The Pious Intent of Promoting Factoring

Preserve of a select few?

- Megha Mittal, Senior Associate (finserv@vinodkothari.com)

Over the last two years, the regulatory developments vis-à-vis factoring, and more specifically, ‘who can be a factor’ has been a to-and-fro ride. With widening of the scope of entities eligible for factoring to its effective roll back vide the Registration of Factors (Reserve Bank) Regulations, 2022 (‘Registration Regulations’), the factoring market found itself stuck in ambiguity arising because of the disparity between the Factoring Regulation (Amendment) Act, 2021 (‘Amendment Act’) and the Registration Regulations. Ironically enough, only days after the notification of Registration Regulations, the Economic Survey 2021-22 was released, which held a rather positive outlook as regards the factoring market, in view of the reliefs provided vide the Amendment Act.

In this article the author humbly tries to highlight the seeming contradiction between the regulatory provisions and the economic outlook, and the need of the hour to have a clear set of provisions.

Free market for factoring – A Glib Talk?

The Factoring Regulation Act, 2011, (‘Principal Act’) being the governing statute, was framed to regulate factoring, but the legislation failed to promote it – the reason being the limited scope of ‘factors’. The Principal Act stated that entities either had to be principally into factoring business, or not do factoring at all. The result has been quite obvious, given the years of existence of the law, factoring continues to be at a low level.

After years of pondering and deliberation[1], in 2021, the Amendment Act was introduced to inter-alia clarify that NBFCs whose financial assets and income from factoring business do not meet the Principal Business Criteria[2] may carry out factoring business and will not be required to register as NBFC-Factor. This change was welcomed by all and showed prospects of the long-outstanding expansion in the Indian factoring volumes and NBFCs carrying out factoring business.

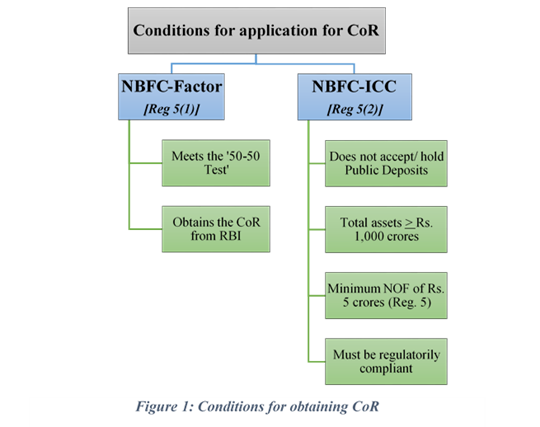

However, this relief was short-lived – The Registration of Factors (Reserve Bank) Regulations, 2022[3] (‘Registration Regulations’), has once again put forth conditions similar to the erstwhile

Principal Act, to provide that only NBFCs having a Certificate of Registration are entitled to carry out factoring business[4] (Ref to Fig 1).

Despite an undoing of sorts, it was ironical that Economic Survey 2021-22, released only days after the Registration Regulation still seemed to be signing paeans about a positive outlook of factoring market in India[5] holding the stance that “Removal of principal business criteria has significantly increased the number of eligible NBFCs that can undertake factoring business.” The Survey goes on to state that “The amendments have liberalized the restrictive provisions in the Act and at the same time ensure that a strong regulatory / oversight mechanism is in place under RBI. Overall, this change would lead to widening of factoring ecosystem in the country and help MSMEs significantly, by providing added avenues for availing credit facility.”

Evidently, there exists either a discord between the lawmaker (Central Government) and RBI (Regulator) or a counter-intuitive stance by the Government as regards the future of factoring market despite the trail of developments discussed above.

Analysis

In a press release dated 20th January, 2022,[6] the Reserve Bank of India stated that as a result of the Registration Regulations, the number of NBFCs eligible to undertake factoring business increased significantly from 7 to 182. While this 25 times increase is seemingly massive, a change in perspective would reflect a different picture – As on 31st January, 2022 India had over 9000 NBFCs registered in India.

From within this large pool of NBFCs, restricting factoring business only to entities which meet the PBC Test or have a net worth as high as Rs. 1,000 crores seems disproportionate. Further, given that India’s current contribution in the global factoring volumes is as low as 0.1% conditions introduced vide the Registration Regulations could lead to further fetters to the industry. On the other hand, allowing NBFCs to carry out factoring sans the aforesaid pre-conditions would lead to a better performance, and hence justify a truly positive outlook for the market.

Additionally, in the instant case, the service in question is as common as ‘assignment of receivables’

Conclusion

Given the slow rate of progress that the Indian factoring sector had witnessed over the years, doing away with the previous requirements for eligibility of factors, and opening up the factoring business to all NBFCs was considered to be a step taken by the RBI in the right direction when it notified the Amendment Act. It was being considered as the legislation which would eventually lead to alleviating many of the challenges that the Indian factoring industry faces currently.

However, instead of building on the subsequent progress made, the Central Government seems to have undone the progress by reintroducing strict eligibility requirements for NBFCs – A rat which could have become a lion, has been turned into a rat again. This is seen as a potential barrier in the growth of the Indian factoring industry, which needs regulatory support and more players in order to witness substantial growth in the years to come.

[1] UK Sinha Committee Report and The 24th Standing Committee Report

[2] The Principal Business Criteria Test provides that the income from factoring must be greater than 50% of the total income, and similarly, the assets pertaining to the factoring business must be greater than 50% of the total assets.

[3]https://prsindia.org/files/bills_acts/acts_parliament/2021/The%20Factoring%20Regulation%20(Amendment)%20Act,%202021.pdf

[4] See discussion in our article Factors’ Registration Regulations: Going back to Square-one?

[5] Box 4 of Chapter 4 of the Economic Survey, 2021-22

[6] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=53131

Our other articles of related interest –

https://vinodkothari.com/2022/01/factors-registration-regulations-going-back-to-square-one/

https://vinodkothari.com/2021/02/factoring-law-amendments-backed-by-standing-committee/

https://vinodkothari.com/wp-content/uploads/2020/10/Legal-Framework-for-Factoring-favorably-amended-for-NBFCs-and-MSMEs-final.pdf

https://vinodkothari.com/staff-publications-factoring/

Leave a Reply

Want to join the discussion?Feel free to contribute!