Factors’ Registration Regulations: Going back to Square-one?

– Megha Mittal

On 14th January, 2022, the Reserve Bank of India (‘RBI’) notified the Registration of Factors (Reserve Bank) Regulations, 2022[1] (‘Registration Regulations’) laying down the manner of granting Certificate of Registration (‘CoR’) to companies which propose to do factoring business. Applicable with immediate effect, this may essentially seem like an undoing of the Factoring Regulation (Amendment) Act, 2021. One of the several objectives of the said Amendment was to allay a doubt, arising from the existing language of the Factoring Act, that entities either had to be principally into factoring business, or not do factoring at all. The RBI’s Regulations almost lead to the very result – either an entity has a Certificate of Registration (COR) as a factor, or it does not do factoring at all.

In this article, we analyse the Registration Regulations, and discuss the expected ramifications in the already lagging factoring market in India.

Background

Factoring services made an entry into the Indian market back in 1987, with the deliberate attempt of the ‘Vaghul Committee[2].’ Later, in 1988, the Kalyansundaram Committee laid emphasis on setting up independent agencies to provide factoring services. Eventually, the Factoring Regulation Act, 2011 (‘Principal Act’) was enacted to provide for “regulating” the assignment of receivables to factors, making provisions for registration for carrying out factoring business, and the rights and obligations of the parties to the factoring contract.[3] It may seem ironic to talk about “regulating” factoring, because the idea of the factoring law was mooted by Unidroit, which wanted the law to promote factoring. However, what was intended to be an enabling or promotional piece had a regulatory overtone.

The result was obvious – the regulatory stance of the legislation failed to promote factoring. – From a policy perspective, every time any policymaker talks about factoring, we always highlight the significance of factoring, particularly for financing the working capital needs of SMEs. Expanding trade and credit volumes could have provided a great platform for the Indian factoring market to thrive upon.

Section 3 of the Principal Act, read with the RBI FAQs on Factoring[4], lead to a common view by stakeholders that an NBFC cannot carry on the business of assignment of receivables at all, unless it is registered as a factoring company, that is to say an NBFC-Factor[5]. This interpretation posed as a significant barrier in the growth of factoring business in India as a significant chunk of NBFCs were disabled from carrying out factoring services, since registration as a ‘factor’ was not feasible if the same is not carried out as a principal business activity[6].

In June 2019, the Expert Committee on Micro, Small and Medium Enterprises chaired by Mr. U. K. Sinha[7], with an intention to facilitate receivable financing for MSMEs, recommended allowing NBFCs other than NBFC-Factors to carry out the business of invoice discounting or receivables financing.

In this backdrop, the Factoring Regulation (Amendment) Bill, 2020[8] sought to clarify that NBFCs whose financial assets and income from factoring business is less than 50% of its total assets or gross income may carry out factoring business and will not be required to register as NBFC-Factor[9] – the same was eventually given effect vide the Factoring Regulation (Amendment) Act, 2021. (‘Amendment Bill’).[10]

The rolling out of the Amendment Bill was welcomed as it showed prospects of the long-outstanding expansion in the Indian factoring volumes and NBFCs carrying out factoring business.

With the Registration Regulations in place, though it is now clear as to which entities can act as factors, it has once again closed the gates for NBFCs, not having a CoR, from carrying out factoring business.

Understanding the Registration Regulations

As suggested by its name, the Registration Regulations essentially lay down regulations dealing with registration of factors.

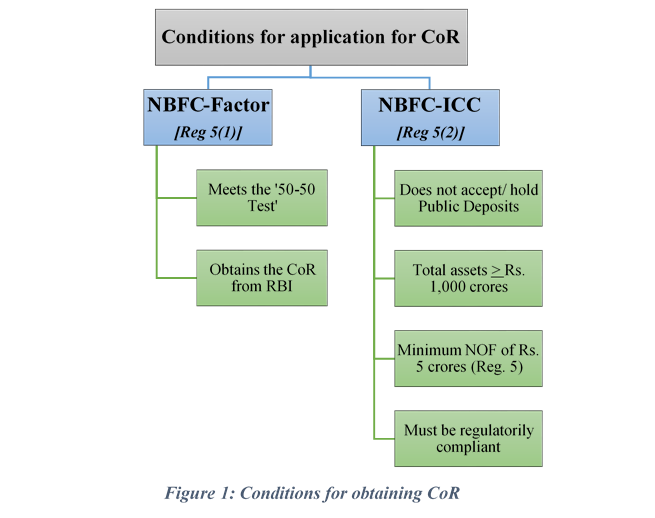

The Registration Regulations provide that factoring services can be carried out by either an NBFC-Factor[11] or an NBFC-Investment and Credit Company (NBFC-ICC)[12] after having obtained the CoR from RBI. Prerequisites for making an application to RBI for each of the eligible classes have been captured in Figure 1.

The Registration Regulations further provide that every company seeking a CoR must have a minimum Net Owned Fund (NOF) of ₹5 crore, or as specified by the Reserve Bank from time to time[13].

Other salient features are –

- Any existing NBFC-ICC, which does not satisfy the conditions prescribed in regulation 5(2), but intends to undertake factoring business, shall approach RBI for conversion from NBFC-ICC to NBFC-Factor. Such NBFC-ICCs shall comply with the PBC as specified in Regulation 4.

- Application for such conversion shall be submitted with all supporting documents meant for new registration as NBFC-Factor, together with surrender of original CoR issued by the Reserve Bank to the NBFC-ICC

- Exemptions under section 5 of the Principal Act, with respect to banks, and body corporates established under an Act of Parliament or State Legislature, or a Government Company, continue to be in operation

- NBFC-Factor or eligible NBFC-ICC which has been granted CoR by the Reserve Bank under these regulations, shall commence factoring business within six months from the date of grant of CoR.

Analysis

In light of the discussion above, the following may be observed –

Eligible Factors – Inclusive and Exclusive CoRs

The new set of registration conditions have led to the identification two broad classes of registration – an ‘Inclusive Registration’ and an ‘Exclusive Registration’

From the discussion in the foregoing paragraphs, we understand that where an NBFC-ICC acts as a factor, it retains its registration required for its principal business, say, lending and investment, granted by the RBI – the CoR for carrying out factoring services is simply an additional registration that the NBFC-ICC obtains – hence, inclusive in nature.

On the other hand, a registration specifically as an NBFC-Factor implies that factoring is the principal business of such an entity – hence, such a registration is exclusive in nature, implying that the factoring is the exclusive business of such an entity.

Ouster of a Significant Market

The definition of ‘receivables’ under the Principal Act[14], is wide enough to cover receivables arising from all forms of supply of good and services, and also include receivables arising from transactions such as toll agreements, lease agreements, power purchase agreements and alike. Evidently, the factoring market covered within its umbrella a wide range receivables.

Now, as a result of the new set of conditions, any NBFC which does meet the principal-business criteria can only carry out factoring business if it satisfies all the conditions laid down in Regulation 5 (2). At this juncture, it is important to note that the requirement of ‘regulatory compliance’ can have very wide connotations –uncertainty with respect to its scope, benchmarks for identifying a ‘compliant’ company, and similar factors could be highly subjective, thus making registration heavily dependent on how the regulator interprets ‘regulatory compliance’.

Additionally, the minimum asset size of Rs. 1,000 crores would lead to a complete exclusion of a significant number of small companies unable to meet this criteria. Therefore, what is meant for, and always appreciated as a device of SME finance, becomes the preserve of an exclusive club!

In this pretext, it must be noted that as on 30th September, 2021, the number of registered NBFC-Factors in India, is as low as six.[15] Thus, with the participation already at its minimal level, and a global penetration of merely 0.1%. conditions introduced vide the Registration Regulations could lead to further fetters to the industry.

Though, it may seem, that the Regulations are affecting only factoring business, which is anyways a low key business in India, but with the wide ambit of definition of “factoring business”, any activity, other than secured lending, which is using assignment of receivables as its basis, is likely be impacted. This may include a whole lot of very important sectors: assignment of lease receivables, any future flows such as school fees, copyright fees, concession income, royalty income, infrastructure flows such as PPA receivables, toll receivables, etc.

Eligible Parties and Permissible Transactions

In view of the Registration Regulations, it becomes important to understand (a) who is an eligible assignor and assignee (factor) and (b) transactions which are permissible as per the new set of regulations.

Eligible Assignors and Assignees (Factors)

At the outset, it must be noted that the Principal Act governs and regulates only assignees, that is, the factors – the Principal Act does not impose any restrictions on who can be an assignor. Hence, any entity, irrespective of its nature, is an eligible assignor.

As regards eligible assignees are concerned, based on the above discussion and the extant provisions of the Principal Act, following may be identified as eligible assignees/ factors (‘Eligible Factors’) –

- NBFC-Factors as per Regulations 2 (4), registered as per Regulation 5 (1)

- NBFC-ICC as per Regulation 2 (5), registered under Regulation 5 (2); and

- Entities identified under section 5 of the Principal Act, viz. banks, and body corporates established under an Act of Parliament or State Legislature, or a Government Company

Hence, irrespective of the nature of the assignor, any assignment to any of the above-identified ‘Eligible Factors’ are permissible under the Principal Act.

(Non)Permissible Transactions

Upon a combined reading of the Principal Act and the Registration Regulations, the following broad heads of transactions may be identified as permissible or non-permissible –

- Intra-FI transactions

In view of the excluded transactions under section 31 (j) of the Principal Act, any assignment between two financial transactions, that is, between banks and NBFCs is outside the purview of factoring regulations, and as such, shall be unaffected.

- Assignee being an NBFC other than Eligible Factors

Based on the discussion above, it can be stated with certainty that assignment to an NBFC other than Eligible Factors shall no longer be permissible.

- Loan/ Credit Transactions against security of receivables

As per section 2 (j) (i), ‘factoring business’ excludes credit facilities provided by a bank or a non-banking financial company in its ordinary course of business against security of receivables. Hence, any transaction in such nature, shall be evidently excluded from the purview of the Principal Act, and as such is permissible whether or not conditions laid down in the Registration Regulations are met.

The above discussion may be summarized as follows –

|

Assignor / Seller |

Assignee/ Buyer/ Factor |

Whether allowed |

Rationale |

|

NBNFI |

NBFC-Factor |

Allowed |

Assignee identified under Regulation 5(1) |

|

NBFC-ICC |

Allowed |

If CoR obtained under Regulation 5 (2) |

|

|

Bank |

Allowed |

Exempted as per Section 5 |

|

|

Body Corporate incorporated under any Act of Parliament or State Legislature |

Allowed |

||

|

Government Company |

Allowed |

||

|

NBNFI |

Allowed |

Outside the purview of the Factoring Laws – governed by general laws of assignment |

|

|

Factor other a company – Trust/ LLP/ Partnership/ Individual/ AoP |

Allowed |

||

|

NBFC other than Eligible Factors |

Not Allowed |

Assignee not identified as ‘factor’ in light of the Registration Regulations |

|

|

Banks and NBFCs |

Any party, other than Company |

Allowed |

If the assignee is a financial institution, whether or not eligible as per the Registration Regulations by operation of section 31(j) factoring laws shall not apply. On the other hand, if an NBFC is an entity other than a company, the assignee shall not fall within the purview of factoring laws. |

Conclusion

The foregoing discussion only strengthens the argument that the registration requirements introduced vide the Registration Regulations is a step-backwards from the little development that seemed close in light of the Factoring Amendment Act. Given the current market situation of the factoring industry and its performance on a global scale, the new set of prerequisites for registration would act as a major barrier in the growth of an industry which has already been struggling to make its mark.

[1] https://egazette.nic.in/WriteReadData/2022/232690.pdf

[2]https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/CR637_19872E959BF4B54549D981C7FF70F0F5E7D8.PDF

[3] Twenty-Fourth Report of the Standing Committee of Finance

[4]https://m.rbi.org.in/SCRIPTs/FAQView.aspx?Id=88#:~:text=The%20Factoring%20Act%2C%202011%20defines,security%20interest%20over%20any%20receivables%E2%80%9D.

[5] Detailed analysis at RBI FAQs muddle up Factoring Business in India

[6] Indian Securitisation Foundation (ISF) reprised the matter to the RBI and had made representations to the regulator, on providing clarity on the position of NBFCs carrying factoring activities as non-principal business. Dated March 28, 2017 –

[7] See the Report of the Committee here- https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=924

[8] http://164.100.47.4/BillsTexts/LSBillTexts/Asintroduced/115_2020_LS_Eng.pdf

[9] See detailed discussion in Fractured Factoring: Amendments may give a push to a potent trade finance solution

[10]https://prsindia.org/files/bills_acts/acts_parliament/2021/The%20Factoring%20Regulation%20(Amendment)%20Act,%202021.pdf

[11] As defined in Regulation 2 (4)

[12] As defined in Regulation 2 (5)

[13] Regulation 4

[14] Section 2 (p) defines receivables to mean the money owed by a debtor and not yet paid to the assignor for goods or services and includes payment of any sum, by whatever name called, required to be paid for the toll or for the use of any infrastructure facility or services

[15] https://rbi.org.in/Scripts/BS_NBFCList.aspx – Canbank Factors Limited; India Factoring & Finance Solutions Pvt Ltd; SBI Global Factors Ltd. [Formerly: Global Trade Finance Limited]; Siemens Factoring Private Limited; IFCI Factors Ltd; and Pinnacle Capital Solutions Private Limited

Leave a Reply

Want to join the discussion?Feel free to contribute!