Posts

SEBI’s proposal to aid financially “stressed” companies

/0 Comments/in Corporate Laws, SEBI /by Vinod Kothari Consultants-Proposal for relaxation in pricing norms for preferential issue and making an open offer

Henil Shah | Executive

Introduction

In layman’s term, a company with falling share prices, inability to pay off its obligations is said to be a company with financial distress. It’s safe to say that for such a company, one of the foremost priority is to secure a source of funds in order to fund their operations to upturn its economic conditions thereby avoiding Insolvency/Bankruptcy. Keeping the same view in mind, the Securities and Exchange Board of India (‘SEBI’) deliberated the matter to its Primary Market Advisory Committee (‘PMAC’), which identified the following key issues to be addressed in order to assist the financially stressed companies to raise funds:

- Criteria for determining a company as stressed

- Determination of a reasonable price for preferential allotment

- Exemptions from open offer obligations under the SAST Regulations

Based on the recommendations given by PMAC, SEBI on April 22, 2020 released a Consultation paper “Pricing of preferential issues and exemption from open offer for acquisitions in companies having stressed assets”[1] seeking public comments till May 13, 2020.

Rationale behind the proposed changes

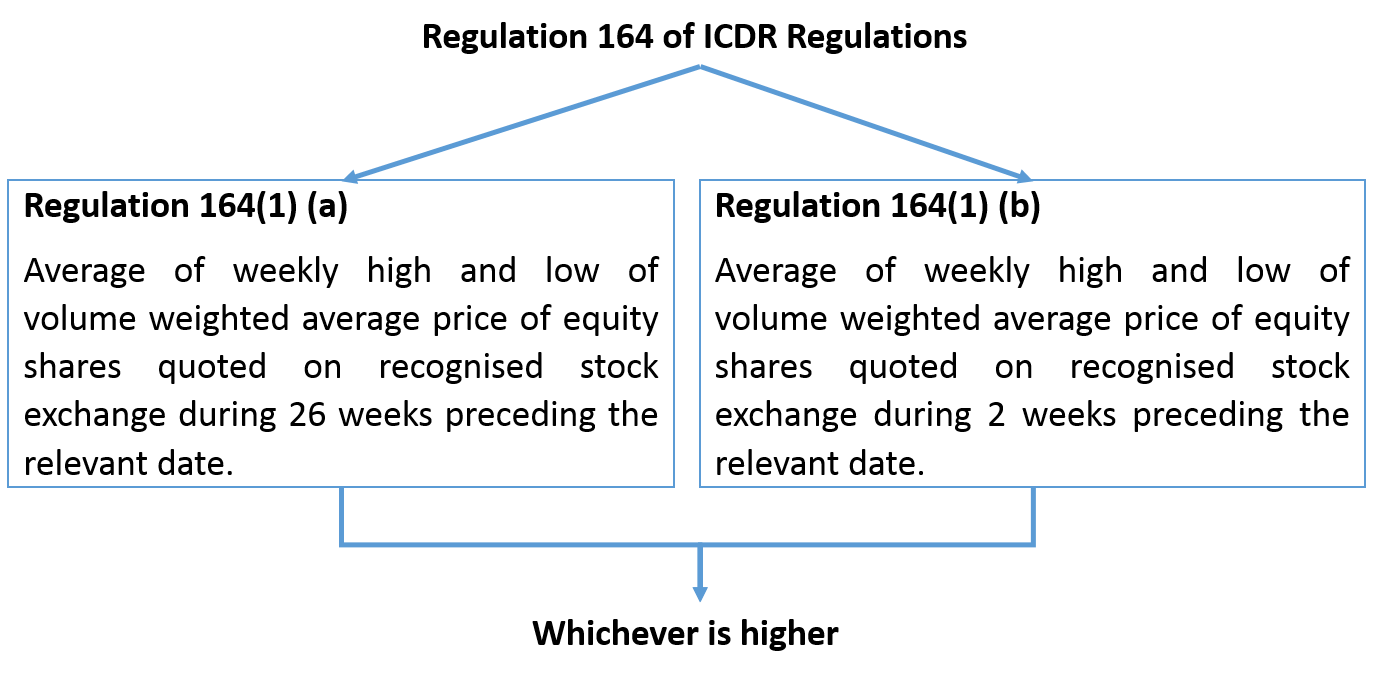

One of the key modes of raising funds by a company especially a financially distressed company is by way of preferential issue of equity shares or convertible instruments. Knowing the probable investors ready to invest in the company makes preferential issue one of the most commonly used ways for raising funds. For a listed company, under a preferential issue, the issue price has to be determined as per the pricing provisions of Chapter V of SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (“ICDR Regulations”). The ICDR Regulations provides the pricing mechanism for both frequently traded shares and infrequently traded shares. In case of frequently trades shares, the price shall be determined as per the provisions of Regulation 164(1) (a) & (b) of the ICDR Regulations which are as follows.

i. Onerous pricing mechanism

Considering the continuous falling prices of the shares over a period of 26 weeks due to the company being in stress, the determination of the price as per the pricing mechanism provided in Regulation 164(1)(a) becomes too onerous for the investor. Further, the price under Regulation 164(1)(a) is much higher than that as determined as per Regulation 164(1)(b). Hence, the pricing mechanism acts as a major deterrent for the investors from subscribing to the shares offered under the preferential issue.

ii. Exemptions only to 5 QIBs restricting investor pool

Though the ICDR Regulations allow issuance to QIBs at a price determined as per regulation 164(1) (b) however, the same is restricted to only 5 QIBs and is not applicable to the investors other than QIBs thereby restricting the investor pool.

iii. Open offer obligations for the acquirer

Another roadblock which the issuers tend to face is from the view point of the investors i.e. an incoming investor who has an impending burden on complying with an open offer obligation in case where the subscription to the preferential offer leads to the triggering of the open offer obligations under SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011(‘SAST Regulations’).

As per the extant provisions, the acquisition pursuant to a resolution plan approved under the Insolvency and Bankruptcy Code, 2016 is exempted from meeting the open offer obligations but no such exemption has been provided in case for acquisition in the financially distressed entity which are not under any resolution plan.

Therefore, where the listed entity is already under distress and suffering from a financial crisis, huge open offer obligations and the cost involved therein discourage the probable investors from taking any controlling interest in such entity.

Rescue mechanism by way of proposed changes

What will be regarded as “stressed”?

It is proposed that only such listed companies which meet any 2 (two) of the following 3 (three) conditions will be determined as a “stressed” company and shall be able to avail the benefits while making an offer under preferential issue once the proposed changes come alive.

- A listed company which has made disclosure of defaults on payment of interest/ principal amount of loans from banks/ financial institutions and listed and unlisted debt securities for 2 consequent quarters in terms of the SEBI Circular[2] issued in this regard;

Default for the purpose of the above circular shall mean non –payment of interest or principal in full on the pre-agreed due date. Provided in case of revolving facilities default shall be considered when outstanding balance remains continuously in excess of the sanctioned limit or drawing power, whichever is lower for more than 30 days.

- Existence of Inter-Creditor agreement in terms of Reserve Bank of India (Prudential Framework for Resolution of Stressed assets) Directions 2019[3];

Inter-credit agreement in terms of the RBI directions stands for agreement executed among all the lenders of a defaulting borrower, providing for ground rules for finalisation and implementation of resolution plan in respect to the borrower.

- Credit rating of the listed instruments of the company has been downgraded to “D”.

Proposal for relaxed pricing norms under the ICDR Regulations:

Unlike the current pricing requirements as provided in Regulations 164(1) (a) & (b) for a preferential issue, the price of the shares to be issued by a stressed company as aforesaid shall be a price which shall not be less than the average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on a recognised stock exchange during the two weeks preceding the relevant date.

Exemptions proposed under the SAST Regulations

Where due to the subscription of shares offered under preferential issue by a financially stressed company triggers open offer obligations as per SAST Regulations, the same shall be exempted.

Additional conditions for availing the exemptions

The Consultation Paper also provides for an additional set of requirements to be complied in case were the benefits of the proposed exemptions are to be availed.

- Persons/entities that are not part of the promoter or promoter group will not be eligible to participate in the preferential issue.

- Obtaining of shareholders’ consent for the exemption to make an open offer by the proposed investors along with the proposal of preferential issue. The shareholders’ approval shall be an approval of majority of minority excluding the promoters and promoter group and any proposed allottee that already hold securities in the issuer.

- Disclosure of the proposed use of the proceeds of such preferential issue in the explanatory statement. This requirement is nothing new as the provisions of regulation 163 of ICDR Regulations and Rule 13 of the Companies (Share Capital and Debenture) Rules, 2014 do provide for mandatorily mentioning object for which the preferential issue is being made in the explanatory statement of the notice.

- Appointment of a monitoring agency. Though there is no requirement of appointing a monitoring agency as per the provisions of chapter V (Preferential Issue) requirement of ICDR Regulations, the concept of the monitoring agency is not new as several chapters of the regulations provide for appointment and functions to be performed by the monitoring agency in case where offer size exceeds a predefined limit.

- Mandatory lock in requirements of shares issued on preferential basis for 3 years which is same as provided in chapter V (Preferential issue) requirement of ICDR Regulations.

Conclusion

Considering the stressed status of the company, it is believed that aligning the pricing requirement with that of pricing requirement in case of preferential issue to QIBs, shall effectively increase the pool of investors. Similarly, the proposed exemption from making of an open offer shall lessen the additional burden on an incoming investor to comply with the stringent requirements thereby attracting investors to put in money in such companies.

Accordingly, SEBI’s intention behind the proposed changes may be said to be a welcome move as it will definitely help the financially stressed companies to revive.

Our write up on prudential framework for resolution for stressed assets can be accessed at:

http://vinodkothari.com/2019/06/fresa/

Our other write ups can be accessed at: http://vinodkothari.com/category/corporate-laws/

[1] https://www.sebi.gov.in/reports-and-statistics/reports/apr-2020/consultation-paper-preferential-issue-in-companies-having-stressed-assets_46542.html

[2] https://www.sebi.gov.in/legal/circulars/nov-2019/disclosures-by-listed-entities-of-defaults-on-payment-of-interest-repayment-of-principal-amount-on-loans-from-banks-financial-institutions-and-unlisted-debt-securities_45036.html

[3] https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=11580&Mode=0

Highlights of SEBI’s temporary relaxations for Rights Issue

/0 Comments/in Corporate Laws, Covid-19, SEBI, SEBI and listing-related compliances - Covid-19, UPDATES /by Vinod Kothari ConsultantsAmbika Mehrotra & Ankit Vashishth

In line with various other relaxations introduced by the Securities and Exchange Board of India (‘SEBI’), amid the global pandemic, it has now come up with a Circular dated 21st April, 2020 [1]granting temporary relief under certain provisions of the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (‘ICDR regulations’) in respect of Rights Issue. The rights issues opening on or before March 31, 2021 will get benefited from the said Circular.

It goes without saying that during the period of this of economical breakdown, the industrial undertakings are in need of funds for various purposes. In this hour of crisis, SEBI’s move seems to ease out the stringent requirements in the statues which hamper the facility of raising funds by companies especially through rights issue.

The amended provisions broadly serve the intent of having a relatively flexible eligibility criteria for a fast track rights issue and lesser chances of refund of the amount in case of non- receipt of subscription amount.

A snapshot of the relaxations and their impact is enlisted below: –

Eligibility conditions related to Fast Track Rights Issues

| Relevant Regulation

|

Pre- amendment | Post-amendment | Impact Analysis |

| 99(a) | the equity shares of the issuer have been listed on any stock exchange for a period of at least three years immediately preceding the reference date

|

the equity shares of the issuer have been listed on any stock exchange for a period of at least eighteen months immediately preceding the reference date

|

Relaxation in the pre-condition with respect to listing of equity shares from 3 years to 18 months. |

| 99(c ) | the average market capitalisation of public shareholding of the issuer is at least two hundred and fifty crore rupees

|

the average market capitalisation of public shareholding of the issuer is at least one hundred crores

|

Companies with smaller market size i.e. more Rs. 100 crore and above also permitted to enter into Fast Track Issue. |

| 99(f) and its proviso | the issuer has been in compliance with the equity listing agreement or the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as applicable, for a period of at least three years immediately preceding the reference date:

Provided that if the issuer has not complied with the provisions of the listing agrîment or the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as applicable, relating to composition of board of directors, for any quarter during the last three years immediately preceding the reference date, but is compliant with such provisions at the time of filing of letter of offer, and adequate disclosures are made in the letter of offer about such non-compliances during the three years immediately preceding the reference date, it shall be deemed as compliance with the condition; |

the issuer has been in compliance with the equity listing agreement or the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as applicable, for a period of at least eighteen months immediately preceding the reference date:

Provided that if the issuer has not complied with the provisions of the listing agreement or the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as applicable, relating to composition of board of directors, for any quarter during the last eighteen months immediately preceding the reference date, but is compliant with such provisions at the time of filing of letter of offer, and adequate disclosures are made in the letter of offer about such non-compliances during the three years immediately preceding the reference date, it shall be deemed as compliance with the condition;

|

The timeline for being in compliance with listing regulations has been reduced from 3 years to 18 months.

This is in line with the requirement under Regulation 99(a) wrt listing of equity shares for a period of atleast 18 months instead of 3 years. |

| 99(h) | No show-cause notices have been issued or prosecution proceedings have been initiated by the SEBI and pending against the issuer or its promoters or whole-time directors as on the reference date. | No show-cause notices, excluding under adjudication proceedings, have been issued by the SEBI and pending against the issuer or its promoters or whole-time directors as on the reference date.

In cases where against the issuer or its promoters/ directors/ group companies,

i. a show cause notice(s) has been issued by the Board in an adjudication proceeding or

ii. prosecution proceedings have been initiated by the Board; necessary disclosures in respect of such action (s) along-with its potential adverse impact on the issuer shall be made in the letter of offer. |

Regulation 99(h) restricts the company to make fast track rights issue in case there had been any show-cause notices or prosecution proceedings issued/initiated against the company/ its promoters/ WTDs.

The temporary relaxation however allows the company to be eligible for rights issue to the extent where adjudication proceedings or prosecution proceedings in respect of the above as well as the group companies are concerned, on making the required disclosures in this regard and its adverse impact, in the letter of offer |

| 99(i) | the issuer or promoter or promoter group or director of the issuer has not settled any alleged violation of securities laws through the consent or settlement mechanism with the Board during three years immediately preceding the reference date;

|

The issuer or promoter or promoter group or director of the issuer has fulfilled the settlement terms or adhered to directions of the settlement order(s) in cases where it has settled any alleged violation of securities laws through the consent or settlement mechanism with the Board. | Prior to the relaxation, any violation in the securities laws by the issuer/ promoter/ promoter group/ director made the issuer ineligible. This however has now been relaxed to permit the issue in case the above violators, having violated the securities laws at anytime during the past have fulfilled the settlement terms or followed the directions under the settlement order(s) |

| 99(j) | The equity shares of the issuer have not been suspended from trading as a disciplinary measure during last 3 years immediately preceding the reference date. | The equity shares of the issuer have not been suspended from trading as a disciplinary measure during last 18 months immediately preceding the reference date. | In line with Regulation 99(a) and (f) |

| 99(m) | There are no audit qualifications on the audited accounts of the issuer in respect of those financial years for which such accounts are disclosed in the letter of offer | For audit qualifications, if any, in respect of any of the financial years for which accounts are disclosed in the letter of offer, the issuer shall provide the restated financial statements adjusting for the impact of the audit qualifications.

Further, that for the qualifications wherein impact on the financials cannot be ascertained the same shall be disclosed appropriately in the letter of offer. |

Prior to the Circular, any qualification in the audit report led to ineligibility. This condition has now been re-framed to make the companies eligible on providing the restated financial statements adjusting for the impact of the audit qualifications or providing clarifications in case such impact cannot be ascertained |

Relaxation with respect to Minimum Subscription:

| Relevant Regulation

|

Pre- amendment | Post-amendment | Remarks |

| 86(1) | The minimum subscription to be received in the issue shall be at least ninety per cent. of the offer through the offer document. | The minimum subscription to be received in the issue shall be at least seventy five percent of the offer through the offer document.

Provided that if the issue is subscribed between 75% to 90%, issue will be considered successful subject to the condition that out of the funds raised atleast 75% of the issue size shall be utilized for the objects of the issue other than general corporate purpose. |

The minimum subscription amount has been reduced from 90% to 75%.

However, the Circular seems to put another restriction on the utilization of atleast 75% of the funds for the objects of the issue other than general corporate purpose if the actual subscription goes beyond 75% but within 90% of the offer. |

Minimum threshold for not filing draft letter of offer

| Relevant Regulation

|

Pre- amendment | Post-amendment | Remarks |

| Applicability of the Regulations:

3(b) |

rights issue by a listed issuer; where the aggregate value of the issue is ten crore rupees or more;

|

rights issue by a listed issuer; where the aggregate value of the issue is twenty-five crores or more;

|

The conditions prescribed in Chapter III of ICDR Regulations shall not apply in case of Rights Issue carrying an issue size of less than Rs. 25 crores. |

|

Proviso to Reg. 3 |

Provided that in case of rights issue of size less than ten crore rupees, the issuer shall prepare the letter of offer in accordance with requirements as specified in these regulations and file the same with the Board for information and dissemination on the Board’s website. | Provided that in case of rights issue of size less than twenty-five crore rupees, the issuer shall prepare the letter of offer in accordance with requirements as specified in these regulations and file the same with the Board for information and dissemination on the Board’s website. | The change is made considering the revised limit of applicability of the Regulations for a rights issue. |

|

60 |

Unless otherwise provided in this Chapter, an issuer offering specified securities of aggregate value of ten crore rupees or more, through a rights issue shall satisfy the conditions of this Chapter | Unless otherwise provided in this Chapter, an issuer offering specified securities of aggregate value twenty-five crore rupees or more, through a rights issue shall satisfy the conditions of this Chapter. | The change is made considering the revised limit of applicability of the Regulations for a rights issue. |

One-time Relaxation on opening of issue

In addition to the above Circular, SEBI has also issued another circular on the same date i.e. April 21, 2019[2] for granting one-time relaxation on the basis of the representations received from various stakeholders with respect to the opening of issue period within 12 months from the date of issuance of the observations by SEBI, for an Initial Public Offer (IPO), Further Public Offer (FPO) or Rights Issue as per Regulation 44, 140 and 85 respectively of the ICDR Regulations, expiring during this period of lockdown i.e. between March 1, 2020 and September 30, 2020 to be extended by 6 months, from the date of expiry of the above-mentioned observations received from SEBI.

However, the extension to this issue opening period shall be granted on obtaining an undertaking from lead manager of the issue confirming compliance with Schedule XVI of the ICDR Regulations with respect to the nature of changes in the offer document which require filing of updated offer document, while submitting the updated offer document to SEBI.

Conclusion

These temporary relaxations will surely bring in a sigh of relief for the stakeholders including the companies intending to raise funds through rights issue, during this interim period of disruption due the outbreak of COVID-19, considering the stagnancy of operations in the country.

Read our related articles below –

SEBI ICDR Regulations, 2018– Snapshot on changes in rights, bonus, QIP and preferential issue;

SEBI (ICDR) Regulations, 2018-Key Amendments;

Covid-19 – Incorporated Responses | Regulatory measures in view of COVID-19.

[1] https://www.sebi.gov.in/legal/circulars/apr-2020/relaxations-from-certain-provisions-of-the-sebi-issue-of-capital-and-disclosure-requirements-regulations-2018-in-respect-of-rights-issue_46537.html

[2] https://www.sebi.gov.in/legal/circulars/apr-2020/one-time-relaxation-with-respect-to-validity-of-sebi-observations_46536.html

COVID- 19 AND DEBENTURE RESTRUCTURING

/3 Comments/in SEBI /by Vinod Kothari Consultants-Munmi Phukon, Pammy Jaiswal and Richa Saraf (corplaw@vinodkothari.com)

ICRA has published a report on 23.04.2020[1], listing out some 328 entities[2] who have availed or sought a payment relief from the lending institutions or investors. The list also includes names of such entities that have received an in-principle approval from investors in their market instruments (like non-convertible debentures)- prior to the original due date- for shifting the original due date ahead, but where a formal approval from the investors was received either after the original due date or is still pending to be received.

Earlier, Securities and Exchange Board of India (SEBI) had, vide circular no. SEBI/ HO/ MIRSD/ CRADT/ CIR/ P/ 2020/53 dated 30.03.2020[3], addressed to the credit rating agencies (CRAs), granted certain relaxation from compliance with certain provisions of the circulars issued under SEBI (Credit Rating Agencies) Regulations, 1999 due to the COVID-19 pandemic. The circular stipulated that appropriate disclosures in this regard shall be made in the press release, seemingly, the report published by ICRA is a part of the disclosure requirement specified by SEBI.

In view of the COVID crisis, companies in large numbers are approaching investors or will be approaching investors for restructuring of the debentures, therefore, it becomes pertinent to discuss- how the restructuring is carried on? whether a meeting of debenture holders will be required to be convened? what will be the consequences if the restructuring is not done? and other related questions. Below we discuss the same.

Force Majeure– An Excuse to Default?

In financial terms, “default” means failure to pay debts, whether principal or interest. Under ISDA Master Agreement[4], failure by the party to make, when due, any payment is listed as an event of default and one of the termination events. However, the ISDA Master Agreement provides that in case of a force majeure event, payments can be deferred. Most of the standard agreements, contain specific clauses pertaining to force majeure, where the party required to perform any contractual obligation is required to intimate the other party as soon as it becomes aware of happening of any force majeure event. While in some cases, due to impossibility of performance, the agreement itself is frustrated; in some other cases, the obligations are merely deferred till the event persists.

Our article “COVID- 19 and The Shut Down: The Impact of Force Majeure” can be accessed from the link: http://vinodkothari.com/2020/03/covid-19-and-the-shut-down-the-impact-of-force-majeure/

Consequences of default- Rights available to debenture holders:

A debenture holder has several options available in case of default: (a) insolvency proceedings; (b) enforcement of security interest; (c) proceedings for recovery of debt due. Below we discuss the same:

– Right to call for meeting of debenture holders: Rule 18 (4) of the Companies (Share Capital and Debentures) Rules, 2014 stipulates that the meeting of all the debenture holders shall be convened by the debenture trustee on:

- requisition in writing signed by debenture holders holding at least 1/10th in value of the debentures for the time being outstanding; or

- the happening of any event, which constitutes a breach, default or which in the opinion of the debenture trustees affects the interest of the debenture holders.

– Right to make an application before NCLT: Section 71(10) of the Companies Act, 2013 provides that on failure of the company to redeem the debentures on the date of their maturity or failure to pay interest on the debentures when it is due, an application may be filed by any or all of the debenture holders or debenture trustee, seeking redemption of the debentures forthwith on payment of principal and interest due thereon.

– Application under IBC: Section 5(7) of IBC defines a “financial creditor” to mean any person to whom a financial debt is owed and includes a person to whom such debt has been legally assigned or transferred to, and Section 5(8) of IBC defines “financial debt” as a debt along with interest, if any, which is disbursed against the consideration for the time value of money and includes any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument. Thus, debenture holders are treated as financial creditors for the purpose of IBC and may exercise all the rights as available to a financial creditor.

As per Section 6 of IBC-“Where any corporate debtor commits a default, a financial creditor, an operational creditor or the corporate debtor itself may initiate corporate insolvency resolution process in respect of such corporate debtor in the manner as provided under this Chapter”. Accordingly, the debenture holders (whether secured or not) may apply for initiation of corporate insolvency resolution process against the company under Section 7 of IBC. In fact the Central Government has, vide notification no. S.O. 1091(E) dated 27th February, 2019, notified that such right may also be exercised by the debenture holder, through a debenture trustee.

– Right to enforce security interest: The right of foreclosure is a counter-part of right of redemption. Just like a company has a right of redeeming the security after payment of debt amount, a secured debenture holder has a right of foreclosure or sale in case of default in redemption. In the case of Baroda Rayon Corporation Limited vs. ICICI Limited[5] and in Canara Bank vs. Apple Finance Limited[6], Bombay High Court upheld the right of the debenture trustee to sell off the properties of the company for the benefit of the debenture holders.

Here, it is pertinent to understand how the debenture holders shall exercise the right of foreclosure. The law distinguishes between security interests based on the nature of the collateral. For instance, in case of security interests on immovable properties, Chapter IV of Transfer of Property Act, 1882 applies. Further, the security interest, in case of secured debentures, can be enforced in the following manner: (a) In case the debenture holder is a bank/ financial institution, as per the provisions of Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002; and (b) In case the debenture holder is not a bank/ financial institution, as per the common law procedures.

– Other remedies: Any default in the terms of the debentures is a breach of contract, and the debenture holder may sue the company for breach of contract as per the provisions of Contract Act, 1872, and further seek for compensation as per the terms of the debenture, or in absence of specific term in the agreement, compensation may be claimed as per the provisions of Section 73 of the Contract Act, 1872.

Issues cropping up due to COVID- 19 and the resolution thereof:

In view of the COVID pandemic one of the issue that was arising was that the issuers of debt instruments who were not able to fulfil the obligations as per the terms of the debentures or redeem the same on the maturity date were running to courts for seeking interlocutory reliefs, seeking to restrain the debenture holders from exercising any rights against the defaulting issuer. In the case of Indiabulls Housing Finance Ltd. vs. SEBI[7], the petitioner prayed for an ad interim direction to restrain any coercive action against it, with respect to the repayment to be made by it to its non-convertible debenture holders. In the said case, granting the prayer, the Hon’ble Delhi High Court directed maintenance of status quo with respect to the repayments to be made by the petitioner to the NCD holders.

Further, there was a lack of clarity on how rating and valuation of a security would be revised in view of the default or the restructuring? Therefore, SEBI has issued the following circulars:

- SEBI, vide a circular no. SEBI/ HO/ MIRSD/ CRADT/ CIR/ P/ 2020/53 dated March 30, 2020[8], granted certain relaxation from compliance with certain provisions of the circulars issued under SEBI (Credit Rating Agencies) Regulations, 1999 due to the COVID-19 pandemic.

With respect to recognition of default, the circular stipulates that CRAs recognize default based on the guidance issued vide SEBI circular dated May 3, 2010[9] and November 1, 2016[10], however, based on its assessment, if the CRA is of the view that the delay in payment of interest/principle has arisen solely due to the lockdown conditions creating temporary operational challenges in servicing debt, including due to procedural delays in approval of moratorium on loans by the lending institutions, CRAs may not consider the same as a default event and/or recognize default.

- Further, SEBI has, vide its circular no. SEBI/HO/IMD/DF3/CIR/P/2020/70 dated 23.04.2020[11], reviewed certain provisions of the circular dated 09.2019[12] issued under SEBI (Mutual Funds) Regulations, 1996. In the circular, SEBI has stipulated that based on assessment, if the valuation agencies appointed by Association of Mutual Funds in India are of the view that the delay in payment of interest/principal or extension of maturity of a security by the issuer has arisen solely due to COVID-19 pandemic lockdown creating temporary operational challenges in servicing debt, then valuation agencies may not consider the same as a default for the purpose of valuation of money market or debt securities held by mutual funds.

Restructuring Process and the Formalities associated thereto:

In the context of COVID, the restructuring of debentures shall mean nothing but deferral of the date of redemption. The terms of the debentures, including the maturity date, etc is specified in the terms of issuance. The terms of issuance also provides how the variation in terms can be effectuated. Therefore, it is pertinent that to make any changes in terms of debentures, the relevant clauses in the issuance terms are considered.

In terms of Reg. 59 (2) of the SEBI LODR Regulations, 2015, any material modification to the structure of debentures in terms of coupon redemption etc. are required to approved by the Board of Directors and the debenture trustee (DT). Further, in terms of Reg. 59(1), prior approval of the stock exchange(s) shall also be required for such material modification which shall be given by the stock exchange(s) only after obtaining the approval of the Board and the DT.

In addition to the approval as aforesaid, in terms of Regulation 15(2)(b) of SEBI DT Regulations, DT is required to call a meeting of the debenture holders on happening of any event which in the opinion of the DT affects the interest of the holders. Similar provision is there in the Companies (Share Capital and Debenture) Rules, 2014 also [sub- rule (4) of Rule 18].

Unlike the requirements of obtaining shareholders’ consent by way of special/ ordinary resolution for various matters including variation of rights thereof, there is no explicit provision for obtaining of a consent of the debenture holders for restructuring of the debentures under the Companies Act, 2013 (‘CA 13’). However, the provisions of SS 2 being, mutatis mutandis, applicable to a meeting of debenture holders also, all the provisions w.r.t convening/ conducting of general meeting such as, sending of notice, explanatory statement etc. as applicable to general meetings shall apply to the meeting of debenture holders.

However, looking at the current crisis situation, where calling of a physical meeting is not possible, and issuers will be required to hold the meeting of the debenture holders, in case consent by e-mail is not possible due to the large number of debenture holders, through video conferencing mode. The modalities for participation (like voting, two-way communication, recording, etc.) and other compliances related of sending of notices etc. may be in the manner clarified by the MCA Circular dated 13.04.2020[13].

In a nutshell, the procedural requirements to be followed for restructuring of debentures shall be as provided hereunder.

| S. No

|

Relevant Provisions | Actionable/ Compliance | Remarks |

| 1. | Regulation 50 (3) of LODR Regulations | Prior intimation to the stock exchange (SE) for the meeting board of directors, at which the restructuring is proposed to be considered.

|

2 working days in before the board meeting.

(excl. date of intimation and date of meeting) |

| 2. | Sec. 173 of CA 13 | BM to be convened by the Company for proposed restructuring including the revised terms subject to approval of the stock exchanges and the debenture holders.

|

Through VC considering the COVID 19 Guidelines issued by the Govt. Our FAQs in this regard may be found at : https://www.google.com/url?q=http://vinodkothari.com/2020/03/board-meetings-during-shutdown/&sa=D&source=hangouts&ust=1587820272757000&usg=AFQjCNEictCwK_-LNnlH7oiB1GMmdRzO6w

|

| 3. | Regulation 59(2)(a) of LODR Regulations

|

Obtain approval of the DT | Before applying to SEs. |

| 4. | Regulation 59 of the Listing Regulations | Seek prior approval from the stock exchange

|

After taking the consent of the board of directors and DT.

|

| 5. | Regulation 15(2) of DT Regulations, 1993 | Separate meeting of debenture holders to be called for deferment in repayment due to liquidity crunch in the hour of crisis.

|

The meeting may be called by the company itself or through the DT.

Since the scope of SS 2 issued by ICSI includes meetings of debenture holders also, the company will have to observe the requirements of SS 2 in convening the meeting of debenture holders. However, considering the current crisis situation, such meeting may be convened through VC facility as clarified by MCA Circular dated 13th April, 2020. Our FAQs in this regard may be found at http://vinodkothari.com/2020/04/general-meetings-by-video-conferencing-recognising-the-inevitable/

|

| 6. | Regulation 51 (2) of the Listing Regulations | Intimation to the stock exchanges being an action that shall affect payment of interest or redemption of NCDs

|

ASAP but not later than 24 hours of Board decision. |

Documentation Requirements:

In usual circumstances, if any variation is carried out in the debenture terms, the parties enter into an addendum, amending the clauses contained in the debenture subscription agreement (and also, in the trust deed/ security documents, if required), however, given the current scenario and the lock down, it is not possible for parties to sign and execute the agreements. Since the restructuring already has the approval of the majority debenture holders, it is deemed that the resolution “overrides the terms of issuance”. Thus, in our view, the resolution passed by the debenture holders approving the restructuring should suffice, and modification in the agreements may not be required.

[1] https://www.icra.in/Rationale/ShowRationaleReport/?Id=94320

[2] The rating agency has stated that the list is not a comprehensive one, as information about some rated entities are not readily available as of now, and separate disclosures will be made w.r.t. such entities.

[3]https://www.sebi.gov.in/legal/circulars/mar-2020/relaxation-from-compliance-with-certain-provisions-of-the-circulars-issued-under-sebi-credit-rating-agencies-regulations-1999-due-to-the-covid-19-pandemic-and-moratorium-permitted-by-rbi-_46449.html

[4] https://www.sec.gov/Archives/edgar/data/1065696/000119312511118050/dex101.html

[5] 2002 (2) BomCR 608, (2002) 2 BOMLR 915, 2003 113 CompCas 466 Bom, 2002 (2) MhLj 322

[6] AIR 2008 Bom 16, (2007) 77 SCL 92 Bom

[7]https://images.assettype.com/barandbench/2020-04/6ec54849-0188-4fe3-a841-88c2861124d5/Indiabulls_vs_SEBI.pdf

[8]https://www.sebi.gov.in/legal/circulars/mar-2020/relaxation-from-compliance-with-certain-provisions-of-the-circulars-issued-under-sebi-credit-rating-agencies-regulations-1999-due-to-the-covid-19-pandemic-and-moratorium-permitted-by-rbi-_46449.html

[9] https://www.sebi.gov.in/legal/circulars/may-2010/guidelines-for-credit-rating-agencies_1467.html

[10]https://www.sebi.gov.in/legal/circulars/nov-2016/enhanced-standards-for-credit-rating-agencies-cras-_33585.html

[11]https://www.sebi.gov.in/legal/circulars/apr-2020/review-of-provisions-of-the-circular-dated-september-24-2019-issued-under-sebi-mutual-funds-regulations-1996-due-to-the-covid-19-pandemic-and-moratorium-permitted-by-rbi_46549.html

[12] https://www.sebi.gov.in/legal/circulars/sep-2019/valuation-of-money-market-and-debt-securities_44383.html

[13] http://www.mca.gov.in/Ministry/pdf/Circular17_13042020.pdf

Please click below for youtube presentation on the above topic:

Our other content related to COVID-19 disruption may be referred here: http://vinodkothari.com/covid-19-incorporated-responses/

Our other articles relating to restructuring on account of COVID-19 disruption may also be viewed here:

Our presentation can be viewed here – https://vinodkothari.com/2021/09/structuring-of-debt-instruments/

Extended meaning of “encumbrance” on promoter holdings in listed entities

/0 Comments/in Corporate Laws, SEBI /by Vinod Kothari Consultants-SEBI’s Order in Yes Bank promoters indicates long arm of the provision

Munmi Phukon | Partner | Vinod Kothari & Company

Introduction

While structuring of instruments like debentures, parties resort to various covenants in order to protect the interests of the investors and also to reflect the intent and purpose of the parties more specifically. One fairly commonplace practice with promoters of Indian listed companies to raise funds on the strength of their shareholding in their companies. It is often observed that, in structuring such transactions, companies find innovative ways of creating pseudo security interests on shares. Therefore, a careful analysis of the documentation entered into by the parties is required to conclude whether the covenants amount to creation of an encumbrance or not.

SEBI has recently dealt with such a case[1], in which SEBI throws some light on what could constitute an encumbrance for the purpose of SEBI (SAST) Regulations, 2011 (Regulations). SEBI considered the covenants mentioned in the debenture trust deed (DTD) executed by the promoter entities of the listed entity at the time of issuance of NCDs and held the promoters liable for non-disclosure of the encumbrance created on the shares held in the listed entity.

Legislative intent and purpose of the SAST Regulations

SAST Regulations are considered to be a social welfare legislation. The aim and intent of the Regulations is to protect the interest of the investors and ensuring market integrity. That is why, the Regulations recognise the importance of event based and periodic disclosures, specifically by the promoters of the entity, through Regulation 29 to 31 thereof. It has always been seen as a measure for ensuring better corporate governance which in turn enables the regulators and stock exchanges to monitor the transactions of the promoters.

Requirements related to encumbered shares under the Regulations

Transactions involving promoters’ shares are considered crucial in order to ensure transparency as regards the ownership/ control of the target company as well as price discovery of the shares in an informed manner. The genesis of the requirements of such disclosures arose in the beginning of 2009 when SEBI made it mandatory by amending the provisions of the erstwhile Regulations.

Later, similar requirements were provided in the revamped SAST Regulations vide Regulation 31 which requires the promoters to disclose about the shares of the target company encumbered by them on a yearly basis to the stock exchange(s) where the shares of the target company are listed and also to the target company. The promoters have also been mandated, by virtue of an amendment made in the said Regulation, to give declaration to the audit committee of the target company and the stock exchange(s) on a yearly basis about not having any encumbrance.

Further, SEBI vide its Circular dated 7th August, 2019[2] read with its Press Release-PR No.16/2019[3] requires the promoters to disclose to the stock exchange(s) and the target company, the detailed reasons for encumbrance if the combined encumbrance by the promoter along with PACs with him equals or exceeds, a) 50% of their shareholding in the target company; or b) 20% of the total share capital of the target company and also any positive changes therein thereafter within two working days from the creation of such encumbrance.

Furthermore, Regulation 29 requiring disclosure of acquisition/ disposal of shares of the target company by an acquirer on meeting certain threshold, interestingly, also provides that shares taken by way of encumbrance shall be treated as an acquisition, and shares given upon release of encumbrance shall be treated as a disposal and shall also require disclosure. In this context, it is pertinent to note if the pledgee/creditor gets voting rights also or has the right to cause the shareholder to vote as per the instructions of the creditor, the transaction would well amount to acquisition of control and hence, triggering the Regulation 3 as well.

The term ‘encumbrance’ under the Regulations

The term ‘encumbrance’ is defined under Regulation 28(3) of the SAST Re gulations. Further, there has been an amendment to the existing definition w.e.f 29th July, 2019 vide SEBI (Substantial Acquisition of Shares and Takeovers) (Second Amendment) Regulations, 2019[4]. Evidently, the text of the existing definition signifies that it is an inclusive explanation and not an exhaustive one keeping the same open to different interpretations.

gulations. Further, there has been an amendment to the existing definition w.e.f 29th July, 2019 vide SEBI (Substantial Acquisition of Shares and Takeovers) (Second Amendment) Regulations, 2019[4]. Evidently, the text of the existing definition signifies that it is an inclusive explanation and not an exhaustive one keeping the same open to different interpretations.

SEBI had tried to clarify the broad definition through its FAQs that, non- disposal undertaking (NDU) will be covered under the purview of ‘encumbrance’. The FAQs also clarified that NDUs may, inter alia, include the following:

“- not encumbering shares to another party without the prior approval of the party with whom the shares have been encumbered;

- non-disposal of shares beyond a certain threshold so as to retain control;

- non-disposal of shares entailing risk of appropriation or invocation by the party with whom the shares have been encumbered or for its benefit.”

As mentioned above, the existing text of the definition has been expanded. As claimed by SEBI itself, the amendments have been made in the context of recent concerns w.r.t. promoter/ companies raising funds from Mutual Funds/ NBFCs through structured obligations, pledge of shares, non- disposal undertakings, corporate/ promoter guarantees and various other complex structures, which reads as below:

“(3) For the purposes of this Chapter, the term “encumbrance” shall include,

- any restriction on the free and marketable title to shares, by whatever name called, whether executed directly or indirectly;

- pledge, lien, negative lien, non-disposal undertaking; or

- any covenant, transaction, condition or arrangement in the nature of encumbrance, by whatever name called, whether executed directly or indirectly.”

Brief of the SEBI’s Order

The Order of SEBI seems to be an attempt of making an interpretation of certain clauses of the debenture trust deeds (DTDs) entered into by the promoter entities in the context of the then definition of ‘encumbrance’ provided u/r 28(3). SEBI found the following clauses in the DTDs and construed the same as creation of encumbrance on the shares of the listed company:

- Maintenance of asset cover ratio at all times i.e. maintenance of equity shares held by the promoters in the listed entity, over and above the borrowing of the promoter.

- In case of breach of the said condition, even though the debentures can be redeemed, however, only with an approval of the debenture holders for such early redemption;

- The requirement of creation of security in favour of the DTs by way of exclusive pledge of the shares held by the promoter in the listed entity while availing any further borrowing and also with prior notice and giving of right of first refusal to the debenture holders;

- Maintenance of borrowing cap at all times i.e. borrowing over the value of the shares held in the listed entity and the requirement of obtaining of a consent of the debenture holders in case of sell, disposal or encumbrance of the said shares.

SEBI contended that the covenants related to maintenance of asset cover/ borrowing cap at all times restrict the abilities of the borrowers/ promoters to dispose of the shares of the listed entity held by them. Therefore, the same should be considered as encumbrance for the purpose of Regulation 28(3). Further, the requirement of obtaining prior approval/ consent of the debenture holders before disposing of the shares tantamount to be a non- disposal undertaking as clarified vide the FAQs which include not encumbering shares to another party without prior approval of the party with whom the shares have been encumbered.

Meaning of ‘encumbrance’ in jurisprudence

In two passages in Salmon on Jurisprudence, 12th Edition, at Page 241 under the sub-heading “Rights in re propria and rights in re aliena” the learned author has stated thus:

“Rights may be divided into two kinds, distinguished by the civilians as Jura in re propria[5] and jura in re aliena[6]. The latter may also be conveniently termed encumbrances, if we use that term in its widest permissible sense. A right in re aliena or encumbrance is one which limits or derogates from some more general right belonging to some other person in respect of the same subject -matter. All other are jura in re propria.”

At Page 242 the learned author has observed as follows:

“it is essential to an encumbrance that it should in the technical language of our law, run with, the right encumbered by it. In other words, the document and the servant rights are necessarily concurrent. By time it is meant that an encumbrance must follow the encumbered right into the hands of new owners, so that a change of ownership will not free the right from the burden imposed upon it. If this is not so — if the right is transferable free from the burden — there is no true encumbrance.”

Thus, the true test of an encumbrance is the concurrence of the right with property – that the right attaches to property and travels along with it. Salmon has discussed encumbrances elaborately and mentions 4 types of encumbrances: leases, servitudes, security interests, and trusts. A lease confers a right to use the property. Servitude is a right to the limited use of the property such as the right of way or easements. Security interests (including mortgages) are encumbrances vested in a creditor. A trust is the obligation attached to property to hold it for the benefit of another.

Madras High Court also in the matter of M. Ratanchand Chordia And Ors. vs Kasim Khaleeli[7] held as below:

“The word “Encumbrances” in regard to a person or an estate denotes a burden which ordinarily consists of debts, obligations and responsibilities. In the sphere of law it connotes a liability attached to the property arising out of a claim or lien subsisting in favour of a person who is not the owner of the property. Thus a mortgage, a charge and vendor’s lien are all instances of encumbrances. The essence of an encumbrance is that it must bear upon the property directly and in-directly and not remotely or circuitously. It is a right in re aliena circumscribing and subtracting from the general proprietary right of another person. An encumbered right, that is a right subject to a limitation, is called servient while the encumbrance itself is designated as dominant.”

An analysis of the meaning of encumbrance

The following important features of encumbrances arise from the discussion above:

- An encumbrance is a burden attached to property;

- If it is a burden for the owner, it must be a benefit for the person holding the encumbrance. This also follows from the discussion by Salmond which has taken encumbrances to be jura in re propria, that is, rights over estate of someone else. That is, the burden created by the owner must be such which can operate as a benefit in the hands of the person holding the encumbrance;

- The burden must necessarily be attached to the asset in question;

- Since the essence of attachment or concurrence of the burden is that the burden will pass on a person acquiring the property, it necessarily follows that the burden must be on an ascertainable, identifiable property;

- A mere restraint on sale or negative covenant is not an encumbrance. A leading English case law on whether a negative covenants “runs” with the property is Tulk v Moxhay(1848) 41 ER 1143. This classic ruling holds that a negative covenant is passable to the buyer of the property only where the parties intended the same to pass, and the burden “touches and concerns” the property. Here, a question of intent of parties will come in.

Different forms of quasi security interests on shares

Negative Lien or Negative Pledge

Negative Lien is used in banking parlance for a borrower to undertake not to create any charge on his property without the consent of the lender.

A negative pledge covenant does not give the negative pledgee a security interest or, in general, any other right in the debtor’s property.

It was held in Knott[8] that Negative Pledgee’s remedies are purely contractual and that the covenant confers no right in the property.

The generally accepted view as mentioned before is that the negative pledge does not create a proprietary or security interest and is therefore not registrable. [Tracy Hobbs, The Negative Pledge: A Brief Guide, 8(7) J.I.B.L.269 (1993)]

Springing Lien

A “springing lien” refers to lien granted in the future by a debtor (borrower or lessee) in favor of its creditors whereby the right conferred on the lender springs into a full-fledged lien or pledge either on the happening of certain events, or the discretion of the person holding the pledge.

Whether a so-called springing lien will amount to encumbrance or security interest will depend on intent of parties. If the debtor is free to deal with the subject matter before the trigger events that transform a springing lien into full-fledged lien have taken place, it cannot be said that the lien is an obligation attached to property. Therefore, it will not amount to encumbrance. However, if the lien comes attached with restrictions on sale, it will amount to encumbrance, because the combination of restriction on sale, and automatic attachment of a right on the asset that cannot be sold, in conjunction, will amount to a passable burden on property.

Conclusion

As discussed earlier, an encumbrance carries certain features along with it. A mere restraint on sale or negative covenant is not an encumbrance. Having said so, SEBI’s view in this context may not be in line with the jurisprudence of encumbrance.

However, it is seen that SEBI has been constantly endeavoring to expand the scope of the disclosure requirements, in the wake of various corporate governance failure recently witnessed by the country. SEBI, realizing the recent concerns w.r.t. promoters raising funds through structured obligations, pledge of shares, NDUs and various other complex structures and its impact on the corporate governance structures, had amended the meaning of encumbrance provided in Regulation 28(3). The said amendment has been made to include all such structures including any restriction on the free and marketable title to shares, by whatever name called, whether executed directly or indirectly or any covenant, transaction, condition or arrangement in the nature of encumbrance, by whatever name called, whether executed directly or indirectly.

Considering the amended definition of the term ‘encumbrance’, apparently, SEBI’s intent gets clearer that it wants to include all the possible arrangements/ structures which may carry a potential dilution in the promoter holding. The views held by SEBI are still open for a contest before the Securities Appellate Tribunal.

Read our related articles:

For more updates, please visit our website.

[1] https://www.sebi.gov.in/enforcement/orders/mar-2020/adjudication-order-in-respect-of-two-entities-in-the-matter-of-yes-bank-ltd-_46477.html

[2] https://www.sebi.gov.in/legal/circulars/aug-2019/disclosure-of-reasons-for-encumbrance-by-promoter-of-listed-companies_43837.html

[3] https://www.sebi.gov.in/media/press-releases/jun-2019/sebi-board-meeting_43417.html

[4] https://www.sebi.gov.in/legal/regulations/jul-2019/securities-and-exchange-board-of-india-substantial-acquisition-of-shares-and-takeovers-second-amendment-regulations-2019_43812.html

[5] Right over one’s own property

[6] Right over someone else’s property

[7] https://indiankanoon.org/doc/548843/

[8] Knott v. Shepherdstown Manufacturing Co. 5 S.E. 266 (W. Va. 1888)

Deemed public offers and private placement- searching the lost boundary!

/0 Comments/in Corporate Laws, SEBI /by Vinod Kothari Consultants-Analysis of SAT ruling in the matter of Canning Industries Cochin Limited

Read our related write ups below –

Revised, stringent private placement framework becomes effective: a step-by-step guide to compliance

Revamping private placement mechanism

Comparison and Mapping of Rule 14 of PAS Rules dealing with Private Placement

Video lectures –

Further Issue of Shares | Overview of Basic Concepts

Lecture 2 | Private placement of securities | Power of 30 | Vinod Kothari & Company

SEBI regards maintenance of ‘cover ratio’ & ‘borrowing cap’ as ‘encumbrance’

/0 Comments/in Corporate Laws, SEBI /by Vinod Kothari ConsultantsPenalises promoter entities for non-disclosure under SAST

Ambika Mehrotra & Smriti Wadhera

Introduction

The term ‘encumbrance’ as referred to in various court rulings is not a novel term used in law. Although defined in various rulings, in its generic sense, encumbrance means to specify any burden, obstruction, or impediment on an asset, that lessens its value or makes it less marketable. The Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (SAST Regulations) prior to the amendment introduced vide SEBI (Substantial Acquisition of Shares and Takeovers) (Second Amendment) Regulations, 2019, w.e.f. 29-07-2019[1], defined encumbrance under Regulation 28(3) as

“a pledge, lien or any such transaction, by whatever name called”

However, SEBI had further widened the scope of encumbrance vide the said regulation. Though, the earlier interpretation as was clear enough to say that the definition was an inclusive explanation and not an exhaustive one. In order to provide a simplistic explanation/clarification of terms/concepts related to SAST Regulations, SEBI has also come with its FAQs on SAST Regulations[2] to setting various interpretational issues in this regard. The above regulations provide that the shares taken by way of an encumbrance shall be treated as an acquisition and its release shall be treated as disposal under the said Regulations. Accordingly, the disclosures w.r.t acquisition or disposal of shares in any manner, as such, shall mutatis mutandis apply in the case of such transactions. Having said that SEBI has also clarified this requirement in its recent order dated March 31, 2020[3].

In this article, we intend to cover various points of law discussed by SEBI while clarifying the ambit of encumbrance.

Disparity gazes out in reporting utilisation

/0 Comments/in Corporate Laws, SEBI /by Vinod Kothari Consultants-Format indicates mandatory reporting by all listed entities

Pammy Jaiswal | corplaw@vinodkothari.com

Background

Listed entities raise funds by way of public issue, rights issue, preferential issue and qualified institutional placement of specified securities or by way of public issue or private placement of debt securities. In each of the case, there is an offer document wherein objects of the issue are required to be specified. There may be a categorised allocation that may be stated in the offer document with respect to objects of the issue. It is likely that a company may either end up using certain amounts for objects not stated in the offer document or beyond category wise limit specified. Utilisation of proceeds is monitored by the Audit Committee and also by the monitoring agency appointed in terms of SEBI ICDR Regulations, where required.

Reg. 32 (2) as well as Reg. 52 (7) of the SEBI Listing Regulations requires the listed entities to report the deviation and material deviation, respectively, in utilisation of the proceeds raised through corporate actions specified above. Under Reg 32, the statement of deviation is required to be submitted on a quarterly basis; while Reg. 52 (7) mandates submission of along with half yearly financial results.

While the reporting requirement was there under clause 43A of the Equity Listing Agreement, there was no format for such reporting till December, 2019.

The format of the reporting was issued by SEBI under Reg. 32 (2) on 24th December, 2019[1] and thereafter under Reg. 52 (7) on 17th January, 2020[2]. This article highlights the deviation in the provisions and format and the practical issue faced by listed entities.

Contradiction in the provisions

Relevant extracts of Reg. 32 (applicable to companies with specified securities listed):

“(1) The listed entity shall submit to the stock exchange the following statement(s) on a quarterly basis for public issue, rights issue, preferential issue etc. ,-

(a) indicating deviations, if any, in the use of proceeds from the objects stated in the offer document or explanatory statement to the notice for the general meeting, as applicable;

(b) indicating category wise variation (capital expenditure, sales and marketing, working capital etc.) between projected utilisation of funds made by it in its offer document or explanatory statement to the notice for the general meeting, as applicable and the actual utilisation of funds.“

Relevant extracts from Reg. 52 (applicable to companies with debt securities or NCRPS[3] listed):

“ (7) The listed entity shall submit to the stock exchange on a half yearly basis along with the half yearly financial results, a statement indicating material deviations, if any, in the use of proceeds of issue of non-convertible debt securities and non-convertible redeemable preference shares from the objects stated in the offer document.”

Chapter VI of the Listing Regulations is applicable on entities which have listed their specified securities as well as NCDs or NCRPSs or both.

Relevant extracts from Reg. 63 (2) (applicable to companies having specified securities and either debt securities or NCRPS[4] or both listed):

“(2) The listed entity described in sub-regulation (1) shall additionally comply with the following regulations in Chapter V:

(a) xxx

(b) xxx

(c) regulation 52(3), (4), (5) and (6);”

As evident above, Reg 52 (7) is not applicable to equity listed entities as it is required to comply with Reg, 32.

Disparity requiring clarification from SEBI

1. Reporting of deviation in utilisation of proceeds in relation to debt securities/ NCRPS by equity listed entities

Reg. 52(7) is not applicable to companies that have listed i.e., specified securities as well as NCDs or NCRPs or both. Further, Reg, 32 only covers issuances relating to specified securities i.e. public issue, rights issue, preferential issue, QIP etc.

Pursuant to the aforesaid provisions, an equity listed entity is not required to submit details of deviation in utilisation of proceeds arising out of public issue or private placement of debt securities or NCRPS.

2. Requirement of NIL reporting

Reg 32 as well as Reg. 52(7) mandates reporting if there is any deviation. Requirement to submit a NIL report every quarter or half year respectively has not been expressly provided.

The format, on the contrary, provides as under:

Is there a Deviation / Variation in use of funds raised? Yes / No

While SEBI Circular does not provide any clear guidance on the said issue, ‘Guidance and FAQ on Regulation 32 of SEBI LODR, 2015 – Statement of deviation(s) or variation(s) issued by NSE states the following:

“Since the Regulation only mentions about Statement of Deviation or Variation not about utilisation, is it mandatory for the Companies to give utilisation if there is no deviation or variation?

Reply: Companies need to give statement of utilisation as Regulation 32 (2) states that “The statement(s) specified in sub-regulation (1), shall be continued to be given till such time the issue proceeds have been fully utilised or the purpose for which these proceeds were raised has been achieved”. If companies do not give utilisation Exchange and Investors won’t know when the fund are fully utilised or the purpose for which these proceeds were raised has been achieved.”

3. Object of the issue

If disclosure under Reg. 32 as well as Reg. 52 gets triggered reporting only when there is a deviation or variation in the use of the proceeds from the objects mentioned in the offer document, it is important to clarify what events would amount to deviation.

One must understand that while the law uses the term objects of the issue, a company can raise funds for both general as well as specific purpose. For companies engaged in financing activities, the raising of funds is normally for general corporate purpose or working capital purpose unlike other classes of companies where the object for raising funds is specific.

Referring to the information memorandum of some of the NBFCs issuing debt securities, we find that the objects of the issue are generic in nature as follows:

- Shriram Transport Finance Company Limited[5]

The Proceeds of the issue will be utilized for onlending to grow the asset book, financing of commercial vehicles.

- Tata Capital Financial Services Limited[6]

For the purpose of onward lending, financing, and for repayment /prepayment of interest and principal of existing borrowings of TCFS.

General Corporate Purposes*

*The Net Proceeds will be first utilized towards the Objects mentioned above. The balance is proposed to be utilized for general corporate purposes, subject to such utilization not exceeding 25% of the amount raised in the Issue, in compliance with the SEBI Debt Regulations.

- Fullerton India Credit Capital Limited[7]

The issuer shall use the proceeds from the issue of the Debentures to finance business growth and general business purpose.

Further, some NBFCs and banking companies as mentioned below, have provided the following objects in their placement documents/ information memorandum:

- L&T Finance Holdings Limited[8]

Subject to compliance with Applicable Laws and regulations, the Company intends to use the proceeds for redemption of preference shares, and funding the operations of the Company, including but not limited to, repayment of loans of the Company or to invest in its Subsidiaries in the form of Tier I and Tier II capital to enhance their capital adequacy.

- HDFC Bank Limited[9]

Subject to compliance with applicable laws and regulations, we intend to use the Net Proceeds of the Issue, together with the proceeds of the ADR Offering and the Preferential Allotment, to strengthen our capital structure and ensuring adequate capital to support growth and expansion, including enhancing our solvency and capital adequacy ratio.

Whereas an infrastructure company like National Highways Authority of India Limited[10] provides a specific object in its offer document:

To part finance various projects being implemented by NHAI under the NHDP/Bharatmala Pariyojana and other national highway projects as approved by the Government of India.

When do we say amount is fully utilised?

In case of amounts raised for general purpose:

- For NBFCs, the funds are raised to be deployed immediately either for refilling the working capital or direct investment or lending activities. Accordingly, one time intimation should suffice. The amount is said to be utilised for general purpose the moment the amount is transferred from separate bank account (opened under Section 42) to the regular bank account.

- For other companies, where the funds are raised for a specific project or activity, then the reporting has to be made till the proceeds are fully utilised as per the specific object.

4. Review by the audit committee

The requirement of reporting under Reg. 32 is on a quarterly basis which means for the first three quarters, within 45 days from the end of the quarter and for the last quarter, within a period of 60 days from the end of the said last quarter.

However, the requirement of reporting under Reg. 52 is on a half yearly basis. The time period is 45 days from the half year end.

In both the cases, the audit committee has to review the said report and provide its comments, if any.

Disparity requiring clarification from SEBI

In view of aforesaid guidance from NSE, if ‘NIL’ reporting is mandatory, whether the ‘Nil’ report is also required to be placed before Audit Committee or the Board, as the case may be, and thereafter submitted to Stock Exchanges?

5. Timelines for submission under COVID situation

Normally, the companies are required to submit the certificate under Reg. 32 (2) within 45 days from the end of the quarter (for the first three quarters) and within 60 days from the end of the last quarter. However, the time period allowed under Reg. 52 (7) is 45 days from the end of the half-year.

While SEBI has relaxed the timelines for submission of various returns/ intimations/ certificates and financial statements, however, the specific relaxation under Reg. 32 (2) as well as Reg. 52 (7) is still awaited.

In our view, considering the current situation, getting the comments of the audit committee within 45 days is not required in such cases and the same can be reviewed within the a period of 60 days or such extended time period as permitted by SEBI. Hence, there is no question for calling the meeting within such earlier time frame. Also, since this matter requires due discussion between the audit committee members, a circular resolution is surely not suggested.

6. Cases in which the monitoring agency has been appointed under ICDR

SEBI ICDR Regulations provide for appointment of a monitoring agency by the issuer in case the issue size exceeds INR 100 cr.

The monitoring agency is required to submit its report to the issuer in the specified format on a quarterly basis, till at least ninety five per cent. of the proceeds of the issue, excluding the proceeds raised for general corporate purposes, have been utilised.

Further, the format issued by SEBI under Reg. 32 also requires the issuer to mention about such monitoring agency along with its report/ comments.

Monitoring agencies have no relevance for bond issuances, therefore, the format under Reg. 52(7) does not require reporting on the same.

Conclusion

Pending clarification, in our view, a ‘NIL’ report may be filed by the companies. Further, as discussed above, SEBI should clarify on the applicability position for companies having both the specified securities and NCDs/ NCRPs or both listed.

Also, in view of the current pandemic surrounded situation, a clarification with respect to the timelines for reporting should also be given.

[1] SEBI Circular dated 24th December, 2019

[2] SEBI Circular dated 17th January, 2020

[3] Non Convertible Redeemable Preference Shares

[4] Non Convertible Redeemable Preference Shares

[5] https://www.bseindia.com/downloads/ipo/20204518228STFC%20IM%2003042020.pdf

[6]https://www.tatacapital.com/content/dam/tata-capitalpdf/Tata%20Capital%20Financial%20Services%20Limited%20-%20Tranche%20II%20Prospectus%20dated%20Au….pdf

[7] https://drupalbucketficc.s3.amazonaws.com/sites/default/files/2019-08/Signed-IM-Series-81.pdf

[8] https://www.ltfs.com/content/dam/lnt-financial-services/home-page/investors/documents/announcement/2019/Information%20Memorandum%20for%20issue%20of%20up%20to%20195,00,000%20NCRPS.pdf

[9] https://v1.hdfcbank.com/htdocs/common/pdf/Preliminary_Placement_Document2018.pdf

[10] https://www.bseindia.com/downloads/ipo/202045181841NHAI%20IM%2003042020.pdf

SEBI clarifies the event for becoming aware by target companies

/0 Comments/in SEBI /by Vinod Kothari ConsultantsConsensual restructuring of debt obligations, due to COVID disruption, not to be taken as default, clarifies SEBI

/1 Comment/in Covid-19, Financial Services, Financial services/ NBFCs/Fin-tech - Covid-19, SEBI /by Vinod Kothari ConsultantsVinod Kothari

The global economy, as also that of India, is passing through a systemic disruption due to the COVID crisis. The Reserve Bank of India in its Seventh Bi-monthly Monetary Policy Statement 2019-20 dated March 27, 2020[1] has permitted banks and non-banking financial institutions to provide a moratorium to borrowers for a period of 3 months.

As a result, cashflows of banks and financial institutions from underlying loans will be disrupted, at least for the period of the moratorium. It is a different thing that the disruption may actually prolong, but 3 months as of now is what is explicitly regarded by the RBI has COVID-driven.