the Board and in case of a fast track issue, the date of filing the offer document with the Registrar of Companies, and before opening of the issue. |

The requirements of minimum promoters’ contribution shall not apply in case of:

a) an issuer which does not have any identifiable promoter; b) where the equity shares of the issuer are frequently traded on a stock exchange for a period of at least three years immediately preceding the reference date, and the issuer has a track record of dividend payment for at least three immediately preceding years: (i) the issuer has redressed at least ninety five per cent of the complaints received from the investors till the end of the quarter immediately preceding the month of the reference date, and; (ii) the issuer has been in compliance with the SEBI (LODR) Regulations, 2015 for a minimum period of three years immediately preceding the reference date: (iii) Provided that if the issuer has not complied with the provisions of the SEBI (LODR) Regulations, 2015, relating to composition of board of directors, for any quarter during the last three years immediately preceding the date of filing of draft offer document/ offer document, but is compliant with such provisions at the time of filing of draft offer document/ offer document, and adequate disclosures are made in the offer document about such non-compliances during the three years immediately preceding the date of filing the draft offer document/ offer document, it shall be deemed as compliance with the condition: Provided further that where the promoters propose to subscribe to the specified securities offered to the extent greater than higher of the two options available in clause (a) of sub-regulation (1) of regulation 113, the subscription in excess of such percentage shall be made at a price determined in terms of the provisions of regulation 164 or the issue price, whichever is higher. Explanation: The reference date for the purpose of computing the annualised trading turnover referred to in the said Explanation shall be the date of filing the draft offer document with the Board and in case of a fast track issue, the date of filing the offer document with the Registrar of Companies, and before opening of the issue. |

| Regulation 115: Lock-in of specified securities held by promoters | |

| The specified securities held by the promoters shall not be transferable (hereinafter referred to as “locked-in”) for the periods as stipulated hereunder:

a) minimum promoters’ contribution including contribution made by alternative investment funds, or foreign venture capital investors, as applicable, shall be locked-in for a period of three years from the date of commencement of commercial production or from the date of allotment in the further public offer, whichever is later; b) promoters’ holding in excess of minimum promoters’ contribution shall be locked-in for a period of one year: c) The SR equity shares shall be under lock-in until their conversion to equity shares having voting rights same as that of ordinary shares, provided they are in compliance with the other provisions of these regulations. Provided that the excess promoters’ contribution as provided in the proviso to clause (b) of regulation 112 shall not be subject to lock-in. |

The specified securities held by the promoters shall not be transferable (hereinafter referred to as “locked-in”) for the periods as stipulated hereunder:

a) minimum promoters’ contribution including contribution made by alternative investment funds, or foreign venture capital investors, as applicable, shall be locked-in for a period of three years from the date of commencement of commercial production or from the date of allotment in the further public offer, whichever is later; b) promoters’ holding in excess of minimum promoters’ contribution shall be locked-in for a period of one year: c) The SR equity shares shall be under lock-in until their conversion to equity shares having voting rights same as that of ordinary shares, provided they are in compliance with the other provisions of these regulations. Provided that the excess promoters’ contribution as provided in the proviso to clause (b) of regulation 112 shall not be subject to lock-in. |

| Chapter V: Preferential issue, Part V: Lock-in and Restrictions on Transferability | |

| Regulation 167: Lock-in | |

| (4) The equity shares issued on a preferential basis pursuant to any resolution of stressed assets under a framework specified by the Reserve Bank of India or a resolution plan approved by the National Company Law Tribunal under the Insolvency and Bankruptcy Code 2016, shall be locked-in for a period of one year from the trading approval | (4) The equity shares issued on a preferential basis pursuant to any resolution of stressed assets under a framework specified by the Reserve Bank of India or a resolution plan approved by the National Company Law Tribunal under the Insolvency and Bankruptcy Code 2016, shall be locked-in for a period of one year from the trading approval.

Provided that the lock-in provision shall not be applicable to the specified securities to the extent to achieve 10% public shareholding. |

Our other related material:

- http://vinodkothari.com/2020/10/eligibility-and-disclosures-under-rights-issue-rationalized/

- http://vinodkothari.com/2020/06/sebis-measures-towards-resuscitation-of-financially-stressed-companies/

- http://vinodkothari.com/2018/09/key-amendments-sebi-icdr-reg-2018/

- http://vinodkothari.com/2019/01/sebi-amends-icdr-regulations-2018/http://vinodkothari.com/2019/01/sebi-amends-icdr-regulations-2018/

- http://vinodkothari.com/2018/09/sebi-icdr-regulations-2018-key-amendments/

[1] https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/meetingfiles/dec-2020/1608617470064_1.pdf#page=1&zoom=page-width,-18,797

[2] https://www.sebi.gov.in/legal/regulations/jan-2021/securities-and-exchange-board-of-india-issue-of-capital-and-disclosure-requirements-amendment-regulations-2021_48704.html

[3] https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/meetingfiles/dec-2020/1608621922552_1.pdf#page=1&zoom=page-width,-18,801

[4] https://www.sebi.gov.in/legal/rules/feb-1957/securities-contracts-regulations-rules-1957_34671.html