-Pammy Jaiswal and Abhishek Saraf (corplaw@vinodkothari.com)

Driving with the mantra of ease of doing business!

Introduction

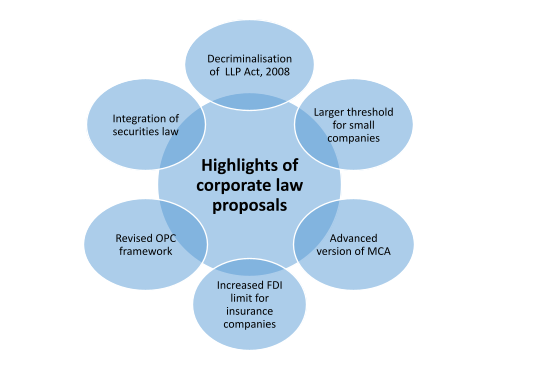

While the Union Budget for the FY 2021-2022 was focused on infrastructure development, the Hon. Finance Minister in her Budget Speech also mentioned about several significant changes in the area of corporate laws. Changes have been proposed to decriminalize the LLP Act, 2008, increase in the threshold of the definition for small companies, introduction of an updated version of the MCA, changes in the OPC framework, increase in the FDI limits in an insurance company, etc.

We have covered each one of these below for the sake of understanding the relevance of these proposals.

Decriminalization of offences under Limited Liability Act, 2008 (LLP Act)

Considering the fact that the Government has completed taking its steps for decriminalization of offences by amending the Companies Act, 2013, Finance Minister in her speech mentioned that it is now the time for decriminalization of the offences under the LLP Act. Having said that it is important to note that the Government has already started taking tangible steps for giving effect to this proposal. The Company Law Committee (CLC) has presented/issued its Report of the Company Law Committee on Decriminalization of the Limited Liability Partnership Act, 2008 to the Ministry of Corporate Affairs on 4th January, 2021 for decriminalization of certain compoundable offences and shifting them to the In-house Adjudication Mechanism. The said CLC Report is open for public recommendations till 2nd February, 2021.

The said Report proposes to decriminalize 12 offences and 1 penal provision has been proposed to be omitted. The motive behind the same is to de-clog the courts or the NCLTs thereby reducing their burden from non-serious matters. Further, the Report not only contains changes in the LLP Act for decriminalization of offences but also travels much beyond. Some of the other major changes in this regard consists of introduction of explicit provisions for issuance of secured NCDs by LLPs, restricting the merger of LLPs with companies, introduction of accounting standards for certain classes of LLPs, etc. Besides this, the Report also introduces changes in the definition of business of LLPS, alignment of the reference with that of the Companies Act, 2013 (CA, 2013) and much more.

Our detailed article on the same can be accessed from here

Revision in the definition of Small Company

Section 2(85) of the CA, 2013 defines the term ‘small company’ as any company other than public company having paid up share capital not exceeding fifty lakh rupees and turnover not exceeding two crore rupees. It has been proposed in the Budget, to revise the definition of Small Companies by increasing the thresholds for paid up share capital from “not exceeding fifty lakhs rupees” to “not exceeding two crore rupees” and turnover from “not exceeding two crore” to “not exceeding twenty crore rupees”.

Some of the relaxations to the small companies under the CA, 2013 include:

Cash Flow Statement not required to be given under the financial statements;

One board meeting in each half of calendar year is sufficient as compared to four board meetings in a financial year with a gap of not more than 120 days between two board meetings;

Abridged director’s report;

Statutory auditors are not required to report about adequacy of internal controls and their operational effectiveness.

Small Companies or any of their officer in default are subject to lesser penalties under section 446B of the CA, 2013 for non-compliance of any provisions of the CA, 2013.

The increase in thresholds will bring more than 2 lakh additional companies under the definition of ‘small company’ which can have a lower compliance burden including lower penalties for violations and lower filing requirements. Therefore, this proposal can surely be seen as an important drive for ease of doing business.

Changes in One Person Companies (OPC) regulatory framework

Currently, the CA, 2013 provides that an OPC cannot convert itself into any other kind of a company unless a period of 2 years have elapsed since the date of its incorporation. The only relaxation is that if during the said period of 2 years the threshold limits of paid-up share capital exceeds Rs. 50 lacs and the average annual turnover during the relevant period exceeds Rs. 2 crore then the conversion can take place before the expiry of 2 years.

Government has proposed to remove the monetary limit and convert itself into any other kind for the purpose of motivating the growth of OPCs which is mostly done by start-ups.

Further, for the purpose of relaxing the eligibility of persons for forming OPCs, the Government also proposes to ease the residential requirements for the person setting up an OPC from 182 days to 120 days in India. Furthermore, it has also been proposes to allow Non-Resident Indians to operate OPCs in India.

MCA21 Version 3.0

The Ministry has proposed to revamp the MCA portal by launching MCA21 Version 3.0 in the financial year 2021-22. The new version will be using data analytics, artificial intelligence and machine learning drive and will have additional modules for e-scrutiny, e-Adjudication, e-Consultation and Compliance Management.

Strengthening of NCLT framework

It has been proposed to strengthen the NCLT framework to ensure faster resolution of cases. In light of the new normal and increased emphasis on Digital India, e-Courts has been proposed to be implemented.

Further, with a similar intent and to further provide an alternate mode of debt resolution, a separate framework is also proposed for the cases involving the MSMEs.

Increased FDI in insurance companies

The main proposal for insurance companies in the Budget is to increase the permissible FDI limits such companies from the current 49% to 74%. Further, the said increased limit has been proposed with several safeguards with respect to ownership and control which includes:

majority of Directors on the Board and Key Managerial Persons (KMP) to be resident of India;

independent directors- atleast 50% of the directors to be independent directors; and

specified percentage of profits being retained as general reserve.

Further, it is also imperative to mention about the IRDA (Indian Owned and Controlled) Guidelines) which currently provides a limit of 49% of foreign shareholding in an Indian insurance company. Considering the aforesaid proposal, the said limit will be changed to reflect the increased limit. Further the said Guidelines also talks about various control safeguards by Indian promoters and provides the following modes of exercising control in an Indian insurance company:

Virtue of shareholding; (or)

Management rights; (or)

Shareholders agreements; (or)

Voting agreements; (or)

Any other manner as per the applicable laws.

Our article on FDI norms for insurance sector can be accessed from here

Our article on IRDA Guidelines on Indian owned and controlled can be viewed here

Securities Market Code

The Budget has proposed to consolidate the provisions of following laws relating to securities market into a rationalized single Code to be termed as “Securities Market Code”

SEBI Act 1992,

Depositories Act 1996,

Securities Contracts (Regulation) Act 1956, and

Government Securities Act 2007

Stamp duty proposed to be exempted on certain Govt. sale transactions

The Finance Bill has proposed to insert a new section 8G to the Indian Stamp Act, 1899 with respect to stamp duty exemption in case of strategic sale, disinvestment, etc., of an immovable property as discussed hereunder:

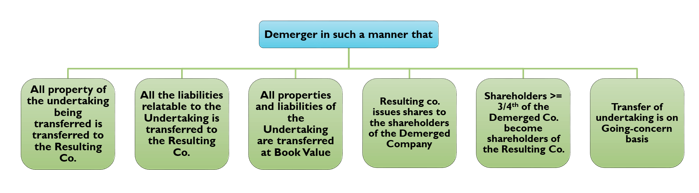

Transaction involving: Strategic sale or disinvestment or demerger or any other scheme of arrangement

Purpose of Transaction: Execution of any instrument for conveyance or transfer of a business or asset or right in any immovable property;

Transferor entities: Government Company, its subsidiaries, unit or joint venture

Transferee entities: Another Government Company or the Central Government or any State Government

Nature of benefit: Transaction shall be exemption from stamp duty if carried out with the approval of the Central Government.

Nature of Government companies covered: Those covered under Section 2(45) of the Companies Act, 2013.

Gap in the proposed amendment: The definition of a ‘Government Company’ under Companies Act, 2013 does not cover companies or body corporates established under a special statute such as SBI, LIC, UTI etc. These body corporates, like government companies, are public sector enterprises owned and controlled by the Government.

While the intention of the Government is to exempt stamp duty in case of exchange of assets between public sector enterprises, there still remains an anomaly whether the said exemption will be applicable in case of conveyance of property, by or to public sector enterprises that do not fall under the definition of Government Company.

Conclusion

Besides various proposals of the Union Budget for the FY 2021-2022, the corporate law proposals, as can be observed from aforesaid discussions, have been introduced to allow ease of doing business. While the changes have been proposed, the final set of changes once in place will allow witnessing the ease of doing mantra as intended by the Government.