Archive for month: March, 2020

Bridging the gap between Ind AS 109 and the regulatory framework for NBFCs

/3 Comments/in Financial Services, Housing finance, Indian Accounting Standards (Ind AS), NBFCs, RBI /by Vinod Kothari Consultants-Abhirup Ghosh

The Reserve Bank of India, on 13th March, 2020, issued a notification[1] providing guidance on implementation of Indian Accounting Standards by non-banking financial companies. This guidance comes after almost 2 years from the date of commencement of first phase of implementation of Ind AS for NBFCs.

The intention behind this Notification is to ensure consistency in certain areas like – asset classification, provisioning, regulatory capital treatment etc. The idea of the Notification is not to provide detailed guidelines on Ind AS implementation. For areas which the Notification has not dealt with, notified accounting standards, application guidance, educational material and other clarifications issued by the ICAI should be referred to.

The Notification is addressed to all non-banking financial companies and asset reconstruction companies. Since, housing finance companies are now governed by RBI and primarily a class of NBFCs, this Notification should also apply to them. But for the purpose of this write-up we wish to restrict our scope to NBFCs, which includes HFCs, only.

The Notification becomes applicable for preparation of financial statements from the financial year 2019-20 onwards, therefore, it seems the actions to be taken under the Notification will have to be undertaken before 31st March, 2020, so far as possible.

In this article we wish to discuss the outcome the Notification along with our comments on each issue. This article consists of the following segments:

- Things to be done by the Board of Directors (BOD)

- Expected Credit Losses (ECL) and prudential norms

- Dealing with defaults and significant increase in credit risk

- Things to be done by the Audit Committee of the Board (ACB)

- Computation of regulatory capital

- Securitisation accounting and prudential norms

- Matters which skipped attention

1. Things to be done by the BOD

The Notification starts with a sweeping statement that the responsibility of preparing and ensuring fair presentation of the financial statements lies with the BOD of the company. In addition to this sweeping statement, the Notification also demands the BOD to lay down some crucial policies which will be essential for the implementation of Ind AS among NBFCs and they are: a) Policy for determining business model of the company; and b) Policy on Expected Credit Losses.

(A) Board approved policy on business models: The Company should have a Board approved policy, which should articulate and document the business models and portfolios of the Company. This is an extremely policy as the entire classification of financial assets, depends on the business model of the NBFC. Some key areas which, we think, the Policy should entail are:

There are primarily three business models that Ind AS recognises for subsequent measurement of financial assets:

(a) hold financial assets in order to collect contractual cash flows;

(b) hold financial assets in order to collect contractual cash flows and also to sell financial assets; and

(c) hold financial assets for the purpose of selling them.

The assessment of the business model should not be done at instrument-by-instrument level, but can be done at a higher level of aggregation. But at the same time, the aggregation should be not be done at an entity-level because there could be multiple business models in a company.

Further, with respect the first model, the Ind AS states that the business model of the company can still be to hold the financial assets in order to collect contractual cash flows even if some of the assets are sold are expected to be sold in future. For instance, the business model of the company shall remain unaffected due to the following transactions of sale:

(a) Sale of financial assets due to increase in credit risk, irrespective of the frequency or value of such sale;

(b) Sale of cash flows are made close to the maturity and where the proceeds from the sale approximate the collection of the remaining contractual cash flows; and

(c) Sale of financial assets due to other reasons, namely, to avoid credit concentration, if such sales are insignificant in value (individually or in aggregate) or infrequent.

For the third situation, what constitutes to insignificant or infrequent has not been discussed in the Ind AS. However, reference can be drawn from the Report of the Working Group of RBI on implementation of Ind AS by banks[2], which proposes that there could be a rebuttable presumption that where there are more than 5% of sale, by value, within a specified time period, of the total amortised cost of financial assets held in a particular business model, such a business model may be considered inconsistent with the objective to hold financial assets in order to collect contractual cash flow.

However, we are not inclined to take the same as prescriptive. Business model of an entity is still a question hinging on several relevant factors, primarily the profit recognition, internal reporting of profits, pursuit of securitization/direct assignment strategy, etc. Of course, the volume may be a persuasive factor.

The Notification also requires that the companies should also have a policy on sale of assets held under amortised cost method, and such policy should be disclosed in the financial statements.

(B) Board approved policy on ECL methodology: the Notification requires the companies to lay down Board approved sound methodologies for computation of Expected Credit Losses. For this purpose, the RBI has advised the companies to use the Guidance on Credit Risk and Accounting for Expected Credit Losses issued by Basel Committee on Banking Supervision (BCBS)[3] for reference.

The methodologies laid down should commensurate with the size, complexity and risks specific to the NBFC. The parameters and assumptions for risk assessment should be well documented along with sensitivity of various parameters and assumptions on the ECL output.

Therefore, as per our understanding, the policy on ECL should contain the following –

(a) The assumptions and parameters for risk assessment – which should basically talk about the probabilities of defaults in different situations. Here it is important to note that the assumptions could vary for the different products that the reporting entity offers to its customers. For instance, if a company offers LAP and auto loans at the same time, it cannot apply same set of assumptions for both these products.

Further, the policy should also lay down indicators of significant increase in credit risk, impairment etc. This would allow the reporting entity in determining classifying its assets into Stage 1, Stage 2 and Stage 3.

(b) Backtesting of assumptions – the second aspect of this policy should deal with backtesting of the assumptions. The policy should provide for mechanism of backtesting of assumption on historical data so as to examine the accuracy of the assumptions.

(c) Sensitivity analysis – Another important aspect of this policy is sensitivity analysis. The policy should provide for mechanism of sensitivity analysis, which would predict the outcome based on variations in the assumptions. This will help in identifying how dependant the output is on a particular input.

Further, the Notification states that any change in the ECL model must be well documented along with justifications, and should be approved by the Board. Here it is important to note that there could two types of variations – first, variation in inputs, and second, variation in the model. As per our understanding, only the latter should be placed before the BOD for its approval.

Further, any change in the assumptions or parameters or the ECL model for the purpose of profit smothering shall seriously be frowned upon by the RBI, as it has clearly expressed its opinion against such practices.

2. Expected Credit Losses (ECL) and prudential norms

The RBI has clarified that whatever be the ECL output, the same should be subject to a regulatory floor which in this case would be the provisions required to be created as the IRAC norms. Let us understand the situation better:

The companies will have to compute two types of provisions or loss estimations going forward – first, the ECL as per Ind AS 109 and its internal ECL model and second, provisions as per the RBI regulations, which has to be computed in parallel, and at asset level.

The difference between the two will have to be dealt with in the following manner:

(A) Impairment Reserve: Where the ECL computed as per the ECL methodology is lower than the provisions computed as per the IRAC norms, then the difference between the two should be transferred to a separate “Impairment Reserve”. This transfer will not be a charge against profit, instead, the Notification states that the difference should be appropriated against the profit or loss after taxes.

Interestingly, no withdrawals against this Impairment Reserve is allowed without RBI’s approval. Ideally, any loss on a financial asset should be first adjusted from the provision created for that particular account.

Further, the continuity of this Impairment Reserve shall be reviewed by the RBI going forward.

A large number of NBFCs have already presented their first financial statements as per Ind AS for the year ended 31st March, 2019. There were two types of practices which were followed with respect to provisioning and loss estimations. First, where the NBFCs charged only the ECL output against its profits and disregarded the regulatory provisioning requirements. Second, where the NBFCs computed provisions as per regulatory requirements as well as ECL and charged the higher amount between the two against the profits.

The questions that arise here are:

(a) For the first situation, should the NBFCs appropriate a higher amount in the current year, so as to compensate for the amount not transferred in the previous year?

(b) For the second situation, should the NBFCs reverse the difference amount, if any, already charged against profit during the current year and appropriate the same against profit or loss?

The answer for both the questions is negative. The provisions of the Notification shall have to be implemented for the preparation of financial statements from the financial year 2019-20 onwards, hence, we don’t see the need for adjustments for what has already been done in the previous year’s financial statements.

(B) Disclosure: The difference between the two will have to be disclosed in the annual financial statements of the company, format of which has been provided in the Notification[4]. Going by the format, the loss allowances created on Stage 1, Stage 2 and Stage 3 cases will have to be shown separately, similarly, the provisions computed on those shall also have to be shown separately.

While Stage 1 and Stage 2 cases have been classified as standard assets in the format, Stage 3 cases cover sub-standard, doubtful and loss assets.

Loss estimations on loan commitments, guarantees etc. which are covered under Ind AS but does not require provisioning under the RBI Directions should also be presented.

3. Dealing with defaults and significant increase in credit risk

Estimation of expected losses in financial assets as per Ind AS depends primarily on credit risk assessment and identifying situations for impairment. Considering the importance of issue, the RBI has voiced its opinion on identification of “defaults” and “significant increase in credit risk”.

(A)Defaults: The next issue which has been dealt with in the Notification is the meaning of defaults. Currently, there seems to be a departure between the Ind AS and the regulatory definition of “defaults”. While the former allows the company to declare an account as default based on its internal credit risk assessments, the latter requires that all cases with delay of more than 90 days should be treated as default. The RBI expects the accounting classification to be guided by the regulatory definition of “defaults”.

If a company decides not to impair an account even after a 90 days delay, then the same should be approved by the Audit Committee.

This view is also in line with the definition of “default” proposed by the BASEL framework for IRB framework, which is:

“A default is considered to have occurred with regard to a particular obligor when one or more of the following events has taken place.

(a) It is determined that the obligor is unlikely to pay its debt obligations (principal, interest, or fees) in full;

(b) A credit loss event associated with any obligation of the obligor, such as a charge-off, specific provision, or distressed restructuring involving the forgiveness or postponement of principal, interest, or fees;

(c) The obligor is past due more than 90 days on any credit obligation; or

(d) The obligor has filed for bankruptcy or similar protection from creditors.”

Further, the number of cases of defaults and the total amount outstanding and overdue should be disclosed in the notes to the financial statements. As per the current regulatory framework, NBFCs have to present the details of sub-standard, doubtful and loss assets in its financial statements. Hence, this disclosure requirement is not new, only the sub-classification of NPAs have now been taken off.

(B) Dealing with significant increase in credit risk: Assessment of credit risk plays an important role in ECL computation under Ind AS 109. Just to recapitulate, credit risk assessments can be lead to three possible situations – first, where there is no significant increase in credit risk, second, where there is significant increase in credit risk, but no default, and third, where there is a default. These three outcomes are known as Stage 1, Stage 2 and Stage 3 cases respectively.

In case an account is under Stage 1, the loss estimation has to be done based on probabilities of default during next 12 months after the reporting date. However, if an account is under Stage 2 or Stage 3, the loss estimation has to be done based on lifetime probabilities of default.

Technically, both Stage 1 and Stage 2 cases would fall under the definition of standard assets for the purpose of RBI Directions, however, from accounting purposes, these two stages would attract different loss estimation techniques. Hence, the RBI has also voiced its opinion on the methodology of credit risk assessment for Stage 2 cases.

The Notification acknowledges the presence of a rebuttable presumption of significant increase in credit risk of an account, should there be a delay of 30 days or more. However, this presumption is rebuttable if the reporting entity has reasonable and supportable information that demonstrates that the credit risk has not increased significantly since initial recognition, despite a delay of more than 30 days. In a reporting entity opts to rebut the presumption and assume there is no increase in credit risk, then the reasons for such should be properly documented and the same should be placed before the Audit Committee.

However, the Notification also states that under no circumstances the Stage 2 classification be deferred beyond 60 days overdue.

4. Things to be done by the ACB

The Notification lays down responsibilities for the ACB and they are:

(A) Approval of any subsequent modification in the ECL model: In order to be doubly sure about that any subsequent change made to the ECL model is not frivolous, the same has to be placed before the Audit Committee for their approval. If approved, the rationale and basis of such approval should be properly documented by the company.

(B) Reviewing cases of delays and defaults: As may have been noted above, the following matters will have to be routed through the ACB:

(a) Where the reporting entity decides not to impair an account, even if there is delay in payment of more than 90 days.

(b) Where as per the risk assessment of the reporting entity, with respect to an account involving a delay of more than 30 days, it rebuts that there is no significant increase in credit risk.

In both the cases, if the ACB approves the assumptions made by the management, the approval along with the rationale and justification should be properly documented.

5. Computation of Regulatory Capital

The Notification provides a bunch of clarifications with respect to calculation of “owned funds”, “net owned funds”, and “regulatory capital”, each of which has been discussed here onwards:

(A) Impact of unrealised gains or losses arising on fair valuation of financial instruments: The concept of fair valuation of financial instruments is one of the highlights of IFRS or Ind AS. Ind AS 109 requires fair valuation of all financial instruments. The obvious question that arises is how these gains or losses on fair valuation will be treated for the purpose of capital computation. RBI’s answer to this question is pretty straight and simple – none of these of gains will be considered for the purpose of regulatory capital computation, however, the losses, if any, should be considered. This view seems to be inspired from the principle of conservatism.

Here it is important to note that the Notification talks about all unrealised gains arising out of fair valuation of financial assets. Unrealised gain could arise in two situations – first, when the assets are measured on fair value through other comprehensive income (FVOCI), and second, when the assets are measured on fair value through profit or loss (FVTPL).

In case of assets which are fair valued through profit or loss, the gains or losses once booked are taken to the statement of profit or loss. Once taken to the statement of profit or loss, these gains or losses lose their individuality. Further, these gains or losses are not shown separately in the Balance Sheet and are blended with accumulated profits or losses of the company. Monitoring the unrealised gains from individual assets would mean maintenance of parallel accounts, which could have several administrative implications.

Further, when these assets are finally sold and gain is realised, only the difference between the fair value and value of disposal is booked in the profit and loss account. It is to be noted here that the gain on sale of assets shown in the profit and loss account in the year of sale is not exactly the actual gain realised from the financial asset because a part of it has been already booked during previous financial years as unrealised gains. If we were to interpret that by “unrealised gains” RBI meant unrealised gains arising due to FVTPL as well, the apparent question that would arise here is – whether the part which was earlier disregarded for the purpose of regulatory capital will now be treated as a part of capital?

Needless to say, extending the scope of “unrealised gains” to mean unrealised gains from FVTPL can create several ambiguities. However, the Notification, as it stands, does not contain answers for these.

In addition to the above, the Notification states the following in this regard:

- Even unrealised gains arising on transition to Ind AS will have to be disregarded.

- For the purpose of computation of Tier I capital, for investments in NBFCs and group companies, the entities must reduce the lower of cost of acquisition or their fair value, since, unrealised gains are anyway deducted from owned funds.

- For any other category of investments, unrealised gains may be reduced from the value of asset for the purpose of risk-weighting.

- Netting off of gains and losses from one category of assets is allowed, however, netting off is not allowed among different classes of assets.

- Fair value gains on revaluation of property, plant and equipment arising from fair valuation on the date of transition, shall be treated as a part of Tier II capital, subject to a discount of 55%.

- Any unrealised gains or losses recognised in equity due to (a) own credit risk and (b) cash flow hedge reserve shall be derecognised while determining owned funds.

(B) Treatment of ECL: The Notification allows only Stage 1 ECL, that is, 12 months ECL, to be included as a part of Tier II capital as general provisions and loss reserves. Lifetime ECL shall not be reckoned as a part of Tier II capital.

6. Securitisation accounting and prudential norms

All securitisation transactions undergo a strict test of de-recognition under Ind AS 109. The conditions for de-recognition are such that most of the structures, prevalent in India, fail to qualify for de-recognition due to credit enhancements. Consequently, the transaction does not go off the books.

The RBI has clarified that the cases of securitisation that does not go off the books, will be allowed capital relief from regulatory point of view. That is, the assets will be assigned 0% risk weight, provided the credit enhancement provided for the transaction is knocked off the Tier I (50%) and Tier II (remaining 50%).

There are structures where the level of credit enhancement required is as high as 20-25%, the question here is – should the entire credit support be knocked off from the capital? The answer to this lies in the RBI’s Securitisation Guidelines from 2006[5], which states that the knocking off of credit support should be capped at the amount of capital that the bank would have been required to hold for the full value of the assets, had they not been securitised, that is 15%.

For securitisation transactions which qualify for complete de-recognition, we are assuming the existing practice shall be followed.

But apart from the above two, there can also be cases, where partial de-recognition can be achieved – fate of such transactions is unclear. However, as per our understanding, to the extent of retained risk, by way of credit enhancement, there should be a knock off from the capital. For anything retained by the originator, risk weighting should be done.

Matters which skipped attention

There are however, certain areas, which we think RBI has missed considering and they are:

- Booking of gain in case of de-recognition of assets: As per the RBI Directions on Securitisation, any gain on sale of assets should be spread over a period of time, on the other hand, the Ind AS requires upfront recognition of gain on sale of assets. The gap between the two should been bridged through this Notification.

- Consideration of OCI as a part of Regulatory Capital: As per Basel III framework, other comprehensive income forms part of Common Equity Tier I [read our article here], however, this Notification states all unrealised gains should be disregarded. This, therefore, is an area of conflict between the Basel framework and the RBI’s stand on this issue.

Read our articles on the topic:

- NBFC classification under IFRS financial statements: http://vinodkothari.com/wp-content/uploads/2018/11/Article-template-VKCPL-3.pdf

- Ind AS vs Qualifying Criteria for NBFCs-Accounting requirements resulting in regulatory mismatch?: http://vinodkothari.com/2019/07/ind-as-vs-qualifying-criteria-for-nbfcs/

- Should OCI be included as a part of Tier I capital for financial institutions?: http://vinodkothari.com/2019/03/should-oci-be-included-as-a-part-of-tier-i-capital-for-financial-institutions/

- Servicing Asset and Servicing Liability: A new by-product of securitization under Ind AS 109: http://vinodkothari.com/2019/01/servicing-asset-and-servicing-liability/

- Classification and reclassification of financial instruments under Ind AS: http://vinodkothari.com/2019/01/classification-of-financial-asset-liabilities-under-ind-as/

[1] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11818&Mode=0#F2

[2] https://rbidocs.rbi.org.in/rdocs/Content/PDFs/FAS93F78EF58DB84295B9E11E21A91500B8.PDF

[3] https://www.bis.org/bcbs/publ/d350.pdf

[4] https://rbidocs.rbi.org.in/rdocs/content/pdfs/NOTI170APP130320.pdf

[5] https://www.rbi.org.in/scripts/NotificationUser.aspx?Id=2723

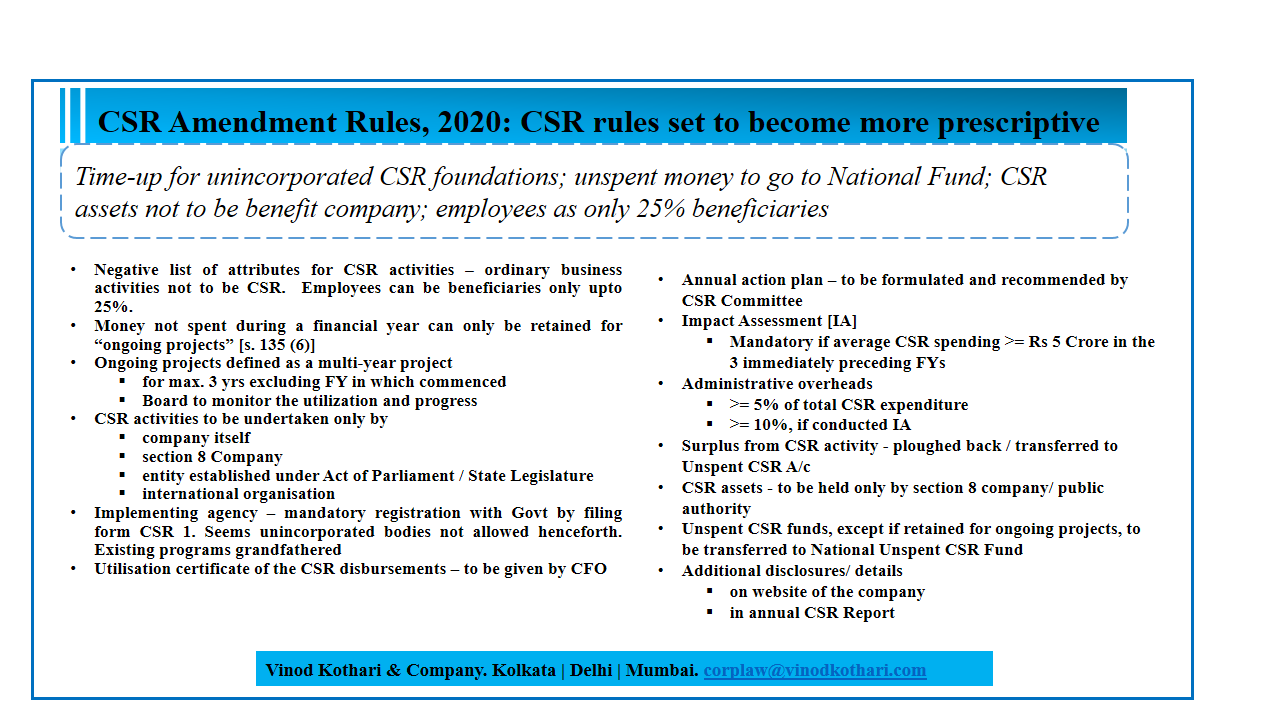

Proposed changes in CSR Rules

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsNitu Poddar and Tanvi Rastogi

corplaw@vinodkothari.com

Section 135 of Companies Act, 2013 dealing with the Corporate Social Responsibility (“CSR”) was amended vide the Companies (Amendment) Act, 2019 inter-alia requiring the provisions to change from “comply or explain” to “comply or suffer” by introducing penal provision for non-compliance. The amendment also provided for parking the unspent amount of ongoing projects in a separate account and any other unspent amount to Clean Ganga Fund or PMNRF or like. Amidst the decriminalisation (of offences under Companies Act) spree by the government, the introduction of penalty in the CSR provisions have surely not been welcomed by the corporates.

In any case, the provisions have not been made effective for want of respective change in the CSR Rules, 2014. Accordingly, MCA has proposed changes[1] in the CSR Rules vide proposal dated March 13, 2020. Substantial changes have been proposed viz. definition of ongoing projects, that the implementing agencies could be only section 8 companies or a government entity, registering of such implementing agencies by filing e-form CSR-1 with the MCA, CFO certificate, additional website disclosures, detailed CSR report, mandatory impact assessment to name a few.

In this write up, we discuss the impact of the significant proposal in the CSR Rules by the MCA.

| Rule No | Heading | Proposal | Remarks / Comments |

|

Rule 2(1)(c) |

Negative attributes of what will not be considered as “CSR” | Corporate Social Responsibility (CSR)” means the activities undertaken by a Company in pursuance of its statutory obligation laid down in section 135 of the Act in accordance with the provisions contained in these Rules, but shall not include the following, namely-

Provided that in case of any activity having less than twenty five percent employees as its beneficiary, then such activity shall be deemed to be CSR activity under these rules |

The 4 items mentioned in the negative attributes of what would not include to be a CSR expenditure is not a new provision. This is already mentioned in the current Rule 4 from where it has been replaced in the definition clause.

Only addition is the clarification in clause (iv) w.r.t the extent to which the employees of the Company could be beneficiary of CSR program. The threshold is less than 25% of the total beneficiary of the CSR program.

What is not clarified is whether the threshold of 25% is with respect to value or number. To our mind, it should be the number of employees.

However, this would make the CSR provisions heavy with mechanical rules which people may contrive easily by scheming CSR spend wherein the number of employees benefitted is within the 25% threshold but the value attributed to them is much higher. |

| Rule 2(1)(e) | Definition of CSR Policy | “CSR Policy” means a statement containing the approach and direction given by the board of a company, as per recommendations of its CSR Committee, for selection, implementation and monitoring of activities to be undertaken in areas or subjects specified in Schedule VII of the Act. | It is clear that unlike the current prevalent practice, where the board lists down the activities from schedule VII for its CSR, the board will have to do a strategic planning with respect to CSR activity to be undertaken by the company. |

| Rule 2(1)(h) | Defining “ongoing projects” and rule thereto | “Ongoing Projects” means a multi-year project undertaken by a Company in fulfillment of its CSR obligation having timelines not exceeding three years excluding the financial year in which it was commenced, and shall also include such projects that were initially not approved as a multi-year project but whose duration has been extended beyond a year by the Board based on reasonable justification.

In case of ongoing projects, the Board of a company shall monitor the implementation of the project with reference to the approved timelines and year wise allocation and shall be competent to make modifications, if any, for smooth implementation of the project within the overall permissible time period.

|

1. The ongoing project can be a program of maximum 4 years (including the first year of commencement); – mere one-time spending surely cannot be a “project”. It requires continued expenditure over time.

2. “Year” would surely mean financial year. Therefore if say a project has been commenced in the month of February, 2020, the three FY therefrom, will be FY 2022-2023. 3. Year wise allocation will have to be made 4. Basis reasonable justification, a bullet program can also be converted to an ongoing project by the board of directors While the timeline of 4 years at one go is proposed, the gaps seems to be two-fold: 1. What about the projects which may take longer than 4 years; so as to keep a close check on India Inc., seems like the govt. intends the companies to make budgets for 4 years and either implement it or transfer amount to the National CSR account 2. Can such projects be extended after completion of the 4 years? – the answer to this seems to be positive |

| Rule 4 | Modes of implementing CSR activities | (1) The Board shall ensure that the CSR activities are undertaken by the company itself or through:

(a) a company established under section 8 of the Act, or (b) any entity established under an Act of Parliament or a State legislature. … Provided that a company may also engage an international organization[2][3] for implementation of a CSR project subject to prior approval of the central government.

|

So far, a section 8 company, trust, or a society, having track record of three years in carrying out similar activity was qualified to be an implementing agency, however only section 8 companies are proposed to be retained to be an implementing agency. The language of clause b indicates that only incorporated entities will be eligible to be an implementing agency. However, the language here is quite vague.

Companies currently undertaking CSR through group foundations incorporated / established in any other form will have to look for other agencies as the CSR through in-house foundations seems to be over Also international organisations identified under section 3 of United Nations (Privileges and Immunities) Act, 1947 can be appointed as implementing agency after approval of central government. This would mean that the Indian branch of such organisation will have to work in a schedule VII activity within India. The method of seeking such prior approval is not proposed. This may require the involvement of Ministry of External Affairs. |

| Rule 4(1) | Mandatory registration of implementing agency with the MCA | Provided that such company/entity, covered under clause (a) or (b), shall register itself with the central government for undertaking any CSR activity by filing the e-form CSR-1 with the Registrar along with prescribed fee.

Provided further that the provisions of this sub-rule shall not affect the CSR projects or programmes that were approved prior to the commencement of the Companies (CSR Policy) Amendment Rules, 2020. |

This is a fresh introduction. The template of the e-Form is present in the draft rules. Also, this would mean that, post these Draft Rules comes into force, these entities will not be hired as implementing agencies until they register themselves. This would lead to regulating of such implementing agencies. |

| Rule 4(3) | Other role of international organisation | A company may engage international organizations for designing, monitoring and evaluation of the CSR projects or programmes as per its CSR policy as well as for capacity building of their own personnel for CSR. | The provision, using the word “may”, is directory and not mandatory. Accordingly, companies can take a call to appoint any other entity to undertake the prescribed overhead jobs in respect of CSR. In any case, the threshold allowed as administrative overhead will be applicable, |

| Rule 4(4) | Board responsibility and CFO certification | Board of a company shall satisfy itself that the funds so disbursed have been utilized for the purpose and in the manner as approved by it and Chief financial Officer or the person responsible for financial management shall certify to the effect. | This is an extremely important proposal. In addition to the monitoring by the board, it requires the CFO or alike to give utilisation certificate of the disbursements made. This makes the role of monitoring all the more crucial. This apart the, CFO will also be required to sign the annual CSR report.

This clause makes the CFO apparently responsible for the entire CSR provision without him being part of the CSR committee or the board of directors. Probably, such certificate shall have to be placed before the CSR committee and / or the board – the draft rules are silent on this. |

| Rule 5 | CSR Committee – responsibility to recommend annual action plan | The CSR Committee shall formulate and recommend to the Board, an annual action plan in pursuance of its CSR policy, which shall include the following:

a) the list of CSR projects or programmes that are approved to be undertaken in areas or subjects specified in Schedule VII of the Act; b) the manner of execution of such projects or programmes as specified in sub-rule (1) of Rule 4; c) the modalities of utilization of funds and implementation schedules for the projects or programmes; and d) monitoring and reporting mechanism for the projects or programmes. |

This seems to be an immediate actionable once the draft rules are effective.

While annual budget and areas of activities was being recommended by the CSR Committee, however, the manner of execution was something that was currently being decided by the board. Also, practically speaking, there used to be one of meeting of CSR in several cases in which the allocating of budget for next FY and approving and signing of the report of last FY used to be done. However, it is proposed that the committee draws a detailed annual action plan to undertake CSR program. Reading the draft rules, it seems like the government is in full mood to get the management on their heels for effective implementation of the CSR provisions along with ensuring that such spent is making impact in the society. |

| Rule 8(3) | Mandatory CSR impact assessment | A company having the obligation of spending average CSR amount of Rs 5 Crore or more in the three immediately preceding financial years in pursuance of sub section 5 of Section 135 of the Act, shall undertake impact assessment for their CSR projects or programmes, and shall disclose details of the same in its Annual Report on CSR.

The impact assessment report is to be attached to the annual report [as per the annexure]

|

The High Level Committee on CSR[4] highlighted importance of the need and impact assessment for projects with higher outlays. This will help in bringing forth the areas requiring more attention, for there development.

Companies having minimum 5 cr of average CSR obligation in last 3 years shall have to undertake mandatory impact assessment. Interestingly, the report of such assessment is proposed to form part of the annual report. There are several question around this: 1. who does this assessment ? surely, the govt acknowledges that an outside entity can also be engaged for such assessment and therefore there is increased limits of allowed overhead expenditure for such companies who are mandatorily required to undertake such assessment 2. also, it is to be noted that the CSR report as mentioned in the annexure, includes surplus from CSR in the total CSR obligation; – will this mean that where there is extraordinary surplus, compliance of this provision becomes applicable because of surplus ? it may in such cases prove to be waste of resources |

| Rule 7(1) | Limit of overhead expenses | The board shall ensure that the administrative overheads incurred in pursuance of sub-section (4) (b) of section 135 of the Act shall not exceed five percent of total CSR expenditure of the company for the financial year.

Provided that a company undertaking impact assessment, in pursuance of sub-rule (3) of Rule 8, may incur administrative overheads not exceeding ten percent of total CSR expenditure for that financial year |

Discussed above |

| Rule 7(2) | Surplus out of CSR program | Any surplus arising out of the CSR projects or programmes or activities shall not form part of the business profit of a company and shall be ploughed back into the same project or shall be transferred to the Unspent CSR Account and spent in pursuance of CSR policy and action plan of the company.

|

Though it may seem to be amendment in this provision, however, there is no effective change. The surplus out of CSR activity was anyway prohibited to form part of business profits of the Company. This is just an explicit clarification to say that it has to be used back for CSR purpose only – either the same program from which such surplus has been generated or any other project as per CSR policy of the company.

What is missing is the time limit within which such surplus has to be transferred to the unspent account. |

| Rule 7(3) | Title holder of CSR assets | The CSR amount may be spent by a company for creation or acquisition of assets which shall only be held by a company established under section 8 of the Act having charitable objects or a public authority[5].

Provided that any asset created by a company prior to the commencement of Companies (CSR Policy) Amendment Rules, 2020, shall within a period of One hundred and eighty days from such commencement comply with the requirement of this rule, which may be extended by a further period of not more than ninety days with the approval of the board based on reasonable justification

|

This is another important proposal which says that any asset acquired / created for the purpose of CSR has to be in the name of a section 8 company or a public authority and cannot be held in the name of the company itself. Considering the quantum of CSR spent being carried through in-house foundations, its seems that this may be heavily opposed by the corporate houses.

Here asset is not defined. However, the intent seems to mean fixed assets only. If otherwise, that would effectively mean that a section 8 company will have to be engaged for any CSR activity because one cannot think of any CSR activity without creation / acquiring of any asset. 180+90 days (extension with reasonable justification) time has been proposed for the compliance of this provision. |

| Rule 7(4) | Unspent amount of ongoing projects to be transferred to Unspent CSR Account | Unspent balance, if any, towards fulfilment of CSR obligation at the time of commencement of these Rules shall be transferred within a period of thirty days from the end of Financial Year 2020-21 to special account viz., ‘Unspent Corporate Social Responsibility Account’ opened by the company and such amount shall be spent by the company in pursuance of its obligation towards the Corporate Social Responsibility Policy within a period of three financial years from the date of such transfer, failing which, the company shall transfer the same to a Fund specified in Schedule VII, within a period of thirty days from the date of completion of the third financial year. | From this provision it seems that the first year of transfer to unspent CSR amount is proposed to be for the FY 2020-21 i.e by 30th April, 2021.

However, the requirement mentioned in the annual CSR report (annexure to the draft rules) seems to suggest that the provision for transfer may be applicable for current FY i.e the unspent amount may be required to be transferred within 30th April, 2020. |

| Rule 9 | Additional disclosures on the website of the company | The Board of Directors of the company shall mandatorily disclose the composition of the CSR Committee, and CSR Policy and Projects approved by the Board on their website for public viewing, as per the particulars specified in the Annexure. | This is again an important proposal for the companies which have / are required to have a functional website. This requires the companies to inter alia mandatorily disclose the CSR projects approved by the board. So far, this was only known from the annual report much after the end of the FY. This proposal indicates that the board will have to make a thought-through plan on the recommendation of the CSR Committee as the same will be displayed on its website and therefore cannot be changed as per the whims and fancies of the board.

This will also put check on the random on-off / philanthropic acts of the promoters which currently is, in many cases, being converted to CSR spent. |

| Rule 10 | National Unspent Corporate Social Responsibility Fund | The Central Government shall establish a fund called the “National Unspent Corporate Social Responsibility Fund” (herein after referred as “the Fund”) for the purposes of sub-section (5) and (6) of section 135 of the Act. The Fund shall be utilized for the purposes of undertaking CSR projects in the in areas or subjects specified in schedule VII of the Act. Provided that until such fund is created the unspent CSR amount in terms of provisions of sub-section (5) and (6) of section 135 of the Act shall be transferred by the company to any fund as specified in schedule VII of the Act.

The manner of administration, authority for administration of the Fund shall be in accordance with such guidelines as may be prescribed by the Central Government from time to time. |

This is the proposed govt fund dedicated to undertake CSR activities. |

| Annexure | Annual CSR Report | Several additional details in line with the rest of the proposal:

1. total CSR obligation to additionally include the surplus arising out of CSR profits 2. CIN of implementing agencies 3. Details of CSR amount spent / unspent for the financial year 4. Details of CSR amount spent against ongoing projects for the financial year 5. Details of CSR amount spent against other than ongoing projects for the financial year 6. Amount spent in Administrative Overheads 7. Details of CSR amount spent/ unspent for the preceding three financial years 8. Details of CSR amount spent for ongoing projects of the preceding financial year(s) 9. Amount transferred to ‘Unspent CSR Account’ pursuant to sub-rule (4) of Rule 7 of Companies (CSR Policy) Rules, 2014 for the financial year 2014-15 to 2019-20 10. In case of creation or acquisition of asset, details relating to the asset so created or acquired through CSR spent in the financial year 11. reason(s) if the company has failed to spend two per cent of the average net profit as per section 135(5)

Signing of the CSR Report: inter alia to be signed by Director or Chief Financial Officer |

There are several additional details required in the report which is by and large in line with the additional requirement.

It may be noted that requirement of CIN of implementing agencies will be applicable for section 8 companies only.

|

While the proposed rules are quite technical, considering the intent of CSR, it should be broadly principle based then laden with heavy rules and the CSR committee could be laden with the onus of compliance of the provisions in such case.

In any case, looking at the Draft Rules, it seems to be loud and clear that gone are those days when the companies used to take the CSR provisions lightly by putting cliché explanations in the annual report for all the gaps for unspent amount. One cannot ignore that, as per CARO-2020, the auditor is also required to comment on the CSR provisions specifically with respect to the amount unspent and whether transferred to the unspent account.

While it would be taking the companies to task if the proposed amendments are brought into force before the end of the current FY, however, it will not be surprising looking at the trend of applicability of CARO-2020 and timing of this Draft Rules.

[1] http://feedapp.mca.gov.in/csr/pdf/draftrules.pdf

[2] International Organization” means an organization notified by the Central Government as an international organization under section 3 of the United Nations (Privileges and immunities) Act, 1947 (46 of 1947), to which the provisions of the Schedule to the said Act apply.”

[3] List of such recognised international organisation – refer footnote to section 3 and 4: http://www.mea.gov.in/Uploads/PublicationDocs/142_1947-The-United-Nations-Privileges-And-Immunities-Act-1947.pdf

[4] https://www.mca.gov.in/Ministry/pdf/CSRHLC_13092019.pdf

[5] Public Authority” means ‘Public Authority’ as defined in sub- clause (h) of section (2) of Right to Information Act, 2005.

Read our article on the topic of CSR here:

Read our article on changes proposed by the high level committee on CSR:

For FAQs related to CSR click here:

http://vinodkothari.com/2014/02/corporate-s-ocial-r-esponsibility-faqs/

Draft CSR Rules Make CSR More Prescriptive

/0 Comments/in Companies Act 2013, Corporate Laws /by Vinod Kothari ConsultantsCryptotrading’s tryst with destiny- Supreme Court revives cryptotrading, RBI’s circular struck down

/0 Comments/in Fintechs and Payment and Settlement Systems, Payment and Settlement Systems, RBI /by Vinod Kothari Consultants-Megha Mittal

April 2018, the Reserve Bank of India (RBI) issued a “Statement on Developmental and Regulatory Policies” (‘Circular’) dated 06.04.2018, thereby prohibiting RBI regulated entities from dealing in/ providing any services w.r.t. virtual currencies, with a 3-month ultimatum to those already engaged in such services. Cut to 4th March, 2020- The Supreme Court of India strikes down RBI’s circular and upheld crypto-trading as valid under the Constitution of India.

Amidst apprehensions of crypto-trading being a highly-volatile and risk-concentric venture, the Apex Court, in its order dated 04.03.2020 observed that RBI, an otherwise staunch critic of cryptocurrencies, failed to present any empirical evidence substantiating cryptocurrency’s negative impact on the banking and credit sector in India; and on the basis of this singular fact, the Hon’ble SC stated RBI’s circular to have failed the test of proportionality.

In this article, the author has made a humble attempt to discuss this landmark judgment and its (dis)advantages to the Indian economy.

AT1 bonds: blessed with perpetuity or cursed with mortality?: Will Yes Bank write-off sensitise investors to risks of AT1 bonds?

/3 Comments/in Financial Services, RBI /by Vinod Kothari Consultants-Financial Services Division

Introduction

In the Yes Bank restructuring proposed by the RBI[1], equity shareholders will not lose all their money, depositors, hopefully, will be fully protected, and other creditors may also sail safe. However, the first casualty is the investors in AT1 bonds, as the same have been fully written off. The returns on AT1 bonds are much lower than those on equity, and only a shade higher than those on Tier 2 bonds; however, in terms of being under the guillotine, they have come even ahead of equity. Sometimes, the risks of investing in an instrument are not understood until there is a casualty. Will the market now become jittery in AT1 investing? Will the cost of AT1 investing go up significantly, so that banks will have to cough up higher servicing costs as they raise AT1 bonds, as compared to Tier 2 bonds, unsecured bonds or secured bonds?

The article discusses the basic features of AT1 bonds and then gets into the impact of the Yes Bank write off on the market for AT1 bonds in India.

Concept of AT1 Bonds

The concept of Additional Tier-1 (AT1) Bonds was introduced by Basel III post the 2008 financial crisis, to protect depositors of a bank on a going concern basis. These bonds are also commonly known as Contingent convertible capital instruments (CoCos)[2]. AT1 or perpetual bonds are quasi debt instruments, which do not have any fixed maturity period. It bears higher risk compared with normal bonds. They are perpetuals as they do not have a redemption date, and are callable at the initiative of the issuer after a minimum period of five years. However, regulators may permit the exercise of call options within the first five years if it can be established that the bank was not in a position to anticipate the event at issuance.

If an issuing bank incurs losses in a financial year, it cannot make coupon payment to its bond holders even if it has enough cash. Further, the essential element of this instrument is that they are hybrid capital securities that absorb losses in accordance with their contractual terms when the capital of the issuing bank falls below a certain level. That is to say, in case the Common Equity Tier-1 (CET 1) ratio falls below a threshold level, the holders of such bonds shall bear the losses without the bank being liquidated.

As per the Basel III requirement, the terms and conditions of AT1 bonds must have a provision that requires such instruments, at the option of the relevant authority, to either be written off or converted into common equity upon the occurrence of the trigger event. Paragraph 55 of Basel III norms provide comprehensive criterions for an instrument to be included in Additional Tier 1 Capital. The relevant extract is reproduced herein below:

Instruments issued by the bank that meet the Additional Tier 1 criteria

- The following box sets out the minimum set of criteria for an instrument issued by the bank to meet or exceed in order for it to be included in Additional Tier 1 capital.

| Criteria for inclusion in Additional Tier 1 capital | ||

| 1. | Issued and paid-in | |

| 2. | Subordinated to depositors, general creditors and subordinated debt of the bank | |

| 3. | Is neither secured nor covered by a guarantee of the issuer or related entity or other arrangement that legally or economically enhances the seniority of the claim vis-à-vis bank creditors | |

| 4. | Is perpetual, i.e. there is no maturity date and there are no step-ups or other incentives to redeem | |

| 5. | May be callable at the initiative of the issuer only after a minimum of five years:

a. To exercise a call option a bank must receive prior supervisory approval; and b. A bank must not do anything which creates an expectation that the call will be exercised; and c. Banks must not exercise a call unless: i. They replace the called instrument with capital of the same or better quality and the replacement of this capital is done at conditions which are sustainable for the income capacity of the bank[3]; or ii. The bank demonstrates that its capital position is well above the minimum capital requirements after the call option is exercised.[4] |

|

| 6. | Any repayment of principal (eg. through repurchase or redemption) must be with prior supervisory approval and banks should not assume or create market expectations that supervisory approval will be given | |

| 7. | Dividend/coupon discretion:

a. the bank must have full discretion at all times to cancel distributions/payments[5] b. cancellation of discretionary payments must not be an event of default c. banks must have full access to cancelled payments to meet obligations as they fall due d. cancellation of distributions/payments must not impose restrictions on the bank except in relation to distributions to common stockholders. |

|

| 8. | Dividends/coupons must be paid out of distributable items | |

| 9. | The instrument cannot have a credit sensitive dividend feature, that is a dividend/coupon that is reset periodically based in whole or in part on the banking organisation’s credit standing. | |

| 10. | The instrument cannot contribute to liabilities exceeding assets if such a balance sheet test forms part of national insolvency law. | |

| 11. | Instruments classified as liabilities for accounting purposes must have principal loss absorption through either

(i) conversion to common shares at an objective pre-specified trigger point or (ii) a write-down mechanism which allocates losses to the instrument at a pre-specified trigger point. The write-down will have the following effects: a. Reduce the claim of the instrument in liquidation; b. Reduce the amount re-paid when a call is exercised; and c. Partially or fully reduce coupon/dividend payments on the instrument. |

|

| 12. | Neither the bank nor a related party over which the bank exercises control or significant influence can have purchased the instrument, nor can the bank directly or indirectly have funded the purchase of the instrument | |

| 13. | The instrument cannot have any features that hinder recapitalisation, such as provisions that require the issuer to compensate investors if a new instrument is issued at a lower price during a specified time frame | |

| 14. | If the instrument is not issued out of an operating entity or the holding company in the consolidated group (eg a special purpose vehicle – “SPV”), proceeds must be immediately available without limitation to an operating entity18 or the holding company in the consolidated group in a form which meets or exceeds all of the other criteria for inclusion in Additional Tier 1 capital | |

Incentive to issue AT1 Bonds

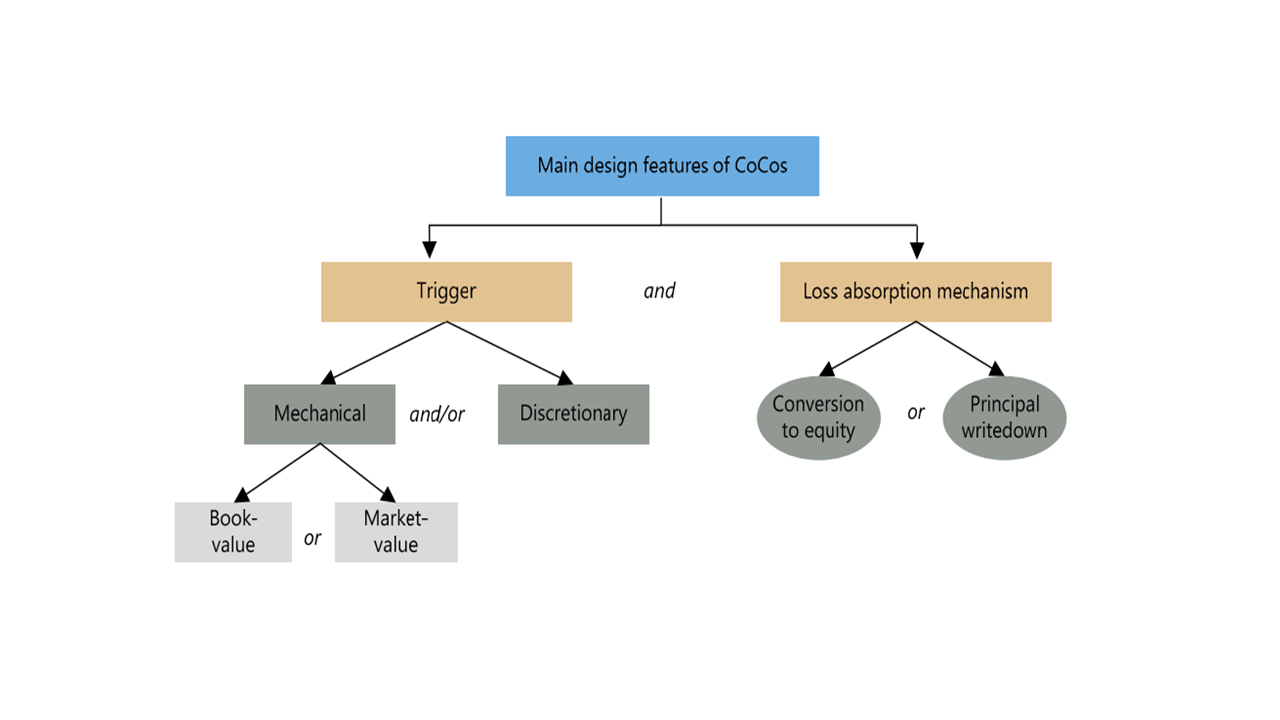

The foremost reasons for issuing AT1 Bonds is the fact that they satisfy the regulatory capital requirements. Most of the investors are private banks, mutual funds and retail investors, having a high risk appetite, while institutional investors are mostly restrained. Since the risk is higher, higher is the yield from these bonds. The rate of return is higher than those of higher-ranked debt instruments of the same issuer. It is dependent on their two factors – the trigger level and the loss absorption mechanism.

Priority order

The claims of the investors in AT1 Bonds and any interest accrued thereon is superior to the claims of investors in equity shares and perpetual non-cumulative preference shares, if any and any other securities that are subordinated to AT 1 Capital in terms of the Basel III Regulations.

However, the claims are subordinated to the claims of depositors, general creditors and any other securities of the issuer that are senior to AT 1 Capital of the Bank in terms of Basel III Regulations. Further, the stand pari passu without preference amongst themselves and other subordinated debt classified as AT1 Capital in terms of Basel III Regulations.

These bonds are neither secured nor covered by any guarantee of the issuer or any of its related entities or any other arrangement that legally or economically enhances the seniority of such claim as compared to the other creditors.

Rating of AT1 Bonds

AT1 Bonds issued by banks are usually rated by rating agencies as plain bonds even if the rating agency uses a tag ‘hybrid’. However, they are assigned ratings as applicable for bonds. Earlier, the absence of a complete set of credit ratings for AT1 Bonds was a hurdle on its growth path. According to the S&P rating methodology, an AT1 Bond rating should be at least two to three notches below the issuer’s credit rating and cannot exceed BBB+[6]. Further downward notching is applied to instruments with triggers near or at the point of non-viability and to those that have a discretionary trigger. On average, given the higher risk, the rating for these bonds is one to four notches lower than the secured bond series of the same bank. For example, while SBI’s tier II bonds are rated AAA by CRISIL, its tier I long-term bonds are rated AA+.

Pricing and Yield

Though the risk is much more than a plain or any other structured bond, however, usually NBFCs and banks offer about 200-300 basis points higher than similar maturity debentures.

Since these bonds have no maturity date they can continue to pay the coupon forever. The issuer has the option to call back the bonds or repay the principal after a period of five years. While AAA rated tier II bond of a public sector bank may have an interest rate of around 7- 7.5% per annum, its AT1 Bond can carry a rate of around 9- 10% per annum. The attraction for investors is higher yield than secured bonds issued by the same entity. But along with the high yield there are certain risks as well; the option with issuer to skip coupon payment and maintaining a CET1 ratio of 5.125%, failing which the bonds can get written down or get converted into equity.

The pricing of AT1 Bonds is consistent with their position in banks’ capital structures. The main determinants of yields are the mechanical trigger level, the loss absorption mechanism, and the existence of a discretionary trigger.

Classification as AT1 Bonds

In some jurisdictions, the respective domestic law does not allow direct issuance of perpetual debt. There can be the following possible circumstances that may be eligible for recognition as AT 1 capital:

- Dated instrument having terms and conditions that include an automatic roll-over feature,

- Instruments with mandatory conversions into common shares on a pre-defined date,

- Subordinated loans

Dated instruments that include automatic roll-over features are designed to appear as perpetual to the regulator and, simultaneously to appear as having a maturity to the tax authorities and/or legal system. This creates a risk that the automatic roll over could be subject to legal challenge and repayment at the maturity date could be enforced. As such, instruments with maturity dates and automatic roll-over features are not treated as perpetual.

An instrument may be treated as perpetual if it will mandatorily convert to common shares at a pre-defined date and has no original maturity date prior to conversion. However, if the mandatory conversion feature is combined with a call option (i.e. the mandatory conversion date and the call are simultaneous or near simultaneous), such that the bank can call the instrument to avoid conversion, the instrument will be treated as having an incentive to redeem and will not be permitted to be included in AT1 Capital.

Subordinated loans meeting all the criteria required for Additional Tier 1 or Tier 2 capital, can be included in the regulatory capital.

Write down and write-off

AT1 Bonds accounted for as liabilities are required to meet both the requirements for the point of non-viability and the principal loss absorbency requirements. To meet the point of non-viability trigger requirements, the instrument needs to be capable of being permanently written-off or converted to common shares at the trigger event. The trigger event is the earlier of[7]:

- a decision that a write-off, without which the firm would become non-viable, is necessary, as determined by the relevant authority; and

- the decision to make a public sector injection of capital, or equivalent support, without which the firm would have become non-viable, as determined by the relevant authority.

Source: CoCos: a primer

The write-down or conversion requirements for Additional Tier 1 instruments accounted for as liabilities, a temporary write-down mechanism is only permitted if it meets the following conditions:

- The trigger level for write-down/conversion must be at least 5.125% Common Equity Tier 1 (CET1).

- The write-down/conversion must generate CET1 under the relevant accounting standards and the instrument will only receive recognition in Additional Tier 1 up to the minimum level of CET1 generated by a full write-down/conversion of the instrument.

- The aggregate amount to be written-down/converted for all such instruments on breaching the trigger level must be at least the amount needed to immediately return the bank’s CET1 ratio to the trigger level or, if this is not possible, the full principal value of the instruments.

Global scenario

AT1 bonds come with the basic feature of protecting the issuer from capital losses. When the issuer is in stress, these bonds extend a helping hand by absorbing the losses. For absorbing the losses, the issuer can either write-off, write-down or convert the AT1 bonds into equity. In fact, the terms of issue of AT1 bonds specifically provide for the method of absorbing losses. Following are a few examples of the methods of absorbing losses provided in the terms of issue of AT1 bonds:

- Deutsche Bank intends of issue AT1 bonds in 2020[8], which would be subject to write-down provisions if its common equity tier 1 capital ratio will fall below 5.13%. as against 13.6% as of December 31, 2019. The securities are also subject to other loss-absorption features pursuant to the applicable capital rules.

- Kookmin Bank issued CoCo Bonds in 2019[9] which can be written off in times of stress — with an interest rate of 4.35 per cent.

Companies have, in many instances, written-off or written-down AT1 bonds. Such as:

- Erste has written-off billions of euros in AT1 bonds in 2014[10].

- Bank of Jinzhou, in 2019[11], stopped paying coupon on its CoCo Bonds to protect its financial health.

Impact on Market for AT1 Bonds

Among the investors, mostly mutual funds and several individual investors, mostly high net worth individuals (HNIs), are exposed to Yes Bank issued AT 1 Bonds which are designed to absorb losses when the capital of the bank falls below certain levels. As of January 31, 2020, 11 mutual funds had exposure worth Rs 2,819 crore to bonds of the bank. Two schemes of Bank of Baroda Mutual Fund–Baroda Treasury Advantage Fund and Baroda Credit Risk Fund had investments worth Rs 53.69 crore in Tier 1 perpetual bonds of Yes Bank. UTI Mutual Fund holds investments worth nearly Rs 50 crore worth of holding in 9.5% perpetual bonds. Indiabulls Housing Finance had invested Rs 662 crore via AT1 Bonds. Several institutional investors are planning to come together to oppose the central bank’s proposal to write down Yes Bank’s perpetual bonds. Their main contention is that tier-I bonds are senior to equity, and cannot be written down without reducing equity.

Based on the information circulating in the market, the Information Memorandum (IM) of AT1 Bonds has provisions that in case there is a reconstitution or amalgamation of the bank under Sec 45 of Banking Regulation Act 1949, the bank will be deemed as non-viable and trigger for written-down / conversion of the AT1 Bonds will be activated. However, the IM sates it cannot be written down unless equity is also reduced.

AT1 bond holders are treated like equity holders. Hence repayment is not likely for these types of bonds. The Yes Bank scheme shall be an eye opener for the investors and is expected to adversely affect the market for AT1 Bonds. This is the first time ever in India that AT1 Bond investor got a hit on their investments. It is likely that the yield on such similar bonds would increase by around 200 basis points from existing levels.

[1] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=49479

[2] https://www.bis.org/publ/qtrpdf/r_qt1309f.pdf

[3] Replacement issues can be concurrent with but not after the instrument is called.

[4] Minimum refers to the regulator’s prescribed minimum requirement, which may be higher than the Basel III

Pillar 1 minimum requirement.

[5] A consequence of full discretion at all times to cancel distributions/payments is that “dividend pushers” are prohibited. An instrument with a dividend pusher obliges the issuing bank to make a dividend/coupon payment on the instrument if it has made a payment on another (typically more junior) capital instrument or share. This obligation is inconsistent with the requirement for full discretion at all times. Furthermore, the term “cancel distributions/payments” means extinguish these payments. It does not permit features that require the bank to make distributions/payments in kind.

[6] Standard & Poor’s (2011)

[7] https://www.bis.org/press/p110113.pdf

[8] https://finance.yahoo.com/news/deutsche-db-plans-offer-additional-131801196.html

[9] https://www.ft.com/content/523a5e62-9802-11e9-9573-ee5cbb98ed36

[10]https://www.washingtonpost.com/business/a-coco-bond-at-3375percent-the-markets-still-crazy/2020/01/23/7a9435ae-3db6-11ea-afe2-090eb37b60b1_story.html

[11] https://www.wsj.com/articles/ailing-chinese-bank-stops-paying-coupons-on-coco-bonds-11567424965

Majority of minority to ensure economic interest in transactions with related parties

/0 Comments/in SEBI /by Vinod Kothari ConsultantsSEBI’s proposal–came late, came correct

-CS Nitu Poddar, Tanvi Rastogi

corplaw@vinodkothari.com

Financial assistance to related entities is a quite a regular transaction. Considering the transfer of obligations, such transactions are subject to certain regulation under the Companies Act, 2013 (Act, 2013) and SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR). However, despite the prohibitions and restrictions, there are several areas within the periphery of transactions with related parties which remain out of the ambit of law and therefore is beyond required checks. Following the proposal of changes in the provisions of RPT vide the report of the working group[1], SEBI has floated a consultative paper[2] on 06-03-2020 proposing certain changes to corporate guarantees being provided by a listed party on behalf of its promoter / promoter related entities, without deriving any economic benefit from such transaction.

In this article, we discuss the coverage of the current provisions, gap therein, need for the proposal and the proposed regime to bridge such gap.

Unrelated-related parties – remains unregulated

As compared to the Act, 2013, LODR has a wider definition of related party where it additionally covers related parties under AS-18 / IND AS-24 and also such member of promoter and promoter group which holds 20% of the total shareholding of the listed entity. Despite such wide definition, practically speaking, there may be several interested entities of the promoter which gets excluded from the technical criteria of being a related party due to absence of required shareholding and consequently transactions with them can easily sail through without being subject to required approvals. As such, currently, a listed entity can grant loan, give guarantee / security in connection of loan to / on behalf of an entity, which technically is not a related party, but either is a promoter or an entity in which the promoter has vested interest against the interest of stakeholders of the lending company.

Existing provisions regulating financial transactions

Currently, section 177, 185 and 186 of Act, 2013 are the major provisions governing any financial transactions. Section 188 of the Act, 2013, does not cover financial transaction within its coverage and therefore the same get ruled out anyway. Section 177 provides for scrutiny of inter-corporate loans as well as approval and modifications of all related party transactions. The challenge of this section are that firstly, transactions with interested unrelated party gets ruled out and consequently the committee is left with the duty of a post mortem scrutiny and not a prior scanning of the transaction. Sec 186 provides for limits of financial transaction i.e giving of loan, investment, guarantee, security in connection with loan and also keeps a check on minimum rates to be charged in case of loan. Transactions beyond the limits require approval by special majority of the shareholders. Sec 185 talks about granting of loan to directors and director-interested entities. While there is complete prohibition of granting of such loan to the director himself or his relative / firm, loan can be granted to interested-companies, subject to approval by special majority of shareholders of the lender company.

To get such approval is not a tough task in a company with high promoter-holding, and the promoters can easily get their transaction through. Unlike sections 188 and 184 where the voting rights of the interested parties are restricted in the general meeting and board meeting respectively, section 185 and 186 does not provide for any such restrictions.

As per Reg 23 of LODR, related party transactions, which includes financial transactions as well, requires approval of shareholders by majority. This approval is by the majority of the minority as all entities falling under the definition of related parties cannot vote to approve the relevant transaction irrespective of whether the entity is a party to the particular transaction or not.

Proposed amendment – need and proposal

It is to be noted that whenever there is a transaction with a promoter related entity, there may be a potential threat to the interest of the non-promoter group / minority shares. Accordingly, approval of the majority of such minority is to be essentially sought to ensure that the resources of the company are not been siphoned away / wrongly used / alienated by the promoters and that the interest of such minority is secured. As mentioned above, in the existing regime, question of approval from such majority of minority arise only for material RPTs under LODR.

Hence, all such transactions which does not fall under the category of “RPT” and / or “material” remains unguarded and thus putting the corporate governance of the company at stake. SEBI, in its report on working group of RPT[3], has clearly put forward its intent to curb such influential transactions by the promoter / promoter group and to revise the definition of related party itself. Once the said proposal is made effective, all transactions with promoter / promoter group will be a RPT. However, inspite of such revision in the definition of RPT, only material transactions will require approval of minority shareholders.

Through the proposal in the consultative paper, SEBI intends to move a step ahead of what the working group discussed. SEBI now proposes to require all guarantee transactions, irrespective of the materiality to be approved by the majority of minority shareholders. Additionally, the directors of lending company are required to establish and record “economic interest” in granting of such guarantee.

Essence of voting by majority of minority

It is no approval, if the person seeking approval and granting approval is the same. In corporate democracy, approval is essentially ought to be sought from the class of people whose rights seem to be prejudiced from transaction proposed in the interest of another class. Reg 23 of LODR and sec 188 of Act, 2013 already recognises such majority of minority approval wherein all the related parties of the company refrain from voting.

Significance of “economic interest”

Any prudent mind would require risk and reward, benefit and burden to be shared proportionately. It is absolutely irrational to say that a listed company is extending guarantee / security in connection with loan but has no benefit in return.

It is to be noted that charging of guarantee commission or charging of interest is not to be misunderstood as presence of economic interest. There are charged only to keep the transaction at arm’s length. However, the exposure of the lender company is the amount of loan / amount guaranteed.

Few examples of embedded economic interest in a transaction can be as follows:

- A holding company extending loan to its wholly-owned subsidiary for funding acquisition of land for building of plant may be benefitted by the figures of such subsidiary at consolidated level;

- A listed company guaranteeing on behalf of another unrelated-related entity which is the customised raw material provider of the lending company

Different scenarios of financial transaction considering the proposal of SEBI:

| S. No. | Transaction between | Existing provision | Proposed amendment | Analysis |

| 1

|

Two unlisted companies | Section 186 / 185, if applicable | Unlisted companies are not covered | No Impact |

| 2 | Listed company with its related party – beyond materiality threshold | Section 186 / 185, if applicable and Reg 23- shareholders’ approval through resolution where no related party shall vote to approve | Ensuring the economic interest + Prior approval from the shareholders on a “majority of minority” basis | Irrespective of the materiality, where there is any transfer of financial obligation, prior approval of unrelated shareholders will be required |

| 3 | Listed company with related party not within materiality threshold | No requirement for shareholders’ approval | Ensuring the economic interest + Prior approval from the shareholders on a “majority of minority” basis | Irrespective of the materiality, where there is any transfer of financial obligation, prior approval of unrelated shareholders will be required |

| 4 | Listed company with unrelated related party[4] | No requirement prescribed under law |

Open issues

- While the proposed amendment is absolutely on-point and timely amendment in the wake of several corporate scams in the recent past being witnessed by the country, however, it will achieve its intent if the same is not kept limited to guarantee / security in connection with loan, but also extended for granting of loan to such unrelated-related entities;

- Also, the list of entities is kept vague in the Paper (promoter(s)/ promoter group/ director / directors relative / KMP etc) and may be better clarified in the amendments, however, the intent seems to be quite clear to include any promoter / promoter group / management related entity;

- Lastly, it is not clear as to who should refrain from voting for majority of minority voting – all promoter / promoter group entities / all related parties of the listed entity;

[1] https://www.sebi.gov.in/reports-and-statistics/reports/jan-2020/report-of-the-working-group-on-related-party-transactions_45805.html

[2] https://www.sebi.gov.in/reports-and-statistics/reports/mar-2020/consultative-paper-with-respect-to-guarantees-provided-by-a-listed-company_46234.html

[3] SEBI Report on working group of RPT dated 27th January, 2020 ibid

[4] Includes promoters which may not fall under definition of related party – like promoter not holding any shareholding in the company

Read our article on proposed changes by working group of SEBI on Related Party Transactions here: http://vinodkothari.com/2020/01/expanding-the-web-of-control-over-related-party-transactions/

Read our articles on the topic of related party transactions here: http://vinodkothari.com/article-corner-on-related-party-transactions/

RESOLUTION VALUE MAY BE LOWER THAN LIQUIDATION VALUE?

/0 Comments/in Case laws, Insolvency and Bankruptcy, Liquidation & Winding-up /by Vinod Kothari Consultants-Richa Saraf

The Apex Court, vide its order dated 22.01.2020, in the matter of Maharasthra Seamless Limited vs. Padmanabhan Venkatesh & Ors.[1] held that there is no requirement that the resolution plan should match the maximized asset value of the corporate debtors. Reiterating the principle laid down in the case of Committee of Creditors of Essar Steel India Limited v. Satish Kumar Gupta[2], the Hon’ble Supreme Court held that once a resolution plan is approved by the committee of creditors (CoC), the Adjudicating Authority has limited power of judicial review.

The judgment of the Supreme Court boldly brings out the object of the Insolvency and Bankruptcy Code, 2016 (“Code”), i.e. “resolution before liquidation”. However, it will be pertinent to understand whether this ruling should be considered as a benchmark? Further, what will be the situation in case of liquidation? Whether sale under liquidation can be done for a value lower than the reserve price?

Below we analyse the ruling, seeking to answer the aforementioned questions.