SEBI eliminates one-to-one analyst meets from the purview of LODR

/0 Comments/in Corporate Laws, LODR, SEBI /by Staff-Recommendations of sub-group dropped under the LODR Amendment

By CS Aisha Begum Ansari, Assistant Manager, Vinod Kothari & Company

Background

Information symmetry is extremely important in a listed company since it helps in effective price discovery and builds the faith of the investors. Analyst and investor meets are one of the many ways used by the companies to disseminate information. The companies usually conduct analyst or investor meets after the disclosure of financial results to answer the questions relating to financial performance, future prospects, etc. based on generally available information without disclosing any unpublished price sensitive information (‘UPSI’). Such meets generally include conference calls or meeting with group of investors or group of analysts as per the prefixed schedule. Further, the same also includes one-to-one meet or calls with investors or analysts, which may either be prefixed or in the nature of walk-in.

While, SEBI mandates provisions under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘Listing Regulations’) and SEBI (Prohibition of Insider Trading) Regulations, 2015 (‘PIT Regulations’) to curb as well as regulate such leak of UPSI; one of the recent changes under the Listing Regulations vide SEBI Listing Regulations (Second Amendment) Regulations, 2021[1] (‘LODR Amendment’) issued on 7th May, 2021 seems to have completely excluded one-to-one meet from the regulatory ambit prescribing disclosure requirements.

This article discusses the regulatory requirement in relation to investor meet, phases of amendment, present requirement and international practice.

Compliance requirements under SEBI Regulations

Erstwhile Listing Agreement

Clause 49 of the Listing Agreement[2] which specified the reporting requirements, obligated the companies to disclose on its website or intimate the stock exchange the presentations made by it to the analysts. Also, the companies were required to disclose in its Report on Corporate Governance, presentations made to institutional investors or the analysts as a means of communication to shareholders.

Listing Regulations (prior to amendment)

The Listing Regulations mandated listed entities to disclose the schedule of analyst or investor meets and presentations to such analysts or investors –

- On the website of the listed entity [Regulation 46(2)(o) of Listing Regulations]

- On the website of the stock exchange where its securities are listed (Clause 15 of Para A, Part A of Schedule III of Listing Regulations).

- Means of communication in the form of presentations made to institutional investors or analyst in the annual corporate governance report. (Para C(8)(e) of Schedule V to Listing Regulations).

Erstwhile PIT Regulations (1992)

The 1992 regulations prescribed elaborate requirement in relation to analyst meets. Listed companies were required to follow the following guidelines while dealing with analysts and institutional investors:—

- Only Public information to be provided – Listed companies were required to provide only public information to the analyst/research persons/large investors like institutions. Alternatively, the information given to the analyst were required to be simultaneously made public at the earliest.

- Recording of discussion – In order to avoid misquoting or misrepresentation, it was suggested that at least two company representative to be present at meetings with analysts, brokers or institutional investors and discussion should preferably be recorded.

- Handling of unanticipated questions – A listed company were required to be careful when dealing with analysts’ questions that raise issues outside the intended scope of discussion. It was suggested that unanticipated questions could be taken on notice and a considered response could be given later. If the answer included price sensitive information, a public announcement was required to be made before responding.

- Simultaneous release of Information – When a company organized meetings with analysts, the company was required to make a press release or post relevant information on its website after every such meet. The company could also consider live webcasting of analyst meets.

PIT Regulations

PIT Regulations, presently, mandate listed entities to develop best practices to make transcripts or records of proceedings of meetings with analysts and other investor relations conferences on the official website to ensure official confirmation and documentation of disclosures made. Further, the listed entity needs to ensure that information shared with analysts and research personnel is not UPSI.

Discussion in working group/ committee reports

Report submitted by the Committee on Corporate Governance[3]

The Committee was of the view that the disclosure of schedules of analyst/ institutional investor meetings does not serve any practical purpose, and there have been instances of its misuse. Hence, the Committee recommended that the disclosure of schedules of analyst/institutional investor meetings may not be required. However, the information to be shared at such meetings has to be strictly in compliance with the SEBI PIT Regulations.

Report on disclosures pertaining to analyst/ investors meets[4]

The issue of information asymmetry between various classes of investors arising out of limited disclosures in respect of analyst meets/ institutional investors meet/ conference calls was discussed by Primary Markets Advisory Committee (PMAC) in the meeting in July, 2020. SEBI, based on the recommendation of PMAC, had formed sub-group which issued the ‘Report on disclosures pertaining to analyst meets, investor meets and conference calls’ (‘Report’) on November 20, 2020.

The Committee deliberated on best practice followed by listed entities in India, regulatory regime in developed countries and acknowledged the fact that existing regulations are not followed in letter and spirit by majority of listed companies thereby causing information asymmetry.

The Report explicitly distinguished between group analysts or investors meet and one-to-one in terms of the regulatory compliance. The Report recommended disclosure of transcripts and recordings of proceedings of group investors meet on the website of the company and to the stock exchange within a prescribed time frame whereas for one-to-one meetings, it recommended disclosing the number of such meetings in the quarterly compliance report on corporate governance along with a confirmation that no UPSI was shared with them.

The committee provided the rationale that the fundamental reason for analysts to seek meetings with the listed entity was to check their hypothesis that they have developed, based on controls and processes that have been built to comply with the public disclosures and complying with regulations relating to handling of private information and that premature public disclosure of these questions may lead to a regime of ‘’mandatory dissemination of proprietary information’’.

It is also important to note that the sub-group in its Report discussed that the content of the discussions for one-to-one meets, should not be intimated to the stock exchange due to following demerits:

- Invasion of privacy of the institutional investors;

- Allow third parties not a part of the meet to take speculative positions for trading decisions; and

- Lead to overload of information to retain investors

Based on the sub-group’s discussion, the following recommendations were made:

- Provide number of one-to-one meet as part of corporate governance report on a quarterly basis while submitting to the stock exchange;

- The same needs to carry an affirmation that no UPSI was shared by any official of the company in such meetings; and

- Company to maintain a record of all one-to-one meetings covering the name/names of the investor who were met, the name of the fund that he/ she represents, name of the brokerage firm which fixed the meeting (if any), the location, date and time of the meeting and a reference to the presentation made and preserve the same for a period of at least eight years.

Discussion in SEBI Board meeting of March 25, 2021[5]

The agenda provides details of recommendation made in relation to group analyst meet, however, does not provide any rationale/ discussion with respect to one-to-one meeting or reason for excluding the requirement from Listing Regulations altogether.

Anomaly in the LODR Amendment

Regulation 46(2)(o) and Clause 15(a) of Para A, Part A of Schedule III of Listing Regulations defines the term ‘meet’ as ‘group meetings or group conference calls’ for the purpose of disclosure of schedule of analyst/ investor meet and presentations made by the company to them.

Further, regulation 46(2)(oa) and Clause 15(b) of Para A, Part A of Schedule III provides for manner of disclosure of audio/ video recordings and transcripts of post earning calls or quarterly calls on the website of the company and to the stock exchange respectively. The said sub-clause has no reference of the term ‘meet’. The said provisions are reproduced below:

Regulation 46(2)(oa):

“(oa) Audio or video recordings and transcripts of post earnings/quarterly calls, by whatever name called, conducted physically or through digital means, simultaneously with submission to the recognized stock exchange(s), in the following manner:

- the presentation and the audio/video recordings shall be promptly made available on the website and in any case, before the next trading day or within twenty-four hours from the conclusion of such calls, whichever is earlier;

- the transcripts of such calls shall be made available on the website within five working days of the conclusion of such calls:

Provided that—

- The information under sub-clause (i) shall be hosted on the website of the listed entity for a minimum period of five years and thereafter as per the archival policy of the listed entity, as disclosed on its website.

- The information under sub-clause (ii) shall be hosted on the website of the listed entity and preserved in accordance with clause (a) of regulation 9.

The requirement for disclosure(s) of audio/video recordings and transcript shall be voluntary with effect from April 01, 2021 and mandatory with effect from April 01, 2022.”

Clause 15(b) of Para A, Part A of Schedule III

“(b) Audio or video recordings and transcripts of post earnings/quarterly calls, by whatever name called, conducted physically or through digital means, simultaneously with submission to the recognized stock exchange(s), in the following manner:

- the presentation and the audio/video recordings shall be promptly made available on the website and in any case, before the next trading day or within twenty-four hours from the conclusion of such calls, whichever is earlier;

- the transcripts of such calls shall be made available on the website within five working days of the conclusion of such calls:

The requirement for disclosure(s) of audio/video recordings and transcript shall be voluntary with effect from April 01, 2021 and mandatory with effect from April 01, 2022.”

Since, the term ‘meet’ is not mentioned in the above provisions, it leads to an interpretation that in case of post earning calls or quarterly calls, irrespective of the fact whether such meeting is with the group of investors or one-to-one meeting, audio/ video recordings and transcripts will be required to be submitted to the stock exchange.

Regulatory regime in other countries

1. United States of America

Regulation Fair Disclosure[6] (referred as ‘Regulation FD’) prohibits companies from selectively disclosing material non-public information (referred as ‘MNPI’) to analysts, institutional investors, and others without concurrently making widespread public disclosure.

Response to question 101.11 of the FAQs on Regulation FD[7] allows directors of the company to speak privately with a shareholder or group of shareholders by implementing policies and procedures to help avoid insider trading. Also, where a shareholder expressly agrees, through confidentiality agreement, to maintain confidentiality of MNPI, a private communication between the director and a shareholder does not violate Regulation FD norms.

2. Canada

Part V of the National Policy on Disclosure Standards[8] provides guidelines with respect to private briefings with analysts/ institutional investors. The Policy does not prohibit one-to-one discussions with analysts but identifies that the potential of selective disclosure of material non-public information is fraught with difficulties. It emphasizes on timely public disclosure of material information and entering into confidentiality agreements with the analysts.

3. United Kingdom

Market Abuse Regulation (“MAR”)[9] prevents selective disclosure of MNPI. MAR requires that the companies must not disclose MNPI selectively at the investor meetings. If they do, an immediate announcement would be required but it would still be a breach of the regulations.

4. Singapore

Rule 703(4) of the Singapore Exchange Listing Rules[10] requires the issuer to observe the Corporate Disclosure Policy as provided under Appendix 7.1. of Rule[11]. Para 23 under PART VIII of the Policy recommends the issuer to observe an “open door” policy in dealing with analysts, journalists, stockholders and others.

Issuer is required to abstain from disseminating material information which has not been disclosed to the public before. However, if such material information is inadvertently disclosed at meetings with analysts or others, it must be publicly disseminated as promptly as possible by the means described in Part VIII.

Conclusion

One-to-one meets carry a significant amount of risk with it for being a source / device for leak of UPSI especially where the same are not explicitly regulated. The intent behind recording and disclosing the same is to safeguard the company officials from any potential charge of breach of PIT Regulations. One will have to wait and watch if the relaxation results in any adverse implications. Further, SEBI will have to clarify on the ambiguity relating to disclosure requirements of one-to-one analysts meet w.e.f. post earning calls or quarterly calls if the intent is to restrict only to ‘meet’ as defined in the respective clauses.

[1] https://egazette.nic.in/WriteReadData/2021/226859.pdf

[2]https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/attachdocs/1293168356651.pdf#page=7&zoom=page-width,-16,792

[3] https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/attachdocs/oct-2017/1509102194616.pdf#page=1&zoom=page-width,638,870

[4] https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/attachdocs/nov-2020/1605853267317.pdf#page=1&zoom=page-width,-16,792

[5] https://www.sebi.gov.in/sebi_data/meetingfiles/apr-2021/1619067296590_1.pdf

[6] https://www.sec.gov/rules/final/33-7881.htm

[7] https://www.sec.gov/divisions/corpfin/guidance/regfd-interp.htm

[8] https://www.osc.ca/sites/default/files/pdfs/irps/pol_20020712_51-201.pdf

[9] https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32014R0596&from=EN

[10] http://rulebook.sgx.com/rulebook/703-0

[11] http://rulebook.sgx.com/rulebook/appendix-71-corporate-disclosure-policy

Our article titled SEBI proposes enhanced disclosures for meetings with analyst, investors, etc. can be accessed through following link:

SEBI notifies substantial amendments in Listing Regulations

/3 Comments/in LODR, SEBI /by StaffProposals approved in SEBI BM of March, 2021 made effective

Payal Agarwal | Executive ( corplaw@vinodkothari.com ) May 07, 2021

Introduction

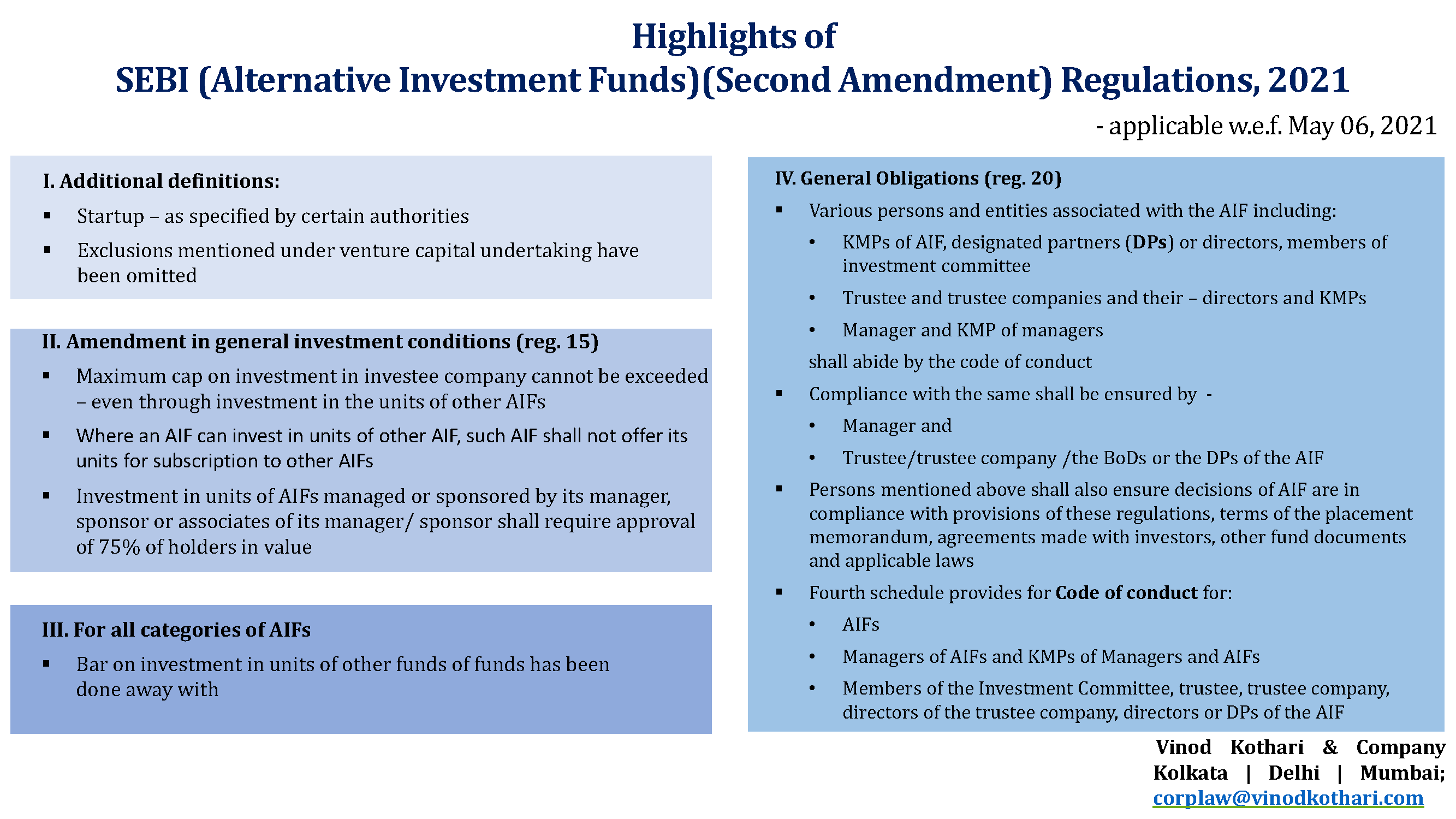

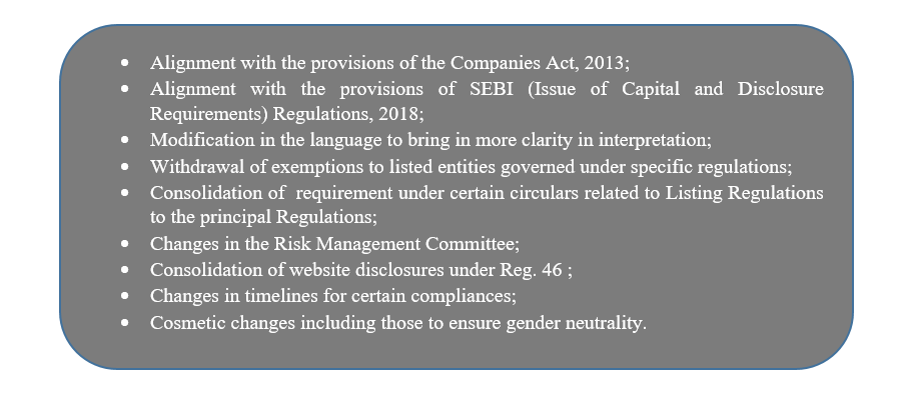

SEBI, the capital market regulator of India, vide a gazette notification dated 06th May, 2021 notified Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) (Second Amendment) Regulations, 2021 [“the Amendment Regulations”] that were approved in SEBI’s Board Meeting held on March 25, 2021. Most of the amendments were already rolled out earlier as consultation papers in 2020. The amendments become effective from May 06, 2021.

This article discusses the major amendments carried out and the likely impact and actionable for the listed entities.

Brief of the amendments are as follows –

A gist of all the amendments under the Amendment Regulations have been captured in a snippet.

A gist of all the amendments under the Amendment Regulations have been captured in a snippet.

1. Applicability of the Listing Regulations

In terms of Regulation 3 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2013 (‘Listing Regulations’) the provisions of Listing Regulations are applicable to entities that list the designated securities on the stock exchange.

The Amendment Regulations clarify that the applicability of certain provisions of Listing Regulations based on market capitalisation will continue to apply even where the entities fall below the prescribed threshold.

While the market capitalisation may be derived for any day, the recognised stock exchanges viz. BSE Limited and National Stock Exchange of India Limited releases a list of listed entities based on market capitalisation periodically. However, the provisions under Listing Regulations become applicable based on market capitalisation as at the end of the immediate previous financial year.

The present amendment on the continuation of applicability of provisions even after the listed entity ceasing to be among the top 500, 1000, 2000 listed entities, as the case may be, seems inappropriate. The applicability of these provisions were originally introduced in view of the size of the listed entities that held major market cap. Indefinite applicability of the said provisions despite fall in the market capitalisation of the listed entity is more of a compliance burden. The provision should be amended by SEBI in line with the timeframe provided under Reg. 15 i.e. where a listed entity does not fall under the list of top 100, 500, 1000, 2000 for three consecutive financial years, the compliance requirement should cease to apply.

Therefore, a conjoint reading of both the provisions should be allowed to take a liberal interpretation in respect of the newly-inserted Regulation 3(2) as well, thereby relaxation of compliance requirements on completion of a look-back period of 3 consecutive financial years.

2. Risk Management Committee

Regulation 21 of Listing Regulations requires the listed entities to constitute a Risk Management Committee (RMC). A comparative study of the erstwhile and the amended provisions w.r.t RMC is given below –

| Topic | Erstwhile provisions | Amended provisions |

| Applicability of RMC | · On top 500 listed entities (Based on market capitalisation) | · On top 1000 listed entities based on market capitalisation |

| Composition | · Members of Board of Directors

· Senior executives of listed entity · 2/3rds IDs in case of SR Equity Shares |

· Minimum 3 members

· Majority being members of board of directors · Atleast 1 Independent Director (ID) · 2/3rds IDs in case of SR Equity Shares |

| Minimum no. of meetings | One | Two |

| Quorum | Not specified | · 2 or 1/3rds of total members of RMC, whichever is higher

· Including atleast 1 member of Board |

| Maximum gap between two meetings | Not specified | Not more than 180 days gap between two consecutive meetings |

| Roles and responsibilities | The board of directors were to define the role and responsibility and delegate monitoring and reviewing of the risk management plan and such other functions, including cyber security. | As provided under Part D of Schedule II, that inter alia includes:

· Formulating of risk management policy; · Oversee implementation of the same; · Monitor and evaluate risks basis appropriate methodology, processes and systems. · Appointment, removal and terms of remuneration of CRO. |

| Power to seek Information | No such power. The same was only available with Audit Committee under Reg. 18 (2) (c). | RMC has powers to seek information from any employee, obtain outside legal or other professional advice and secure attendance of outsiders with relevant expertise, if it considers necessary. |

The roles and responsibilities of the RMC has now been specified in the Regulations itself, which were once left at the discretion of Board. The formulation of Risk Management Policy has also been delegated to the RMC, with particular contents of the policy being specified under the Schedule.

An important role of the RMC, among others, include review of the appointment, removal and terms of remuneration of Chief Risk Officer (CRO). The appointment of CRO is not a mandatory requirement under Listing Regulations. CRO is required to be appointed for all banking companies, and non-banking financial companies (NBFCs) having asset size of Rs. 50 billions or more, being registered as an Investment and Credit company, Infrastructure Finance Companies, Micro Finance Institutions, Factors, or Infrastructure Debt Funds. Further, the Insurance Regulatory and Development Authority of India (IRDAI) Corporate Governance Guidelines requires the insurance companies to appoint CRO.

The role of RMC further provides for co-ordination with other committees where the roles overlap. It is seen that the risk management function is also laid upon the Audit Committee. Therefore, the roles of both the committees might be overlapping. In view of the same, some companies choose to constitute one joint committee combining the roles of both Audit Committee and RMC. From the provisions providing for co-ordination of activities, it may also be taken as a clear indication that the committees cannot be merged into one, but co-ordinate where the activities require so.

Actionables –

- Changes in the constitution of RMC / Constitution of RMC in case of first-time applicability;

- Modification of the Risk Management Policy as per the Amendment Regulations;

- Amending the existing charter of the Committee to align with the amendments.

While the Amendment Regulations are effective immediately, the changes cannot take place overnight. Therefore, it is advisable that the listed entities shall take the matter of constitution/ re-constitution of RMC in the ensuing Board Meeting. The modification of Risk Management Policy will be then taken up by the RMC and can be done within a reasonable period of time.

What should be this period? A probable answer to this should lie in the proviso to clause (a) of Reg. 15 that permits a timeline of six months from the applicability to comply with corporate governance requirements as stipulated under regulations 17 to 27, clauses (b) to (i) and (t) of sub-regulation (2) of regulation 46 and para C, D and E of Schedule V. However, that is applicable only in case of companies covered in Reg. 15 (2) (a). Therefore, the time available is till June 30, 2021 as thereafter, the companies will be required to confirm on RMC composition in the quarterly filings done under Reg. 27.

3. Overriding powers of LODR Regulations

Earlier, proviso to Regulation 15(2)(b) provided a clear stipulation of overriding effect of specific statute in case of conflicting provisions. The Amendment Regulations provides for deletion of the said proviso effective from September 1, 2021. No rationale seems to have been provided in the agenda[1] put up before SEBI at the board meeting for this major amendment.

Regulators viz. RBI, IRDA, PFRDA at times have specific corporate governance related compliances that are stricter and at times conflicting with the requirements of Listing Regulations. For eg. With respect to composition of Audit Committee for a public sector bank, RBI Circular of September, 1995 provides for following composition in case of public sector banks: (a) Executive Director of the Bank (Wholetime director in case of SBI) (b) two official directors (i.e. nominees of Government and RBI) and (c) Two non-official, non-executive directors (at least one of them should be a Chartered Accountant). Directors from staff will not be included in ACB. This is certainly conflicting with the composition provided in Reg. 18 of Listing Regulations.

Subsequent to September 1, 2021 these entities will be regarded as non-compliant of the provisions of Listing Regulations and may be subject to penalty in terms of SEBI Circular dated January, 2020.

4. Reclassification of promoters into public – related exemptions and procedural changes

Regulation 31A of the LODR Regulations specifies the conditions and approvals post which the promoters can be re-classified into public shareholders. SEBI had proposed changes to the same in a consultation paper dated 23rd November, 2020. The consultation paper was critically analysed in our article. Amendments have been made on similar lines in Regulation 31A.

5. Alignment with the provisions of the Companies Act, 2013

Certain amendments have been made to remove the gap between the provisions of LODR Regulations, with that of the Companies Act, 2013 as given below –

- Separate meeting of independent directors – The requirement of conducting a separate meeting of the independent directors without the presence of any other member of the Board of the company is required under both the Companies Act, 2013 as well as the LODR Regulations. However, whereas the Companies Act requires one meeting in a financial year, the LODR Regulations required one meeting in a year (calendar year). Therefore, the same has been substituted with a “financial year” so as to align the requirements of both the governing laws.

- Display of Annual Return on website – Section 92 read with allied rules requires the companies, having a website, to display its Annual Return on the website. New clause has been inserted under Regulation 46 of LODR Regulations that requires placing the Annual Return on the website of the company.

- Changes in requirements pertaining to placing of financial statements on website – The audited financial statements of each of the subsidiaries was required to be placed on the website prior to the Amendment Regulations. New provisos has been inserted under the same so as to avoid preparation of separate financial statements of the subsidiary company, where the requirements under the Companies Act, 2013 are met if the consolidated financial statements are placed instead of separate ones.

6. Mandatory website disclosures

Regulation 46 of the LODR Regulations provides the mandatory contents to be placed on the website of a listed entity. Most of the disclosures were already existing under respective regulations viz. Reg 30, 43A etc. However, the same has been consolidated under regulation 46. This will now enable stock exchanges to levy penalty in terms of SEBI circular dated 22nd January, 2020.

7. Analyst meet

The listed entity is required to disclose the schedule of analyst or institutional investor meet and the presentations made to them on its website under regulation 46 and on the website of the stock exchange under Schedule III. The Amendment Regulations have explained the term ‘meet’ to mean the group meetings and calls, whether digitally or by physical means. The Amendment Regulations will require the listed entity to upload the audio/ video recordings and the transcripts within the prescribed timeframe. The same is in line with SEBI’s Report on disclosures pertaining to analyst meets, investor meets and conference calls. However, the amendment does not cover disclosure of one-to-one investor/ analyst meet conducted with select investors recommended in the said Report.

8. Consolidation of various SEBI circulars

Certain circulars of SEBI lay down various requirements to be complied with in relation to the LODR Regulations. The Amendment Regulations have consolidated the requirements under the principal LODR Regulations.

- Requirement of Secretarial Compliance Report – While the requirement of Annual Secretarial Compliance report were applicable on the listed entities and its material subsidiaries since a few years back, the same has now been specifically provided under newly inserted sub-regulation (2) of Regulation 24A. Earlier, the practice came pursuant to a SEBI circular.

- Timeline for report of monitoring agency regarding deviation in use of proceeds – Pursuant to the requirements of Regulation 32 of the LODR Regulations, the monitoring agency is required to give a report on the utilisation of proceeds of issue on a quarterly basis. While timelines were not specified in the LODR Regulations, the report was required to be given within 45 days from the end of the quarter. This timeline was pursuant to the SEBI circular dated 24th December, 2019 . Now, with the Amendment regulations, the same is specified under regulation 32(6) of the LODR Regulations.

- Requirement of Business responsibility and sustainability report (BRSR)- SEBI had proposed a new format to replace the existing Business Responsibility Report. The proposal was finalised and the BRSR format has been made mandatorily applicable from FY 2022-23 onwards, vide SEBI circular dated April, 2021 . The same has also been consolidated under Regulation 34 of the LODR Regulations. A detailed discussion on BRSR is covered in our article.

Conclusion

The Amendment Regulations are very crucial and significant in nature. While on one hand, certain provisions are aligned with the Companies Act, 2013, whereas on the other hand, overriding powers have been given to LODR Regulations which will require the listed entities formed under special statute to comply with the LODR Regulations in entirety. Uniformity in timelines and relaxation in certain disclosure requirements will encourage ease of doing business, and the coverage of certain provisions extended to listed entities based on market capitalisation will have a remarkable impact on the corporate governance of listed entities.

[1] https://www.sebi.gov.in/web/?file=https://www.sebi.gov.in/sebi_data/meetingfiles/apr-2021/1619067328922_1.pdf#page=18&zoom=page-width,-17,763

Our other materials on the relevant topic can be read here –

- http://vinodkothari.com/2021/06/presentation-on-lodr-amendments/

- http://vinodkothari.com/2020/09/companies-amendment-act-2020/

- http://vinodkothari.com/2019/07/sebi-amends-lodr-in-relation-to-equity-shares-with-superior-rights/

- http://vinodkothari.com/2019/02/overlap-in-reporting-of-secretarial-compliance/

- http://vinodkothari.com/2018/12/faqs-on-sebi-listing-obligations-and-disclosure-requirements-amendment-regulations-2018/

- http://vinodkothari.com/2016/01/sebi-faqs-on-listing-regulations-2015-brings-ambiguity-rather-than-clarity/

SEBI (LODR) (Second Amendment) Regulations, 2021

/0 Comments/in Corporate Laws, LODR, SEBI /by StaffSecond Wave of COVID-19 Triggers Relaxations 2.0

/0 Comments/in Covid-19, SEBI, SEBI and listing-related compliances - Covid-19 /by StaffIn order to ensure that companies remain compliant during ongoing relapse of COVID-19 pandemic, several temporary measures have been introduced by the Capital Markets Regulator w.r.t compliance under LODR regulations.

The measures announced will support companies and other industrial bodies to function and meet the timelines in the period of lockdown.

The list of all the relevant circulars in this regard, recapitulating the requirement of law, original timelines and the relaxations granted by the SEBI are summarized below:

| Sr.

No. |

Regulation /Circular | Particulars | Requirement/Frequency of filing | Original Due Date | Extended Date |

Entities with its specified securities listed[1] |

|||||

| 1 | 24A | Annual Secretarial Compliance Report | Sixty days from end of the financial yea | May 30, 2021 | June 30, 2021 |

| 2 | 33(3) | Financial Results | 45 days from the end of the quarter for quarterly results | May 15, 2021 | June 30, 2021 |

| 60 days from the end of Financial Year for Annual Financial Results | May 30, 2021 | ||||

| 3 | 32 read with circular dated December 24, 2019 | Statement of Deviation or variations in use of funds | 45 days from the end of the quarter for quarterly results | May 15, 2021 | June 30, 2021 |

| 60 days from the end of Financial Year for Annual Financial Results | May 30, 2021 | ||||

Entities with either of their NCDs/NCRPs/PDI listed[2] |

|||||

| 4 | 52(1) &(2) | Submission of Financial Results | For half yearly results: 45 days from the end of the half year | May 15, 2021 | June 30, 2021 |

| For Annual Results: 60 days from the end of Financial Year | May 30, 2021 | ||||

| 5 | 52(7) read with circular dated January 17, 2020 | Statement of deviation or variations in use of funds (along with financial results) | For half yearly results: 45 days from the end of the half year | May 15, 2021 | June 30, 2021 |

| For Annual Results: 60 days from the end of Financial Year | May 30, 2021 | ||||

Entitles with listed municipal bonds |

|||||

| 6 | SEBI circular dated November 13, 2019[3] | Annual Audited Financial Results | 60 days from end of the financial year | May 30, 2021 | June 30, 2021 |

Entities with listed commercial paper |

|||||

| 7 | SEBI Circular dated October 22, 2019[4] | Submission of financial results | 45 days from end of the half year | May 15, 2021 | June 30, 2021 |

| 60 days from end of the financial year | May 30, 2021 | ||||

[1] https://www.sebi.gov.in/legal/circulars/apr-2021/relaxation-from-compliance-with-certain-provisions-of-the-sebi-listing-obligations-disclosure-requirements-regulations-2015-due-to-the-covid-19-pandemic_50000.html

[2] https://www.sebi.gov.in/legal/circulars/apr-2021/relaxation-from-compliance-with-certain-provisions-of-the-sebi-listing-obligations-disclosure-requirements-regulations-2015-other-applicable-circulars-due-to-the-covid-19-pandemic_50001.html

[3] https://www.sebi.gov.in/legal/circulars/nov-2019/continuous-disclosures-and-compliances-by-listed-entities-under-sebi-issue-and-listing-of-municipal-debt-securities-regulations-2015_44942.html

[4] https://www.sebi.gov.in/legal/circulars/oct-2019/framework-for-listing-of-commercial-paper_44715.html

An overview of SPACs and related concerns in India

/0 Comments/in Companies Act 2013, Corporate Laws, SEBI /by Vinod Kothari ConsultantsESG concerns in corporate governance in India

/0 Comments/in Companies Act 2013, Corporate Laws, MCA, SEBI, Sustainability /by Vinod Kothari ConsultantsSikha Bansal, Partner (sikha@vinodkothari.com) and Payal Agarwal, Executive (payal@vinodkothari.com)

Introduction

ESG (where, E stands for Environment, S for Society, and G for Governance) is a term that has earned a lot of attention in the recent years. Related terms used are ESG investing, ESG reporting, ESG rating, etc. – all focussing on and circumscribing same factors.

The ESG analysis is sought as a measure of responsible investing, and goes beyond the traditional method of using only financial factors for evaluation of an investment or potential investment. ESG, in essence, recognises financial relevance of various non-financial elements which impact business in several ways. With sustainable development being the desirable result of whatever we do, efforts have been made to incorporate ESG issues in the analysis of the business performance as a whole.

In context of the same, we have tried identifying ESC concerns in India, in relation to corporate businesses. While in India, we have already something called ‘business responsibility reporting’, we need to see if this sufficiently captures the spirit of ESG and where it stands vis-à-vis global practices.

What is ESG?

Before we go on to the question why we need ESG, we need to understand what ESG, and also, why and how it has assumed so much of importance.

The emergence of ESG dates back to earlier years of 2000s. A report titled “Who Cares Wins: Connecting Financial Markets to a Changing World”[1], highlighted the emerging ESG issues and made several recommendations, including – (i) financial institutions should commit to integrating environmental, social, and governance factors in a more systematic way in research and investment processes, (ii) the companies a leadership role by implementing environmental, social and corporate governance principles and polices and to provide information and reports on related performance in a more consistent and standardised format, and (iii) investors shall explicitly request and reward research that includes environmental, social and governance aspects and to reward well-managed companies. Further, the report recommended that the financial analysts shall not only focus on ESG risks and risk management, but also consider ESG issues as a potential source of competitive advantage. The report also identified the following drivers through which good management of ESG issues can contribute to shareholder value creation[2].

Later, UNEP FI, in its 2005 Report[3], highlighted the distinction between ‘value-driven’ vs. ‘values-driven’ investment, and observes, “ESG considerations are capable of affecting investment decision-making in two distinct ways: they may affect the financial value to be ascribed to an investment as part of the decision-making process and they may be relevant to the objectives that investment decision-makers pursue.” This report noted that, the movement towards mainstream consideration of ESG issues in investment decision-making is a response of variety of factors, including, increasing evidence of the nexus between performance on ESG issues and financial performance, reputational concerns, consumer pressure, public opinion, introduction of corporate environmental reporting obligations, etc.[4]

Some institutional investors believed that environmental, social and governance (ESG) issues were not relevant to portfolio value, and were therefore not consistent with their fiduciary duties. However, in report titled “Fiduciary Duty in the 21st Century’[5], issued by UN agencies and PRI[6], it was clarified that the assumption is no longer supported, and that, failing to consider long-term investment value drivers, which include environmental, social and governance issues, in investment practice is a failure of fiduciary duty. The said report identifies critical importance of incorporating ESG standards into regulatory conceptions of fiduciary duty, for mainly three reasons – firstly, ESG incorporation is an investment norm; second, ESG issues are financially material; and thirdly, policy and regulatory frameworks are changing to require ESG incorporation.

Presently, there are several organisations, projects and reports focussing on ESG issues. These organisations may be governmental as well as independent. For instance, Global Reporting Initiative (GRI)[7] has formulated several standards[8] for sustainability reporting. See also, OECD (2017), Investment governance and the integration of environmental, social and governance factors.

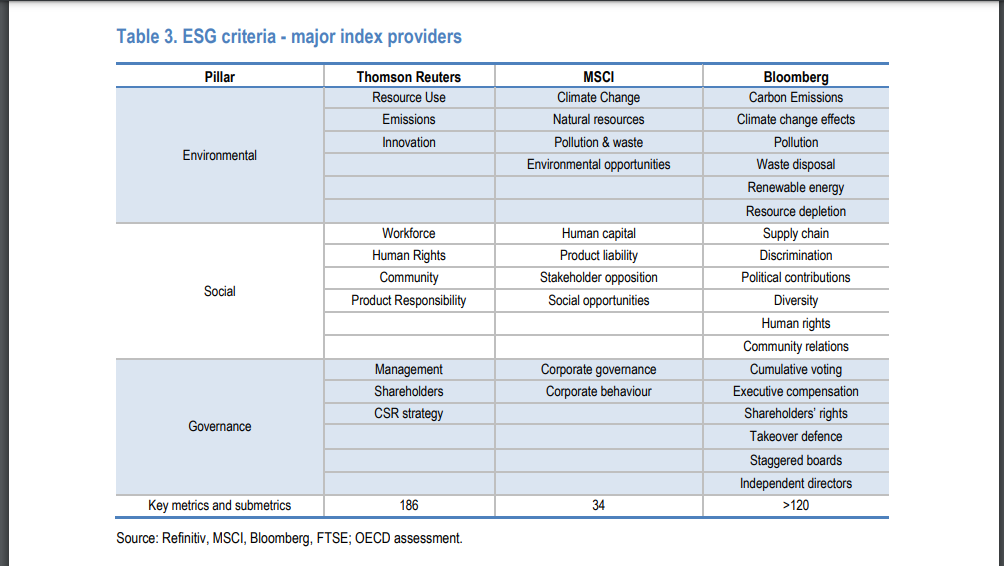

Pillars of ESG

ESG, as stated above, has 3 pillars – Environmental, Social and Governance Each of these pillars comprises of several factors which would be a ‘parameter’ in ESG analysis.

- “environmental” pillar focusses on creating a sustainable environment, where parameters such as impact of a company’s activities on the climate, company’s liability towards the environment, creating eco-friendly products, etc are checked and measured;

- “social” aspect focusses on creating value for the society, by laying emphasis on the human rights issues, workplace health and safety, labour training and management, interaction with communities, customer relationship etc;

- “governance” aspect covers issues on the corporate governance of a company and has two main elements: corporate structures, and corporate behaviour.

We have compiled a list of such factors[9] as below –

ESG Reporting

EU law requires large companies to disclose certain information on the way they operate and manage social and environmental challenges. EU’s directive, 2014/95/EU also called the non-financial reporting directive (NFRD), acknowledges that disclosure of non-financial information is vital for managing change towards a sustainable global economy by combining long-term profitability with social justice and environmental protection and lays down the rules on disclosure of non-financial and diversity information by large companies[10]. The Directive amends the accounting directive 2013/34/EU (by inserting Article 19a) so as to mandate inclusion of non-financial statement containing information to the extent necessary for an understanding of the undertaking’s development, performance, position and impact of its activity, relating to, as a minimum, environmental, social and employee matters, respect for human rights, anti-corruption and bribery matters, etc.

It further provides, “Where the undertaking does not pursue policies in relation to one or more of those matters, the non-financial statement shall provide a clear and reasoned explanation for not doing so.”

The EU has issued its guidelines to help companies disclose environmental and social information, and published guidelines on reporting climate-related information. Also, EU has also launched a public consultation on the review of the NFRD[11].

The OECD Report of 2017[12] compiles ESG reporting requirements (voluntary as well as mandatory) across the world by institutional investors, and by way of corporate disclosures. The report observes that the reporting requirements are usually voluntary (“comply or explain”) and are not prescriptive on the methods or metrics to be used.

The Financial Reporting Council (FRC) of UK released a discussion paper – “A Matter of Principles: The Future of Corporate Reporting” (2020). The discussion paper proposes a network of interconnected reports based on objectives rather than a single comprehensive annual report. The proposals include 3 reports – Business report, the full Financial Statements and a new Public Interest Report. It also focuses on widening the definition of materiality so that it does not remain limited to accounting standards only, but covers other wider range of activities that affect a company significantly. Section 6 of the this Report deals extensively with non-financial reporting, stated to include information relating to employees, suppliers, customers, the community, the environment and human rights.

In a study, “The consequences of mandatory corporate sustainability reporting: evidence from four countries (2015)”, it has been observed that even though the regulations often allowed companies, via comply or explain clauses, to choose not to make greater disclosure, there was a 30%-50% average increase in ESG disclosure as a result of the regulations being introduced (albeit from a low starting base). The greatest increase came in the first year of the regulations coming into force. All three types of disclosure – environmental, social and governance – increased. The findings, therefore, suggest that, contrary to popular belief that an increase in disclosure regulation imposes significant costs on companies and, therefore, has a negative impact on shareholders, the reality is that improved disclosure creates value for companies, not destroys it.

ESG Rating

Investors, institutional institutions, etc. would generally make use of ESG information for investment decisions through ESG ratings provided by ESG rating agencies[13]. This assessment and measurement often forms the basis of informal and shareholder proposal-related investor engagement with companies on ESG matters[14]. ESG factors can provide valuable insights into possible current and future environmental and social risks and opportunities for corporate entities, given the impact and dependence entities have on the environment and society. These ESG issues in turn have the potential to lead to a direct or indirect financial impact on the entity’s profits and investment returns[15].

See Boffo, R., and R. Patalano (2020), “ESG Investing: Practices, Progress and Challenges”, OECD Paris, for an elaborate discussion on ESG rating and indices and the methodologies adopted for the same. The paper also compiles ESG Criteria as used by major index providers as follows[16] –

Even though there are countries where ESG Reporting has been initiated as a voluntary or mandatory measure, the requirement of ESG rating has not been found to be mandated in any country by way of explicit regulations on the same. However, institutional investors, proxy advisor firms etc., are largely using these ratings while making investment decisions as part of making socially responsible investment.

ESG in Indian Context

The Indian legislation has been trying to cover the various aspects of ESG in a fragmented manner.

For instance, the board’s report shall disclose the conservation of energy, technology absorption, etc.[17] The aspects have to be dealt with in detail – the company shall disclose steps taken or impact on conservation of energy, steps taken to utilise alternate sources of energy, capital investment in energy conservation equipments, efforts towards technology absorption, etc. Besides, a director owes a fiduciary duty towards the community as well as for the protection of the environment[18]. Also, CSR activities include various socio-economic activities, required to be disclosed separately in the annual report[19]. However, the closest requirement is that of Business responsibility Reports (BRR) which has been mandated from ESG perspective only, as discussed below.

What is Business Responsibility Report (BRR)?

BRR or Business Responsibility Report can be said to be the foremost step in India in promoting non-financial reporting in India, on a mandatory basis. The initiative was one of the responses to India’s commitment towards the United Nations Guiding Principles on Business & Human Rights (UNGPs) and Sustainable Development Goals.

The BRR is based on the 9 principles in line with the ‘National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business’ (NVG)[20] issued by MCA. The guidelines state that the companies should not be just responsible but also socially, economically and environmentally responsible. Through such reporting, the guidelines expect that businesses will also develop a better understanding of the process of transformation that makes their operations more responsible. The NVG were further revised and the MCA formulated the ‘National Guidelines on Responsible Business Conduct’ (NGRBC)[21]. The said guidelines stipulated that the businesses should –

- conduct and govern themselves with integrity in a manner that is Ethical, Transparent and Accountable,

- provide goods and services in a manner that is sustainable and safe,

- respect and promote the well-being of all employees, including those in their value chains,

- respect the interests of and be responsive to all their stakeholders,

- respect and promote human rights,

- respect and make efforts to protect and restore the environment,

- when engaging in influencing public and regulatory policy, should do so in a manner that is responsible and transparent,

- promote inclusive growth and equitable development, and

- engage with and provide value to their consumers in a responsible manner.

The Securities and Exchange Board of India (SEBI), in 2012[22], through its listing conditions mandated the top 100 listed entities by market capitalisation to file BRR from ESG perspective. This was extended to top 500 companies in FY 2015-16[23]. The coverage has been extended to 1000 companies now[24]. In the year 2020, MCA issued Report of the Committee on the Business Responsibility Reporting, and SEBI issued a Consultation Paper on the format for Business Responsibility and Sustainability Reporting (BRSR, suggesting that BRR shall be renamed as BRSR). See our detailed analysis of the recommendations made in these reports.

See also, our earlier article on BRR. The eventual development in BRR framework is shown below –

BRR – Identifying ways to improve

ESG has no statutory definition, per se. We have tried identifying possible factors, based on various reports, indices, etc. which would reflect a holistic ESG perspective of an entity.

How effective is the present framework of BRR can be understood by way of the following table:

BRR vs ESG – Hits and Misses

| Hits | Misses |

| Climate change | Carbon emissions |

| Resource use , sustainable sourcing | Green building |

| Environmental protection and restoration | Biodiversity and land use |

| Renewable energy | Discharge of effluents |

| Water use | ————- |

| Energy efficiency | ————— |

| Clean tech | —————- |

| Safety of employees, customers | Privacy and data security |

| Skill upgradation training | Financial product liability |

| Labour management | ———— |

| Practice against child labour, sexual harassment, forced labour | ———— |

| Protection of human rights | ————- |

| Satisfactory redressal of customer complaints | ———— |

| Stakeholder engagement | ———— |

| Ethics and bribery | Board structure |

| Anti competitive behaviour | Executive pay |

| Unfair trade practices | Codes and values |

| —————– | Tax transparency |

Most of these gaps in the present BRR format are covered under the proposed BRSR. The BRSR has provisions for reporting on the carbon emissions of a company, discharge of other effluents by the company, and reporting relating to the privacy and data security of the customers etc. Also, the BRSR defines the scope of reporting for every item very precisely.

However, matters such as financial product liability and various aspects of governance still needs a dedicated space.

NSE Study of BRR Reporting in India

A study of NSE, while conducting the ESG analysis of Indian companies, has checked the disclosures provided under the BRR framework by the companies as part of its ESG analysis.

Some significant findings of the study has been pointed below:

- Among the nine principles, the least number of sample companies responded positively for disclosures on principle 7 (i.e., public advocacy). It had the lowest score on all four measures.

- One of the recurring reasons for not framing a policy on the principle 7 is that there is no specific/ formal policy on public advocacy. However, companies have stated that they indirectly covered aspects of principle 7 under other policies. This may be attributed to the fact that in India, advocacy, if at all done, is done in a non-transparent manner.

- The second worst response was with respect to the principles relating to ‘respect and promoting human rights’ and ‘engagement and providing value to customers and consumers’. Once again, probably, these concepts are yet to be assimilated in our system.

- Higher positive responses were found across principle 1 (ethics), principle 3 (employees), principle 4 (stakeholder), principle 6 (environment), and principle 8 (growth and equitable development – social responsibility). This can be attributed to the fact that some of these policies flow from various legal mandates in India. Hence, most companies have formal policies to comply with the law on these principles.

The study highlights that companies have largely scored better on policy disclosures followed by governance factor, compared to environment and social factors. This can be attributed to the fact that governance reforms have transformed into laws by various regulatory agencies within India, in the last two decades. Similarly, many policies have been mandated to be prepared by regulatory authorities. Hence, companies have scored higher on policy disclosure parameters.

Closing Thoughts

The BRR Reporting in India, in terms of key areas, goes a long way in presenting a holistic ESG scenario. Some structural changes in the extant format may facilitate better reporting.

Further, the Indian companies are found to perform well in the governance related matters, in comparison to the environmental and social factors, admittedly for the presence of various statutory requirements and regulatory supervision on the governance requirements of a company. However, the companies need to improve their environmental and social scores as well.

[1] December, 2004. The Report was a joint initiative of financial institutions which were invited by United Nations Secretary-General Kofi Annan to develop guidelines and recommendations on how to better integrate environmental, social and corporate governance issues in asset management, securities brokerage services and associated research functions. See also, “Who Cares Wins” : One Year On” – A Review of the Integration of Environmental, Social and Governance Value Drivers in Asset Management, Financial Research and Investment Processes, published by the International Finance Corporation.

[2] Refer, page 12 exhibit 9 of the said Report

[3] A legal framework for the integration of environmental, social and governance issues into institutional investment”

[4] Refer, page 24 of the said Report.

[5] The website is https://www.fiduciaryduty21.org/ . The report has been last updated in the year 2019.

[6] Principles of Responsible Investing (PRI) is a United Nations-supported initiative, launched in 2006 by UNEP Finance Initiative and the UN Global Compact.It is a network of international investors working together to put the six Principles for Responsible Investment into practice. The PRI were devised by the investment community and reflect the view that environmental, social and governance (ESG) issues can affect the performance of investment portfolios and therefore must be given appropriate consideration by investors if they are to fulfill their fiduciary (or equivalent) duty. In implementing the Principles, signatories contribute to the development of a more sustainable global financial system.

[7] GRI was founded in Boston in 1997 following public outcry over the environmental damage of the Exxon Valdez oil spill. The aim was to create the first accountability mechanism to ensure companies adhere to responsible environmental conduct principles, which was then broadened to include social, economic and governance issues. The first version of what was then the GRI Guidelines (G1) published in 2000 – providing the first global framework for sustainability reporting. The following year, GRI was established as an independent, non-profit institution. In 2016, GRI transitioned from providing guidelines to setting the first global standards for sustainability reporting – the GRI Standards.

[8] The GRI standards can be accessed here https://www.globalreporting.org/standards/

[9] The list is a compilation of the various factors identified by various organisations and reports such as, PRI, MSCI Research, NSE-SES report on ESG analysis of 50 Indian companies, etc.

[10] EU rules on non-financial reporting only apply to large public-interest companies with more than 500 employees. This covers approximately 6,000 large companies and groups across the EU.

[12] OECD (2017) Investment governance and integration of environmental, social and governance factors

[13] Some well- known ESG rating providers include: (a) Dow-Jones Sustainability Index, (b) S & P Global Ratings, (c) MSCI ESG Research etc.

[14] https://corpgov.law.harvard.edu/2017/07/27/

[15] S&P Global Ratings: Exploring Links To Corporate Financial Performance

[16] Source: Boffo, R., and R. Patalano (2020), “ESG Investing: Practices, Progress and Challenges”, OECD Paris

[17]Companies Act, 2013, section 134(3)(m), read with rule 8 of the Companies (Accounts) Rules, 2014

[18] Ibid, section 166.

[19] Ibid, section 135 read with Companies (Corporate Social Responsibility Policy) Rules, 2014.

[20] 2011. A refinement of earlier Corporate Social Responsibility Voluntary Guidelines 2009, released by the Ministry of Corporate Affairs in December 2009.

[21] 2019. See Press Release.

[22] CIR/CFD/DIL/8/2012 dated 13th August, 2012

[23] See update, and notification.

[24] See notification.

Revised Regulatory Framework for IDs of listed entities in India

/0 Comments/in Corporate Laws, LODR, SEBI /by Vinod Kothari Consultants-Independence becomes stricter!

Payal Agarwal, Executive ( payal@vinodkothari.com )

Updated on 6th August, 2021

Introduction

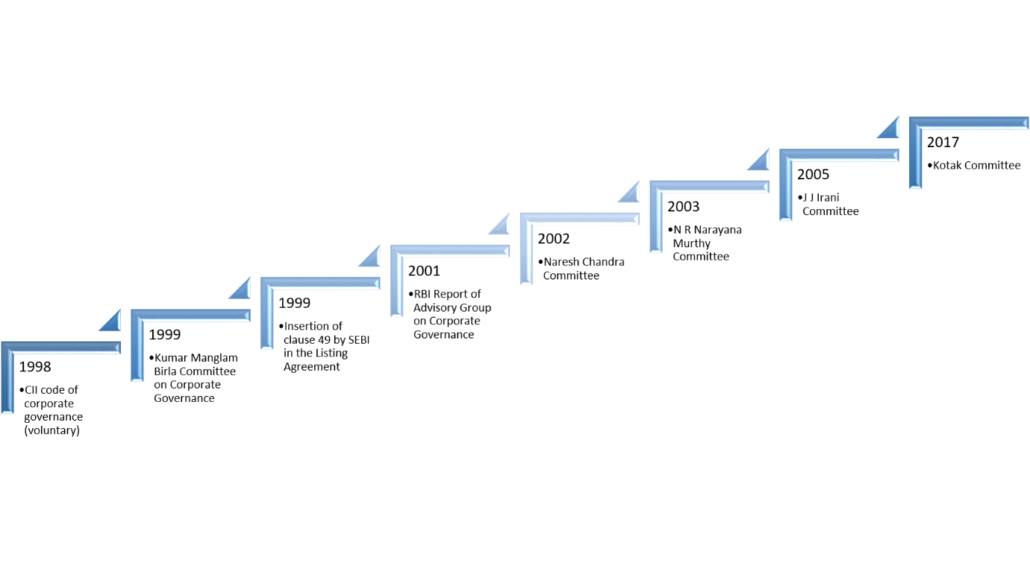

The concept of independent directors was first introduced in the Desirable Corporate Governance Code issued by the Confederation of Indian Industry[1] followed by the recommendation in the Corporate Governance Committee constituted by SEBI and headed by Mr. Kumar Mangalam Birla[2] (Kumar Mangalam Birla Committee). Later in the year 2000, SEBI incorporated the recommendations of the Kumar Mangalam Birla Committee under Clause 49 of the Listing Agreement[3]. Independent directors have always been regarded as the means to strengthen the corporate governance framework in a public or a listed company.

Keeping in mind the intent of the lawmakers to introduce the requirement for having Independent Directors (IDs) on the board of certain companies, it is understood that SEBI cannot accept a situation where the IDs themselves turnout to either be ineffective for strengthening the corporate governance or act against the interest of the public shareholders. Therefore, with the intent to further strengthen the role and responsibility of IDs, SEBI had introduced a Consultation Paper[4] (Paper) on review of regulatory provisions related to IDs on 2nd of March, 2021. Through this Paper, SEBI had proposed to make stringent regulatory changes in the provisions of the Listing Obligation and Disclosure Requirements Regulations (LODR/ Listing Regulations) relating to

- eligibility criteria of IDs,

- role of Nomination and Remuneration Committee (NRC),

- composition of Audit Committee (AC) and Nomination and Remuneration Committee (NRC)

- appointment and removal procedure of IDs

Further, SEBI, in its Board Meeting held in July, 2021 discussed to review the regulatory framework applicable on IDs and incorporate amendments in the Listing Regulations based on public comments and discussions w.e.f. 1st January, 2022. However, the changes in the regulatory framework as notified on 3rd August, 2021 vide SEBI (Listing Obligations and Disclosure Requirements) (Third Amendment) Regulations, 2021 [the Amendment Regulations],was initially notified to be applicable with immediate effect whose applicability has now been deferred to the date as originally decided in the Board Meeting of SEBI, i.e., 1st January, 2021 .

A brief snippet on the changes can be accessed here.

This write up critically covers the changes in the regulatory framework for IDs pursuant to the Amendment Regulations and discusses the potential impact of the same on the working of a company including the corporate governance aspects. The amendments are discussed below under the relevant heads.

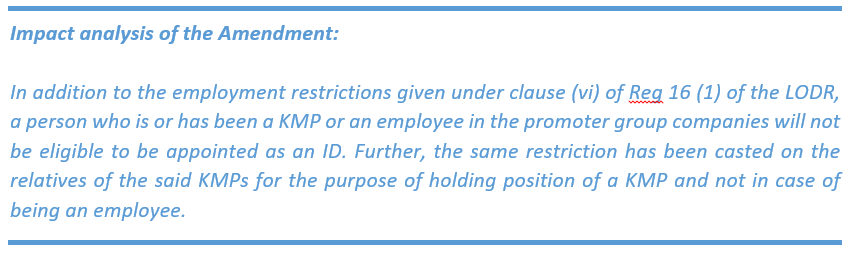

1.Widening the criteria for independence

Regulation 16(1) of the Listing Regulations provides the definition of “independent director”. SEBI seeks to broaden the criteria of “independence” by expanding the outreach of the restrictions given under the said Regulation and at the same time standardising the cooling off period provided therein.

Amendments in line with the Paper

The Paper proposed two amendments in the independence criteria of IDs in addition to the extant definition which have been made applicable with the notification of the Amendment Regulations:

- KMPs and employees of companies falling under the promoter group of the listed entity & relatives of such KMPs should not be eligible to act as an ID until a cooling off period of 3 years has passed.

This is in addition to the existing fetter on the KMP and employee of the listed entity, its holding, subsidiary or associate company.

- Another amendment is with regard to increasing of the cooling-off period in Regulation 16(1)(iv) and Reg 16(1)(v) of the Listing Regulations.

Currently, the Regulations specify a cooling-off period of 2 years in case of material pecuniary transaction between a person or his relative and the listed entity or its holding, subsidiary or associate company. This has been increased to 3 years to make it similar to the other provisions of Regulation 16 where a cooling-off period of 3 years is required to be satisfied.

Amendments not proposed in the Paper

Certain amendments not proposed in the Paper but brought by means of the Amendment Regulations are given below:

- The criteria under Regulation 16(b)(v) earlier provided only for the pecuniary relationship of the relatives of proposed ID with the company. This has been amended in line with Section 149(6)(d) of the Companies Act, 2013.

- Further, a proviso has been inserted after Regulation 16(b)(vi)(A) providing a relief to the proposed ID appointment when the relative of such proposed appointee is a mere employee and not KMP.

Rationale behind the Amendment Regulations:

This amendment aims to make the independence criteria more broader and stricter so that there is no way by which the candidates influenced by promoter group entities can take undue benefit due to any loopholes in the language of law.

On the other hand, the amendment increasing the cooling off period is for making the same uniform all through the independence criteria.

Further, it has to be noted that the amendments are in harmonisation with the provisions of the Companies Act, 2013, as also contemplated in the Board meeting of SEBI and does not bring in any drastic changes in the existing requirements apart from looping in promoter related entities as well.

Actionable arising pursuant to the Amendments

- Revised declaration to be obtained so as to ensure compliance with meeting the revised independence criteria as soon as possible.

2.Process for appointment/ re-appointment and removal of independent directors

The Paper proposed to bring a major change in the procedure of appointment/ re-appointment as well as removal of IDs by means of “dual approval”. However, the said proposal has not been brought under the current Amendment Regulations. The changes have been brought to have the following impact:

| Matter | Requirements under extant provisions | Proposal under Paper | Provisions as per Amendment Regulations |

| Appointment/ Removal of IDs | Ordinary Resolution | § Dual approval (Special Resolution in case the proposal fails)

§ Prior approval of Shareholders |

§ Special Resolution

§ Shareholder’s approval required within earlier of – § Next general meeting § 3 months from appointment of a person on board |

| Re-appointment of IDs | Special Resolution | Dual approval (Special Resolution in case the proposal fails)

|

Special Resolution

(no change from the existing provisions) |

| Filling of vacancy of IDs | Later of the following –

§ Next board meeting § 3 months from vacancy |

Within 3 months from vacancy | Within 3 months from vacancy |

Further, in case of appointment of any other director in board, whether executive, non-executive, additional director, director appointed due to casual vacancy etc , every such appointment has to be regularised by the shareholders within a maximum period of 3 months from such an appointment.

Rationale for such Amendments

- Requirement of passing a special resolution

While SEBI had, in its Paper, proposed the “dual approval” model in line with the legislative requirements of Israel and UK, especially in interest of the minority shareholders, the Board disclosed that majority of comments were against such proposal due to practical difficulties in implementation of the same, citing causes such as delay in appointment due to an unintended deadlock, voting skews in case of minority public shareholders having significant shareholding etc. Due to such practical difficulties, a balanced approach has been chosen to require a special resolution for all cases related to appointment, re-appointment as well as removal.

- Time gap available to regularise the appointment by the shareholders

Similarly, as regards the proposed prior approval before appointment, the majority of comments dissented against the proposal citing reasons of additional compliance burden on companies, giving a midway suggesting that while the prior approval should not be mandated, a timeline should be provided within which the appointment should be approved by the shareholders.

Actionable pursuant to the Amendments

After the Amendment Regulations come into force, it would be necessary to regularise the appointment of all directors appointed in additional capacity within 3 months of the board meeting in which they were appointed by way of shareholders’ approval. Considering the fact that the amendments have been notified well in advance, the companies will not be able to excuse themselves for some further time after the amendments come into effect.

The amendments can be explained with the help of following examples –

1.A director has been appointed in additional capacity on 10th December, 2021. His appointment will have to be approved by shareholders within 3 months, i.e., 10th March, 2022.

2. A director has been appointed as additional director on 20th August, 2021 in the board of a company. The period of 3 months ends on 20th November, 2021. However, since the amendments are effective from 1st January, 2022, he may continue as an additional director in the board of the company till 31st December, 2021. However, if his appointment is not been approved by the shareholders within such period of time, he’ll have to resign from his position. The proposal of his appointment will have to be re-considered afresh by the NRC and board of the company, followed by a shareholders approval within 3 months.

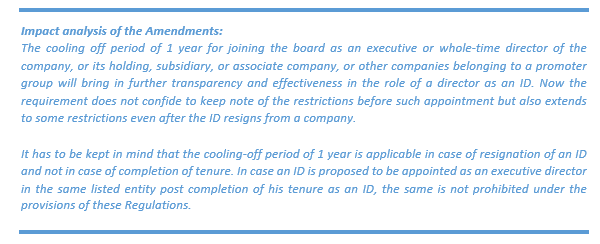

3.Resignation of IDs

Through the Paper, it became clear that the intention of SEBI is to strictly monitor the resignation of the IDs where the real cause of resignation should be clearly known in place of the apparent cause the company and ID may try to show.

The Paper provided for a cooling off period of 1 year in two cases:

- Where the ID resigns on account of discretionary reasons of pre-occupation, other commitments or personal reasons – Mandatory cooling period of 1 year before joining another Board as an ID;

- Similar cooling period of 1 year in case of transition from ID to WTD in the same company.

Further, the Paper also proposed that the complete resignation letter of the outgoing ID needs to be disclosed to the stock exchange. The same has been made effective vide the Amendment Regulations.

While the proposal of cooling-off period in case of transition of an ID as a whole-time director in the same company has been implemented by means of insertion of sub-regulation (11) in existing Regulation 25, the requirement of such cooling-off period has been further extended to the joining of such person as a whole-time or executive director in the holding, subsidiary, associate or other group companies belonging to the same promoter(s) as well.

The first proposal with regard to the cooling-off period in case of resignation due to personal / discretionary reasons has not been brought into force on account of comments received from public raising concerns over showing ingenious reasons in resignation letter to avoid falling into the cooling-off requirements, or compelled to work in pressurizing circumstances.

Rationale for such Amendments

The cooling off period of 1 year before transition of an ID as a WTD in the same company has been proposed to ensure there is no compromise in the independence of the director during his term as an ID.

It is observed that IDs often resign for reasons such as pre-occupation, other commitments or personal reasons and then join the boards of other companies. There is, therefore, a need to further strengthen the disclosures around resignation of Independent Directors. However, considering the comments received from majority of public, such a proposal has not been implemented.

4. Role of NRC in selection of candidates for the role of ID

The NRC is required to recommend the persons to be appointed as IDs in the board of the company. Though the Listing Regulations already requires the NRC to formulate criteria regarding such appointment, the role of NRC, in practice, does not suffice the intent of law properly.

Therefore, vide the Amendment Regulations, SEBI has brought amendment to Para A of Part D of Schedule II of the Listing Regulations thereby specifying the following procedure for selection of candidates for the role of NRC. The procedure is in line with the proposal laid down in the Paper.

- Evaluate the balance of skills, knowledge and experience

- On the basis of above evaluation, prepare description of required roles and capabilities required for that particular appointment of ID

- Identify the suitable candidate fitting the said description

- For identifying persons, NRC may

- use services of external agencies

- May consider candidates from wide variety of backgrounds ( for diversity)

- And consider time commitment of appointees

- The person identified and recommend to the Board should possess capabilities as per description.

Rationale for such Amendment

While the law requires NRC to lay down detailed criteria of qualifications and attributes for directors, apparently there is a lack of transparency in the process followed by NRC. There is therefore, a need to prescribe disclosures regarding the process followed by NRC for selection of candidates for the post of ID.

Actionable pursuant to the Amendments

Any ID appointed on the board of a listed company after the Amendment Regulations come into effect, shall be appointed after following the due procedure as provided in the Amendment Regulations. This implies that even where the meeting of NRC for recommendation of appointment of a person as an ID is held before the Amendment Regulations coming into force, due process will be required to be followed. This is also required to ensure that the additional disclosures required to be made in the notice of general meeting for appointing IDs are available with the company (discussed in later parts of the article).

5.Modification in composition of NRC and AC

The Paper also sought to bring in some changes in the constitution of NRC and AC. The following changes were proposed –

- NRC to comprise of 2/3rds of ID (earlier atleast one-half IDs required)

- AC to comprise of 2/3rds of IDs and 1/3rds of Non-executive directors(NED) that are not related to promoter (presently, the AC requires atleast 3 members of which atleast 2/3rds shall be IDs)

The proposals have been implemented partially. While the changes in composition of NRC as proposed in the Paper has been made effective vide the Amendment Regulations, the changes in composition of AC has been rejected on account of decreasing flexibility of the companies.

Approval of Related Party Transaction by AC

Rather, an important amendment has been made to balance out between the flexibility of the companies on one end and the efficiency of the AC on another. Post amendment, all related party transactions of the companies are required to be approved by only the IDs of the Audit Committee. The executive directors, who are a part of the AC, are not allowed to approve such transactions, however, restriction is not with respect to voting and it is understood that they may accord their dissent to a proposed related party transaction. However, practically, there may be rarely any instance, where the related party transaction, otherwise approved by the independent directors of an AC, has been dissented to by other members of the AC. Further, it shall apply to all the prospective related party transactions, and shall not affect the related party transactions which have already been approved prior to the amendments including the ones under omnibus approval.

A new proviso under Regulation 23(2) has been inserted as follows –

“Provided that only those members of the audit committee, who are independent directors, shall approve related party transactions.”

Rationale for such Amendment

Considering the importance of the Audit Committee with regard to related party transactions and financial matters, it was proposed that AC shall comprise of 2/3rd IDs and 1/3rd Non-Executive Directors (NEDs) who are not related to the promoter, including nominee directors, if any. However, the comments received from the public stakeholders have highlighted the risk of losing flexibility by the companies in case of such rigid composition. Therefore, in view of the same, while the composition of the AC has been kept intact, the requirement of only IDs approving the related party transactions have been made effective. The same serves as a balanced approach ensuring both flexibility of companies and efficiency of Audit Committee.

6.Enhanced disclosure requirements

The Amendment Regulations provide for some additional disclosure requirements in line with the amendments as follows:

At the time of appointment –

- Details of companies from which the listed entities have resigned in the previous three years

- Skills and capabilities required for the role

- Manner in which the proposed appointee meets such requirements

At the time of resignation –

- Complete letter of resignation

- Names of listed entities in which the resigning director holds directorships, indicating the category of directorship and membership of board committees, if any

Actionable pursuant to the Amendments

In the light of the amendments, additional details shall be required to be made available to the shareholders for appointment of independent directors.

Similarly, in case of resignation, the letter of resignation and details of continuing directorship shall be made filed with the stock exchanges by the listed entity as received from the resigning ID.

7. Requirement of D&O Insurance

| Earlier requirement | Requirement post amendment | |

| Applicable to | Top 500 listed entities | Top 1000 listed entities |

| With effect from | 1st October, 2018 | 1st January, 2022 |

Conclusion

The changes brought vide the Amendment Regulations are extremely significant and will have a remarkable impact on the corporate governance of listed entities. More transparency may be achieved by means of these amendments like enhanced disclosure on resignation, appointment, selection of candidates as IDs, etc. of all, the amendments seek to check the interference of promoters at all levels of corporate governance and ensures much more independence to the IDs where the IDs will be independent in both letter and spirit. In areas where the proposals under the Paper seemed to be more rigid, the Amendment Regulations have allowed the companies to take breath in line with the comments received from the public shareholders. However, some amendments required immediate actionable, and especially, at this point of time, when most of the companies are having their AGMs, which was creating a hassle for the listed companies. However, SEBI has come up with a clarification deferring the applicability of the Amendment Regulations. Further, a proposal with respect to remuneration of IDs allowing stock-options to them has been dropped, atleast for the time being in the said Amendment Regulations.

[1] http://www.nfcg.in/UserFiles/ciicode.pdf

[2] http://www.nfcg.in/UserFiles/kumarmbirla1999.pdf

[3] https://www.sebi.gov.in/legal/circulars/feb-2000/corporate-governance_17930.html

[4] https://www.sebi.gov.in/reports-and-statistics/reports/mar-2021/consultation-paper-on-review-of-regulatory-provisions-related-to-independent-directors_49336.html

Our other articles on related topic can be accessed here –

SEBI’s move to allow stock options to independent directors – Whether a threat to independence?

/0 Comments/in Companies Act 2013, Corporate Laws, SEBI /by Vinod Kothari ConsultantsAanchal Kaur Nagpal (corplaw@vinodkothari.com)

It is said that when morality has a fight against profit, it is rarely that profit loses. Humans are always looking for more and quite often give in to their greed. This is the underlying rationale when it comes to safeguarding the independence of an independent director– to cut off anything that would lure them to compromise the interests of the company.

At the same time, given the crucial role they play in corporate governance and the increasing expectations for ensuring a balance between stakeholders’ interests and ensuring an independent insider’s view on the company’s affairs, they need to be sufficiently compensated for the time they spend and the risk-taking they do as directors.

While adequate compensation is crucial, there is a fine line to be drawn between ‘compensation’ and ‘pecuniary interest’. A balance is required to be maintained where IDs are paid remuneration in fair proportion to the value they bring to an organization while also not compromising their ability to pass an independent judgement.